As filed with the Securities and Exchange Commission on May 5, 2015

Registration No. 333-

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TRINITY

INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

75-0225040 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

|

|

| 2525 N. Stemmons Freeway

Dallas, Texas |

|

75207-2401 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

THIRD AMENDED AND RESTATED TRINITY INDUSTRIES, INC.

2004 STOCK OPTION AND INCENTIVE PLAN

(Full title of the plan)

S. THEIS RICE

Senior

Vice President and Chief Legal Officer

JARED S. RICHARDSON

Vice President, Associate General Counsel and Secretary

Trinity Industries, Inc.

2525 N. Stemmons Freeway

Dallas, Texas 75207-2401

(Name and address of agents for service)

(214) 631-4420

(Telephone number, including area code, of agents for service)

Indicate by check number whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

¨ |

|

Smaller reporting company |

|

¨ |

CALCULATION

OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of Securities

to be Registered |

|

Amount

to be

Registered(1)(2) |

|

Proposed

Maximum

Offering Price

Per Share(1) |

|

Proposed

Maximum Aggregate

Offering Price(1) |

|

Amount of

Registration Fee(1) |

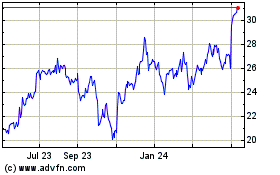

| Common Stock, $1.00 par value(1)(2) |

|

4,000,000 shares(2) |

|

$27.23 |

|

$108,920,000 |

|

$12,656.50 |

| |

| |

| (1) |

The offering price per share, aggregate offering price, and registration fee with respect to the shares of Common Stock, par value $1.00 per share, of Trinity Industries, Inc. issuable pursuant to the employee benefit

plan described herein have been calculated in accordance with Rule 457(c) and (h) under the Securities Act of 1933, as amended, based on the average of the high and low prices of the Trinity Industries, Inc. Common Stock on April 30, 2015 as

reported in the consolidated reporting system of the New York Stock Exchange. |

| (2) |

Pursuant to Rule 416 under the Securities Act of 1933, as amended, this Registration Statement also covers additional shares of common stock of the registrant as may be offered or issued as a result of stock splits,

stock dividends, or similar transactions. |

EXPLANATORY NOTE

Pursuant to General Instruction E to Form S-8, Trinity Industries, Inc. (“Trinity”) hereby incorporates by reference the contents of

each of the three previous Registration Statements filed by Trinity on Form S-8, which are (1) File No. 333-115376, filed with the Securities and Exchange Commission (the “Commission”) on May 11, 2004, (2) File

No. 333-169452, filed with the Commission on September 17, 2010, and (3) File No. 333-183941, filed with the Commission on September 17, 2012, including any amendments thereto or filings incorporated therein. This

Registration Statement is being filed to register an additional 4,000,000 shares of Common Stock of Trinity, $1.00 par value per share, for issuance under the Third Amended and Restated Trinity Industries, Inc. 2004 Stock Option and Incentive Plan,

pursuant to the terms of such plan.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified by Item 1 (Plan Information) and Item 2 (Registrant Information and Employee Plan Annual Information) of

Part I of Form S-8 is omitted from this filing in accordance with the provisions of Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”), and the introductory Note to Part I of Form S-8.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

ITEM 3. INCORPORATION OF DOCUMENTS BY REFERENCE.

Trinity hereby incorporates by reference the documents set forth below in this Registration Statement. All documents subsequently filed by

Trinity pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), prior to the filing of a post-effective amendment that indicates that all securities offered have been sold or

that deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing of such documents. Any statement contained in a document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent a statement contained herein or in any other subsequently filed document that also

is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

| (a) |

Trinity’s Annual Report on Form 10-K filed with the Commission for the fiscal year ended December 31, 2014; |

| (b) |

All other reports filed by Trinity with the Commission pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by Trinity’s Annual Report on Form 10-K referred to in

(a) above; and |

| (c) |

The description of Trinity’s Common Stock, $1.00 par value per share, contained in Trinity’s Registration Statement on Form S-3 dated September 15, 2014

(Registration No. 333-198744). |

ITEM 6. INDEMNIFICATION OF DIRECTORS AND OFFICERS.

Section 145(a) of the Delaware General Corporation Law (the “DGCL”), among other things, provides that a corporation may

indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (collectively, a “Proceeding”)

(other than an action by or in the right of the corporation) by reason of the fact that he or she is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer,

employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him or her in

connection with such action, suit or proceeding if the person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding,

had no reasonable cause to believe his or her conduct was unlawful.

Section 145(b) of the DGCL provides that a corporation may

indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that such person

acted in any of the capacities set forth above, whether for the corporation or at its request, against expenses (including attorneys’ fees) actually and reasonably incurred by him or her in connection with the defense or settlement of such

action or suit if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification may be made in respect of any claim, issue or matter as to

which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication

of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnification for such expenses which the court shall deem proper.

Section 145(c) of the DGCL also provides that, to the extent a present or former director or officer of a corporation has been successful

on the merits or otherwise in the defense of any action, suit or proceeding referred to above or in the defense of any claim, issue or matter therein, he or she shall be indemnified against expenses (including attorneys’ fees) actually and

reasonably incurred by him or her in connection therewith.

2

Section 145(f) of the DGCL provides that the statutory provisions on indemnification are not

exclusive of indemnification provided pursuant to the bylaws, indemnification agreements, vote of stockholders or disinterested directors or otherwise.

The Company’s Bylaws contain provisions regarding the indemnification of directors and officers. Article VI of the Company’s

Bylaws provides for the indemnification of its officers and directors to substantially the same extent permitted by the DGCL, except with respect to Proceedings to enforce indemnification rights, the Company may indemnify a director or officer in

connection with a Proceeding (or part thereof) initiated by that director or officer only if the Proceeding (or part thereof) was authorized by the Board of Directors of the Company. The indemnification described above (unless ordered by a court)

shall be paid by the Company unless a determination is made that indemnification of the director, officer, employee or agent is not proper in the circumstances because he or she has not met the applicable standard of conduct set forth above. This

determination must be made:

| |

• |

|

by the Company’s Board of Directors by a majority vote of a quorum consisting of directors who were not parties to such Proceeding; |

| |

• |

|

if such a quorum is not obtainable, or, even if obtainable a quorum of disinterested directors so directs, by independent legal counsel in a written opinion; or |

| |

• |

|

by the Company’s stockholders. |

Article VI of the Company’s Bylaws provides that

costs, charges and expenses (including attorneys’ fees) incurred by a person seeking indemnification under Article VI of the Company’s Bylaws in defending a Proceeding shall be paid by the Company in advance of the final disposition of

such Proceeding; provided, however, that the payment of such costs, charges and expenses incurred by a director or officer in his or her capacity as a director or officer (and not in any other capacity in which service was or is rendered by such

person while a director or officer) in advance of the final disposition of such Proceeding shall be made only upon receipt of an undertaking by or on behalf of the director or officer to repay all amounts so advanced in the event that it shall

ultimately be determined that such director or officer is not entitled to be indemnified by the Company. Such costs, charges and expenses incurred by other employees and agents may be so paid upon such terms and conditions, if any, as the

Company’s Board of Directors deems appropriate. The Company’s Board of Directors may, upon approval of such director, officer, employee or agent of the Company, authorize the Company’s counsel to represent such person in any

Proceeding, whether or not the Company is a party to such Proceeding.

Section 102(b)(7) of the DGCL provides that a corporation may

provide in its certificate of incorporation that a director of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, but excludes specifically liability

for any:

| |

• |

|

breach of the director’s duty of loyalty to the corporation or its stockholders; |

| |

• |

|

acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; |

| |

• |

|

payments of unlawful dividends or unlawful stock repurchases or redemptions; or |

| |

• |

|

transactions from which the director derived an improper personal benefit. |

The provision does

not limit equitable remedies, such as an injunction or rescission for breach of a director’s fiduciary duty of care.

The

Company’s Certificate of Incorporation, as amended, contains a provision eliminating the personal liability of a director from breaches of fiduciary duty, subject to the exceptions described above.

3

The Company has entered into indemnity agreements with some of its directors and officers that

establish contract rights to indemnification substantially similar to the rights to indemnification provided for in the Company’s Bylaws.

|

|

|

| EXHIBIT |

|

DESCRIPTION |

|

|

| 4.1 |

|

Specimen Common Stock Certificate of Trinity Industries, Inc. (incorporated by reference to Exhibit 4.1 to the Form S-8 Registration Statement (Registration Statement No. 333-159552) filed May 28, 2009). |

|

|

| 5.1* |

|

Opinion of Locke Lord LLP. |

|

|

| 23.1* |

|

Consent of Locke Lord LLP (included in Exhibit 5.1). |

|

|

| 23.2* |

|

Consent of Ernst & Young LLP. |

|

|

| 24.1* |

|

Power of Attorney (included on the signature pages of this Registration Statement). |

|

|

| 99.1* |

|

Third Amended and Restated Trinity Industries, Inc. 2004 Stock Option and Incentive Plan. |

4

ITEM 9. UNDERTAKINGS.

(a) Trinity hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or

any material change to such information in this Registration Statement;

provided, however, that paragraphs (a)(1)(i) and

(a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by Trinity pursuant to Section 13 or

Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

(2) That, for the purpose of

determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to

be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the

securities being registered which remain unsold at the termination of the offering.

(4) That, for purposes of determining any liability

under the Securities Act, each filing of Trinity’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act that is incorporated by reference in this Registration Statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(5) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling

persons of Trinity pursuant to the foregoing provisions, or otherwise, Trinity has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by Trinity of expenses incurred or paid by a director, officer or controlling person of Trinity in the successful defense of any action, suit or

proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, Trinity will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of

appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

5

SIGNATURES AND POWER OF ATTORNEY

Pursuant to the requirements of the Securities Act of 1933, Trinity certifies that it has reasonable grounds to believe that it meets all of

the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Dallas, State of Texas, on this 5th day of May, 2015.

|

|

|

| TRINITY INDUSTRIES, INC. |

|

|

| By: |

|

/s/ James E. Perry |

| Printed Name: |

|

James E. Perry |

| Title: |

|

Senior Vice President and Chief Financial Officer |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each individual whose signature appears below hereby constitutes and authorizes Timothy R. Wallace and

Jared S. Richardson, and each of them, each with full power to act without the other, his or her true and lawful attorneys-in-fact and agents, each with full power of substitution and resubstitution for him or her and in his or her name, place and

stead, in any and all capacities, to sign any or all amendments to this Registration Statement, and to file the same with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto

each of said attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in

person hereby ratifying and confirming that each of said attorneys-in-fact and agents or his or her substitutes may lawfully do or cause to be done by virtue hereto.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the

capacities and on the dates indicated:

|

|

|

|

|

| Name |

|

Title |

|

Date |

|

|

|

| /s/ Timothy R. Wallace |

|

Chairman, Chief Executive Officer, President and Director (Principal Executive Officer) |

|

May 4, 2015 |

| Timothy R. Wallace |

|

|

|

|

|

|

| /s/ James E. Perry |

|

Senior Vice President and Chief Financial Officer (Principal Financial Officer) |

|

May 4, 2015 |

| James E. Perry |

|

|

|

|

|

|

| /s/ Mary E. Henderson |

|

Vice President and Chief Accounting Officer

(Principal Accounting Officer) |

|

May 4, 2015 |

| Mary E. Henderson |

|

|

|

|

|

|

| /s/ John L. Adams |

|

Director |

|

May 4, 2015 |

| John L. Adams |

|

|

|

|

|

|

|

| /s/ Rhys J. Best |

|

Director |

|

May 4, 2015 |

| Rhys J. Best |

|

|

|

|

|

|

|

| /s/ David W. Biegler |

|

Director |

|

May 4, 2015 |

| David W. Biegler |

|

|

|

|

|

|

|

| /s/ Antonio Carrillo |

|

Director |

|

May 4, 2015 |

| Antonio Carrillo |

|

|

|

|

|

|

|

| /s/ Leldon E. Echols |

|

Director |

|

May 4, 2015 |

| Leldon E. Echols |

|

|

|

|

|

|

|

| /s/ Adrián Lajous |

|

Director |

|

May 4, 2015 |

| Adrián Lajous |

|

|

|

|

|

|

|

| /s/ Charles W. Matthews |

|

Director |

|

May 4, 2015 |

| Charles W. Matthews |

|

|

|

|

|

|

|

| /s/ Dunia A. Shive |

|

Director |

|

May 4, 2015 |

| Dunia A. Shive |

|

|

|

|

INDEX TO EXHIBITS

|

|

|

| Exhibit

Number |

|

Exhibit |

|

|

| 4.1 |

|

Specimen Common Stock Certificate of Trinity Industries, Inc. (incorporated by reference to Exhibit 4.1 to the Form S-8 Registration Statement (Registration Statement No. 333-159552) filed May 28, 2009). |

|

|

| 5.1* |

|

Opinion of Locke Lord LLP. |

|

|

| 23.1* |

|

Consent of Locke Lord LLP (included in Exhibit 5.1). |

|

|

| 23.2* |

|

Consent of Ernst & Young LLP. |

|

|

| 24.1* |

|

Power of Attorney (included on the signature pages of this Registration Statement). |

|

|

| 99.1* |

|

Third Amended and Restated Trinity Industries, Inc. 2004 Stock Option and Incentive Plan. |

Exhibit 5.1

|

|

|

|

|

2200 Ross Avenue, Suite 2200

Dallas, TX 75201 Telephone:

214-740-8000 Fax: 214-740-8800

www.lockelord.com

Van M. Jolas Direct Telephone:

214-740-8594 Direct Fax: 214-756-8594

vjolas@lockelord.com |

May 5, 2015

Trinity Industries, Inc.

2525 Stemmons Freeway

Dallas, Texas 75207-2401

| |

Re: |

Registration Statement on Form S-8 of 4,000,000 shares of Common Stock of Trinity Industries, Inc. |

Gentlemen:

We have acted as counsel to Trinity Industries, Inc., a Delaware corporation (the “Company”), with respect to certain legal

matters in connection with the registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to a Registration Statement on Form S-8 (the “Registration Statement”), filed with the Securities and

Exchange Commission, of the offer and sale of up to 4,000,000 shares of Common Stock, par value $1.00 per share (the “Common Stock”), pursuant to the Third Amended and Restated Trinity Industries, Inc. 2004 Stock Option and Incentive Plan

(the “Plan”).

In connection therewith, we have (i) examined (a) the Company’s Certificate of Incorporation, as

amended (the “Certificate of Incorporation”), and the Bylaws, as amended (the “Bylaws”), of the Company, (b) the corporate proceedings of the Company with respect to the approval of the Plan, (c) the Registration

Statement, and (d) such other documents as we have deemed necessary for the expression of the opinion contained herein, and (ii) investigated such matters of law as we have deemed relevant or necessary in rendering this opinion.

Based upon our examination of such papers and documents in rendering this opinion, and based on our review of the Delaware General Corporation

Law, applicable provisions of the Delaware Constitution and reported judicial decisions, we hereby advise you that we are of the opinion that, assuming with respect to shares of Common Stock issued after the date hereof, (i) the receipt of

proper consideration for the issuance thereof in excess of the par value thereof, (ii) the availability of a sufficient number of shares of Common Stock authorized by the Company’s Certificate of Incorporation then in effect,

(iii) compliance with the terms of any agreement entered into in connection with any options or shares of Common Stock or any other awards with respect to Common Stock issued under the Plan, and (iv) no change occurs in the applicable law

or the pertinent facts, the shares of Common Stock purchasable under the Plan will be legally issued, fully paid and non-assessable shares of Common Stock.

Atlanta | Austin | Boston | Chicago | Dallas | Hartford | Hong Kong | Houston | Istanbul | London | Los Angeles | Miami | Morristown | New

Orleans | New York | Orange County | Providence | Sacramento | San Francisco | Stamford | Tokyo | Washington DC | West Palm Beach

Trinity Industries, Inc.

May 5, 2015

Page 2

We have assumed the genuineness of all signatures and the authenticity of all documents

submitted to us as originals, and the conformity to original documents of all documents submitted to us as certified or photostatic copies. As to questions of fact material to this opinion, where such facts have not been independently established,

and as to the content and form of the Certificate of Incorporation, Bylaws, minutes, records, resolutions and other documents or writings of the Company, we have relied, to the extent we deem reasonably appropriate, upon representations or

certificates of officers or directors of the Company and upon documents, records and instruments furnished to us by the Company, without independent verification of their accuracy.

We consent to the filing of this opinion as Exhibit 5.1 to the Registration Statement filed by the Company with the Securities and Exchange

Commission. By so consenting, we do not thereby admit that our firm’s consent is required by Section 7 of the Securities Act.

|

|

|

| Very truly yours, |

|

| LOCKE LORD LLP |

|

|

| By: |

|

/s/ Van M. Jolas |

|

|

Van M. Jolas |

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statement (Form S-8 filed on May 5, 2015) pertaining to the Third Amended and Restated 2004

Trinity Industries, Inc. Stock Option and Incentive Plan of our reports dated February 19, 2015 with respect to the consolidated financial statements of Trinity Industries, Inc. and Subsidiaries and the effectiveness of internal control over

financial reporting of Trinity Industries, Inc. and Subsidiaries included in its Annual Report (Form 10-K) for the year ended December 31, 2014, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Dallas, Texas

May 5, 2015

Exhibit 99.1

THIRD AMENDED AND RESTATED

TRINITY INDUSTRIES, INC.

2004 STOCK OPTION AND INCENTIVE PLAN

1. Purpose of Plan. The Third Amended and Restated Trinity Industries, Inc. 2004 Stock Option and Incentive Plan is intended to enable

the Company to remain competitive and innovative in its ability to attract, motivate, reward and retain a strong management team of superior capability and to encourage a proprietary interest in the Company by persons who occupy key positions in the

Company or its Affiliates or who provide key consulting services to the Company or its Affiliates by enabling the Company to make awards that recognize the creation of value for the stockholders of the Company and promote the Company’s growth

and success. In furtherance of that purpose, eligible persons may receive stock options, stock appreciation rights, restricted stock, restricted stock units, performance awards, dividend equivalent rights, and other awards, or any combination

thereof.

2. Definitions. Unless the context otherwise requires, the following terms when used herein shall have the meanings set

forth below:

“Affiliate” — Any corporation, partnership or other entity in which the Company, directly or

indirectly, owns greater than a fifty percent (50%) interest.

“Award” — A Stock Option, Stock

Appreciation Right, Restricted Stock, Restricted Stock Unit, Performance Award, Dividend Equivalent Right or Other Award under this Plan.

“Board” — The Board of Directors of the Company, as the same may be constituted from time to time.

“Code” — The Internal Revenue Code of 1986, as amended from time to time.

“Committee” — The Committee appointed or designated by the Board to administer the Plan in accordance with

Section 3 hereof.

“Company” — Trinity Industries, Inc., a Delaware corporation, and its successors and

assigns.

“Consultant” means any person performing advisory or consulting services for the Company or an

Affiliate, with or without compensation, to whom the Company chooses to grant an Award in accordance with the Plan, provided that bona fide services must be rendered by such person and such services shall not be rendered in connection with

the offer or sale of securities in a capital raising transaction.

“Disability” — Qualification for

long-term disability benefits under the Company’s or Affiliate’s (as applicable) disability plan or insurance policy; or, if no such plan or policy is then in existence or if the person is not eligible to participate in such plan or

policy, permanent and total inability to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment.

“Dividend Equivalent Right” — The right of the holder thereof to receive credits based on the cash dividends

that would have been paid on the Shares specified in the Award if the Shares were held by the eligible employee to whom the Award is made.

“Effective Date” — The effective date of the Plan as set forth in Section 23.

“Exchange Act” — The Securities Exchange Act of 1934, as amended from time to time.

“Executive Officer” — An officer subject to Section 16 of the Exchange Act or a “covered

employee” as defined in Section 162(m)(3) of the Code.

“Fair Market Value” — Unless otherwise

determined by the Committee in good faith, the closing sales price per share of Shares on the consolidated transaction reporting system for the New York Stock Exchange on the date of determination or, if no sale is made on such date, on the last

sale date immediately preceding the date of determination.

“Incentive Stock Option” — A stock option

meeting the requirements of Section 422 of the Code or any successor provision.

“Non-qualified Stock

Option” — A stock option other than an Incentive Stock Option.

“Stock Option” or “Option”

— An Incentive Stock Option or a Non-qualified Stock Option awarded under this Plan.

“Optionee” — A

person who has been granted a Stock Option under this Plan and who has executed a written stock option agreement with the Company.

“Original Effective Date” — May 10, 2004.

“Other Awards” — An Award issued pursuant to Section 14 hereof.

“Plan” — The Third Amended and Restated Trinity Industries, Inc. 2004 Stock Option and Incentive Plan set forth

herein.

1

“Performance Award” — An Award hereunder of cash, Shares, units or

rights based upon, payable in, or otherwise related to, Shares pursuant to Section 13 hereof.

“Restricted

Stock” — Shares awarded or sold to eligible persons pursuant to Section 11 hereof.

“Restricted Stock

Units” — Units awarded to eligible persons pursuant to Section 12 hereof, which are convertible into Shares at such time as such units are no longer subject to restrictions as established by the Committee.

“Retirement” — Termination of employment that qualifies for the immediate payment of retirement benefits

pursuant to the terms of any defined benefit retirement plan maintained by the Company or any of its Affiliates in which such person participates, or if there is no such defined benefit retirement plan, termination at or after age 65, or other

permitted early retirement after age 60 as determined by the Committee.

“Share” — A share of the

Company’s common stock, par value $1.00 per share, and any share or shares of capital stock or other securities of the Company hereafter issued or issuable upon, in respect of or in substitution or exchange for each such share.

“Stock Appreciation Right” — The right to receive an amount in cash or Shares equal to the excess of the Fair

Market Value of a Share on the date of exercise over the Fair Market Value of a Share on the date of the grant (or other value specified in the agreement granting the Stock Appreciation Right).

3. Administration of the Plan. Except as otherwise provided herein, the Plan shall be administered by the Human Resources Committee of

the Board of Directors, as such Committee is from time to time constituted. The composition and governance of the Human Resources Committee shall be governed by the charter of such Committee as adopted by the Board of Directors. The foregoing

notwithstanding, no action of the Committee shall be void or deemed to be without authority solely because a member failed to meet a qualification requirement set forth in the Charter or this Section 3. The Human Resources Committee may

delegate its duties and powers, to the fullest extent permitted by law, in whole or in part to (i) any subcommittee thereof consisting solely of at least two “non-employee directors” within the meaning of Rule 16b-3 of the General

Rules and Regulations of the Exchange Act who are also “outside directors,” as defined under Section 162(m) of the Code, or (ii) to one or more officers of the Company as provided for below in this Section 3. All references

in the Plan to the “Committee” shall mean the Board, the Human Resources Committee, or any subcommittee, individual or individuals to which or whom it delegates duties and powers pursuant to the immediately preceding sentence. Subject to

the provisions of the Plan and directions from the Board, the Committee is authorized to:

(a) determine the persons to whom Awards are to

be granted;

(b) determine the type of Award to be granted, the number of Shares to be covered by the Award, the pricing of the Award, the

time or times when the Award shall be granted and may be exercised, any restrictions on the exercise of the Award, and any restrictions on Shares acquired pursuant to the exercise of an Award;

(c) conclusively interpret the Plan provisions;

(d) prescribe, amend and rescind rules and regulations relating to the Plan or make individual decisions as questions arise, or both;

(e) rely upon employees of the Company for such clerical and record-keeping duties as may be necessary in connection with the administration of

the Plan; and

(f) specify the time or times at which Shares or cash will be delivered in connection with Awards, including any terms

mandating or permitting elective deferrals of settlement of Awards (which may include deferral of delivery of Shares upon exercise of Options); and

(g) make all other determinations and take all other actions necessary or advisable for the administration of the Plan.

All questions of interpretation and application of the Plan or pertaining to any question of fact or Award granted hereunder shall be decided

by the Committee, whose decision shall be final, conclusive and binding upon the Company and each other affected party.

As mentioned

above, the Committee may, in its discretion and by a resolution adopted by the Committee, authorize one or more officers of the Company (an “Authorized Officer”) to do one or both of the following: (i) designate officers and employees

of the Company, or any Affiliate, to be recipients of Awards to be granted under the Plan and (ii) determine the number of Shares or other rights that will be subject to the Awards granted to such officers and employees; provided, however, that

the resolution of the Committee granting such authority shall (x) specify the total number of Shares or other rights that may be made subject to such Awards, (y) not authorize the Authorized Officer to designate himself or any Executive

Officer as a recipient of any such Award, and (z) otherwise be limited to the extent necessary to comply with Section 157(c) of the Delaware General Corporation Law, other applicable provisions of Delaware law, and requirements of

Section 303A.05 of the Listed Company Manual of the

2

New York Stock Exchange, and further provided that any decision concerning the granting of Awards intended to qualify as “performance-based compensation” under Section 162(m) of

the Code shall be made exclusively by members of the Committee who are at that time “outside directors” as defined under Section 162(m) of the Code.

4. Share Authorization

(a) Subject to adjustment as provided in Section 20 herein, the maximum number of Shares available for issuance to Participants under the

Plan (the “Share Authorization “) shall be:

(1) 17,450,000 Shares (which includes 7,500,000 Shares authorized

under the original Trinity Industries, Inc. 2004 Stock Option and Incentive Plan, 4,500,000 additional Shares authorized under the Amended and Restated Trinity Industries, Inc. 2004 Stock Option and Incentive Plan, 3,200,000 additional Shares

authorized under the Second Amended and Restated Trinity Industries, Inc. 2004 Stock Option and Incentive Plan, and 2,250,000 additional Shares authorized pursuant to this Plan); plus

(2) any Shares subject to outstanding awards as of the Original Effective Date under the prior plans that on or after the

Original Effective Date cease for any reason to be subject to such awards (other than by reason of exercise or settlement of the awards to the extent they are exercised for or settled in vested and nonforfeitable Shares).

(b) Notwithstanding the above, in order to comply with the requirements of Section 422 of the Code and the regulations thereunder, the

maximum number of Shares available for issuance pursuant to Incentive Stock Options, Non-qualified Stock Options, and other Awards shall be: (i) 17,450,000 Shares that may be issued pursuant to Awards in the form of Incentive Stock Options;

(ii) 17,450,000 Shares that may be issued pursuant to Awards in the form of Non-qualified Stock Options; and (iii) 17,450,000 Shares that may be issued pursuant to Awards in forms other than Incentive Stock Options and Non-Qualified Stock

Options.

(c) Shares covered by an Award shall only be counted as used to the extent they are actually issued and delivered to a

participant. Accordingly, if any Award lapses, expires, terminates, or is cancelled prior to the issuance of Shares thereunder, no reduction in the Shares available under the Plan will have been made. If Shares are issued under the Plan and

thereafter are reacquired by the Company, the reacquired Shares shall again be available for issuance under the Plan. Any Shares (i) tendered by a participant (either by actual delivery or by attestation) or retained by the Company as full or

partial payment to the Company for the purchase price of an Award or to satisfy tax withholding obligations, or (ii) covered by an Award that is settled in cash shall be available for Awards under the Plan. Notwithstanding the foregoing

provisions of this Section 4(c), only Shares not issued due to an Award lapse, expiration, termination, cancellation or settlement in cash, Shares reacquired on account of the forfeiture of such Shares pursuant to the terms of the Plan or the

Award, and Shares surrendered in full or partial payment to the Company for the purchase price of an Award may be available again for issuance pursuant to Awards in the form of Incentive Stock Options. All Shares issued under the Plan may be either

authorized and unissued Shares or issued Shares reacquired by the Company.

(d) The maximum aggregate number of Shares that may be granted

pursuant to any Option, Stock Appreciation Right or performance-based Award (or any combination of the foregoing) in any one calendar year to any one Executive Officer shall be 750,000 (the “Annual Performance Stock Award Limit”).

5. Eligibility. Eligibility for participation in the Plan shall be confined to a limited number of persons (i) who are employed by

the Company or one or more of its Affiliates, and who are directors or officers of the Company or one or more of its Affiliates, or who are in managerial or other key positions in the Company or one or more of its Affiliates, or (ii) who are

Consultants who provide key consulting services to the Company or its Affiliates. In making any determination as to persons to whom Awards shall be granted, the type of Award; and/or the number of Shares to be covered by the Award, the Committee

shall consider the position and responsibilities of the person, his or her importance to the Company and its Affiliates, the duties of such person, his or her past, present and potential contributions to the growth and success of the Company and its

Affiliates, and such other factors as the Committee shall deem relevant in connection with accomplishing the purpose of the Plan. Non-employee directors are eligible to receive Awards pursuant to Section 17.

6. Grant of Stock Options. The Committee may grant Stock Options to any eligible person. Each person so selected shall be offered an

Option to purchase the number of Shares determined by the Committee. The Committee shall specify whether such Option is an Incentive Stock Option or Non-qualified Stock Option. Each such person so selected shall have a reasonable period of time

within which to accept or reject the offered option. Failure to accept within the period so fixed by the Committee may be treated as a rejection. Each person who accepts an Option shall enter into a written agreement with the Company, in such form

as the Committee may prescribe, setting forth the terms and conditions of the Option, consistent with the provisions of this Plan. The Optionee and the Company shall enter into separate option agreements for Incentive Stock Options and Non-qualified

Stock Options. At any time and from time to time, the Optionee and the Company may agree to modify an option agreement in order that an Incentive Stock Option may be converted to a Non-qualified Stock Option. The Committee may not (i) reprice

underwater Stock Options by canceling and regranting Stock Options or by lowering the exercise price except for adjustments pursuant to Section 20 hereof, (ii) conduct a cash buyout of any underwater Stock Options, (iii) replace an

underwater Stock Option with another Award, or (iv) take any other action that would be treated as a repricing under generally accepted accounting principles.

3

The Committee may require that an Optionee meet certain conditions before the Option or a portion

thereto may be exercised, as, for example, that the Optionee remain in the employ of the Company or one of its Affiliates for a stated period or periods of time before the Option, or stated portions thereof, may be exercised.

The exercise price of the Shares covered by each Stock Option shall be determined by the Committee; provided, however, that the exercise price

shall not be less than one hundred percent (100%) of the Fair Market Value of Shares on the date of the grant.

The term of a Stock

Option shall be for such period of months or years from the date of its grant as may be determined by the Committee; provided, however, that no Stock Option shall be exercisable later than ten (10) years from the date of its grant.

Each Stock Option granted hereunder may only be exercised to the extent that the Optionee is vested in such option. Each Stock Option shall

vest separately in accordance with the vesting schedule determined by the Committee, in its sole discretion, which will be incorporated in the stock option agreement. The vesting schedule will be accelerated if, in the sole discretion of the

Committee, the Committee determines that acceleration of the vesting schedule would be desirable for the Company. Unless otherwise determined by the Committee and provided in the option agreement evidencing the grant of the Award, if an Optionee

ceases to be an officer, director, or employee of the Company or any Affiliate by reason of Death, Disability, or Retirement, the Optionee or the personal representatives, heirs, legatees, or distributees of the Optionee, as appropriate, shall

become fully vested in each Stock Option granted to the Optionee and shall have the immediate right to exercise any such option to the extent not previously exercised, subject to the other terms and conditions of the Plan.

Regardless of the terms of any Award Agreement, the Committee, at any time when the Company is subject to fair value accounting for

equity-based compensation granted to its employees and/or directors, shall have the right to substitute Stock Appreciation Rights for outstanding Options granted to any Participant, provided the substituted Stock Appreciation Rights call for

settlement by the issuance of Shares, and the terms and conditions of the substituted Stock Appreciation Rights are equivalent to the terms and conditions of the Options being replaced, as determined by the Committee.

7. Limitations on Grant of Incentive Stock Options.

(a) Incentive Stock Options shall not be granted to a non-employee director or more than 10 years after the Effective Date of this Plan, and

the aggregate Fair Market Value (determined as of the date of grant) of the Shares with respect to which any Incentive Stock Option is exercisable for the first time by an Optionee during any calendar year under the Plan and all such plans of the

Company (as defined in Section 424 of the Code) shall not exceed $100,000. If any Option intended to be an Incentive Stock Option fails to qualify due to this limitation or otherwise, it shall be deemed a Non-qualified Stock Option and remain

outstanding in accordance with its terms.

(b) Notwithstanding anything herein to the contrary, in no event shall any employee owning more

than ten percent (10%) of the total combined voting power of the Company or any Affiliate corporation be granted an Incentive Stock Option hereunder unless (i) the option exercise price shall be at least one hundred ten percent

(110%) of the Fair Market Value of the Shares at the time that the option is granted and (ii) the term of the option shall not exceed five (5) years.

8. Non-transferability of Stock Options. A Stock Option shall not be transferable otherwise than by will or the laws of descent and

distribution, and a Stock Option may be exercised, during the lifetime of the Optionee, only by the Optionee; provided, however, the Board or Committee may permit further transferability of a Non-qualified Stock Option on a general or a specific

basis, and may impose conditions and limitations on any permitted transferability, and provided further, unless otherwise provided in the stock option agreement, a Non-qualified Stock Option may be transferred to: one or more members of the

immediate family (being the spouse (or former spouse), children or grandchildren) of the Optionee; a trust for the benefit of one or more members of the immediate family of the Optionee (a “family trust”); a partnership, the sole partners

of which are the Optionee, members of the immediate family of the Optionee, and one or more family trusts; or a foundation in which the Optionee controls the management of the assets. Upon any transfer, a Stock Option will remain subject to all the

provisions of this Plan and the option agreement, including the provisions regarding termination of rights with respect to the Stock Option upon termination of the Optionee’s employment, and the transferee shall have all of the rights of and be

subject to all of the obligations and limitations applicable to the Optionee with respect to the Stock Option, except that the transferee may further transfer the Stock Option only to a person or entity that the Optionee is permitted to transfer the

Stock Option. Any attempted assignment, transfer, pledge, hypothecation, or other disposition of a Stock Option contrary to the provisions hereof, or the levy of any execution, attachment, or similar process upon a Stock Option shall be null and

void and without effect.

4

9. Exercise of Stock Options.

(a) Stock options may be exercised as to Shares only in minimum quantities and at intervals of time specified in the written option agreement

between the Company and the Optionee. Each exercise of a Stock Option, or any part thereof, shall be evidenced by a notice in writing to the Company. The purchase price of the Shares as to which an option shall be exercised shall be paid in full at

the time of exercise, and, at the Committee’s discretion and in accordance with procedures established by the Committee from time to time, may be paid to the Company in one or more of the following ways:

(i) in cash (including check, bank draft, or money order); or

(ii) by the delivery of Shares (including Restricted Stock when authorized by the Committee) already owned by the Optionee, or

directing the Company (when authorized by the Committee) to withhold Shares otherwise issuable upon exercise, having a Fair Market Value equal to the aggregate exercise price; provided that no delivery or withholding of Shares will be permitted

under this provision if it would result in the Company recognizing additional accounting expense after the grant of the Option or upon its exercise;

(iii) by a combination of cash and Shares; or

(iv) by providing with the notice of exercise an order to a designated broker to sell part or all of the Shares and to deliver

sufficient proceeds to the Company, in cash or by check payable to the Company, to pay the full purchase price of the Shares and all applicable withholding taxes.

(b) An Optionee shall not have any of the rights of a stockholder of the Company with respect to the Shares covered by a Stock Option except to

the extent that one or more certificates of such Shares shall have been delivered to the Optionee, or the Optionee has been determined to be a stockholder of record by the Company’s Transfer Agent, upon due exercise of the option.

10. Stock Appreciation Rights. The Committee may grant Stock Appreciation Rights to any eligible person, either as a separate Award or

in connection with a Stock Option. Stock Appreciation Rights shall be subject to such terms and conditions as the Committee shall impose. The grant of the Stock Appreciation Right may provide that the holder may be paid for the value of the Stock

Appreciation Right either in cash or in Shares, or a combination thereof. In the event of the exercise of a Stock Appreciation Right payable in Shares, the holder of the Stock Appreciation Right shall receive that number of whole Shares of stock of

the Company having an aggregate Fair Market Value on the date of exercise equal to the value obtained by multiplying (i) the difference between the Fair Market Value of a Share on the date of exercise over the Fair Market Value on the date of

the grant (or other value specified in the agreement granting the Stock Appreciation Right), by (ii) the number of Shares as to which the Stock Appreciation Right is exercised, with a cash settlement to be made for any fractional Share. If a

Stock Appreciation Right is granted in tandem with a Stock Option, there shall be surrendered and canceled from the option at the time of exercise of the Stock Appreciation Right, in lieu of exercise under the option, that number of Shares as shall

equal the number of shares as to which the Stock Appreciation Right shall have been exercised. However, notwithstanding the foregoing, the Committee, in its sole discretion, may place a ceiling on the amount payable upon exercise of a Stock

Appreciation Right, but any such limitation shall be specified at the time that the Stock Appreciation Right is granted. The exercise price of any Stock Appreciation Right shall in no event be less than the Fair Market Value of the Shares at the

time of the grant.

The term of a Stock Appreciation Right shall be for such period of months or years from the date of its grant as may

be determined by the Committee; provided, however, that no Stock Appreciation Right shall be exercisable later than ten (10) years from the date of its grant.

The Committee may not (i) reprice an underwater Stock Appreciation Right by canceling and regranting a new Stock Appreciation Right;

(ii) conduct a cash buyout of any underwater Stock Appreciation Right, (iii) replace an underwater Stock Appreciation Right with another Award; or (iv) take any other action that would be treated as a repricing under generally

accepted accounting principles.

11. Restricted Stock.

(a) Restricted Stock may be awarded or sold to any eligible person, for no cash consideration, for such minimum consideration as may be

required by applicable law, or for such other consideration as may be specified by the grant. The terms and conditions of Restricted Stock shall be specified by the grant. The Committee, in its sole discretion, shall determine what rights, if any,

the person to whom an Award of Restricted Stock is made shall have in the Restricted Stock during the restriction period and the restrictions applicable to the particular Award, including whether the holder of the Restricted Stock shall have the

right to vote the Shares and receive all dividends and other distributions applicable to the Shares (including through reinvestment in additional Restricted Stock). Each Award of Restricted Stock may have different restrictions and conditions.

Subject to the minimum vesting requirements of Section 22, the Committee shall determine when the restrictions shall lapse or expire and the conditions, if any, under which the Restricted Stock will be forfeited or sold back to the Company; and

the Committee, in its discretion, may prospectively change the restriction period and the restrictions applicable to any particular Award of Restricted Stock. Restricted stock may not be disposed of by the recipient until the restrictions specified

in the Award expire.

5

(b) Any Restricted Stock issued hereunder may be evidenced in such manner as the Committee, in

its sole discretion, shall deem appropriate, including, without limitation, book-entry registration or issuance of a stock certificate or certificates. In the event any stock certificate is issued in respect of Shares of Restricted Stock awarded

hereunder, such certificate shall bear an appropriate legend with respect of the restrictions applicable to such Award. The Company may retain, at its option, the physical custody of the Restricted Stock during the restriction period or require that

the Restricted Stock be placed in an escrow or trust, along with a stock power endorsed in blank, until all restrictions are removed or expire.

12. Restricted Stock Units. Restricted Stock Units may be awarded or sold to any eligible person under such terms and conditions as

shall be established by the Committee. Restricted Stock Units shall be subject to such restrictions as the Committee determines, including, without limitation, (a) a prohibition against sale, assignment, transfer, pledge, hypothecation or other

encumbrance for a specified period; or (b) a requirement that the holder forfeit (or in the case of units sold to the eligible person resell to the Company at cost) such units in the event of termination of employment during the period of

restriction, subject to the minimum vesting requirements of Section 22.

13. Performance Awards.

(a) The Committee may grant Performance Awards to any person. The terms and conditions of Performance Awards shall be specified at the time of

the grant and, subject to Section 22, may include provisions establishing the performance period, the performance criteria to be achieved during a performance period, and the maximum or minimum settlement values. Each Performance Award shall

have its own terms and conditions. If the Committee determines, in its sole discretion, that the established performance measures or objectives are no longer suitable because of a change in the Company’s business, operations, corporate

structure, or for other reasons that the Committee deemed satisfactory, the Committee may modify the performance measures or objectives and/or the performance period, provided that no modifications may be made relating to a Performance Award

intended to qualify as “performance-based compensation” under Code Section 162(m) if and to the extent that the modification would disqualify such Performance Award, and, with respect to such qualifying Performance Awards, the

Committee may not increase the number of Shares or cash that may be earned by any Executive Officer upon satisfaction of any performance criteria established pursuant to this Section 13 or performance goal as provided for in Section 16

hereof.

(b) Performance Awards may be denominated in Shares or cash or valued by reference to the Fair Market Value of a Share or

according to any formula or method deemed appropriate by the Committee, in its sole discretion, subject to the achievement of performance goals as provided for in Section 16 hereof or other specific financial, production, sales or cost

performance objectives that the Committee believes to be relevant to the Company’s business and/or remaining in the employ of the Company for a specified period of time. Performance Awards may be paid in cash, Shares, or other consideration, or

any combination thereof. If payable in Shares, the consideration for the issuance of the Shares may be the achievement of the performance objective established at the time of the grant of the Performance Award. Performance Awards may be payable in a

single payment or in installments and may be payable at a specified date or dates or upon attaining the performance objective. The extent to which any applicable performance objective has been achieved shall be conclusively determined by the

Committee. No dividends may be paid, or Dividend Equivalent Right granted, with respect to any unvested Performance Award.

14. Other

Awards. The Committee may grant to any eligible person other forms of Awards payable in cash or based upon, payable in, or otherwise related to, in whole or in part, Shares if the Committee determines that such other form of Award is consistent

with the purpose and restrictions of this Plan. The terms and conditions of such other form of Award shall be specified by the grant, subject to Section 22. Such Other Awards may be granted for no cash consideration, (as, for example, bonus

Shares), for such minimum consideration as may be required by applicable law, or for such other consideration as may be specified by the grant (as for example, Shares granted in lieu of other rights to compensation, mandatorily or at the election of

the participant).

15. Dividend Equivalent Rights.

(a) The Committee may grant a Dividend Equivalent Right to any eligible employee, either as a component of another Award or as a separate

Award; provided, however, that no Dividend Equivalent Rights may be granted with respect to any Options or Stock Appreciation Rights. The terms and conditions of the Dividend Equivalent Right shall be specified by the grant. Dividend equivalents

credited to the holder of a Dividend Equivalent Right may be paid currently or may be deemed to be reinvested in additional Shares (which may thereafter accrue additional dividend equivalents). Any such reinvestment shall be at the Fair Market Value

at the time thereof. Dividend Equivalent Rights may be settled in cash or Shares, or a combination thereof, in a single payment or in installments. A Dividend Equivalent Right granted as a component of another Award may provide that such Dividend

Equivalent Right shall be settled upon exercise, settlement, or payment of, or lapse of restrictions on, such other Award, and that such Dividend Equivalent Right granted as a component of another Award may also contain terms and conditions

different from such other Award.

6

(b) Any Award under this Plan that is settled in whole or in part in cash on a deferred basis may

provide for interest equivalents to be credited with respect to such cash payment. Interest equivalents may be compounded and shall be paid upon such terms and conditions as may be specified by the grant.

16. Performance Goals.

(a) Awards of Restricted Stock, Restricted Stock Units, Performance Awards (whether relating to cash or Shares) and Other Awards (whether

relating to cash or Shares) under the Plan may be made subject to the attainment of performance goals within the meaning of Section 162(m) of the Code relating to one or more of the following business criteria: book value; cash flow (including,

but not limited to, operating cash flow, free cash flow, cash flow return on equity, and cash flow return on investment); earnings (either in aggregate or on a per-share basis); earnings before or after either, or any combination of, interest,

taxes, depreciation, or amortization; economic value added; expenses/costs; gross or net income; gross or net operating margins; gross or net operating profits; gross or net revenues/sales; inventory turns; margins; market share; operating

efficiency; operating income; operational performance measures; pre-tax income; productivity ratios and measures; profitability ratios; return measures (including, but not limited to, return on assets, equity, capital, invested capital, sales or

revenues); share price (including, but not limited to, growth in share price and total shareholder return); transactions relating to acquisitions or divestitures; or working capital (“Performance Criteria”). Any Performance Criteria may be

used to measure the performance of the Company as a whole or any business unit of the Company and may be measured in absolute terms, relative to a peer group or index, relative to past performance, or as otherwise determined by the Committee. Any

Performance Criteria may include or exclude (i) extraordinary, unusual and/or non-recurring items of gain or loss, (ii) gains or losses on the disposition of a business, (iii) changes in tax or accounting regulations or laws, or

(iv) the effect of a merger or acquisition, as identified in the Company’s quarterly and annual earnings releases. In all other respects, Performance Criteria shall be calculated in accordance with the Company’s financial statements,

under generally accepted accounting principles, or under a methodology established by the Committee within 90 days after the beginning of the performance period relating to the Award (but not after more than 25% of the performance period has

elapsed) which is consistently applied and identified in the audited financial statements, including footnotes, or the Management Discussion and Analysis section of the Company’s annual report. However, the Committee may not in any event

increase the amount of compensation payable to an individual upon the attainment of a performance goal.

(b) For any Performance Awards or

Other Awards that are denominated in cash, such that the Annual Performance Stock Award Limit in Section 4(d) is not an effective limitation for purposes of Treasury Regulation 1.162-27(e), the maximum amount payable to any Executive Officer

with respect to all performance periods beginning in a fiscal year of the Company shall not exceed $10,000,000.

17. Non-Employee

Directors. Non-employee directors may only be granted awards under this Plan in accordance with this Section 17. The Board or the Committee will grant all Awards to non-employee directors. Subject to the limit set forth in Section 4(a)

on the number of Shares that may be issued in the aggregate under the Plan, the maximum number of shares that may be issued to non-employee directors shall be 900,000 Shares, and no non-employee director may receive Awards subject to more than

40,000 Shares in any calendar year. Awards made pursuant to this Section 17 shall be with terms and conditions otherwise consistent with the provisions of this Plan.

18. Change in Control. Except as otherwise provided in this Section 18, or as otherwise determined by the Committee at the time of

grant of an Award and provided for in the agreement evidencing the grant of the Award, upon a Change in Control, all outstanding Stock Options and Stock Appreciation Rights shall become vested and exercisable; all restrictions on Restricted Stock

and Restricted Stock Units shall lapse; all Performance Goals shall be deemed achieved at target levels and all other terms and conditions met; all Restricted Stock Units and Performance Awards (whether relating to cash or Shares) shall be paid out

as promptly as practicable; and all Other Awards (whether relating to cash or Shares) shall be delivered or paid. The Committee may also provide for the cash settlement of Options and Stock Appreciation Rights.

(a) A “Change in Control” shall be deemed to have occurred if the event set forth in any one of the following paragraphs shall have

occurred:

(i) any Person is or becomes the Beneficial Owner, directly or indirectly, of securities of the Company (not

including in the securities beneficially owned by such Person any securities acquired directly from the Company or its Affiliates) representing 30% or more of the combined voting power of the Company’s then outstanding securities, excluding any

Person who becomes such a Beneficial Owner in connection with a transaction described in clause (A) of paragraph (iii) below; or

(ii) the following individuals cease for any reason to constitute a majority of the number of directors then serving:

individuals who, on the Effective Date of this Plan, constitute the Board and any new director (other than a director whose initial assumption of office is in connection with an actual or threatened election contest,

7

including but not limited to a consent solicitation, relating to the election of directors of the Company) whose appointment or election by the Board or nomination for election by the

Company’s stockholders was approved or recommended by a vote of at least two-thirds (2/3) of the directors then still in office who either were directors on the Effective Date of this Plan or whose appointment, election or nomination for

election was previously so approved or recommended; or

(iii) there is consummated a merger or consolidation of the Company

or any direct or indirect subsidiary of the Company with any other corporation, other than (A) a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior to such merger or consolidation

continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity or any parent thereof) at least 60% of the combined voting power of the securities of the Company or such surviving entity

or any parent thereof outstanding immediately after such merger or consolidation or (B) a merger or consolidation effected to implement a recapitalization of the Company (or similar transaction) in which no Person is or becomes the Beneficial

Owner, directly or indirectly, of securities of the Company (not including in the securities Beneficially Owned by such Person any securities acquired directly from the Company or its Affiliates other than in connection with the acquisition by the

Company or its Affiliates of a business) representing 30% or more of the combined voting power of the Company’s then outstanding securities; or

(iv) the stockholders of the Company approve a plan of complete liquidation or dissolution of the Company or there is

consummated an agreement for the sale or disposition by the Company of all or substantially all of the Company’s assets, other than a sale or disposition by the Company of all or substantially all of the Company’s assets to an entity, at

least 60% of the combined voting power of the voting securities of which are owned by stockholders of the Company in substantially the same proportions as their ownership of the Company immediately prior to such sale.

For purposes hereof:

“Affiliate” shall have the meaning set forth in Rule 12b-2 promulgated under Section 12 of the Exchange Act.

“Beneficial Owner” shall have the meaning set forth in Rule 13d-3 under the Exchange Act.

“Exchange Act” shall mean the Securities Exchange Act of 1934, as amended from time to time.

“Person” shall have the meaning given in Section 3(a)(9) of the Exchange Act, as modified and used in Sections

13(d) and 14(d) thereof, except that such term shall not include (1) the Company or any of its subsidiaries, (2) a trustee or other fiduciary holding securities under an employee benefit plan of the Company or any of its Affiliates,

(3) an underwriter temporarily holding securities pursuant to an offering of such securities or (4) a corporation owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions as their ownership of

stock of the Company.

(b) Notwithstanding any provision of this Plan, in the event of a Change in Control in connection with which the

holders of Shares receive shares of common stock that are registered under Section 12 of the Exchange Act, there shall be substituted for each Share available under this Plan, whether or not then subject to an outstanding option, the number and

class of shares into which each outstanding Share shall be converted pursuant to such Change in Control, and all outstanding options, other than options to which this Section 18 does not apply as provided in the first paragraph of this Section,

shall immediately be exercisable in full. In the event of any such substitution, the purchase price per share of each option shall be appropriately adjusted by the Committee, such adjustments to be made without an increase in the aggregate purchase

price.

(c) Notwithstanding any provision of this Plan, in the event of a Change in Control in connection with which the holders of Shares

receive consideration other than shares of common stock that are registered under Section 12 of the Exchange Act, each outstanding option shall be surrendered to the Company by the holder thereof, and each such option shall immediately be

canceled by the Company, and the holder shall receive, within ten (10) days of the occurrence of such Change in Control, a cash payment from the Company in an amount equal to the number of Shares then subject to such option, multiplied by the

excess, if any, of (i) the greater of (A) the highest per share price offered to stockholders of the Company in any transaction whereby the Change in Control takes place or (B) the Fair Market Value of a Share on the date of

occurrence of the Change in Control over (ii) the purchase price per Share subject to the option. The Company may, but is not required to, cooperate with any person who is subject to Section 16 of the Exchange Act to assure that any cash

payment in accordance with the foregoing to such person is made in compliance with Section 16 of the Exchange Act and the rules and regulations thereunder.

19. Compliance with Securities and Other Laws. In no event shall the Company be required to sell or issue Shares under any Award if the

sale or issuance thereof would constitute a violation of applicable federal or state securities law or regulation or a violation of any other law or regulation of any governmental authority or any national securities exchange. As a condition to any

sale or issuance of Shares, the Company may place legends on Shares,

8

issue stop transfer orders, and require such agreements or undertakings as the Company may deem necessary or advisable to assure compliance with any such law or regulation, including, if the

Company or its counsel deems it appropriate, representations from the person to whom an Award is granted that he or she is acquiring the Shares solely for investment and not with a view to distribution and that no distribution of the Shares will be

made unless registered pursuant to applicable federal and state securities laws, or in the opinion of counsel of the Company, such registration is unnecessary.

20. Adjustments Upon Changes in Capitalization. In the event of any corporate event or transaction (including, but not limited to, a

change in the shares of the Company or the capitalization of the Company) such as a merger, consolidation, reorganization, recapitalization, separation, stock dividend, stock split, reverse stock split, split up, spin-off, or other distribution of

stock or property of the Company, combination of Shares, exchange of Shares, dividend in kind, or other like change in capital structure or distribution (other than normal cash dividends) to stockholders of the Company, or any similar corporate

event or transaction affects the fair value of an Award, the Committee, in its sole discretion, shall adjust any or all of the following so that the fair value of the Award immediately after the transaction or event is equal to the fair value of the

Award immediately prior to the transaction or event, the number and kind of Shares that may be issued under the Plan or under particular forms of Awards, the number and kind of Shares subject to outstanding Awards, the option price or grant price

applicable to outstanding Awards, the Annual Performance Stock Award Limit, limits on non-employee director Awards under Section 17, and other value determinations applicable to outstanding Awards.

The Committee, in its sole discretion, may also make appropriate adjustments in the terms of any Awards under the Plan to reflect or related

to such changes or distributions and to modify any other terms of outstanding Awards, including modifications of performance goals and changes in the length of Performance Periods. The determination of the Committee as to the foregoing adjustments,

if any, shall be conclusive and binding on Participants under the Plan.

Subject to the provisions of Section 21, without affecting

the number of Shares reserved or available hereunder, the Committee may authorize the issuance or assumption of benefits under this Plan in connection with any merger, consolidation, acquisition of property or stock, or reorganization upon such

terms and conditions as it may deem appropriate, subject to compliance with the Incentive Stock Option rules under Section 422 of the Code, where applicable.

21. Exchange or Cancellation of Incentives Where Company Does Not Survive. In the event of any merger, consolidation or share exchange

pursuant to which the Company is not the surviving or resulting corporation, there shall be substituted for each Share subject to the unexercised portions of outstanding Stock Options or Stock Appreciation Rights, that number of shares of each class

of stock or other securities or that amount of cash, property, or assets of the surviving, resulting or consolidated company which were distributed or distributable to the stockholders of the Company in respect to each Share held by them, such

outstanding Stock Options or Stock Appreciation Rights to be thereafter exercisable for such stock, securities, cash, or property in accordance with their terms.

Notwithstanding the foregoing, however, all Stock Options or Stock Appreciation Rights may be canceled by the Company, in its sole discretion,

as of the effective date of any such reorganization, merger, consolidation, or share exchange, or of any proposed sale of all or substantially all of the assets of the Company, or of any dissolution or liquidation of the Company, by either:

(a) giving notice to each holder thereof or his personal representative of its intention to cancel such Stock Options or Stock Appreciation

Rights and permitting the purchase during the thirty (30) day period next preceding such effective date of any or all of the Shares subject to such outstanding Stock Options or Stock Appreciation Rights, including, in the Committee’s

discretion, some or all of the Shares as to which such Stock Options or Stock Appreciation Rights would not otherwise be vested and exercisable; or

(b) paying the holder thereof an amount equal to a reasonable estimate of the difference between the net amount per share payable in such

transaction or as a result of such transaction, and the exercise price per Share of such Stock Option (hereinafter the “Spread”), multiplied by the number of Shares subject to the Stock Option. In estimating the Spread, appropriate

adjustments to give effect to the existence of the Stock Options shall be made, such as deeming the Stock Options to have been exercised, with the Company receiving the exercise price payable thereunder, and treating the Shares receivable upon