Sam Adams Brewer Cuts Profit Outlook

October 29 2015 - 8:10PM

Dow Jones News

Boston Beer Co., the maker of Samuel Adams Boston Lager, on

Thursday cut its profit projection for the year, citing continued

weakness of its iconic brand.

The Boston company, which also gave preliminary projections for

2016, now expects to make $7 to $7.40 a share in 2015, compared

with its earlier view of $7.10 to $7.50 a share. It also projects

depletions, or sales by distributors to retailers, to increase 3%

to 6%, down from its already lowered estimate of 6% to 9%.

In 2016, Boston Beer projects depletions and shipments to

increase by a percentage in the mid- to high-single digits.

Shares, down 15% this year, fell 2% to $240 in late trading.

Company officials have blamed disappointing results in some of

its Samuel Adams beers on increased competition.

The Brewers Association, which represents small brewers, defines

craft breweries as those who make fewer than 6 million barrels a

year. In the most recent period, Boston Beer's core shipment volume

was about 1.3 million barrels, up 4% from the year earlier.

Chairman Jim Koch said Thursday that the company is introducing

new styles this quarter to the Samuel Adams Rebel IPA line,

including an unfiltered double IPA called "Rebel Raw," and is

planning to launch a Samuel Adams Nitro series next quarter.

Last quarter, Chief Executive Martin Roper said company

officials expected to revamp the Samuel Adams brand by next year

with new packaging and a new advertising campaign. In the latest

period, the company reported an increase of $13.2 million, or 20%,

in advertising and selling costs

Overall, for the third quarter ended Sept. 26, Boston Beer

reported a profit of $38.6 million, or $2.85 a share, compared with

$37.9 million, or $2.79 a share, a year earlier.

Net revenue rose 8.7% to $293.1 million.

Analysts surveyed by Thomson Reuters had projected profit of

$2.69 a share on $288 million in revenue.

Gross margin improved to 53.6% from 53% a year earlier.

Founded in 1984 by Mr. Koch, the Boston company revolutionized

the beer industry in the U.S. with a "craft" beer from Mr. Koch's

family recipe book.

Today, the company sells more than 80 beers under the Samuel

Adams or Sam Adams brands along with its subsidiary Alchemy &

Science. It also sells malt beverages under the Twisted Tea brand

and hard ciders under the Angry Orchard brand.

Write to Maria Armental at maria.armental@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 19:55 ET (23:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

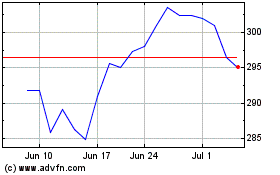

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

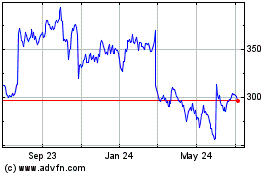

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Apr 2023 to Apr 2024