By Jeannette Neumann

MADRID--Plunging oil prices, global market turmoil and

uncertainty over the makeup of Spain's next government have been

walloping Spanish banks' shares ahead of quarterly results that

investors and analysts don't expect to provide much cheer.

Investors say they will be looking at whether the banks are

boosting capital ratios to better position their balance sheets

against the turbulence. "The market is a lot more focused on

capital developments," said Iacopo Dalu, at London-based hedge fund

Amber Capital.

Overall, Spain's major domestic banks and the Spanish units of

Banco Santander SA and Banco Bilbao Vizcaya Argentaria SA are

expected to report a slight decline in net interest income in the

fourth quarter compared with the previous three months, Société

Générale SA analyst Carlos García González said. That measure of

profit is being hit by rock-bottom interest rates and shrinking

total loan volume as individuals and businesses continue to reduce

their debt.

With Spain's economy growing, provisions for bad loans at most

of the banks are likely to fall in the fourth quarter compared with

a year earlier. But investors and analysts say the decline will be

less pronounced because of the additional funds lenders are

expected to cough up to cushion against potential losses at Abengoa

SA, a major Spanish renewable energy and engineering firm that

filed for preliminary creditor protection in November.

Each bank is also required by Spanish regulators to book its

contributions to Spain's deposit guarantee fund in the fourth

quarter.

Spain's banks are reporting their 2015 annual results against an

uncertain global backdrop that has sent stock markets into a tizzy

as traders fret about Chinese growth, oil price declines and the

impact of the U.S. Federal Reserve's lifting of interest rates.

The landscape at home is also rocky, as Spaniards wait to see

which political parties will join to form a government in the wake

of December's inconclusive parliamentary election.

The governing coalition that emerges will decide whether to

continue selling off shares in Bankia SA, which is 64% owned by the

state. The privatization of Spain's No. 4 bank by market value,

which was bailed out in 2012, has been on hold since the government

sold a small share in 2014.

An independence movement in the wealthy Catalonia region has

been gathering steam, raising concern about the future of two major

banks based there, Caixabank SA and Banco de Sabadell SA.

At Santander and BBVA, investors say they will be closely

attuned to capital ratios. In the third quarter of last year,

Santander's capital ratio inched only slightly higher from the

previous three months and BBVA's fell, and both remained below

those of big-bank peers. Investors say they want to see signs of

fourth-quarter improvement.

Analysts anticipate that declines in the currencies of emerging

markets will chip away at Santander's and BBVA's profits when they

are converted into euros on the lenders' financial statements.

Emerging markets, primarily Mexico and Turkey, generate two-thirds

of BBVA's earnings. Brazil, which is in recession, contributes

about one-fifth of Santander's net profit.

"We continue to see their emerging markets operations as an area

of risk," Barclays PLC analyst Rohith Chandra-Rajan wrote in a

research report.

Capital ratio worries, emerging market currency concerns and a

7.5-billion-euro ($8.1 billion) share sale in January 2015 have

sent Santander's stock price down around 35% in the past 12 months,

Ana Botín's first full year as executive chairman.

The decline has been so great that analysts who have typically

shunned Santander shares took notice.

"We do not believe Santander has created value for its

shareholders over the past 15 years," Exane BNP Analyst Santiago

López Díaz wrote in a research report. "At its current price,

however, Santander represents a reasonable investment with a

relative margin of safety within European banking."

Santander reports fourth-quarter earnings on Wednesday.

When Caixabank announces results two days later, investors say

they will look at how much the lender writes down the value of its

stake in Spanish oil major Repsol SA.

Oil's price dive has driven down Caixabank's 9.5% direct holding

in Repsol to EUR1.1 billion from the estimated EUR2.7 billion value

the lender has assigned to the investment in financial statements,

Morgan Stanley analyst Alvaro Serrano wrote in a research

report.

"They're not going to write it down all the way to the current

market value, because that will erode too much capital," Berenberg

Bank analyst Andrew Lowe said. He expects a smaller write-down to

"appease the regulators that they're doing something about it."

He said he believes Caixabank's sale of two stakes in December

is evidence of pressure from regulators on European banks to

strengthen capital. For Caixabank, he added, "the Repsol issue is

the next step to address."

Banco Popular Español SA, which also reports on Friday, has a

hefty portfolio of nonperforming property loans that still choke

its balance sheet eight years after Spain's real-estate boom went

bust.

Investors say they would like to see Popular sell off soured

loans and foreclosures more quickly. But its low provisions on bad

debts means the bank would have to sell at a steep loss, and that

poses a dilemma: Popular could either redirect more revenue toward

provisions to boost coverage levels, eating up profits, or sell

additional shares in the market to raise funds, making current

shareholders' investments worth less.

As Popular tries to figure out its action plan, investors'

concerns have snowballed, sending the bank's shares nosediving more

than 20% since the beginning of the year.

Spain's banks are reporting their 2015 annual results against an

uncertain global backdrop that has sent stock markets into a tizzy

as traders fret about Chinese growth, oil price declines and the

impact of the U.S. Federal Reserve's lifting of interest rates.

The landscape at home is also rocky, as Spaniards wait to see

which political parties will join to form a government in the wake

of December's inconclusive parliamentary election.

The governing coalition that emerges will decide whether to

continue selling off shares in Bankia SA, which is 64%-owned by the

state. The privatization of Spain's No. 4 bank by market value,

which was bailed out in 2012, has been on hold since the government

sold down a small share in 2014.

An independence movement in the wealthy Catalonia region has

been gathering steam, raising concern about the future of two major

banks based there, Caixabank SA and Banco de Sabadell SA.

At Santander and BBVA, investors say they will be closely

attuned to capital ratios. In the third quarter of last year,

Santander's capital ratio inched only slightly higher from the

previous three months and BBVA's fell, and both remained below

those of big-bank peers. Investors say they want to see signs of

fourth-quarter improvement.

Analysts anticipate that declines in the currencies of emerging

markets will chip away at Santander's and BBVA's profit when they

are converted into euros on the lenders' financial statements.

Emerging markets, primarily Mexico and Turkey, generate two-thirds

of BBVA's earnings. Brazil, which is in recession, contributes

about one-fifth of Santander's net profit.

"We continue to see their emerging markets operations as an area

of risk," Barclays PLC analyst Rohith Chandra-Rajan wrote in a

research report.

Capital ratio worries, emerging market currency concerns and a

€7.5 billion ($8.1 billion) share sale in January 2015 have sent

Santander's stock price down around 35% in the past 12 months, Ana

Botín's first full year as executive chairman.

The decline has been so great that analysts who have typically

shunned Santander shares took notice.

"We do not believe Santander has created value for its

shareholders over the past 15 years," Exane BNP Analyst Santiago

López Díaz wrote in a research report. "At its current price,

however, Santander represents a reasonable investment with a

relative margin of safety within European banking."

Santander reports fourth-quarter earnings on Wednesday.

When Caixabank announces results two days later, investors say

they will look at how much the lender writes down the value of its

stake in Spanish oil major Repsol SA.

The oil-price dive has driven down Caixabank's 9.5% direct

holding in Repsol to €1.1 billion from the estimated €2.7 billion

value the lender has assigned to the investment in financial

statements, Morgan Stanley analyst Alvaro Serrano wrote in a

research report.

"They're not going to write it down all the way to the current

market value, because that will erode too much capital," Berenberg

Bank analyst Andrew Lowe said. He expects a smaller write down to

"appease the regulators that they're doing something about it."

He said he believes Caixabank's sale of two stakes in December

is evidence of pressure from regulators on European banks to

strengthen capital. For Caixabank, he added, "the Repsol issue is

the next step to address."

Banco Popular Español SA, which also reports on Friday, has a

hefty portfolio of nonperforming property loans that still choke

its balance sheet eight years after Spain's real-estate boom went

bust.

Investors say they would like to see Popular sell off soured

loans and foreclosures more quickly. But its low provisions on bad

debts means the bank would have to sell at a steep loss, and that

poses a dilemma: Popular could either redirect more revenue toward

provisions to boost coverage levels, eating up profits, or sell

additional shares in the market to raise funds, making current

shareholders' investments worth less.

As Popular tries to figure out its action plan, investors'

concerns have snowballed, sending the bank's shares nose-diving

more than 20% since the beginning of the year.

Write to Jeanette Neumann at jeanette.neumann@wsj.com

-0-

(MORE TO FOLLOW) Dow Jones Newswires

January 26, 2016 08:11 ET (13:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

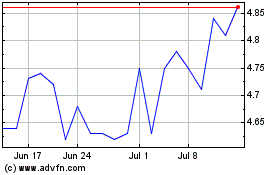

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

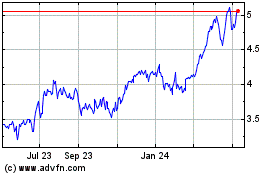

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024