U.S. Industrial Production Flat in October

November 16 2016 - 10:10AM

Dow Jones News

WASHINGTON—Industrial output was flat in October as unusually

warm weather depressed demand for home and office heating, but the

U.S. manufacturing and mining sectors showed continued signs of

stabilization.

Industrial production—a measure of output from America's

factories, power plants and mines—was unchanged on a seasonally

adjusted basis in October from the prior month, the Federal Reserve

said Wednesday. Economists surveyed by The Wall Street Journal had

expected a 0.2% increase.

Production fell 0.2% in September, revised down from an

initially estimated 0.1% rise. Output had dropped 0.1% in August,

revised up from an earlier estimate of a 0.5% decline.

Utilities production dropped sharply in October and September,

offsetting modest gains in factory output. Mining production surged

last month at the fastest pace in 2½ years.

Total production fell 0.9% over the past year.

Capacity utilization, a gauge of slack in the industrial

economy, ticked down 0.1 percentage point to 75.3% last month.

Economists had expected an October reading of 75.5%.

In October, output rose 0.2% from the prior month in the

manufacturing category, matching its September increase. Still,

factory production was down 0.2% last month from a year

earlier.

Utilities production was down 2.6% in October after falling 3.0%

in September. The Fed said "warmer-than-normal temperatures reduced

the demand for heating." It was the warmest October since 1963

across the 48 contiguous U.S. states and the third-warmest October

on record, according to the National Oceanic and Atmospheric

Administration.

Mining production jumped 2.1% in October, the largest gain since

March 2014. The Fed said gains for coal mining outweighed declines

in oil and gas extraction. Still, mining output remained down 7.0%

from a year earlier.

The U.S. industrial economy has appeared to stabilize in recent

months following two years of pressure from a strong dollar, which

dampened demand for U.S. exports, and low oil prices that squeezed

the domestic energy industry.

The Institute for Supply Management's closely watched gauge of

manufacturing activity signaled expansion in October for the second

straight month, and the index has indicated rising factory activity

in seven of the past eight months. In addition, the number of

active U.S. oil rigs has been rising since the summer, according to

oil-field services company Baker Hughes Inc.

"Oil and commodity prices have somewhat recovered, and our

business in heavy-industry markets generally appears to have

stabilized," said Blake Moret, chief executive at Rockwell

Automation Inc., on a call with analysts last week. "Current

forecasts call for improved global GDP and industrial production

growth rates, as well as higher levels of global capital

expenditures. We therefore expect improvement to continue."

But soft spots persist across the economy. Matt Farrell, chief

executive at consumer-goods manufacturer Church & Dwight Co.,

told analysts earlier this month that while unemployment is steady,

overall growth has been slow and families are facing rising

health-care costs.

"I wouldn't say it's the best outlook for the consumer," he

said.

Broader U.S. economic growth picked up over the summer after a

slow start to the year, with gross domestic product expanding at an

inflation-adjusted annual rate of 2.9% in the third quarter,

according to the Commerce Department. The outlook for the final

three months of 2016 is uncertain. Forecasting firm Macroeconomic

Advisers on Tuesday predicted GDP growth at a 1.8% pace in the

fourth quarter, while the Federal Reserve Bank of Atlanta's GDPNow

model projected a 3.3% growth rate.

Stronger growth in the second half of the year could boost the

odds of a rate increase by the Federal Reserve at its Dec. 13-14

policy meeting, already seen as likely by private economic

forecasters and financial markets. The central bank's benchmark

short-term interest rate has been set at a range of 0.25% to 0.5%

since last December.

"Absent significant negative economic news over the next month,

the market's assessment of the likelihood of tightening in December

seems plausible," Federal Reserve Bank of Boston President Eric

Rosengren said Tuesday.

Wednesday's report reflected industrial conditions ahead of last

week's U.S. presidential election.

Write to Ben Leubsdorf at ben.leubsdorf@wsj.com and Jeffrey

Sparshott at jeffrey.sparshott@wsj.com

(END) Dow Jones Newswires

November 16, 2016 09:55 ET (14:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

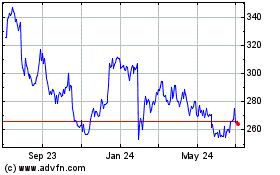

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From Mar 2024 to Apr 2024

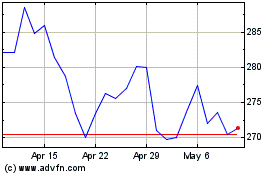

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From Apr 2023 to Apr 2024