Report of Foreign Issuer (6-k)

July 17 2015 - 6:27AM

Edgar (US Regulatory)

1934 Act Registration

No. 1-14700

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2015

Taiwan

Semiconductor Manufacturing Company Ltd.

(Translation of Registrant’s Name Into English)

No. 8, Li-Hsin Rd. 6,

Hsinchu Science Park,

Taiwan

(Address of

Principal Executive Offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F þ Form 40-F ¨

(Indicate by check mark whether the registrant by furnishing the information contained in

this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ¨ No

þ

(If “Yes” is marked, indicated below the file number assigned to the registrant

in connection with Rule 12g3-2(b): 82: .)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Company Ltd. |

|

|

|

|

| Date: July 17, 2015 |

|

|

|

By |

|

/s/ Lora Ho |

|

|

|

|

|

|

Lora Ho |

|

|

|

|

|

|

Vice President & Chief Financial Officer |

tsmc

2015 Second Quarter Earnings Conference

July 16, 2015

© 2015 TSMC, Ltd

Open Innovation Platform

tsmc

TSMC Property

Agenda

Welcome Elizabeth Sun

2Q15 Financial Results and 3Q15 Outlook Lora Ho

Key Messages Mark Liu / C.C. Wei / Lora Ho Q&A

© 2015 TSMC, Ltd

Open Innovation Platform

tsmc

TSMC Property

Safe Harbor Notice

TSMC’s statements of its current expectations are forward-looking statements subject to significant risks and uncertainties and actual results may differ materially from those

contained in the forward-looking statements.

Information as to those factors that could cause actual results to vary can be found in TSMC’s Annual Report on

Form 20-F filed with the United States Securities and Exchange Commission (the “SEC”) on April 13, 2015 and such other documents as TSMC may file with, or submit to, the SEC from time to time.

Except as required by law, we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

© 2015 TSMC, Ltd

Open Innovation Platform

|

|

Statements of Comprehensive Income

TSMC Property

Selected Items from Statements of Comprehensive Income 2Q15 2Q15 2Q15 2Q15 1Q15

2Q14 over over Guidance (In NT$ billions) 1Q15 2Q14 Net Revenue 205.44 204-207 222.03 183.02 -7.5% 12.2% Gross Margin 48.5% 47.5% - 49.5% 49.3% 49.8% -0.8 ppt -1.3 ppts Operating Expenses (22.56) (22.54) (20.25) 0.1% 11.4% Operating Margin 37.5%

36.5% - 38.5% 39.0% 38.6% -1.5 ppts -1.1 ppts Non-Operating Items 21.06 1.63 3.38 1189.8% 522.4% Net Income to Shareholders of the Parent Company 79.42 78.99 59.70 0.5% 33.0% Net Profit Margin 38.7% 35.6% 32.6% +3.1 ppts +6.1 ppts EPS (NT Dollar)

3.06 3.05 2.30 0.5% 33.0% ROE 29.0% 29.1% 26.9% -0.1 ppt +2.1 ppts Shipment (Kpcs, 12”-equiv. Wafer) 2,240 2,287 2,053 -2.1% 9.1% Average Exchange Rate--USD/NTD 30.84 31.03 31.53 30.12 -2.2% 2.4%

* Diluted weighted average outstanding shares were 25,930mn units in 2Q15.

** ROE figures are

annualized based on average equity attributable to shareholders of the parent company.

© 2015 TSMC, Ltd

Open Innovation Platform

|

|

TSMC Property

2Q15 Revenue by Application

Industrial/Standard 23% Computer 7% Consumer 8% Communication 62%

Communication 150 0 Revenue (NT$B) QoQ -3% 0 1Q15 2Q15

Computer 150 0 Revenue

(NT$B) QoQ -24% 0 1Q15 2Q15

Consumer 150 0 Revenue (NT$B) QoQ -21% 0 1Q15 2Q15

Industrial/Standard 150 0 Revenue (NT$B) QoQ -1% 0 1Q15 2Q15

© 2015

TSMC, Ltd

Open Innovation Platform

TSMC Property

2Q15 Revenue by Technology

0.15/0.18um 13% 0.25um and above 5% 20nm 20% 28nm 27% 40/45nm 14%

65nm 11% 90nm 7% 0.11/0.13um

28nm and above revenue

Revenue (NT$B)

100 90 80 70 60 50 40 30 20 10 0

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

2Q15

20nm Revenue (NT$B)

28 nm Revenue (NT$B)

© 2015 TSMC, Ltd

Open Innovation Platform

|

|

TSMC Property

© 2015 TSMC, Ltd

Balance Sheets & Key Indices

Selected Items from Balance Sheets 2Q15 1Q15 2Q14 (In NT$ billions) Amount % Amount % Amount % Cash & Marketable Securities 550.35 34.3% 518.98 33.3% 314.59 23.4% Accounts

Receivable 99.74 6.2% 99.12 6.4% 86.89 6.4% Inventories 66.28 4.1% 64.60 4.2% 50.95 3.8% Long-term Investments 27.77 1.7% 32.18 2.1% 28.38 2.1% Net PP&E 829.70 51.6% 813.22 52.2% 837.17 62.3% Total Assets 1,608.85 100.0% 1,556.90 100.0% 1,344.96

100.0% Current Liabilities 309.38 19.2% 187.56 12.1% 246.64 18.4% Long-term Interest-bearing Debts 202.66 12.6% 214.05 13.7% 211.65 15.7% Total Liabilities 542.22 33.7% 432.98 27.8% 467.31 34.8% Total Shareholders’ Equity 1,066.63 66.3%

1,123.92 72.2% 877.65 65.2% Key Indices A/R Turnover Days 44 44 40 Inventory Turnover Days 62 57 51 Current Ratio (x) 2.4 3.7 1.9 Asset Productivity (x) 1.0 1.1 0.9

* Total outstanding shares were 25,930mn units at 6/30/15.

** Asset

productivity = Annualized net revenue / Average net PP&E

|

|

Cash Flows

TSMC Property

(In NT$ billions) 2Q15 1Q15 2Q14 Beginning Balance 437.41 358.45 231.70 Cash

from operating activities 111.07 156.00 81.75 Capital expenditures (53.81) (48.88) (73.33) Short-term loans (12.99) (17.34) 10.40 Investments and others 47.22 (10.82) 4.53 Ending Balance 528.90 437.41 255.05 Free Cash Flow(1) 57.26 107.12 8.42

| (1) |

Free cash flow = Cash from operating activities – Capital expenditures

|

© 2015 TSMC, Ltd

3Q15 Guidance TSMC Property

Based on our current business outlook and exchange rate assumption, management expects:

Revenue to be between NT$ 207 billion and NT$ 210 billion, at a forecast exchange rate of 31.00 NT dollars to 1 US dollar

Gross profit margin to be between 47% and 49%

Operating profit margin to be between 36.5% and

38.5%

© 2015 TSMC, Ltd

Open Innovation Platform

|

|

TSMC Property

Recap of Recent Major Events

TSMC Pledges to Buy 100 million kWh of Green Power (

2015/06/16 )

TSMC Board of Directors Unanimously Re-elects Dr. Morris Chang as Chairman and Sets June 29 as Ex-dividend Date and July 5 as Record

Date for Common Share Dividends ( 2015/06/10 )

TSMC to Sell 5% of Vanguard International Semiconductor ( 2015/06/09 )

TSMC Shareholders Approve NT$4.5 Cash Dividend and Elect Board of Directors ( 2015/06/09 )

TSMC Announces Taichung Expansion Site Reforestation Plans ( 2015/05/21 )

TSMC Announces Candidates for Board of Directors ( 2015/04/24)

© 2015

TSMC, Ltd

Please visit TSMC’s website (http://www.tsmc.com) and Market Observation Post System (http://mops.twse.com.tw) for details and other announcements

TSMC Property

© 2015 TSMC, Ltd

http://www.tsmc.com invest@tsmc.com

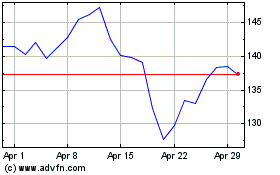

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

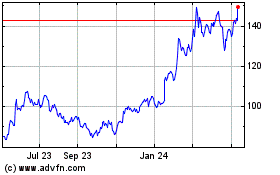

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024