Glass Lewis Backs Medivation Board in Sanofi Dispute

June 24 2016 - 11:42AM

Dow Jones News

By Brittney Laryea

Proxy advisory firm Glass Lewis & Co. recommended Friday

that Medivation Inc. shareholders should support the company's

current board and reject Sanofi SA's efforts to acquire the U.S.

company in the ongoing takeover battle.

In May, the French drug maker approached Medivation's

shareholders, calling for a vote to remove its entire board. Sanofi

is seeking to engage in acquisition talks with Medivation, which

has rejected Sanofi's unsolicited $9.3 billion takeover offer.

Medivation said Friday, "We are pleased with Glass Lewis'

report, which underscores our belief that Sanofi's opportunistic

proposal grossly undervalues Medivation."

A Sanofi representative said that based on conversations with

Medivation shareholders, "there is overwhelming support for

Medivation to undertake a sale process that includes Sanofi." The

representative reiterated Sanofi's position that sales talks could

lead to a higher offer.

Sanofi's offer April 28 valued Medivation at $52.50 a share,

which represented a 50% premium to Medivation's average share price

for the two months before takeover speculation emerged. Since April

28, Medivation shares have traded above the offer price.

Friday, amid a broader market selloff following Britain's

surprise vote to leave the European Union, Medivation fell 2.2% to

$57.95 in morning trading in New York. Sanofi's American Depositary

Receipts dropped 4.8% to $39.22.

The Paris-based Sanofi, which has a history of hostile biotech

takeovers, wants to buy Medivation to expand its cancer-treatment

business.

Medivation focuses on hard-to-treat cancers and markets one

prostate cancer therapy, Xtandi. The company also has two

additional oncology assets in clinical development.

Write to Brittney Laryea at Brittney.Laryea@wsj.com

(END) Dow Jones Newswires

June 24, 2016 11:27 ET (15:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

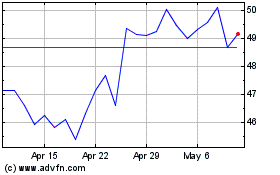

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024