After several years spent lost in the shuffle of Android handset

makers, LG Electronics Inc. is giving up on the China market and

making a renewed push in the U.S. with a high-end flagship

smartphone, in a bid to regain the world's No. 3 spot.

LG's G5 smartphone, launched on the sidelines of the Mobile

World Congress in Barcelona, has a radically different design that

has won plaudits from critics, bolstering investor hopes that the

South Korean company may have finally found its hit phone. LG needs

a best seller as its mobile unit has posted losses for the past two

quarters.

The metal-framed G5 has a modular design, which allows users

to easily swap in accessories like a camera pack with an optical

zoom, a high-fidelity audio booster or an extra battery.

In its efforts to make the G5 a hit, LG executives said the

company is planning simultaneous launches in the U.S., Europe and

South Korea, working with 200 carrier partners when the phone goes

on sale in April.

"We want to give it a big drive this time, setting aside more

budget for marketing than we could probably afford," said Juno Cho,

LG's mobile chief, without disclosing specific figures.

Mr. Cho was named LG's mobile chief at the end of 2014, largely

due to his experience in the U.S. He spent four years as an

executive involved in setting business strategies for LG's North

American operations.

But LG has a lot of catching up to do. Last year, it ranked

sixth in the global smartphone market with a 5.3% market share,

behind Samsung Electronics Co., Apple Inc. and a trio of Chinese

smartphone makers—Huawei Technologies Co., Lenovo Group Ltd. and

Xiaomi Corp., according to data tracker TrendForce. It ranked third

globally in early 2013, but was toppled by Huawei. Still, with

Lenovo and Xiaomi struggling to improve their market share, LG sees

an opportunity to challenge Huawei for the No. 3 spot with

differentiated devices.

Analysts estimate that LG could ship more than 10 million units

of the G5 this year; which, while modest compared with expected

sales for Samsung's Galaxy S7, would be a record for the

company.

"Now that smartphones have fully penetrated the market, it's so

hard to impress the consumer, and the G5 can do that," says

Jefferson Wang, a wireless and mobility consultant at

Philadelphia-based IBB Consulting Group. "They've hit the areas

that are traditionally important for the consumer: photos and

music."

If the device takes off, LG could also benefit from sales of

accessories, which have juicier profit margins, analysts say.

In a reflection of its ambitions, LG eschewed its usual practice

of renting out a modest hotel conference room on the sidelines of

Mobile World Congress for its launch event. Instead, it booked a

jumbo airplane hangar-sized hall on a hill overlooking Barcelona.

In a break from practice, it held its event just hours before

Samsung's event, and in direct competition with Huawei's news

conference.

Committing to a bigger marketing budget could make LG a key

partner for U.S. carriers, who are looking for fresh products to

drive excitement and typically pour in marketing dollars alongside

handset manufacturers, says Jeff Fieldhack, a Rancho Santa Fe,

Calif.-based research director for Counterpoint Technology Market

Research.

Spending big on advertising could help LG steal market share

from struggling handset makers like HTC Corp., Sony Corp. and

Microsoft Corp., Mr. Fieldhack added.

Mr. Cho concedes that marketing could take a toll on the

company's bottom line. But executives say that with a potential hit

smartphone on its hands, now is the time for LG to be

aggressive.

Late last year, LG introduced the V10 smartphone in the U.S. In

order to play up the device's video-shooting features to consumers

in their 20s and 30s, it hired movie star Joseph Gordon-Levitt to

promote the phone.

Thanks in part to these efforts, LG's smartphone shipments in

the U.S. market rose to 13% in the last three months of 2015,

according to research firm Counterpoint. That marked a strong gain

for LG from a year earlier—a period during which both Apple and

Samsung lost ground.

Despite its progress, challenges still abound. The company has

backpedaled from China, the world's largest smartphone market, due

to stiff competition where companies like Samsung, which was

dominant there for years, and Lenovo, a technology pioneer in

China, have also struggled.

LG's China sales accounted for just 6% of the company's total

revenue, including sales of televisions and home appliances, during

the first three quarters of 2015. This compares with 28% for North

America and 26% for South Korea during the same period.

"China is a very brand-sensitive market, and it requires huge

retail costs in the early stages to push products," Mr. Cho

said.

Its focus on the U.S. also comes as other Chinese makers like

Huawei are eyeing the market.

To diversify, LG is also pushing into other segments such as

accessories to go with phones, including a lightweight

virtual-reality headset, a 360-degree camera and a rolling robot

that can serve as a real-time surveillance camera for the home.

Write to Min-Jeong Lee at min-jeong.lee@wsj.com and Jonathan

Cheng at jonathan.cheng@wsj.com

(END) Dow Jones Newswires

February 24, 2016 00:35 ET (05:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

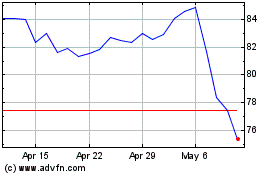

Sony (NYSE:SONY)

Historical Stock Chart

From Mar 2024 to Apr 2024

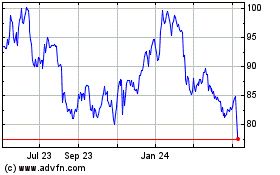

Sony (NYSE:SONY)

Historical Stock Chart

From Apr 2023 to Apr 2024