Borders To Cut Prices On Kobo, Aluratek E-Book Readers

August 31 2010 - 12:45PM

Dow Jones News

Borders Group Inc. (BGP) will cut prices on two of its

electronic-book readers by about $20 on Wednesday, as the

struggling bookstore chain tries to gain a foothold for its

fledgling e-book initiative amid fierce competition.

Its Kobo reader, powered by Canada's Kobo Inc., in which Borders

has an equity stake, will drop to $129.99 from $149.99 and its

Aluratek Libre reader will go to $99.99 from $119.99 apiece. The

devices aim to compete with more popular, and more expensive,

offerings like Amazon.com Inc.'s (AMZN) Kindle, Barnes & Noble

Inc.'s (BKS) Nook and the Apple Inc. (AAPL) iPad, and follow price

cuts on the Nook and Kindle earlier this summer.

Borders has struggled with eroding sales and a flagging share

price while paring down debt to levels it hopes will allow it to

survive in the poor economy against better-positioned rivals. It

will release fiscal-second-quarter earnings Wednesday morning, and

investors will look to see if it's suffering similar store-traffic

declines as Barnes & Noble, itself dealing with a proxy contest

involving investor Ron Burkle's Yucaipa Cos. while it explores

options to inject value into its slumping stock.

When Borders announced its branded e-book store in early July,

it set the ambitious goal of 17% market share in a year's time.

Barnes & Noble said last Tuesday it had already captured over

17% of the market, giving it better market share in e-books than it

has in physical books.

Borders President Mike Edwards said in an interview that it's

too early to tell what level of market penetration Borders has,

given the newness of the business, but he said the price cuts don't

"have anything to do with pricing in the marketplace." Borders

knows achieving its market-share goal is "entirely contingent on

selling devices," Edwards said, and it wanted to make sure it had

an offering priced below $100 to attract customers.

Edwards declined to discuss specifics of Borders' results before

Wednesday's news release and subsequent conference call, but said

major investor Bennett LeBow won't be speaking on the call. The

reclusive LeBow is chairman of Liggett tobacco owner Vector Group

Ltd. (VGR) and is now chairman and chief executive of Borders. He

made a $25 million investment in Borders group this year that could

see him invest another nearly $79 million to amass a 35% equity

stake.

In addition to 11.1 million Borders common shares, LeBow

received warrants to buy 35.1 shares at $2.25 apiece, more than

double the $1.11 that Borders fetched in light and unchanged

Tuesday trading. Edwards said Borders has modeled LeBow converting

his warrants into its financial plans, but said any delay in

conversion isn't material to its operations compared to its issues

with managing inventory, coping with a large debt load and dealing

with underperforming stores.

-By Maxwell Murphy, Dow Jones Newswires; 212-416-2171;

maxwell.murphy@dowjones.com

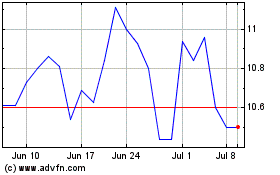

Vector (NYSE:VGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

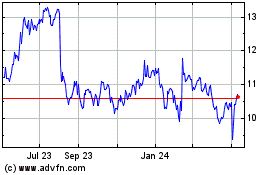

Vector (NYSE:VGR)

Historical Stock Chart

From Apr 2023 to Apr 2024