Tenaris S.A. (NYSE: TS) (BAE: TS) (BMV: TS) (MILAN: TEN) ("Tenaris") today

announced its results for the quarter ended March 31, 2014 in comparison with

its results for the quarter ended March 31, 2013.

Summary of 2014 First Quarter Results

(Comparison with fourth and first quarters of 2013)

Q1 2014 Q4 2013 Q1 2013

------- --------------- ---------------

Net sales ($ million) 2,580 2,674 (4%) 2,678 (4%)

Operating income ($ million) 566 589 (4%) 554 2%

Net income ($ million) 428 408 5% 423 1%

Shareholders' net income ($ million) 423 409 3% 425 (1%)

Earnings per ADS ($) 0.72 0.69 3% 0.72 (1%)

Earnings per share ($) 0.36 0.35 3% 0.36 (1%)

EBITDA- ($ million) 718 745 (4%) 699 3%

EBITDA margin (% of net sales) 27.8% 27.8% 26.1%

-EBITDA is defined as operating income plus depreciation, amortization and

impairment charges/(reversals)

In the first quarter, although we benefited from improving trends in the U.S.

market and the usual seasonal effect in Canada, our sales declined 4%

sequentially, due primarily to lower sales in the Middle East, following the

exceptional level of sales we had in the fourth quarter of 2013, as well as in

Mexico, Colombia and Venezuela. We maintained our EBITDA and operating margins

at a high level reflecting operating efficiencies and a continuing good mix of

products.

Cash provided by operating activities reached $612 million during the quarter

and at the end of the quarter we had a net cash position (cash and other current

investments less total borrowings) of $1.3 billion.

Market Background and Outlook

In the United States, drilling activity is picking up, particularly in the

Permian basin, but during the first quarter drilling efficiencies were affected

by the cold weather. Looking into the second half of the year, the final

determination in the anti-dumping trade case will have an impact on our sales.

In Canada, drilling activity in the first quarter was in line with the previous

year and we expect that to continue through the year in accordance with the

usual seasonal variations.

In Mexico, Pemex is concentrating on its most productive regions and

reorganizing as the reform of the energy sector moves forward. We expect a

recovery in sales in the second half as additional rigs are being contracted.

In South America, shale drilling activity is increasing in Argentina while, in

Brazil, projects continue to be delayed and our sales of line pipe and OCTG

products in Brazil will be affected throughout the year.

In the Eastern Hemisphere, drilling activity has been increasing led by the

Middle East and deepwater drilling in sub-Saharan Africa. However, purchases of

OCTG in the Middle East in the last few quarters have been at an exceptionally

high level and we expect an inventory adjustment in the coming quarters, which

should be partially compensated by higher sales in sub-Saharan Africa and other

countries of the region.

Considering these various factors, we expect our overall results for 2014 to be

in line with those for 2013.

Analysis of 2014 First Quarter Results

Tubes Sales volume

(thousand metric tons) Q1 2014 Q4 2013 Q1 2013

------- --------------- ---------------

Seamless 669 665 1% 657 2%

Welded 241 249 (3%) 289 (17%)

Total 910 914 (1%) 946 (4%)

Tubes Q1 2014 Q4 2013 Q1 2013

------- --------------- ---------------

(Net sales - $ million)

North America 1,085 1,019 6% 1,143 (5%)

South America 440 516 (15%) 595 (26%)

Europe 256 205 25% 268 (4%)

Middle East & Africa 536 628 (15%) 400 34%

Far East & Oceania 101 112 (10%) 82 23%

Total net sales ($ million) 2,418 2,480 (3%) 2,488 (3%)

Operating income ($ million) 561 585 (4%) 526 6%

Operating income (% of sales) 23.2% 23.6% 21.1%

Net sales of tubular products and services decreased 3% sequentially and 3% year

on year. In North America, sales increased reflecting higher seasonal sales in

Canada and higher onshore drilling activity from our customers in the Permian,

partially offset by lower activity in Mexico. In South America, sales decreased

due to lower OCTG sales in Colombia and Venezuela. In Europe, sales increased

due to higher OCTG and line pipe offshore sales in the North Sea. In the Middle

East and Africa, sales remained strong but declined from the exceptional level

of the previous quarter, when we had a record level of sales to Saudi Arabia. In

the Far East and Oceania, the decline in sales reflected lower sales of line

pipe in the region and lower sales for Australian offshore developments.

Operating income from tubular products and services decreased 4% sequentially,

mainly reflecting a reduction in sales, but increased 6% year on year. The year

on year increase in operating income is mainly due to a richer mix of products

sold together with improved operational efficiencies.

Others Q1 2014 Q4 2013 Q1 2013

------- --------------- ---------------

Net sales ($ million) 162 194 (16%) 190 (15%)

Operating income ($ million) 4 5 (20%) 28 (79%)

Operating income (% of sales) 2.8% 2.4% 14.5%

Net sales of other products and services decreased 16% sequentially and 15% year

on year. The sequential decline in sales was mainly due to lower sales at our

industrial equipment business in Brazil and of sucker rods, while the decline in

operating income was mainly due to lower margins at our industrial equipment

business in Brazil.

Selling, general and administrative expenses, or SG&A, amounted to $489

million, or 18.9% of net sales, in the first quarter of 2014, compared to $497

million, 18.6% in the previous quarter and $476 million, 17.8% in the first

quarter of 2013.

Financial results amounted to a gain of $42 million in the first quarter of

2014, compared to a gain of $8 million in the previous quarter and a loss of $9

million in the same period of 2013. During the quarter we had a $51 million gain

on foreign exchange results, mainly resulting from the Argentine peso

devaluation (22.3%) on our short operative and financial position in Argentine

pesos.

Equity in earnings of associated companies generated a gain of $19 million in

the first quarter of 2014, compared to a gain of $12 million in the previous

quarter and in the first quarter of 2013. These results are mainly derived from

our equity investment in Ternium (NYSE: TX) and Usiminas (BSP: USIM).

Income tax charges totaled $199 million in the first quarter of 2014, 32.7% of

income before equity in earnings of associated companies and income tax,

compared to $202 million, or 33.8% in the previous quarter and $134 million or

24.6% in the first quarter of 2013. As in the previous quarter, our tax rate was

negatively affected primarily by the effect of the Argentine peso devaluation on

the tax base used to calculate deffered tax at our Argentine subsidiaries which

have the U.S. dollar as their functional currency.

Results attributable to non-controlling interests amounted to gains of $6

million in the first quarter of 2014, compared to losses of $1 million in the

previous quarter and of $2 million in the first quarter of 2013. These results

are mainly attributable to NKKTubes, our Japanese subsidiary.

Cash Flow and Liquidity

Net cash provided by operations during the first quarter of 2014 was $612

million, compared to $427 million in the previous quarter and $556 million in

the first quarter of 2013.

Capital expenditures amounted to $189 million for the first quarter of 2014,

compared to $184 million in the previous quarter and in the first quarter of

2013.

At the end of the quarter, our net cash position (cash and other current

investments less total borrowings) amounted to $1.3 billion.

Conference call

Tenaris will hold a conference call to discuss the above reported results, on

May 2, 2014, at 10:00 a.m. (Eastern Time). Following a brief summary, the

conference call will be opened to questions. To access the conference call dial

in +1 877 474.9502 within North America or +1 857 244.7555 Internationally. The

access number is "64180052". Please dial in 10 minutes before the scheduled

start time. The conference call will be also available by webcast at

www.tenaris.com/investors

A replay of the conference call will be available on our webpage

http://ir.tenaris.com/ or by phone from 2:00 pm on May 2 through 12:00 am on May

9. To access the replay by phone, please dial +1 888 286.8010 or +1 617 801.6888

and enter passcode "11333713" when prompted.

Some of the statements contained in this press release are "forward-looking

statements". Forward-looking statements are based on management's current views

and assumptions and involve known and unknown risks that could cause actual

results, performance or events to differ materially from those expressed or

implied by those statements. These risks include but are not limited to risks

arising from uncertainties as to future oil and gas prices and their impact on

investment programs by oil and gas companies.

Consolidated Condensed Interim Income Statement

Three-month period ended

(all amounts in thousands of U.S. dollars) March 31,

-----------------------------

2014 2013

-------------- --------------

Continuing operations Unaudited

Net sales 2,579,944 2,678,305

Cost of sales (1,527,034) (1,645,432)

-------------- --------------

Gross profit 1,052,910 1,032,873

Selling, general and administrative expenses (488,860) (475,565)

Other operating income (expense) net 1,720 (3,723)

-------------- --------------

Operating income 565,770 553,585

Interest income 9,062 6,081

Interest expense (13,003) (13,909)

Other financial results 46,434 (1,381)

-------------- --------------

Income before equity in earnings of associated

companies and income tax 608,263 544,376

Equity in earnings of associated companies 18,821 12,197

-------------- --------------

Income before income tax 627,084 556,573

Income tax (199,065) (133,856)

-------------- --------------

Income for the period 428,019 422,717

============== ==============

Attributable to:

Owners of the parent 422,505 424,777

Non-controlling interests 5,514 (2,060)

-------------- --------------

428,019 422,717

============== ==============

Consolidated Condensed Interim Statement of Financial Position

(all amounts in thousands of

U.S. dollars) At March 31, 2014 At December 31, 2013

--------------------- ---------------------

Unaudited

ASSETS

Non-current assets

Property, plant and equipment,

net 4,754,390 4,673,767

Intangible assets, net 3,027,964 3,067,236

Investments in associated

companies 932,822 912,758

Other investments 1,816 2,498

Deferred tax assets 201,401 197,159

Receivables 209,129 9,127,522 152,080 9,005,498

---------- ----------

Current assets

Inventories 2,705,667 2,702,647

Receivables and prepayments 199,777 220,224

Current tax assets 134,675 156,191

Trade receivables 2,064,390 1,982,979

Available for sale assets 21,572 21,572

Other investments 1,531,776 1,227,330

Cash and cash equivalents 659,765 7,317,622 614,529 6,925,472

---------- ---------- ---------- ----------

Total assets 16,445,144 15,930,970

========== ==========

EQUITY

Capital and reserves

attributable to owners of the

parent 12,724,313 12,290,420

Non-controlling interests 136,992 179,446

---------- ----------

Total equity 12,861,305 12,469,866

========== ==========

LIABILITIES

Non-current liabilities

Borrowings 175,894 246,218

Deferred tax liabilities 744,204 751,105

Other liabilities 281,510 277,257

Provisions 70,925 1,272,533 66,795 1,341,375

---------- ----------

Current liabilities

Borrowings 736,213 684,717

Current tax liabilities 320,600 266,760

Other liabilities 305,367 250,997

Provisions 26,509 25,715

Customer advances 102,592 56,911

Trade payables 820,025 2,311,306 834,629 2,119,729

---------- ---------- ---------- ----------

Total liabilities 3,583,839 3,461,104

========== ==========

Total equity and liabilities 16,445,144 15,930,970

========== ==========

Consolidated Condensed Interim Statement of Cash Flows

Three-month period ended

March 31,

-----------------------------

(all amounts in thousands of U.S. dollars) 2014 2013

-------------- --------------

Unaudited

Cash flows from operating activities

Income for the period 428,019 422,717

Adjustments for:

Depreciation and amortization 152,664 145,370

Income tax accruals less payments 70,790 15,213

Equity in earnings of associated companies (18,821) (12,197)

Interest accruals less payments, net (8,099) (30,725)

Changes in provisions 4,924 3,134

Changes in working capital 16,660 16,321

Other, including currency translation

adjustment (34,293) (4,168)

-------------- --------------

Net cash provided by operating activities 611,844 555,665

============== ==============

Cash flows from investing activities

Capital expenditures (189,045) (183,885)

Advance to suppliers of property, plant and

equipment (28,651) 7,746

Investment in associated companies (1,380) -

Loan to associated companies (18,748) -

Proceeds from disposal of property, plant and

equipment and intangible assets 4,027 4,386

Dividends received from associated companies - 1,196

Changes in investments in short terms

securities (304,446) (158,582)

-------------- --------------

Net cash used in investing activities (538,243) (329,139)

============== ==============

Cash flows from financing activities

Dividends paid to non-controlling interest in

subsidiaries (47,889) (16,671)

Acquisitions of non-controlling interests (90) (538)

Proceeds from borrowings 494,407 625,732

Repayments of borrowings (468,670) (677,045)

-------------- --------------

Net cash used in financing activities (22,242) (68,522)

============== ==============

============== ==============

Increase in cash and cash equivalents 51,359 158,004

============== ==============

Movement in cash and cash equivalents

At the beginning of the period 598,145 772,656

Effect of exchange rate changes 185 (5,106)

Increase in cash and cash equivalents 51,359 158,004

-------------- --------------

At March 31, 649,689 925,554

============== ==============

At March 31,

-----------------------------

2014 2013

-------------- --------------

Cash and cash equivalents

Cash and bank deposits 659,765 948,777

Bank overdrafts (10,076) (23,223)

-------------- --------------

649,689 925,554

============== ==============

FOR FURTHER INFORMATION PLEASE CONTACT:

Giovanni Sardagna

Tenaris

1-888-300-5432

www.tenaris.com

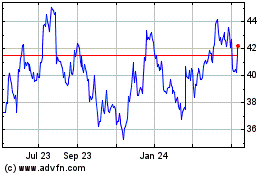

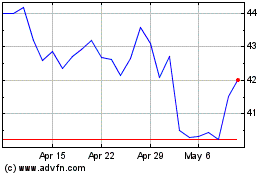

Ternium (NYSE:TX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ternium (NYSE:TX)

Historical Stock Chart

From Apr 2023 to Apr 2024