In the spring, Avon Products Inc. began a strategic review of

its business and this week Chief Executive Sheri McCoy got her

deal—one in which the beauty company will sell off most of its

money-losing North American business.

The transaction with Cerberus Capital Management LP, which would

inject $435 million into Avon and carve out the North American

business into a separate company with another $170 million

investment, buys Ms. McCoy more time to figure out a viable plan

for Avon's remaining operations.

"We firmly believe this partnership will change the trajectory

of the company," Ms. McCoy said during a conference call

Thursday.

Without the financial drag from Avon's U.S. business, the

company can position its international businesses "for accelerated

growth in beauty and direct selling," she added.

The North American operations contribute about 15% of Avon's

sales.

The deal also involves an overhaul of Avon's board. Five

directors will be replaced and a Cerberus representative will take

over as Avon's chairman. Two other executives from the

private-equity firm will take seats on what will be an 11-person

board, moves that could leave the CEO vulnerable to an ouster.

Ms. McCoy, 57 years old, has struggled to revive Avon since she

took the top job 31/2 years ago. Avon's annual sales have fallen

more than 25% since 2011, the year before Ms. McCoy joined the

company. Its share price has tumbled 81% since her arrival, and

ended down 6 cents Thursday at $4.03 each.

Some former employees and Wall Street analysts have been

frustrated with what they describe as a lack of a clear corporate

strategy. Inside Avon, Ms. McCoy has been known to say: "I can't

tell you what the right strategy is—it's different for every

market," according to a former executive.

The transaction, which the company expects to complete in the

coming months, makes Cerberus Avon's biggest shareholder, with a

16.6% stake, in addition to owning 80.1% of the North American

business. Avon said Thursday it will suspend its dividend to

conserve cash, but it will pay a 5% preferred dividend to

Cerberus.

The deal was immediately opposed by an activist investor who is

part of a group that recently disclosed a 3% stake in Avon. James

Mitarotonda, chief executive of Barington Capital Group, said the

Avon board agreed to "fire sale" prices and reiterated an earlier

demand for a new leader.

"We are astonished that Sheri McCoy remains as CEO," he said.

"We intend to explore all available options."

A chemical engineer by training and a former top Johnson &

Johnson executive, Ms. McCoy knew little about Avon's direct-sales

model when she joined in April 2012. Avon relies on a sprawling

network of 6 million representatives to peddle makeup and other

products mostly to women.

At the time of her appointment, Avon's sales were already in

decline and directors wanted a new CEO who would take a fresh look

at the business, according to a person familiar with the

matter.

Shortly after Ms. McCoy joined Avon, some directors encouraged

her to seek advice about direct selling from her predecessor,

Andrea Jung, according to another person familiar with the matter.

"That relationship never gelled," this person said.

Ms. McCoy made a series of management changes and focused more

resources on a dozen top markets including Brazil, Russia and

Mexico. The company closed operations in underperforming countries

such as France, Ireland and South Korea, and shed brands including

a sterling-silver jewelry line and skin care products.

She also shifted Avon's product mix to include more gifts,

accessories and home goods to encourage customers to buy from the

company more often because most women don't need new cosmetics that

frequently.

But critics and some former employees say Ms. McCoy has been

wary of making drastic changes to Avon's business model. The

company has been slow to embrace Internet sales and reluctant to

try selling some of its products in retail stores because of the

risk of alienating sales representatives, say analysts and former

employees.

The problem, analysts say, is that representatives aren't

selling enough products and their ranks are thinning in many

countries as women find other career opportunities that pay better.

Some representatives also have been frustrated by supply-chain

problems within Avon, which have resulted in delays or mistakes in

some orders.

On Thursday Ms. McCoy said the deal with Cerberus will enable

Avon to focus on growing its business in overseas markets, which

now generate 86% of the company's revenue and all of its

profits.

As part of the Cerberus deal, Avon said Oscar Munoz, president

of North America and hired by Ms. McCoy from rival Tupperware

Brands Corp., will leave in January. Several other executives she

recruited to help with the turnaround also recently exited or will

exit soon, including two senior vice presidents.

It is unclear how long Ms. McCoy plans to stay in her role and

how much support she will have from Avon's board after nearly half

its members are replaced. The company plans to hold an investor

event on Jan. 21, when Ms. McCoy is expected to provide more

details about her growth strategy for Avon.

Last month, Avon said it would broaden the role of its chief

financial officer, James Scully, giving him the additional title of

chief operating officer come Jan. 1. That move has been broadly

interpreted by analysts and company insiders as putting Mr. Scully,

a former J. Crew Group Inc. chief operating officer, in line to

succeed Ms. McCoy.

"The problem with Avon is that there isn't a clear fix," said

Ali Dibadj, a Sanford Bernstein analyst.

Dana Mattioli

(END) Dow Jones Newswires

December 17, 2015 20:05 ET (01:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

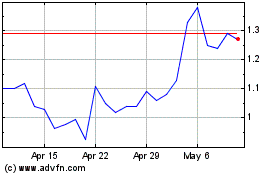

Tupperware Brands (NYSE:TUP)

Historical Stock Chart

From Mar 2024 to Apr 2024

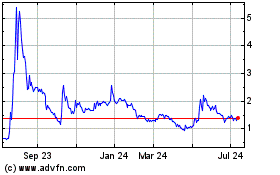

Tupperware Brands (NYSE:TUP)

Historical Stock Chart

From Apr 2023 to Apr 2024