Boston Beer Cuts Annual Guidance on Lower Volumes

July 21 2016 - 6:30PM

Dow Jones News

Boston Beer Co., the maker of Samuel Adams Boston Lager, warned

it would cut costs to adjust to lower volumes, and it further

reduced its projections for the year, citing continued weakness of

its brand.

The company, which has now reported three consecutive quarters

of sales and profit declines, now projects shipments and

depletions, or sales by distributors to retailers, to remain flat

from the year earlier or fall as much as 4%, compared with its

earlier view of a 4% decline to a 2% increase.

Meanwhile, the company now expects to earn $6.40 to $7 a share,

down from its earlier view of $6.50 to $7.30 for the year.

Still, shares—which are down 18% this year—rose 2.6% to $169 in

after-hours trading Thursday as the company's financial results

were better than expected.

Without giving specifics, Chief Executive Martin Roper referred

in a news release to an increased "focus and urgency on cost

savings" given the lower volume projections and said company

officials are "evaluating all our opportunities to better fit the

current volume environment."

For the latest quarter, Boston Beer's core shipment volume fell

4% to 1.1 million barrels, driven by declines in Samuel Adams,

Angry Orchard and Traveler brands. The company reported a profit of

$26.6 million, or $2.06 a share, compared with $29.9 million, or

$2.18 a share, a year earlier.

Net revenue, which excludes excise taxes, rose 3% to $244.8

million.

Analysts surveyed by Thomson Reuters had projected profit of

$1.94 a share on $238.9 million in revenue.

Gross margin narrowed to 51.8% from 54% a year earlier.

Founded in 1984 by C. James Koch, the company revolutionized the

beer industry in the U.S. when it started selling a "craft" beer

from the Koch family recipe book. It was a beer that Mr. Koch's

great-grandfather had made at his brewery in St. Louis in the

1870s.

Mr. Koch, the company's chairman and former chief executive,

went bar to bar selling the concoction, named after Samuel Adams,

the Revolutionary War leader and onetime brewer. The first cases of

Samuel Adams Boston Lager were sold on Patriots' Day in Boston in

1985. Last year, the company sold about 4.3 million barrels, up

nearly 4% from the year earlier.

The Brewers Association, which represents small brewers, defines

craft breweries as those who make up to 6 million barrels a

year.

One of the largest brewers still based in the U.S., Boston Beer

has been hard hit by shifting consumer preferences and a surge in

competition as craft beers became trendy. In response, it has

introduced new styles and is planning to revamp its Sam Adams brand

with new packaging this year.

Jonathan N. Potter, an LVMH Moë t Hennessy Louis Vuitton and

Diageo PLC executive, is scheduled to join the company next month

as chief marketing officer.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

July 21, 2016 18:15 ET (22:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

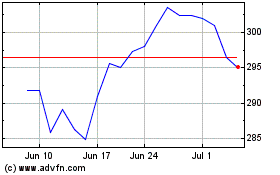

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

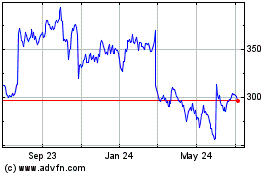

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Apr 2023 to Apr 2024