UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

(MARK ONE)

[X] ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ____ TO ____

Commission File No. 1-13455

A. Full title of the plan and address of the plan, if different from that of the issuer named below:

TETRA Technologies, Inc. 401(k) Retirement Plan

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

TETRA Technologies, Inc.

24955 Interstate 45 North

The Woodlands, Texas 77380

TABLE OF CONTENTS

|

| |

Report of Independent Registered Public Accounting Firm | Page 2 |

Audited Financial Statements | |

|

| | |

| Statements of Net Assets Available for Benefits at December 31, 2014 and 2013 | Page 3 |

| Statement of Changes in Net Assets Available for Benefits for the Year Ended December 31, 2014 | Page 4 |

| Notes to Financial Statements | Page 5 |

|

| | |

| Schedule H, Line 4(i) – Schedule of Assets (Held at End of Year) | Page 12 |

Report of Independent Registered Public Accounting Firm

Administrator of TETRA Technologies, Inc. 401(k) Retirement Plan

We have audited the accompanying statements of net assets available for benefits of TETRA Technologies, Inc. 401(k) Retirement Plan as of December 31, 2014 and 2013, and the related statement of changes in net assets available for benefits for the year ended December 31, 2014. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Plan's internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of TETRA Technologies, Inc. 401(k) Retirement Plan at December 31, 2014 and 2013, and the changes in its net assets available for benefits for the year ended December 31, 2014, in conformity with U.S. generally accepted accounting principles.

The accompanying supplemental schedule of assets (held at end of year) as of December 31, 2014, has been subjected to audit procedures performed in conjunction with the audit of TETRA Technologies, Inc. 401(k) Retirement Plan’s financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

Houston, Texas

June 26, 2015

TETRA Technologies, Inc. 401(k) Retirement Plan

Statements of Net Assets Available for Benefits

|

| | | | | | | | |

|

| December 31, |

|

| 2014 | | 2013 |

ASSETS |

| |

|

| |

|

Receivables: |

| |

|

| |

|

Notes receivable from participants |

| $ | 5,889,646 |

| | $ | 4,032,394 |

|

Investments, at fair value |

| 136,297,279 |

| | 100,396,860 |

|

Net assets reflecting investments at fair value |

| 142,186,925 |

| | 104,429,254 |

|

Adjustment from fair value to contract value for |

| |

| | |

|

fully benefit-responsive investment contracts |

| (140,657 | ) | | (208,849 | ) |

Net assets available for benefits |

| $ | 142,046,268 |

| | $ | 104,220,405 |

|

See accompanying notes.

TETRA Technologies, Inc. 401(k) Retirement Plan

Statement of Changes in Net Assets Available for Benefits

Year Ended December 31, 2014

|

| | | |

Additions: | |

|

Employer contributions | $ | 4,282,910 |

|

Participant contributions | 11,934,895 |

|

Rollover contributions | 366,348 |

|

Interest and dividends | 6,913,518 |

|

Interest income on notes receivable from participants | 182,500 |

|

Net appreciation (depreciation) in fair value of investments | (6,640,134 | ) |

Total additions | 17,040,037 |

|

| |

|

Deductions: | |

|

Benefits paid to participants | 19,288,133 |

|

Administrative expenses | 21,058 |

|

Total deductions | 19,309,191 |

|

| |

|

Other changes in plan assets: | |

Transfer from qualified plan | 40,095,017 |

|

| |

Net increase | 37,825,863 |

|

| |

|

Net assets available for benefits: | |

|

Beginning of year | 104,220,405 |

|

End of year | $ | 142,046,268 |

|

| |

|

See accompanying notes.

TETRA Technologies, Inc. 401(k) Retirement Plan

Notes to Financial Statements

December 31, 2014

1. Description of Plan

The following description of the TETRA Technologies, Inc. 401(k) Retirement Plan (the Plan) is provided for general information only. Participants should refer to the Plan Document and Summary Plan Description for a more complete description of the Plan’s provisions, a copy of which is available from TETRA Technologies, Inc. (the Company or Plan Administrator).

General

The Plan, which initially became effective January 1, 1990, is a profit sharing plan as defined by Section 401(a) of the Internal Revenue Code of 1986, as amended (IRC) and contains a provision for salary reduction contributions under Section 401(k) of the IRC. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). The Company is the designated administrator of the Plan and the Plan is advised by the 401(k) Committee, which currently consists of certain officers of the Company. T. Rowe Price Trust Company (TRP or Trustee) is the trustee of the Plan.

Eligibility

Employees who have attained age 18 are eligible to participate in the Plan beginning on the first day of any calendar month coincident with or following completion of six months of service. However, the following employees or classes of employees are not eligible to participate: (i) employees who are non-resident aliens and who receive no earned income from the Company which constitutes income from sources within the United States; (ii) leased employees; and (iii) reclassified employees and independent contractors.

Contributions

The maximum elective contribution limit is 70% of eligible Plan compensation. Contributions for each participant are limited in any calendar year to annual “regular” and “catch-up” contribution limits as determined pursuant to the IRC. Unless the employee elects otherwise, 3% of each eligible employee’s eligible Plan compensation is automatically contributed to the Plan on a pre-tax basis. The Plan provides an automated service which increases the employee’s elective contribution rate by 1% at the same time each year until a 6% elective contribution rate has been reached. The 6% elective contribution is the amount needed to take advantage of the full Company match, if any. The employee is reminded annually before the change takes place and can elect to change the amount at any time by contacting TRP. Employees have the option to elect a 0% elective contribution rate or to change their elective contribution rate in accordance with the Plan.

The Company may contribute an amount equal to a specified matching percentage of the participant’s elective contribution. During 2014, the Company made matching contributions of 50% of the first 6% of the participant’s elective contributions per pay period.

The Company may also, at the discretion of the Board of Directors, make a profit sharing contribution to the Plan at the end of each fiscal year. Such Company contribution will be allocated to Plan participants, who are employed on December 31st, in the same ratio that each participant’s eligible Plan compensation bears to the total eligible Plan compensation of all participants. No profit sharing contribution was made for the 2014 Plan year.

Participants have the right to direct the investment of their contributions, including the Company’s matching contributions and profit sharing, into any of the investment options offered by the Plan. Prior to October 1, 2014 in the event no participant investment direction was given, participant contributions, the related Company match, and any profit sharing contributions were automatically allocated to a diversified portfolio through September 30, 2014. This portfolio invests 60% in stock funds and 40% in fixed income funds using a wide variety of funds in the Plan. Effective October 1, 2014, participant contributions and company contributions for which no participant investment direction is given are automatically allocated to age appropriate target date mutual funds. These target date mutual funds provide an asset allocation mix and investment strategy based on a future retirement date. If contributions for a participant are

automatically allocated to the diversified portfolio or a target date mutual fund, the participant may elect to change such investments in accordance with the Plan.

Company Stock Fund

The Plan permits participants to invest in common stock of the Company through the Plan’s Company Stock Fund. The Company Stock Fund may also hold cash or other short-term securities, although these are expected to be a small percentage of the fund.

The Plan limits the amount a participant can invest in the Company Stock Fund to encourage diversification of participants’ accounts. Each payroll period, a participant can direct up to a maximum of 50% of their contributions in the Company Stock Fund. In addition, a participant may not transfer amounts from other investment funds into the Company Stock Fund to the extent the transfer would result in more than 50% of the participant’s total account balance being invested in the Company Stock Fund.

Vesting

Participants are immediately vested in their elective contributions, as adjusted for earnings and losses thereon. Vesting in the matching contribution and profit sharing contribution portions of their accounts, as adjusted for earnings and losses thereon, is based on years of service. Participants are 25% vested after two years of service and vest an additional 25% each year thereafter, becoming 100% vested after five years of service. Upon a participant’s death, disability or normal retirement, the participant becomes 100% vested in his or her entire account. Except as otherwise described herein, participants forfeit the non-vested matching contribution and profit sharing contribution portions of their accounts in the Plan upon termination of employment with the Company.

Benefit Payments and Forfeitures

Upon separation from service for any reason, a participant’s vested balance is payable in a lump sum or installments. Amounts which are forfeited due to termination of employment are used to reduce the Company’s contributions, if any. During 2014, $542,381 in forfeitures was applied against employer contributions. Cumulative forfeitures relating to prior period activity and available to be applied against any future employer contributions were approximately $121,573 and $93,618 as of December 31, 2014 and 2013 respectively.

Plan Amendment and Termination

The Company has the right under the Plan to amend or terminate the Plan, subject to applicable law. In the event of Plan termination, participants will become 100% vested in their accounts.

Participant Loans

Participants, during their time of employment, may borrow from their fund accounts a minimum of $1,000, up to a maximum equal to the lesser of $50,000 or 50% of their vested account balances. Loan terms range from 1 to 5 years, or up to 15 years for the purchase of the participant’s primary residence. The loans are secured by the balances in the participants’ accounts and bear interest at rates established at the inception of the loan, set at one percentage point higher than the prime lending rate as posted in the Wall Street Journal (or similar financial publication). Principal and interest are paid ratably, generally through payroll deductions.

Administrative Expenses

Certain administrative expenses are paid by the Company.

Plan Transfer

On August 4, 2014, the Company completed the acquisition of Compressor Systems, Inc. ("CSI", a subsidiary of Warren Equipment Company). On October 27, 2014, net assets and account balances attributable to employees of CSI who were participants of the Warren Equipment Company 401(k) Plan (Warren Plan) were transferred from the Warren Plan and to the Plan. As a result of the acquisition of CSI, former CSI participants in the Warren Plan became participants in the Plan, and net assets of approximately $40.1 million were transferred into the Plan on October 27, 2014.

Additionally, the transferred participants are 100% vested in employer contributions from the Warren Plan that occurred before the transfer date. The assets transferred into the Plan are included in the Statement of Changes in Net Assets Available for Benefits as "Other changes in plan assets."

2. Summary of Accounting Policies

Basis of Accounting

The accompanying financial statements of the Plan have been prepared using the accrual basis of accounting in accordance with U.S. generally accepted accounting principles (GAAP). Benefit payments to participants are recorded upon distribution.

As required by subsections 9-19 of Accounting Standards Codification (ASC) Subtopic 946.210.45, Financial Services – Investment Companies, Balance Sheet, Other Presentation Matters, investments in the accompanying Statements of Net Assets Available for Benefits include fully benefit-responsive investment contracts and are recognized at fair value. ASC Topic 962, Plan Accounting – Defined Contribution Pension Plans, requires fully benefit-responsive investment contracts to be reported at fair value in the Plan’s Statements of Net Assets Available for Benefits with a corresponding adjustment to reflect these investments at contract value.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates that affect the amounts reported in the financial statements and accompanying notes and schedule. Actual results could differ from those estimates.

Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as administrative expenses and are recorded when they are incurred. No allowance for credit losses has been recorded as of December 31, 2014 or 2013. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

Investment Valuation and Income Recognition

The Plan’s investments are stated at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). See Note 4 for further discussion of fair value measurements. Investments in common collective trust funds include the Stable Value Fund. The Stable Value Fund invests in fully benefit-responsive investment contracts (as defined by Subtopic 946 previously discussed) including primarily guaranteed and synthetic investment contracts issued by banks, insurance companies and other issuers (wrap contacts). The Stable Value Fund is recorded at fair value (see Note 4). However, since these contracts are fully benefit-responsive, an adjustment is made to reflect this investment at contract value, which represents cost plus accrued income less redemptions. The fair value of the guaranteed investment contracts is generally determined by discounting the scheduled future payments required under the contract. The fair value of wrap contracts reflects the discounted present value of the difference between the current wrap contract cost and its replacement cost, based on issuer quotes. For assets other than investment contracts, including securities underlying synthetic investment contracts, fair value generally is reflected by market value at close of business on the valuation date.

Short term investments are valued at cost, which approximates fair value. Purchases and sales of securities are recorded on a trade date basis. Interest income is recorded on the accrual basis and dividends are recorded on the ex-dividend date.

3. Investments

Individual investments that represent 5% or more of the Plan’s net assets at either December 31, 2014 or 2013 are as follows:

|

| | | | | | | | |

|

| December 31, |

|

| 2014 |

| 2013 |

TETRA Technologies, Inc. common stock |

| $ | 5,350,107 |

| | $ | 10,241,178 |

|

Retirement 2025 Fund |

| 14,978,280 |

| | — |

|

Retirement 2020 Fund |

| 14,722,623 |

| | — |

|

Retirement 2030 Fund |

| 11,672,431 |

| | — |

|

Retirement 2035 Fund |

| 11,273,056 |

| | — |

|

Retirement 2040 Fund |

| 9,788,043 |

| | — |

|

TRP Stable Value Fund, at contract value* |

| 9,562,004 |

| | 14,735,710 |

|

Retirement 2045 Fund |

| 8,425,140 |

| | — |

|

TRP Equity Income | | 7,801,882 |

| | 14,985,098 |

|

Retirement 2015 Fund | | 7,609,987 |

| | — |

|

TRP Growth Stock Fund | | ** |

| | 11,905,032 |

|

PIMCO Total Return Fund | | ** |

| | 10,958,142 |

|

American EuroPacific Growth Fund | | ** |

| | 5,497,845 |

|

Artisan Mid Cap | | ** |

| | 5,713,598 |

|

Ridgeworth Total Return Bond I | | ** |

| | 5,975,248 |

|

* The fair value of this fully benefit-responsive investment totaled $9,702,662 and $14,944,559 at December 31, 2014 and 2013, respectively.

** Amount is less than 5% as of December 31.

During 2014, the Plan’s investments (including gains and losses of investments bought, sold, and held during the year) appreciated (depreciated) in value as follows:

|

| | | |

Mutual funds | $ | (2,155,173 | ) |

Common stock | (4,484,961 | ) |

| $ | (6,640,134 | ) |

4. Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., an exit price). The fair value hierarchy prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

Level 1 – Unadjusted quoted prices in active markets that are accessible to the reporting entity at the measurement date for identical assets and liabilities.

Level 2 – Inputs other than quoted prices in active markets for identical assets and liabilities that are observable either directly or indirectly for substantially the full term of the asset or liability. Level 2 inputs include the following:

| |

• | quoted prices for similar assets and liabilities in active markets |

| |

• | quoted prices for identical or similar assets or liabilities in markets that are not active |

| |

• | observable inputs other than quoted prices that are used in the valuation of the asset or liabilities (e.g.,interest rate and yield curve quotes at commonly quoted intervals) |

| |

• | inputs that are derived principally from or corroborated by observable market data by correlation or other means |

Level 3 – Unobservable inputs for the asset or liability (i.e., supported by little or no market activity). Level 3 inputs include management’s own assumption about the assumptions that market participants would use in pricing the asset or liability (including assumptions about risk).

The level in the fair value hierarchy within which the fair value measurement is classified is determined based on the lowest priority input that is significant to the fair value measure in its entirety.

The following tables set forth by level within the fair value hierarchy, the Plan’s assets carried at fair value for the years ended December 31, 2014 and 2013:

|

| | | | | | | | | | | | | | | | |

|

| Assets at Fair Value as of December 31, 2014 |

|

| Level 1 |

| Level 2 |

| Level 3 |

| Total |

TETRA Technologies, Inc. common stock | | $ | 5,350,107 |

| | $ | — |

| | $ | — |

| | $ | 5,350,107 |

|

Stable Value Fund (a) | | — |

| | 9,702,662 |

| | — |

| | 9,702,662 |

|

Mutual funds: | | | | | | | | |

Large cap stock | | 13,203,694 |

| | — |

| | — |

| | 13,203,694 |

|

Mid cap stock | | 7,241,091 |

| | — |

| | — |

| | 7,241,091 |

|

Small cap stock | | 3,030,900 |

| | — |

| | — |

| | 3,030,900 |

|

Intermediate term bond | | 5,516,010 |

| | — |

| | — |

| | 5,516,010 |

|

Foreign large blend | | 3,706,901 |

| | — |

| | — |

| | 3,706,901 |

|

Target date funds | | 88,545,914 |

| | — |

| | — |

| | 88,545,914 |

|

Total assets at fair value | | $ | 126,594,617 |

| | $ | 9,702,662 |

| | $ | — |

| | $ | 136,297,279 |

|

|

| | | | | | | | | | | | | | | | |

| | Assets at Fair Value as of December 31, 2013 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

Company stock | | $ | 10,241,178 |

| | $ | — |

| | $ | — |

| | $ | 10,241,178 |

|

Stable Value Fund (a) | | — |

| | 14,944,559 |

| | — |

| | 14,944,559 |

|

Mutual funds: | | | | | | | | |

Large cap stock | | 26,890,130 |

| | — |

| | — |

| | 26,890,130 |

|

Mid cap stock | | 14,071,073 |

| | — |

| | — |

| | 14,071,073 |

|

Small cap stock | | 5,698,200 |

| | — |

| | — |

| | 5,698,200 |

|

Intermediate term bond | | 16,933,389 |

| | — |

| | — |

| | 16,933,389 |

|

Foreign large blend | | 11,618,331 |

| | — |

| | — |

| | 11,618,331 |

|

Total assets at fair value | | $ | 85,452,301 |

|

| $ | 14,944,559 |

| | $ | — |

| | $ | 100,396,860 |

|

(a) This category includes a common/collective trust fund that is designed to deliver safety and stability by preserving principal and accumulating earnings. This fund is primarily invested in guaranteed investment contracts and synthetic investment contracts. Participant-directed redemptions have no restrictions; however, the Plan is required to provide a one year redemption notice to liquidate its entire share in the fund. The fair value of this fund is based on the net asset value as reported by the issuer of the fund, which is determined based on the fair value of the underlying investment contracts in the fund. The fair value differs from the contract value. As previously discussed in Note 2, contract value is the relevant measurement attributable to fully benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan.

The Plan’s valuation methodology used to measure the fair values of Company stock and mutual funds were derived from quoted market prices, as these instruments have active markets. The valuation technique used to measure fair value of common/collective trust funds is included in Note 2.

5. Income Tax Status

The underlying non-standardized prototype plan has received an opinion letter from the Internal Revenue Service (IRS) dated March 31, 2008, stating that the form of the Plan is qualified under Section 401(a) of the IRC, and therefore, the related trust is tax exempt. In accordance with Revenue Procedures 2014-6 and 2011-49, the Plan Administrator has determined that it is eligible to and has chosen to rely on the current IRS prototype plan opinion letter. Once qualified, the Plan is required to operate in conformity with the IRC to maintain its qualification. The Plan Administrator

believes the Plan is being operated in compliance with the applicable requirements of the Code and therefore, believes the Plan is qualified and the related trust is tax-exempt.

U.S. generally accepted accounting principles require plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2014, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits in progress for any tax periods. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to 2011.

6. Reconciliation of the Financial Statements to the Form 5500

The following is a reconciliation of the net assets available for benefits and the changes in net assets available for benefits per the financial statements to the Form 5500.

|

| | | | | | | | |

| | December 31, 2014 | | December 31, 2013 |

Net assets available for benefits per the financial | | |

| | |

|

statements | | $ | 142,046,268 |

| | $ | 104,220,405 |

|

Adjustment from contract value to fair value for | |

|

| | |

fully benefit-responsive investment contracts | | 140,657 |

| | 208,849 |

|

Net assets available for benefits per the | | |

| | |

|

Form 5500 | | $ | 142,186,925 |

| | $ | 104,429,254 |

|

The following is a reconciliation of the net increase in net assets available for benefits per the financial statements to the net gain per the Form 5500.

|

| | | |

| Year Ended |

| December 31, 2014 |

Net increase in net assets available for benefits per | |

the financial statements | $ | 37,825,863 |

|

Change in adjustment from contract value to fair | |

|

value for fully benefit-responsive investment contracts | (68,192 | ) |

Net gain per Form 5500 | $ | 37,757,671 |

|

Fully benefit-responsive investment contracts are valued at contract value on the statement of net assets available for benefits, whereas the Form 5500 requires all investments to be valued at fair value.

7. Risks and Uncertainties

The Plan provides for investments in various investment securities, which in general, are exposed to various risks, such as interest rate, credit, and overall market volatility risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the statements of net assets available for benefits and participant account balances.

8. Related Party Transactions

Certain investments of the Plan are managed by T. Rowe Price Trust Company, the Trustee of the Plan, and therefore, these transactions qualify as party-in-interest transactions. The Plan also invests in shares of the Company's common stock and these transactions also qualify as party-in-interest transactions. All of these transactions are exempt from the prohibited transactions rules.

Supplemental Schedule

TETRA Technologies, Inc. 401(k) Retirement Plan

Schedule H, Line 4(i) – Schedule of Assets (Held at End of Year)

EIN: 74-2148293 PN: 001

December 31, 2014

|

| | | | | | | |

| Identity of Issue, Borrower, | | | | Current |

| Lessor, or Similar Party | | Description of Investment | | Value |

| | | | | |

|

* | T. Rowe Price | | Retirement 2025 Fund | | $ | 14,978,280 |

|

* | T. Rowe Price | | Retirement 2020 Fund | | 14,722,623 |

|

* | T. Rowe Price | | Retirement 2030 Fund | | 11,672,431 |

|

* | T. Rowe Price | | Retirement 2035 Fund | | 11,273,056 |

|

* | T. Rowe Price | | Retirement 2040 Fund | | 9,788,043 |

|

* | T. Rowe Price | | TRP Stable Value Fund | | 9,702,662 |

|

* | T. Rowe Price | | Retirement 2045 Fund | | 8,425,140 |

|

* | T. Rowe Price | | Equity Income Fund | | 7,801,882 |

|

* | T. Rowe Price | | Retirement 2015 Fund | | 7,609,987 |

|

* | Participant loans | | Loans with various maturities and interest rates ranging from 4.09% to 10.50% per annum | | 5,889,646 |

|

* | T. Rowe Price | | Retirement 2050 Fund | | 5,626,352 |

|

* | T. Rowe Price | | TRP Growth Stock Fund | | 5,401,812 |

|

* | TETRA Technologies, Inc. | | TETRA Technologies, Inc. common stock | | 5,350,107 |

|

| PIMCO | | Total Return Fund | | 4,798,723 |

|

| Artisan Funds | | Mid Cap Growth Fund | | 3,279,045 |

|

| American Funds | | EuroPacific Growth Fund | | 2,448,064 |

|

| T. Rowe Price | | Retirement 2055 Fund | | 2,365,682 |

|

| Dreyfus | | Mid Cap Value Fund | | 2,061,131 |

|

| Vanguard | | Selected Value Fund | | 1,900,915 |

|

| Columbia | | Small Cap Fund | | 1,664,391 |

|

* | T. Rowe Price | | Retirement 2010 Fund | | 1,596,590 |

|

| Walthausen | | Small Cap Fund | | 1,366,509 |

|

| Matthews | | Asia Dividend Fund | | 730,322 |

|

| Ridgeworth | | Total Return Bond I | | 717,287 |

|

| Thornburg | | International Value Fund | | 528,515 |

|

* | T. Rowe Price | | TRP Retire Bal Inv | | 214,087 |

|

* | T. Rowe Price | | Retirement 2005 Fund | | 167,739 |

|

* | T. Rowe Price | | Retirement 2060 Fund | | 105,904 |

|

| | | | | $ | 142,186,925 |

|

* Party-in-interest

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| TETRA Technologies, Inc. 401(k) |

| Retirement Plan |

| |

By: | /s/Stuart M. Brightman |

| Stuart M. Brightman |

| President & Chief Executive Officer |

| TETRA Technologies, Inc. |

Date: June 26, 2015

EXHIBIT INDEX

|

| | |

EXHIBIT NO. | | DESCRIPTION |

23.1 | | Consent of Independent Registered Public Accounting Firm |

EXHIBIT 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statements (Form S-8 Nos. 33-41337, 333-04284, 333-149348) pertaining to the 401(k) Retirement Plan of TETRA Technologies, Inc. of our report dated June 26, 2015, with respect to the financial statements and schedule of TETRA Technologies, Inc. 401(k) Retirement Plan included in this Annual Report (Form 11-K) for the year ended

December 31, 2014.

/s/ Ernst & Young LLP

Houston, Texas

June 26, 2015

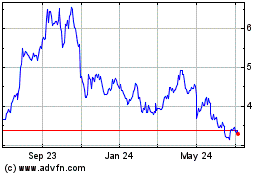

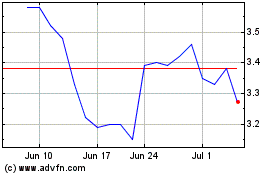

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Apr 2023 to Apr 2024