Unilever Sales Rise on Ice Cream, Emerging-Market Demand -- 2nd Update

October 15 2015 - 1:38PM

Dow Jones News

By Saabira Chaudhuri

LONDON-- Unilever PLC on Thursday said its third-quarter revenue

rose sharply as sales of ice cream jumped and the company logged

strong growth in emerging markets.

The maker of Magnum ice cream and Dove shampoo reported sales

growth on an underlying basis--which strips out the impact of

acquisitions, disposals and exchange-rate changes--of 5.7% in the

three months ended in September, up sharply from 2.1% growth in the

same period a year earlier.

Shares closed up 3.6% in London at GBP28.90 ($44.36) as Unilever

said it expects underlying sales growth for the year toward the

upper end of the 2%-to-4% range it had previously disclosed.

Unilever said results were helped by an easy comparison with a

year-earlier quarter in which revenue in China was hit when the

company had to reduce the volume of products it supplied to big

retailers there after overestimating demand. Better weather and a

recall in the U.S. by Blue Bell Creameries after its ice cream was

linked to a listeria outbreak helped drive strong growth in demand

for ice cream.

Sales in Latin America were helped by advanced purchases before

announced price increases in Brazil, but Unilever warned volume

would decline in the fourth quarter.

Despite the strong results, Chief Executive Paul Polman struck a

cautious tone, saying in a statement: "We continue to see soft

global markets with no immediate sign of getting help from an

improving global economy."

"We would not take the improved numbers as a sign of green

shoots," said Susquehanna analyst Pablo Zuanic, adding that

consumer-goods companies face continued challenges outside of North

America.

Unilever's exposure to emerging markets--where the Anglo-Dutch

consumer-products company makes the bulk of its sales--has held it

in good stead for years but recently a slowdown in markets like

Brazil, China and Russia has kept a lid on growth.

The group's third quarter showed a partial reversal of that

trend, with China's results helped by the easy comparison with the

year earlier. The company also logged stronger growth in Russia and

better volumes in India as well as in Latin America where volume

growth accelerated "despite challenging macroeconomic conditions

and consumer incomes being squeezed by currency devaluation."

On an underlying basis, sales growth in emerging markets

strengthened to 8.4% from 5.6% a year earlier.

In developed markets, underlying sales growth was 2.1%, compared

with a 2.5% decline a year earlier. North America returned to

growth driven by both volume and price, while Unilever saw good

growth in the U.K., Germany and Central and Eastern Europe.

Overall revenue climbed 9.4% to EUR13.4 billion, including a

positive currency impact of 2.9%. Profit figures weren't

disclosed.

The company has been pushing deeper into personal-care products

like shampoo and deodorants with appeal across different markets,

and away from slower-growing food brands. Personal-care revenue

climbed 6.2% on an underlying basis, while revenue from foods rose

1.6% on this basis.

Unilever last year created a prestige division, which sells

high-end cosmetics and personal-care products and makes about

EUR400 million in annual sales. Chief Financial Officer Graeme

Pitkethly is targeting raising the unit's sales to EUR1 billion,

recently saying Unilever sees a large opportunity in the fragmented

EUR33 billion market for skin and hair care.

In refreshments--essentially the tea and ice cream

businesses--underlying sales jumped 8.5% while in home-care they

rose 6.6%.

Mr. Polman said the company's ice-cream unit performed

particularly well in the quarter. Unilever has muscled deeper into

the ice-cream business of late, earlier this month saying it had

bought Italian artisan ice-cream maker Grom.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 15, 2015 13:23 ET (17:23 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

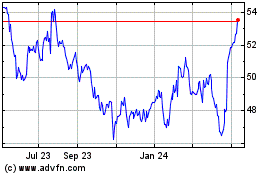

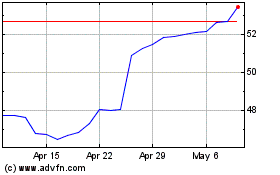

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024