TTX Co To Sell $150 Million 30-Year Bonds - Source

November 18 2010 - 10:15AM

Dow Jones News

TTX Co., a U.S. railcar and freight services provider, is

preparing to sell $150 million in 30-year debt that is expected to

price late Thursday, according to a person familiar with the

sale.

The bonds are expected to be rated Baa1 by Moody's Investors

Service and A+ by Standard & Poor's.

Citigroup Inc. (C) and Credit Suisse Group (CS, CSGN.VX) are

leading the sale, with proceeds expected to be used for general

corporate purposes including repayment of short-term debt and for

equipment purchases.

Price talk on the bonds is not yet out.

-By Katy Burne, Dow Jones Newswires; 212-416-2213;

Katy.Burne@dowjones.com.

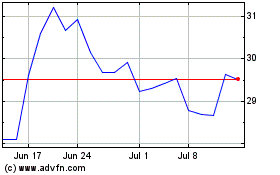

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

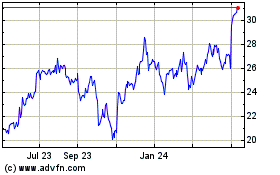

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Apr 2023 to Apr 2024