Santander Profit Dented by Restructuring Costs -- Update

July 27 2016 - 2:40AM

Dow Jones News

By Jeannette Neumann

MADRID-- Banco Santander SA said Wednesday that net profit fell

in the second quarter from a year earlier as one of Europe's

largest banks booked an anticipated restructuring charge due to

branch closures and employee layoffs.

Santander said net profit was EUR1.278 billion ($1.41 billion)

in the second quarter, in line with analysts' estimates, compared

with EUR2.54 billion a year earlier.

Analysts had anticipated that lower lending income and the

restructuring charge would lead Santander to report a net profit of

EUR1.27 billion, according to a poll by data provider FactSet.

The Spanish lender, run by Executive Chairman Ana Botín, said

net interest income in the second quarter was EUR7.57 billion

compared with EUR8.28 billion a year earlier.

Net interest income, a key profit driver for retail banks, is

the difference between what lenders pay clients for deposits and

charge for loans. Analysts had anticipated net interest income of

EUR7.73 billion, according to FactSet.

Santander reported a capital ratio in the second quarter of

10.36% under international regulations known as "fully loaded"

Basel III criteria, up slightly from 10.27% in the first quarter.

Santander said that was in line to meet its target of 11% in

2018.

The consequences of Britons' vote to leave the European Union,

such as a drop in the pound, wasn't expected to take a major toll

on Santander in the second quarter. Investors expect Brexit to slow

Britain's economy and lessen the revenue Santander generates in its

U.K. unit in coming quarters.

Santander booked a EUR475 million charge in the second quarter

triggered by the closure of around 450 bank branches in Spain and

the layoffs or reassignments of around 1,380 employees. Santander

had indicated at the end of June that those restructuring costs

would be around EUR500 million and would be offset in part by the

sale of a stake it holds in Visa. That stake sale generated EUR227

million, Santander said Wednesday.

Spain has among the greatest number of bank branches per person

in Europe, and it is common for small, rural towns in the country

to have several branches. Santander and other Spanish banks are on

the hunt for revenue, and they are starting to cull their bank

branches, which can be expensive to maintain.

Write to Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

July 27, 2016 02:25 ET (06:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

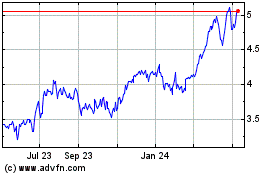

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

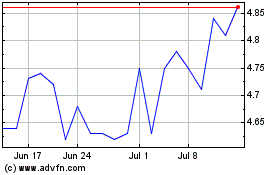

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024