UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| |

Date of Report

| |

(Date of earliest event reported):

| February 11, 2016

|

| | | | |

Commission

File Number

| | Exact Name of Registrants as Specified in their Charters, State of Incorporation,

Address and Telephone Number

| | IRS Employer

Identification

Number

|

1-14201

| | SEMPRA ENERGY

(A California Corporation)

488 8th Avenue

San Diego, California 92101

(619) 696-2000

| | 33-0732627

|

| | | | |

| | | | |

| | | | |

1-01402

| | SOUTHERN CALIFORNIA GAS COMPANY

(A California Corporation)

555 West Fifth Street

Los Angeles, California 90013

(213) 244-1200

| | 95-1240705

|

|

|

(Former name or former address, if changed since last report.)

|

| |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

[ ]

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

[ ]

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

[ ]

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

[ ]

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| |

FORM 8-K

Item 8.01 Other Events

On October 23, 2015, the Southern California Gas Company (the “Company”), an indirect subsidiary of Sempra Energy, discovered a leak at one of its injection and withdrawal wells, SS25, at its Aliso Canyon natural gas storage facility, located in the northern part of the San Fernando Valley in Los Angeles County. The Aliso Canyon facility, which has been operated by the Company since 1972, is situated in the Santa Susana Mountains. SS25 is more than one mile away from and 1,200 feet above the closest homes. It is one of more than 100 injection and withdrawal wells at the storage facility.

Addressing the Leak and Mitigation Efforts

On December 4, 2015, the Company commenced drilling a relief well designed to stop the leak by plugging SS25 at its base. On February 11, 2016, the Company began pumping fluids through the relief well into SS25 near the base of the well, which has temporarily controlled the flow of natural gas through the well and has stopped the leak. While this is a positive development, to permanently seal the well, cement will need to be injected into SS25 at its base, which could occur over the next several days. The Company will continue to work in coordination with the California Division of Oil, Gas, and Geothermal Resources (“DOGGR”) and other agencies during the course of attempting to permanently seal the well. The Company is also continuing its preparations to drill a back-up relief well as a precautionary measure and will continue those efforts at least until it is confident that the leak has been permanently sealed, which at this point is not assured.

The Company has been providing temporary relocation support to residents in the nearby community who request it. As of February 10, 2016, approximately 6,400 households utilized temporary relocation services, and over 1,700 have since moved back into their homes. In addition, the Company has been providing air filtration and purification systems to those residents in the nearby community requesting them. Once the DOGGR confirms that the SS25 well has been permanently sealed, the Company will start winding down its temporary relocation program. Subject to certain exceptions, residents who temporarily relocated to short-term housing, such as hotels, will have up to eight days/seven nights to transition back home, and residents who have been placed in rental housing will have through the agreed term of their leases to return home. The Company also intends to mitigate the environmental impact of the actual natural gas released.

The total costs that will be incurred to remediate and stop the leak and to mitigate environmental and local community impacts will be significant, and to the extent not covered by insurance, or if there were to be significant delays in receiving insurance recoveries, such costs could have a material adverse effect on the Company’s and Sempra Energy’s cash flows, financial condition and results of operations. We discuss our insurance coverage under the heading “Insurance” below.

Governmental Investigations and Civil and Criminal Litigation

Various governmental agencies, including the DOGGR, Los Angeles County Department of Public Health, South Coast Air Quality Management District (“SCAQMD”), California Air Resources Board (“CARB”), California Public Utilities Commission (“CPUC”), U.S. Environmental Protection Agency, Los Angeles District Attorney’s Office and California Attorney General’s Office, are investigating this incident. On January 25, 2016, the DOGGR and CPUC selected Blade Energy Partners to conduct an independent analysis under their supervision and to be funded by the Company to investigate the technical root cause of the Aliso Canyon leak. The Company has been working in close cooperation with these agencies.

As of February 10, 2016, 67 lawsuits have been filed against the Company, some of which have also named Sempra Energy, asserting causes of action for negligence, strict liability, property damage, fraud, nuisance, and trespass, among other things, and additional litigation may be filed against us in the future related to this incident. Many of these complaints seek class action status, compensatory and punitive damages, injunctive relief, and attorneys’ fees. The Los Angeles City Attorney and Los Angeles County Counsel filed a complaint on behalf of the people of the State of California against the Company for public nuisance and violation of the California Unfair Competition Law. The California Attorney General, acting in her independent capacity and on behalf of the people of the State of California and the CARB, joined this lawsuit. The complaint, as amended to include the California Attorney General, adds allegations of violations of California Health and Safety Code sections 41700, prohibiting discharge of air contaminants that cause annoyance to the public, and 25510, requiring reporting of the release of hazardous material, as well as California Government Code section 12607 for equitable relief for the protection of natural resources. The complaint seeks an order for injunctive relief, to abate the public nuisance, and to impose civil penalties. The SCAQMD filed a complaint against the Company seeking civil penalties for alleged violations of several nuisance-related statutory provisions arising from the leak and delays in stopping the leak. That suit seeks up to $250,000 in civil penalties for each day the violations occurred.

On February 2, 2016, the Los Angeles District Attorney’s Office filed a misdemeanor criminal complaint against the Company seeking penalties for alleged failure to provide timely notice of the leak pursuant to California Health and Safety Code section 25510(a), Los Angeles County Code section 12.56.030, and Title 19 California Code of Regulations section 2703(a), and for violating California Health and Safety Code section 41700 prohibiting discharge of air contaminants that cause annoyance to the public.

All of these complaints are being reviewed by the Company and outside legal counsel. The costs of defending against these civil and criminal lawsuits and cooperating with these investigations, and any damages and civil and criminal fines and other penalties, if awarded or imposed, could be significant, and to the extent not covered by insurance, or if there were to be significant delays in receiving insurance recoveries, could have a material adverse effect on the Company’s and Sempra Energy’s cash flows, financial condition and results of operations. We discuss our insurance coverage under the heading “Insurance” below.

Governmental Orders, Additional Regulation and Reliability

During the month of January 2016, the Hearing Board of the SCAQMD conducted public hearings on a stipulated abatement order regarding the Aliso Canyon leak. On January 23, 2016, the Hearing Board ordered the Company to, among other things: stop all injections of natural gas except as directed by the CPUC, withdraw the maximum amount of natural gas feasible in a contained and safe manner, subject to orders of the CPUC, and permanently seal the well once the leak has ceased; continuously monitor the well site with infrared cameras until 30 days after the leak has ceased; provide the public with daily air monitoring data collected by the Company; provide the SCAQMD with certain natural gas injection, withdrawal and emissions data from the Aliso Canyon facility; prepare and submit to the SCAQMD for its approval an enhanced leak detection and reporting well inspection program for the Aliso Canyon facility; provide the SCAQMD with funding to develop a continuous air monitoring plan for the Aliso Canyon facility and the nearby school and community; prepare and submit to the SCAQMD for its approval an air quality notification plan to provide notice to SCAQMD, other public agencies and the nearby community in the event of a future reportable release; and provide the SCAQMD with funding to conduct an independent health study on the potential impacts of exposure to the constituents of the natural gas released from the facility as well as any odor suppressants used to mitigate odors from the leaking well. Additional hearings in the state legislature as well as with various other regulatory agencies have been or are expected to be scheduled.

The Company estimates that as of February 10, 2016, approximately 57 Bcf of natural gas has been delivered to customers or moved to other gas storage facilities from an initial starting point of approximately 77 Bcf of gas in storage on October 23, 2015 at the Aliso Canyon facility. The Company has been directed by the CPUC to maintain a minimum of 15 Bcf of working natural gas to ensure reliability of the system through the spring and summer months, and based upon the CARB estimates of lost gas, the facility is approximately at this level. As a result and consistent with the order issued by the Hearing Board of the SCAQMD as described above, the Company is no longer withdrawing gas from this facility. As the amounts of natural gas set forth above are approximations, the Company cannot at this time reliably measure the amount of natural gas lost from the leak. Once the well has been permanently sealed, the Company will conduct a measurement of natural gas lost from the leak and will provide that information to the relevant regulatory bodies.

Natural gas withdrawn from storage is important for ensuring service reliability during peak demand periods, including heating needs in the winter, as well as peak electric generation needs in the summer. Aliso Canyon, with a storage capacity of 86 Bcf, is the largest and most important element of the Company’s natural gas delivery system, serving millions of homes and businesses across Southern California. Aliso Canyon represents 63 percent of the Company’s owned natural gas storage capacity.

As previously announced in the Company’s Form 8-K dated January 6, 2016, the Governor of California issued an order (the “Governor’s Order”) proclaiming a state of emergency to exist in Los Angeles County due to the natural gas leak and implementing a number of orders applicable to the Company and various state agencies. The Company has not injected natural gas into the Aliso Canyon natural gas storage facility since October 25, 2015, and in accordance with the Governor’s Order and subject to contrary CPUC reliability-based direction, the Company will continue this moratorium on further injections until the completion of (i) a comprehensive review, utilizing independent experts, of the safety of the storage wells and air quality of the surrounding community and (ii) an evaluation by an independent panel of scientific and medical experts on whether additional measures are needed to protect public health. In addition, effective February 5, 2016, the DOGGR amended the California Code of Regulations to require all underground natural gas storage facility operators, including the Company, to take further steps to ensure the safety of their gas storage operations. If this facility were to be taken out of service for any meaningful period of time, it could result in significantly higher than expected future operating costs and/or additional asset requirements, and natural gas reliability and electric generation could be jeopardized, which could result in impairment of the Aliso Canyon facility. The Aliso Canyon facility had a net book value of $243 million at December 31, 2015. Any significant impairment of this asset could have a material adverse effect on the Company’s and Sempra Energy’s results of operations for the period in which it is recorded, and higher operating costs and additional capital expenditures may not be recoverable in customer rates, which could have a material adverse effect on the Company’s and Sempra Energy’s results of operations, cash flows and financial condition.

Cost Estimates

Pursuant to the Company’s Form 8-K dated January 6, 2016, the Company estimated that as of December 31, 2015 it had spent approximately $50 million addressing the leak and mitigating environmental and community impacts, including temporary relocation, and drilling the relief well and attempts to stop or mitigate the emissions. Since that time, the number of households that have participated in the temporary relocation program has increased from approximately 2,200 as of December 31, 2015 to approximately 6,400 households as of February 10, 2016, contributing substantially to our total cost estimate described below.

The Company’s total costs consisting of amounts paid and forecasted to be paid to address the leak and mitigate certain environmental and community impacts, including temporary relocation, drilling relief wells, attempts to stop or mitigate the emissions, and the value of lost gas are estimated to be between $250 million and $300 million. The Company believes that it is probable that this amount, less deductibles of $4 million, will be covered by insurance. These amounts do not include any reserves for damage awards, any civil or criminal fines and other penalties that may be imposed, and associated legal costs, or the costs related to our intention to mitigate the environmental impact of the actual natural gas released from the leak, as these amounts are not reliably estimable as to amount or timing at this time.

Insurance

We have at least four types of insurance policies that we believe will cover many of the current and expected claims, losses, costs, and litigation (collectively, “Claims”) associated with the natural gas leak at Aliso Canyon. The total combined limit available under all of these policies is in excess of $1 billion. We have put these insurers on notice about the leak, the nature of potential losses and the filing of lawsuits and are actively pursuing coverage with these carriers. These policies are subject to various policy limits depending on the type of Claim and are subject to various exclusions and other coverage limitations. The Company does not anticipate that the payment of deductibles on these policies will be material.

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

We make statements in this report that are not historical fact and constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are necessarily based upon assumptions with respect to the future, involve risks and uncertainties, and are not guarantees of performance. These forward-looking statements represent our estimates and assumptions only as of the filing date of this report. We assume no obligation to update or revise any forward-looking statement as a result of new information, future events or other factors.

In this report, when we use words such as “believes,” “expects,” “anticipates,” “plans,” “estimates,” “projects,” “forecasts,” “contemplates,” “intends,” “depends,” “should,” “could,” “would,” “will,” “confident,” “may,” “potential,” “possible,” “proposed,” “target,” “pursue,” “goals,” “outlook,” “maintain,” or similar expressions, or when we discuss our guidance, strategy, plans, goals, opportunities, projections, initiatives, objectives or intentions, we are making forward-looking statements.

Factors, among others, that could cause our actual results and future actions to differ materially from those described in forward-looking statements include

§

local, regional, national and international economic, competitive, political, legislative and regulatory conditions and developments;

§

actions and the timing of actions, including issuances of permits to construct and licenses for operation, by the California Public Utilities Commission, California State Legislature, U.S. Department of Energy, Federal Energy Regulatory Commission, Nuclear Regulatory Commission, Atomic Safety and Licensing Board, California Energy Commission, U.S. Environmental Protection Agency, California Air Resources Board, and other regulatory, governmental and environmental bodies in the United States and other countries in which we operate;

§

the timing and success of business development efforts and construction, maintenance and capital projects, including risks in obtaining, maintaining or extending permits, licenses, certificates and other authorizations on a timely basis and risks in obtaining adequate and competitive financing for such projects;

§

energy markets, including the timing and extent of changes and volatility in commodity prices, and the impact of any protracted reduction in oil and natural gas prices from historical averages;

§

the impact on the value of our natural gas storage assets from low natural gas prices, low volatility of natural gas prices and the inability to procure favorable long-term contracts for natural gas storage services;

§

delays in the timing of costs incurred and the timing of the regulatory agency authorization to recover such costs in rates from customers;

§

deviations from regulatory precedent or practice that result in a reallocation of benefits or burdens among shareholders and ratepayers;

§

capital markets conditions, including the availability of credit and the liquidity of our investments;

§

inflation, interest and currency exchange rates;

§

the impact of benchmark interest rates, generally Moody’s A-rated utility bond yields, on our San Diego Gas & Electric Company’s (SDG&E) and the Company’s cost of capital;

§

the availability of electric power, natural gas and liquefied natural gas, and natural gas pipeline and storage capacity, including disruptions caused by failures in the North American transmission grid, pipeline explosions and equipment failures and the decommissioning of San Onofre Nuclear Generating Station (SONGS);

§

cybersecurity threats to the energy grid, natural gas storage and pipeline infrastructure, the information and systems used to operate our businesses and the confidentiality of our proprietary information and the personal information of our customers, terrorist attacks that threaten system operations and critical infrastructure, and wars;

§

the ability to win competitively bid infrastructure projects against a number of strong competitors willing to aggressively bid for these projects;

§

weather conditions, conservation efforts, natural disasters, catastrophic accidents, and other events that may disrupt our operations, damage our facilities and systems, and subject us to third-party liability for property damage or personal injuries, some of which may not be covered by insurance;

§

risks that our partners or counterparties will be unable or unwilling to fulfill their contractual commitments;

§

risks posed by decisions and actions of third parties who control the operations of investments in which we do not have a controlling interest;

§

risks inherent with nuclear power facilities and radioactive materials storage, including the catastrophic release of such materials, the disallowance of the recovery of the investment in, or operating costs of, the nuclear facility due to an extended outage and facility closure, and increased regulatory oversight, including motions to modify settlements;

§

business, regulatory, environmental and legal decisions and requirements;

§

expropriation of assets by foreign governments and title and other property disputes;

§

the impact on reliability of SDG&E’s electric transmission and distribution system due to increased amount and variability of power supply from renewable energy sources and increased reliance on natural gas and natural gas transmission systems;

§

the impact on competitive customer rates of the growth in distributed and local power generation and the corresponding decrease in demand for power delivered through SDG&E’s electric transmission and distribution system;

§

the inability or determination not to enter into long-term supply and sales agreements or long-term firm capacity agreements due to insufficient market interest, unattractive pricing or other factors;

§

the resolution of litigation; and

§

other uncertainties, all of which are difficult to predict and many of which are beyond our control.

We caution you not to rely unduly on any forward-looking statements. You should review and consider carefully the risks, uncertainties and other factors that affect our business as described in this report and in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on a combined basis for Sempra Energy, SDG&E and the Company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

SEMPRA ENERGY

(Registrant)

| |

Date: February 11, 2016

| By: /s/ Trevor I. Mihalik

|

| Trevor I. Mihalik

Senior Vice President, Controller and

Chief Accounting Officer

|

|

SOUTHERN CALIFORNIA GAS COMPANY

(Registrant)

| |

Date: February 11, 2016

| By: /s/ Bruce A. Folkmann

|

| Bruce A. Folkmann

Vice President, Controller, Chief Financial Officer and Chief Accounting Officer

|

|

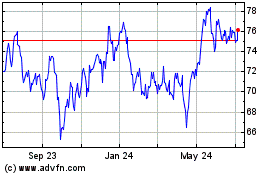

Sempra (NYSE:SRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

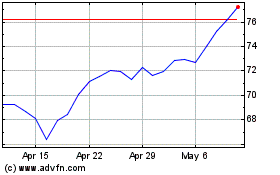

Sempra (NYSE:SRE)

Historical Stock Chart

From Apr 2023 to Apr 2024