As filed with the Securities and Exchange Commission on June 17, 2015.

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Rockwell Automation, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

25-1797617 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

|

|

| 1201 South 2nd Street

Milwaukee, Wisconsin |

|

53204 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Rockwell Automation 1165(e) Plan

(Full title of the plans)

DOUGLAS M. HAGERMAN, ESQ.

Senior Vice President, General Counsel and Secretary

Rockwell Automation, Inc.

1201 South 2nd Street

Milwaukee, Wisconsin 53204

(Name and address of agent for service)

(414) 382-2000

(Telephone number, including area code, of agent for service)

Copy to:

MARC A. ALPERT, ESQ.

Chadbourne & Parke LLP

30 Rockefeller Plaza

New

York, New York 10112

(212) 408-5100

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act (Check one).

|

|

|

|

|

|

|

| Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

¨ |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of securities

to be registered |

|

Amount

to be

registered(1) |

|

Proposed

maximum offering

price per share(2) |

|

Proposed

maximum aggregate

offering price(2) |

|

Amount of

registration fee |

| Common Stock, par value $1 per share(3) |

|

25,000 shares |

|

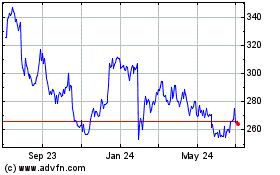

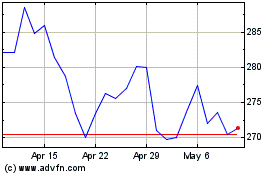

$126.26 |

|

$3,156,500.00 |

|

$366.79 |

| |

| |

| (1) |

The shares of Common Stock set forth in the Calculation of Registration Fee table which may be offered pursuant to this Registration Statement include, pursuant to Rule 416 under the Securities Act of 1933, as amended

(the “Securities Act”), such additional number of shares of the Registrant’s Common Stock as may become issuable as a result of any stock splits, stock dividends or similar events. |

| (2) |

Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(h) under the Securities Act, based on the average of the high and low per share market price of the Common Stock for New York Stock

Exchange–Composite Transactions on June 12, 2015. |

| (3) |

In addition, pursuant to Rule 416(c) under the Securities Act, this Registration Statement also covers an indeterminate amount of interests to be offered or sold pursuant to the employee benefit plans described herein.

|

EXPLANATORY NOTE

Pursuant to General Instruction E of Form S-8, this registration statement hereby incorporates by reference the contents of the registration statement on

Form S-8 (Registration No. 333-157203) filed by Rockwell Automation on February 10, 2009, relating to the Rockwell Automation 1165(e) Plan (the “Plan”).

1

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. |

Incorporation of Documents by Reference. |

The

following documents, which are on file with the Securities and Exchange Commission (the “Commission”), are incorporated herein by reference and made a part hereof:

| |

(a) |

Annual Report on Form 10-K of Rockwell Automation, Inc. (“Rockwell Automation”) for the year ended September 30, 2014; |

| |

(b) |

Annual Report on Form 11-K of the Rockwell Automation 1165(e) Plan for the year ended December 31, 2014; |

| |

(d) |

Quarterly Reports on Form 10-Q of Rockwell Automation for the quarters ended December 31, 2014 and March 31, 2015; |

| |

(e) |

Current Reports on Form 8-K of Rockwell Automation dated February 6, 2015, February 17, 2015 and March 27, 2015; and |

| |

(f) |

The description of Rockwell Automation’s Common Stock, par value $1 per share, which is incorporated in Rockwell Automation’s Registration Statement on Form 8-A dated October 30, 1996 by reference to the

material under the caption “Description of New Rockwell Capital Stock” on pages 105-115 of Rockwell Automation’s Proxy Statement-Prospectus dated October 29, 1996, constituting a part of Rockwell Automation’s Registration

Statement on Form S-4 (Registration No. 333-14969). |

All documents subsequently filed by Rockwell

Automation and the Rockwell Automation 1165(e) Plan pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), prior to the filing of a

post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated herein by reference and

be a part hereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated herein by reference shall be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes that statement. Any such statement so modified or superseded shall

not constitute a part of this Registration Statement, except as so modified or superseded.

|

|

|

|

|

| 4-a |

|

— |

|

Restated Certificate of Incorporation of Rockwell Automation, filed as Exhibit 3 to Rockwell Automation’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2002, is hereby incorporated by reference. |

|

|

|

| 4-b |

|

— |

|

By-Laws of Rockwell Automation, as amended and restated September 10, 2014, filed as Exhibit 3.2 to Rockwell Automation’s Current Report on Form 8-K dated September 15, 2014, are hereby incorporated by

reference. |

|

|

|

| 4-c |

|

— |

|

Copy of Rockwell Automation 1165(e) Plan together with all amendments through January 1, 2011. |

|

|

|

| 5-a |

|

— |

|

Opinion of Douglas M. Hagerman, Esq., Senior Vice President, General Counsel and Secretary of Rockwell Automation, as to the legality of any newly issued Common Stock covered by this Registration

Statement. |

2

|

|

|

|

|

| 5-b |

|

— |

|

Opinion of Goldman, Antonetti & Córdova, LLC with respect to compliance of the Rockwell Automation 1165(e) Plan with Section 1022(i)(1) of the Employee Retirement Income Security Act of 1974. |

|

|

|

| 15 |

|

— |

|

Letter of Deloitte & Touche LLP regarding Unaudited Financial Information. |

|

|

|

| 23-a |

|

— |

|

Consent of Deloitte & Touche LLP, an independent registered public accounting firm. |

|

|

|

| 23-b |

|

— |

|

Consent of Baker Tilly Virchow Krause, LLP, an independent registered public accounting firm. |

|

|

|

| 23-c |

|

— |

|

Consent of Douglas M. Hagerman, Esq., Senior Vice President, General Counsel and Secretary of Rockwell Automation, contained in his opinion filed as Exhibit 5-a to this Registration Statement. |

|

|

|

| 23-d |

|

— |

|

Consent of Goldman, Antonetti & Córdova, LLC. |

|

|

|

| 23-e |

|

— |

|

Consent of Quarles & Brady LLP. |

|

|

|

| 24 |

|

— |

|

Powers of Attorney authorizing certain persons to sign this Registration Statement on behalf of certain directors and officers of Rockwell Automation. |

3

SIGNATURES

The Registrant. Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to

believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Milwaukee, State of Wisconsin on the 17th day of June, 2015.

|

|

|

| ROCKWELL AUTOMATION, INC. |

|

|

| By |

|

/s/ Douglas M. Hagerman |

|

|

(Douglas M. Hagerman, Senior Vice President, |

|

|

General Counsel and Secretary) |

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been

signed on the 17th day of June, 2015 by the following persons in the capacities indicated:

|

|

|

| Signature |

|

Title |

|

|

| KEITH D. NOSBUSCH* |

|

Chairman of the Board, President and Chief Executive Officer (principal executive

officer) and a Director |

|

|

| BETTY C. ALEWINE* |

|

Director |

|

|

| J. PHILLIP HOLLOMAN* |

|

Director |

|

|

| VERNE G. ISTOCK* |

|

Director |

|

|

| BARRY C. JOHNSON* |

|

Director |

|

|

| STEVEN R. KALMANSON* |

|

Director |

|

|

| JAMES P. KEANE* |

|

Director |

|

|

| LAWRENCE D. KINGSLEY* |

|

Director |

|

|

| WILLIAM T. MCCORMICK, JR.* |

|

Director |

|

|

| DONALD R. PARFET* |

|

Director |

|

|

| LISA A. PAYNE* |

|

Director |

|

|

| THEODORE D. CRANDALL* |

|

Senior Vice President and Chief Financial Officer (principal financial officer) |

|

|

| DAVID M. DORGAN* |

|

Vice President and Controller (principal accounting officer) |

|

|

|

|

|

| * |

|

By |

|

/s/ Douglas M. Hagerman |

|

|

|

|

(Douglas M. Hagerman, Attorney-in-fact)** |

| ** |

By authority of the powers of attorney filed herewith. |

4

The Plan. Pursuant to the requirements of the Securities Act of 1933, the Plan has duly caused

this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Milwaukee, State of Wisconsin on the 17th day of June, 2015.

|

|

|

| ROCKWELL AUTOMATION 1165(e) PLAN |

|

|

| By |

|

/s/ Teresa E. Carpenter |

|

|

(Teresa E. Carpenter, Plan Administrator) |

5

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

|

|

|

| 4-a |

|

Restated Certificate of Incorporation of Rockwell Automation, filed as Exhibit 3 to Rockwell Automation’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2002, is hereby incorporated by reference. |

|

|

| 4-b |

|

By-Laws of Rockwell Automation, as amended September 10, 2014, filed as Exhibit 3.2 to Rockwell Automation’s Current Report on Form 8-K dated September 15, 2014, are hereby incorporated by reference. |

|

|

| 4-c |

|

Copy of Rockwell Automation 1165(e) Plan together with all amendments through January 1, 2011. |

|

|

| 5-a |

|

Opinion of Douglas M. Hagerman, Esq., Senior Vice President, General Counsel and Secretary of Rockwell Automation, as to the legality of any newly issued Common Stock covered by this Registration Statement. |

|

|

| 5-b |

|

Opinion of Goldman, Antonetti & Córdova, LLC with respect to compliance of the Rockwell Automation 1165(e) Plan with Section 1022(i)(1) of the Employee Retirement Income Security Act of 1974. |

|

|

| 15 |

|

Letter of Deloitte & Touche LLP regarding Unaudited Financial Information. |

|

|

| 23-a |

|

Consent of Deloitte & Touche LLP, an independent registered public accounting firm. |

|

|

| 23-b |

|

Consent of Baker Tilly Virchow Krause, LLP, an independent registered public accounting firm. |

|

|

| 23-c |

|

Consent of Douglas M. Hagerman, Esq., Senior Vice President, General Counsel and Secretary of Rockwell Automation, contained in his opinion filed as Exhibit 5-a to this Registration Statement. |

|

|

| 23-d |

|

Consent of Goldman, Antonetti & Córdova, LLC. |

|

|

| 23-e |

|

Consent of Quarles & Brady LLP. |

|

|

| 24 |

|

Powers of Attorney authorizing certain persons to sign this Registration Statement on behalf of certain directors and officers of Rockwell Automation. |

6

Exhibit 4-c

ROCKWELL AUTOMATION

1165(e) PLAN

(Effective as

of January 1, 2009)

Plan 011

93262

Table of Contents

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| ARTICLE I: |

|

DEFINITIONS |

|

|

2 |

|

|

|

|

| 1.010 |

|

Accounts |

|

|

2 |

|

|

|

|

| 1.020 |

|

Affiliated Company |

|

|

2 |

|

|

|

|

| 1.030 |

|

After-tax Contribution Account |

|

|

2 |

|

|

|

|

| 1.040 |

|

Average Pre-tax Contribution Percentage |

|

|

2 |

|

|

|

|

| 1.050 |

|

Basic After-tax Contribution |

|

|

2 |

|

|

|

|

| 1.060 |

|

Basic Pre-tax Contribution |

|

|

2 |

|

|

|

|

| 1.070 |

|

Beneficiary |

|

|

2 |

|

|

|

|

| 1.080 |

|

Board of Directors |

|

|

3 |

|

|

|

|

| 1.090 |

|

Catch-up Contribution |

|

|

3 |

|

|

|

|

| 1.100 |

|

Code |

|

|

3 |

|

|

|

|

| 1.110 |

|

Company |

|

|

3 |

|

|

|

|

| 1.120 |

|

Company Contribution Account |

|

|

3 |

|

|

|

|

| 1.130 |

|

Company Contributions |

|

|

3 |

|

|

|

|

| 1.140 |

|

Company Matching Contributions |

|

|

3 |

|

|

|

|

| 1.150 |

|

Compensation |

|

|

3 |

|

|

|

|

| 1.160 |

|

[Reserved] |

|

|

|

|

|

|

|

| 1.170 |

|

Divested Business Employee |

|

|

3 |

|

|

|

|

| 1.180 |

|

Effective Date |

|

|

3 |

|

|

|

|

| 1.190 |

|

Eligible Employee |

|

|

3 |

|

|

|

|

| 1.200 |

|

Eligible Retirement Plan |

|

|

4 |

|

|

|

|

| 1.210 |

|

Employee |

|

|

4 |

|

|

|

|

| 1.220 |

|

Employee Benefit Plan Committee |

|

|

4 |

|

|

|

|

| 1.230 |

|

Employee Benefits Appeals Committee |

|

|

4 |

|

|

|

|

| 1.240 |

|

Employment Commencement Date |

|

|

4 |

|

|

|

|

| 1.250 |

|

Employment Severance Date |

|

|

4 |

|

|

|

|

| 1.260 |

|

ERISA |

|

|

5 |

|

|

|

|

| 1.270 |

|

5% Owner |

|

|

5 |

|

|

|

|

| 1.280 |

|

Flex Force Employee |

|

|

5 |

|

|

|

|

| 1.290 |

|

Fund(s) |

|

|

5 |

|

-i-

Plan 011

Effective January 1, 2009

|

|

|

|

|

|

|

| 1.300 |

|

Hardship |

|

|

5 |

|

|

|

|

| 1.310 |

|

Highly Compensated Employee Group |

|

|

6 |

|

|

|

|

| 1.320 |

|

Hour of Service |

|

|

6 |

|

|

|

|

| 1.330 |

|

Investment Fund |

|

|

7 |

|

|

|

|

| 1.340 |

|

Leave |

|

|

7 |

|

|

|

|

| 1.350 |

|

Named Fiduciary |

|

|

7 |

|

|

|

|

| 1.360 |

|

Non-Highly Compensated Employee Group |

|

|

7 |

|

|

|

|

| 1.370 |

|

Participant |

|

|

7 |

|

|

|

|

| 1.380 |

|

Participant Contributions |

|

|

7 |

|

|

|

|

| 1.390 |

|

Plan |

|

|

7 |

|

|

|

|

| 1.400 |

|

Plan Administrator |

|

|

7 |

|

|

|

|

| 1.410 |

|

Plan Year |

|

|

7 |

|

|

|

|

| 1.420 |

|

Pre-tax Contribution Account |

|

|

7 |

|

|

|

|

| 1.430 |

|

Pre-tax Contribution Percentage Limit |

|

|

7 |

|

|

|

|

| 1.440 |

|

PR Code |

|

|

8 |

|

|

|

|

| 1.450 |

|

PRTD |

|

|

8 |

|

|

|

|

| 1.460 |

|

Reemployment Date |

|

|

8 |

|

|

|

|

| 1.470 |

|

Retired Participant |

|

|

8 |

|

|

|

|

| 1.480 |

|

Retirement |

|

|

8 |

|

|

|

|

| 1.490 |

|

Rockwell |

|

|

8 |

|

|

|

|

| 1.500 |

|

Rockwell Automation Stock Fund |

|

|

8 |

|

|

|

|

| 1.510 |

|

Rollover Account |

|

|

8 |

|

|

|

|

| 1.520 |

|

Rollover Contributions |

|

|

8 |

|

|

|

|

| 1.530 |

|

Supplemental After-tax Contribution |

|

|

9 |

|

|

|

|

| 1.540 |

|

Supplemental Pre-tax Contributions |

|

|

9 |

|

|

|

|

| 1.550 |

|

Tender Offer |

|

|

9 |

|

|

|

|

| 1.555 |

|

Testing Compensation |

|

|

9 |

|

|

|

|

| 1.560 |

|

Trust Agreement |

|

|

9 |

|

|

|

|

| 1.570 |

|

Trust Fund |

|

|

9 |

|

|

|

|

| 1.580 |

|

Trustee |

|

|

9 |

|

-ii-

Plan 011

Effective January 1, 2009

|

|

|

|

|

|

|

| 1.590 |

|

Valuation Date |

|

|

9 |

|

|

|

|

| 1.600 |

|

Vesting Service |

|

|

9 |

|

|

|

|

| ARTICLE II: |

|

PARTICIPATION AND CONTRIBUTIONS |

|

|

10 |

|

|

|

|

| 2.010 |

|

Participation. |

|

|

10 |

|

|

|

|

| 2.020 |

|

Basic Contributions. |

|

|

10 |

|

|

|

|

| 2.030 |

|

Supplemental Contributions. |

|

|

10 |

|

|

|

|

| 2.040 |

|

Changes Between Pre-tax and After-tax Contributions. |

|

|

11 |

|

|

|

|

| 2.045 |

|

Catch-up Contributions. |

|

|

11 |

|

|

|

|

| 2.050 |

|

Rollover Contributions. |

|

|

11 |

|

|

|

|

| 2.060 |

|

Matching Contribution Formula. |

|

|

12 |

|

|

|

|

| 2.070 |

|

Rules Concerning Matching Contributions. |

|

|

12 |

|

|

|

|

| 2.080 |

|

Limit on Employer Contributions |

|

|

13 |

|

|

|

|

| ARTICLE III: |

|

CONTRIBUTION LIMITATIONS |

|

|

14 |

|

|

|

|

| 3.010 |

|

Limitations on Employee Pre-tax Contributions |

|

|

14 |

|

|

|

|

| 3.020 |

|

Limits for Catch-up Contributions. |

|

|

16 |

|

|

|

|

| 3.025 |

|

Qualified Nonelective Contributions |

|

|

16 |

|

|

|

|

| 3.030 |

|

Incorporation by Reference. |

|

|

16 |

|

|

|

|

| ARTICLE IV: |

|

PLAN INVESTMENTS |

|

|

17 |

|

|

|

|

| 4.010 |

|

Investment Elections |

|

|

17 |

|

|

|

|

| 4.020 |

|

Transfers from Investment Funds. |

|

|

17 |

|

|

|

|

| 4.030 |

|

Transfers from the Rockwell Automation Stock Fund |

|

|

17 |

|

|

|

|

| 4.040 |

|

Mandatory Transfer from the Rockwell Automation Stock Fund |

|

|

17 |

|

|

|

|

| 4.050 |

|

General Transfer Rules and Limitations. |

|

|

18 |

|

|

|

|

| 4.060 |

|

Participant’s Accounts |

|

|

18 |

|

|

|

|

| 4.070 |

|

Valuation and Participant Statements |

|

|

18 |

|

|

|

|

| ARTICLE V: |

|

VESTING AND ACCOUNT DISTRIBUTIONS |

|

|

20 |

|

|

|

|

| 5.010 |

|

Vesting |

|

|

20 |

|

|

|

|

| 5.020 |

|

Retirement, Death, Termination of Employment. |

|

|

21 |

|

|

|

|

| 5.030 |

|

[Reserved] |

|

|

21 |

|

|

|

|

| 5.040 |

|

Form of Distributions – Stock or Cash. |

|

|

21 |

|

-iii-

Plan 011

Effective January 1, 2009

|

|

|

|

|

|

|

| 5.050 |

|

Payment Method for Distributions to Retiring Participants |

|

|

21 |

|

|

|

|

| 5.060 |

|

[Reserved] |

|

|

22 |

|

|

|

|

| 5.070 |

|

Participant’s Consent to Distribution of Benefits |

|

|

22 |

|

|

|

|

| 5.075 |

|

Cashout Forfeitures and Repayments |

|

|

22 |

|

|

|

|

| 5.080 |

|

Distributions to Beneficiaries |

|

|

23 |

|

|

|

|

| 5.090 |

|

Transfer of Distribution Directly to Eligible Retirement Plan |

|

|

23 |

|

|

|

|

| 5.100 |

|

Uncashed Checks |

|

|

24 |

|

|

|

|

| ARTICLE VI: |

|

WITHDRAWALS AND LOANS |

|

|

25 |

|

|

|

|

| 6.010 |

|

Withdrawals from Accounts by Participants under Age 59-1/2 |

|

|

25 |

|

|

|

|

| 6.020 |

|

Withdrawal from Accounts by Participants Over Age 59-1/2 |

|

|

26 |

|

|

|

|

| 6.030 |

|

Hardship Withdrawals from Pre-tax Accounts |

|

|

27 |

|

|

|

|

| 6.040 |

|

Forfeitures and Suspensions. |

|

|

28 |

|

|

|

|

| 6.050 |

|

Allocation of Withdrawals Among Investment Funds |

|

|

28 |

|

|

|

|

| 6.060 |

|

Loans |

|

|

28 |

|

|

|

|

| ARTICLE VII: |

|

DEATH BENEFITS |

|

|

30 |

|

|

|

|

| 7.010 |

|

Designation of a Beneficiary |

|

|

30 |

|

|

|

|

| 7.020 |

|

Spouse as Automatic Beneficiary |

|

|

30 |

|

|

|

|

| 7.030 |

|

Beneficiary Changes |

|

|

30 |

|

|

|

|

| 7.040 |

|

Participant’s Estate as Beneficiary in Certain Cases |

|

|

30 |

|

|

|

|

| 7.050 |

|

Payment to a Beneficiary |

|

|

31 |

|

|

|

|

| ARTICLE VIII: |

|

TRUST AGREEMENT |

|

|

32 |

|

|

|

|

| 8.010 |

|

Establishment of Trust Fund |

|

|

32 |

|

|

|

|

| 8.020 |

|

Investment Funds and Stock Funds |

|

|

32 |

|

|

|

|

| 8.030 |

|

Trustee’s Powers and Authority. |

|

|

32 |

|

|

|

|

| 8.040 |

|

Statutory Limits. |

|

|

32 |

|

|

|

|

| 8.050 |

|

Duty of Trustee as to Common Stock in Stock Funds. |

|

|

33 |

|

|

|

|

| 8.060 |

|

Rights in the Trust Fund |

|

|

34 |

|

|

|

|

| 8.070 |

|

Taxes, Fees and Expenses of the Trustee |

|

|

34 |

|

|

|

|

| ARTICLE IX: |

|

ADMINISTRATION |

|

|

36 |

|

|

|

|

| 9.010 |

|

General Administration |

|

|

36 |

|

-iv-

Plan 011

Effective January 1, 2009

|

|

|

|

|

|

|

| 9.020 |

|

Employee Benefit Plan Committee |

|

|

36 |

|

|

|

|

| 9.025 |

|

Employee Benefits Appeals Committee |

|

|

36 |

|

|

|

|

| 9.030 |

|

Employee Benefit Plan Committee Records |

|

|

36 |

|

|

|

|

| 9.035 |

|

Employee Benefits Appeals Committee Records |

|

|

36 |

|

|

|

|

| 9.040 |

|

Funding Policy |

|

|

37 |

|

|

|

|

| 9.050 |

|

Allocation and Delegation of Duties Under Plan |

|

|

37 |

|

|

|

|

| 9.060 |

|

Employee Benefit Plan Committee Powers |

|

|

37 |

|

|

|

|

| 9.070 |

|

Plan Administrator |

|

|

37 |

|

|

|

|

| 9.080 |

|

Reliance Upon Documents and Opinions |

|

|

38 |

|

|

|

|

| 9.090 |

|

Requirement of Proof |

|

|

38 |

|

|

|

|

| 9.100 |

|

Limitation and Indemnification |

|

|

38 |

|

|

|

|

| 9.110 |

|

Mailing and Lapse of Payments |

|

|

39 |

|

|

|

|

| 9.120 |

|

Non-Alienation |

|

|

39 |

|

|

|

|

| 9.130 |

|

Notices and Communications |

|

|

39 |

|

|

|

|

| 9.140 |

|

Company Rights |

|

|

40 |

|

|

|

|

| 9.150 |

|

Payments on Behalf of Incompetent Participants or Beneficiaries |

|

|

40 |

|

|

|

|

| ARTICLE X: |

|

PARTICIPANT CLAIMS |

|

|

41 |

|

|

|

|

| 10.010 |

|

Claims and Appeals Procedures |

|

|

41 |

|

|

|

|

| 10.020 |

|

Limitation on Legal Action |

|

|

42 |

|

|

|

|

| ARTICLE XI: |

|

AMENDMENT, MERGERS, TERMINATION, ETC. |

|

|

43 |

|

|

|

|

| 11.010 |

|

Amendment |

|

|

43 |

|

|

|

|

| 11.020 |

|

Transfer of Assets and Liabilities |

|

|

43 |

|

|

|

|

| 11.030 |

|

Merger Restriction |

|

|

43 |

|

|

|

|

| 11.040 |

|

Suspension of Contributions |

|

|

43 |

|

|

|

|

| 11.050 |

|

Discontinuance of Contributions |

|

|

44 |

|

|

|

|

| 11.060 |

|

Termination |

|

|

44 |

|

|

|

|

| ARTICLE XII: |

|

MISCELLANEOUS |

|

|

45 |

|

|

|

|

| 12.010 |

|

Benefits Payable only from Trust Fund |

|

|

45 |

|

|

|

|

| 12.020 |

|

Requirement for Release |

|

|

45 |

|

|

|

|

| 12.030 |

|

Transfers of Stock |

|

|

45 |

|

-v-

Plan 011

Effective January 1, 2009

|

|

|

|

|

|

|

| 12.040 |

|

Rights of Reemployed Veterans |

|

|

45 |

|

|

|

|

| 12.050 |

|

Qualification of the Plan |

|

|

45 |

|

|

|

|

| 12.060 |

|

Interpretation |

|

|

45 |

|

|

|

|

| 12.070 |

|

No Contract of Employment |

|

|

45 |

|

|

|

|

| APPENDIX A |

|

EXCLUDED EMPLOYERS |

|

|

47 |

|

|

|

|

| APPENDIX B |

|

PROCEDURES, TERMS AND CONDITIONS OF LOANS |

|

|

48 |

|

-vi-

Plan 011

Effective January 1, 2009

ROCKWELL AUTOMATION

1165(E) PLAN

Plan

Number 011

WHEREAS, Rockwell Automation, Inc. (the “Company”) currently sponsors the Caribbean Integration Engineers, Inc. 1165(e) Plan

(the “CIE Plan”) and the Rockwell Automation Retirement Savings Plan for Salaried Employees (the “Salaried Savings Plan”); and

WHEREAS, the CIE Plan currently benefits certain employees of the Company working in Puerto Rico; and

WHEREAS, the Salaried Savings Plan currently benefits both certain employees of the Company working in the U.S. and certain employees of the Company working

in Puerto Rico; and

WHEREAS, the Company desires to offer one defined contribution retirement plan for the benefit of all its employees working in Puerto

Rico, with the same level of benefits as the Company currently provides to such employees under the CIE Plan and the Salaried Savings Plan; and

WHEREAS,

the Company has frozen the benefits under the CIE Plan and the Puerto Rico employee portion of the Salaried Savings Plan effective January 1, 2009;

NOW THEREFORE, the Company hereby establishes this Rockwell Automation 1165(e) Plan for the benefit of its eligible employees working in Puerto Rico effective

January 1, 2009.

1

Plan 011

Effective January 1, 2009

ROCKWELL AUTOMATION

1165(E) PLAN

ARTICLE I:

DEFINITIONS

1.010 Accounts means a Participant’s Pre-tax Account, After-tax Account, Rollover Account and Company

Contribution Account.

1.020 Affiliated Company means Rockwell Automation, Inc. and:

| (a) |

any corporation which is a member of a controlled group of corporations (as defined in PR Code Section 1028) which includes Rockwell Automation, Inc.; |

| (b) |

any trade or business (whether or not incorporated) which is under common control (as defined in PR Code Section 1028) with Rockwell Automation, Inc.; and |

| (c) |

any other company deemed to be an Affiliated Company by Rockwell Automation’s Board of Directors. |

Notwithstanding the foregoing, for purposes of determining whether an employee is an Eligible Employee, only an affiliate to which the Board of Directors has

extended this Plan shall be considered an Affiliated Company. Affiliated Companies to which the Plan has not been extended are listed on Appendix A hereto.

1.030 After-tax Contribution Account means a Plan Account with respect to a Participant which is comprised of Basic and

Supplemental After-tax Contributions, as adjusted for gains or losses related thereto.

1.040 Average Pre-tax Contribution

Percentage means the average for a particular Plan Year of the percentages, calculated separately for the Highly Compensated Employee Group and for the Non-Highly Compensated Employee Group with respect to each Participant in each such

Group, which are equal to the amount of each Participant’s Pre-tax Contributions in a Plan Year, divided by the Participant’s Testing Compensation for the Plan Year.

1.050 Basic After-tax Contribution means an amount contributed by a Participant to the Plan through payroll deductions pursuant to

the Participant’s election under Section 2.020(b).

1.060 Basic Pre-tax Contribution means an amount contributed to

the Plan on behalf of a Participant pursuant to the Participant’s election under Section 2.020(a).

1.070

Beneficiary means the one or more persons or trusts entitled to a Participant’s Plan Account balance, pursuant to the provisions of Article VII, if the Participant should die prior to payment to him of his entire

Account Balance.

-2-

Plan 011

Effective January 1, 2009

1.080 Board of Directors means the Board of Directors of Rockwell Automation;

provided, however, that any action or determination under Sections 1.020, 1.110 and 2.070, as well as under Article XI, may be taken by any officer of the Company who is authorized to do so by the Board of Directors.

1.090 Catch-up Contribution means an amount contributed to the Plan on behalf of a Participant pursuant to the Participant’s

election under Section 2.045.

1.100 Code means the Internal Revenue Code of 1986, as from time to time amended.

1.110 Company means Rockwell Automation, Inc., a Delaware corporation, and any Affiliated Company to which the Board of Directors

has extended this Plan.

1.120 Company Contribution Account means a Plan Account with respect to a Participant which is

comprised of his Company Matching Contributions, as adjusted for gains or losses related thereto and as separately accounted for.

1.130

Company Contributions means, collectively, Company Matching Contributions.

1.140 Company Matching

Contributions means the contributions made to the Trust Fund by Rockwell Automation or an Affiliated Company pursuant to the provisions of Section 2.060 or 2.070.

1.150 Compensation means total compensation paid by the Company to a Participant during the Plan Year that is includible in income

for income tax purposes and any Pre-Tax Contributions made pursuant to this Plan. Notwithstanding the foregoing sentence, Compensation shall not include reimbursements or other expense allowances, fringe benefits (cash and non-cash), moving

expenses, deferred compensation and welfare benefits regardless of whether such amounts are includible in gross income.

1.160

[reserved]

1.170 Divested Business Employee means an individual who is no longer an Employee of the Company

because he is a current or former employee of a component of the Company which was sold, spun off or otherwise divested by the Company.

1.180

Effective Date means January 1, 2009.

1.190 Eligible Employee means any Employee (including any

officer) employed on a U.S. or Puerto Rico payroll of an Affiliated Company, or on a U.S. or Puerto Rico payroll of a division, plant, office or location of an Affiliated Company and working in Puerto Rico.

-3-

Plan 011

Effective January 1, 2009

Eligible Employee does not include:

| (a) |

any director of the Company who is not an Employee; |

| (b) |

any Employee who is not working in Puerto Rico; |

| (c) |

any person or Employee compensated by special fees or pursuant to a special contract or arrangement; |

| (d) |

any Employee who is covered by a collective bargaining agreement; |

| (e) |

any Employee of an entity, division, plant, office or location that is specified on Appendix A to the Plan; or |

| (f) |

any Flex Force Employee. |

1.200 Eligible Retirement Plan means an individual

retirement account described in Section 1169 of the PR Code, or a qualified trust described in Section 1165(a) of the PR Code, that accepts the distributee’s Eligible Rollover Distribution. In the case of an Eligible Rollover

Distribution to a Beneficiary who is the Participant’s surviving spouse, an Eligible Retirement Plan is also an individual retirement account or qualified trust described above.

1.210 Employee means any person who is employed by the Company or by an Affiliated Company.

1.220 Employee Benefit Plan Committee means the Employee Benefit Plan Committee of the Company appointed pursuant to

Section 9.020 of the Plan and having the responsibilities prescribed in Article IX and elsewhere throughout the Plan.

1.230 Employee

Benefits Appeals Committee means the Employee Benefits Appeals Committee of the Company appointed pursuant to Section 9.025 of the Plan and having the responsibilities prescribed in Article X and elsewhere throughout the Plan.

1.240 Employment Commencement Date means the date on which a person first becomes an Employee of the Company or an Affiliated

Company.

1.250 Employment Severance Date means:

| (a) |

the date on which an Employee quits, retires, is discharged or dies, |

| (b) |

in the case of an Employee who remains absent from work pursuant to a written Leave, the first anniversary of such Leave, except that an Employee who has a Leave which is in excess of one (1) year who thereafter

returns to work with the Company for a period at least equal to the entire period of the Leave will not be considered as having an Employment Severance Date by reason of such absence. |

-4-

Plan 011

Effective January 1, 2009

If an Employee enters the United States military service or public health service directly from employment with

the Company, has not voluntarily reenlisted and returns to employment with the Company for a period of at least one (1) year immediately after his return to the Company, the Employee will not be deemed to have an Employment Severance Date by

reason of such military service or public health service.

1.260 ERISA means the Employee Retirement Income Security Act

of 1974, as it may be amended from time to time.

1.270 5% Owner means a person who owns:

| (a) |

more than five percent (5%) of the outstanding stock of the Company, or |

| (b) |

stock possessing more than five percent (5%) of the total combined voting power of all stock of the Company. |

1.280 Flex Force Employee means an Employee who is a member of the substitute workforce of the Company hired to assist in the

completion of special projects, an Employee hired from an “on call” pool, an Employee hired to serve as a replacement for a regular Employee who is temporarily absent from work, an Employee hired to fill other temporary needs of the

Company or an Employee hired to assist with transition or with other matters for a limited period of time.

1.290 Fund(s)

means one or more of the Investment Funds or the Rockwell Automation Stock Fund.

1.300 Hardship means an immediate and heavy

financial need of the Participant for which the amount required is not reasonably available to the Participant from other sources and which arises for one of the following reasons:

| |

(1) |

The construction or purchase (excluding mortgage payments) of a principal residence of the Participant; |

| |

(2) |

The payment of tuition and related educational fees for up to 12 months of post-secondary education for the Participant or his or her spouse, children or dependents; |

| |

(3) |

The payment of medical expenses described in Section 1023(aa)(2)(P) of the PR Code incurred by the Participant or the Participant’s spouse or dependents, or to obtain medical care giving rise to such expenses;

|

| |

(4) |

The payment of expenses incurred by the Participant for the funeral of a family member; |

| |

(5) |

The prevention of the eviction of the Participant from his or her principal residence or foreclosure on a mortgage on the Participant’s principal residence; or |

-5-

Plan 011

Effective January 1, 2009

| |

(6) |

A financial need that has been identified as a deemed immediate and heavy financial need in a ruling, notice or other document of general applicability issued under the authority of the Puerto Rico Secretary of the

Treasury. |

For purposes of this Section, the term “dependent” shall be defined as set forth in Section 1025(d) of the PR

Code.

As used herein, financial Hardship will mean an immediate and heavy financial need that based on the facts and circumstances cannot be met from

other resources that are reasonably available to the Participant. For this purpose, the Participant’s resources are deemed to include those assets of the Participant’s Spouse and minor children that are reasonably available to the

Participant. A distribution will be deemed to satisfy an immediate and heavy financial need of the Participant if the Participant represents in writing to the Plan Administrator that the distribution is necessary to satisfy an immediate and heavy

financial need and all of the following requirements are satisfied:

| |

(1) |

The distribution is not in excess of the amount of the immediate and heavy financial need of the Participant; provided, however, that the amount of such distribution may include the amount of any federal, state or local

taxes or penalties reasonably anticipated to result from the withdrawal; |

| |

(2) |

The Participant has obtained all distributions, other than hardship distributions, and all nontaxable loans currently available to Participant from commercial sources and under the Plan and all of the plans maintained

by the Employer or any other employer; |

| |

(3) |

Such need cannot reasonably be relieved through reimbursement or compensation by insurance or otherwise, by liquidation of the Participant’s assets, or by cessation of Pre-Tax Contributions to the Plan.

|

1.310 Highly Compensated Employee Group means those individuals who are employed by a participating Company who

are more highly compensated than two-thirds of all Eligible Employees employed by the same participating Company or any participating Company, as applicable under the PR Code.

The Plan Administrator may determine which Employees are highly compensated employees for purposes of this Section in any manner permitted by the said PR Code

provision. Such determination (as well as the determination of which Employees are not highly compensated employees) will be made by the Plan Administrator on a consistent basis from Plan Year to Plan Year.

1.320 Hour of Service means hours for which an Employee is paid or entitled to payment:

| (a) |

for the performance of duties for the Company or an Affiliated Company; or |

-6-

Plan 011

Effective January 1, 2009

| (b) |

on account of a period of time during which no duties are performed (irrespective of whether the employment relationship has terminated) due to vacation, holiday, illness, incapacity (including disability), layoff, jury

duty, military duty or leave of absence. |

1.330 Investment Fund means one of the investment vehicles available

to Participants.

1.340 Leave means a leave of absence which has been granted or approved by the Company.

1.350 Named Fiduciary means the Employee Benefit Plan Committee, the Plan Administrator, the Employee Benefits Appeals Committee

and the Trustee.

1.360 Non-Highly Compensated Employee Group means Employees who are not in the Highly Compensated Employee

Group, as determined by the Plan Administrator.

1.370 Participant means a person who has elected to participate in the

Plan in accordance with Article II; provided, however, that such term will include a person who no longer has an effective election under Article II only so long as he retains an Account under the Plan.

1.380 Participant Contributions means, as applicable, a Participant’s:

| (a) |

Basic Pre-tax and Basic After-tax Contributions; |

| (b) |

Supplemental Pre-tax and Supplemental After-tax Contributions; |

| (c) |

Catch-up Contributions; and |

| (d) |

Transfer and/or Rollover Contributions. |

1.390 Plan means this Rockwell Automation

1165(e) Plan, as from time to time amended.

1.400 Plan Administrator means the person from time to time so designated by name

or corporate office by the Employee Benefit Plan Committee to carry out the administrative functions of this Plan.

1.410 Plan

Year means each twelve month period ending on the last day of December.

1.420 Pre-tax Contribution Account means

a Plan Account with respect to a Participant which is comprised of his Basic Pre-tax Contributions, Supplemental Pre-tax Contributions and Catch-up Contributions, all as adjusted for gains or losses.

1.430 Pre-tax Contribution Percentage Limit means the maximum contribution percentage in each Plan Year for Highly Compensated

Employee Group Participants and, for any Plan Year, may be equal to either (a) or (b) below:

| (a) |

the Average Pre-tax Contribution Percentage for the Non-Highly Compensated Employee Group, multiplied by one and twenty-five hundredths (1.25); or |

-7-

Plan 011

Effective January 1, 2009

| (b) |

an amount which does not exceed the Average Pre-tax Contribution Percentage for the Non-Highly Compensated Employee Group by more than two (2) percentage points, and the Average Pre-tax Contribution Percentage for

the Non-Highly Compensated Employee Group, multiplied by two (2). |

If a Participant who is a member of the Highly Compensated Employee Group

is a participant in any other plan established or maintained by an Affiliated Company pursuant to which elective deferrals under a cash or deferred arrangement or matching contributions, or employee contributions, are made, such other plan will be

deemed to be a part of this Plan for the purpose of determining the Pre-tax Contribution Percentage Limit with respect to that Participant.

1.440

PR Code means the Puerto Rico Internal Revenue Code of 1994, as amended. Reference to a section of the PR Code will include that section, applicable Regulations promulgated there under and any comparable section of any

future legislation that amends, supplements or supersedes said section, effective as of the date such comparable section is effective with respect to the Plan.

1.450 PRTD means the Puerto Rico Treasury Department.

1.460 Reemployment Date means the date on which a person first becomes an Employee of the Company following an Employment

Severance Date.

1.470 Retired Participant means a Participant who has had a Retirement.

1.480 Retirement means a termination of employment (i) after attainment of age 65 or (ii) after attainment of age 55

with at least 10 years of service.

1.490 Rockwell means Rockwell Automation, Inc., a Delaware corporation.

1.500 Rockwell Automation Stock Fund means the Investment Fund established by the Trustee on July 1, 2005 to purchase and

hold the Common Stock of the Company and to receive and hold Company Matching Contributions, as described in Section 8.020(b).

1.510

Rollover Account means a Plan Account described in Section 2.050 which has its purpose the holding of amounts which are received by the Plan on a Participant’s behalf as a Rollover Contribution.

1.520 Rollover Contributions mean the amounts described in Section 2.050 which are transferred to a Participant’s

Rollover Account pursuant to the terms of subsection (b) of that Section.

-8-

Plan 011

Effective January 1, 2009

1.530 Supplemental After-tax Contribution means the amounts contributed by a

Participant to the Plan through payroll deductions pursuant to Section 2.030(b).

1.540 Supplemental Pre-tax

Contributions means the amounts contributed to the Plan on behalf of a Participant pursuant to the Participant’s election under Section 2.030(a).

1.550 Tender Offer means any tender offer for, or request or invitation for tenders of, common stock subject to §14(d)(1) of

the Securities Exchange Act of 1934, as amended, or any regulation thereunder, except for any such tender offer or request or invitation for tenders made by the Company or any Affiliated Company for its own common stock.

1.555 Testing Compensation means the compensation of a Participant, as is defined in Code §414(s) as limited by the PR Code.

1.560 Trust Agreement means the trust agreement entered into pursuant to Article VIII of this Plan.

1.570 Trust Fund means the fund, including the earnings thereon, held by the Trustee for all contributions made under this Plan by

Participants and the Company.

1.580 Trustee means the trustee or trustees of the trust described in Article VIII of this

Plan.

1.590 Valuation Date means any New York Stock Exchange trading day.

1.600 Vesting Service means the period commencing with an Employee’s Employment Commencement Date and ending with his

Employment Severance Date and the period from an Employee’s Reemployment Date to his subsequent Employment Severance Date. In addition, Vesting Service includes the period of time between an Employee’s Employment Severance Date and his

Reemployment Date, if that period does not exceed twelve (12) months.

-9-

Plan 011

Effective January 1, 2009

ARTICLE II: PARTICIPATION AND CONTRIBUTIONS

2.010 Participation. An Eligible Employee will be permitted to elect to become a Participant in the Plan as soon as is practicable following his

commencement of service with an Affiliated Company. To the extent administratively feasible, an Eligible Employee’s election to contribute to the Plan will become effective on the first payroll payment date following his commencement of service

as an Eligible Employee and will remain in effect, unless he elects otherwise, so long as he continues to be an Eligible Employee.

Notwithstanding the

foregoing, any Eligible Employee who is hired or rehired on or after January 1, 2009 and who has not previously made an affirmative contrary Pre-Tax Contribution election shall be deemed to have elected an automatic Pre-Tax Contribution of

three percent (3%) of such Participant’s Compensation to be contributed under the Plan. Such deemed automatic 3% Pre-Tax contribution shall be effective as of January 1, 2009 and shall continue in effect as described in the paragraph

above.

2.020 Basic Contributions. A Participant may take either or both of the actions described in subsections (a) and (b) below:

| (a) |

elect to defer receipt of an amount equal to 1% through 6% of his regular Compensation (such deferral to be elected in whole percentages), and to instead have that amount paid to the Plan as a Basic Pre-tax Contribution

to his Pre-tax Contribution Account; |

| (b) |

authorize having deducted from his regular Compensation 1% through 6% (such deduction to be authorized in whole percentages) and then have the amount of such deduction (as adjusted for all applicable taxes due on that

amount) paid to the Plan as a Basic After-tax Contribution to his After-tax Contribution Account; |

provided, however, that the percentages

elected to be deferred or deducted and then made as Basic Pre-tax and Basic After-tax Contributions may together not exceed 6% of the Participant’s Compensation .

2.030 Supplemental Contributions. A Participant who has made the elections and/or authorizations described in Section 2.020 will also be permitted

to take either or both of the actions described in subsections (a) and (b) below:

| (a) (1) |

if he is a non-Highly Compensated Employee, elect to defer receipt of an amount equal to 7% through 50% of his regular Compensation (such deferral to be elected in whole percentages), and to instead have that amount

paid to the Plan as a Supplemental Pre-tax Contribution to his Pre-tax Contribution Account; |

| |

(2) |

if he is a Highly Compensated Employee, elect to defer receipt of an amount equal to 7% through 16% of his regular Compensation (such deferral to be elected in whole percentages), and to instead have that amount paid to

the Plan as a Supplemental Pre-tax Contribution to his Pre-tax Contribution Account; |

-10-

Plan 011

Effective January 1, 2009

| (b) |

if he is either a non-Highly Compensated Employee or a Highly Compensated Employee, authorize having deducted from his regular Compensation 7% through 10% (such deduction to be authorized in whole percentages) and then

have the amount of such deduction (as adjusted for all applicable taxes due on that amount) paid to the Plan as a Supplemental After-tax Contribution to his After-tax Contribution Account; |

provided, however, that the percentages elected to be deferred or deducted and then made as Supplemental Pre-tax and Supplemental After-tax Contributions may

together not exceed 44% of the Participant’s Compensation if he is a non-Highly Compensated Employee or 10% of the Participant’s Compensation if he is a Highly Compensated Employee.

Further, notwithstanding the foregoing, the sum of the Basic After-tax Contributions and the Supplemental After-tax Contributions shall not exceed in any

given year 10% percent of the Participant’s Compensation for the Plan Year since becoming a Participant.

2.040 Changes Between Pre-tax and

After-tax Contributions. A Participant will be permitted to elect to increase or decrease at any time (and as often as he wishes) the rate of his Pre-tax and After-tax Contributions. Any such increase or decrease of the rate of the

Participant’s Pre-tax and After-tax Contributions will be effective as soon as is reasonably possible after receipt by the Plan Administrator of the Participant’s election.

2.045 Catch-up Contributions. In addition to the Basic Pre-tax Contributions and the Supplemental Pre-tax Contributions described, respectively, in

Sections 2.020 and 2.030, subject to Section 3.020 and notwithstanding any of the nondiscrimination rules described in the PR Code or limitations on Participant Contributions as are otherwise in effect under this Plan, including, but not

limited to any such rules or limitations as are set forth in Sections 3.010 and 12.010, any Participants in the Plan who on or prior to the last day of a Plan Year will have attained age 50 and who has in place an election under Section 2.020

of at least 1% of Compensation will be permitted to elect to have an additional amount equal to 1% through 75% of his regular Compensation contributed as a pre-tax Catch-up Contribution to the Plan on his behalf during that Plan Year, so long as the

total of any such Catch-up Contributions during the Plan Year are not in excess of the applicable dollar amount set forth in the said Section 3.020.

2.050 Rollover Contributions. Transfers to this Plan of a Participant’s interest in another individual account plan will be permitted as set forth

below:

| (a) |

A Participant who is an Eligible Employee may elect (by providing the Plan Administrator with notice thereof) to have the entire amount credited to his account in a qualified individual account plan of a former employer

transferred from such plan to this Plan as a Rollover Contribution, subject to the following: |

| |

(1) |

Such Rollover Contributions are eligible for receipt hereunder only if they are in the form of cash and are derived entirely from employee contributions or vested employer contributions to a retirement plan described in

and subject to PR Code §1165. |

-11-

Plan 011

Effective January 1, 2009

| |

(2) |

No portion of such Rollover Contributions may be derived from a transfer from a qualified plan which at any time had permitted benefit payments in the form of a life annuity. |

| |

(3) |

The Plan is authorized to accept a Rollover Contribution from any Participant who is an Eligible Employee if such contribution meets the following criteria: (a) such contribution represents the entire balance

credited to the Participant in a employee benefit plan qualified under Sections 1165(a) or 1165(e) of the PR Code of a former employer which is distributed to the Participant within a single taxable year by reason of separation from service;

(b) such contribution is transferred directly by the trustee of the transferor plan or is rolled over by the Participant within sixty (60) days after receipt of the distribution; (c) the spousal consent requirements of ERISA

Section 205 are complied with, if applicable; and (d) such contribution meets any other conditions as determined necessary by the Plan, the Trustee or the Plan Administrator to comply with Section 1165(b)(2) of the PR Code.

|

| (b) |

Rollover Contributions will be credited to separate Rollover Accounts, which will be separate from the Participant’s Pre-tax and After-tax Contribution Accounts and, as such, will be subject to investment elections

which are separate from those related to the Participant’s Pre-tax and After-tax Contribution accounts, but which will be subject to the same process as is set forth in Article IV of this Plan. |

2.060 Matching Contribution Formula.

| (a) |

The Company will contribute to the Plan on behalf of each Participant out of its current or accumulated profits Company Matching Contributions equal to fifty percent (50%) of the Participant’s Basic Pre-tax

Contributions and Basic After-tax Contributions (up to 6% of Compensation ) made pursuant to Section 2.020. Such Company Matching Contributions will be made in the form and subject to the limitations set forth in Section 2.070. Any

forfeiture of Company Matching Contributions occurring during a Plan Year shall be used to reduce Company Matching Contributions for such Plan Year. |

2.070 Rules Concerning Matching Contributions.

| (a) |

No Company Matching Contributions will be made with respect to a Participant’s Supplemental Pre-tax Contributions, Catch-up Contributions, Supplemental After-tax Contributions or Rollover Contributions.

|

| (b) |

Company Matching Contributions will be made in the form of Rockwell Automation common stock, but may be made, in the discretion of the Board of

Directors, in cash or in any |

-12-

Plan 011

Effective January 1, 2009

| |

combination of cash and Rockwell Automation common stock. Rockwell Automation common stock which is contributed will be valued at the New York Stock Exchange closing price on the Valuation Date

immediately preceding the date on which the contribution is made. |

| (c) |

Company Matching Contributions will be directed to the Rockwell Automation Stock Fund unless otherwise distributed or transferred as described above. |

2.080 Limit on Employer Contributions

The contribution

of a Company in Puerto Rico for any Plan Year will in no event exceed the maximum amount allowable as a deduction to the Company under the provisions of Section 1023(n) of the PR Code. The Company may make contributions to the Plan without

regard to net profits, current or accumulated.

-13-

Plan 011

Effective January 1, 2009

ARTICLE III: CONTRIBUTION LIMITATIONS

3.010 Limitations on Employee Pre-tax Contributions.

| (a) |

The aggregate amount in any calendar year of all of a Participant’s: |

| |

(1) |

Basic and Supplemental Pre-tax Contributions to this Plan; and |

| |

(2) |

elective deferrals under any other cash or deferred arrangement (as defined in PR Code §1165(e)). |

may not exceed Nine Thousand Dollars ($9,000.00), or such larger sum as may be in effect under PR Code §1165(e)(7).

| (b) |

Prior to the beginning of, and periodically during, each Plan Year, the Plan Administrator will cause a test to be conducted of Pre-tax Contribution elections under Sections 2.020(a) and 2.030(a) in order to determine

whether the Average Pre-tax Contribution Percentage for the Highly Compensated Employee Group exceeds the Pre-tax Contribution Percentage Limit. If it is determined that the Pre-tax Contributions made for any Plan Year by the Highly Compensated

Employee Group would (if not reduced) cause the Average Pre-tax Contribution Percentage of that Group to exceed the Pre-tax Contribution Percentage Limit, the Plan Administrator will first reduce any Supplemental Pre-tax Contributions and then the

Basic Pre-tax Contributions elected by Participants in the Highly Compensated Employee Group, so that the Pre-tax Contribution Percentage Limit will not be exceeded for the Plan Year: |

| |

(1) |

Such reduction will be effective as of the first payroll date in the month following such determination and will be made by first reducing the Pre-tax Contribution Accounts of Highly Compensated Employee Group

Participants who have the greatest dollar amount of Pre-tax Contributions (but not below the Highly Compensated Employee Group Participants with the next highest dollar amount of Pre-tax Contributions), and then, if necessary, reducing the Pre-tax

Contributions of the Highly Compensated Employee Group Participants with the next highest dollar amount of Pre-tax Contributions (including the Pre-tax Contributions of the Highly Compensated Employee Group Participants whose Pre-tax Contributions

have already been reduced by the Plan Administrator), and continuing in descending order until the Average Pre-tax Contribution Percentage for the Highly Compensated Employee Group satisfies the Pre-tax Contribution Limit. |

| |

(2) |

Such excess Pre-tax Contributions will be distributed to the affected Participants who are Highly Compensated Employee Group Participants as soon as

practicable after the end of such Plan Year and in all events prior the end of the next following Plan Year. Income allocable to such excess Pre-tax Contributions with respect to any Participant that are distributed in the next following Plan Year

shall equal the sum of the |

-14-

Plan 011

Effective January 1, 2009

| |

allocable gain or loss for the Plan Year, and any allocable gain or loss for the period between the end of the Plan Year and the date of the corrective distribution (i.e., the “gap

period”). Income allocable to excess Pre-tax Contributions for the Plan Year and any gap period shall be calculated under any reasonable method as determined by the Plan Administrator, provided that such method is used for allocating income to

Participants’ Pre-tax Contribution Accounts and is used consistently for all Participants and for all corrective distributions under the Plan for the Plan Year. |

| (c) |

Reductions in Basic or Supplemental Pre-tax Contributions pursuant to subsection (b) of this Section will continue until the Plan Administrator determines that changed circumstances permit a revision of such

Pre-tax Contributions, in which case the Plan Administrator will determine the amount by which such Pre-tax Contributions may be revised for the balance of the Plan Year. |

| (d) |

In order to determine the amount of excess Pre-tax Contributions, if any, for the members of the Highly Compensated Employee Group, the Plan Administrator or his delegate will: |

| |

(1) |

determine the “highly compensated employee” (as defined in PR Code §1165(e)(3)(E)(iii)) in the Group with the highest Pre-tax Contribution Percentage (i.e., the amount of such employee’s Pre-tax

Contributions in a particular Plan Year, divided by his Compensation for the Plan Year); |

| |

(2) |

determine how much the said Percentage would have to be reduced to either satisfy the Average Pre-tax Contribution Percentage test under PR Code §1165(e)(3) or cause such Percentage to equal the Pre-tax

Contribution Percentage of the highly compensated employee with the next highest Percentage; and |

| |

(3) |

repeat making the determination set forth in Paragraph (2) until such time as the Average Pre-tax Contribution Percentage test described in that Paragraph is satisfied. |

The amount of excess Pre-tax Contributions for the members of the Highly Compensated Employee Group is equal to the amount equal to the sum of the

hypothetical reductions described above, multiplied by such members’ Testing Compensation.

| (e) |

To the extent permitted by regulation, the Plan Administrator may during or following a Plan Year cause Supplemental or Basic Pre-tax Contributions made on behalf of Highly Compensated Employee Group Participants to be

recharacterized (on a uniform and non-discriminatory basis) as Supplemental or Basic After-tax Contributions to the extent necessary to prevent the Average Pre-tax Contribution Percentage for that Plan Year for those Participants from exceeding the

Pre-tax Contribution Percentage Limit. |

-15-

Plan 011

Effective January 1, 2009

3.020 Limits for Catch-up Contributions. Notwithstanding the limitations set forth in the preceding

Section 3.010 or any other provision of this Plan, the aggregate amount of Catch-up Contributions for a given Plan Year of any Participant who, as of the end of a Plan Year, is at least age fifty (50), who intends to have Basic and Supplemental

Pre-tax Contributions made to the Plan during the Plan Year which could be in excess of the limit set forth in the said Section 3.010 and who has a Basic Pre-tax or After tax Contribution election of at least 1% in place, will be permitted to

elect to have Catch-up Contributions made on his behalf to the Plan in amounts totaling $1,000 or any other limit provided in Section 1165(e)(7)(C) of the PR Code.

To the extent that any such Catch-up Contribution is in excess of the limits of this Section and, if not otherwise limited pursuant to any other provisions of

this Plan which are applicable to Participant Contributions or Company Matching Contributions, such excess will nevertheless be contributed to the Plan as an After-tax Contribution of such Participant.

3.025 Qualified Nonelective Contributions. The Company may make qualified nonelective contributions on behalf of any Eligible Employee who is working

in Puerto Rico, in order to satisfy applicable requirements of the PR Code. Such contributions shall be fully vested at all times and shall be made in a manner that also complies with the PR Code.

3.030 Incorporation by Reference. The limitations of PR Code Section 1165(e) are hereby incorporated by reference. Articles II and III of the Plan

set forth the basic requirements of PR Code §1165(e). In the event of any conflict between the provisions of these Articles II and III and the PR Code §1165(e), the provisions of the PR Code thereunder shall govern. The Plan also

incorporates by reference any subsequent PRTD guidance applicable under these PR Code provisions.

-16-

Plan 011

Effective January 1, 2009

ARTICLE IV: PLAN INVESTMENTS

4.010 Investment Elections. In addition to the elections and authorizations set forth in Article II, a Participant will be permitted to elect in

which Investment Funds his Participant Contributions will be invested.

| (a) |

Such investments will be elected by the Participant among the Investment Funds in one percent (1%) increments, with the total of the elected percentage increments equaling one hundred percent (100%).

|

| (b) |

The Participant will be permitted to change, on a daily basis, any previous Investment Fund election or elections he has made with regard to his Contributions pursuant to subsection (a). |

| (c) |

The elections and changes to such elections which a Participant makes pursuant to this Section will be made by means of any method (including any available telephonic or electronic method which is acceptable to the Plan

Administrator at the time the election or change is made by the Participant), and may be made at any time and will be effective as of the New York Stock Exchange closing immediately following the making of that election or change; provided, however,

if it is determined by the Plan Administrator or his delegate that an investment election made by a Participant is invalid or defective, such an invalid or defective election will be deemed to have been made in favor of the appropriate target

retirement Investment Fund based on such Participant’s date of birth. |

| (d) |

The Account of any Participant who initially fails to make a valid investment election prior to becoming a participant in the Plan shall be invested in the appropriate target retirement Investment Fund based on such

Participant’s date of birth (or such other Investment Fund as selected by the Trustee or as directed by the Plan Administrator). |

4.020 Transfers from Investment Funds. A Participant will be permitted to have the whole or a portion of the value of his interest in any of the

Plan’s Investment Funds (including the Rockwell Automation Stock Fund).

4.030 Transfers from the Rockwell Automation Stock Fund. A

Participant who is an Employee of the Company may elect to have some or all of his interest in the Rockwell Automation Stock Fund, regardless of a Participant’s years of Vesting Service. transferred to any Investment Fund. A Participant who is

no longer an Employee (including a Participant who is a Divested Business Employee) or a Beneficiary may not make any transfers into the Rockwell Automation Stock Fund.

4.040 Mandatory Transfer from the Rockwell Automation Stock Fund. For each Plan Year, the Plan Administrator shall select a date prior to June 30

on which any Participant who is not an Employee as of the preceding December 31 (including a Participant who is a Divested Business Employee) shall be deemed to have elected to transfer that portion of his interest in the Rockwell Automation

Stock Fund that exceeds 15% of his total Account value to a target retirement Investment Fund based on such Participant’s date of birth. The Plan Administrator shall give affected Participants at least sixty (60) days prior notice of such

transfer.

-17-

Plan 011

Effective January 1, 2009

4.050 General Transfer Rules and Limitations. The Fund transfers described in the preceding Sections will

be subject to the following limitations:

| (a) |

Any such transfer will be effected in dollar amounts or in increments of 1% of the value of the Participant’s interest in a transferring Fund, but in no event will any such transfer be in an amount less than Two

Hundred and Fifty Dollars ($250.00), except that if the balance of a Participant’s interest in a Fund is less than Two Hundred and Fifty Dollars ($250.00), the Participant may elect to have the entire balance of his interest in the Fund

transferred. |

| (b) |

Transfer elections may be made at any time, but each such election by a Participant will be effective and be thereafter irrevocable as of the New York Stock Exchange closing immediately following the Participant’s

election. The elections may be made by means of any method (including any available telephonic or electronic method) which is acceptable to the Plan Administrator; provided, however, that, if it is determined by the Plan Administrator or his

delegate that an investment election made by a Participant is invalid or defective, the Participant’s election will, until duly corrected by him, be deemed to have not been made. |

4.060 Participant’s Accounts. Separate Participant Contribution, Rollover (if applicable) and Company Contribution Accounts will be established

and maintained by the Trustee to represent all amounts, adjusted for gains or losses thereon, which have been contributed by or on behalf of a Participant as Participant Contributions, Rollover Contributions and Company Matching Contributions. Such

separate Accounts must contain sufficient information to permit a determination of the dollar balance of the Participant’s Accounts at any time and to permit, with respect to the Rockwell Automation Stock Fund, a determination of the number of

equivalent shares of common stock held on the Participant’s behalf in such Fund. Each Contribution on behalf of a Participant to an Investment Fund or the Rockwell Automation Stock Fund and each payment made to a Participant from an Investment

Fund or the Rockwell Automation Stock Fund will result in a credit or charge to the Account representing the Participant’s interest in such Fund. In addition, dividend proceeds on Rockwell Automation common stock held in the Rockwell Automation

Stock Fund will be used for the purchase, when possible, of additional shares of Rockwell Automation common stock for the Fund, therefore, will result in appropriate adjustments to the balances in the said Fund and to the value of the

Participant’s interest in the said Fund.

4.070 Valuation and Participant Statements. As of each Valuation Date, an amount equal to the fair

market value of the Funds (other than dividends received which are attributable to whole shares of Rockwell Automation common stock which were or are to be transferred to Participant Accounts subsequent to the record date for such dividend) will be