Report of Foreign Issuer (6-k)

June 16 2016 - 10:04AM

Edgar (US Regulatory)

Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

June 2016

Vale S.A.

Avenida das Américas, No. 700 – Bloco 8, Sala 218

22640-100 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

|

|

(Check One) Form 20-F

x

Form 40-F

o

|

|

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

Table of Contents

|

|

Transmitted

only to

SEC, NYSE, CVM,

BM&FBOVESPA, AMF,

Euronext Paris and

HKEx

|

Vale informs increase of relevant shareholding ownership

Rio de Janeiro, June 16, 2016 — Vale S.A. (Vale) informs, pursuant to Paragraph 6 of Article 12 of Ruling 358/02 issued by the Brazilian Securities Commission (CVM), as subsequently amended, that Capital Group International, Inc. (CGII), as an independent investment division of Capital Research and Management Company (CRMC), a company organized and existing under the laws of the United States of America, headquartered at 333, Southern Hope Street, Los Angeles, California 900071, United States of America (“CRMC”), and legally represented in Brazil by J.P. Morgan S.A. Distributor Securities, registered with the CNPJ/MF under no 33.851.205/0001-30, and Citibank DTVM S.A., registered with the CNPJ/MF under no 33.868.597/001-40, increased the number of preferred class “A” shares issued by Vale, through transactions on behalf of its clients on stock exchanges.

CGII owned 202,630,699 preferred shares, corresponding to 9.99% of this type of share and, as a result of these transactions, now manages 205,947,699 preferred shares, representing 10.16% of this type of share.

In addition to the aforementioned share participation, Capital Research Global Investors and Capital World Investors, also as an independent divisions of investments at CRMC, administer 207,176,332 preferred shares and 5,620,000 preferred shares, corresponding to 10.22% and to 0.28% of this type of share.

CGII also stated that: (i) it is a minority investment that does not alter the control or the administrative structure of Vale; (ii) there is not, at this time, a specific quantity of shares issued by Vale being targeted by CGII; (iii) there are no other securities or derivatives referenced to such shares held directly or indirectly by CGII or person or persons attached to it; (iv) there is no agreement or contract regulating the exercise of voting rights or the purchase and sale of securities issued by Vale where CGII or a related party are involved.

For further information, please contact:

+55-21-3485-3900

Andre Figueiredo: andre.figueiredo@vale.com

Carla Albano Miller: carla.albano@vale.com

Fernando Mascarenhas: fernando.mascarenhas@vale.com

Andrea

Gutman: andrea.gutman@vale.com

Bruno Siqueira: bruno.siqueira@vale.com

Claudia Rodrigues: claudia.rodrigues@vale.com

Mariano

Szachtman: mariano.szachtman@vale.com

Renata Capanema: renata.capanema@vale.com

This press release may include statements that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future and not on historical facts, involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão de Valores Mobiliários (CVM), the French Autorité des Marchés Financiers (AMF), and The Stock Exchange of Hong Kong Limited, and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in Vale’s annual report on Form 20-F.

3

Table of Contents

|

|

Transmitted only to

SEC, NYSE, CVM,

BM&FBOVESPA, AMF,

Euronext Paris and

HKEx

|

Vale informs increase of relevant shareholding ownership

Rio de Janeiro, June 16, 2016 — Vale S.A. (Vale) informs, pursuant to Paragraph 6 of Article 12 of Ruling 358/02 issued by the Brazilian Securities Commission (CVM), as subsequently amended, that BlackRock, Inc., a company organized and existing under the laws of the United States of America, headquartered at 55 East 52

nd

Street, New York, New York 10022-0002, United States of America, and legally represented in Brazil by HSBC Bank Brasil S.A., registered with the CNPJ/MF under no 1.701.201/0001-89, Citibank DTVM SA, registered with the CNPJ/MF under no 33.868.597/0001-40, JP Morgan, registered with the CNPJ/MF under no 33.851.205/0001-30 and Deutsche Bank São Paulo, registered with the CNPJ/MF under no 62.331.228/0001-11, increased the number of preferred class “A” shares issued by Vale, through transactions on behalf of its clients on stock exchanges.

BlackRock, Inc. now manages a total of 101,655,903 preferred shares, representing 5.01% of this type of share.

In addition to the aforementioned share participation, BlackRock, Inc holds a total of 2,265,600 derivatives referenced to such shares, representing 0.11% of this type of share.

BlackRock, Inc. also stated that: (i) it is a minority investment that does not alter the control or the administrative structure of Vale; (ii) there are no other securities or derivatives referenced to such shares held directly or indirectly by BlackRock, Inc. or persons attached to it; (iii) there is no agreement or contract regulating the exercise of voting rights or the purchase and sale of securities issued by Vale where BlackRock, Inc. or a related party are involved.

For further information, please contact:

+55-21-3485-3900

Andre Figueiredo: andre.figueiredo@vale.com

Carla Albano Miller: carla.albano@vale.com

Fernando Mascarenhas: fernando.mascarenhas@vale.com

Andrea

Gutman: andrea.gutman@vale.com

Bruno Siqueira: bruno.siqueira@vale.com

Claudia Rodrigues: claudia.rodrigues@vale.com

Mariano Szachtman: mariano.szachtman@vale.com

Renata Capanema: renata.capanema@vale.com

This press release may include statements that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future and not on historical facts, involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão de Valores Mobiliários (CVM), the French Autorité des Marchés Financiers (AMF), and The Stock Exchange of Hong Kong Limited, and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in Vale’s annual report on Form 20-F.

4

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vale S.A.

|

|

|

|

(Registrant)

|

|

|

|

|

|

Date: June 15, 2016

|

By:

|

/s/ Rogerio Nogueira

|

|

|

|

Director of Investor Relations

|

|

|

|

|

|

5

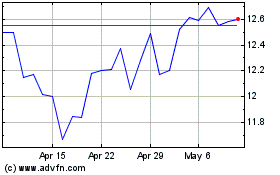

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

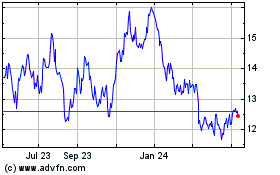

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024