UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 7)*

SPRINT

CORPORATION

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

85207 U 10 5

(CUSIP

Number)

|

|

|

| Kenneth A. Siegel, Esq.

Morrison & Foerster LLP

Shin-Marunouchi Building, 29th Floor

5-1, Marunouchi 1-Chome

Chiyoda-ku, Tokyo, 100-6529 Japan

011-81-3-3214-6522 |

|

Robert S. Townsend, Esq.

Morrison & Foerster LLP

425 Market Street San

Francisco, CA 94105-2482 (415) 268-7000 |

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

August 18, 2015

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter the disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

|

|

|

|

|

|

|

| 1 |

|

Name of

Reporting Persons SoftBank Group Corp. |

| 2 |

|

Check the Appropriate Box if a Member

of a Group (a) x (b) ¨ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds

WC, BK (1) |

| 5 |

|

Check Box if Disclosure of Legal

Proceedings Is Required Pursuant to Item 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of

Organization Japan |

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

3,249,868,825 (1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

3,249,868,825 (1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,249,868,825 (1)(2) |

| 12 |

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount

in Row (11) 80.79% (2)(3) |

| 14 |

|

Type of Reporting Person

HC, CO |

| (1) |

Such figure reflects (i) a reclassification exempt under Rule 16b-7 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in which Sprint Corporation (formerly known as

“Starburst II, Inc.” and referred to herein as “Sprint”) Class B Common Stock, par value $0.01 per share (“Sprint Class B Common Stock”), held by Starburst I, Inc. (“Starburst I”) was

reclassified into 3,076,525,523 shares of Sprint common stock, par value $0.01 per share (the “Sprint Common Stock”); (ii) the issuance by Sprint to Starburst I of the Sprint Warrant, dated July 10, 2013 (the

“Warrant”), which is subject to anti-dilution adjustment, as described in the Warrant; and (iii) purchases of Sprint Common Stock made in compliance with Rule 10b-18 (“Rule 10b-18”) under the Exchange Act (as

more fully described in Item 3 of this Schedule 13D, the “Galaxy Purchases”) by Galaxy Investment Holdings, Inc. (“Galaxy”). |

| (2) |

As more fully described in the responses to Item 2 and Items 4 through 6 of this Schedule 13D, SoftBank Group Corp. (formerly known as SoftBank Corp. and referred to herein as “SoftBank”),

Starburst I and Galaxy (collectively, the “Reporting Persons”) may be deemed to be members of a “group” under Section 13(d) of the Exchange Act by virtue of SoftBank’s ownership of Starburst I and Galaxy, the

Agreement and Plan of Merger, dated as of October 15, 2012, by and among Sprint Nextel Corporation (“Sprint Nextel”), SoftBank, Starburst I, Sprint and Starburst III, Inc., as amended as of November 29,

2012, April 12, 2013 and June 10, 2013 (as amended, the “Merger Agreement”), the Warrant, and the Galaxy Purchases. |

| (3) |

Percentage of class that may be deemed to be beneficially owned by SoftBank is based on the outstanding Sprint Common Stock as set forth in Sprint’s Quarterly Report on Form 10-Q, filed with the Securities and

Exchange Commission (the “Commission”) on August 7, 2015 (and including shares of Sprint Common Stock issuable upon exercise of the Warrant). |

|

|

|

|

|

|

|

| 1 |

|

Name of

Reporting Persons Starburst I, Inc. |

| 2 |

|

Check the Appropriate Box if a Member

of a Group (a) x (b) ¨ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal

Proceedings Is Required Pursuant to Item 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of

Organization Delaware |

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

3,131,105,447 (1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

3,131,105,447 (1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,131,105,447 (1)(2) |

| 12 |

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount

in Row (11) 77.83% (2)(3) |

| 14 |

|

Type of Reporting Person

HC, CO |

| (1) |

Such figure reflects (i) a reclassification exempt under Rule 16b-7 under the Exchange Act in which Sprint Class B Common Stock held by Starburst I was reclassified into 3,076,525,523 shares of Sprint Common Stock

and (ii) the issuance of the Warrant, which is subject to anti-dilution adjustment, as described in the Warrant. |

| (2) |

As more fully described in the responses to Item 2 and Items 4 through 6 of this Schedule 13D, the Reporting Persons may be deemed to be members of a “group” under Section 13(d) of the Exchange Act

by virtue of SoftBank’s ownership of Starburst I and Galaxy, the Merger Agreement, the Warrant and the Galaxy Purchases. Starburst I expressly disclaims beneficial ownership with respect to the shares of Sprint Common Stock deemed to be

beneficially owned by SoftBank and Galaxy, except to the extent of Starburst I’s direct pecuniary interest in the shares of Sprint Common Stock directly beneficially owned by Starburst I. |

| (3) |

Percentage of class is based on the outstanding Sprint Common Stock as set forth in Sprint’s Quarterly Report on Form 10-Q, filed with the Commission on August 7, 2015 (and including shares of Sprint Common

Stock issuable upon exercise of the Warrant). |

|

|

|

|

|

|

|

| 1 |

|

Name of

Reporting Persons Galaxy Investment Holdings, Inc. |

| 2 |

|

Check the Appropriate Box if a Member

of a Group (a) x (b) ¨ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal

Proceedings Is Required Pursuant to Item 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of

Organization Delaware |

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

118,763,378 (1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

118,763,378 (1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

118,763,378 |

| 12 |

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount

in Row (11) 2.99% (2)(3) |

| 14 |

|

Type of Reporting Person

HC, CO |

| (1) |

Such figure reflects the Galaxy Purchases. |

| (2) |

As more fully described in the responses to Item 2 and Items 4 through 6 of this Schedule 13D, the Reporting Persons may be deemed to be members of a “group” under Section 13(d) of the Exchange Act

by virtue of SoftBank’s ownership of Starburst I and Galaxy, the Merger Agreement, the Warrant, and the Galaxy Purchases. Galaxy expressly disclaims beneficial ownership with respect to the shares of Sprint Common Stock deemed to be

beneficially owned by SoftBank and Starburst I, except to the extent of Galaxy’s direct pecuniary interest in the shares of Sprint Common Stock directly beneficially owned by Galaxy. |

| (3) |

Percentage of class is based on the outstanding Sprint Common Stock as set forth in Sprint’s Quarterly Report on Form 10-Q, filed with the Commission on August 7, 2015. |

EXPLANATORY NOTE

This Amendment No. 7 (this “Schedule 13D”) is being jointly filed on behalf of SoftBank Group Corp. (formerly known as

SoftBank Corp.), a Japanese kabushiki kaisha (“SoftBank”), Starburst I, Inc., a Delaware corporation and wholly owned subsidiary of SoftBank (“Starburst I”) and Galaxy Investment Holdings, Inc., a Delaware

corporation and wholly owned subsidiary of SoftBank (“Galaxy”, and together with SoftBank and Starburst I, the “Reporting Persons”, and each a “Reporting Person”) with respect to Sprint Corporation,

a Delaware corporation (referred to herein as “Sprint” or the “Issuer”). This Schedule 13D amends the Schedule 13D filed by SoftBank, Starburst I, Sprint and Starburst III, Inc., a Kansas corporation

(“Merger Sub”) on October 25, 2012, as amended on April 22, 2013 and June 11, 2013, as amended and restated on July 12, 2013, as amended on August 6, 2013 and August 27, 2013, and as amended and

restated on September 18, 2013 (as amended and/or restated from time to time, the “Original 13D”), which relates to the common stock of Sprint, par value $0.01 per share (the “Sprint Common Stock”).

In connection with the completion of the Merger, as defined in the Agreement and Plan of Merger, dated as of October 15, 2012, by and

among Sprint Nextel Corporation (“Sprint Nextel”), SoftBank, Starburst I, Sprint, and Merger Sub, as amended as of November 29, 2012, April 12, 2013 and June 10, 2013 (as amended, the “Merger

Agreement”, which is incorporated by reference from Exhibits 99.2 through 99.5 to this Schedule 13D), Merger Sub was merged into Sprint Nextel, Sprint became the parent company of Sprint Nextel, with Sprint Nextel becoming its wholly owned

subsidiary, and Sprint Nextel changed its name to “Sprint Communications, Inc.”

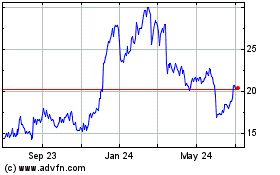

This Schedule 13D is being filed to reflect

open market purchases of Sprint Common Stock by Galaxy between August 10, 2015 and August 18, 2015 in compliance with Rule 10b-18 (“Rule 10b-18”) under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) (such purchases, the “New Galaxy Purchases”).

Other than as set forth below, all Items in the Original

13D are unchanged. Capitalized terms used herein which are not defined herein have the meanings given to them in the Original 13D.

| Item 2. |

Identity and Background. |

Item 2 of the Original 13D is hereby amended and restated

in its entirety to read as follows:

“(a) through (f) This Schedule 13D is being jointly filed on behalf of SoftBank, Starburst

I and Galaxy.

The Sprint Common Stock reported on this Schedule 13D is beneficially owned directly by Starburst I and Galaxy, as

described in Item 5 to this Schedule 13D. SoftBank is included as a Reporting Person solely because it is the sole owner of both Starburst I and Galaxy. Pursuant to (i) SoftBank’s ownership of Starburst I and Galaxy; (ii) the

Merger Agreement; (iii) the issuance by Sprint to Starburst I of the Sprint Warrant, dated July 10, 2013 (the “Warrant”, a copy of which is included as Exhibit 99.6 and incorporated by reference into Items 2 through 6 of

this Schedule 13D); (iv) the Galaxy Purchases (as defined in Item 3 hereof); and (v) Rule 13d-5(b)(1) under the Exchange Act, SoftBank, Starburst I and Galaxy may be deemed to be a “group” and such “group” may be

deemed to have acquired beneficial ownership for purposes of Section 13(d) of the Exchange Act, of all of the Sprint Common Stock beneficially owned by such “group.” Starburst I expressly disclaims beneficial ownership with respect to

the shares of Sprint Common Stock deemed to be beneficially owned by SoftBank and Galaxy, except to the extent of Starburst I’s direct pecuniary interest in the shares of Sprint Common Stock directly beneficially owned by Starburst I. Galaxy

expressly disclaims beneficial ownership with respect to the shares of Sprint Common Stock deemed to be beneficially owned by SoftBank and Starburst I, except to the extent of Galaxy’s direct pecuniary interest in the shares of Sprint Common

Stock directly beneficially owned by Galaxy.

|

|

|

|

|

SoftBank Group Corp. |

| (a) Name of Person Filing |

|

SoftBank Group Corp. |

| (b) Address of Principal Business Office |

|

1-9-1, Higashi-Shimbashi Minato-ku, Tokyo 105-7303 Japan |

| (c) Principal Business |

|

SoftBank is currently engaged in various businesses in the information industry, including mobile communications, broadband infrastructure, fixed-line telecommunications, and Internet culture. |

|

|

|

| (d) – (e) Criminal and Civil Proceedings |

|

During the last five years, neither SoftBank nor, to SoftBank’s knowledge, any of the individuals referred to in Appendix A-1, has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors)

or was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating

activities subject to, federal or state securities laws, or finding violations with respect to such laws. |

| (f) Place of Organization |

|

Japan |

|

|

|

|

Starburst I, Inc. |

| (a) Name of Person Filing |

|

Starburst I, Inc. |

| (b) Address of Principal Business Office |

|

One Circle Star Way, San Carlos, California 94070 |

| (c) Principal Business |

|

Wholly owned subsidiary of SoftBank formed for purposes of holding a portion of SoftBank’s indirect interest in Sprint. |

| (d) – (e) Criminal and Civil Proceedings |

|

During the last five years, neither Starburst I nor, to Starburst I’s knowledge, any of the individuals referred to in Appendix A-2, has been convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors) or was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or

prohibiting or mandating activities subject to, federal or state securities laws, or finding violations with respect to such laws. |

| (f) Place of Organization |

|

Delaware |

|

|

|

|

Galaxy Investment Holdings, Inc. |

| (a) Name of Person Filing |

|

Galaxy Investment Holdings, Inc. |

| (b) Address of Principal Business Office |

|

One Circle Star Way, San Carlos, California 94070 |

| (c) Principal Business |

|

Wholly owned subsidiary of SoftBank formed for purposes of holding a portion of SoftBank’s indirect interest in Sprint. |

| (d) – (e) Criminal and Civil Proceedings |

|

During the last five years, neither Galaxy nor, to Galaxy’s knowledge, any of the individuals referred to in Appendix A-3, has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or

was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating

activities subject to, federal or state securities laws, or finding violations with respect to such laws. |

| (f) Place of Organization |

|

Delaware” |

| Item 3. |

Source and Amount of Funds or Other Consideration. |

Item 3 of the Original 13D is

hereby amended and restated in its entirety to read as follows:

“The Reporting Persons own (directly or by being deemed a beneficial owner) the Sprint

Common Stock pursuant to (i) a reclassification exempt under Rule 16b-7 under the Exchange Act, in which Sprint Class B Common Stock, par value $0.01 per share (the “Sprint Class B Common Stock”), held by Starburst I was

reclassified into 3,076,525,523 shares of Sprint Common Stock, (ii) the issuance by Sprint to Starburst I of the Warrant, which is subject to anti-dilution adjustment, as described in the Warrant, and (iii) the Galaxy Purchases, as defined

herein.

SoftBank financed the acquisition of Sprint Class B Common Stock by Starburst I through a combination of borrowings under a

bridge loan agreement dated December 18, 2012 with Mizuho Corporate Bank, Ltd. (now Mizuho Bank, Ltd.), Sumitomo Mitsui Banking Corporation, The Bank of Tokyo-Mitsubishi UFJ, Ltd. and Deutsche Bank AG, Tokyo Branch; proceeds from a global

offering of senior U.S. dollar and euro notes on April 23, 2013; and proceeds from Japanese domestic offerings of yen-denominated unsecured corporate bonds on March 1, 2013, March 12, 2013 and June 20, 2013.

Pursuant to the Merger Agreement, no additional consideration was payable in connection with the issuance to Starburst I of the Warrant to

purchase 54,579,924 shares of Sprint Common Stock at a price of $5.25 per share. The Warrant is exercisable at any time until July 10, 2018.

Between August 1, 2013 and September 16, 2013, Galaxy purchased 74,559,641 shares of Sprint Common Stock (the “Prior Galaxy

Purchases” and, together with the New Galaxy Purchases, the “Galaxy Purchases”) in accordance with Rule 10b-18, for an aggregate purchase price of $498,508,805.88, exclusive of any fees, commissions or other expenses.

Between August 10, 2015 and August 18, 2015, Galaxy consummated the New Galaxy Purchases of 44,203,737 shares of Sprint Common

Stock, for an aggregate purchase price of $180,952,463, exclusive of any fees, commissions or other expenses (the shares acquired pursuant to the Galaxy Purchases are referred to herein as the “Galaxy Shares”). The Galaxy Purchases

were financed from SoftBank’s general working capital. Galaxy directly beneficially owns the Galaxy Shares.”

| Item 4. |

Purpose of Transaction. |

Item 4 of the Original 13D is hereby amended and restated in its entirety

to read as follows:

“Purpose of the Transaction

SoftBank may be deemed a beneficial owner of the Sprint Common Stock in connection with the Merger and the subsequent reclassification

described in Item 3 to this Schedule 13D, the issuance of the Warrant, and the Galaxy Purchases. The Merger is intended to make Sprint a stronger, more competitive company that will deliver significant benefits to U.S. consumers based on

SoftBank’s expertise in the deployment of next-generation wireless networks and track record of success in taking share in mature markets from larger telecommunications competitors.

Starburst I directly owns the Sprint Common Stock in connection with the Merger and the subsequent reclassification described in Item 3

to this Schedule 13D, and may be deemed to beneficially own the shares of Sprint Common Stock issuable upon exercise of the Warrant.

Between August 1, 2013 and September 16, 2013, Galaxy consummated the Prior Galaxy Purchases of 74,559,641 shares of Sprint Common

Stock in the open market in accordance with Rule 10b-18. Between August 10, 2015 and August 18, 2015, Galaxy consummated the New Galaxy Purchases of 44,203,737 shares of Sprint Common Stock in the open market in accordance with Rule

10b-18, or approximately 1.11% of the outstanding shares of Sprint Common Stock, based on the outstanding Sprint Common Stock as set forth in Sprint’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (the

“Commission”) on August 7, 2015. Galaxy directly beneficially owns the Galaxy Shares. SoftBank currently expects Galaxy to make further purchases of Sprint Common Stock. However, SoftBank expects that such purchases will not

increase SoftBank’s beneficial ownership in Sprint to 85% or more of the outstanding shares of Sprint Common Stock (which outstanding share count does not include the shares of Sprint Common Stock that would be issued upon exercise of the

Warrant).

Plans or Proposals

The Reporting Persons, as stockholders in Sprint, intend to review their investment in Sprint and have discussions with representatives of

Sprint and/or other stockholders of Sprint from time to time and, as a result thereof, may at any time and from time to time determine to take any available course of action and may take any steps to implement any such course of action. Such review,

discussions, actions or steps may involve one or more of the types of transactions specified in clauses (a) through (j) of Item 4 of this Schedule 13D, including purchase or sale of Sprint Common Stock, business combination or other

extraordinary corporate transactions, sales or purchases of material assets, changes in the board of directors or management of Sprint, changes to Sprint’s business or corporate structure, shared service agreements, collaborations, joint

ventures and other business arrangements between or involving SoftBank and Sprint. Any action or actions the Reporting Persons might undertake in respect of the Sprint Common Stock will be dependent upon the Reporting Persons’ review of

numerous factors, including, among other things, the price level and liquidity of the Sprint Common Stock; general market and economic conditions; ongoing evaluation of Sprint’s business, financial condition, operations, prospects and strategic

alternatives; the relative attractiveness of alternative business and investment opportunities; tax considerations; and other factors and future developments. Notwithstanding anything to the contrary herein, the Reporting Persons specifically

reserve the right to change their intentions with respect to any or all of such matters.”

| Item 5. |

Interest in Securities of the Issuer. |

Item 5(a), (b) and (c) of the

Original 13D are hereby amended and restated in their entirety to read as follows:

“(a)-(b) As of August 18, 2015, each

Reporting Person may be deemed to have beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) and shared power to vote or direct the vote of up to the number of shares of Sprint Common Stock set forth in the table below and

may be deemed to constitute a “group” under Section 13(d) of the Exchange Act as described in Item 2 of this Schedule 13D, which is incorporated herein by reference.

|

|

|

|

|

|

|

|

|

| Reporting Person |

|

Shares of Sprint

Common Stock Such

Reporting Person

May Be Deemed to

Beneficially Own |

|

|

Percent of Voting

Power of Sprint

Common Stock(1) |

|

| SoftBank Group Corp.(2) |

|

|

3,249,868,825 |

|

|

|

80.79 |

% |

| Starburst I, Inc.(3) |

|

|

3,131,105,447 |

|

|

|

77.83 |

% |

| Galaxy Investment Holdings, Inc.(4) |

|

|

118,763,378 |

|

|

|

2.99 |

% |

| (1) |

The respective percentages of beneficial ownership are based on 3,968,170,784 shares of Sprint Common Stock outstanding as set forth in Sprint’s Quarterly Report on Form 10-Q, filed with the Commission on

August 7, 2015 (and, as to SoftBank and Starburst I beneficial ownership, including shares of Sprint Common Stock issuable upon exercise of the Warrant). |

| (2) |

Consists of 3,076,525,523 shares of Sprint Common Stock held by Starburst I as a result of the Reclassification; the 54,579,924 shares of Sprint Common Stock underlying the Warrant, which may be exercised in whole or in

part, at any time until July 10, 2018; and 118,763,378 shares of Sprint Common Stock held by Galaxy. |

| (3) |

Consists of 3,076,525,523 shares of Sprint Common Stock held by Starburst I following the Reclassification and 54,579,924 shares of Sprint Common Stock issuable upon exercise of the Warrant, which may be exercised in

whole or in part, at any time until July 10, 2018. Starburst I expressly disclaims beneficial ownership with respect to the shares of Sprint Common Stock deemed to be beneficially owned by SoftBank and Galaxy, except to the extent of Starburst

I’s direct pecuniary interest in the shares of Sprint Common Stock directly beneficially owned by Starburst I. |

| (4) |

Galaxy expressly disclaims beneficial ownership with respect to the shares of Sprint Common Stock deemed to be beneficially owned by SoftBank and Starburst I, except to the extent of Galaxy’s direct pecuniary

interest in the shares of Sprint Common Stock directly beneficially owned by Galaxy. |

(c) The information contained in Items

3 and 4 to this Schedule 13D is herein incorporated by reference. In connection with the closing of the Merger, all Sprint Nextel common stock and options to acquire Sprint Nextel common stock held by directors and executive officers of Sprint

Nextel (immediately prior to the consummation of the Merger) were exchanged for Merger Consideration (as defined in the Merger Agreement) or options to purchase Sprint Common Stock pursuant to the terms of the Merger Agreement.

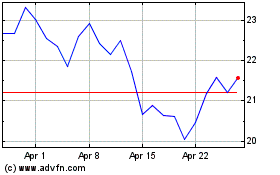

The weighted average price per share, exclusive of any fees, commissions or other expenses for the New Galaxy Purchases made between

August 10, 2015 and August 18, 2015 are as set forth in the following table:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase Date |

|

|

Shares Purchased |

|

|

Weighted Average

Price per Share |

|

|

Price Range for

Shares Purchased |

|

| |

August 10, 2015 |

|

|

|

7,993,500 |

|

|

$ |

3.74 |

|

|

$ |

3.41 - $3.87 |

|

| |

August 11, 2015 |

|

|

|

7,993,500 |

|

|

$ |

3.90 |

|

|

$ |

3.78 - $4.00 |

|

| |

August 12, 2015 |

|

|

|

6,886,301 |

|

|

$ |

3.76 |

|

|

$ |

3.60 - $3.91 |

|

| |

August 13, 2015 |

|

|

|

2,729,018 |

|

|

$ |

3.98 |

|

|

$ |

3.91 - $4.04 |

|

| |

August 14, 2015 |

|

|

|

5,416,720 |

|

|

$ |

4.06 |

|

|

$ |

3.90 - $4.20 |

|

| |

August 17, 2015 |

|

|

|

8,652,800 |

|

|

$ |

4.61 |

|

|

$ |

4.24 - $4.74 |

|

| |

August 18, 2015 |

|

|

|

4,531,898 |

|

|

$ |

4.71 |

|

|

$ |

4.63 - $4.88 |

|

The Reporting Persons undertake to provide Sprint, any stockholder of Sprint, or the Staff of the Commission,

upon request, full information regarding the number of shares purchased at each separate price within the ranges set forth in this Item 5(c) to this Schedule 13D.

Except as set forth above or incorporated herein, none of (i) the Reporting Persons and, (ii) to the Reporting Persons’

knowledge, the persons set forth on Appendix A-1, A-2 or A-3 of this Schedule 13D has effected any transaction in Sprint Common Stock during the past 60 days.”

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 of the Original 13D is hereby amended to (i) delete the first paragraph thereof, and (ii) add the following paragraph to

the end thereof:

“On March 17, 2014, Galaxy granted to Ronald D. Fisher an award of restricted stock units (the “RSU

Award”) for 2,846,508 shares of Sprint Common Stock owned by Galaxy, as reported by the Reporting Persons in a Form 4 filed March 19, 2014. Galaxy granted the RSU Award to Mr. Fisher in connection with Mr. Fisher’s

positions with Galaxy and SoftBank Holdings Inc.and in connection with the service that Mr. Fisher provides to the U.S. wholly owned subsidiaries of SoftBank, including, but not limited to, Galaxy and Starburst I, and as an incentive to

continue such services. Each restricted stock unit represents a contingent right for Mr. Fisher to receive one share of Sprint Common Stock, or, in the sole discretion of Galaxy, a cash payment in lieu of all or a portion thereof. Subject to

the provisions of the agreement for the RSU Award, the restricted stock units will vest in four equal installments on November 15 of 2015, 2016, 2017 and 2018. As to all unvested amounts, Galaxy retains voting rights of the Sprint Common Stock

underlying the RSU Award, and may be deemed a beneficial owner of those shares. A copy of the agreement for the RSU Award is included as Exhibit 99.8 to this Schedule 13D and is incorporated by reference into this Item 6.”

| Item 7. |

Material to be Filed as Exhibits. |

Item 7 of the Original 13D is hereby amended as follows:

By replacing Exhibits 99.8 and 99.11 with the following:

|

|

|

| “99.8 |

|

Restricted Stock Unit Agreement, dated as of March 17, 2014, by and between Galaxy Investment Holdings, Inc. and Ronald D. Fisher. |

|

|

| 99.11 |

|

Power of Attorney, dated as of August 12, 2015, executed by Ronald D. Fisher as President of Galaxy Investment Holdings, Inc.” |

By deleting Exhibit 99.12 in its entirety.

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated: August 19, 2015

|

|

|

| SOFTBANK GROUP CORP. |

|

|

| By: |

|

/s/ Joshua O. Lubov |

| Name: |

|

Joshua O. Lubov |

| Title: |

|

Attorney-in-Fact |

|

| STARBURST I, INC. |

|

|

| By: |

|

/s/ Joshua O. Lubov |

| Name: |

|

Joshua O. Lubov |

| Title: |

|

Attorney-in-Fact |

|

| GALAXY INVESTMENT HOLDINGS, INC. |

|

|

| By: |

|

/s/ Joshua O. Lubov |

| Name: |

|

Joshua O. Lubov |

| Title: |

|

Attorney-in-Fact |

Appendix A-1

EXECUTIVE OFFICERS AND DIRECTORS

OF

SOFTBANK GROUP CORP.

Set forth below is a list of each executive officer and director of SoftBank Group Corp. setting forth the business address and present principal

occupation or employment (and the name and address of any corporation or organization in which such employment is conducted) of each person.

|

|

|

|

|

| Name and Business Address |

|

Present Principal Occupation

(principal business of

employer) |

|

Name and Address of Corporation

or Other Organization

(if

different from address

provided in Column 1) |

| Masayoshi Son*, a citizen of Japan SoftBank

Group Corp. 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo

105-7303 Japan |

|

Representative Director, Chairman & CEO of SoftBank Group Corp. |

|

|

|

|

|

| Nikesh Arora*, a citizen of the

United States of America

SoftBank Group Corp. 1-9-1 Higashi-Shimbashi,

Minato-ku, Tokyo 105-7303 Japan |

|

Representative Director, President and COO of SoftBank Group Corp. |

|

|

|

|

|

| Ken Miyauchi*, a citizen of Japan SoftBank

Group Corp. 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo

105-7303 Japan |

|

Representative Director, President & CEO of SoftBank Corp., a wholly owned subsidiary of SoftBank Group Corp. |

|

SoftBank Corp. 1-9-1 Higashi-Shimbashi,

Minato-ku, Tokyo 105-7303 Japan |

|

|

|

| Ronald D. Fisher*, a citizen of the United States of America

SoftBank Group Corp. 1-9-1 Higashi-Shimbashi,

Minato-ku, Tokyo 105-7303 Japan |

|

Director and President of SoftBank Holdings Inc., a wholly owned subsidiary of SoftBank Group Corp. |

|

SoftBank Holdings Inc. 38 Glen Avenue

Newton, Massachusetts 02459 |

|

|

|

| Yun Ma*, a citizen of the People’s Republic of China

SoftBank Group Corp. 1-9-1 Higashi-Shimbashi,

Minato-ku, Tokyo 105-7303 Japan |

|

Executive Chairman of Alibaba Group Holding Limited, an online shopping sites operator |

|

Alibaba Group Holding Limited 969 West Wen Yi

Road Yu Hang District Hangzhou, 311121

People’s Republic of China |

|

|

|

| Tadashi Yanai*, a citizen of Japan SoftBank

Group Corp. 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo

105-7303 Japan |

|

Chairman, President & CEO of FAST RETAILING CO., LTD., a casual apparel business |

|

FAST RETAILING CO., LTD. 717-1 Sayama, Yamaguchi City,

Yamaguchi 754-0894

Japan |

|

|

|

|

|

| Mark Schwartz*, a citizen of the

United States of America

SoftBank Group Corp. 1-9-1 Higashi-Shimbashi,

Minato-ku, Tokyo 105-7303 Japan |

|

Vice Chairman of The Goldman Sachs Group, Inc. and Chairman of Goldman Sachs Asia Pacific, global banking businesses |

|

Goldman Sachs (Asia) LLC Cheung Kong Center,

68th Floor 2 Queens’s Road Central Hong

Kong |

|

|

|

| Shigenobu Nagamori*, a citizen of Japan

SoftBank Group Corp. 1-9-1 Higashi-Shimbashi,

Minato-ku, Tokyo 105-7303 Japan |

|

Chairman of the Board, President & Chief Executive Officer, Nidec Corporation, a motor manufacturer |

|

Nidec Corporation 338,

Kuzetonoshiro-cho,

Minami-ku, Kyoto 601-8205

Japan |

|

|

|

| Manabu Miyasaka*, a citizen of Japan SoftBank

Group Corp. 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo

105-7303 Japan |

|

Representative Director and President of Yahoo Japan Corporation, an internet company |

|

Yahoo Japan Corporation Midtown Tower 9-7-1 Akasaka Minato-ku, Tokyo 107-6211 Japan |

|

|

|

| Yoshimitsu Goto, a citizen of Japan SoftBank

Group Corp. 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo

105-7303 Japan |

|

Executive Corporate Officer of SoftBank Group Corp. |

|

|

|

|

|

| Fumihiro Aono, a citizen of Japan SoftBank

Group Corp. 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo

105-7303 Japan |

|

Corporate Officer of SoftBank Group Corp. |

|

|

|

|

|

| Masato Suzaki, a citizen of Japan SoftBank

Group Corp. 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo

105-7303 Japan |

|

Corporate Officer of SoftBank Group Corp. |

|

|

|

|

|

| Kazuko Kimiwada, a citizen of Japan SoftBank

Group Corp. 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo

105-7303 Japan |

|

Corporate Officer of SoftBank Group Corp. |

|

|

|

|

|

| Katsumasa Niki, a citizen of Japan SoftBank

Group Corp. 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo

105-7303 Japan |

|

Corporate Officer of SoftBank Group Corp. |

|

|

|

|

|

|

|

| Tatsuhiro Murata**, a citizen of Japan SoftBank

Group Corp. 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo

105-7303 Japan |

|

Full-time Audit & Supervisory Board Member of SoftBank Group Corp. |

|

|

|

|

|

| Maurice Atsushi Toyama**, a citizen of the United States of America

SoftBank Group Corp. 1-9-1 Higashi-Shimbashi,

Minato-ku, Tokyo 105-7303 Japan |

|

Full-time Audit & Supervisory Board Member of SoftBank Group Corp. |

|

|

|

|

|

| Soichiro Uno**, a citizen of Japan SoftBank

Group Corp. 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo

105-7303 Japan |

|

Partner at Nagashima Ohno & Tsunematsu, an international law firm |

|

Nagashima Ohno & Tsunematsu JP Tower, 2-7-2

Marunouchi, Chiyoda-ku, Tokyo 100-7036 Japan |

|

|

|

| Kouichi Shibayama**, a citizen of Japan

SoftBank Group Corp. 1-9-1 Higashi-Shimbashi,

Minato-ku, Tokyo 105-7303 Japan |

|

Advisor at PwC Tax Japan, an international accounting firm |

|

PwC Tax Japan Kasumigaseki Bldg. 15F, 2-5 Kasumigaseki 3-chome, Chiyoda-ku,

Tokyo 100-6015 Japan |

|

|

|

| Hidekazu Kubokawa**, a citizen of Japan

SoftBank Group Corp. 1-9-1 Higashi-Shimbashi,

Minato-ku, Tokyo 105-7303 Japan |

|

Representative Partner at Yotsuya Partners Accounting Firm |

|

Yotsuya Partners Accounting Firm 4F, 3-7 Yotsuya, Shinjuku-ku, Tokyo

160-0004 Japan |

| ** |

Audit & Supervisory Board Member |

Appendix A-2

EXECUTIVE OFFICERS AND DIRECTORS

OF

STARBURST I, INC.

Set forth below is a list of each executive officer and director of Starburst I, Inc. setting forth the business address and present principal

occupation or employment (and the name and address of any corporation or organization in which such employment is conducted) of each person. Unless otherwise indicated, each individual is a United States citizen.

|

|

|

|

|

| Name and Business Address |

|

Present Principal Occupation

(principal business of

employer) |

|

Name and Address of Corporation

or

Other Organization

(if different from address

provided in Column 1) |

| Ronald D. Fisher* **, a citizen of the

United States of America

Starburst I, Inc. One Circle Star Way

San Carlos, California 94070 |

|

Director and President of SoftBank Holdings Inc., a wholly owned subsidiary of SoftBank Group Corp. |

|

SoftBank Holdings Inc. 38 Glen Avenue

Newton, Massachusetts 02459 |

|

|

|

| Kabir Misra* ***, a citizen of the

United States of America

Starburst I, Inc. One Circle Star Way

San Carlos, California 94070 |

|

Partner, SoftBank Capital, a venture capital organization affiliated with the SoftBank Group |

|

SoftBank Capital One Circle Star Way

San Carlos, California 94070 |

| *** |

Secretary and Treasurer |

Appendix A-3

EXECUTIVE OFFICERS AND DIRECTORS

OF

GALAXY INVESTMENT

HOLDINGS, INC.

Set forth below is a list of each executive officer and director of Galaxy Investment Holdings, Inc. setting forth the business

address and present principal occupation or employment (and the name and address of any corporation or organization in which such employment is conducted) of each person.

|

|

|

|

|

| Name and Business Address |

|

Present Principal Occupation

(principal business of

employer) |

|

Name and Address of Corporation

or Other Organization

(if

different from address

provided in Column 1) |

| Ronald D. Fisher* **, a citizen of the

United States of America

Galaxy Investment Holdings, Inc. One Circle Star Way

San Carlos, California 94070 |

|

Director and President of SoftBank Holdings Inc., a wholly owned subsidiary of SoftBank Group Corp. |

|

SoftBank Holdings Inc. 38 Glen Avenue

Newton, Massachusetts 02459 |

|

|

|

| Yoshimitsu Goto*, a citizen of Japan Galaxy

Investment Holdings, Inc. One Circle Star Way San Carlos,

California 94070 |

|

Executive Corporate Officer of SoftBank Group Corp. |

|

SoftBank Group Corp. 1-9-1

Higashi-Shimbashi, Minato-ku, Tokyo 105-7303

Japan |

|

|

|

| Katsumasa Niki*, a citizen of Japan Galaxy

Investment Holdings, Inc. One Circle Star Way San Carlos,

California 94070 |

|

Corporate Officer of SoftBank Group Corp. |

|

SoftBank Group Corp. 1-9-1

Higashi-Shimbashi, Minato-ku, Tokyo 105-7303

Japan |

|

|

|

| Joshua O. Lubov***, a citizen of the

United States of America

Galaxy Investment Holdings, Inc. One Circle Star Way

San Carlos, California 94070 |

|

Treasurer and Chief Financial Officer of SoftBank Inc., a wholly owned subsidiary of SoftBank Group Corp. |

|

SoftBank Inc. 38 Glen Avenue

Newton, Massachusetts 02459 |

| *** |

Secretary and Treasurer |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Description |

|

|

| 99.1 |

|

Joint Filing Agreement, dated as of August 5, 2013, by and between SoftBank Group Corp., Starburst I, Inc. and Galaxy Investment Holdings, Inc. (incorporated herein by reference to Exhibit 99.1 of the Schedule 13D Amendment filed by

SoftBank Group Corp., Starburst I, Inc., and Galaxy Investment Holdings, Inc. on August 6, 2013). |

|

|

| 99.2 |

|

Agreement and Plan of Merger, dated as of October 15, 2012, by and among Sprint Nextel Corporation, SoftBank Group Corp. (f/k/a SoftBank Corp.), Starburst I, Inc., Sprint Corporation (then known as “Starburst II, Inc.”)

and Starburst III, Inc. (included as part of Annex A beginning on page Annex A-1 to the Proxy Statement-Prospectus of Sprint Corporation filed May 1, 2013 and incorporated herein by reference) (File No. 333-186448). |

|

|

| 99.3 |

|

First Amendment to Agreement and Plan of Merger, dated as of October 15, 2012, entered into as of November 29, 2012, by and among Sprint Nextel Corporation, SoftBank Group Corp. (f/k/a SoftBank Corp.), Starburst I, Inc., Sprint

Corporation (then known as “Starburst II, Inc.”) and Starburst III, Inc. (included as part of Annex A beginning on page Annex A-132 to the Proxy Statement-Prospectus of Sprint Corporation filed May 1, 2013 and incorporated herein by

reference) (File No. 333-186448). |

|

|

| 99.4 |

|

Second Amendment to Agreement and Plan of Merger, dated as of October 15, 2012, entered into as of April 12, 2013, by and among Sprint Nextel Corporation, SoftBank Group Corp. (f/k/a SoftBank Corp.), Starburst I, Inc., Sprint

Corporation (then known as “Starburst II, Inc.”) and Starburst III, Inc. (included as part of Annex A beginning on page Annex A-134 to the Proxy Statement-Prospectus of Sprint Corporation filed May 1, 2013 and incorporated herein by

reference) (File No. 333-186448). |

|

|

| 99.5 |

|

Third Amendment to Agreement and Plan of Merger, dated as of October 15, 2012, entered into as of June 10, 2013, by and among Sprint Nextel Corporation, SoftBank Group Corp. (f/k/a SoftBank Corp.), Starburst I, Inc., Sprint

Corporation (then known as “Starburst II, Inc.”) and Starburst III, Inc. (incorporated herein by reference to Exhibit 2.1 of Sprint Corporation’s Current Report on Form 8-K filed June 11, 2013) (File No. 333-186448). |

|

|

| 99.6 |

|

Warrant Agreement for Sprint Corporation Common Stock, dated as of July 10, 2013 (incorporated herein by reference to Exhibit 10.6 of Sprint Corporation’s Current Report on Form 8-K filed July 11, 2013) (File No.

001-04721). |

|

|

| 99.7 |

|

Amended and Restated Certificate of Incorporation of Sprint Corporation (incorporated herein by reference to Exhibit 3.1 of Sprint Corporation’s Current Report on Form 8-K filed July 11, 2013) (File No. 001-04721). |

|

|

| 99.8* |

|

Restricted Stock Unit Agreement, dated as of March 17, 2014, by and between Galaxy Investment Holdings, Inc. and Ronald D. Fisher. |

|

|

| 99.9 |

|

Power of Attorney, dated as of August 5, 2013, executed by Masayoshi Son (incorporated herein by reference to Exhibit 99.9 of the Schedule 13D Amendment filed by SoftBank Group Corp., Starburst I, Inc., and Galaxy Investment

Holdings, Inc. on August 6, 2013). |

|

|

| 99.10 |

|

Power of Attorney, dated as of August 5, 2013, executed by Ronald D. Fisher (incorporated herein by reference to Exhibit 99.10 of the Schedule 13D Amendment filed by SoftBank Corp., Starburst I, Inc., and Galaxy Investment Holdings,

Inc. filed August 6, 2013). |

|

|

| 99.11* |

|

Power of Attorney, dated as of August 12, 2015, executed by Ronald D. Fisher as President of Galaxy Investment Holdings, Inc. |

Exhibit 99.8

GALAXY INVESTMENT HOLDINGS, INC.

RESTRICTED STOCK UNIT AGREEMENT

THIS RESTRICTED STOCK UNIT AGREEMENT (this “Agreement) is entered into as of March 17, 2014, by and between Galaxy Investment

Holdings, Inc., a Delaware corporation (the “Company”) and Ronald D. Fisher (the “Executive”).

RECITALS

WHEREAS,

Executive is currently the President of Softbank Holdings Inc. (“Holdings”), is providing services to the Company, and serves as President and Chairman of SoftBank Inc., (“Softbank U.S.”);

WHEREAS, in consideration for Executive’s services to the U.S. wholly – owned subsidiaries of Softbank Corp., including but not

limited to the Company, Holdings and Softbank U.S., and as an incentive to continue such services, the Company has determined that it would be in the best interests of the Company, Holdings and Softbank U.S. to grant Executive an award of restricted

stock units to acquire shares of Sprint Corporation (“Sprint”) common stock (“Sprint Common Stock”) owned by the Company, or, in the sole discretion of the Company, a cash payment in lieu of all or a portion

thereof; and

NOW, THEREFORE, in consideration of the covenants, promises and representations set forth herein, and for other good and

valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

AGREEMENT

1. Issuance of Units. The Company hereby issues to Executive an award (the “Award”) of

2,846,508 restricted stock units (the “Units”), subject to the terms and conditions set forth in this Agreement.

2. Vesting Schedule.

(a) Subject to Executive’s Continuous Service and other limitations set forth in this Agreement, the Units will

“vest” in accordance with the following schedule (the “Vesting Schedule”): twenty-five percent (25%) of the Units will vest on each November 15 of 2015, 2016, 2017 and 2018.

(b) Notwithstanding the foregoing, the Award shall be subject to the following accelerated vesting provisions:

(i) In the event of Executive’s death, 100% of the unvested Units then subject to the Award will vest immediately

prior to Executive’s death;

(ii) In the event of Executive’s Disability, 100% of the unvested

Units then subject to the Award will vest immediately prior to the date of Executive’s Disability; and

(iii) In the event of the termination of Executive’s Continuous Service by the Company or a Related Entity

without Cause, 100% of the unvested Units then subject to the Award will vest immediately prior to the date of such termination.

(c) In the event of Executive’s change in status from Employee, Director or Consultant to any other status of

Employee, Director or Consultant, the determination of whether such change in status results in a termination of Continuous Service will be determined in accordance with Section 409A of the Code.

(d) During any authorized leave of absence, unless otherwise determined by the Company, the vesting of the Units as

provided in the Vesting Schedule shall be suspended (to the extent permitted under Section 409A of the Code) and the duration of such suspension will parallel the duration of the leave of absence under the Company’s then effective leave of

absence policy. The Vesting Schedule of the Units shall be extended by the length of the suspension. Vesting of the Units shall resume upon Executive’s termination of the leave of absence and return to service to the Company or a Related

Entity; provided, however, that if the leave of absence exceeds six (6) months, and a return to service upon expiration of such leave is not guaranteed by statute or contract, then (a) Executive’s Continuous Service shall be deemed to

terminate on the first date following such six-month period and (b) Executive will forfeit the Units that are unvested on the date of Executive’s termination of Continuous Service. An authorized leave of absence shall include sick leave,

military leave, or other bona fide leave of absence (such as temporary employment by the government). Notwithstanding the foregoing, with respect to a leave of absence due to any medically determinable physical or mental impairment of Executive that

can be expected to result in death or can be expected to last for a continuous period of not less than six (6) months, where such impairment causes Executive to be unable to perform the duties of Executive’s position of employment or

substantially similar position of employment, a twenty-nine (29) month period of absence shall be substituted for such six (6) month period above.

(e) For purposes of this Agreement, the term “vest” shall mean, with respect to any Units, that such Units are

no longer subject to forfeiture to the Company. If Executive would become vested in a fraction of a Unit, such Unit shall not vest until Executive becomes vested in the entire Unit.

(f) Vesting shall cease upon the date of termination of Executive’s Continuous Service for any reason. In the event

Executive’s Continuous Service is terminated for any reason, any unvested Units held by Executive (and any dividend equivalents credited in respect of such Units) immediately upon such termination of Continuous Service (after giving effect to

any vesting acceleration provided pursuant to Section 2(b) above) shall be forfeited and deemed reconveyed to the Company and the Company shall thereafter be the legal and beneficial owner of such reconveyed Units and shall have all rights and

interest in or related thereto without further action by Executive.

2

3. Transfer Restrictions. The Units (and any dividend equivalents

credited in respect of such Units) may not be transferred in any manner other than by will or by the laws of descent and distribution. Any attempt to transfer the Units (and any dividend equivalents credited in respect of such Units) in violation of

this Section 3 will be null and void and will be disregarded.

4. Conversion of Units and Transfer of

Shares.

(a) General. Subject to Sections 4(b) and 4(c), one share of Sprint Common Stock shall be

transferable to Executive for each Unit subject to the Award (the “Shares”) upon vesting. Immediately thereafter, or as soon as administratively feasible, the Company will, or will cause a Related Entity to, transfer the appropriate

number of Shares to Executive after satisfaction of any required tax or other withholding obligations. The Company may, however, in its sole discretion, make, or cause a Related Entity to make, a cash payment in lieu of the transfer of the Shares

for vested Units in an amount equal to the Fair Market Value of one share of Sprint Common Stock multiplied by the number of vested Units, or settle the vested Units in a combination of Shares or cash. Any fractional Unit remaining after the Award

is fully vested shall be discarded and shall not be converted into a fractional Share (or cash). Notwithstanding the foregoing, the relevant number of Shares (or cash) shall be transferred no later than March 15th of the year following the calendar year in which the Award vests, unless the Award is subject to Section 409A, in which case, the relevant number of Shares (or cash) shall be transferred in

accordance with Treasury Regulation Section 1.409A-3(d), as may be amended from time to time.

(b) Delay of Conversion. The conversion of the Units into Shares under Section 4(a) above shall be delayed

in the event the Company reasonably anticipates that the transfer of the Shares would constitute a violation of federal securities laws or other Applicable Law. If the conversion of the Units into Shares is delayed by the provisions of this

Section 4(b), the conversion of the Units into Shares shall occur at the earliest date at which the Company reasonably anticipates that transferring the Shares will not cause a violation of federal securities laws or other Applicable Law. For

purposes of this Section 4(b), the transfer of Shares that would cause inclusion in gross income or the application of any penalty provision or other provision of the Code is not considered a violation of Applicable Law.

(c) Delay of Transfer of Shares (or Cash). The Company shall delay or cause to be delayed the transfer of any

Shares (or cash) under this Section 4 to the extent necessary to comply with Section 409A(a)(2)(B)(i) of the Code (relating to payments made to certain “specified employees” of certain publicly-traded companies); in such event,

any Shares (or cash) to which Executive would otherwise be entitled during the six (6) month period following the date of Executive’s termination of Continuous Service will be transferable on the first business day following the expiration

of such six (6) month period.

5. Dividend Equivalents. In the event Sprint declares a cash dividend on

the Sprint Common Stock prior to the date the Award is settled in full or terminates, dividend equivalents will be credited in respect of any outstanding Units. At the Company’s discretion, such dividend equivalents may be: (i) payable in

cash with the value of such dividend equivalents measured by the per share dividend paid with respect to the Sprint Common Stock; or (ii) reinvested in additional Units, with the number of additional Units equal to the quotient obtained by

dividing

3

(A) the aggregate amount or value of the dividends paid with respect to that number of Shares equal to the number of Units subject to the Award on the date the dividends are paid by the Company

to the Company’s stockholders by (B) the Fair Market Value of a Share on the dividend payment date, rounded down to the nearest whole Unit. The dividend equivalents (whether payable in cash or reinvested in additional Units) will be

subject to all of the terms and conditions of the Award, including that the dividend equivalents will vest and become payable upon the same terms and at the same time as the original Units to which they relate.

6. Right to Shares. Executive shall not have any right in, to or with respect to any of the Shares (including

any voting rights or rights with respect to dividends paid on the Sprint Common Stock) transferable under the Award until the Award is settled by the transfer of such Shares to Executive.

7. Taxes.

(a) Tax Liability. Executive is ultimately liable and responsible for all taxes owed by Executive in connection

with the Award (including any dividend equivalents), regardless of any action the Company or any Related Entity takes with respect to any tax withholding obligations that arise in connection with the Award. Neither the Company nor any Related Entity

makes any representation or undertaking regarding the treatment of any tax withholding in connection with any aspect of the Award, including the grant, vesting, assignment, release or cancellation of the Units, the delivery of Shares or cash, the

subsequent sale of any Shares acquired upon vesting and the receipt of any dividends or dividend equivalents. The Company does not commit and is under no obligation to structure the Award to reduce or eliminate Executive’s tax liability.

(b) Payment of Withholding Taxes. Prior to any event in connection with the Award (e.g., vesting) that the

Company or any Related Entity determines may result in any tax withholding obligation, whether United States federal, state, local or non-U.S., including any social insurance, employment tax, payment on account or other tax-related obligation (the

“Tax Withholding Obligation”), Executive must arrange for the satisfaction of the minimum amount of such Tax Withholding Obligation in a manner acceptable to the Company.

(i) By Share Withholding. If permissible under Applicable Law, Executive authorizes the Company to, upon the

exercise of its sole discretion, withhold from those Shares otherwise transferable to Executive the whole number of Shares sufficient to satisfy the minimum applicable Tax Withholding Obligation. Executive acknowledges that the withheld Shares may

not be sufficient to satisfy Executive’s minimum Tax Withholding Obligation. Accordingly, Executive agrees to pay to the Company or any Related Entity as soon as practicable, including through additional payroll withholding, any amount of the

Tax Withholding Obligation that is not satisfied by the withholding of Shares described above.

(ii) By Sale of

Shares. Executive may instruct and authorize the Company and any brokerage firm determined acceptable to the Company for such purpose to sell on Executive’s behalf a whole number of Shares from those Shares transferable to Executive as the

Company determines to be appropriate to generate cash proceeds sufficient to satisfy the minimum applicable Tax Withholding Obligation. Such Shares will be sold on the day such Tax

4

Withholding Obligation arises (e.g., a vesting date) or as soon thereafter as practicable. Executive will be responsible for all broker’s fees and other costs of sale, and Executive agrees

to indemnify and hold the Company harmless from any losses, costs, damages, or expenses relating to any such sale. To the extent the proceeds of such sale exceed Executive’s minimum Tax Withholding Obligation, the Company agrees to pay such

excess in cash to Executive. Executive acknowledges that the Company or its designee is under no obligation to arrange for such sale at any particular price, and that the proceeds of any such sale may not be sufficient to satisfy Executive’s

minimum Tax Withholding Obligation. Accordingly, Executive agrees to pay to the Company or any Related Entity as soon as practicable, including through additional payroll withholding, any amount of the Tax Withholding Obligation that is not

satisfied by the sale of Shares described above.

(iii) By Check, Wire Transfer or Other Means. Within such

time period before any Tax Withholding Obligation arises (e.g., a vesting date) as may be required by the Administrator, Executive may elect to satisfy Executive’s Tax Withholding Obligation by delivering to the Company an amount that the

Company determines is sufficient to satisfy the Tax Withholding Obligation by (x) wire transfer to such account as the Company may direct, (y) delivery of a certified check payable to the Company, or (z) such other means as specified

from time to time by the Administrator.

Notwithstanding the foregoing, the Company or a Related Entity also may satisfy any Tax Withholding Obligation by

offsetting any amounts (including, but not limited to, salary, bonus and severance payments) payable to Executive by the Company and/or a Related Entity. Furthermore, in the event of any determination that the Company has failed to withhold a sum

sufficient to pay all withholding taxes due in connection with the Award, Executive agrees to pay the Company the amount of such deficiency in cash within five (5) days after receiving a written demand from the Company to do so, whether or not

Executive is an employee of the Company at that time.

8. Executive Acknowledgements.

(a) Executive acknowledges and agrees that the Units shall vest, if at all, only during the period of Executive’s

Continuous Service (not through the act of being hired, being granted this Award or acquiring the Shares hereunder).

(b) Executive acknowledges and agrees that nothing in this Agreement shall confer upon Executive any right to

continuation of Executive’s Continuous Service, nor shall it interfere in any way with Executive’s right or the right of SoftBank, the Company or any Related Entity to terminate Executive’s Continuous Service at any time, with or

without cause, and with or without notice. Executive acknowledges that unless Executive has a written employment agreement with the Company to the contrary, Executive’s status is at will.

(c) Executive acknowledges receipt of a copy of the Agreement and represents that he is familiar with the terms and

provisions thereof, and hereby accepts the Award subject to all of the terms and provisions hereof and thereof. Executive has reviewed this Agreement in its entirety, has had an opportunity to obtain the advice of counsel prior to executing this

Agreement and fully understands all provisions of this Agreement. Executive further agrees and acknowledges that this Award is a non-elective arrangement pursuant to Section 409A of the Code.

5

(d) Executive further acknowledges that, from time to time, Sprint may be

in a “blackout period” and/or subject to applicable federal securities laws that could subject Executive to liability for engaging in any transaction involving the sale of the Shares transferred in connection with this Award. Executive

further acknowledges and agrees that, prior to the sale of any Shares acquired under this Award, it is Executive’s responsibility to determine whether or not such sale of Shares will subject Executive to liability under insider trading rules

and policies of SoftBank, the Company and Sprint or other applicable federal securities laws.

(e) The Company may,

in its sole discretion, decide to deliver this Agreement or any documents related to this Award by electronic means, and Executive hereby consents to receive this Agreement and any documents related to this Award by electronic delivery.

(f) Executive hereby agrees that all questions of interpretation and administration relating to this Agreement shall be

resolved by the Administrator in accordance with Section 12 of this Agreement. Executive further agrees to the venue and jurisdiction selection in accordance with Section 13 of this Agreement. Executive further agrees to notify the Company

upon any change in his residence address indicated in this Agreement.

9. Adjustments Upon Changes in

Capitalization of Sprint. The number of Shares covered by the Award, as well as any other terms that the Administrator determines require adjustment, shall be proportionately adjusted for (i) any increase or decrease in the number of issued

Shares resulting from a stock split, reverse stock split, stock dividend, recapitalization, combination or reclassification of the Shares, or similar transaction affecting the Shares, (ii) any other increase or decrease in the number of issued

Shares effected without receipt of consideration by Sprint, or (iii) any other transaction with respect to Sprint Common Stock including a corporate merger, consolidation, acquisition of property or stock, separation (including a spin-off or

other distribution of stock or property), reorganization, liquidation (whether partial or complete) or any similar transaction; provided, however that conversion of any convertible securities of Sprint shall not be deemed to have been “effected

without receipt of consideration.” In the event of any distribution of cash or other assets to Sprint stockholders other than a normal cash dividend, the Administrator shall also make such adjustments as provided in this Section 9 or

substitute or exchange the Award or grant new awards to effect such adjustments (collectively “adjustments”). Any such adjustments to the Award will be effected in a manner that precludes the enlargement of rights and benefits under the

Award. In connection with the foregoing adjustments, the Administrator may, in its discretion, prohibit the issuance of Shares, cash or other consideration pursuant to the Award during certain periods of time. Except as the Administrator determines,

no issuance by Sprint of shares of any class, or securities convertible into shares of any class, shall affect, and no adjustment by reason hereof shall be made with respect to, the number of Shares subject to the Award.

10. Entire Agreement: Governing Law. This Agreement constitutes the entire agreement of the parties with respect

to the subject matter hereof and supersedes in its entirety all prior undertakings and agreements of the Company or any Related Entity and Executive with respect to the subject matter hereof, and, except as set forth in Section 15, may not be

modified

6

adversely to Executive’s interest except by means of a writing signed by the Company and Executive. These agreements are to be construed in accordance with and governed by the internal laws

of the State of Delaware without giving effect to any choice of law rule that would cause the application of the laws of any jurisdiction other than the internal laws of the State of Delaware to the rights and duties of the parties. Should any

provision of this Agreement be determined to be illegal or unenforceable, the other provisions shall nevertheless remain effective and shall remain enforceable.

11. Construction. The captions used in this Agreement are inserted for convenience and shall not be deemed a

part of the Award for construction or interpretation. Except when otherwise indicated by the context, the singular shall include the plural and the plural shall include the singular. Use of the term “or” is not intended to be exclusive,

unless the context clearly requires otherwise.

12. Administration and Interpretation. Any question or

dispute regarding the administration or interpretation of this Agreement shall be submitted by Executive or by the Company to the Administrator. The resolution of such question or dispute by the Administrator shall be final and binding on all

persons.

13. Venue and Jurisdiction. The parties agree that any suit, action, or proceeding arising out of

or relating to this Agreement shall be brought exclusively in the United States District Court for the District of Delaware (or should such court lack jurisdiction to hear such action, suit or proceeding, in a Delaware state court in New Castle

County) and that the parties shall submit to the jurisdiction of such court. The parties irrevocably waive, to the fullest extent permitted by law, any objection the party may have to the laying of venue for any such suit, action or proceeding

brought in such court. THE PARTIES ALSO EXPRESSLY WAIVE ANY RIGHT THEY HAVE OR MAY HAVE TO A JURY TRIAL OF ANY SUCH SUIT, ACTION OR PROCEEDING. If any one or more provisions of this Section 13 shall for any reason be held invalid or

unenforceable, it is the specific intent of the parties that such provisions shall be modified to the minimum extent necessary to make it or its application valid and enforceable.

14. Notices. Any notice required or permitted hereunder shall be given in writing and shall be deemed

effectively given upon personal delivery, upon deposit for delivery by an internationally recognized express mail courier service or upon deposit in the United States mail by certified mail (if the parties are within the United States), with postage

and fees prepaid, addressed to the other party at its address as shown in these instruments, or to such other address as such party may designate in writing from time to time to the other party.

15. Amendment and Delay to Meet the Requirements of Section 409A. Executive acknowledges that the Company,

in the exercise of its sole discretion and without the consent of Executive, may amend or modify this Agreement in any manner and delay the transfer of any Shares transferable pursuant to this Agreement to the minimum extent necessary to meet the

requirements of Section 409A of the Code as amplified by any Treasury regulations or guidance from the Internal Revenue Service as the Company deems appropriate or advisable. In addition, the Company makes no representation that the Award will

comply with Section 409A of the Code and makes no undertaking to prevent Section 409A of the Code from applying to the Award or to mitigate its effects on any deferrals or payments made in respect of the Units. Executive is encouraged to

consult a tax adviser regarding the potential impact of Section 409A of the Code.

7

16. Definitions. The following definitions shall apply as used

herein.

(a) “Administrator” means the Board (or its designee).

(b) “Applicable Laws” means the legal requirements relating to this Agreement and the Award granted

hereunder with respect to applicable provisions of federal securities laws, state corporate and securities laws, the Code, the rules of any applicable stock exchange or national market system, and the rules of any non-U.S. jurisdiction applicable to

Awards granted to residents therein.

(c) “Board” means the Board of Directors of the Company or

SoftBank.

(d) “Cause” means, with respect to the termination by the Company or a Related Entity

of the Executive’s Continuous Service, that such termination is for “Cause” as such term (or word of like import) is expressly defined in a then-effective written agreement between the Executive and the Company or such Related Entity,

or in the absence of such then-effective written agreement and definition, is based on, in the determination of the Administrator, the Executive’s: (i) performance of any act or failure to perform any act in bad faith and to the detriment

of the Company or a Related Entity; (ii) dishonesty, intentional misconduct or material breach of any agreement with the Company or a Related Entity; or (iii) commission of a crime involving dishonesty, breach of trust, or physical or

emotional harm to any person.

(e) “Code” means the Internal Revenue Code of 1986, as amended.

(f) “Consultant” means any person (other than an Employee or a Director, solely with respect to

rendering services in such person’s capacity as a Director) who is engaged by the Company or any Related Entity to render consulting or advisory services to the Company or such Related Entity.

(g) “Continuous Service” means that the provision of services to the Company or a Related Entity in

any capacity of Employee, Director or Consultant is not interrupted or terminated. In jurisdictions requiring notice in advance of an effective termination as an Employee, Director or Consultant, Continuous Service shall be deemed terminated upon

the actual cessation of providing services to the Company or a Related Entity notwithstanding any required notice period that must be fulfilled before a termination as an Employee, Director or Consultant can be effective under Applicable Laws.

Executive’s Continuous Service shall be deemed to have terminated either upon an actual termination of Continuous Service or upon the entity for which Executive provides services ceasing to be a Related Entity. Continuous Service shall not be

considered interrupted in the case of (i) any approved leave of absence, (ii) transfers among the Company, any Related Entity, or any successor, in any capacity of Employee, Director or Consultant, or (iii) any change in status as

long as the individual remains in the service of the Company or a Related Entity in any capacity of Employee, Director or Consultant (except as otherwise provided in this Agreement). An approved leave of absence shall include sick leave, military

leave, or any other authorized personal leave.

8

(h) “Director” means a member of the Board or the board

of directors of any Related Entity.

(i) “Disability” means, unless such term (or word of like

import) is expressly defined in a then-effective written agreement between Executive and the Company or a Related Entity, a permanent and total disability as determined under the long-term disability plan of the Company or the Related Entity to

which Executive provides services unless Executive is not a participant in such long-term disability plan or in the absence of such long-term disability plan, in which case, “Disability” means a mental or physical condition which totally

and presumably permanently prevents Executive from engaging in any substantial gainful employment with the Company or the Related Entity to which Executive provides services prior to the inception of the disability; provided that, if the Award is

subject to Section 409A, “Disability” means a disability within the meaning of Code Section 409A(a)(2)(C) and Treasury regulation section 1.409A-3(i)(4), as each may be amended from time to time. Executive will not be considered

to have incurred a Disability unless he or she furnishes proof of such impairment sufficient to satisfy the Administrator in its discretion.

(j) “Employee” means any person, including an Officer or Director, who is in the employ of the Company

or any Related Entity, subject to the control and direction of the Company or any Related Entity as to both the work to be performed and the manner and method of performance. The payment of a director’s fee by the Company or a Related Entity

shall not be sufficient to constitute “employment” by the Company or the Related Entity.

(k) “Exchange Act” means the Securities Exchange Act of 1934, as amended.

(l) “Fair Market Value” means, as of any date, the value of Sprint Common Stock determined as follows:

(i) If the Sprint Common Stock is listed on one or more established stock exchanges or national market systems,

including without limitation the New York Stock Exchange, its Fair Market Value shall be the closing sales price for such stock (or the closing bid, if no sales were reported) as quoted on the principal exchange or system on which the Sprint Common

Stock is listed (as determined by the Administrator) on the date of determination (or, if no closing sales price or closing bid was reported on that date, as applicable, on the last trading date such closing sales price or closing bid was reported),

as reported in The Wall Street Journal or such other source as the Administrator deems reliable;

(ii) If the

Sprint Common Stock is regularly quoted on an automated quotation system (including the OTC Bulletin Board) or by a recognized securities dealer, its Fair Market Value shall be the closing sales price for such stock as quoted on such system or by

such securities dealer on the date of determination, but if selling prices are not reported, the Fair Market Value of a share of Sprint Common Stock shall be the mean between the high bid and low asked prices for the Sprint Common Stock on the date

of determination (or, if no such prices were reported on that date, on the last date such prices were reported), as reported in The Wall Street Journal or such other source as the Administrator deems reliable; or

9

(iii) In the absence of an established market for the Sprint Common Stock

of the type described in (i) and (ii), above, the Fair Market Value thereof shall be determined by the Administrator in good faith.

(m) “Officer” means a person who is an officer of the Company or a Related Entity within the meaning

of Section 16 of the Exchange Act and the rules and regulations promulgated thereunder.

(n) “Parent” means a “parent corporation”, whether now or hereafter existing, as defined in