Turkcell Mulls Share Buyback, Will Study Borrowing Options

August 26 2015 - 6:02AM

Dow Jones News

By Yeliz Candemir

ISTANBUL--Turkey's biggest mobile-phone operator by subscribers,

Turkcell Iletisim Hizmetleri AS (TKC, TCELL.IS) said late Tuesday

it is considering buying back up to 10% of its outstanding share

capital and will study its borrowing options.

In a statement to the Istanbul Stock Exchange, Turkcell said

Chief Executive Kaan Terzioglu has been authorized to seek approval

from the country's Capital Markets Board and related institutions

for a share buyback.

Turkcell also said it would evaluate borrowing alternatives,

including loans and debt issuance for an amount up to $3 billion

for refinancing purposes, funding infrastructure investments and

other potential investment opportunities.

"This is positive for the stock, given current domestic

political instability and global market turbulence," said

Istanbul-based brokerage Deniz Invest. "Turkcell has been looking

for inorganic growth opportunities in the region for a while, and

we believe part of any borrowing will be used for this. We also

view this decision as slightly positive for the stock, as it is a

concrete step toward inorganic growth."

At 0845 GMT, Turkcell shares were trading 3.6% higher at

TRY11.50, compared with a 0.5% drop in the benchmark BIST-100

Index.

Write to Yeliz Candemir at yeliz.candemir@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 26, 2015 05:47 ET (09:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

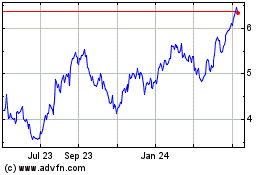

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Aug 2024 to Sep 2024

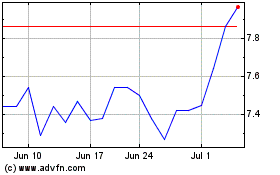

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Sep 2023 to Sep 2024