| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

|

TIM Participações S.A. and

TIM Participações S.A. and

subsidiaries

Quarterly Information as at

March 31, 2015

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

|

Company Information

Capital

Approval of Dividends

Parent Company Financial Statements

Balance Sheet Assets

Balance Sheet Liabilities and Shareholders' Equity

Statements of Income

Statements of Comprehensive Income

Statements of Cash Flow

Statements of Changes in Shareholders' Equity

01/01/2015 to 03/31/2015

01/01/2014 to 03/31/2014

Statements of Added Value

Consolidated Company Financial Statements

Balance Sheet Assets

Balance Sheet Liabilities and Shareholders' Equity

Statements of Income

Statements of Comprehensive Income

Statements of Cash Flow

Statements of Changes in Shareholders' Equity

01/01/2015 to 03/31/2015

01/01/2014 to 03/31/2014

Statements of Added Value

Earnings release

Notes to quarterly information

Opinions and Statements

Report of Independent Registered Public Accounting Firm - Unqualified

Fiscal's Council Opinion or Equivalent Board

Directors’ Statement on the Financial Statements

Director’s Statement on the Auditor’s Report on Special Review

| | | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Company Information

|

| | | | |

Company name:

| TIM PARTICIPAÇÕES SA

|

Last change in the Company Name:

| 08/30/2004

| Prior Company Name:

| Tele Celular Sul Participações S.A.

| |

Record date:

| 05/22/1998

| C.N.P.J.:

| 02.558.115/0001-21

| |

CVM Code:

| 01763-9

| CVM incorporation date:

| 08/19/1998

| |

Situação do Registro na CVM:

| Active

| Inicial date of record date at CVM:

| 09/10/1998

| |

Country of origin:

| Brazil

| Contry of securities registration:

| Brazil

| |

Issuer's page in Internet:

| www.tim.com.br/ri

|

|

| |

Type of participant:

| Listed Company

|

|

| |

Record category at CVM:

| Categoria A

| Current category registration date:

| 01/01/2010

| |

Issuer's situation:

| Operational

| Inicial date:

| 10/09/1998

| |

Type of Control:

| Private

| Last change in control:

|

| |

Last change in accounting period

|

| Accounting period:

| Day: 31 Month: 03

| |

Activity:

| Telecommunication

| |

Activity description:

|

| |

Journal name

| Journal State

| | | |

Jornal do Commercio

| RJ

| | | |

Valor Econômico

| SP

| | | |

| | | | |

Country

| Incorporation date

| | | |

United States of America

| 12/16/1998

| | | |

| | | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Parent Company Information – Capital

|

| |

Number of Shares

| Current Quarter

|

(units)

| 03/31/2015

|

Paid up capital

| |

Common

| 2,421,032,479

|

Preferred

| -

|

Total

| 2,421,032,479

|

Treasury Stock

| |

Common

| 795,888

|

Preferred

| -

|

Total

| 795,888

|

| | | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Parent Company Information – Approval of Dividends

|

| | | | | | |

Event

| Approval

| Proceeds

| First Payment

| Especie

| Class

| Dividends per Stock (Reais / Stock)

|

-

| -

| -

| -

| -

| -

| -

|

| | | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Parent Company Balance Sheet - Assets

(in thousands of Reais)

|

| | | |

Account Code

| Account Description

| 03/31/2015

| 12/31/2014

|

1

| Total Assets

| 16,102,378

| 15,787,526

|

1.01

| Current Assets

| 460,051

| 463,010

|

1.01.01

| Cash and Cash Equivalents

| 42,262

| 43,455

|

1.01.03

| Trade Accounts Receivable

| 329

| 329

|

1.01.03.02

| Other Accounts Receivable

| 329

| 329

|

1.01.06

| Taxes and Contributions Recoverable

| 20,889

| 20,648

|

1.01.06.01

| Current Taxes and Contributions Recoverable

| 20,889

| 20,648

|

1.01.06.01.02

| Direct Taxes and Contributions Recoverable

| 20,889

| 20,648

|

1.01.08

| Other Current Assets

| 396,571

| 398,578

|

1.01.08.03

| Others

| 396,571

| 398,578

|

1.01.08.03.01

| Dividends receivable

| 385,835

| 385,835

|

1.01.08.03.03

| Other Assets

| 10,736

| 12,743

|

1.02

| Non-Current Assets

| 15,642,327

| 15,324,516

|

1.02.01

| Long-Term Assets

| 66,234

| 65,729

|

1.02.01.01

| Financial assets valued at fair value through profit or loss

| 99

| 98

|

1.02.01.01.02

| Available for Sale

| 99

| 98

|

1.02.01.09

| Other Non-Current Assets

| 66,135

| 65,631

|

1.02.01.09.05

| Judicial Deposits

| 66,135

| 65,631

|

1.02.02

| Investments

| 15,418,537

| 15,101,231

|

1.02.02.01

| Investments on Subsidiaries

| 15,418,537

| 15,101,231

|

1.02.02.01.02

| Investments on Subsidiaries

| 15,418,537

| 15,101,231

|

1.02.04

| Intangible

| 157,556

| 157,556

|

1.02.04.01

| Intangible Assets

| 157,556

| 157,556

|

| | | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Parent Company Balance Sheet – Liabilities and Shareholders’ Equity

(in thousands of Reais)

|

| | | |

Account Code

| Account Description

| 03/31/2015

| 12/31/2014

|

2

| Total Liabilities

| 16,102,378

| 15,787,526

|

2.01

| Current Liabilities

| 432,345

| 432,125

|

2.01.01

| Social and Labor Obligations

| 2,543

| 2,119

|

2.01.01.02

| Labor Obligations

| 2,543

| 2,119

|

2.01.02

| Suppliers - Trade Payable

| 1,181

| 1,218

|

2.01.02.01

| Domestic Suppliers

| 1,181

| 1,218

|

2.01.03

| Taxes, fees and contributions payable

| 122

| 239

|

2.01.03.01

| Federal Obligations

| 81

| 204

|

2.01.03.01.02

| Other Federal Obligations

| 81

| 204

|

2.01.03.03

| Municipal Obligations

| 41

| 35

|

2.01.03.03.01

| ISS

| 41

| 35

|

2.01.05

| Other Obligations

| 428,499

| 428,549

|

2.01.05.02

| Others

| 428,499

| 428,549

|

2.01.05.02.01

| Dividends payable

| 420,945

| 421,002

|

2.01.05.02.04

| Other Current Liabilities

| 7,554

| 7,547

|

2.02

| Non-Current Liabilities

| 33,742

| 33,367

|

2.02.02

| Other Obligations

| 29,764

| 29,764

|

2.02.02.02

| Others

| 29,764

| 29,764

|

2.02.02.02.03

| Other Liabilities

| 29,764

| 29,764

|

2.02.04

| Provisions

| 3,978

| 3,603

|

2.02.04.01

| Tax, Labor and Civil Provisions

| 3,978

| 3,603

|

2.02.04.01.02

| Civil and Labor Provisions

| 3,478

| 3,103

|

2.02.04.01.05

| Regulatory Provisions

| 500

| 500

|

2.03

| Shareholders' Equity

| 15,636,291

| 15,322,034

|

2.03.01

| Paid up Capital

| 9,866,298

| 9,866,298

|

2.03.02

| Capital Reserves

| 1,342,657

| 1,341,101

|

2.03.02.01

| Offering's Goodwill

| 380,560

| 380,560

|

2.03.02.04

| Stock Option

| 17,928

| 16,372

|

2.03.02.05

| Treasury Stock

| (3,369)

| (3,369)

|

2.03.02.07

| Reserve for Tax Benefits

| 947,538

| 947,538

|

2.03.04

| Revenue Reserves

| 4,112,332

| 4,112,332

|

2.03.04.01

| Legal Reserve

| 515,956

| 515,956

|

2.03.04.10

| Reserve for expansion

| 3,596,376

| 3,596,376

|

2.03.05

| Retained Earnings

| 312,701

| -

|

2.03.08

| Other Comprehensive Income

| 2,303

| 2,303

|

| | | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Parent Company - Statements of Income

(in thousands of Reais)

|

| | | |

Account Code

| Account Description

| Year-to-date - current year 01/01/2015 to 03/31/2015

| Year-to-date - current year 01/01/2014 to 03/31/2014

|

3.04

| Operating Revenues (Expenses)

| 311,432

| 371,711

|

3.04.02

| General and Administrative

| (4,103)

| (5,645)

|

3.04.05

| Other Operating Expenses

| (347)

| (5)

|

3.04.06

| Equity Pick Up

| 315,882

| 377,361

|

3.05

| Operating Income

| 311,432

| 371,711

|

3.06

| Financial Results

| 1,269

| 421

|

3.06.01

| Financial Revenues

| 1,431

| 555

|

3.06.02

| Financial Expenses

| (162)

| (134)

|

3.07

| Income Before Taxes /Profit Sharing

| 312,701

| 372,132

|

3.09

| Profit for the Period

| 312,701

| 372,132

|

3.11

| Profit for the Period

| 312,701

| 372,132

|

3.99

| Earnings per share (R$/share)

| -

| -

|

3.99.01

| Earnings per share basic

| -

| -

|

3.99.01.01

| ON

| 0.12920

| 0.15397

|

3.99.02

| Earnings per share diluted

| -

| -

|

3.99.02.01

| ON

| 0.12916

| 0.15385

|

| | | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Parent Company - Statements of Comprehensive Income

(in thousands of Reais)

|

| | | |

Account Code

| Account Description

| Year-to-date - current year 01/01/2015 to 03/31/2015

| Year-to-date - current year 01/01/2014 to 03/31/2014

|

4.01

| Profit for the Period

| 312,701

| 372,132

|

4.03

| Comprehensive Income for the Period

| 312,701

| 372,132

|

| | | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Parent Company - Statements of Cash Flow (Indirect Method)

(in thousands of Reais)

|

| | | |

Account Code

| Account Description

| Year-to-date - current year 01/01/2015 to 03/31/2015

| Year-to-date - current year 01/01/2014 to 03/31/2014

|

6.01

| Net cash and cash equivalents used by operating activities

| (1,135)

| (7,093)

|

6.01.01

| Cash and cash equivalents used by operating activities

| (2,854)

| (5,057)

|

6.01.01.01

| Earning before income tax (EBIT)

| 312,701

| 372,132

|

6.01.01.03

| Equity in equity pick up

| (315,882)

| (377,361)

|

6.01.01.06

| Provision for administrative and legal proceedings

| 403

| -

|

6.01.01.08

| Monetary fluctuation on judicial deposits and provision for administrative and legal proceedings

| (209)

| (106)

|

6.01.01.09

| Stock options

| 133

| 278

|

6.01.02

| Variations in assets and liabilities

| 1,719

| (2,036)

|

6.01.02.01

| Taxes and contributions recoverable

| (241)

| 244

|

6.01.02.03

| Judicial Deposits

| (282)

| (3,902)

|

6.01.02.04

| Other current and non-current assets

| 2,007

| (873)

|

6.01.02.05

| Labor obligations

| 424

| 640

|

6.01.02.06

| Suppliers

| (37)

| 1,861

|

6.01.02.07

| Taxes, fees and contributions payable

| (117)

| (15)

|

6.01.02.08

| Payments of legal and administrative proceedings

| (41)

| -

|

6.01.02.09

| Other current and non-current liabilites

| 6

| 9

|

6.02

| Net cash and cash equivalents generated (used) by investment activities

| (1)

| 11

|

6.02.01

| Financial assets valued at fair value through profit or loss

| (1)

| 11

|

6.03

| Net cash and cash equivalents used by financing activities

| (57)

| (41)

|

6.03.04

| Dividends paid

| (57)

| (41)

|

6.05

| Decrease on cash and cash equivalents

| (1,193)

| (7,123)

|

6.05.01

| Beginning cash and cash equivalents balance

| 43,455

| 19,112

|

6.05.02

| Ending cash and cash equivalents balance

| 42,262

| 11,989

|

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Parent Company Statements of Changes in Shareholders´ Equity from 01/01/2015 to 03/31/2015

(in thousands of Reais)

|

| | | | | | | |

Account Code

| Account Description

| Capital

| Capital Reserves

| Revenues Reserves

| Retained Earnings

| Other Comprehensive Income

| TOTAL SHAREHOLDERS' EQUITY

|

5.01

| Beginning balance

| 9,866,298

| 1,341,101

| 4,112,332

| -

| 2,303

| 15,322,034

|

5.03

| Adjusted Beginning balance

| 9,866,298

| 1,341,101

| 4,112,332

| -

| 2,303

| 15,322,034

|

5.04

| Shareholder´s Transactions

| -

| 1,556

| -

| -

| -

| 1,556

|

5.04.03

| Stock option

| -

| 1,556

| -

| -

| -

| 1,556

|

5.05

| Total Comprehensive Income

| -

| -

| -

| 312,701

| -

| 312,701

|

5.05.01

| Profit for the Period

| -

| -

| -

| 312,701

| -

| 312,701

|

5.07

| Ending balance

| 9,866,298

| 1,342,657

| 4,112,332

| 312,701

| 2,303

| 15,636,291

|

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Parent Company Statements of Changes in Shareholders´ Equity from 01/01/2014 to 03/31/2014

(in thousands of Reais)

|

| | | | | | | |

Account Code

| Account Description

| Capital

| Capital Reserves

| Revenues Reserves

| Retained Earnings

| Other Comprehensive Income

| TOTAL SHAREHOLDERS' EQUITY

|

5.01

| Beginning balance

| 9,839,770

| 1,214,271

| 3,538,586

| -

| 2,013

| 14,594,640

|

5.03

| Adjusted Beginning balance

| 9,839,770

| 1,214,271

| 3,538,586

| -

| 2,013

| 14,594,640

|

5.04

| Shareholder´s Transactions

| -

| 1,550

| -

| -

| -

| 1,550

|

5.04.03

| Stock option

| -

| 1,550

| -

| -

| -

| 1,550

|

5.05

| Total Comprehensive Income

| -

| -

| -

| 372,132

| -

| 372,132

|

5.05.01

| Profit for the Period

| -

| -

| -

| 372,132

| -

| 372,132

|

5.07

| Ending balance

| 9,839,770

| 1,215,821

| 3,538,586

| 372,132

| 2,013

| 14,968,322

|

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Parent Company Statements of Added Value

(in thousands of Reais)

|

| | | |

Account Code

| Account Description

| Year-to-date - current year 01/01/2015 to 03/31/2015

| Year-to-date - current year 01/01/2014 to 03/31/2014

|

7.02

| Raw Material Acquired from Third Parties

| (1,025)

| (2,527)

|

7.02.02

| Material, Energy, Services and Others

| (1,025)

| (2,527)

|

7.03

| Gross Added Value

| (1,025)

| (2,527)

|

7.05

| Net Added Value Produced

| (1,025)

| (2,527)

|

7.06

| Added Value Received from Transfers

| 317,313

| 377,916

|

7.06.01

| Equity Pick Up

| 315,882

| 377,361

|

7.06.02

| Financial Revenues

| 1,431

| 555

|

7.07

| Total Added Value to Share

| 316,288

| 375,389

|

7.08

| Sharing Added Value

| 316,288

| 375,389

|

7.08.01

| Labor

| 2,392

| 2,428

|

7.08.01.01

| Remuneration

| 2,067

| 2,132

|

7.08.01.02

| Benefits

| 253

| 255

|

7.08.01.03

| F.G.T.S.

| 50

| 41

|

7.08.01.04

| Others

| 22

| -

|

7.08.02

| Taxes, Fees and Contributions

| 993

| 649

|

7.08.02.01

| Federal

| 979

| 634

|

7.08.02.03

| Municipal

| 14

| 15

|

7.08.03

| Earnings - Borrowed Capital

| 202

| 180

|

7.08.03.01

| Interest

| 151

| 131

|

7.08.03.02

| Rentals

| 51

| 49

|

7.08.04

| Earnings - Owned Capital

| 312,701

| 372,132

|

7.08.04.03

| Retained Earnings

| 312,701

| 372,132

|

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Consolidated Company Balance Sheet - Assets

(in thousands of Reais)

|

| | | |

Account Code

| Account Description

| 03/31/2015

| 12/31/2014

|

1

| Total assets

| 31,947,477

| 32,695,111

|

1.01

| Current Assets

| 10,172,230

| 11,174,415

|

1.01.01

| Cash and Cash Equivalents

| 3,550,188

| 5,232,992

|

1.01.03

| Trade Accounts Receivable

| 3,223,756

| 3,537,417

|

1.01.03.01

| Clients

| 3,223,756

| 3,537,417

|

1.01.04

| Inventories

| 385,687

| 264,033

|

1.01.06

| Taxes and Contributions Recoverable

| 1,727,982

| 1,642,625

|

1.01.06.01

| Current Taxes and Contributions Recoverable

| 1,727,982

| 1,642,625

|

1.01.06.01.01

| Indirect Taxes and Contributions Recoverable

| 1,320,330

| 1,285,143

|

1.01.06.01.02

| Direct Taxes and Contributions Recoverable

| 407,652

| 357,482

|

1.01.07

| Prepaid Expenses

| 975,691

| 266,264

|

1.01.08

| Other Current Assets

| 308,926

| 231,084

|

1.01.08.03

| Others

| 308,926

| 231,084

|

1.01.08.03.01

| Operations with derivatives

| 112,059

| 47,541

|

1.01.08.03.02

| Other assets

| 195,342

| 182,018

|

1.01.08.03.03

| Financial leasing

| 1,525

| 1,525

|

1.02

| Non-Current Assets

| 21,775,247

| 21,520,696

|

1.02.01

| Long-Term Assets

| 3,385,417

| 3,283,133

|

1.02.01.01

| Financial assets valued at fair value through profit or loss

| 40,911

| 41,149

|

1.02.01.01.01

| Available for Sale

| 40,911

| 41,149

|

1.02.01.03

| Trade Accounts Receivable

| 27,872

| 29,886

|

1.02.01.03.01

| Clients

| 27,872

| 29,886

|

1.02.01.06

| Deferred Taxes

| 870,977

| 889,064

|

1.02.01.06.01

| Deferred Income Tax and Social Contribution

| 870,977

| 889,064

|

1.02.01.07

| Prepaid Expenses

| 63,233

| 70,587

|

1.02.01.09

| Other Non-Current Assets

| 2,382,424

| 2,252,447

|

1.02.01.09.03

| Operations with derivatives

| 547,174

| 463,157

|

1.02.01.09.04

| Other Non-Current Assets

| 11,934

| 11,926

|

1.02.01.09.05

| Judicial Deposits

| 1,016,618

| 986,017

|

1.02.01.09.06

| Indirect Taxes and Contributions Recoverable

| 588,309

| 574,490

|

1.02.01.09.07

| Direct Taxes and Contributions Recoverable

| 23,657

| 23,346

|

1.02.01.09.08

| Financial leasing

| 194,732

| 193,511

|

1.02.03

| Property, Plant and Equipment

| 8,928,056

| 8,914,929

|

1.02.03.01

| Property, Plant and Equipment in Operation

| 8,357,091

| 8,243,084

|

1.02.03.03

| Construction work in progress

| 570,965

| 671,845

|

1.02.04

| Intangible

| 9,461,774

| 9,322,634

|

1.02.04.01

| Intangible Assets

| 7,934,555

| 7,795,415

|

1.02.04.01.02

| Software rights

| 3,129,308

| 3,025,260

|

1.02.04.01.03

| Authorizations

| 1,391,607

| 1,463,353

|

1.02.04.01.04

| Other Intangible

| 3,413,640

| 3,306,802

|

1.02.04.02

| Goodwill

| 1,527,219

| 1,527,219

|

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Consolidated Company Balance Sheet - Liabilities and Shareholders´ Equity

(in thousands of Reais)

|

| | | |

Account Code

| Account Description

| 03/31/2015

| 12/31/2014

|

2

| Total liabilities

| 31,947,477

| 32,695,111

|

2.01

| Current Liabilities

| 7,543,827

| 9,123,256

|

2.01.01

| Social and Labor Obligations

| 248,733

| 208,629

|

2.01.01.02

| Labor Obligations

| 248,733

| 208,629

|

2.01.02

| Suppliers - Trade Payable

| 4,020,126

| 5,402,204

|

2.01.02.01

| Domestic Suppliers

| 3,884,965

| 5,295,382

|

2.01.02.02

| Non-Domestic Suppliers

| 135,161

| 106,822

|

2.01.03

| Taxes, fees and contributions payable

| 670,121

| 808,207

|

2.01.03.01

| Federal Obligations

| 142,606

| 207,586

|

2.01.03.01.01

| Income Tax and Social Contribution Payable

| 33,863

| 74,891

|

2.01.03.01.02

| Other Federal Obligations

| 108,743

| 132,695

|

2.01.03.02

| State Obligations

| 487,750

| 561,845

|

2.01.03.02.01

| ICMS

| 487,750

| 561,845

|

2.01.03.03

| Municipal Obligations

| 39,765

| 38,776

|

2.01.03.03.01

| ISS

| 39,765

| 38,776

|

2.01.04

| Loans and Financing

| 1,252,763

| 1,281,554

|

2.01.04.01

| Loans and Financing

| 1,252,763

| 1,281,554

|

2.01.04.01.01

| Domestic Currency

| 871,729

| 966,039

|

2.01.04.01.02

| Other Currencies

| 381,034

| 315,515

|

2.01.05

| Other Obligations

| 1,352,084

| 1,422,662

|

2.01.05.02

| Others

| 1,352,084

| 1,422,662

|

2.01.05.02.01

| Dividends payable

| 420,945

| 421,002

|

2.01.05.02.04

| Operations with derivatives

| 64,374

| 67,044

|

2.01.05.02.05

| Authorizations Payable

| 435,083

| 493,169

|

2.01.05.02.06

| Other liabilities

| 427,780

| 437,805

|

2.01.05.02.07

| Financial leasing

| 3,902

| 3,642

|

2.02

| Non-Current Liabilities

| 8,767,359

| 8,249,821

|

2.02.01

| Loans and Financing

| 5,799,412

| 5,472,865

|

2.02.01.01

| Loans and Financing

| 5,799,412

| 5,472,865

|

2.02.01.01.01

| Domestic Currency

| 3,281,454

| 3,374,733

|

2.02.01.01.02

| Other Currencies

| 2,517,958

| 2,098,132

|

2.02.02

| Other Obligations

| 1,701,916

| 1,602,354

|

2.02.02.02

| Others

| 1,701,916

| 1,602,354

|

2.02.02.02.03

| Operations with derivatives

| 10,892

| -

|

2.02.02.02.04

| Indirect Taxes, Fees and Contributions Payable

| 96

| 94

|

2.02.02.02.05

| Direct Taxes and Contributions Payable

| 232,039

| 229,027

|

2.02.02.02.06

| Authorizations Payable

| 970,954

| 879,012

|

2.02.02.02.07

| Other liabilities

| 159,454

| 168,194

|

2.02.02.02.08

| Financial leasing

| 328,481

| 326,027

|

2.02.03

| Deferred Taxes

| 563,486

| 481,173

|

2.02.03.01

| Deferred Income Tax and Social Contribution

| 563,486

| 481,173

|

2.02.04

| Provisions

| 702,545

| 693,429

|

2.02.04.01

| Tax, Labor and Civil Provisions

| 428,435

| 407,154

|

2.02.04.01.01

| Tax Provisions

| 207,700

| 194,845

|

2.02.04.01.02

| Civil and Labor Provisions

| 64,891

| 62,947

|

2.02.04.01.03

| Benefits Provisions

| 644

| 645

|

2.02.04.01.04

| Civil Provisions

| 108,902

| 103,303

|

2.02.04.01.05

| Regulatory Provisions

| 46,298

| 45,414

|

2.02.04.02

| Other Provisions

| 274,110

| 286,275

|

2.02.04.02.03

| Asset Retirement Obligation

| 274,110

| 286,275

|

2.03

| Shareholders' Equity

| 15,636,291

| 15,322,034

|

2.03.01

| Paid up Capital

| 9,866,298

| 9,866,298

|

2.03.02

| Capital Reserves

| 1,342,657

| 1,341,101

|

2.03.02.01

| Offering's Goodwill

| 380,560

| 380,560

|

2.03.02.04

| Stock Option

| 17,928

| 16,372

|

2.03.02.05

| Treasury stock

| (3,369)

| (3,369)

|

2.03.02.07

| Reserve for Tax Benefits

| 947,538

| 947,538

|

2.03.04

| Revenue Reserves

| 4,112,332

| 4,112,332

|

2.03.04.01

| Legal Reserve

| 515,956

| 515,956

|

2.03.04.10

| Reserve for expansion

| 3,596,376

| 3,596,376

|

2.03.05

| Retained Earnings

| 312,701

| -

|

2.03.08

| Other Comprehensive Income

| 2,303

| 2,303

|

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Consolidated Company Statements of Income

(in thousands of Reais)

|

| | | |

Account Code

| Account Description

| Year-to-date - current year 01/01/2015 to 03/31/2015

| Year-to-date - current year 01/01/2014 to 03/31/2014

|

3.01

| Net Operating Revenues from Goods Sold and/or Services Rendered

| 4,546,712

| 4,702,224

|

3.02

| Cost of Goods Sold and/or Services Rendered

| (2,314,853)

| (2,429,774)

|

3.03

| Gross Income

| 2,231,859

| 2,272,450

|

3.04

| Operating Revenues (Expenses)

| (1,703,658)

| (1,685,475)

|

3.04.01

| Sales

| (1,243,330)

| (1,245,073)

|

3.04.02

| General and Administrative

| (278,127)

| (251,297)

|

3.04.04

| Other Operating Revenues

| 18,602

| 9,096

|

3.04.05

| Other Operating Expenses

| (200,803)

| (198,201)

|

3.04.05.01

| Authorizations' Amortization

| (84,004)

| (78,410)

|

3.04.05.02

| Other Operating Expenses

| (116,799)

| (119,791)

|

3.05

| Operating Income

| 528,201

| 586,975

|

3.06

| Financial Results

| (77,738)

| (35,835)

|

3.06.01

| Financial Revenues

| 691,362

| 158,281

|

3.06.02

| Financial Expenses

| (769,100)

| (194,116)

|

3.07

| Income Before Taxes /Profit Sharing

| 450,463

| 551,140

|

3.08

| Income Tax and Social Contribution

| (137,762)

| (179,008)

|

3.08.01

| Current

| (37,362)

| (131,825)

|

3.08.02

| Deferred

| (100,400)

| (47,183)

|

3.09

| Profit for the Period

| 312,701

| 372,132

|

3.11

| Consolidated Profit for the Period

| 312,701

| 372,132

|

3.11.01

| Atributted to shareholders

| 312,701

| 372,132

|

3.99

| Earnings per share (R$/share)

| -

| -

|

3.99.01

| Earnings per share basic

| -

| -

|

3.99.01.01

| ON

| 0.12920

| 0.15397

|

3.99.02

| Earnings per share diluted

| -

| -

|

3.99.02.01

| ON

| 0.12916

| 0.15385

|

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Consolidated Company Statements of Comprehensive Income

(in thousands of Reais)

|

| | | |

Account Code

| Account Description

| Year-to-date - current year 01/01/2015 to 03/31/2015

| Year-to-date - current year 01/01/2014 to 03/31/2014

|

4.01

| Profit for the Period

| 312,701

| 372,132

|

4.03

| Comprehensive Income for the Period

| 312,701

| 372,132

|

4.03.01

| Atributted to Shareholder's

| 312,701

| 372,132

|

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Consolidated Company Statements of Cash Flow – Indirect Method

(in thousands of Reais)

|

| | | |

Accont Code

| Account description

| Year-to-date - current year 01/01/2015 to 03/31/2015

| Year-to-date - current year 01/01/2014 to 03/31/2014

|

6.01

| Net cash and cash equivalents used by operating activities

| (727,345)

| (1,028,383)

|

6.01.01

| Cash and cash equivalents generated by operating activities

| 1,576,073

| 1,558,076

|

6.01.01.01

| Earning before income tax (EBIT)

| 450,463

| 551,141

|

6.01.01.02

| Depreciation and amortization

| 811,299

| 730,313

|

6.01.01.03

| Monetary fluctuation on judicial deposits and provision for administrative and legal proceedings

| (3,826)

| 6,430

|

6.01.01.04

| Loss and disposal of fixed assets

| 73

| 2,147

|

6.01.01.05

| Stock options

| 1,556

| 1,550

|

6.01.01.06

| Provision for administrative and legal proceedings

| 69,739

| 65,049

|

6.01.01.07

| Interest on ARO

| 1,927

| 1,586

|

6.01.01.08

| Interest and monetary and exchange variation on loans and other financial adjustments

| 182,941

| 113,111

|

6.01.01.10

| Allowance for doubtful accounts

| 56,541

| 76,103

|

6.01.01.12

| Interest on leasing payable

| 11,170

| 10,646

|

6.01.01.13

| Interest on leasing receivable

| (5,810)

| -

|

6.01.02

| Variations in assets and liabilities

| (2,303,418)

| (2,586,459)

|

6.01.02.01

| Trade Accounts receivable

| 284,213

| (60,009)

|

6.01.02.02

| Taxes and contributions recoverable

| (98,171)

| (155,041)

|

6.01.02.03

| Inventories

| (121,653)

| (32,596)

|

6.01.02.04

| Prepaid expenses

| (702,073)

| (750,509)

|

6.01.02.05

| Escrow deposits

| (20,053)

| (41,513)

|

6.01.02.06

| Other current and non-current assets

| (10,972)

| (34,966)

|

6.01.02.07

| Labor obligations

| 40,104

| 32,089

|

6.01.02.08

| Suppliers

| (1,419,787)

| (1,431,004)

|

6.01.02.09

| Taxes, fees and Contributions payable

| (179,075)

| (38,944)

|

6.01.02.10

| Payments of legal and administrative proceedings

| (55,179)

| (51,571)

|

6.01.02.11

| Authorizations payable

| 13,309

| (4,097)

|

6.01.02.12

| Other current and non-current liabilities

| (34,080)

| (18,298)

|

6.01.02.13

| Actuarial liability

| (1)

| -

|

6.02

| Net cash and cash equivalents used by investing activities

| (923,509)

| (620,257)

|

6.02.01

| Financial assets valued at fair value through profit or loss

| 238

| (7,380)

|

6.02.02

| Additions to property plant and equipment and intangibles

| (909,655)

| (605,925)

|

6.02.03

| ARO

| (14,092)

| (6,952)

|

6.03

| Net cash and cash equivalents used by financing activities

| (31,950)

| (19,729)

|

6.03.01

| New loans

| -

| 211,426

|

6.03.02

| Loans amortization

| (323,372)

| (240,386)

|

6.03.03

| Dividends paid

| (57)

| (41)

|

6.03.04

| Operations with derivatives

| 295,353

| 16,549

|

6.03.05

| Refund granted to shareholders - stocks group TIM Fiber RJ S.A.

| (7)

| (1)

|

6.03.06

| Financial leasing payable disbursement

| (8,456)

| (7,276)

|

6.03.07

| Financial leasing receivable receipts

| 4,589

| -

|

6.05

| Decrease on cash and cash equivalents

| (1,682,804)

| (1,668,369)

|

6.05.01

| Beginning cash and cash equivalents balance

| 5,232,992

| 5,287,642

|

6.05.02

| Ending cash and cash equivalents balance

| 3,550,188

| 3,619,273

|

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Consolidated Company Statements of Changes in Shareholders´ Equity from 01/01/2015 to 03/31/2015

(in thousands of Reais)

|

| | | | | | | | | |

Account Code

| Account Description

| Capital

| Capital Reserves

| Revenues Reserves

| Retained Earnings

| Other Comprehensive Income

| TOTAL SHAREHOLDERS' EQUITY

| Minority Interest

| Consolidated SHAREHOLDERS' EQUITY

|

5.01

| Beginning balance

| 9,866,298

| 1,341,101

| 4,112,332

| -

| 2,303

| 15,322,034

| -

| 15,322,034

|

5.03

| Adjusted Beginning balance

| 9,866,298

| 1,341,101

| 4,112,332

| -

| 2,303

| 15,322,034

| -

| 15,322,034

|

5.04

| Shareholder´s Transactions

| -

| 1,556

| -

| -

| -

| 1,556

| -

| 1,556

|

5.04.03

| Stock option

| -

| 1,556

| -

| -

| -

| 1,556

| -

| 1,556

|

5.05

| Total Comprehensive Income

| -

| -

| -

| 312,701

| -

| 312,701

| -

| 312,701

|

5.05.01

| Profit for the Period

| -

| -

| -

| 312,701

| -

| 312,701

| -

| 312,701

|

5.07

| Ending balance

| 9,866,298

| 1,342,657

| 4,112,332

| 312,701

| 2,303

| 15,636,291

| -

| 15,636,291

|

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Consolidated Company Statements of Changes in Shareholders´ Equity from 01/01/2014 to 03/31/2014

(in thousands of Reais)

|

| | | | | | | | | |

Account Code

| Account Description

| Capital

| Capital Reserves

| Revenues Reserves

| Retained Earnings

| Other Comprehensive Income

| TOTAL SHAREHOLDERS' EQUITY

| Minority Interest

| Consolidated SHAREHOLDERS' EQUITY

|

5.01

| Beginning balance

| 9,839,770

| 1,214,271

| 3,538,586

| -

| 2,013

| 14,594,640

| -

| 14,594,640

|

5.03

| Adjusted Beginning balance

| 9,839,770

| 1,214,271

| 3,538,586

| -

| 2,013

| 14,594,640

| -

| 14,594,640

|

5.04

| Shareholder´s Transactions

| -

| 1,550

| -

| -

| -

| 1,550

| -

| 1,550

|

5.04.03

| Stock option

| -

| 1,550

| -

| -

| -

| 1,550

| -

| 1,550

|

5.05

| Total Comprehensive Income

| -

| -

| -

| 372,132

| -

| 372,132

| -

| 372,132

|

5.05.01

| Profit for the Period

| -

| -

| -

| 372,132

| -

| 372,132

| -

| 372,132

|

5.07

| Ending balance

| 9,839,770

| 1,215,821

| 3,538,586

| 372,132

| 2,013

| 14,968,322

| -

| 14,968,322

|

| | |

Free Translation into English of Quarterly Information (ITR)Originally Issued in Portuguese

Consolidated Company Statements of Added Value

(in thousands of Reais)

|

| | | |

Account Code

| Account Description

| Year-to-date - current year 01/01/2015 to 03/31/2015

| Year-to-date - current year 01/01/2014 to 03/31/2014

|

7.01

| Revenues

| 6,132,535

| 6,251,152

|

7.01.01

| Net Operating Revenues from Goods Sold and/or Services Rendered

| 6,189,076

| 6,327,255

|

7.01.04

| Allowance for doubtful accounts

| (56,541)

| (76,103)

|

7.02

| Raw Material Acquired from Third Parties

| (2,427,935)

| (2,617,248)

|

7.02.01

| Cost of Goods Sold and/or Services Rendered

| (1,551,667)

| (1,727,931)

|

7.02.02

| Material, Energy, Services and Others

| (876,268)

| (889,317)

|

7.03

| Gross Added Value

| 3,704,600

| 3,633,904

|

7.04

| Retentions

| (811,300)

| (730,313)

|

7.04.01

| Depreciation and Amortization

| (811,300)

| (730,313)

|

7.05

| Net Added Value Produced

| 2,893,300

| 2,903,591

|

7.06

| Added Value Received from Transfers

| 691,363

| 158,281

|

7.06.02

| Financial Revenues

| 691,363

| 158,281

|

7.07

| Total Added Value to Share

| 3,584,663

| 3,061,872

|

7.08

| Sharing Added Value

| 3,584,663

| 3,061,872

|

7.08.01

| Labor

| 205,880

| 186,514

|

7.08.01.01

| Remuneration

| 146,809

| 132,949

|

7.08.01.02

| Benefits

| 41,472

| 37,723

|

7.08.01.03

| F.G.T.S.

| 13,859

| 12,058

|

7.08.01.04

| Others

| 3,740

| 3,784

|

7.08.02

| Taxes, Fees and Contributions

| 2,148,244

| 2,168,317

|

7.08.02.01

| Federal

| 779,272

| 819,811

|

7.08.02.02

| State

| 1,361,907

| 1,342,421

|

7.08.02.03

| Municipal

| 7,065

| 6,085

|

7.08.03

| Earnings - Borrowed Capital

| 917,838

| 334,909

|

7.08.03.01

| Interest

| 768,591

| 192,772

|

7.08.03.02

| Rentals

| 149,247

| 142,137

|

7.08.04

| Earnings - Owned Capital

| 312,701

| 372,132

|

7.08.04.03

| Retained Earnings

| 312,701

| 372,132

|

TIM Participações S.A. and

TIM Participações S.A. and Subsidiaries

EARNINGS RELEASE

(A free translation of the original in Portuguese)

TIM PARTICIPAÇÕES S.A. Announces its Consolidated Results for the First Quarter of 2015

|

|

|

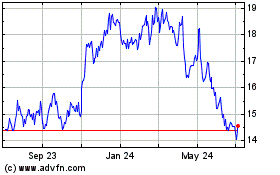

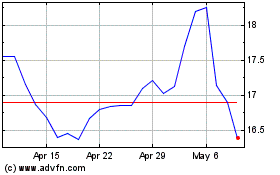

BM&FBOVESPA*

(lot = 1 share)

TIMP3: R$9.66

NYSE*

(1 ADR = 5 ON shares)

TSU: US$15.51

(*) closing prices of May 5th, 2015

|

Rio de Janeiro, May 5th, 2015 – TIM Participações S.A. (BOVESPA: TIMP3; and NYSE: TSU), the company which controls directly TIM Celular S.A. and Intelig Telecomunicações Ltda., announces its results for the first quarter of 2015. TIM Participações S.A. (“TIM Participações” or “TIM”) provides telecommunication services with a nationwide presence in Brazil.

The following financial and operating consolidated information, except where otherwise indicated, is presented according to IFRS (International Financial Reporting Standards) and in Brazilian Reais (R$), pursuant to Brazilian Corporate Law. All comparisons refer to the first of 2014 (1Q14) and fourth quarter of 2014 (4Q14), except when otherwise indicated. |

Investor Relations Contacts

ri@timbrasil.com.br

Twitter: @TIM ri

www.tim.com.br/ir

(+55 21) 4109-3360 / 4109-4017 / 4109-3751 / 4109-3446

TIM IR App:

![[tsurelease1q15003.gif]](tsurelease1q15003.gif)

|

Operational Highlights

·

Post-paid “Control Plan” posted a strong performance in 1Q15 with +23% YoY;

·

Data services came at 34 million users, +27% YoY and already 45% of total base;

·

Smartphones accounting for 90% of devices sold in 1Q15. Penetration of smartphone over total base reached 53%;

·

Data ARPU grew 29% YoY in 1Q15 (vs. 18% YoY in 1Q14);

·

Strong investments in Network & Infrastructure of around R$1 bln, largely financed by tower sales;

·

Live TIM reached 150k users in 1Q15, doubling versus 1Q14. Addressable households reached ~1.7 mln.

Financial Highlights

·

+3.5% of net revenues “Business Generated” (outgoing+VAS) versus 1Q14.

·

+46% YoY on gross data revenues (ex-SMS);

·

Fixed business recovered: Net Revenues at +12% YoY in 1Q15;

·

Costs under control, with total opex -5% YoY in 1Q15;

·

EBITDA margin 29.5%, continuing expand on a yearly basis (28% in 1Q14) and resilient EBITDA growth of 2% YoY in 1Q15. |

MESSAGE FROM CEO

Dear Shareholders, Analysts and Stakeholders,

As we have highlighted for the close of the 2014 fiscal year, we start 2015 in a much tougher macroeconomic environment, with a reduction in expectations for growth and a significant appreciation of the FX from a year prior. Composing this picture, we also continue to observe the very fast transformation of the mobile industry towards a data world, in line with the company’s strategy and key market trends.

But despite this more challenging scenario, the company continued to present solid execution, demonstrating the resilience of our core business and its main operational metrics even in face of short-term revenue headwinds due to a new round of regulatory MTR (VU-M) reductions and an acceleration of the SMS decline, impacted by the widespread adoption of the messaging app global phenomenon, which has also an impact on the overall industry voice usage.

While continuing to execute on its long-term strategy of becoming a leader in Mobile Internet, based on the most innovative data portfolio in the industry as well as on a robust infrastructure investment plan announced earlier this year, TIM delivered in the first quarter of 2015 a very positive performance of data revenue growth (+46% YoY), with solid postpaid growth, outgoing revenue growth of 3.5%, a reduction of 5.3% in Opex, improving fixed business results and an increase in the Service EBITDA margin to the mid 30s, leading to positive EBITDA growth of 1.7%.

Accelerating infrastructure investments: Close to R$ 1billion invested in the quarter

After announcing our most recent 3-year industrial plan in February, where a clear commitment with the development of a data-centric infrastructure was presented, the first quarter of 2015 demonstrated the company’s adherence to the strategy and its execution capacity on the infrastructure front. In the first quarter alone we invested R$924 million on network infrastructure, an impressive increase of 51% over investments during the same period in 2014. It is also important to state that the absolute majority of total investments were allocated to the growth of the 3G and 4G networks and its supporting fiber optics transmission, in line with the vision of building a solid data-centric infrastructure for the future.

The intensive approach to infrastructure remains a key component of our strategic pillars, and continues to bring significant improvements to our quality indicators. As a highlight, in the recent publication of Anatel’s conclusions on TIM’s results of its Quality Improvement Plan initiated in 2012, the agency highlights the “clear signals of quality investment, with investments in levels above originally planned, continuous improvements in the results and in the reduction of complaints”. By following the results published on Anatel’s own quality app, it is possible to see TIM as the operator with the largest number of 4G antennas in the state capitals, as well as a leadership position in the largest city in the country, São Paulo, in the dimensions of both voice as well as 3G data accessibility.

Based on these improvements, we see important advancements in our overall mobile operator preference as well as in postpaid perception in the results of our customer satisfaction surveys. We believe those metrics are a strong signal we are on the right track, and we will continue to accelerate to develop a leading class data infrastructure in the country.

Solid performance of Data services: Accounting for 1/3 of total service revenues

Q1 2015 represented yet another strong quarter for the performance of our Data services, fueled by the continuous network infrastructure improvements, penetration of smartphones in our user base and adoption of our data connectivity, content and application offers. Total data users grew 27% when compared to the same quarter in 2014, and data+content revenues accelerated to an impressive 46% YoY, also lifted by a Data ARPU increase of close to 30% YoY. With this performance, even with a significant decline in SMS revenues, overall VAS revenues advanced to represent 32% of total service revenues, clearly indicating the sustainability of the mobile data-centric strategy.

4G also grew consistently during the quarter, and, through net additions of over 2.4 million users when compared to Q1 14, TIM continued to grow its 4G market share to beyond 30%, in a clear demonstration of successful market positioning for the future.

Innovative offers: Bridging the community effect and migrating to data

As of the end of 2014, TIM led the offer innovation in the industry again with a strategic alliance with the world’s largest messaging provider, WhatsApp, and promotionally included zero-rated access to the OTT’s application in some of our flagship Control Plans. Starting in Q1, we extended this promotion and innovation to most of our postpaid plans, as well as just recently announced the extension to prepaid data plans as well, a move which clearly differentiates TIM as the offer innovator in data. With the massive adoption of data and messaging services, in addition to providing a differentiated benefit to our user base, we start to see a reduction in the dependency of voice communities as the element of choice for new prepaid and control plan subscribers, and position TIM as the first mover in adapting to this market trend.

Disciplined approach on costs leads to all time high Q1 EBITDA margin

During the short-term transition scenarios which present revenue headwinds as already mentioned, a focused, disciplined approach to operational efficiency is a must, and TIM continues to execute well in this dimension. Based on cost reduction in leased lines and in several components of G&A as well as S&M expenses, the company’s overall Operating Expenses were reduced by over 5% YoY, leading to a 1.7% positive growth of EBITDA and to record total and service EBITDA margins, at respectively 29.5% and 35.3%. Important to highlight that excluding the MTR reduction effects, EBITDA growth would be at the +8.9% YoY mark, indicating the long-term sustainability of the operational results achieved. As for Net Profit, first quarter ended with R$312million, impacted by the effect of higher depreciation and amortization due to the acceleration of our Capex rollout in the short-term.

Conclusion and Perspectives

In summary, we open 2015 with yet another quarter of positive results, in a balanced view of strategic, operational and financial indicators. As highlighted during the announcement of our 2015-2017 industrial plan, despite the potential short-term challenges such as the macroeconomic scenario and revenue headwinds due to the structural transformation of the industry’s business models, we remain committed to our long-term vision and execution, and believe TIM is successfully positioning to be a winner in the Mobile Data landscape which is now being shaped. Offer innovation, future-proof infrastructure investments and a differentiation on customer experience are the main elements of this vision, which continues to be supported by an incredibly strong and committed team and a genuine desire to “connect and take care of each customer, so everyone can do more”.

Rodrigo Abreu

CEO

MARKETING PROGRESS

WhatsApp offer extended in 1Q15

Following the success and solid customer adherence in 4Q14, the Company has extended the WhatsApp offer to Express family plans, which has as main feature the billing process through a credit card. With WhatsApp offer, the most used messaging application in Brazil, customers are allowed to send unlimited messages, share photos and videos through the app without consuming customers’ data package. The offer is available at both Liberty Express +40 and Liberty Express +120 plans.

Liberty Express +40 costs R$74.90/month and in addition to unlimited WhatsApp messages, customers will also have (i) unlimited local and long distance on-net calls, (ii) 40 minutes of local off-net calls (iii) 300MB of data cap, (iii) unlimited SMS to any operator, (iv) unlimited access to TIMmusic by deezer and (v) R$10 of credit for additional services. Liberty Express +120 is priced at R$124.90/month and has the same benefits as Liberty Express +40 but with 120 minutes of local off-net calls and a data cap of 600MB.

TIM Money: to Infinity customers

In partnership with Caixa Econômica bank and MasterCard, TIM launched a financial product called TIM Multibank Caixa, a virtual version of a prepaid banking card associated with a mobile number. The product will enable TIM customers to pay bills, perform bank transfers and top up through its own handset for mobile services and also to make purchases with a MasterCard card. The product is designed to empower unbanked people, which represent more than 50% of the Company’s prepaid base.

Value Added Services: Actively driving content

To support ongoing VAS revenues growth TIM kept pushing forward on innovative products for its customer base. In the first quarter TIM launched three new content products:

·

TIM Audiobook: provides unlimited access to a wide range of audiobooks enabling customers to sync to smartphones and tablets in order to access the app’s content without the need for internet connection. Charges a fixed amount on a weekly (R$3.99) or monthly (R$18.99) basis.

·

TIM Kids: an entertainment and education platform for children that provides multiple content such as videos, books, music and games for R$3.99 per week.

·

TIM Income Tax: a service that helps customers to complete income tax forms through SMS and/or website for R$1.99 per week.

Handset Business

In 1Q15, TIM promoted two major handset launches: the 4G version of the new Moto G by Motorola and the Samsung Galaxy J1. The new version of the best-selling smartphone in Motorola's history is equipped with 4G technology, support for dual chip and is designed to offer faster connectivity and better performance to listen to music and even watch movies.

Launched exclusive by TIM in March, the new Samsung Galaxy J1 is considered to be the best value 4G enabled device in the market. The smartphone features 12GB internal memory, 2MP front camera and support for dual chip for R$679. All devices sold by TIM are unlocked and can be paid up to 12 installments using a credit card.

As for the market share of smartphones, TIM maintained the leadership position among the players in March, with a solid position of 48.5%.

Other Marketing Iniciatives:

Blah App: 1 million downloads – To celebrate the milestone of one million downloads TIM released data traffic for the app, allowing customers to send unlimited messages, share photos and videos through the app without consuming data package.

Soccer – Partnership program was extended to Paraná State to develop agreements with its two major soccer teams. Additionally, the Company launched the TIM Torcedor app to offer exclusive content from each supported club and enables fans to buy tickets through the handset.

SmarTV Top Up – In partnership with Samsung, TIM launched an innovative service that will allow customers to top up any prepaid or control plan through their own Samsung SmartTV menu.

Corporate Internet Shared Plan – The Liberty Company Multi plan allows corporate clients to connect up to three different devices in a single data package. The plan offers packages from 1GB to 50GB per month starting at R$34.90.

OPERATIONAL PERFORMANCE

BRAZILIAN MOBILE MARKET OVERVIEW

(Information based on the most recent data released by Anatel – February/15)

Brazilian mobile market reached 282.6 million lines by the end of February/15, adding 1.8 million lines in the period which represents a yearly growth of 3.6%, to a penetration rate of 138.7%, up from 135.0% in February/14. Overall subscriber base has reduced the pace, mainly due to: i) high penetrated market, with customers using multiple SIM-cards and ii) macroeconomic slowdown with tightening policies. Nonetheless, some segments are still experience double digit growth, such as machine-to-machine business, the hybrid plans (aka “Controle”) and recently data plans.

·

Postpaid segment reached 68.8 million lines in February (+13.4% versus Feb/14) with net adds reaching 963.6k lines (vs. 1.1 million in the same period of last year).

·

Prepaid segment reached 213.8 million lines (virtually flat YoY), accounting for 75.7% of total Brazilian market (vs. 77.8% in Feb/14). Net adds for prepaid reached 862.0k lines (vs. 502.6k in the same period of last year).

TIM has maintained its market share position versus the 1Q14, as described below:

TIM’s PERFORMANCE

(Internal figures for March/15)

TIM’s subscriber base reached 75.7 million lines in March, up 2.5% when compared to the same period of last year.

3G technology: TIM’s total subscriber base with 3G devices ended 1Q15 with 42.3 million users, a sound increase near to 60% against the same period of last year, and demonstrating the success of company’s strategy to stimulate the smartphone’s penetration among its users through data offers.

As for the 4G, TIM reached another important milestone of 3.0 million users by the end of March/15, an increase of almost 50% over December/14, and 990k new users in the quarter, a clear evidence that the Company’s strategy on 4G is paying off.

Net additions totaled 29 thousand lines (vs. 486 thousand in the same period of last year), as a result of gross addition of 9.4 million lines (up 1.6% vs. 1Q14), minus disconnections totaling 9.3 million lines in the period (up 6.8% YoY). Churn rate in 1Q15 stood at 12.3% and up from 11.9% in the same period of last year.

Postpaid customer base reached 13.0 million users in March/15, 6.4% yearly growth. During 1Q15, TIM added 507 thousands users in the postpaid segment (vs. -56k net adds in the same period of last year).

As for prepaid segment, 1Q15 ended with 62.7 million users, up 1.7% YoY. “Infinity Pré” accounted for 60.0 million users or 95.4% of the prepaid customer base. TIM continues to lead the prepaid market in Brazil, with market share of 29.5% in that segment, thanks to its pioneering position, simplicity and transparent concepts.

Live TIM: Moving to the next level

Live TIM ended 1Q15 reaching the milestone of 150 thousand users, adding almost 20 thousand new clients in the quarter and doubling the customer base of 75 thousand users from the 1Q14. Most of customers are on the 35Mbps offer, nevertheless, as the portfolio grows, customers are adhering to higher speeds.

Current average speed is at ~35Mbps per connection, way above market average of 3.0Mbps. It is worth mentioning that the good results achieved are mainly due to top notch quality of the service, which is reflecting on customer’s satisfaction index above market average.

At the end of 1Q15, Live TIM had 26.6 thousand buildings connected (vs. 11.9 thousand in 1Q14), and an addressable market of over 1.7 million households in São Paulo and Rio de Janeiro regions. Prospect clients registered in Live TIM’s website reached another milestone of 1 million (vs. 597k in 1Q14).

4

QUALITY AND NETWORK

QUALITTY DEVELOPMENTS

As for network quality KPI’s we will be showing this quarter an indicator based on the number of states that met the agency’s target. All figures shown below are the official data disclosed by Anatel. Considering voice indicators, from November/14 onward TIM stood within Anatel’s target, both accessibility and drop metrics, in 100% of states where the Company provide services at. As for data indicators in 3G network, the same result was achieved in data drop connections metric, while accessibility reached 93% in February/15.

This quarter, Anatel released the results of its 2-year Quality Plan which was carried out from August/2012 to July/2014. The overall result was based on Anatel’s network indicators (accessibility and drop) in both voice and data over 26 states and the federal district, their capitals and cities over 300,000 inhabitants. The results show TIM with significant performance, with 86.1% in July/2014 of all metrics within Anatel’s Quality Plan targets. When compared to February/2015 results, TIM posted an increase of 400bps, reaching 90.1% of all metrics within target.

Also within the scope of the Anatel’s Quality Plan (2012-14), it has also disclosed the number of complaints at the agency. Regarding TIM results, its worth highlighting that complaints related to network services (over 100,000 users) posted a relevant decrease of 41% in the period while general complaints stood flat.

In addition to Anatel’s indicators, Company’s effort to improve quality is also being translated into a significant evolution in terms of customer perception as shown in a recent customer satisfaction survey developed by Provokers – an independent agency hired by TIM. The market research indicates that TIM has managed to maintain its high levels of overall services preference (29%), becoming the number one player in that category. It’s also worth highlighting that TIM is managing to reduce rejection levels in the postpaid segment to 14% in Nov/14 from 17% in Nov/12, another sign that investments in quality are paying off.

Regarding quality indicators related to data usage, particularly on Speed Test (measured by Ookla1), TIM is pleased to announce that it has been continuously improving its performance in Throughput and Latency indicators. Average throughput (downlink) in 2G/3G network in 1Q15 posted an increase of 80% YoY, staying above market average for the first quarter since 1Q14. As for latency, TIM stood as the company with the lowest latency levels, being 26% below market average.

As for caring indicators, TIM’s group (mobile and fixed) kept its position of being the least demanded economic group at the consumer’s protection agencies (PROCON - SINDEC2) in 1Q15, with a volume of demands 60% lower than the market’s average in the quarter.

NETWORK EVOLUTION

As for network evolution, aproximately 700 TRXs (elements for voice), coupled with more than 600 access elements (BTS, NodeB and e-NodeB) and 1.7 thousand km of optical fiber were implemented in the first quarter of 2015. The elements implementation roll out along with other network prospects – such as sites densification, Wi-Fi and small cell expansion, backhauling infrastructure development, cell-site fine tuning and others – are allowing the Company to keep improving its network quality.

TIM Wi-Fi project kept its good pace in the first quarter. The company added 164 new hotspots, totaling more than 1,5K in the whole country. Comparing with the same period of 2014, the number of hotspots increased 70%. Also, TIM Wi-Fi is available in 22 airports of 15 states.

In the first quarter of 2015, the Mobile BroadBand Project (MBB) focused its efforts on the coverage densification of the most important cities that were already included in 2014. Those cities are the pilar of the mobile VAS revenue growth. In 2014, the MBB project reached 125 cities and the plan is reach 195 until the end of 2015.

Cities that have completed the MBB implementation reached a remarkable average throughput gain, which proves the efficient approach used by the project, tackling Access (HSPA+ and dual carrier), Transport (backhaul and backbone using FTTS and high capacity microwave links), and IP-Core (caching, peering and transit).

GSM coverage totaled 94.9% of the urban population in the first quarter of 2015, serving 3,439 cities. 3G coverage reached 78 new cities in 1Q15, serving 1,414 cities or 79.7% of the urban population in Brazil. The Company executed a efficienty implementation plan during the first quarter of 2015, increasing significantly the number of cities covered with 3G. As for the 4G, TIM finished the first quarter of 2015 with 38.3% of the Brazilian urban population covered, +2.7 p.p. when compared to the 4Q14.

CORPORATE SOCIAL RESPONSIBILITY

TIM Institute, whose mission is to create and enhance resources for the democratization of science, technology, and innovation in Brazil, continues, in 2015, with ten initiatives underway, all guided by four principles: education, technology applications, inclusion, and work.

In March of this year, TIM Tec, another project of TIM Institute, which offers distance professionalizing courses to more than 3 thousands students on 10 diferents subjects. This project uses the Massive Open Online Course – MOOC concept, on which every course released on the web are for free and open. This plataform focuses on students from high school and from other technical and professionalizing courses. This initiative is also aligned with the federal government program for professional and technical educational, called PRONATEC.

In continuity with the partnership, stablished since 2014, with Brazilian Public School Mathematical Olympiad (OBMEP), the Institute started funding 50 scholarships for the students who choose to enroll on exact sciences graduation courses. Students must have won medals during previous editions of OBMEP and have chosen graduation courses such as Astronomy, Biology, Computing, Engineering, Statistics, Physics, Mathematics or Chemistry. Each one of the selected students will receive R$1,200 for 12 months, renewable for 48 months. In 2014, the OBMEP completed 10 years, with more than 18 millions participating students and 6,5 thousands winners.

It is also important to highlight that, for the fifth consecutive year, TIM was confirmed on the Carbon Efficient Index (ICO2), of BVM&FBovespa, which is composed by companies compromised with sustainable development and whose adopt low carbon cost practices.

ENERGY CONSUMPTION

In line with its Environmental Policy principles, TIM considers energy consumption as one of its challenges, that evolves according to the table below.

Energy efficiency is carried out through some actions, such as: Swap project (replacing the access equipment with more modern and efficient models), and the RAN Sharing agreement. In environmental terms, this initiative reduces energy consumption and also has a positive urban impact as it implies in reducing the number of new stations, minimizing the inconvenience to population. (EN5 indicator, GRI3 3.1).

The Biosites are innovative structures that allow a specific network coverage with higher efficiency in the use of energy and space. By the end of March 2015 TIM had 68 activated Biosites, an expressive incremental when compared with 23 activated Biosites at December, 2014.

FINANCIAL PERFORMANCE

OPERATING REVENUES

Gross revenues totaled R$6,820 million in 1Q15 (-3.2% YoY), still impacted by a strong interconnection revenue (MTR and SMS) drop of 38.7% YoY. In this context, it is important to highlight VAS performance, growing 22% YoY contributing to a “Business Generated” (outgoing voice + data usage + other) revenues evolution.

Gross revenues breakdown and other highlights are presented as follows:

Usage and monthly fee gross revenues reached R$2,584 million in the quarter, a decrease of 7.8% YoY chiefly impacted by a tougher macroeconomic scenario and migration to data services.

Value Added Services (VAS) gross revenues totaled R$1,826 million in the quarter, another solid double digit growth of 22%. The increase was mainly driven by the growth of smartphones penetration, reaching 53.0% of customer base (vs. 33.7% in 1Q14) and the continuous growth of data customers, that reached 44.8% (up from 36.2% in 1Q14) of total base. It is important to point out that if we take into account only the prepaid users, which represents 82.8% of our customer base, the penetration of smartphones soared from 31.1% in 1Q14 to 52.8% in 1Q15.

As a percentage of mobile gross service revenues, VAS reached 32.0% in 1Q15 up from 25.2% in 1Q14.

Long distance gross revenues came at R$722 million in 1Q15, a drop of 11.4% YoY, as a result of commoditization process of this service and the switch of calls to data plataforms.

Interconnection gross revenues in 1Q15 dropped 38.7% YoY to R$475 million, chiefly influenced by MTR cuts of 25% in February 2014 and 33% in February 2015. Additionally SMS continued to be substituted by messaging applications.

Fixed business gross revenues, including TIM Soluções Corporativas, TIM Fixo and Live TIM, totaled R$236 million this quarter, an increase of 6.6% when compared to the same period of last year. This result is a consequence of successful efforts to restructure TIM Soluções Corporativas (former Intelig) and the consistent performance of the ultra broad-band business.

Other Mobile Revenues reached R$98.3 million in the quarter, a sound increase of 46.1% YoY, mainly driven by the growth on infrastructure sharing.

Product sales gross revenues increased by 1.8% YoY, reaching R$878 million in this quarter. This performance is mainly due to an increase of 24.5% YoY on the average sale price caused by a better sales mix (smartphones), compensating the reduction of 19.5% YoY in the number of devices sold during the quarter.

As a result, Total Net Revenues reached R$4,547 (-3.3% YoY) in 1Q15 and Net Serives Revenues at R$3,940 million (-3.9% YoY). “Business Generated” Revenues grew 3.5% YoY.

For a better understanding of business operational performance, excluding MTR cuts effects, total net services revenues in this quarter would have totaled R$4,097 million, flat on a year-over-year basis.

The magnitude of MTR incidence on revenues have been decreasing significantly and achieving its lowest level at approximately 10%.

ARPU (average revenue per user) reached R$17 in 1Q15, down -5.5% YoY, largely impacted by MTR cut aforesaid. However, ARPU ex-MTR impact would have fallen by only 1.6% YoY.

MOU (minutes of use) reached 120 minutes in 1Q15, down 14.0% when compared to 1Q14, mostly due to the surge of new technologies related to data and consequent usage pattern migration.

OPERATING COSTS AND EXPENSES

In first quarter of 2015, Total Opex reached R$3,207 million, a decrease of -5.3% YoY or R$178 million, mostly explained by a strong saving of network & interconnection costs (-15.1% YoY), which more than compensated higher personal expenses (+11.4% YoY) and higher handset costs (+1.8% YoY). Excluding handset costs in Q1, total operating expenses were down by 6.9% YoY.

Operating expenses breakdown in 1Q15 is presented as follows:

Personnel Expenses reached R$254 million, up 11.4% YoY in 1Q15. The variation is mainly driven by an increase in the total number of employees, reaching 12,785 people in the 1Q15, up by 4.6% or 560 people when compared to 1Q14. Network expansion and insource program, together with own stores expansion (to 175 in 1Q15 from 162 in 1Q14) were the main drivers for such increase. Also, the Company adjusted salaries near to inflation on top of others benefits adjustments.

Selling & Marketing expenses amounted to R$984 million in the quarter, stable versus last year, due to less expenditures on rents, shipping of customer’s bills and handset’s distribution cost. These effects helped to compensate higher expenditures on commissioning and advertising. On the other hand, prepaid disconnection policy aided TIM to keep a clean customer base, showing a downward trend for FISTEL taxes at -1% YoY to R$256 mln.

Network & Interconnection costs totaled R$1,014 million this quarter, a solid reduction of 15.1% over 1Q14. The performance of this line is still heavly driven by MTR cut, voice and SMS off-net traffic reduction, , and also 10% YoY drop of leased linecost, following the development of own infrastructure and TIM Fiber network utilization.

In the first quarter, General & Administrative expenses (G&A) amounted to R$143 million, a drop of 4.4% YoY. The result is driven mainly by the reduction in legal advisory services expenses related to the tower sale process and savings on maintainance costs.

Cost of Goods Sold reached R$657 million, up 1.8% when compared to 1Q14, due to a better device mix, concentrated in smartphones, following the strategy to equip the customer base, and offsetting a lower volume of handsets sold (-19.5% YoY).

Bad debt in the quarter came at R$57 million and as percentage of gross revenues, it reached 0.83% in 1Q15 (vs. 1.08% in 1Q14), a good performance considering a tougher macroeconomic scenario.

Other operating expenses totaled R$98 million, a drop of 11% YoY mainly due to a reduction in fines paid during the quarter and lower contingencies.

Subscriber Acquisition Costs (where SAC = subsidy + commissioning + total advertising expenses) came at R$31 per gross adds in 1Q15, an increase of 4.6% YoY, as a result of higher commissioning expenses due to the mix of postpaid gross additions. SAC/ARPU ratio (indicating the payback per customer) remained at 2.1x in 1Q15, stable when compared to 1Q14.

FROM EBITDA TO NET INCOME

In 1Q15, EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) totaled R$1,340 million, 1.7% higher compared to R$1,317 million in 1Q14. Improving EBITDA performance has been supported, throughout the last quarters, by a better contribution margin4 (+1.7% YoY) as value added services continue to play a key role, along with a lower off-net traffic cost for voice and SMS and continuos savings on network cost.

EBITDA margin of 29.5% showed once again a significant improvement of 145bps, reaching historical levels for a first quarter. In the same period of last year, EBITDA margin stood at 28.0%. EBITDA margin on services (excluding handset revenues and costs) came at 35.3% in 1Q15, up by 209bps when compared to 33.2% in the same period of last year.

Excluding MTR cut impact, EBITDA would have reached R$1,434 million in 1Q15, representing a 8.9% yearly growth. It is also important to highlight that EBITDA exposure to the MTR effects have been constantly dropping, renewing once again its lowest level of 14%.

In 1Q15, Depreciation and Amortization totaled R$811 million, up 11.1% YoY when compared to the same period of last year due to an increase in depreciation and amortization, following an acceleration of network and infrastructure investments.

EBIT (earnings before interest and taxes) totaled R$528 million in 1Q15, representing a decrease of 10.0% YoY while EBIT margin came at 11.6% (vs. 12.5% in 1Q14).

Net financial result came at -R$78 million, an increase vs. -R$36 million in the same period of last year, mainly due to the “mark-to-market” (MTM) of our hedging portfolio that registered a variation of -R$23 million in 1Q15 compared to a positive R$30 million in 1Q14. In light of the mentioned effect, Financial Expenses reached R$247 million in the quarter (+38.9% YoY). This performance was partially compensated by higher Financial Revenues (R$167 million, +16.7% YoY), largely impacted by higher interest on cash position.

Income and Social Contribution taxes came at R$138 million, representing a decrease of -23.0% when compared to R$179 million in the same period of last year due to a reduction in the tax base for income tax and social contribution (earnings before tax decreased -18.3% YoY). Effective tax rate decreased to 30.6% in 1Q15 from 32.5% in 1Q14.

Net Income totaled R$313 million, a decrease of 16.0% YoY and EPS (Earnings per Share) reached R$0.13 in 1Q15 (vs. R$0.15 in 1Q14).

CAPEX

Capex reached R$924 million, a sound increase of 50.7% when compared to 1Q14, due to higher investments in network aiming to improve availability and quality of services. It’s worth highlighting that 93% of the total Capex in Q1 has been dedicated to infrastructure, largely related to 3G and 4G technologies.

DEBT, CASH AND FREE CASH FLOW

Gross Debt reached R$6,669 million in the end of march/15, including the first disbursement in 2Q14 of R$1,749 million by BNDES to help financing CAPEX 2014-15 and R$65.1 million related to the adjusted EAD payment of the 700 MHz auction that is under discussion (booked as debt since 4Q14).