UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

THERMO FISHER

SCIENTIFIC INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-8002 |

|

04-2209186 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 81 Wyman Street

Waltham, MA |

|

02454 |

| (Address of principal executive offices) |

|

(Zip Code) |

Seth H. Hoogasian (781) 622-1000

(Name and telephone number, including area code, of the person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form

applies:

| x |

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

Introduction

This Form SD for Thermo Fisher Scientific Inc. (“Thermo Fisher,” the “Company,” “we,” or “our”) is provided in

accordance with Rule 13p-1 under the Securities Exchange Act of 1934 (“Rule 13p-1”) for the reporting period from January 1, 2014 to December 31, 2014.

In accordance with this regulation, we designed and executed a supply chain due diligence process in accordance with Annex I of the Organisation for Economic

Co-operation and Development’s (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (“OECD Guidance”) as outlined in this Form SD and detailed in the

accompanying Conflict Minerals Report.

Company Overview

Thermo Fisher is a Delaware corporation and was incorporated in 1956. The company completed its initial public offering in 1967 and was listed on the New York

Stock Exchange in 1980. Thermo Fisher has approximately 50,000 employees and serves more than 400,000 customers within pharmaceutical and biotech companies, hospitals and clinical diagnostic labs, universities, research institutions and government

agencies, as well as environmental, industrial quality and process control settings. We serve our customers with products through four premier brands, Thermo Scientific, Applied Biosystems, Invitrogen and Fisher Scientific. Our mission is to enable

our customers to make the world healthier, cleaner and safer by helping our customers accelerate life sciences research, solve complex analytical challenges, improve patient diagnostics and increase laboratory productivity. In line with this

mission, we are committed to the responsible sourcing of materials used in our products, and we strive to interact with partners who share these values.

Section 1 – Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Our overall process for conflict minerals included steps such as defining our conflict minerals program, setting forth our expectations on this topic for our

supply base in a conflict minerals statement, designing and executing a reasonable country of origin inquiry (“RCOI”), and performing some supply chain due diligence.

Conflict Minerals Program

In response to the SEC’s

Conflict Minerals Rule, we assembled a conflict minerals project team, which is led by a dedicated Project Manager. The goal of this Project Team is to build a strong foundation within and outside of our organization and, with our supply chain

partners, to strive for a transparent and responsible supply chain to support conflict minerals reporting for 2014 and in future years. Our company’s conflict minerals statement supports these goals and is available on our public website.

Published Results. A copy of this Form SD and attached Conflict Minerals Report in accordance with Rule 12b-12 (17 CFR 240.12b-12) may be found

publicly on our internet website at: http://www.thermofisher.com.

Item 1.02 Exhibit

Based on our Reasonable Country of Origin inquiry, and subsequent due diligence, we are attaching as an exhibit to this Form SD the Conflict Minerals Report

required by Item 1.01.

Section 2 – Exhibits

Item 2.01 Conflict Minerals Report

Exhibit 1.01

– Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

|

|

|

|

|

| Date: May 29, 2015 |

|

|

|

By: |

|

/s/ Seth H. Hoogasian |

|

|

|

|

Name: |

|

Seth H. Hoogasian |

|

|

|

|

Title: |

|

Senior Vice President, General Counsel and Secretary |

|

|

|

|

|

|

|

Exhibit 1.01

Conflict Minerals Report

This Conflict Minerals Report for Thermo Fisher Scientific Inc.

(“Thermo Fisher,” the “Company,” “we,” or “our”) is provided in accordance with Rule 13p-1 under the Securities Exchange Act of 1934 (“Rule 13p-1”) for the reporting period from January 1, 2014

to December 31, 2014.

Rule 13p-1 is applicable to SEC issuers that manufacture products where “conflict minerals are necessary

to the functionality or production” of the product.1 This regulation requires SEC registrants to disclose annually through the Form SD whether certain minerals (namely tin, tungsten,

tantalum, and gold, collectively known as “Conflict Minerals” or “3TG”) originated in the Democratic Republic of the Congo (“DRC”) or an adjoining country (collectively referred to as the “Covered Countries”).

In certain circumstances, this regulation also requires companies to furnish annually to the SEC a public report outlining the due diligence exercised by the company to determine the source and origin of 3TGs in the product(s) they produce.2

In accordance with this regulation, we designed and executed a supply chain due

diligence process in accordance with Annex I of the Organisation for Economic Co-operation and Development’s (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas

(“OECD Guidance”).3

Forward-Looking Statements

Forward-looking statements, within the meaning of Section 21E of the Securities Exchange Act of 1934, are made throughout this Report. Any

statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believes,” “anticipates,” “plans,” “expects,”

“seeks,” “estimates,” and similar expressions are intended to identify forward-looking statements. While the Company may elect to update forward-looking statements in the future, it specifically disclaims any obligation to do so,

even if the Company’s estimates change and readers should not rely on those forward-looking statements as representing the Company’s views as of any date subsequent to the date of the filing of this report. A number of important factors

could cause the results of the Company to differ materially from those indicated by such forward-looking statements, including those detailed under the heading, “Future Due Diligence Considerations” in Part III.

Company Overview

Thermo Fisher is a Delaware corporation and was incorporated in 1956. The Company completed its initial public offering in 1967 and was listed

on the New York Stock Exchange in 1980. Thermo Fisher has approximately 50,000 employees and serves more than 400,000 customers within pharmaceutical and biotech companies, hospitals and clinical diagnostic labs, universities, research institutions

and government agencies, as well as environmental, industrial quality and process control settings.

We serve our customers with products

through four premier brands, Thermo Scientific, Applied Biosystems, Invitrogen and Fisher Scientific. Thermo Scientific, Applied Biosystems and Invitrogen, our self-manufactured brands, as well as our private-label Fisher Scientific products are

in-scope for our 2014 SEC conflict minerals reporting. Third party products that are sold by Fisher Scientific are out of scope, as the Company had no control over the manufacturing of these products. For a broader description of our brands, please

refer to our most recent annual 10-K filing.

| 3 |

OECD (2011), OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas: Second Edition, OECD Publishing. |

Our mission is to enable our customers to make the world healthier, cleaner and safer by helping

our customers accelerate life sciences research, solve complex analytical challenges, improve patient diagnostics and increase laboratory productivity. In line with this mission, we are committed to the responsible sourcing of materials used in our

products, and we strive to interact with partners who share these values.

| II. |

MEASURES TAKEN TO MEET OECD DUE DILIGENCE GUIDANCE |

Design of Measures to Meet

OECD Guidance

Our conflict minerals due diligence framework has been designed to be in line with the steps of the OECD Guidance,

as applicable for downstream companies (as the term is defined in the OECD Guidance), in all material respects. In conformity to the OECD Guidance’s five step process, we designed our due diligence measures to:

| |

1. |

Establish strong Company management systems for conflict minerals supply chain due diligence and reporting compliance; |

| |

2. |

Identify and assess conflict minerals risks in our supply chain; |

| |

3. |

Design and implement strategies to respond to conflict minerals risks identified; |

| |

4. |

Contribute to independent third-party audits of the due diligence practices of conflict minerals smelters and refiners by participating in industry organizations; and |

| |

5. |

Report on our conflict minerals supply chain due diligence activities, as required by Rule 13p-1. |

Measures Performed to Meet OECD Guidance

As our reasonable country of original inquiry (“RCOI”) indicated that some of our products contain 3TG minerals sourced from the

Covered Countries, we performed due diligence measures in line with the five steps outlined above. This section outlines what each step of our process covered, followed by the procedures we performed to address these requirements.

Step One: Establish strong Company management systems for conflict minerals supply chain due diligence and reporting compliance

In order to establish strong management systems for conflict minerals, we first established a cross functional project stakeholder group with

representation from the necessary internal departments. This group was led by our Legal and Sourcing departments, and we had a dedicated Project Manager for this process. We engaged a major international accounting firm to assist the Company in

designing and implementing our conflict minerals program. We also engaged Assent Compliance to assist with the implementation of the Company’s conflict minerals program.

We developed a conflict minerals statement, which can be viewed on our public website, and established a project framework captured in our

Conflict Minerals Standard Operating Procedure.

We designed and distributed a series of internal training materials and conducted

training sessions to educate affected internal employees on our conflict minerals process and how to communicate with external parties on this subject.

Conflict minerals language was added to our standard supplier contracts and our Supplier Code of Conduct to support our conflict minerals

program. We invited our suppliers to attend a live Q&A webinar session. The recorded session and concurrent written presentation was distributed to all in-scope suppliers.

Step Two: Identify and assess conflict minerals risks in our supply chain

In accordance with improving our supply chain due diligence for this reporting year, we refined our scoping process to identify a more optimal

subset of our supply base. This was accomplished by

enlisting our product commodity experts who were tasked to assign 3TG risk levels for each product commodity classification in their area of expertise. This process resulted in 7,865 in-scope

suppliers representing approximately 64% of our manufactured spend.

Reasonable Country of Origin Inquiry

(“RCOI”)

Acting on the Company’s behalf, Assent Compliance conducted the supplier survey portion of the RCOI. The

survey employed the Conflict Minerals Reporting Template, version 3.02 (the “CMRT”), developed by the Electronic Industry Citizenship Coalition® and The Global e-Sustainability

Initiative. The CMRT was developed to facilitate general disclosures and information regarding smelters that provide materials to the supplier. It includes questions regarding the supplier’s conflict-free sourcing policy, the engagement process

with its direct suppliers, and identification of the smelters used by the supplier. Non-responsive suppliers were contacted a minimum of three times by the Assent Compliance Manager and then were also contacted by the Assent Compliance Supply Chain

team in one on one communications. This included two to three follow ups from the supply chain team. After three incidents of non-responsiveness, suppliers were then contacted via email and phone by the Company’s procurement team members as an

escalation to encourage their response via CMRT forms to Assent Compliance.

Assent Compliance’s communications include training and

education on the completion of the CMRT form as well as access to a Supplier Resource Center designed to alleviate any remaining confusion for suppliers. All communications were monitored and tracked in Assent’s system for future reporting and

transparency.

Due Diligence Performed

A notable addition to our program is automated data validation on all submitted CMRTs. The goal of data validation is to increase the accuracy

of submissions and identify any contradictory answers in the CMRT. All submitted forms are accepted and classified as valid or incomplete so that data is still retained. Suppliers are contacted in regards to incomplete forms and are encouraged to

resubmit a valid form.

We received survey responses from approximately one-half of our in-scope suppliers. Approximately 95 percent of

our responding suppliers indicated that they either did not use 3TG or were not sourcing 3TG from the Covered Countries.

Some of the

responses provided by suppliers to the CMRT included the names of facilities listed by the suppliers as smelters or refiners. Other than to the extent of the communication outlined in Step Four, we do not typically have a direct relationship with

3TG smelters and refiners and do not perform or direct audits of these entities within our supply chain. Assent Compliance compared these facilities listed in the responses to the list of smelters maintained by the Conflict-Free Sourcing Initiative

(“CFSI”), the United States Department of Commerce and the London Bouillon Market Association and, if a supplier indicated that the facility was certified as “Conflict-Free,” confirmed that the name was listed by CFSI. We have

validated 281 smelters or refiners as listed by our suppliers and are working to validate the additional smelter/refiner entries from the submitted CMRTs. For the steps to be taken in regard to the rest of these smelters, please see our involvement

in the Conflict-Free Sourcing Initiative outlined in Step Four. We have included the current list of valid smelters disclosed to us by our suppliers in Exhibit 1 of this report.

Step Three: Design and implement strategies to respond to conflict minerals risks identified

From our perspective at this stage in conflict minerals compliance, it appears that many of our suppliers are in the middle of their process

and do not have answers beyond “unknown”. We are helping suppliers receive training and education to better their processes. Evaluating and tracking the strength of their program helps us adhere to the OECD Due Diligence Guidelines and can

assist in making key risk mitigation decisions as the program progresses.

We evaluated the strengths of each of our suppliers’

programs based on a series of criteria. A supplier’s willingness to improve their program will be tracked and incorporated into our future conflict minerals program, including procurement decisions.

Step Four: Contribute to independent third-party audits of the due diligence practices of

conflict minerals smelters and refiners by participating in industry organizations

As a member of the CFSI, we leveraged the due

diligence conducted on smelters and refiners by the CFSI’s Conflict-Free Smelter Program (the “CFSP”). The CFSP independently audits the source, including mines of origin and chain of custody of the 3TG minerals used by smelters and

refiners that agree to participate in the CFSP. The smelters and refiners that are found to be CFSP compliant are those for which the independent audit has verified that the smelter’s or refiner’s conflict minerals originated from conflict

free mines in the Covered Countries.

In order to further the efforts of the CFSI, we are actively participating on the data collection

team that is revising and testing future conflict minerals survey templates. We are also collaborating with the CFSI on many levels, including providing the CFSI with smelter information and communicating directly with the facilities that the CFSI

is actively pursuing.

Step Five: Report on our conflict minerals supply chain due diligence activities, as required by Rule 13p-1

Based on the results of the supplier survey and associated supplier due diligence, a Form SD and this Conflict Minerals Report were

prepared. This document has been prepared to describe the steps of our conflict minerals process and has been reviewed and approved by executive management.

To facilitate other companies in their reporting, we also reported the results of our RCOI and supplier due diligence to our customers who

solicited a conflict minerals response using the conflict minerals survey template version 3.02.

Report of Independent Private

Sector Auditor

Pursuant to the SEC Rule, we were not required to have an independent private sector audit for this report.

However, we have worked with our external auditors to ensure that our process is auditable in future years. We will continue to develop and build upon our due diligence measures for the current year to increase supplier response and further

understand the smelters within our supply chain.

| III. |

FUTURE DUE DILIGENCE CONSIDERATIONS |

In order to improve on our supply chain due

diligence practices from the current year, we plan to incorporate the following measures, among others, for compliance in future years:

| |

• |

|

Re-examine our scoping approach to ensure that we have surveyed the optimal subset of our supply base |

| |

• |

|

Implement a risk rating smelter system and collaborate with our supply base to mitigate the highest risk smelters in our supply chain |

| |

• |

|

Implement program enhancements that provide additional tools and resources for our international suppliers and suppliers with less sophisticated programs |

| |

• |

|

Strengthen our supplier due diligence by surveying more frequently and expanding supplier training opportunities |

| IV. |

DUE DILIGENCE RESULTS |

After conducting the due diligence described in this report, we have found that none of our

suppliers that source from the Covered Countries have reason to believe that they benefited or financed armed conflict in the Covered Countries.

As of April 17, 2015, 210 of the smelters identified by our supply base are verified or progressing towards a conflict free validation per

the CFSI. An additional 71 smelters are known smelters per the CFSI. Finally, we are working on validating whether additional smelters identified by our supply base are actual smelters as opposed to being simply another tier of supplier or

non-existent company. Please note that smelter information provided by our suppliers has not been directly tied to our products as we received company level disclosures.

Based on the smelter lists provided by suppliers via the CMRTs, we are aware that there are 20 smelters sourcing from the Covered Countries and

which have also been certified as conflict-free. Many suppliers are still unable to provide the smelters or refiners used for materials supplied to us. Furthermore, many of the responses provided at the company or business unit level indicated an

“unknown” status in terms of determining the origin of 3TGs.

Exhibit 1: EICC-GeSI Smelter List

|

|

|

|

|

| Mineral |

|

Smelter4 |

|

Facility Location |

| Gold |

|

Aida Chemical Industries Co. Ltd. |

|

Japan |

| Gold |

|

Allgemeine Gold- und Silberscheideanstalt A.G.* |

|

Germany |

| Gold |

|

Almalyk Mining and Metallurgical Complex (AMMC)** |

|

Uzbekistan |

| Gold |

|

AngloGold Ashanti Mineração Ltda* |

|

Brazil |

| Gold |

|

Argor-Heraeus SA* |

|

Switzerland |

| Gold |

|

Asahi Pretec Corporation* |

|

Japan |

| Gold |

|

Asaka Riken Co Ltd |

|

Japan |

| Gold |

|

Atasay Kuyumculuk Sanayi Ve Ticaret A.S. |

|

Turkey |

| Gold |

|

Aurubis AG |

|

Germany |

| Gold |

|

Bangko Sentral ng Pilipinas (Central Bank of the Philippines) |

|

Philippines |

| Gold |

|

Boliden AB |

|

Sweden |

| Gold |

|

Caridad |

|

Mexico |

| Gold |

|

Cendres & Métaux SA** |

|

Switzerland |

| Gold |

|

Central Bank of the DPR of Korea |

|

Republic Of Korea |

| Gold |

|

Chimet SpA* |

|

Italy |

| Gold |

|

Chugai Mining |

|

Japan |

| Gold |

|

Codelco |

|

Chile |

| Gold |

|

Daejin Indus Co. Ltd |

|

Republic Of Korea |

| Gold |

|

DaeryongENC |

|

Republic Of Korea |

| Gold |

|

Do Sung Corporation |

|

Republic Of Korea |

| Gold |

|

Dowa* |

|

Japan |

| Gold |

|

FSE Novosibirsk Refinery |

|

Russian Federation |

| Gold |

|

Heimerle + Meule GmbH* |

|

Germany |

| Gold |

|

Heraeus Ltd Hong Kong* |

|

Hong Kong |

| Gold |

|

Heraeus Precious Metals GmbH & Co. KG* |

|

Germany |

| Gold |

|

Hwasung CJ Co. Ltd |

|

Republic Of Korea |

| Gold |

|

Inner Mongolia Qiankun Gold and Silver Refinery Share Company Limited |

|

China |

| Gold |

|

Ishifuku Metal Industry Co., Ltd.* |

|

Japan |

| Gold |

|

Istanbul Gold Refinery* |

|

Turkey |

| Gold |

|

Japan Mint |

|

Japan |

| Gold |

|

Jiangxi Copper Company Limited |

|

China |

| Gold |

|

Johnson Matthey Inc* |

|

United States |

| Gold |

|

Johnson Matthey Limited* |

|

Canada |

| Gold |

|

JSC Ekaterinburg Non-Ferrous Metal Processing Plant |

|

Russian Federation |

| Gold |

|

JSC Uralectromed |

|

Russian Federation |

| Gold |

|

JX Nippon Mining & Metals Co., Ltd* |

|

Japan |

| Gold |

|

Kazzinc Ltd** |

|

Kazakhstan |

| Gold |

|

Kojima Chemicals Co. Ltd* |

|

Japan |

| Gold |

|

Korea Metal Co. Ltd |

|

Republic Of Korea |

| Gold |

|

Kyrgyzaltyn JSC |

|

Kyrgyzstan |

| Gold |

|

L’ azurde Company For Jewelry |

|

Saudi Arabia |

| Gold |

|

LS-Nikko Copper Inc* |

|

Republic Of Korea |

| Gold |

|

Materion* |

|

United States |

| Gold |

|

Matsuda Sangyo Co. Ltd* |

|

Japan |

| Gold |

|

Metalor Technologies (Hong Kong) Ltd* |

|

Hong Kong |

| Gold |

|

Metalor Technologies SA* |

|

Switzerland |

| Gold |

|

Metalor USA Refining Corporation* |

|

United States |

| Gold |

|

Met-Mex Peñoles, S.A.** |

|

Mexico |

| Gold |

|

Mitsubishi Materials Corporation* |

|

Japan |

| Gold |

|

Mitsui Mining and Smelting Co., Ltd.* |

|

Japan |

| Gold |

|

Moscow Special Alloys Processing Plant |

|

Russian Federation |

| Gold |

|

Nadir Metal Rafineri San. Ve Tic. A.Ş. |

|

Turkey |

|

|

|

|

|

| Gold |

|

Navoi Mining and Metallurgical Combinat** |

|

Uzbekistan |

| Gold |

|

Nihon Material Co. LTD* |

|

Japan |

| Gold |

|

Ohio Precious Metals LLC.* |

|

United States |

| Gold |

|

OJSC “The Gulidov Krasnoyarsk Non-Ferrous Metals Plant” (OJSC Krastvetmet) |

|

Russian Federation |

| Gold |

|

OJSC Kolyma Refinery |

|

Russian Federation |

| Gold |

|

PAMP SA* |

|

Switzerland |

| Gold |

|

Pan Pacific Copper Co. LTD |

|

Japan |

| Gold |

|

Prioksky Plant of Non-Ferrous Metals |

|

Russian Federation |

| Gold |

|

PT Aneka Tambang (Persero) Tbk |

|

Indonesia |

| Gold |

|

PX Précinox SA |

|

Switzerland |

| Gold |

|

Rand Refinery (Pty) Ltd* |

|

South Africa |

| Gold |

|

Royal Canadian Mint* |

|

Canada |

| Gold |

|

Sabin Metal Corp. |

|

United States |

| Gold |

|

SAMWON METALS Corp. |

|

Republic Of Korea |

| Gold |

|

Schone Edelmetaal** |

|

Netherlands |

| Gold |

|

SEMPSA Joyeria Plateria SA* |

|

Spain |

| Gold |

|

Shandong Zhaojin Gold & Silver Refinery Co. Ltd |

|

China |

| Gold |

|

SOE Shyolkovsky Factory of Secondary Precious Metals |

|

Russian Federation |

| Gold |

|

Solar Applied Materials Technology Corp.* |

|

Taiwan |

| Gold |

|

Sumitomo Metal Mining Co. Ltd.* |

|

Japan |

| Gold |

|

Suzhou Xingrui Noble |

|

China |

| Gold |

|

Tanaka Kikinzoku Kogyo K.K.* |

|

Japan |

| Gold |

|

The Great Wall Gold and Silver Refinery of China** |

|

China |

| Gold |

|

The Refinery of Shandong Gold Mining Co. Ltd |

|

China |

| Gold |

|

Tokuriki Honten Co. Ltd* |

|

Japan |

| Gold |

|

Torecom |

|

Republic Of Korea |

| Gold |

|

Umicore Brasil Ltda |

|

Brazil |

| Gold |

|

Umicore SA Business Unit Precious Metals Refining* |

|

Belgium |

| Gold |

|

United Precious Metal Refining, Inc.* |

|

United States |

| Gold |

|

Valcambi SA* |

|

Switzerland |

| Gold |

|

Western Australian Mint trading as The Perth Mint* |

|

Australia |

| Gold |

|

Xstrata Canada Corporation* |

|

Canada |

| Gold |

|

Yokohama Metal Co Ltd |

|

Japan |

| Gold |

|

Zhongyuan Gold Smelter of Zhongjin Gold Corporation |

|

China |

| Gold |

|

Zijin Mining Group Co. Ltd |

|

China |

| Tantalum |

|

Conghua Tantalum and Niobium Smeltry* |

|

China |

| Tantalum |

|

Duoluoshan* |

|

China |

| Tantalum |

|

Exotech Inc.* |

|

United States |

| Tantalum |

|

F&X* |

|

China |

| Tantalum |

|

Gannon & Scott |

|

United States |

| Tantalum |

|

Global Advanced Metals* |

|

United States |

| Tantalum |

|

H.C. Starck GmbH* |

|

Germany |

| Tantalum |

|

Hi-Temp* |

|

United States |

| Tantalum |

|

JiuJiang JinXin Nonferrous Metals Co. Ltd.* |

|

China |

| Tantalum |

|

JiuJiang Tambre Co. Ltd.* |

|

China |

| Tantalum |

|

Kemet Blue Powder* |

|

United States |

| Tantalum |

|

King-Tan Tantalum Industry Ltd |

|

China |

| Tantalum |

|

LMS Brasil S.A.* |

|

Brazil |

| Tantalum |

|

Mitsui Mining & Smelting* |

|

Japan |

| Tantalum |

|

Molycorp Silmet* |

|

Estonia |

| Tantalum |

|

Ningxia Orient Tantalum Industry Co., Ltd.* |

|

China |

| Tantalum |

|

Plansee* |

|

Austria |

| Tantalum |

|

QuantumClean* |

|

United States |

| Tantalum |

|

RFH* |

|

China |

| Tantalum |

|

Solikamsk Metal Works* |

|

Russian Federation |

| Tantalum |

|

Taki Chemicals* |

|

Japan |

|

|

|

|

|

| Tantalum |

|

Tantalite Resources* |

|

South Africa |

| Tantalum |

|

Telex* |

|

United States |

| Tantalum |

|

Ulba* |

|

Kazakhstan |

| Tantalum |

|

Zhuzhou Cement Carbide* |

|

China |

| Tin |

|

CNMC (Guangxi) PGMA Co. Ltd. |

|

China |

| Tin |

|

Cookson* |

|

United States |

| Tin |

|

Cooper Santa |

|

Brazil |

| Tin |

|

CV Duta Putra Bangka |

|

Indonesia |

| Tin |

|

CV Gita Pesona |

|

Indonesia |

| Tin |

|

CV JusTindo |

|

Indonesia |

| Tin |

|

CV Makmur Jaya |

|

Indonesia |

| Tin |

|

CV Nurjanah |

|

Indonesia |

| Tin |

|

CV Prima Timah Utama |

|

Indonesia |

| Tin |

|

CV Serumpun Sebalai |

|

Indonesia |

| Tin |

|

CV United Smelting |

|

Indonesia |

| Tin |

|

EM Vinto |

|

Bolivia |

| Tin |

|

Fenix Metals |

|

Poland |

| Tin |

|

Geiju Non-Ferrous Metal Processing Co. Ltd.* |

|

China |

| Tin |

|

Gejiu Zi-Li |

|

China |

| Tin |

|

Gold Bell Group |

|

China |

| Tin |

|

Huichang Jinshunda Tin Co. Ltd |

|

China |

| Tin |

|

Jiangxi Nanshan |

|

China |

| Tin |

|

Kai Unita Trade Limited Liability Company |

|

China |

| Tin |

|

Linwu Xianggui Smelter Co |

|

China |

| Tin |

|

Liuzhou China Tin |

|

China |

| Tin |

|

Malaysia Smelting Corporation (MSC)* |

|

Malaysia |

| Tin |

|

Metallo Chimique |

|

Belgium |

| Tin |

|

Mineração Taboca S.A.* |

|

Brazil |

| Tin |

|

Minmetals Ganzhou Tin Co. Ltd. |

|

China |

| Tin |

|

Minsur* |

|

Peru |

| Tin |

|

Mitsubishi Materials Corporation* |

|

Japan |

| Tin |

|

Novosibirsk Integrated Tin Works |

|

Russian Federation |

| Tin |

|

OMSA* |

|

Bolivia |

| Tin |

|

PT Alam Lestari Kencana |

|

Indonesia |

| Tin |

|

PT Artha Cipta Langgeng |

|

Indonesia |

| Tin |

|

PT Babel Inti Perkasa |

|

Indonesia |

| Tin |

|

PT Babel Surya Alam Lestari |

|

Indonesia |

| Tin |

|

PT Bangka Kudai Tin |

|

Indonesia |

| Tin |

|

PT Bangka Putra Karya |

|

Indonesia |

| Tin |

|

PT Bangka Timah Utama Sejahtera |

|

Indonesia |

| Tin |

|

PT Bangka Tin Industry |

|

Indonesia |

| Tin |

|

PT Belitung Industri Sejahtera |

|

Indonesia |

| Tin |

|

PT BilliTin Makmur Lestari |

|

Indonesia |

| Tin |

|

PT Bukit Timah* |

|

Indonesia |

| Tin |

|

PT DS Jaya Abadi |

|

Indonesia |

| Tin |

|

PT Eunindo Usaha Mandiri |

|

Indonesia |

| Tin |

|

PT Fang Di MulTindo |

|

Indonesia |

| Tin |

|

PT HP Metals Indonesia |

|

Indonesia |

| Tin |

|

PT Karimun Mining |

|

Indonesia |

| Tin |

|

PT Koba Tin |

|

Indonesia |

| Tin |

|

PT Mitra Stania Prima |

|

Indonesia |

| Tin |

|

PT Panca Mega |

|

Indonesia |

| Tin |

|

PT Refined Banka Tin |

|

Indonesia |

| Tin |

|

PT Sariwiguna Binasentosa |

|

Indonesia |

| Tin |

|

PT Seirama Tin investment |

|

Indonesia |

| Tin |

|

PT Stanindo Inti Perkasa |

|

Indonesia |

|

|

|

|

|

| Tin |

|

PT Sumber Jaya Indah |

|

Indonesia |

| Tin |

|

PT Tambang Timah* |

|

Indonesia |

| Tin |

|

PT Timah Nusantara |

|

Indonesia |

| Tin |

|

PT Timah* |

|

Indonesia |

| Tin |

|

PT Tinindo Inter Nusa |

|

Indonesia |

| Tin |

|

PT Tommy Utama |

|

Indonesia |

| Tin |

|

PT Yinchendo Mining Industry |

|

Indonesia |

| Tin |

|

Thaisarco* |

|

Thailand |

| Tin |

|

White Solder Metalurgia* |

|

Brazil |

| Tin |

|

Yunnan Chengfeng |

|

China |

| Tin |

|

Yunnan Tin Company Limited* |

|

China |

| Tungsten |

|

A.L.M.T. Corp. |

|

Japan |

| Tungsten |

|

ATI Tungsten Materials |

|

United States |

| Tungsten |

|

Chaozhou Xianglu Tungsten Industry Co Ltd |

|

China |

| Tungsten |

|

China Minmetals Nonferrous Metals Co Ltd |

|

China |

| Tungsten |

|

Chongyi Zhangyuan Tungsten Co Ltd |

|

China |

| Tungsten |

|

Dayu Weiliang Tungsten Co., Ltd. |

|

China |

| Tungsten |

|

Fujian Jinxin Tungsten Co., Ltd.*** |

|

China |

| Tungsten |

|

Ganzhou Grand Sea W & Mo Group Co Ltd |

|

China |

| Tungsten |

|

Global Tungsten & Powders Corp*** |

|

United States |

| Tungsten |

|

HC Starck GmbH*** |

|

Germany |

| Tungsten |

|

Hunan Chenzhou Mining Group Co |

|

China |

| Tungsten |

|

Hunan Chun-Chang Nonferrous Smelting & Concentrating Co., Ltd. |

|

China |

| Tungsten |

|

Japan New Metals Co Ltd |

|

Japan |

| Tungsten |

|

Jiangxi Minmetals Gao’an Non-ferrous Metals Co., Ltd. |

|

China |

| Tungsten |

|

Jiangxi Rare Earth & Rare Metals Tungsten Group Corp |

|

China |

| Tungsten |

|

Jiangxi Tungsten Industry Group Co Ltd*** |

|

China |

| Tungsten |

|

Kennametal Inc.*** |

|

United States |

| Tungsten |

|

Tejing (Vietnam) Tungsten Co Ltd |

|

Vietnam |

| Tungsten |

|

Wolfram Bergbau und Hütten AG*** |

|

Austria |

| Tungsten |

|

Wolfram Company CJSC*** |

|

Russian Federation |

| Tungsten |

|

Xiamen Tungsten Co Ltd*** |

|

China |

| Tungsten |

|

Xinhai Rendan Shaoguan Tungsten Co., Ltd. |

|

China |

| Tungsten |

|

Zhuzhou Cemented Carbide Group Co Ltd |

|

China |

| 4 |

Per the Conflict Free Smelter Program, as of 4/30/2014 Source: http://www.conflictfreesourcing.org/conflict-free-smelter-refiner-lists/ |

| * |

Verified as Conflict Free as of 4/30/2014 |

| ** |

Member of the London Bullion Market Association as of 4/30/2014 |

| *** |

Progressing Towards Conflict Free Status as of 4/30/2014 |

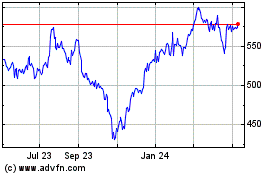

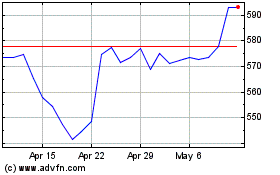

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Apr 2023 to Apr 2024