UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Act of 1934

Date of Report (Date of earliest event reported):

February 24, 2015

THE VALSPAR CORPORATION

(Exact name of registrant as specified in its

charter)

| Delaware |

1-3011 |

36-2443580 |

| (State or other jurisdiction |

(Commission |

(I.R.S. Employer |

| of incorporation) |

File Number) |

Identification No.) |

| |

|

|

| 901 – 3rd Avenue South, Minneapolis, Minnesota |

55402 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (612) 851-7000

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 2.02. |

Results of Operations and Financial Condition. |

| |

|

| |

On February 24, 2015, the Company issued the press release attached as Exhibit 99.1, which sets out the Company's results of operations for the first quarter of fiscal 2015. |

| |

|

| |

|

| Item 9.01. |

Financial Statements and Exhibits. |

| |

|

| (d) |

Exhibits |

| |

|

| |

99.1. First Quarter Earnings Press Release dated February 24, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

THE VALSPAR CORPORATION |

|

| |

|

|

| |

|

|

| |

|

|

| Dated: February 24, 2015 |

/s/Rolf Engh |

|

| |

Name: Rolf Engh |

|

| |

Title: Secretary |

|

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

First Quarter Earnings Press Release dated February 24, 2015 |

Exhibit 99.1

|

|

News Release |

| |

|

|

Valspar Reports Fiscal 2015 First Quarter

Results

·

First quarter net sales increased 4 percent (up 7 percent in

local currency) to $992 million

·

First quarter diluted EPS (as adjusted) increased 21 percent

to $0.85

·

Volumes increased 7 percent driven by continued strength in Coatings

segment

·

Fiscal 2015 annual diluted EPS (as adjusted) guidance reaffirmed

at $4.45 to $4.65

Minneapolis – (BUSINESS WIRE) – February

24, 2015 – The Valspar Corporation (NYSE: VAL) today reported fiscal first quarter 2015 net sales of $992 million, an

increase of 4 percent over the prior year. Reported net income and earnings per diluted share for the current fiscal year include

nonrecurring items, which are detailed in the “Reconciliation of Non-GAAP Financial Measures” included in this release.

First quarter 2015 adjusted net income and earnings per diluted share, excluding these nonrecurring items, were $71 million and

$0.85, respectively. First quarter 2014 adjusted net income and earnings per diluted share were $61 million and $0.70, respectively.

“We are pleased to report a good start to the

year with sales growth of 4 percent and EPS growth of 21 percent in the first quarter,” said Gary E. Hendrickson, chairman

and chief executive officer. “These results were driven by improved sales and profitability in our Coatings segment, strong

performance from China, new business wins in many of our product lines and the benefits from productivity initiatives.”

“Both the Coatings and Paints segments increased

volumes and grew sales in local currency,” Hendrickson added. “We saw continued momentum in Coatings, with all product

lines growing volume and sales. In the Paints segment, volumes increased and sales were up modestly in local currency, driven by

our international regions.”

Fiscal First Quarter 2015 Segment Results

Net sales in the Coatings segment increased 7 percent

to $586 million in the fiscal first quarter of 2015. Net sales in local currency increased 10 percent, and volumes were up 10 percent.

Volume increased in all product lines and geographic regions. Coatings segment adjusted earnings before interest and taxes (EBIT)

of $91 million (or 15.5% of net sales) increased 16 percent as a result of increased volume and benefits from productivity initiatives.

Net sales in the Paints segment decreased 1 percent

to $359 million in the fiscal first quarter of 2015. Net sales in local currency increased 2 percent, and volumes increased 5 percent.

Volume growth was led by the Europe, Australia and Asia regions and was partially offset by declines in North America. Paints segment

adjusted EBIT of $29 million (or 8.0% of net sales) was down 16 percent from the prior year. The decline was primarily due to difficult

prior year comparisons (adjusted EBIT increased 50 percent in first quarter of fiscal 2014) and from a product line adjustment

by one of the company’s customers as previously disclosed.

Sale of Non-Strategic Assets

During the fiscal first quarter

of 2015, the company completed the divestiture of certain assets related to a non-strategic product in our Coatings segment. The

company recorded this asset sale in the first quarter of 2015, which included a pre-tax gain of approximately $48 million to reported

income from operations. This gain has been excluded from the company’s fiscal first quarter of 2015 “adjusted”

results.

Fiscal 2015 Guidance

The company is reaffirming its

fiscal 2015 annual diluted EPS (as adjusted) guidance of $4.45 to $4.65. As a result of the expected impact of a stronger U.S.

Dollar, the company is updating its fiscal 2015 annual sales guidance to approximately flat sales compared to fiscal 2014, from

the previous guidance of growth in the low single-digits.

Dividends and Share Repurchases

During the quarter, the company paid a quarterly dividend

of $0.30 per common share outstanding, or $24.6 million. Valspar is a member of the S&P High Yield Dividend Aristocrats®,

which is comprised of companies increasing dividends every year for at least 20 consecutive years. Also during the quarter, the

company repurchased 983 thousand shares, for $83.6 million.

An earnings

conference call is scheduled for 11:00 a.m. Eastern Time (10:00 a.m. Central Time) today and will be webcast and accessible from

the Investor Relations section of Valspar’s website at http://investors.valspar.com.

About The Valspar Corporation

The Valspar Corporation (NYSE: VAL) is a global leader in the paint and coatings industry. Since 1806, Valspar has been dedicated

to bringing customers the latest innovations, the finest quality and the best customer service in the coatings industry. For more

information, visit www.valspar.com.

# # #

Investor Contact:

Bill Seymour

612.656.1328

william.seymour@valspar.com

Media Contact:

Kimberly A. Welch

612.656.1347

kim.welch@valspar.com

FORWARD-LOOKING

STATEMENTS

Certain statements

contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere

in this report constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Private Securities Litigation Reform Act of

1995 provides a safe harbor for forward-looking statements. Forward-looking statements are based on management’s current

expectations, estimates, assumptions and beliefs about future events, conditions and financial performance. Forward-looking statements

are subject to risks, uncertainties and other factors, many of which are outside our control and could cause actual results to

differ materially from such statements. Any statement that is not historical in nature is a forward-looking statement. We may identify

forward-looking statements with words and phrases such as “expects,” “projects,” “estimates,”

“anticipates,” “believes,” “could,” “may,” “will,” “plans to,”

“intends,” “should” and similar expressions. These risks, uncertainties and other factors include,

but are not limited to, deterioration in general economic conditions, both domestic and international, that may adversely affect

our business; fluctuations in availability and prices of raw materials, including raw material shortages and other supply chain

disruptions, and the inability to pass along or delays in passing along raw material cost increases to our customers; dependence

of internal sales and earnings growth on business cycles affecting our customers and growth in the domestic and international coatings

industry; market share loss to, and pricing or margin pressure from, larger competitors with greater financial resources; significant

indebtedness that restricts the use of cash flow from operations for acquisitions and other investments; dependence on acquisitions

for growth, and risks related to future acquisitions, including adverse changes in the results of acquired businesses, the assumption

of unforeseen liabilities and disruptions resulting from the integration of acquisitions; risks and uncertainties associated with

operating in foreign markets, including achievement of profitable growth in developing markets; impact of fluctuations in foreign

currency exchange rates on our financial results; loss of business with key customers; damage to our reputation and business resulting

from product claims or recalls, litigation, customer perception and other matters; our ability to respond to technology changes

and to protect our technology; possible interruption, failure or compromise of the information systems we use to operate our business;

changes in governmental regulation, including more stringent environmental, health and safety regulations; our reliance on the

efforts of vendors, government agencies, utilities and other third parties to achieve adequate compliance and avoid disruption

of our business; unusual weather conditions adversely affecting sales; changes in accounting policies and standards and taxation

requirements such as new tax laws or revised tax law interpretations; the nature, cost and outcome of pending and future litigation

and other legal proceedings; and civil unrest and the outbreak of war and other significant national and international events.

We undertake no obligation to subsequently revise any forward-looking statement to reflect new information, events or circumstances

after the date of such statement, except as required by law.

THE VALSPAR CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED)

For the Three Months Ended January 30,

2015 and January 24, 2014

(Dollars in thousands, except per share

amounts)

| |

|

Three Months Ended |

| |

|

January 30, |

|

January 24, |

| |

|

2015 |

|

2014 |

| |

|

|

|

|

| Net Sales |

|

$ |

991,973 |

|

|

$ |

956,119 |

|

| Cost of Sales |

|

|

653,832 |

|

|

|

630,960 |

|

| Restructuring Charges - Cost of Sales |

|

|

4,849 |

|

|

|

6,106 |

|

| Gross Profit |

|

|

333,292 |

|

|

|

319,053 |

|

| Research and Development |

|

|

32,602 |

|

|

|

30,558 |

|

| Selling, General and Administrative |

|

|

189,641 |

|

|

|

187,235 |

|

| Restructuring Charges |

|

|

1,694 |

|

|

|

5,700 |

|

| Operating Expenses |

|

|

223,937 |

|

|

|

223,493 |

|

| Gain on Sale of Certain Assets |

|

|

48,001 |

|

|

|

— |

|

| Income From Operations |

|

|

157,356 |

|

|

|

95,560 |

|

| Interest Expense |

|

|

16,315 |

|

|

|

15,932 |

|

| Other (Income) Expense, Net |

|

|

(965 |

) |

|

|

371 |

|

| Income Before Income Taxes |

|

|

142,006 |

|

|

|

79,257 |

|

| Income Taxes |

|

|

38,032 |

|

|

|

25,704 |

|

| Net Income |

|

$ |

103,974 |

|

|

$ |

53,553 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Average Number of Shares O/S - basic |

|

|

81,724,627 |

|

|

|

85,147,728 |

|

| Average Number of Shares O/S - diluted |

|

|

83,866,879 |

|

|

|

87,641,304 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Net Income per Common Share - basic |

|

$ |

1.27 |

|

|

$ |

0.63 |

|

| Net Income per Common Share - diluted |

|

$ |

1.24 |

|

|

$ |

0.61 |

|

THE VALSPAR CORPORATION

SEGMENT INFORMATION (UNAUDITED AND

SUBJECT TO RECLASSIFICATION)

For the Three Months Ended January 30,

2015 and January 24, 2014

(Dollars in thousands)

| |

|

Three Months Ended |

| |

|

January 30, |

|

January 24, |

| |

|

2015 |

|

2014 |

| |

|

|

|

|

| Coatings Segment |

|

|

|

|

|

|

|

|

| Net Sales |

|

$ |

586,367 |

|

|

$ |

548,585 |

|

| Earnings Before Interest and Taxes (EBIT) |

|

|

135,609 |

|

|

|

69,975 |

|

| |

|

|

|

|

|

|

|

|

| Key Metrics (GAAP): |

|

|

|

|

|

|

|

|

| Sales Growth |

|

|

6.9% |

|

|

|

10.2% |

|

| EBIT, % of Net Sales |

|

|

23.1% |

|

|

|

12.8% |

|

| |

|

|

|

|

|

|

|

|

| Key Metrics (non-GAAP)1: |

|

|

|

|

|

|

|

|

| Adjusted EBIT |

|

$ |

90,961 |

|

|

$ |

78,595 |

|

| Adjusted EBIT, % of Net Sales |

|

|

15.5% |

|

|

|

14.3% |

|

| |

|

|

|

|

|

|

|

|

| Paints Segment |

|

|

|

|

|

|

|

|

| Net Sales |

|

$ |

358,604 |

|

|

$ |

361,405 |

|

| EBIT |

|

|

25,329 |

|

|

|

30,997 |

|

| |

|

|

|

|

|

|

|

|

| Key Metrics (GAAP): |

|

|

|

|

|

|

|

|

| Sales Growth |

|

|

(0.8% |

) |

|

|

9.8% |

|

| EBIT, % of Net Sales |

|

|

7.1% |

|

|

|

8.6% |

|

| |

|

|

|

|

|

|

|

|

| Key Metrics (non-GAAP)1: |

|

|

|

|

|

|

|

|

| Adjusted EBIT |

|

$ |

28,519 |

|

|

$ |

33,816 |

|

| Adjusted EBIT, % of Net Sales |

|

|

8.0% |

|

|

|

9.4% |

|

| |

|

|

|

|

|

|

|

|

| Other and Administrative |

|

|

|

|

|

|

|

|

| Net Sales |

|

$ |

47,002 |

|

|

$ |

46,129 |

|

| EBIT |

|

|

(2,617 |

) |

|

|

(5,783 |

) |

| |

|

|

|

|

|

|

|

|

| Key Metrics (GAAP): |

|

|

|

|

|

|

|

|

| Sales Growth |

|

|

1.9% |

|

|

|

(5.0% |

) |

| EBIT, % of Net Sales |

|

|

(5.6% |

) |

|

|

(12.5% |

) |

| |

|

|

|

|

|

|

|

|

| Key Metrics (non-GAAP)1: |

|

|

|

|

|

|

|

|

| Adjusted EBIT |

|

$ |

(2,617 |

) |

|

$ |

(5,416 |

) |

| Adjusted EBIT, % of Net Sales |

|

|

(5.6% |

) |

|

|

(11.7% |

) |

| |

1 |

The information on this page includes non-GAAP financial measures. Please refer to the "RECONCILIATION OF NON-GAAP FINANCIAL MEASURES" included in this release for detailed information. |

THE VALSPAR CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

As of January 30, 2015 and January 24,

2014

(Dollars in thousands)

| |

|

January 30,

2015 |

|

|

January 24,

2014 |

|

| |

| Assets |

| Current Assets: |

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents |

|

$ |

191,766 |

|

|

$ |

192,591 |

|

| Restricted Cash |

|

|

2,720 |

|

|

|

3,241 |

|

| Accounts and Notes Receivable, Net |

|

|

747,800 |

|

|

|

669,975 |

|

| Inventories |

|

|

511,171 |

|

|

|

504,151 |

|

| Deferred Income Taxes |

|

|

29,805 |

|

|

|

40,440 |

|

| Prepaid Expenses and Other |

|

|

109,636 |

|

|

|

117,452 |

|

| Total Current Assets |

|

|

1,592,898 |

|

|

|

1,527,850 |

|

| Goodwill |

|

|

1,103,225 |

|

|

|

1,147,356 |

|

| Intangibles, Net |

|

|

587,960 |

|

|

|

611,374 |

|

| Other Assets |

|

|

93,707 |

|

|

|

56,237 |

|

| Long-Term Deferred Income Taxes |

|

|

7,017 |

|

|

|

6,835 |

|

| Property, Plant & Equipment, Net |

|

|

622,054 |

|

|

|

632,912 |

|

| Total Assets |

|

$ |

4,006,861 |

|

|

$ |

3,982,564 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

| Short-term Debt |

|

$ |

193,702 |

|

|

$ |

540,162 |

|

| Current Portion of Long-Term Debt |

|

|

162,502 |

|

|

|

— |

|

| Trade Accounts Payable |

|

|

578,954 |

|

|

|

593,777 |

|

| Income Taxes |

|

|

36,731 |

|

|

|

12,307 |

|

| Other Accrued Liabilities |

|

|

364,463 |

|

|

|

358,238 |

|

| Total Current Liabilities |

|

|

1,336,352 |

|

|

|

1,504,484 |

|

| Long Term Debt, Net of Current Portion |

|

|

1,350,081 |

|

|

|

1,012,354 |

|

| Deferred Income Taxes |

|

|

218,914 |

|

|

|

240,679 |

|

| Other Long-Term Liabilities |

|

|

138,749 |

|

|

|

135,666 |

|

| Total Liabilities |

|

|

3,044,096 |

|

|

|

2,893,183 |

|

| Stockholders' Equity |

|

|

962,765 |

|

|

|

1,089,381 |

|

| Total Liabilities and Stockholders' Equity |

|

$ |

4,006,861 |

|

|

$ |

3,982,564 |

|

THE VALSPAR CORPORATION

SELECTED INFORMATION (UNAUDITED AND

SUBJECT TO RECLASSIFICATION)

For the Three Months Ended January 30,

2015 and January 24, 2014

(Dollars in thousands)

| |

|

Three Months Ended |

| |

|

January 30, |

|

January 24, |

| |

|

2015 |

|

2014 |

| |

|

|

|

|

| Depreciation and Amortization |

|

$ |

23,901 |

|

|

$ |

28,142 |

|

| |

|

|

|

|

|

|

|

|

| Capital Expenditures |

|

|

17,839 |

|

|

|

20,991 |

|

| |

|

|

|

|

|

|

|

|

| Dividends Paid |

|

|

24,574 |

|

|

|

22,226 |

|

THE VALSPAR CORPORATION

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (UNAUDITED)

For the Three Months Ended January 30,

2015 and January 24, 2014

(Dollars in thousands, except per share

amounts)

The following information provides reconciliations of non-GAAP

financial measures from operations presented in the accompanying news release to the most comparable financial measures calculated

and presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). The company has provided

non-GAAP financial measures, which are not calculated or presented in accordance with GAAP, as information supplemental and in

addition to the financial measures presented in the accompanying news release that are calculated and presented in accordance with

GAAP. Such non-GAAP financial measures should not be considered superior to, as a substitute for, or as an alternative to, and

should be considered in conjunction with, the GAAP financial measures presented in the news release. The non-GAAP financial measures

in the accompanying news release may differ from similar measures used by other companies. The following tables reconcile gross

profit, operating expense, earning before interest and taxes (EBIT), net income, net income per common share - diluted, and diluted

earnings per share (EPS) guidance for the periods presented (GAAP financial measures) to adjusted gross profit, adjusted operating

expense, adjusted earning before interest and taxes (EBIT), adjusted net income, adjusted net income per common share - diluted,

and adjusted diluted earnings per share (EPS) guidance (non-GAAP financial measures) for the periods presented.

| |

|

Three Months Ended

January 30, 2015 |

|

Three Months Ended

January 24, 2014 |

| |

|

Dollars |

|

% of Net Sales |

|

Dollars |

|

% of Net Sales |

| |

|

|

|

|

|

|

|

|

| Coatings Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Before Interest and Taxes (EBIT) |

|

$ |

135,609 |

|

|

|

23.1% |

|

|

$ |

69,975 |

|

|

|

12.8% |

|

| Restructuring Charges - Cost of Sales |

|

|

2,390 |

|

|

|

0.4% |

|

|

|

4,265 |

|

|

|

0.8% |

|

| Restructuring Charges - Operating Expense |

|

|

963 |

|

|

|

0.2% |

|

|

|

4,355 |

|

|

|

0.8% |

|

| Gain on Sale of Certain Assets |

|

|

(48,001 |

) |

|

|

(8.2% |

) |

|

|

— |

|

|

|

0.0% |

|

| Adjusted EBIT |

|

$ |

90,961 |

|

|

|

15.5% |

|

|

$ |

78,595 |

|

|

|

14.3% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Paints Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBIT |

|

$ |

25,329 |

|

|

|

7.1% |

|

|

$ |

30,997 |

|

|

|

8.6% |

|

| Restructuring Charges - Cost of Sales |

|

|

2,459 |

|

|

|

0.7% |

|

|

|

1,775 |

|

|

|

0.5% |

|

| Restructuring Charges - Operating Expense |

|

|

731 |

|

|

|

0.2% |

|

|

|

1,044 |

|

|

|

0.3% |

|

| Adjusted EBIT |

|

$ |

28,519 |

|

|

|

8.0% |

|

|

$ |

33,816 |

|

|

|

9.4% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other and Administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBIT |

|

$ |

(2,617 |

) |

|

|

(5.6% |

) |

|

$ |

(5,783 |

) |

|

|

(12.5% |

) |

| Restructuring Charges - Cost of Sales |

|

|

— |

|

|

|

0.0% |

|

|

|

66 |

|

|

|

0.1% |

|

| Restructuring Charges - Operating Expense |

|

|

— |

|

|

|

0.0% |

|

|

|

301 |

|

|

|

0.7% |

|

| Adjusted EBIT |

|

$ |

(2,617 |

) |

|

|

(5.6% |

) |

|

$ |

(5,416 |

) |

|

|

(11.7% |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit |

|

$ |

333,292 |

|

|

|

33.6% |

|

|

$ |

319,053 |

|

|

|

33.4% |

|

| Restructuring Charges - Cost of Sales |

|

|

4,849 |

|

|

|

0.5% |

|

|

|

6,106 |

|

|

|

0.6% |

|

| Adjusted Gross Profit |

|

$ |

338,141 |

|

|

|

34.1% |

|

|

$ |

325,159 |

|

|

|

34.0% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses |

|

$ |

223,937 |

|

|

|

22.6% |

|

|

$ |

223,493 |

|

|

|

23.4% |

|

| Restructuring Charges - Operating Expense |

|

|

(1,694 |

) |

|

|

(0.2% |

) |

|

|

(5,700 |

) |

|

|

(0.6% |

) |

| Adjusted Operating Expenses |

|

$ |

222,243 |

|

|

|

22.4% |

|

|

$ |

217,793 |

|

|

|

22.8% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBIT |

|

$ |

158,321 |

|

|

|

16.0% |

|

|

$ |

95,189 |

|

|

|

10.0% |

|

| Restructuring Charges - Total |

|

|

6,543 |

|

|

|

0.7% |

|

|

|

11,806 |

|

|

|

1.2% |

|

| Gain on Sale of Certain Assets |

|

|

(48,001 |

) |

|

|

(4.8% |

) |

|

|

— |

|

|

|

0.0% |

|

| Adjusted EBIT |

|

$ |

116,863 |

|

|

|

11.8% |

|

|

$ |

106,995 |

|

|

|

11.2% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

103,974 |

|

|

|

|

|

|

$ |

53,553 |

|

|

|

|

|

| After Tax Restructuring Charges - Total |

|

|

4,118 |

|

|

|

|

|

|

|

7,581 |

|

|

|

|

|

| After Tax Gain on Sale of Certain Assets |

|

|

(37,216 |

) |

|

|

|

|

|

|

— |

|

|

|

|

|

| Adjusted Net Income |

|

$ |

70,876 |

|

|

|

|

|

|

$ |

61,134 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income per Common Share - diluted |

|

$ |

1.24 |

|

|

|

|

|

|

$ |

0.61 |

|

|

|

|

|

| After Tax Restructuring Charges - Total |

|

|

0.05 |

|

|

|

|

|

|

|

0.09 |

|

|

|

|

|

| After Tax Gain on Sale of Certain Assets |

|

|

(0.44 |

) |

|

|

|

|

|

|

— |

|

|

|

|

|

| Adjusted Net Income per Common Share - diluted |

|

$ |

0.85 |

|

|

|

|

|

|

$ |

0.70 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Fiscal 2015 Annual Adjusted Diluted EPS Guidance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted EPS Guidance |

|

|

|

|

|

|

|

|

|

$ |

4.79 - $ 4.94 |

|

|

|

|

|

| After Tax Restructuring Charges |

|

|

|

|

|

|

|

|

|

|

0.10 - 0.15 |

|

|

|

|

|

| After Tax Gain on Sale of Certain Assets |

|

|

|

|

|

|

|

|

|

|

(0.44) |

|

|

|

|

|

| Adjusted Diluted EPS Guidance |

|

|

|

|

|

|

|

|

|

$ |

4.45 - $ 4.65 |

|

|

|

|

|

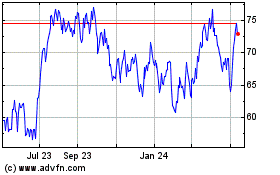

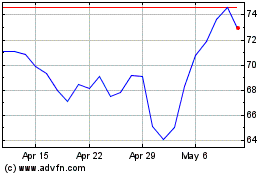

Valaris (NYSE:VAL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Valaris (NYSE:VAL)

Historical Stock Chart

From Sep 2023 to Sep 2024