Notification That Annual Report Will Be Submitted Late (nt 10-k)

March 01 2017 - 5:18PM

Edgar (US Regulatory)

|

|

|

|

|

OMB APPROVAL

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

|

|

OMB Number: 3235-0058

Expires: October 31, 2018

Estimated average burden hours per response . . . . . . 2.50

|

|

SEC FILE NUMBER

000-53533

|

|

CUSIP NUMBER

H8817H 10 0

|

|

|

|

|

|

|

|

|

|

(Check one):

|

|

☑ Form 10-K

|

☐ Form 20-F

|

☐ Form 11-K

|

☐ Form 10-Q

|

☐ Form 10-D

|

|

|

|

☐ Form N-SAR

|

☐ Form N-CSR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Period Ended:

|

December 31, 2016

|

|

|

|

☐ Transition Report on Form 10-K

|

|

|

|

|

|

☐ Transition Report on Form 20-F

|

|

|

|

|

|

☐ Transition Report on Form 11-K

|

|

|

|

|

|

☐ Transition Report on Form 10-Q

|

|

|

|

|

|

☐ Transition Report on Form N-SAR

|

|

|

|

|

|

For the Transition Period Ended:

|

|

|

Read Instructions (on back page) Before Preparing Form. Please Print or Type.

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

|

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

|

|

|

TRANSOCEAN LTD.

|

|

Full Name of Registrant

|

|

|

|

|

|

Former Name if Applicable

|

|

|

|

10 Chem de Blandonnet

|

|

Address of Principal Executive Office

(Street and Number)

|

|

|

|

Vernier, Switzerland, V8 -1214

|

|

City, State and Zip Code

|

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b‑25(b), the following should be completed. (Check box if appropriate)

|

|

|

|

|

|

(a)

|

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense

|

|

☒

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10‑K, Form 20‑F, Form 11‑K, Form N‑SAR or Form N‑CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10‑Q or subject distribution report on Form 10‑D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

(c)

|

The accountant’s statement or other exhibit required by Rule 12b‑25(c) has been attached if applicable.

|

PART III — NARRATIVE

State below in reasonable detail why Forms 10‑K, 20‑F, 11‑K, 10‑Q, 10‑D, N‑SAR, N‑CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Transocean Ltd. (the “Company”) is unable to file, without unreasonable effort or expense, its Annual Report on Form 10-K for the year ended December 31, 2016 (the “Form 10-K”). Additional time is needed for the Company to complete the Form 10-K, including management’s evaluation of the Company’s disclosure controls and procedures and internal control over financial reporting and the resolution of certain non-cash, tax accounting matters. In addition, the Company expects to disclose a material weakness in its internal control over financial reporting in its Form 10-K related to its controls over income tax accounting. The Company intends to file the Form 10-K within the time period prescribed in Rule 12b-25 promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”).

PART IV — OTHER INFORMATION

|

|

|

|

|

|

|

|

(1)

|

Name and telephone number of person to contact in regard to this notification

|

|

|

Mark L. Mey

|

|

713

|

|

232-7500

|

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

|

|

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s).

|

|

|

|

|

|

|

|

|

|

☑ Yes ☐ No

|

|

|

|

|

|

|

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

|

|

|

|

|

|

|

|

|

|

☑ Yes ☐ No

|

|

|

|

|

|

|

|

|

|

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

|

Revenues for the year ended December 31, 2016 were $4,161 million, compared to $7,386 million for the year ended December 31, 2015. Income before income taxes for the year ended December 31, 2016 was $934 million, reflecting a decrease of approximately 8% compared to the prior year. The foregoing differences result from market conditions described in the Company’s disclosures made pursuant to the Exchange Act.

The Company has not completed its determination of income tax expense and other items dependent on such determination, as a result of the matters described in Part III above. Accordingly, adjustments may be required to the net income reported in the Company’s preliminary earnings release issued on February 23, 2017, and furnished as an exhibit to its Current Report on Form 8-K dated February 23, 2017, and to previously reported results for the years ended December 31, 2015 and 2014, which were not described in the preliminary earnings release. We expect such adjustments to be immaterial for any year presented to be in the Form 10-K.

Forward Looking Information

The statements included in this Form 12b-25 regarding future financial performance and results of operations and other statements that are not historical facts are forward looking statements within the meaning of Section 27A of the United States Securities Act of 1933 and Section 21E of the Exchange Act. Forward looking statements in this Form 12b-15 include, but are not limited to, statements about the following subjects:

|

|

·

|

|

our results of operations, including revenues and income before income taxes;

|

|

|

·

|

|

our expectations regarding the impact of any determination of income tax accounting matters, including income tax expense and the effects of any adjustments on financial statements for prior years;

|

|

|

·

|

|

the timing of our filing of the Form 10-K;

|

|

|

·

|

|

our evaluation of our disclosure controls and procedures and internal control over financial reporting; and

|

|

|

·

|

|

effects of accounting changes and adoption of accounting policies.

|

Forward looking statements in this Form 12b-25 are identifiable by use of the following words and other similar expressions:

|

§

|

“anticipates”

|

§

|

“could”

|

§

|

“forecasts”

|

§

|

“might”

|

§

|

“projects”

|

|

§

|

“believes”

|

§

|

“estimates”

|

§

|

“intends”

|

§

|

“plans”

|

§

|

“scheduled”

|

|

§

|

“budgets”

|

§

|

“expects”

|

§

|

“may”

|

§

|

“predicts”

|

§

|

“should”

|

Such statements are subject to numerous risks, uncertainties and assumptions, including, but not limited to:

|

|

·

|

|

those described under “Risk Factors” in the Company’s filings with the U.S. Securities and Exchange Commission (“SEC”);

|

|

|

·

|

|

the finalization of the Company’s financial statements, audit and reviews, including the determination of income tax expense;

|

|

|

·

|

|

management’s evaluation of the Company’s disclosure controls and procedures and internal control over financial reporting;

|

|

|

·

|

|

the adequacy of and access to sources of liquidity;

|

|

|

·

|

|

our inability to obtain drilling contracts for our rigs that do not have contracts;

|

|

|

·

|

|

our inability to renew drilling contracts at comparable dayrates;

|

|

|

·

|

|

operational performance;

|

|

|

·

|

|

the impact of regulatory changes;

|

|

|

·

|

|

the cancellation of drilling contracts currently included in our reported contract backlog;

|

|

|

·

|

|

losses on impairment of long lived assets;

|

|

|

·

|

|

shipyard, construction and other delays;

|

|

|

·

|

|

the results of meetings of our shareholders;

|

|

|

·

|

|

changes in political, social and economic conditions;

|

|

|

·

|

|

the effect and results of litigation, regulatory matters, settlements, audits, assessments and contingencies; and

|

|

|

·

|

|

other factors discussed in the Company’s other filings with the SEC, which are available free of charge on the SEC website at www.sec.gov.

|

The foregoing risks and uncertainties are beyond the Company’s ability to control, and in many cases, the Company cannot predict the risks and uncertainties that could cause our actual results to differ materially from those indicated by the forward looking statements. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated. All subsequent written and oral forward looking statements attributable to the Company or to persons acting on its behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward looking statements. Each forward looking statement speaks only as of the date of the particular statement. The Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward looking statement to reflect any change in the Company’s expectations or beliefs with regard to the statement or any change in events, conditions or circumstances on which any forward looking statement is based, except as required by law.

TRANSOCEAN LTD.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date:

|

March 1, 2017

|

|

By

|

/s/ Mark L. Mey

|

|

|

|

|

|

Mark L. Mey

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

INSTRUCTION: The form may be signed by an executive officer of the registrant or by any other duly authorized representative. The name and title of the person signing the form shall be typed or printed beneath the signature. If the statement is signed on behalf of the registrant by an authorized representative (other than an executive officer), evidence of the representative’s authority to sign on behalf of the registrant shall be filed with the form.

|

|

ATTENTION

|

|

|

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

|

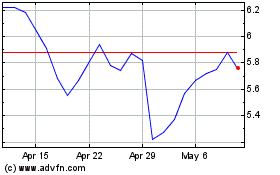

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

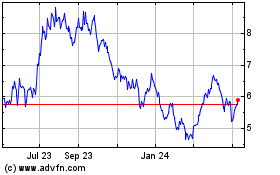

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024