UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 18, 2015

Service Corporation International

(Exact name of Registrant as specified in its charter)

Texas

(State or other jurisdiction

of incorporation) |

1-6402-1

(Commission File Number) |

74-1488375

(I.R.S. Employer

Identification Number) |

|

1929 Allen Parkway

Houston, Texas

(Address of principal executive offices)

|

77019

(Zip code) |

(713) 522-5141

(Registrant’s telephone number, including area code)

N.A.

(Former name or former address, if changes since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 | Entry into a Material Definitive Agreement |

On August 18, 2015, Service Corporation International (the “Company”)

issued $300 million aggregate principal amount of its 5.375% Senior Notes due 2024 (the “Notes”) in a reopening of

its existing series of such Notes, pursuant to the indenture dated as of February 1, 1993 between the Company and The Bank of New

York Mellon Trust Company, N.A., as successor to The Bank of New York, as trustee, as supplemented by the Twelfth Supplemental

Indenture dated as of May 12, 2014. The aggregate proceeds from the sale of the Notes, net of underwriters’ discounts and

offering expenses, will be used to redeem all of the Company’s outstanding 6.750% Senior Notes due 2016 and to repay approximately

$99 million of outstanding borrowings under its revolving credit facility.

| Item 2.03 | Creation of a Direct Financial Obligation or

an Obligation under an Off-Balance Sheet Arrangement of a Registrant |

The information provided in Item 1.01 to the extent applicable

is incorporated herein by reference.

On August 18, 2015, the Company issued a press release announcing

that it had completed the sale of $300 million aggregate principal amount of its 5.375% Senior Notes due 2024 (the “Notes”)

in a reopening of its existing series of such Notes. A copy of this press release is attached as Exhibit 99.1 and incorporated

by reference.

In connection with the completion of the sale of the Notes,

the Company is filing certain exhibits as part of this Form 8-K. The information contained in this Current Report on Form 8-K,

including the exhibits hereto, is neither an offer to sell nor a solicitation of an offer to purchase any of the Notes or any other

securities of the Company.

| Item 9.01 | Financial Statements and Exhibits |

(d) The following exhibits are included with this report:

| Exhibit No. |

Description |

| |

|

| 4.1 |

Indenture dated as of February 1, 1993 between Service Corporation International and The Bank of New York Mellon Trust Company, N.A., as successor to The Bank of New York, as trustee (incorporated by reference to Exhibit 4.1 to Form S-4 filed September 2, 2004 (File No. 333-118763)) |

| |

|

| 4.2 |

Twelfth Supplemental Indenture dated as of May 12, 2014 between Service Corporation International and The Bank of New York Mellon Trust Company, N.A., as successor to The Bank of New York, as trustee (incorporated by reference to Exhibit 4.1 to Form 8-K filed May 12, 2014 (Film No. 001-06402)) |

| |

|

| 4.3 |

Form of 5.375% Senior Notes due 2024 (included in Exhibit 4.2) |

| |

|

| 5.1 |

Opinion of Locke Lord LLP |

| |

|

| 99.1 |

Press release dated August 18, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: August 18, 2015 |

|

|

|

| |

|

|

|

| |

Service Corporation International |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Gregory T. Sangalis |

|

| |

|

Name: |

Gregory T. Sangalis |

|

| |

|

Title: |

Senior Vice President, |

|

| |

|

|

General Counsel and Secretary |

|

EXHIBITS

| Exhibit No. |

Description |

| |

|

| 4.1 |

Indenture dated as of February 1, 1993 between Service Corporation International and The Bank of New York Mellon Trust Company, N.A., as successor to The Bank of New York, as trustee (incorporated by reference to Exhibit 4.1 to Form S-4 filed September 2, 2004 (File No. 333-118763)) |

| |

|

| 4.2 |

Twelfth Supplemental Indenture dated as of May 12, 2014 between Service Corporation International and The Bank of New York Mellon Trust Company, N.A., as successor to The Bank of New York, as trustee (incorporated by reference to Exhibit 4.1 to Form 8-K filed May 12, 2014 (Film No. 001-06402)) |

| |

|

| 4.3 |

Form of 5.375% Senior Notes due 2024 (included in Exhibit 4.2) |

| |

|

| 5.1 |

Opinion of Locke Lord LLP |

| |

|

| 99.1 |

Press release dated August 18, 2015 |

Exhibit 5.1

| |

2800

JPMorgan Chase Tower, 600 Travis

Houston,

TX 77002

Telephone:

713-226-1200

Fax:

713-223-3717

www.lockelord.com |

August 18, 2015

Service Corporation International

1929 Allen Parkway

Houston, Texas 77019

Ladies and Gentlemen:

Service Corporation International, a Texas

corporation (“SCI” or the “Company”), has engaged us to render the opinion we express below

in connection with its offering of $300,000,000 aggregate principal amount of the Company’s 5.375% Senior Notes due 2024

(the “Securities”), which it is offering under the registration statement on Form S-3 (File. No. 333-184087)

(as amended or supplemented, the “Registration Statement”) filed with the Securities and Exchange Commission

(the “Commission”) under the Securities Act of 1933, as amended (together with the rules and regulations of

the Commission thereunder, the “Securities Act”), which relates to the Company’s offering and sale of

various securities under the Securities Act.

You have advised us that the Securities

will be issued under an indenture dated as of February 1, 1993 (the “Base Indenture”) between the Company and

The Bank of New York Mellon Trust Company, N.A., as successor to The Bank of New York, as trustee (the “Trustee”),

as supplemented by the Twelfth Supplemental Indenture dated as of May 12, 2014 (the “Supplemental Indenture”)

between the Company and the Trustee (the Base Indenture as supplemented by the Supplemental Indenture, the “Indenture”).

For purposes of the opinion expressed below,

we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents, corporate records

and other instruments as we have deemed necessary for the purposes of this opinion, including:

| (i) | the organizational documents of the Company, |

| (ii) | minutes and records of the corporate proceedings of

the Company, |

| (iii) | the Registration Statement and the exhibits thereto, |

| (iv) | the prospectus supplement dated August 10, 2015 filed

with the Commission under the Securities Act’s Rule 424(b), |

Service Corporation International

August 18, 2015

Page 2

| (vI) | the underwriting agreement dated August 10, 2015 (the “Underwriting Agreement”)

between the Company and Merrill Lynch, Pierce, Fenner & Smith Incorporated, as representative of the several underwriters listed

on Schedule 1 thereto, |

| | | |

| (vii) | the resolutions of the board of directors of the Company (the “Board”) and a

committee of the Board, which authorize the issuance of the Securities and approve the terms of the offering and sale of the Securities,

and |

| | | |

| (viii) | certificates, instruments and other documents of public officials and of representatives of the

Company. |

In giving this opinion, we have assumed

the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us

as copies and the authenticity of the originals of all documents submitted to us as copies. We have also assumed the legal capacity

of all natural persons, the genuineness of the signatures of persons signing all documents in connection with which this opinion

is rendered, the authority of such persons signing on behalf of the parties thereto other than the Company and the due authorization,

execution and delivery of all documents by the parties thereto other than the Company. We have not independently established or

verified any facts relevant to the opinion expressed herein, but have relied upon statements and representations of the officers

and other representatives of the Company.

Based upon and subject to the foregoing

qualifications, assumptions and limitations and the further limitations set forth below, we are of the opinion that the Securities

will, when they have been duly executed, authenticated, issued and delivered in accordance with the provisions of the Indenture,

and duly purchased and paid for in accordance with the provisions of the Underwriting Agreement, constitute legal, valid and binding

obligations of the Company.

Our opinion expressed above is subject

to the qualifications that we express no opinion as to the applicability of, compliance with, or effect of (i) any bankruptcy,

insolvency, reorganization, fraudulent transfer, fraudulent conveyance, moratorium or other similar law affecting the enforcement

of creditors’ rights generally, (ii) general principles of equity (regardless of whether enforcement is considered in a proceeding

in equity or at law), (iii) public policy considerations which may limit the rights of parties to obtain certain remedies, and

(iv) any laws except the federal securities laws of the United States and the laws of the State of Texas, including the applicable

provisions of the reported judicial decisions interpreting these laws.

Service Corporation International

August 18, 2015

Page 3

We hereby consent to the filing of this

opinion with the Commission as Exhibit 5.1 to the Company’s Current Report on Form 8-K reporting the offering of the Securities.

In giving this consent, we do not thereby admit that we are in the category of persons whose consent is required under Section

7 of the Securities Act or the rules and regulations of the Commission.

Sincerely,

/s/ Locke Lord LLP

LOCKE LORD LLP

Exhibit 99.1

Service Corporation International Completes Offering of $300 Million of Senior

Notes

HOUSTON, Aug. 18, 2015 /PRNewswire/ -- Service Corporation International (NYSE: SCI) (the "Company") announced today that it had successfully completed its previously announced public offering of $300 million aggregate principal amount of its 5.375% Senior Notes due 2024 (the "Notes") in a reopening of its existing series of such Notes. The Company intends to use the net proceeds from the offering to redeem all of its outstanding 6.750% Senior Notes due 2016 and to repay approximately $99 million of outstanding borrowings under its revolving credit facility.

This press release does not constitute an offer to sell nor the solicitation of an offer to buy

nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful. The notes will be offered only by means of a prospectus supplement and accompanying base prospectus. This press release does not constitute a notice of redemption with respect to the notes being redeemed.

Cautionary Statement on Forward-Looking Statements

The statements in this press release that are not historical facts are forward-looking statements made in reliance on the "safe harbor" protections provided under the Private Securities Litigation Reform Act of 1995. These statements may be accompanied by words such as "believe," "estimate," "project," "expect," "anticipate" or "predict" that convey the uncertainty of future events or outcomes. These statements are based on assumptions that

we believe are reasonable; however, many important factors could cause our actual results in the future to differ materially from the forward-looking statements made herein and in any other documents or oral presentations made by us or on our behalf. Important factors which could cause actual results to differ materially from those in forward-looking statements include, among others, unfavorable conditions in the financing markets and our ability to successfully complete the proposed offering on favorable terms.

For further information on these and other risks and uncertainties, see our SEC filings, including our 2014 Annual Report on Form 10-K. Copies of this document as well as other SEC filings can be obtained from our website at www.sci-corp.com. We assume no obligation to publicly update or revise any forward-looking statements made herein or any other forward-looking

statements made by us, whether as a result of new information, future events or otherwise.

About Service Corporation International

Service Corporation International, headquartered in Houston, Texas, is North America's leading provider of deathcare products and services. As of June 30, 2015, the Company operated 1,550 funeral service locations and 467 cemeteries (including 262 combination locations) in North America, which are geographically diversified across 45 states, eight Canadian provinces, the District of Columbia and Puerto Rico. Through its business, the Company markets the Dignity Memorial® brand, which offers assurance of quality, value, caring service and exceptional customer satisfaction. For more information about Service Corporation, please visit www.sci-corp.com. The information contained on, or that may be accessed through, our website is not

incorporated by reference into, and is not a part of, this press release.

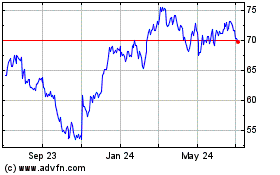

Service (NYSE:SCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Service (NYSE:SCI)

Historical Stock Chart

From Apr 2023 to Apr 2024