FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of 2/23/2016

Ternium S.A.

(Translation of Registrant's name into English)

Ternium S.A.

29, Avenue de la Porte-Neuve

L-2227 Luxembourg

(352) 2668-3152

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F Ö Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes No Ö

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

The attached material is being furnished to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended.

This report contains Ternium S.A.’s press release announcing fourth quarter 2015 results.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TERNIUM S.A.

|

By: /s/ Pablo Brizzio

Name: Pablo Brizzio

Title: Chief Financial Officer |

By: /s/ Daniel Novegil

Name: Daniel Novegil

Title: Chief Executive Officer |

Dated: February 23, 2016

Sebastián Martí

Ternium - Investor Relations

+1 (866) 890 0443

+54 (11) 4018 2389

www.ternium.com

Ternium Announces Fourth Quarter and Full Year 2015 Results

Luxembourg, February 23, 2016 – Ternium S.A. (NYSE: TX) today announced its results for the fourth quarter and full year period ended December 31, 2015.

The financial and operational information contained in this press release is based on Ternium S.A.’s operational data and consolidated financial statements prepared in accordance with International Financial Reporting Standards (IFRS) and presented in U.S. dollars (USD) and metric tons.

Summary of Fourth Quarter 2015 Results

| |

4Q 2015 |

|

3Q 2015 |

|

4Q 2014 |

| |

|

|

|

|

|

|

|

|

Steel Shipments (tons) |

2,310,000 |

|

2,463,000 |

-6% |

|

2,354,000 |

-2% |

|

Iron Ore Shipments (tons) |

906,000 |

|

892,000 |

2% |

|

1,022,000 |

-11% |

|

Net Sales (USD million) |

1,809.9 |

|

1,945.4 |

-7% |

|

2,154.6 |

-16% |

|

Operating Income (USD million) |

191.6 |

|

140.5 |

36% |

|

191.3 |

0% |

|

EBITDA1 (USD million) |

297.1 |

|

250.4 |

19% |

|

300.9 |

-1% |

|

EBITDA per Ton2 (USD) |

128.6 |

|

101.7 |

|

|

127.8 |

|

|

EBITDA Margin (% of net sales) |

16.4% |

|

12.9% |

|

|

14.0% |

|

|

Equity in Results of Non-Consolidated Companies |

(213.4) |

|

(48.8) |

|

|

(5.3) |

|

|

Net (Loss) Income (USD million) |

(126.5) |

|

40.0 |

|

|

71.4 |

|

|

Equity Holders' Net (Loss) Income (USD million) |

(126.2) |

|

24.8 |

|

|

53.0 |

|

|

(Losses) Earnings per ADS (USD) |

(0.64) |

|

0.13 |

|

|

0.27 |

|

- EBITDA of USD297.1 million in the fourth quarter 2015, USD46.7 million higher than EBITDA in the third quarter 2015 as a result of higher EBITDA per ton, partially offset by lower shipments.

- Impairment of investment in Usiminas of USD191.9 million. The book value of Ternium’s investment in Usiminas as of December 31, 2015 was USD240.0 million.

1 EBITDA in the fourth quarter 2015 equals operating income of USD191.6 million adjusted to exclude depreciation and amortization of USD105.5 million.

2 Consolidated EBITDA divided by steel shipments.

- Net foreign exchange losses of USD30.1 million, mainly due to the depreciation of the Argentine Peso, offset by changes in Ternium’s net equity position in the currency translation adjustments line.

- Losses per American Depositary Share (ADS)3 of USD0.64 in the fourth quarter 2015, including a loss per ADS of USD0.91 in connection with the above mentioned impairment of the investment in Usiminas.

- Capital expenditures of USD123.8 million in the fourth quarter 2015, compared to USD115.3 million in the third quarter 2015.

- Net debt position of USD1.1 billion at the end of December 2015, down from USD1.3 billion at the end of September 2015 and equivalent to 1.1 times net debt to last twelve months EBITDA.

Ternium’s operating income in the fourth quarter 2015 was USD191.6 million, up by USD51.1 million compared to the third quarter 2015 due to higher operating margin4, partially offset by lower shipments, mainly in Mexico. Operating margin increased sequentially principally as a result of USD34 lower operating cost per ton5, partially offset by USD6 lower steel revenue per ton. The decrease in operating cost per ton was mainly due to lower costs of purchased slabs, raw materials and energy. Steel revenue per ton decreased principally as a result of lower realized steel prices in Mexico.

Compared to the fourth quarter 2014, the company’s operating income in the fourth quarter 2015 was stable as a result of slightly higher operating margin, offset by slightly lower shipments. A USD135 decrease in operating cost per ton was partially offset by a USD128 decrease in steel revenue per ton. The decrease in operating cost per ton was mainly due to lower cost of purchased slabs, raw materials and energy. Steel revenue per ton decreased principally as a result of lower steel prices in Ternium’s main steel markets, partially offset by a higher value added product mix.

The company’s net result in the fourth quarter 2015 was a net loss of USD126.5 million, including a USD191.9 million impairment charge on Ternium’s investment in Usiminas, compared to a net gain of USD40.0 million in the third quarter 2015. Net financial expenses were USD33.6 million higher sequentially, mainly as a result of higher net foreign exchange losses in Ternium’s Argentine subsidiary Siderar, principally due to the non-cash negative impact of the Argentine Peso’s 28% depreciation against the U.S. dollar on Siderar’s U.S. dollar financial position, which is offset by changes in Ternium’s net equity position in the currency translation adjustments line.

Net results in the fourth quarter 2015 were USD197.9 million lower than in the fourth quarter 2014. This year-over-year decrease was mainly due to the above mentioned impairment of Ternium’s investment in Usiminas and USD62.2 million higher net financial expenses, partially offset by USD72.1 million lower income tax expense.

3 Each American Depositary Share (ADS) represents 10 shares of Ternium’s common stock. Results are based on a weighted average number of shares of common stock outstanding (net of treasury shares) of 1,963,076,776.

4 Operating margin is equal to revenue per ton less operating cost per ton.

5 Operating cost per ton is equal to cost of sales plus SG&A, divided by shipments.

Summary of Full Year 2015 Results

| |

FY 2015 |

|

FY 2014 |

| |

|

|

|

|

|

Steel Shipments (tons) |

9,600,000 |

|

9,381,000 |

2% |

|

Iron Ore Shipments (tons) |

2,729,000 |

|

2,835,000 |

-4% |

|

Net Sales (USD million) |

7,877.4 |

|

8,726.1 |

-10% |

|

Operating Income (USD million) |

639.3 |

|

1,056.2 |

-40% |

|

EBITDA (USD million) |

1,073.1 |

|

1,471.0 |

-27% |

|

EBITDA per Ton (USD) |

111.8 |

|

156.8 |

|

|

EBITDA Margin (% of net sales) |

13.6% |

|

16.9% |

|

|

Net Income (Loss) (USD million) |

59.8 |

|

(104.2) |

|

|

Equity Holders' Net Income (Loss) (USD million) |

8.1 |

|

(198.8) |

|

|

Earnings (Losses) per ADS (USD) |

0.04 |

|

(1.01) |

|

| |

|

|

|

|

- EBITDA6 of USD1.1 billion in 2015, down from EBITDA of USD1.5 billion in 2014.

- Earnings per ADS7 of USD0.04 in 2015, including a loss per ADS of USD0.91 in connection with the above mentioned impairment of the investment in Usiminas.

- Capital expenditures of USD466.6 million in 2015, compared to USD443.5 million in 2014.

- Net debt decrease of USD669.2 million in 2015. Of note in the period was a decrease of USD509.1 million in working capital and USD209.4 million dividend payments.

Operating income in 2015 was USD639.3 million, USD416.8 million lower than operating income in 2014. Steel shipments increased by 219,000 tons year-over-year, mainly as a result of a 301,000 ton increase in Mexico and a 41,000 ton increase in the Southern Region, partially offset by a 124,000 ton decrease in Other Markets. Operating margin decreased, mainly reflecting USD108 lower steel revenue per ton, partially offset by USD70 lower operating cost per ton. Steel revenue per ton decreased as a result of lower steel prices in Ternium’s main steel markets, partially offset by a higher value added product mix. The decrease in operating cost per ton was mainly due to lower purchased slabs, raw material and energy costs.

Net income in 2015 was USD59.8 million, compared to a USD104.2 million net loss in 2014. Both years were affected by impairments to the recoverable value of Ternium’s investment in Usiminas, of USD191.9 million and USD739.8 million in 2015 and 2014, respectively. The USD164.0 million higher result in the year-over-year comparison was mainly due to the above mentioned lower impairment of Ternium’s investment in Usiminas and to lower income tax expenses, partially offset by lower operating income and higher net financial expenses.

6 EBITDA in 2015 equals operating income of USD639.3 million adjusted to exclude depreciation and amortization of USD433.8 million.

7 Each American Depositary Share (ADS) represents 10 shares of Ternium’s common stock. Results are based on a weighted average number of shares of common stock outstanding (net of treasury shares) of 1,963,076,776.

Impairment of Investment in Usiminas

Usiminas’ financial statements as of December 31, 2015 described a downgraded economic scenario for the company that caused a significant impact on its financial leverage and cash generation. In addition, Usiminas’ auditors (KPMG) included in their report on these financial statements an emphasis of matter paragraph which, without qualifying their opinion, indicated the existence of “a material uncertainty that may cast significant doubt about the Company’s ability to continue as a going concern” as a result of the risk of not achieving an action plan defined by Usiminas’ management to equalize its financial obligations with cash generation. Consequently, Ternium, in a conservative approach and considering the guidance of IAS 36, assessed the recoverable value of its investment in Usiminas based on Usiminas ordinary shares average market price for December 2015, and impaired its investment by USD 191.9 million. The resulting book value of Ternium’s investment in Usiminas as of December 31, 2015 is USD240.0 million.

Annual Dividend Proposal

Ternium’s board of directors proposed that an annual dividend of USD0.09 per share (USD0.90 per ADS), or approximately USD180.4 million in the aggregate, be approved at the company’s annual general shareholders’ meeting, which is scheduled to be held on May 4, 2016. If the annual dividend is approved at the shareholders’ meeting, it will be paid on May 13, 2016, with record-date of May 10, 2016.

Market Background and Outlook

The steel industry continued to be characterized in 2015 by significant overcapacity, mainly in China. This, together with a deceleration of China’s economic growth rate, led to an unprecedented level of low-priced Chinese steel exports, in many cases under unfair trade conditions, that exerted significant pressure on global steel prices. Ternium was not exempt from these developments, as the company’s average realized prices fell 12% year-over-year in 2015, including a 15% decrease in Mexico, the market that represents two thirds of Ternium’s shipments.

In this complex environment, the company was able to achieve record steel shipments of 9.6 million tons in 2015, primarily by focusing on high value-added products and innovative services within its differentiation strategy. This strategic focus was supported by Mexico’s strong manufacturing industry and active government policy against unfair trade practices. In fact, Ternium’s shipments in Mexico grew 5% in 2015 versus the prior year.

The company’s EBITDA per ton of USD112 in 2015 decreased by USD45 year-over-year as falling costs for purchased slabs, raw materials, labor and energy, did not match the above mentioned decrease in revenue per ton, in part as a result of a gradual pass-through of these input prices to Ternium’s cost of sales. In addition, EBITDA per ton in 2015 was negatively affected by an increase in local costs at Ternium’s Argentine subsidiary as a result of another year of elevated inflation levels in the country.

Following seasonally weaker shipments in Mexico in the fourth quarter 2015, Ternium expects shipments in this market in the first quarter 2016 to return to previous quarters’ levels, supported by healthy sales to the industrial and non-residential construction sectors. Steel prices in the North American market halted their downward trend by the end of the fourth quarter 2015, supported by decreasing service center inventories due to a significant reduction in capacity utilization rates in the U.S. steel industry and lower import levels resulting from actions taken against unfair trade practices.

The company anticipates shipments in the Southern Region to decrease in the first quarter 2016 mainly as a result of a destocking of the value chain, together with the usual seasonality at the beginning of the year. Following a significant devaluation of the local currency in Argentina by the end of December 2015, steel prices decreased in this market by approximately 24% in U.S. dollar terms between December 2015 and February 2016. Cost per ton in Argentina should also sequentially decrease in the first quarter 2016, as a result of the effect of the currency depreciation on local costs and the company’s inventories.

Ternium expects operating income in the first quarter 2016 to approach the level reached in the fourth quarter 2015, with lower EBITDA per ton and higher shipments. The company anticipates average realized prices to sequentially decrease in its main markets in the first quarter of the year. This decrease is expected to be partially offset by a reduction in cost per ton, mainly due to the effect of the devaluation of the Argentine Peso and to the gradual pass-through of lower raw material and purchased slab prices in Mexico to Ternium’s cost of sales.

Analysis of Fourth Quarter 2015 Results

Net loss attributable to Ternium’s equity owners in the fourth quarter 2015 was USD126.2 million, compared to net gain attributable to Ternium’s equity owners of USD53.0 million in the fourth quarter 2014. Including non-controlling interest, net loss for the fourth quarter 2015 was USD126.5 million, compared to net gain of USD71.4 million in the fourth quarter 2014. The net loss in the fourth quarter 2015 included the above mentioned USD191.9 million loss related to an impairment of Ternium’s investment in Usiminas. Losses per ADS in the fourth quarter 2015 were USD0.64, compared to earnings per ADS of USD0.27 in the fourth quarter 2014.

Net sales in the fourth quarter 2015 were USD1.8 billion, or 16% lower than net sales in the fourth quarter 2014. The following table outlines Ternium’s consolidated net sales for the fourth quarter 2015 and the fourth quarter 2014:

| |

|

Net Sales (million USD) |

|

|

|

4Q 2015 |

4Q 2014 |

Dif. |

|

Mexico |

|

954.2 |

1,215.8 |

-22% |

|

Southern Region |

|

650.3 |

667.0 |

-3% |

|

Other Markets |

|

199.6 |

257.3 |

-22% |

|

Total steel products net sales |

|

1,804.1 |

2,140.1 |

-16% |

|

Other products1 |

|

5.3 |

9.6 |

-45% |

|

Steel segment net sales |

|

1,809.4 |

2,149.7 |

-16% |

|

|

|

|

|

|

|

Mining segment net sales |

|

45.4 |

71.4 |

-36% |

|

Intersegment eliminations |

|

(44.8) |

(66.5) |

|

|

Net sales |

|

1,809.9 |

2,154.6 |

-16% |

1 The item "Other products" primarily includes pig iron.

Cost of sales was USD1.4 billion in the fourth quarter 2015, a decrease of USD326.7 million compared to the fourth quarter 2014. This was principally due to a USD320.3 million, or 23%, decrease in raw material and consumables used, mainly reflecting lower iron ore, coking coal, scrap, energy and purchased slabs costs, and a 2% decrease in steel shipments; and to a USD6.4 million decrease in other costs, mainly including a USD10.3 million decrease in labor cost, a USD6.2 million decrease in services and fees and a USD5.6 million decrease in depreciation of property, plant and equipment and amortization of intangible assets, partially offset by a USD14.4 million increase in maintenance expenses.

Selling, General & Administrative (SG&A) expenses in the fourth quarter 2015 were USD180.1 million, or 9.9% of net sales, a decrease of USD21.6 million compared to SG&A expenses in the fourth quarter 2014 mainly due to lower labor costs, freight and transportation expenses, services and fees expenses and lower taxes and contributions (other than income tax).

Operating income in the fourth quarter 2015 was USD191.6 million, or 10.6% of net sales, compared to operating income of USD191.3 million, or 8.9% of net sales, in the fourth quarter 2014. The following table outlines Ternium’s operating income by segment for the fourth quarter 2015 and fourth quarter 2014:

|

|

Steel segment |

Mining segment |

Intersegment

eliminations |

Total |

|

USD million |

|

4Q 2015 |

4Q 2014 |

|

4Q 2015 |

4Q 2014 |

|

4Q 2015 |

4Q 2014 |

|

4Q 2015 |

4Q 2014 |

|

Net Sales |

|

1,809.4 |

2,149.7 |

|

45.4 |

71.4 |

|

(44.8) |

(66.5) |

|

1,809.9 |

2,154.6 |

|

Cost of sales |

|

(1,434.0) |

(1,766.6) |

|

(46.0) |

(67.8) |

|

41.6 |

69.4 |

|

(1,438.4) |

(1,765.1) |

|

SG&A expenses |

|

(177.1) |

(196.8) |

|

(3.0) |

(4.9) |

|

- |

- |

|

(180.1) |

(201.7) |

|

Other operating income , net |

|

(0.3) |

3.3 |

|

0.4 |

0.2 |

|

- |

- |

|

0.1 |

3.5 |

|

Operating income (expense) |

|

198.1 |

189.5 |

|

(3.3) |

(1.1) |

|

(3.2) |

2.8 |

|

191.6 |

191.3 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

292.3 |

285.2 |

|

8.0 |

12.8 |

|

(3.2) |

2.8 |

|

297.1 |

300.9 |

| |

|

|

|

|

|

|

|

|

|

|

Steel reporting segment

The steel segment’s operating income was USD198.1 million in the fourth quarter 2015, an increase of USD8.5 million compared to the fourth quarter 2014.

Net sales of steel products in the fourth quarter 2015 decreased 16% compared to the fourth quarter 2014, reflecting a USD128 decrease in steel revenue per ton shipped and a 45,000 tons decrease in shipments. Revenue per ton decreased 14%, reflecting lower steel prices in Ternium´s main steel markets, partially offset by a better product mix. Shipments decreased 2% year-over-year in the fourth quarter 2015 mainly due to lower shipments in Mexico and in Other Markets.

| |

|

Net Sales (million USD) |

|

Shipments (thousand tons) |

|

Revenue / ton (USD/ton) |

| |

|

4Q 2015 |

4Q 2014 |

Dif. |

|

4Q 2015 |

4Q 2014 |

Dif. |

|

4Q 2015 |

4Q 2014 |

Dif. |

|

Mexico |

|

954.2 |

1,215.8 |

-22% |

|

1,406.7 |

1,425.3 |

-1% |

|

678 |

853 |

-20% |

|

Southern Region |

|

650.3 |

667.0 |

-3% |

|

643.6 |

640.8 |

0% |

|

1,010 |

1,041 |

-3% |

|

Other Markets |

|

199.6 |

257.3 |

-22% |

|

259.3 |

288.0 |

-10% |

|

770 |

894 |

-14% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total steel products |

|

1,804.1 |

2,140.1 |

-16% |

|

2,309.6 |

2,354.1 |

-2% |

|

781 |

909 |

-14% |

|

Other products1 |

|

5.3 |

9.6 |

-45% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Steel segment |

|

1,809.4 |

2,149.7 |

-16% |

|

|

|

|

|

|

|

|

|

1 The item "Other products" primarily includes pig iron. |

Operating cost decreased 18% year-over-year in the fourth quarter 2015, due to a 16% decrease in cost per ton and the above mentioned 2% decrease in shipments. The decrease in operating cost per ton was mainly the result of lower raw material, purchased slabs and energy costs.

Mining reporting segment

The mining segment’s operating income was a loss of USD3.3 million in the fourth quarter 2015, compared to a loss of USD1.1 million in the fourth quarter 2014, mainly reflecting lower net sales, partially offset by a lower operating cost.

Net sales of mining products in the fourth quarter 2015 were 36% lower than net sales in the fourth quarter 2014, mainly as a result of lower revenue per ton and lower shipments. Shipments were 906,000 tons, 11% lower than in the fourth quarter 2014.

| |

|

Mining segment |

|

|

|

4Q 2015 |

4Q 2014 |

Dif. |

|

Net Sales (million USD) |

|

45.4 |

71.4 |

-36% |

|

Shipments (thousand tons) |

|

906.1 |

1,021.9 |

-11% |

|

Revenue per ton (USD/ton) |

|

50 |

70 |

-28% |

Operating cost decreased 32% year-over-year, mainly due to the above mentioned 11% decrease in shipment volumes and a 24% decrease in operating cost per ton. The decrease in operating cost per ton was mainly the result of lower energy costs and freight and transportation expenses.

EBITDA in the fourth quarter 2015 was USD297.1 million, or 16.4% of net sales, compared to USD300.9 million, or 14.0% of net sales, in the fourth quarter 2014.

Net financial results were a USD53.5 million loss in the fourth quarter 2015, compared to an USD8.7 million gain in the fourth quarter 2014. During the fourth quarter 2015, Ternium’s net financial interest results totaled a loss of USD15.5 million, compared to a loss of USD26.3 million in the fourth quarter 2014, reflecting lower indebtedness and weighted average interest rates.

Net foreign exchange results were a loss of USD30.1 million in the fourth quarter 2015 compared to a gain of USD26.3 million in the fourth quarter 2014. The fourth quarter 2015 loss was mainly due to the

negative impact of the Argentine Peso’s 28% depreciation against the U.S. dollar on Ternium’s Argentine subsidiary Siderar’s U.S. dollar financial position. Siderar’s functional currency is the Argentine Peso. These results are non-cash when measured in U.S. dollars and are offset by changes in Ternium’s net equity position in the currency translation adjustments line, as the value of Siderar’s net U.S. dollar position is not altered by the Argentine Peso fluctuation when stated in U.S. dollars in Ternium’s consolidated financial statements.

Change in fair value of financial instruments included in net financial results was a USD7.4 million loss in the fourth quarter 2015 compared to a USD9.6 million gain in the fourth quarter 2014. The loss in the fourth quarter 2015 was mainly related to certain foreign exchange derivative instruments entered into to compensate for the interest rate charges derived from Siderar’s Argentine Peso denominated financial debt. In accordance with IFRS, the positive impact in U.S. dollar terms of the Argentine Peso’s 28% depreciation on Siderar’s Argentine Peso denominated financial debt has been included in Other Comprehensive Income.

Equity in results of non-consolidated companies was a loss of USD213.4 million in the fourth quarter 2015, compared to a loss of USD5.3 million in the fourth quarter 2014. Equity in results of non-consolidated companies in the fourth quarter 2015 included the above mentioned USD191.9 million loss related to an impairment of Ternium’s investment in Usiminas.

Income tax expense in the fourth quarter 2015 was USD51.2 million, or 68% of income before income tax expense, compared with an income tax expense of USD123.3 million in the fourth quarter 2014, or 63% of income before income tax expense. Effective tax rate in both periods was higher than usual. Effective tax rate in the fourth quarter 2015 was mainly affected by the impact of non-taxable losses stemming from the investment in Usiminas, while effective tax rate in the fourth quarter 2014 was mainly affected by the non-cash impact on deferred taxes of the significant depreciation of the Mexican peso and the Colombian peso against the U.S. dollar during the period, which reduces, in U.S. dollar terms, the tax base used to calculate deferred tax at our Mexican and Colombian subsidiaries (which have the U.S. dollar as their functional currency).

Net loss attributable to non-controlling interest in the fourth quarter 2015 was USD0.3 million, compared to net gain of USD18.3 million in the same period in 2014, a decrease mainly related to a lower result attributable to non-controlling interest in Siderar.

Analysis of Full Year 2015 Results

Net income attributable to Ternium’s equity owners in 2015 was USD8.1 million, compared to a net loss attributable to Ternium’s equity owners of USD198.8 million in 2014. Including non-controlling interest, net income in 2015 was USD59.8 million, compared to net loss of USD104.2 million in 2014. Both years were affected by impairments to the recoverable value of Ternium’s investment in Usiminas, of USD191.9 million and USD739.8 million in 2015 and 2014, respectively. Earnings per ADS in 2015 were USD0.04, compared to losses per ADS of USD1.01 in 2014.

Net sales in 2015 were USD7.9 billion, 10% lower than net sales in 2014. The following table shows Ternium’s consolidated net sales for 2015 and 2014:

| |

|

Net Sales (million USD) |

|

|

|

2015 |

2014 |

Dif. |

|

Mexico |

|

4,354.8 |

4,863.9 |

-10% |

|

Southern Region |

|

2,567.2 |

2,641.5 |

-3% |

|

Other Markets |

|

905.4 |

1,159.3 |

-22% |

|

Total steel products net sales |

|

7,827.4 |

8,664.8 |

-10% |

|

Other products1 |

|

47.7 |

35.8 |

33% |

|

Steel segment net sales |

|

7,875.2 |

8,700.5 |

-9% |

|

|

|

|

|

|

|

Mining segment net sales |

|

203.1 |

313.2 |

-35% |

|

Intersegment eliminations |

|

(200.8) |

(287.6) |

|

|

Net sales |

|

7,877.4 |

8,726.1 |

-10% |

1 The item “Other products” primarily includes pig iron.

Cost of sales was USD6.5 billion in 2015, a decrease of USD447.9 million compared to 2014. This was principally due to a USD477.2 million, or 9%, decrease in raw material and consumables used, mainly reflecting lower iron ore, coking coal, scrap, energy and purchased slabs costs, partially offset by a 2% increase in shipments; and to a USD29.3 million increase in other costs, including a USD23.0 million increase in maintenance expenses and a USD17.9 million increase in depreciation of property, plant and equipment and amortization of intangible assets, partially offset by a USD9.1 million decrease in services and fees and a USD2.9 million decrease in insurance expenses.

Selling, General & Administrative (SG&A) expenses in 2015 were USD770.3 million, or 9.8% of net sales, a decrease of USD46.2 million compared to 2014, mainly as a result of lower labor cost, freight and transportation expenses, and services and other expenses.

Other net operating income in 2015 was a USD9.5 million gain, lower than the USD71.8 million gain in 2014. Other net operating income in 2014 included a USD57.5 million income recognition on insurance recovery related to Ternium’s subsidiary Siderar.

Operating income in 2015 was USD639.3 million, or 8.1% of net sales, compared to operating income of USD1.1 billion, or 12.1% of net sales, in 2014. The following table shows Ternium’s operating income by segment for 2015 and 2014.

|

|

Steel segment |

|

Mining segment |

|

Intersegment eliminations |

|

Total |

|

USD million |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

Net Sales |

|

7,875.2 |

|

8,700.5 |

|

203.1 |

|

313.2 |

|

(200.8) |

|

(287.6) |

|

7,877.4 |

|

8,726.1 |

|

Cost of sales |

|

(6,456.6) |

|

(6,960.0) |

|

(214.7) |

|

(255.2) |

|

194.0 |

|

290.1 |

|

(6,477.3) |

|

(6,925.2) |

|

SG&A expenses |

|

(757.1) |

|

(799.8) |

|

(13.2) |

|

(16.6) |

|

- |

|

- |

|

(770.3) |

|

(816.5) |

|

Other operating income (expenses), net |

|

9.2 |

|

70.7 |

|

0.3 |

|

1.0 |

|

- |

|

- |

|

9.5 |

|

71.8 |

|

Operating income (expense) |

|

670.7 |

|

1,011.4 |

|

(24.5) |

|

42.3 |

|

(6.9) |

|

2.4 |

|

639.3 |

|

1,056.2 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

1,055.0 |

|

1,380.6 |

|

24.9 |

|

87.9 |

|

(6.9) |

|

2.4 |

|

1,073.1 |

|

1,471.0 |

Steel reporting segment

The steel segment’s operating income was USD670.7 million in 2015, a decrease of USD340.7 million compared to 2014, reflecting lower net sales and the above mentioned lower other net operating income, partially offset by lower operating cost.

Net sales of steel products in 2015 decreased 9% compared to 2014, reflecting a USD108 decrease in steel revenue per ton shipped, partially offset by a 219,000 ton increase in shipments. Revenue per ton decreased, reflecting lower steel prices in Ternium´s main steel markets, partially offset by a better product mix in Mexico. The increase in shipments in 2015 was mainly due to higher shipments in Mexico and the Southern Region, partially offset by lower shipments in Other Markets.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net Sales (million USD) |

|

Shipments (thousand tons) |

|

Revenue / ton (USD/ton) |

|

|

|

2015 |

2014 |

Dif. |

|

2015 |

2014 |

Dif. |

|

2015 |

2014 |

Dif. |

|

Mexico |

|

4,354.8 |

4,863.9 |

-10% |

|

5,933.4 |

5,632.2 |

5% |

|

734 |

864 |

-15% |

|

Southern Region |

|

2,567.2 |

2,641.5 |

-3% |

|

2,552.2 |

2,510.9 |

2% |

|

1,006 |

1,052 |

-4% |

|

Other Markets |

|

905.4 |

1,159.3 |

-22% |

|

1,114.6 |

1,238.5 |

-10% |

|

812 |

936 |

-13% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total steel products |

|

7,827.4 |

8,664.8 |

-10% |

|

9,600.3 |

9,381.5 |

2% |

|

815 |

924 |

-12% |

|

Other products1 |

|

47.7 |

35.8 |

33% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Steel segment |

|

7,875.2 |

8,700.5 |

-9% |

|

|

|

|

|

|

|

|

|

1 The item “Other products” primarily includes pig iron. |

|

|

|

|

|

|

Operating cost decreased 7% due to a 9% decrease in operating cost per ton, partially offset by a 2% increase in shipments. The decrease in operating cost per ton was mainly due to lower raw material, purchased slabs and energy costs.

Mining reporting segment

The mining segment’s operating result was a loss of USD24.5 million in 2015, compared to a USD42.3 million gain in 2014, mainly reflecting lower iron ore sales, partially offset by a lower operating cost.

Net sales of mining products in 2015 were 35% lower than in 2014, reflecting a 31% lower revenue per ton and 6% lower shipments.

|

|

|

|

|

| |

|

Mining segment |

|

|

|

2015 |

2014 |

Dif. |

|

Net Sales (million USD) |

|

203.1 |

313.2 |

-35% |

|

Shipments (thousand tons) |

|

3,635.6 |

3,857.3 |

-6% |

|

Revenue per ton (USD/ton) |

|

56 |

81 |

-31% |

Operating cost decreased 16% year-over-year, mainly due to the above mentioned 6% decrease in shipment volumes and an 11% decrease in operating cost per ton. The decrease in operating cost per ton was mainly the result of lower energy costs and freight and transportation expenses.

EBITDA in 2015 was USD1.1 billion, or 13.6% of net sales, compared with USD1.5 billion, or 16.9% of net sales, in 2014.

Net financial results were a USD99.4 million loss in 2015, compared with a USD69.5 million loss in 2014.

Ternium’s net interest results totaled a loss of USD81.5 million in 2015, compared to a loss of USD110.2 million in 2014, reflecting lower average indebtedness and weighted average interest rates.

Net foreign exchange results were a loss of USD5.2 million in 2015 compared to a gain of USD26.7 million in 2014. The loss in 2015 was primarily associated with the negative impact of the Argentine Peso’s 34% depreciation against the U.S. dollar on Ternium’s Argentine subsidiary Siderar’s net short U.S. dollar position as above mentioned (Siderar’s functional currency is the Argentine Peso), partially offset by the effect of the Mexican Peso’s 14% depreciation against the U.S. dollar on a net short local currency position in Ternium Mexican subsidiaries (Ternium Mexican subsidiaries functional currency is the U.S. dollar).

Change in fair value of financial instruments included in net financial results was a USD10.2 million loss in 2015 compared with a USD17.8 million gain in 2014.

Equity in results of non-consolidated companies was a loss of USD272.8 million in 2015, compared to a loss of USD751.8 million in 2014. Both years were affected by impairments to the recoverable value of Ternium’s investment in Usiminas, of USD191.9 million and USD739.8 million in 2015 and 2014, respectively.

Income tax expense in 2015 was USD207.3 million, compared to an income tax expense of USD339.1 million in 2014. The relatively high effective tax rate on both periods was mainly due to non-taxable losses stemming from the investment in Usiminas and to the depreciation of the Mexican peso against the U.S. dollar, which reduces, in U.S. dollar terms, the tax base used to calculate deferred tax at our Mexican subsidiaries (which have the U.S. dollar as their functional currency), among other non-cash effects on deferred taxes.

Net gain attributable to non-controlling interest in 2015 was USD51.7 million, compared to a net gain of USD94.6 million in 2014, mainly due to a lower result attributable to non-controlling interest in Siderar.

Cash Flow and Liquidity

Net cash provided by operating activities in the year 2015 was USD1.3 billion. Working capital decreased by USD509.1 million in the year 2015 as a result of a USD349.7 million decrease in inventories, an aggregate USD125.7 million net decrease in trade and other receivables and an aggregate USD33.8 million net increase in accounts payable and other liabilities. Inventories decreased in the year 2015, mainly reflecting lower costs of purchased steel, raw materials, goods in process and finished goods, as well as overall lower inventory volumes, partially offset by higher inventory volumes of purchased steel.

Capital expenditures in the year 2015 were USD466.6 million, slightly higher than capital expenditures in 2014. The main investments carried out during the period included, in Mexico, those made for the upgrade of hot-rolling and galvanizing mills, and the revamping of steel making and iron ore reduction facilities and, in Argentina, those made for the expansion and enhancement of the coking facilities, the upgrade of the hot-rolling mill and the enhancement of the steelmaking facilities.

In the year 2015, Ternium had free cash flow of USD856.8 million8. During the year the company acquired the remaining minority stake in Ferrasa for USD74.0 million. In addition, Ternium’s net repayment of borrowings in the year 2015 was USD557.1 million. Net dividends paid to shareholders were USD176.7 million and net dividends paid by subsidiaries to non-controlling interest were USD32.7 million. As of December 31, 2015, Ternium’s net debt position was USD1.1 billion9.

Net cash provided by operating activities in the fourth quarter 2015 was USD313.5 million. Working capital decreased by USD49.4 million in the fourth quarter 2015 as a result of an aggregate USD148.6 million decrease in trade and other receivables and a USD48.0 million decrease in inventories, partially offset by an aggregate USD147.2 million decrease in accounts payable and other liabilities. Inventories decreased in the fourth quarter 2015 mainly reflecting overall lower costs and lower inventory volumes of raw materials and finished goods, partially offset by higher inventory volumes of purchased steel and goods in process. Capital expenditures in the fourth quarter 2015 were USD123.8 million, compared to capital expenditures of USD108.7 million in the fourth quarter 2014. Ternium had free cash flow of USD189.6 million10 in the period.

Forward Looking Statements

Some of the statements contained in this press release are “forward-looking statements”. Forward-looking statements are based on management’s current views and assumptions and involve known and unknown risks that could cause actual results, performance or events to differ materially from those expressed or implied by those statements. These risks include but are not limited to risks arising from uncertainties as to gross domestic product, related market demand, global production capacity, tariffs, cyclicality in the industries that purchase steel products and other factors beyond Ternium’s control.

About Ternium

Ternium is a leading steel producer in Latin America, with an annual production capacity of approximately 11.0 million tons of finished steel products. The company manufactures and processes a broad range of value-added steel products for customers active in the construction, automotive, home appliances, capital goods, container, food and energy industries. With production facilities located in Mexico, Argentina, Colombia, the southern United States and Guatemala, Ternium serves markets in the Americas through its integrated manufacturing system and extensive distribution network. In addition, Ternium participates in the control group of Usiminas, a Brazilian steel company. More information about Ternium is available at www.ternium.com.

8 Free cash flow in the year 2015 equals net cash provided by operating activities of USD1.3 billion less capital expenditures of USD466.6 million.

9 Net debt position at December 31, 2015 equals borrowings of USD1.5 billion less cash and equivalents plus other investments of USD0.4 billion.

10 Free cash flow in the fourth quarter 2015 equals net cash provided by operating activities of USD313.5 million less capital expenditures of USD123.8 million.

Consolidated Income Statement

|

USD million |

|

4Q 2015 |

4Q 2014 |

|

2015 |

2014 |

| |

|

|

|

|

|

Net sales |

|

1,809.9 |

|

2,154.6 |

|

7,877.4 |

|

8,726.1 |

|

Cost of sales |

|

(1,438.4) |

|

(1,765.1) |

|

(6,477.3) |

|

(6,925.2) |

|

Gross profit |

|

371.6 |

|

389.5 |

|

1,400.2 |

|

1,800.9 |

|

Selling, general and administrative expenses |

|

(180.1) |

|

(201.7) |

|

(770.3) |

|

(816.5) |

|

Other operating income, net |

|

0.1 |

|

3.5 |

|

9.5 |

|

71.8 |

|

Operating income |

|

191.6 |

|

191.3 |

|

639.3 |

|

1,056.2 |

| |

|

|

|

|

|

|

|

|

|

Finance expense |

|

(17.6) |

|

(28.0) |

|

(89.5) |

|

(117.9) |

|

Finance income |

|

2.1 |

|

1.7 |

|

8.0 |

|

7.7 |

|

Other financial (expenses) income, net |

|

(38.0) |

|

35.0 |

|

(17.9) |

|

40.7 |

|

Equity in losses of non-consolidated companies |

|

(213.4) |

|

(5.3) |

|

(272.8) |

|

(751.8) |

|

(Loss) Profit before income tax expense |

|

(75.3) |

|

194.7 |

|

267.1 |

|

234.9 |

|

Income tax expense |

|

(51.2) |

|

(123.3) |

|

(207.3) |

|

(339.1) |

|

(Loss) Profit for the period |

|

(126.5) |

|

71.4 |

|

59.8 |

|

(104.2) |

| |

|

|

|

|

|

|

|

|

|

Attributable to: |

|

|

|

|

|

|

|

|

|

Owners of the parent |

|

(126.2) |

|

53.0 |

|

8.1 |

|

(198.8) |

|

Non-controlling interest |

|

(0.3) |

|

18.3 |

|

51.7 |

|

94.6 |

|

(Loss) Profit for the period |

|

(126.5) |

|

71.4 |

|

59.8 |

|

(104.2) |

Consolidated Statement of Financial Position

|

USD million |

|

December 31,

2015 |

|

December 31,

2014 |

| |

|

|

|

|

| |

|

|

|

|

|

Property, plant and equipment, net |

|

4,207.6 |

|

4,481.0 |

|

Intangible assets, net |

|

888.2 |

|

948.9 |

|

Investments in non-consolidated companies |

|

250.4 |

|

748.2 |

|

Deferred tax assets |

|

98.1 |

|

115.6 |

|

Receivables, net |

|

36.1 |

|

47.5 |

|

Trade receivables, net |

|

- |

|

0.1 |

|

Total non-current assets |

|

5,480.4 |

|

6,341.3 |

| |

|

|

|

|

|

Receivables |

|

89.5 |

|

112.2 |

|

Derivative financial instruments |

|

1.8 |

|

4.3 |

|

Inventories, net |

|

1,579.1 |

|

2,134.0 |

|

Trade receivables, net |

|

511.5 |

|

720.2 |

|

Other investments |

|

237.2 |

|

150.0 |

|

Cash and cash equivalents |

|

151.5 |

|

213.3 |

|

Total current assets |

|

2,570.5 |

|

3,334.1 |

| |

|

|

|

|

|

Non-current assets classified as held for sale |

|

11.7 |

|

14.8 |

| |

|

|

|

|

|

Total assets |

|

8,062.6 |

|

9,690.2 |

| |

|

|

|

|

|

Capital and reserves attributable to the owners of the parent |

|

4,033.1 |

|

4,697.2 |

|

Non-controlling interest |

|

769.8 |

|

937.5 |

| |

|

|

|

|

|

Total Equity |

|

4,803.0 |

|

5,634.7 |

| |

|

|

|

|

|

Provisions |

|

8.1 |

|

9.1 |

|

Deferred tax liabilities |

|

609.5 |

|

670.5 |

|

Other liabilities |

|

320.7 |

|

371.9 |

|

Trade payables |

|

13.4 |

|

12.0 |

|

Borrowings |

|

607.2 |

|

900.6 |

|

Total non-current liabilities |

|

1,559.0 |

|

1,964.1 |

| |

|

|

|

|

|

Current income tax liabilities |

|

41.1 |

|

51.1 |

|

Other liabilities |

|

156.7 |

|

210.2 |

|

Trade payables |

|

568.5 |

|

564.5 |

|

Derivative financial instruments |

|

20.6 |

|

1.4 |

|

Borrowings |

|

913.8 |

|

1,264.2 |

|

Total current liabilities |

|

1,700.6 |

|

2,091.4 |

| |

|

|

|

|

|

Total liabilities |

|

3,259.6 |

|

4,055.5 |

| |

|

|

|

|

|

Total equity and liabilities |

|

8,062.6 |

|

9,690.2 |

Consolidated Statement of Cash Flows

|

USD million |

|

4Q 2015 |

|

4Q 2014 |

|

2015 |

|

2014 |

| |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

(Loss) Profit for the period |

|

(126.5) |

|

71.4 |

|

59.8 |

|

(104.2) |

| |

|

|

|

|

|

|

|

|

|

Adjustments for: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

105.5 |

|

109.6 |

|

433.8 |

|

414.8 |

|

Equity in losses of non-consolidated companies |

|

213.4 |

|

5.3 |

|

272.8 |

|

751.8 |

|

Changes in provisions |

|

0.6 |

|

(1.6) |

|

3.2 |

|

0.1 |

|

Net foreign exchange results and others |

|

44.5 |

|

(4.3) |

|

61.5 |

|

28.7 |

|

Interest accruals less payments |

|

6.2 |

|

0.4 |

|

5.5 |

|

5.2 |

|

Income tax accruals less payments |

|

20.4 |

|

25.3 |

|

(23.9) |

|

(39.5) |

|

Results on the sale of participation in subsidiary company |

|

- |

|

- |

|

1.7 |

|

- |

|

Changes in working capital |

|

49.4 |

|

2.2 |

|

509.1 |

|

(551.0) |

| |

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

313.5 |

|

208.3 |

|

1,323.5 |

|

505.8 |

| |

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

(123.8) |

|

(108.7) |

|

(466.6) |

|

(443.5) |

|

Proceeds from the sale of property, plant & equipment |

|

0.3 |

|

0.4 |

|

1.2 |

|

1.5 |

|

Sale of participation in subsidiary company, net of cash disposed |

|

- |

|

- |

|

(0.7) |

|

- |

|

Acquisition of business/stake - Purchase consideration Usiminas |

|

- |

|

(249.0) |

|

- |

|

(249.0) |

|

Investment in non-consolidated companies - Techgen |

|

(9.6) |

|

- |

|

(9.6) |

|

(3.0) |

|

Loans granted to non-consolidated companies - Techgen |

|

(10.4) |

|

- |

|

(10.4) |

|

- |

|

(Increase) Decrease in Other Investments |

|

(86.4) |

|

(46.4) |

|

(85.9) |

|

18.3 |

| |

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

(229.9) |

|

(403.7) |

|

(572.1) |

|

(675.8) |

| |

|

|

|

|

|

|

|

|

|

Dividends paid in cash to company's shareholders |

|

- |

|

- |

|

(176.7) |

|

(147.2) |

|

Dividends paid in cash to non-controlling interest |

|

- |

|

- |

|

(32.7) |

|

(33.6) |

|

Acquisition of non-controlling interest |

|

- |

|

- |

|

(74.0) |

|

- |

|

Contributions from non-controlling shareholders in consolidated subsidiaries |

|

- |

|

- |

|

30.9 |

|

- |

|

Proceeds from borrowings |

|

141.0 |

|

257.1 |

|

822.7 |

|

1,038.8 |

|

Repayments of borrowings |

|

(271.0) |

|

(191.9) |

|

(1,379.7) |

|

(773.4) |

| |

|

|

|

|

|

|

|

|

|

Net cash (used in) provided by financing activities |

|

(129.9) |

|

65.3 |

|

(809.6) |

|

84.6 |

| |

|

|

|

|

|

|

|

|

|

Decrease in cash and cash equivalents |

|

(46.4) |

|

(130.1) |

|

(58.2) |

|

(85.4) |

|

Shipments |

|

Thousand tons |

|

4Q 2015 |

4Q 2014 |

3Q 2015 |

|

2015 |

2014 |

| |

|

|

|

|

|

|

|

|

Mexico |

|

1,406.7 |

1,425.3 |

1,532.9 |

|

5,933.4 |

5,632.2 |

|

Southern Region |

|

643.6 |

640.8 |

641.4 |

|

2,552.2 |

2,510.9 |

|

Other Markets |

|

259.3 |

288.0 |

288.2 |

|

1,114.6 |

1,238.5 |

|

Total steel segment |

|

2,309.6 |

2,354.1 |

2,462.6 |

|

9,600.3 |

9,381.5 |

| |

|

|

|

|

|

|

|

|

Total mining segment |

|

906.1 |

1,021.9 |

891.5 |

|

3,635.6 |

3,857.3 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Revenue / ton |

|

USD/ton |

|

4Q 2015 |

4Q 2014 |

3Q 2015 |

|

2015 |

2014 |

| |

|

|

|

|

|

|

|

|

Mexico |

|

678 |

853 |

695 |

|

734 |

864 |

|

Southern Region |

|

1,010 |

1,041 |

1,010 |

|

1,006 |

1,052 |

|

Other Markets |

|

770 |

894 |

777 |

|

812 |

936 |

|

Total steel segment |

|

781 |

909 |

787 |

|

815 |

924 |

| |

|

|

|

|

|

|

|

|

Total mining segment |

|

50 |

70 |

57 |

|

56 |

81 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Net Sales |

|

USD million |

|

4Q 2015 |

4Q 2014 |

3Q 2015 |

|

2015 |

2014 |

| |

|

|

|

|

|

|

|

|

Mexico |

|

954.2 |

1,215.8 |

1,065.3 |

|

4,354.8 |

4,863.9 |

|

Southern Region |

|

650.3 |

667.0 |

648.0 |

|

2,567.2 |

2,641.5 |

|

Other Markets |

|

199.6 |

257.3 |

224.1 |

|

905.4 |

1,159.3 |

|

Total steel products |

|

1,804.1 |

2,140.1 |

1,937.3 |

|

7,827.4 |

8,664.8 |

|

Other products1 |

|

5.3 |

9.6 |

7.7 |

|

47.7 |

35.8 |

|

Total steel segment |

|

1,809.4 |

2,149.7 |

1,945.0 |

|

7,875.2 |

8,700.5 |

| |

|

|

|

|

|

|

|

|

Total mining segment |

|

45.4 |

71.4 |

51.1 |

|

203.1 |

313.2 |

| |

|

|

|

|

|

|

|

|

Total steel and mining segments |

|

1,854.8 |

2,221.1 |

1,996.1 |

|

8,078.3 |

9,013.7 |

| |

|

|

|

|

|

|

|

|

Intersegment eliminations |

|

(44.8) |

(66.5) |

(50.7) |

|

(200.8) |

(287.6) |

| |

|

|

|

|

|

|

|

|

Total net sales |

|

1,809.9 |

2,154.6 |

1,945.4 |

|

7,877.4 |

8,726.1 |

1 The item “Other products” primarily includes pig iron.

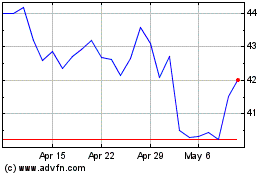

Ternium (NYSE:TX)

Historical Stock Chart

From Mar 2024 to Apr 2024

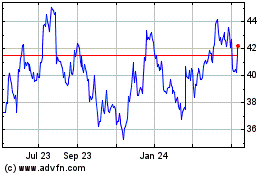

Ternium (NYSE:TX)

Historical Stock Chart

From Apr 2023 to Apr 2024