Vector Group Ltd. (NYSE:VGR) today announced financial results

for the three and nine months ended September 30, 2015.

GAAP Financial Results

Third quarter 2015 revenues were $449.9 million, compared to

revenues of $419.9 million in the third quarter of 2014. The

Company recorded operating income of $69.6 million in the third

quarter of 2015, compared to operating income of $63.0 million in

the third quarter of 2014. Net income attributed to Vector Group

Ltd. for the 2015 third quarter was $12.2 million, or $0.10 per

diluted common share, compared to net income of $14.9 million, or

$0.13 per diluted common share, in the 2014 third quarter.

For the nine months ended September 30, 2015, revenues

were $1.23 billion, compared to $1.17 billion for

the first nine months of 2014. The Company recorded

operating income of $169.6 million for the

2015 nine-month period, compared to operating income

of $166.0 million for the 2014 nine-month period.

Net income attributed to Vector Group Ltd. for the

2015 nine-month period was $51.0 million,

or $0.42 per diluted common share, compared to net income

of $25.4 million, or $0.23 per diluted common share,

for the first nine months of 2014.

Non-GAAP Financial Results

Non-GAAP financial results also include adjustments for purchase

accounting associated with the Company's acquisition of its

additional 20.59% interest in Douglas Elliman Realty, LLC in

December 2013, litigation settlement and judgment expenses in the

Tobacco segment, non-cash stock compensation expense (for purposes

of Pro-forma Adjusted EBITDA only), and non-cash interest items

associated with the Company's convertible debt. Reconciliations of

non-GAAP financial results to the comparable GAAP financial results

for the three and nine months ended September 30, 2015 and

2014 are included in Tables 2 through 10.

Three months ended September 30, 2015 compared to the three

months ended September 30, 2014

Third quarter 2015 Pro-forma Adjusted Revenues (as described in

Table 2 attached hereto) were $450.4 million compared to $419.9

million in 2014. The increase was primarily due to an increase in

Pro-forma Adjusted Revenues in the Real Estate segment of $32.3

million offset by a decline of $1.4 million from the E-cigarette

segment.

Pro-forma Adjusted EBITDA attributed to Vector Group (as

described below and in Table 3 attached hereto) were $72.7 million

for the third quarter of 2015 as compared to $65.0 million for the

third quarter of 2014. The increase in Pro-forma Adjusted EBITDA

attributed to Vector Group for the three months ended September 30,

2015 was primarily attributable to higher profits in the Tobacco

segment.

Pro-forma Adjusted Net Income (as described below and in Table 4

attached hereto) was $12.8 million or $0.11 per diluted share for

the three months ended September 30, 2015 and $22.0 million or

$0.20 per diluted share for the three months ended September 30,

2014.

Pro-forma Adjusted Operating Income (as described below and in

Table 5 attached hereto) was $71.1 million for the three months

ended September 30, 2015 and $65.0 million for the three months

ended September 30, 2014.

Nine months ended September 30,

2015 compared to the nine months

ended September 30, 2014

For the nine months ended September 30,

2015 Pro-forma Adjusted Revenues (as described in Table 2

attached hereto) were $1.23 billion compared

to $1.18 billion in 2014. The increase was primarily

due to an increase in Pro-forma Adjusted Revenues of $63.3 million

in the Real Estate segment offset by a decline of $9.1 million from

the E-cigarette segment.

Pro-forma Adjusted EBITDA attributed to Vector Group (as

described below and in Table 3 attached hereto) was $188.3

million for the nine months ended September 30,

2015 as compared to $174.3 million for

the nine-month period of 2014. The increase in Pro-forma

Adjusted EBITDA attributed to Vector Group was primarily

attributable to higher profits in the Tobacco segment. This was

offset by a decline of Pro-forma Adjusted EBITDA from the Real

Estate segment.

Pro-forma Adjusted Net Income (as described below and in Table 4

attached hereto) was $55.8 million or $0.46 per

diluted share for the nine months ended September 30,

2015 and $52.1 million or $0.47 per

diluted share for the nine months ended September 30,

2014.

Pro-forma Adjusted Operating Income (as described below and in

Table 5 attached hereto) was $178.5 million for

the nine months ended September 30,

2015 and $173.2 million for the nine months

ended September 30, 2014.

Tobacco Segment Financial Results

For the third quarter 2015, the Tobacco segment had revenues of

$264.2 million, compared to $264.5 million for the third quarter

2014. The decline in revenues was primarily due to a 2.2% decline

in unit sales volume partially offset by favorable net pricing

variances.

Tobacco Adjusted Operating Income (described below and included

in Table 6 attached hereto) for the third quarter 2015 and 2014 was

$63.2 million and $53.2 million, respectively.

For the nine months ended September 30, 2015, the

Tobacco segment had revenues of $747.1 million, compared

to $748.5 million for the nine months ended

September 30, 2014. The decline in revenues was primarily due

to a 2.6% decline in unit sales volume partially offset by

favorable net pricing variances.

Tobacco Adjusted Operating Income (described below and included

in Table 6 attached hereto) for the nine months ended

September 30, 2015 and 2014 was $172.8

million and $147.7 million, respectively.

For the three and nine months ended September 30, 2015, the

Tobacco segment had conventional cigarette sales of approximately

2.24 billion and 6.34 billion units compared to 2.29 billion and

6.50 billion units for the three and nine months ended September

30, 2014.

Real Estate Segment Financial Results

For the third quarter 2015, the Real Estate segment had

Pro-forma Adjusted Revenues of $186.0 million, compared to $153.7

million for the third quarter 2014. The increase in revenues was

primarily due to an increase in revenues at Douglas Elliman. For

the third quarter 2015, Real Estate Pro-forma Adjusted EBITDA

attributed to the Company were $11.2 million, compared to $13.7

million for the third quarter 2014.

For the nine months ended September 30, 2015, the Real

Estate segment had Pro-forma Adjusted Revenues of $480.3 million,

compared to $417.0 million for the nine months ended

September 30, 2014. The increase in revenues was primarily due

to an increase in revenues at Douglas Elliman. For the nine months

ended September 30, 2015, Real Estate Pro-forma Adjusted EBITDA

attributed to the Company were $23.0 million, compared to $34.0

million for the nine months ended September 30, 2014.

Douglas Elliman's results are included in Vector Group Ltd.'s

Real Estate segment and Douglas Elliman continued its strong growth

by reporting increases in its Pro-Forma Adjusted Revenues of 19.3%

for the nine months ended September 30, 2015 from the comparable

2014 period. During 2015, Douglas Elliman continued to make

strategic investments by bolstering its development marketing

division and incurring increased advertising and marketing expenses

to strengthen the long-term value of the Douglas Elliman brand.

Douglas Elliman's Pro-Forma Adjusted Revenues for the third

quarter 2015 were $185.5 million, compared to $153.2 million for

the third quarter 2014. For the third quarter 2015, Douglas

Elliman's Pro-forma Adjusted EBITDA were $16.3 million ($11.5

million attributed to the Company), compared to $21.4 million

($15.1 million attributed to the Company) for the third quarter

2014.

Douglas Elliman's Pro-Forma Adjusted Revenues for the nine

months ended September 30, 2015 were $475.8 million, compared

to $398.7 million for the nine months ended September 30,

2014. For the nine months ended September 30, 2015, Douglas

Elliman's Pro-forma Adjusted EBITDA were $29.9 million ($21.1

million attributed to the Company), compared to $44.5 million

($31.4 million attributed to the Company) for the nine months ended

September 30, 2014.

For the three and nine months ended September 30, 2015, Douglas

Elliman achieved closed sales of approximately $6.6 billion and

$16.2 billion, compared to $5.2 billion and $13.3 billion for the

three and nine months ended September 30, 2014.

E-cigarettes segment Financial Results

For the third quarter 2015, the E-cigarette segment had

Pro-forma Adjusted Revenues of $201,000 and a loss of Pro-forma

Adjusted EBITDA of $2.1 million compared to Pro-forma Adjusted

Revenues of $1.6 million and a loss of Pro-forma Adjusted EBITDA of

$2.9 million for the third quarter 2014.

For the nine months ended September 30, 2015, the E-cigarette

segment had Pro-forma Adjusted Revenues of $881,000 and a loss of

Pro-forma Adjusted EBITDA of $7.7 million compared to Pro-forma

Adjusted Revenues of $10.0 million and a loss of Pro-forma Adjusted

EBITDA of $7.1 million for the nine months ended September 30,

2014.

Non-GAAP Financial Measures

Pro-forma Adjusted Revenues, Pro-forma Adjusted EBITDA,

Pro-forma Adjusted Net Income, Pro-forma Adjusted Operating Income,

Tobacco Adjusted Operating Income, New Valley LLC Pro-forma

Adjusted Revenues, New Valley LLC Pro-forma Adjusted EBITDA,

Douglas Elliman Realty, LLC Adjusted Revenues, and Douglas Elliman

Realty, LLC Adjusted EBITDA (hereafter referred to as "the Non-GAAP

Financial Measures") are financial measures not prepared in

accordance with generally accepted accounting principles (“GAAP”).

The Company believes that the Non-GAAP Financial Measures are

important measures that supplement discussions and analysis of its

results of operations and enhances an understanding of its

operating performance. The Company believes the Non-GAAP Financial

Measures provide investors and analysts with a useful measure of

operating results unaffected by differences in capital structures,

capital investment cycles and ages of related assets among

otherwise comparable companies. Management uses the Non-GAAP

Financial Measures as measures to review and assess operating

performance of the Company's business, and management and investors

should review both the overall performance (GAAP net income) and

the operating performance (the Non-GAAP Financial Measures) of the

Company's business. While management considers the Non-GAAP

Financial Measures to be important, they should be considered in

addition to, but not as substitutes for or superior to, other

measures of financial performance prepared in accordance with GAAP,

such as operating income, net income and cash flows from

operations. In addition, the Non-GAAP Financial Measures are

susceptible to varying calculations and the Company's measurement

of the Non-GAAP Financial Measures may not be comparable to those

of other companies. Attached hereto as Tables 2 through 10 is

information relating to the Company's the Non-GAAP Financial

Measures for the three and nine months ended September 30,

2015 and 2014.

Conference Call to Discuss Third Quarter 2015 Results

As previously announced, the Company will host a conference call

and webcast on Tuesday, November 3, 2015 at 9:00 A.M. (ET) to

discuss third quarter 2015 results. Investors can access the call

by dialing 800-859-8150 and entering 93041671 as the

conference ID number. The call will also be available via live

webcast at www.investorcalendar.com.

Webcast participants should allot extra time to register before the

webcast begins.

A replay of the call will be available shortly after the call

ends on November 3, 2015 through November 17, 2015. To

access the replay, dial 877-656-8905 and enter

93041671 as the conference ID number. The archived webcast

will also be available at www.investorcalendar.com for one year.]

Vector Group is a holding company that indirectly

owns Liggett Group LLC, Vector Tobacco

Inc. and Zoom E-Cigs LLC and directly owns New

Valley LLC, which owns a controlling interest in Douglas

Elliman Realty, LLC. Additional information concerning the company

is available on the Company's website, www.VectorGroupLtd.com.

TABLE 1

VECTOR GROUP LTD. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Dollars in

Thousands, Except Per Share Amounts)

Three Months Ended Nine Months Ended September 30, September

30, 2015 2014 2015 2014 (Unaudited)

(Unaudited) Revenues Tobacco* $ 264,170

$ 264,520 $ 747,145 $ 748,468 Real estate 185,563 153,748 478,841

415,280 E-Cigarettes 201 1,608 881 9,977

Total revenues 449,934 419,876 1,226,867 1,173,725

Expenses: Cost of sales: Tobacco* 174,418 189,728 506,315 537,667

Real estate 121,078 96,442 309,306 261,531 E-Cigarettes 421

1,066 1,518 6,357 Total cost of sales 295,917

287,236 817,139 805,555 Operating, selling, administrative

and general expenses 79,114 69,431 232,737 200,431 Litigation

settlement and judgment expense 3,750 225 5,843 1,725 Restructuring

expense 1,548 — 1,548 — Operating

income 69,605 62,984 169,600 166,014 Other income

(expenses): Interest expense (32,898 ) (44,034 ) (96,405 ) (123,670

) Change in fair value of derivatives embedded within convertible

debt 7,044 7,127 18,760 7,447 Acceleration of interest expense

related to debt conversion — (994 ) — (5,112 ) Equity (loss) income

from real estate ventures (916 ) 3,258 1,278 3,002 Equity (loss)

income from investments (579 ) 829 (2,273 ) 1,462 (Loss) gain on

sale of investment securities available for sale (821 ) 33 12,018

(38 ) Impairment of investment securities available for sale

(12,211 ) — (12,211 ) — Other, net 133 2,466 3,554

8,167 Income before provision for income taxes 29,357

31,669 94,321 57,272 Income tax expense 13,508 11,964

37,551 21,007 Net income 15,849 19,705 56,770

36,265 Net income attributed to non-controlling interest

(3,644 ) (4,826 ) (5,741 ) (10,881 ) Net income attributed

to Vector Group Ltd. $ 12,205 $ 14,879 $ 51,029

$ 25,384 Per basic common share: Net

income applicable to common shares attributed to Vector Group Ltd.

$ 0.10 $ 0.13 $ 0.42 $ 0.23 Per

diluted common share: Net income applicable to common shares

attributed to Vector Group Ltd. $ 0.10 $ 0.13 $ 0.42

$ 0.23 Cash distributions and dividends

declared per share $ 0.38 $ 0.36 $ 1.14 $ 1.09

* Revenues and Cost of goods sold include excise taxes of

$112,773, $115,323, $319,044 and $327,434 respectively.

TABLE 2

VECTOR GROUP LTD. AND

SUBSIDIARIES

RECONCILIATION OF PRO-FORMA ADJUSTED

REVENUES

(Unaudited)

(Dollars in

Thousands)

LTM Three Months Ended Nine Months Ended September 30,

September 30, September 30, 2015 2015 2014 2015

2014 Revenues $ 1,644,457 $ 449,934

$ 419,876 $ 1,226,867 $ 1,173,725

Purchase accounting adjustments (a) 1,529 481 —

1,444 1,683 Total adjustments 1,529 481 — 1,444 1,683

Pro-forma Adjusted Revenues (b) $ 1,645,986 $ 450,415

$ 419,876 $ 1,228,311 $ 1,175,408

Pro-forma Adjusted Revenues by Segment Tobacco (b) $

1,019,936 $ 264,170 $ 264,520 $ 747,145 $ 748,468 E-cigarettes (507

) 201 1,608 881 9,977 Real Estate (c) 626,557 186,044 153,748

480,285 416,963 Corporate and Other — — — —

— Total (b) $ 1,645,986 $ 450,415 $ 419,876

$ 1,228,311 $ 1,175,408

a.

Amounts represent purchase accounting

adjustments recorded in the periods presented in connection with

the increase of the Company's ownership of Douglas Elliman Realty,

LLC, which occurred in 2013.

b.

Includes excise taxes of $437,696 for the

last twelve months ended September 30, 2015 and $112,773, $115,323,

$319,044 and $327,434 for the three and nine months ended September

30, 2015 and 2014,respectively.

c.

Includes Pro-forma Adjusted Revenues from

Douglas Elliman Realty, LLC of $620,371 for the last twelve months

ended September 30, 2015 and $185,481, $153,205, $475,807, and

$398,666 for the three and nine months ended September 30, 2015 and

2014, respectively.

TABLE 3

VECTOR GROUP LTD. AND

SUBSIDIARIES

COMPUTATION OF PRO-FORMA

ADJUSTED EBITDA

(Unaudited)

(Dollars in

Thousands)

LTM Three Months Ended Nine Months Ended September 30,

September 30, September 30, 2015 2015

2014

2015 2014 Net income attributed to Vector

Group Ltd. $ 62,623 $ 12,205 $ 14,879 $ 51,029

$ 25,384 Interest expense 133,726 32,898 44,034 96,405

123,670 Income tax expense 49,795 13,508 11,964 37,551 21,007 Net

income attributed to non-controlling interest 7,118 3,644 4,826

5,741 10,881 Depreciation and amortization 25,296 6,673

6,045 19,396 18,599 EBITDA $ 278,558 $

68,928 $ 81,748 $ 210,122 $ 199,541 Change in fair value of

derivatives embedded within convertible debt (a) (30,722 ) (7,044 )

(7,127 ) (18,760 ) (7,447 ) Equity loss (income) from investments

(b) 2,493 579 (829 ) 2,273 (1,462 ) (Gain) loss on sale of

investment securities available for sale (12,045 ) 821 (33 )

(12,018 ) 38 Impairment of investment securities available for sale

12,211 12,211 — 12,211 — Equity income (loss) from real estate

ventures (c) (2,379 ) 916 (3,258 ) (1,278 ) (3,002 ) Pension

settlement charge 1,607 — — 1,607 — Acceleration of interest

expense related to debt conversion 93 — 994 — 5,112 Stock-based

compensation expense (d) 4,872 1,248 1,040 3,648 2,027 Litigation

settlement and judgment expense (e) 6,593 3,750 225 5,843 1,725

Impact of MSA settlement (f) (5,715 ) (5,715 ) — (5,715 ) (1,419 )

Restructuring expense 1,548 1,548 — 1,548 — Purchase accounting

adjustments (g) 1,521 366 407 1,056 1,013 Other, net (5,939 ) (133

) (2,466 ) (3,554 ) (8,167 ) Pro-forma Adjusted EBITDA $ 252,696 $

77,475 $ 70,701 $ 196,983 $ 187,959 Pro-forma Adjusted EBITDA

attributed to non-controlling interest (10,976 ) (4,735 ) (5,660 )

(8,732 ) (13,614 ) Pro-forma Adjusted EBITDA attributed to Vector

Group Ltd. $ 241,720 $ 72,740 $ 65,041 $

188,251 $ 174,345

Pro-forma Adjusted EBITDA

by Segment Tobacco $ 236,462 $ 66,084 $ 56,097 $ 181,580 $

156,285 E-cigarettes (13,733 ) (2,146 ) (2,910 ) (7,710 ) (7,100 )

Real Estate (h) 40,145 15,981 19,369 31,698 47,589 Corporate and

Other (10,178 ) (2,444 ) (1,855 ) (8,585 ) (8,815 ) Total $ 252,696

$ 77,475 $ 70,701 $ 196,983 $ 187,959

Pro-forma Adjusted EBITDA Attributed to Vector

Group by Segment Tobacco $ 236,462 $ 66,084 $ 56,097 $ 181,580

$ 156,285 E-cigarettes (13,733 ) (2,146 ) (2,910 ) (7,710 ) (7,100

) Real Estate (i) 29,169 11,246 13,709 22,966 33,975 Corporate and

Other (10,178 ) (2,444 ) (1,855 ) (8,585 ) (8,815 ) Total $ 241,720

$ 72,740 $ 65,041 $ 188,251 $ 174,345

a.

Represents income or losses recognized

from changes in the fair value of the derivatives embedded in the

Company's convertible debt.

b.

Represents income or losses recognized

from investments that the Company accounts for under the equity

method.

c.

Represents equity income (loss) recognized

from the Company's investment in certain real estate businesses

that are not consolidated in its financial results.

d.

Represents amortization of stock-based

compensation.

e.

Represents accruals for settlements of

judgment expenses in the Engle progeny tobacco litigation.

f.

Represents the Company's tobacco segment's

settlement of a long-standing dispute related to the Master

Settlement Agreement.

g.

Amounts represent purchase accounting

adjustments recorded in the periods presented in connection with

the increase of the Company's ownership of Douglas Elliman Realty,

LLC, which occurred in 2013.

h.

Includes Pro-forma Adjusted EBITDA for

Douglas Elliman Realty, LLC of $36,010 for the last twelve months

ended September 30, 2015 and $16,294, $21,355, $29,885,and $44,530

for the three and nine months ended September 30, 2015 and 2014,

respectively. Amounts reported in this footnote reflect 100% of

Douglas Elliman Realty, LLC's entire Pro-forma Adjusted EBITDA.

i.

Includes Pro-forma Adjusted EBITDA for

Douglas Elliman Realty, LLC less non-controlling interest of

$25,420 for the last twelve months ended September 30, 2015 and

$11,502, $15,074, $21,096, and $31,434 the three and nine months

ended September 30, 2015 and 2014, respectively. Amounts reported

in this footnote have adjusted Douglas Elliman Realty, LLC's

Pro-forma Adjusted EBITDA for non-controlling interest.

TABLE 4

VECTOR GROUP LTD. AND

SUBSIDIARIES

RECONCILIATION OF PRO-FORMA ADJUSTED

NET INCOME

(Unaudited)

(Dollars in

Thousands, Except Per Share Amounts)

Three Months Ended Nine Months Ended September 30, September

30, 2015 2014 2015 2014 Net

income attributed to Vector Group Ltd. $ 12,205 $

14,879 $ 51,029 $ 25,384 Acceleration of

interest expense related to debt conversion — 994 — 5,112 Change in

fair value of derivatives embedded within convertible debt (7,044 )

(7,127 ) (18,760 ) (7,447 ) Non-cash amortization of debt discount

on convertible debt 7,187 14,581 19,646 41,728 Loss on

extinguishment of 11% Senior Secured Notes due 2015 — — — —

Litigation settlement and judgment expense (a) 3,750 225 5,843

1,725 Pension settlement charge — — 1,607 — Impact of MSA

settlement (b) (5,715 ) — (5,715 ) (1,419 ) Restructuring expense

1,548 —

1,548 — Out-of-period adjustment related to Douglas Elliman

acquisition in 2013 (c) — — — (1,231 ) Douglas Elliman Realty, LLC

purchase accounting adjustments (d) 1,351 1,252 3,945

4,831 Total adjustments 1,077 9,925 8,114 43,299

Tax expense related to adjustments (448 ) (4,104 ) (3,376 )

(17,904 ) Adjustments to income tax expense due to purchase

accounting (e) — 1,305 — 1,305

Pro-forma Adjusted Net Income attributed to Vector Group Ltd. $

12,834 $ 22,005 $ 55,767 $ 52,084

Per diluted common share: Pro-forma Adjusted Net

Income applicable to common shares attributed to Vector Group Ltd.

$ 0.11 $ 0.20 $ 0.46 $

0.47

a.

Represents accruals for settlements of

judgment expenses in the Engle progeny tobacco litigation.

b.

Represents the Company's tobacco segment's

settlement of a long-standing dispute related to the Master

Settlement Agreement.

c.

Represents an out-of-period adjustment

related to a non-accrual of a receivable from Douglas Elliman

Realty in the fourth quarter of 2013 and would have increased the

Company's gain on acquisition of Douglas Elliman in 2013.

d.

Represents 70.59% of purchase accounting

adjustments in the periods presented for assets acquired in

connection with the increase of the Company's ownership of Douglas

Elliman Realty, LLC, which occurred in 2013.

e.

Represents adjustments to income tax

expense due to a change in the Company's marginal income tax rate

from 40.6% to 41.35% as a result of its acquisition of 20.59% of

Douglas Elliman Realty, LLC on December 13, 2013.

TABLE 5

VECTOR GROUP LTD. AND

SUBSIDIARIES

RECONCILIATION OF PRO-FORMA ADJUSTED

OPERATING INCOME

(Unaudited)

(Dollars in

Thousands)

LTM Three Months Ended Nine Months Ended September 30,

September 30, September 30, 2015 2015 2014 2015

2014 Operating income $ 216,974 $ 69,605

$ 62,984 $ 169,600 $ 166,014

Litigation settlement and judgment expense (a) 6,593 3,750 225

5,843 1,725 Pension settlement charge 1,607 — — 1,607 —

Restructuring expense 1,548 1,548 — 1,548 — Impact of MSA

settlement (b) (5,715 ) (5,715 ) — (5,715 ) (1,419 ) Douglas

Elliman Realty, LLC purchase accounting adjustments (c) 7,272

1,913 1,773 5,588 6,843 Total

adjustments 11,305 1,496 1,998 8,871 7,149 Pro-forma

Adjusted Operating Income (d) $ 228,279 $ 71,101 $

64,982 $ 178,471 $ 173,163

a.

Represents accruals for settlements of

judgment expenses in the Engle progeny tobacco litigation.

b.

Represents the Company's tobacco segment's

settlement of a long-standing dispute related to the Master

Settlement Agreement.

c.

Amounts represent purchase accounting

adjustments recorded in the periods presented in connection with

the increase of the Company's ownership of Douglas Elliman Realty,

LLC, which occurred in 2013.

d.

Does not include a reduction for 29.41%

non-controlling interest in Douglas Elliman Realty, LLC.

TABLE 6

VECTOR GROUP LTD. AND

SUBSIDIARIES

RECONCILIATION OF TOBACCO ADJUSTED

OPERATING INCOME

(Unaudited)

(Dollars in

Thousands)

LTM Three Months Ended Nine Months Ended September 30,

September 30, September 30, 2015 2015 2014 2015

2014 Operating income from tobacco segment $

221,239 $ 63,630 $ 52,993 $ 169,515 $

147,395 Litigation settlement and judgment expense (a) 6,593

3,750 225 5,843 1,725 Pension settlement charge 1,607 — — 1,607 —

Restructuring expense 1,548 1,548 — 1,548 — Impact of MSA

settlement (b) (5,715 ) (5,715 ) — (5,715 ) (1,419 ) Total

adjustments 4,033 (417 ) 225 3,283 306 Tobacco Adjusted

Operating Income $ 225,272 $ 63,213 $ 53,218 $

172,798 $ 147,701

a.

Represents accruals for settlements of

judgment expenses in the Engle progeny tobacco litigation.

b.

Represents the Company's tobacco segment's

settlement of a long-standing dispute related to the Master

Settlement Agreement.

TABLE 7

VECTOR GROUP LTD. AND

SUBSIDIARIES

ANALYSIS OF NEW VALLEY LLC PRO-FORMA

ADJUSTED REVENUES

(Unaudited)

(Dollars in

Thousands)

LTM Three Months Ended Nine Months Ended September 30,

September 30, September 30, 2015 2015 2014 2015

2014 New Valley LLC revenues $ 625,028 $

185,563 $ 153,748 $ 478,841 $ 415,280

Purchase accounting adjustments (a) 1,529 481

— 1,444 1,683 Total adjustments 1,529 481 — 1,444

1,683 New Valley LLC Pro-forma Adjusted Revenues (b) $

626,557 $ 186,044 $ 153,748 $ 480,285 $

416,963

a.

Amounts represent purchase accounting

adjustments recorded in connection with the increase of the

Company's ownership of Douglas Elliman Realty, LLC., which occurred

in 2013.

b.

Includes Pro-forma Adjusted Revenues from

Douglas Elliman Realty, LLC of $620,371 for the last twelve months

ended September 30, 2015 and $185,481, $153,205, $475,807,and

$398,666 for the three and nine months ended September 30, 2015 and

2014, respectively.

TABLE 8

VECTOR GROUP LTD. AND

SUBSIDIARIES

COMPUTATION OF NEW VALLEY LLC PRO-FORMA

ADJUSTED EBITDA

(Unaudited)

(Dollars in

Thousands)

LTM Three Months Ended Nine Months Ended September 30,

September 30, September 30, 2015 2015 2014 2015

2014 Net income attributed to Vector Group

Ltd. from subsidiary non-guarantors (a) $ 13,974 $ 4,695

$ 8,202 $ 10,215 $ 17,661 Interest expense (a)

5 1 3 4 40 Income tax expense (a) 9,912 3,395 6,630 7,904 15,420

Net income attributed to non-controlling interest (a) 7,118

3,644 4,826 5,741 10,881 Depreciation and amortization 11,867

3,388 2,740 9,372 9,709 EBITDA $

42,876 $ 15,123 $ 22,401 $ 33,236 $ 53,711 Income (loss) from

non-guarantors other than New Valley 73 (1 ) 21 66 86 Equity income

(loss) from real estate ventures (b) (2,379 ) 916 (3,258 ) (1,278 )

(3,002 ) Purchase accounting adjustments (c) 1,521 366 407 1,056

1,013 Other, net (1,775 ) (305 ) (234 ) (1,286 ) (4,297 ) Pro-forma

Adjusted EBITDA $ 40,316 $ 16,099 $ 19,337 $ 31,794 $ 47,511

Pro-forma Adjusted EBITDA attributed to non-controlling interest

(10,976 ) (4,735 ) (5,660 ) (8,732 ) (13,614 ) Pro-forma Adjusted

EBITDA attributed to New Valley LLC $ 29,340 $ 11,364

$ 13,677 $ 23,062 $ 33,897 Pro-forma

Adjusted EBITDA by Segment Real Estate (d) $ 40,145 $ 15,981 $

19,369 $ 31,698 $ 47,589 Corporate and Other 171 118

(32 ) 96 (78 ) Total (f) $ 40,316 $ 16,099 $

19,337 $ 31,794 $ 47,511 Pro-forma

Adjusted EBITDA Attributed to New Valley LLC by Segment Real Estate

(e) $ 29,169 $ 11,246 $ 13,709 $ 22,966 $ 33,975 Corporate and

Other 171 118 (32 ) 96 (78 ) Total (f) $

29,340 $ 11,364 $ 13,677 $ 23,062 $

33,897

a.

Amounts are derived from Vector Group

Ltd.'s Consolidated Financial Statements. See Note entitled "Vector

Group Ltd.'s Condensed Consolidating Financial Information"

contained in Vector Group Ltd.'s Form 10-K and Form 10-Q for the

year ended December 31, 2014 and the quarterly period ended

September 30, 2015.

b.

Represents equity income (loss) recognized

from the Company's investment in certain real estate businesses

that are not consolidated in its financial results.

c.

Amounts represent purchase accounting

adjustments recorded in the periods presented in connection with

the increase of the Company's ownership of Douglas Elliman Realty,

LLC, which occurred in 2013.

d.

Includes Pro-forma Adjusted EBITDA for

Douglas Elliman Realty, LLC of $36,010 for the twelve months ended

September 30, 2015 and $16,294, $21,355, $29,885,and $44,530 for

the three and nine months ended September 30, 2015 and 2014,

respectively. Amounts reported in this footnote reflect 100% of

Douglas Elliman Realty, LLC's entire Pro-forma Adjusted EBITDA.

e.

Includes Pro-forma Adjusted EBITDA for

Douglas Elliman Realty, LLC less non-controlling interest of

$25,420 for the last twelve months ended September 30, 2015 and

$11,502, $15,074, $21,096, and $31,434 for the three and nine

months ended September 30, 2015 and 2014, respectively. Amounts

reported in this footnote have adjusted Douglas Elliman Realty,

LLC's Pro-forma Adjusted EBITDA for non-controlling interest.

f.

New Valley's Pro-forma Adjusted EBITDA

does not include an allocation of Vector Group Ltd.'s "Corporate

and Other" segment's expenses (for purposes of computing Pro-Forma

Adjusted EBITDA contained in Table 3 of this press release) of

$10,178 for the last twelve months ended September 30, 2015 and

$2,444, $1,855, $8,585 and $8,815 for the three and nine months

ended September 30, 2015 and 2014, respectively.

TABLE 9

VECTOR GROUP LTD. AND

SUBSIDIARIES

ANALYSIS OF DOUGLAS ELLIMAN REALTY, LLC

PRO-FORMA ADJUSTED REVENUES

(Unaudited)

(Dollars in

Thousands)

LTM Three Months Ended Nine Months Ended September 30,

September 30, September 30, 2015 2015 2014 2015

2014 Douglas Elliman Realty, LLC

revenues $ 618,842 $ 185,000 $ 153,205 $ 474,363 $

396,983 Purchase accounting adjustments (a) 1,529 481

— 1,444 1,683 Total adjustments 1,529 481 —

1,444 1,683 Douglas Elliman Realty, LLC Pro-forma Adjusted

Revenues $ 620,371 $ 185,481 $ 153,205 $

475,807 $ 398,666

a.

Amounts represent purchase accounting

adjustments recorded in the periods presented in connection with

the increase of the Company's ownership of Douglas Elliman Realty,

LLC, which occurred in 2013.

TABLE 10

VECTOR GROUP LTD. AND

SUBSIDIARIES

COMPUTATION OF DOUGLAS ELLIMAN REALTY,

LLC PRO-FORMA ADJUSTED EBITDA

(Unaudited)

(Dollars in

Thousands)

LTM Three Months Ended Nine Months Ended September 30,

September 30, September 30, 2015 2015 2014 2015

2014 Net income attributed to Douglas

Elliman Realty, LLC $ 24,395 $ 12,437 $ 16,407 $ 19,713

$ 33,732 Interest expense 4 — 3 3 37 Income tax expense

1,149 349 513 876 1,101 Depreciation and amortization 11,625

3,329 2,661 9,195 9,425 Douglas Elliman

Realty, LLC EBITDA $ 37,173 $ 16,115 $ 19,584 $ 29,787 $ 44,295

Equity (loss) income from real estate ventures (a) (932 )

(211 ) 2,027 (908 ) (86 ) Purchase accounting adjustments (b) (162

) 366 2,090 1,056 2,696 Other, net (69 ) 24 (2,346 ) (50 )

(2,375 ) Douglas Elliman Realty, LLC Pro-forma Adjusted EBITDA $

36,010 $ 16,294 $ 21,355 $ 29,885 $

44,530

a.

Represents equity income recognized from

the Company's investment in certain real estate businesses that are

not consolidated in its financial results.

b.

Amounts represent purchase accounting

adjustments recorded in the periods presented in connection with

the increase of the Company's ownership of Douglas Elliman Realty,

LLC, which occurred in 2013.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151102006804/en/

Sard Verbinnen & CoEmily Deissler/Benjamin

Spicehandler/Spencer Waybright212-687-8080orSard Verbinnen & Co

- EuropeJonathan Doorley/Conrad Harrington+44 (0)20 3178

8914orVector Group Ltd.J. Bryant Kirkland III, 305-579-8000

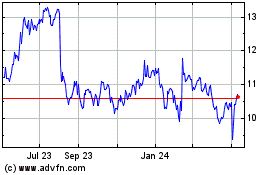

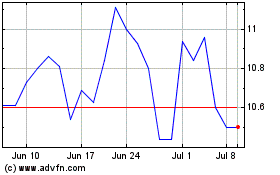

Vector (NYSE:VGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vector (NYSE:VGR)

Historical Stock Chart

From Apr 2023 to Apr 2024