Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

January 28 2016 - 10:41AM

Edgar (US Regulatory)

pursuant to Rule 425 under

the Securities Act of 1933 and

deemed filed pursuant to Rule 14a-12 under

the Securities Exchange Act of 1934

Subject Company: Terex Corporation

(Commission File No. 001-10702)

Published in Kauppalehti on January 26, 2016

Konecranes' Gustavson: The Chinese company tests the waters

Stig Gustavson, the chairman of the Board of Directors of Konecranes, doubts realistic possibilities of Zoomlion to succeed in the acquisition of the US company Terex Corporation.

"The Chinese company is now "testing the waters", Gustavson thinks.

He says he has during Tuesday studied the background of the Chinese company and noted that the company does not seem to be in a good shape financially.

"If I am at all capable to read balance sheets, the Chinese company will not be able to finance the acquisition of Terex from its own balance sheet. What we are talking about here is a billion scale deal which raises the question, from where and on what conditions will they get the financing. And if what they are looking at is an advantageous loan from the government, that is something which will not be tolerated in the US" Gustavson thinks.

"Additionally it seems that the company has worked a lot with the Chinese military and the company is involved in the nuclear programs of the country. It has also had dealings with Iran when the US sanctions were applicable."

"This is a large and complicated matter, since so many different parties are involved. But we have an agreement with Terex, and that cannot be terminated easily."

Provided the approach by the Chinese will develop into a real bid, the process will according to Gustavson take at least two years to complete. He recalls that it has from the Terex side been indicated, that the progress of the transaction with Konecranes continues, and that all processes required for the merger e.g. with the competition authorities proceed in accordance with a customary timetable.

"The process is still on track, but this is a big and long process. We have so far received green light from competition authorities in two countries, but the major jurisdictions are still pending. We have said that it may be possible to close the deal during the second quarter of this year."

Konecranes published a stock exchange release late on Tuesday in which it confirmed its intention to continue to pursue the merger of equals with Terex as planned. " Konecranes continues to believe that the merger represents a highly compelling opportunity for both companies and their shareholders, and stands behind and remains committed to the merger" the release states.

FORWARD LOOKING STATEMENTS

This document contains forward-looking statements regarding future events, including statements regarding Terex or Konecranes, the transaction described in this document and the expected benefits of such transaction and future financial performance of the combined businesses of Terex and Konecranes based on each of their current expectations. These statements involve risks and uncertainties that may cause results to differ materially from those set forth in the statements. When included in this document, the words “may”, “expects”, “intends”, “anticipates”, “plans”, “projects”, “estimates” and the negatives thereof and analogous or similar expressions are intended to identify forward-looking statements. However, the absence of these words does not mean that the statement is not forward-looking. Terex and Konecranes have based these forward-looking statements on current expectations and projections about future events. These statements are not guarantees of future performance.

Because forward-looking statements involve risks and uncertainties, actual results could differ materially. Such risks and uncertainties, many of which are beyond the control of Konecranes, include, among others: the ability of Terex and Konecranes to obtain shareholder approval for the transaction, the ability of Terex and Konecranes to obtain regulatory approval for the transaction, the possibility that the length of time required to complete the transaction will be longer than anticipated, the achievement of the expected benefits of the transaction, risks associated with the integration of the businesses of Terex and Konecranes, the possibility that the businesses of Terex and Konecranes may suffer as a result of uncertainty surrounding the proposed transaction, and other factors, risks and uncertainties that are more specifically set forth in Terex’ public filings with the SEC and Konecranes’ annual and interim reports. Konecranes disclaims any obligation to update the forward-looking statements contained herein.

IMPORTANT ADDITIONAL INFORMATION

This document relates to the proposed merger of Terex and Konecranes through which all of Terex’ common stock will be exchanged for Konecranes ordinary shares (or American depositary shares, if required). This document is for informational purposes only and does not constitute an offer to purchase or exchange, or a solicitation of an offer to sell or exchange, all of common stock of Terex, nor is it a substitute for the Preliminary Prospectus included in the Registration Statement on Form F-4 (the “Registration Statement”) to be filed by Konecranes with the SEC, the Prospectus/Proxy to be filed by Terex with the SEC, the listing prospectus of Konecranes to be filed by Konecranes with the Finnish Financial Supervisory Authority (and as amended and supplemented from time to time, the “Merger Documents”). No offering of securities shall be made in the United States except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE MERGER DOCUMENTS AND ALL OTHER RELEVANT DOCUMENTS THAT KONECRANES OR TEREX HAS FILED OR MAY FILE WITH THE SEC, NASDAQ HELSINKI, OR FINNISH FINANCIAL SUPERVISORY AUTHORITY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING THE PROPOSED MERGER.

The information contained in this document must not be published, released or distributed, directly or indirectly, in any jurisdiction where the publication, release or distribution of such information is restricted by laws or regulations. Therefore, persons in such jurisdictions into which these materials are published, released or distributed must inform themselves about and comply with such laws or regulations. Konecranes and Terex do not accept any responsibility for any violation by any person of any

such restrictions. The Merger Documents and other documents referred to above, if filed or furnished by Konecranes or Terex with the SEC, as applicable, will be available free of charge at the SEC’s website (www.sec.gov) or by writing to Anna-Mari Kautto, Investor Relations Assistant, Konecranes Plc, P.O. Box 661, FI-05801 Hyvinkää, Finland or Elizabeth Gaal, Investor Relations Associate, Terex, 200 Nyala Farm Road, Westport, CT 06880, USA.

Konecranes and Terex and their respective directors, executive officers and employees and other persons may be deemed to be participants in the solicitation of proxies in respect of the transaction. Information regarding Konecranes' directors and executive officers is available in Konecranes’ annual report for fiscal year 2014 at www.konecranes.com. Information about Terex' directors and executive officers and their ownership of Terex ordinary shares is available in its Schedule 14A filed with the SEC on April 1, 2015. Other information regarding the interests of such individuals as well as information regarding Konecranes’ and Terex' directors and officers will be available in the proxy statement/prospectus when it becomes available. These documents can be obtained free of charge from the sources indicated above.

3

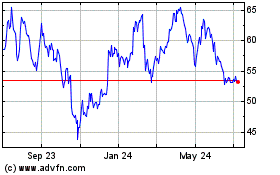

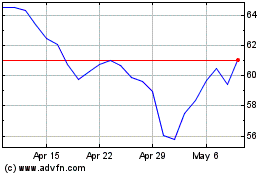

Terex (NYSE:TEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Terex (NYSE:TEX)

Historical Stock Chart

From Apr 2023 to Apr 2024