Toll Brothers Sees Strong 2017, Powered by Millennial Buyers -- Update

December 06 2016 - 3:57PM

Dow Jones News

By Chris Kirkham and Joshua Jamerson

Luxury home builder Toll Brothers Inc. on Tuesday reported

double-digit revenue growth in its fourth-quarter results and

projected a strong performance going into 2017 despite softening in

some markets.

In recent months the company has faced concerns from investors

that its exposure to slowing luxury markets such as New York City

could hurt results. Chief executive Douglas Yearley said Tuesday

the company has benefited by operating in "a demographic sweet spot

in the luxury market."

"We're not in the superluxury end of the market. We are not part

of any of those stories about Greenwich, Conn., and the Hamptons,"

Mr. Yearley said. "There is a huge market out there at our price

point that wants a new home."

At the same time, executives announced further details about a

new line of homes at lower price points geared toward first-time

buyers who have delayed home purchasing and aim to bypass

traditional starter homes. The company plans to launch the

"T-Select" line of homes in January in Houston, which will feature

fewer options than the company's traditional properties.

The move is part of an effort to build some homes at a faster

clip to boost return on equity, which has been lower than usual in

recent years due to the slow pace of the housing recovery. High

labor and land costs also have weighed on the home building

industry in recent months, as shares of most large builders have

underperformed the broader stock market.

"We are not turning this ship in a dramatic direction," Mr.

Yearley said. "We are just supplementing it with one more product

line" that will "bring in more buyers that we haven't yet

touched."

Results in the fourth quarter were broad-based across the

country, with every region showing contract growth for its

traditional home building business.

But the company reported fewer contracts for its City Living

condo division, which has projects in New York City and some other

East Coast markets. Revenue in the segment decreased sharply to

$13.9 million from $131.1 million in the year-ago period. The

average price per unit jumped to $2.3 million from $1.7

million.

Several of the company's New York City projects have been

largely sold out toward the end of the year. Executives said the

New York City market isn't as hot as it had been two years ago, but

that the units there still provide some of the company's highest

gross profit margins in the U.S.

Overall for the quarter, Toll posted a profit of $114.4 million,

or 67 cents a share, down from $147.2 million, or 80 cents a share,

a year earlier.

Revenue rose 29% to $1.86 billion.

The company delivered 2,224 units in the quarter, an increase of

22% over the year-earlier period. Toll Brothers ended the year with

a backlog of $3.98 billion, up 14% from a year ago.

Toll beat expectations on revenue and new orders, but gross

profit margins were slightly lower than expected. Looking to next

year, the company expects to deliver 6,500 to 7,500 units, up from

a final count of 6,098 this year.

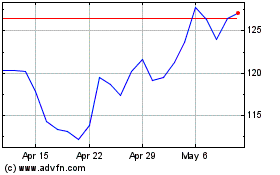

Shares of Toll Brothers, which have declined 1.6% over the past

three months, were up more than 4.4% Tuesday afternoon.

Write to Chris Kirkham at chris.kirkham@wsj.com and Joshua

Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

December 06, 2016 15:42 ET (20:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

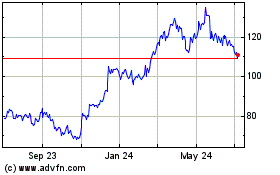

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Sep 2023 to Sep 2024