UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 23, 2015 (November 20, 2015)

TRANSOCEAN LTD.

(Exact name of registrant as specified in its charter)

|

| | | | |

Switzerland | | 000-53533 | | 98-0599916 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

|

| | |

10 Chemin de Blandonnet 1214 Vernier, Geneva Switzerland | | CH-1214 |

(Address of principal executive offices) | | (zip code) |

Registrant’s telephone number, including area code: +41 (22) 930-9000

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events

On November 20, 2015, the board of directors of Transocean Ltd. (the “Company”) authorized the Company’s management to take action to delist the Company’s shares from the SIX Swiss Exchange (the “SIX”). The Company's shares will continue to be listed and traded on the New York Stock Exchange, and the Company will remain incorporated in Switzerland. The Company expects the delisting from the SIX to become effective in the first quarter of 2016.

Our press release dated November 23, 2015, concerning our intent to delist from the SIX Swiss Exchange is incorporated by reference herein.

Forward-Looking Statements

The statements in this Form 8-K that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements may contain words such as "possible," "intend," "will," "if," "expect" or other similar expressions. Forward-looking statements are based on management's current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, changes in tax estimates, impairment of goodwill, asset impairments, operating hazards and delays, risks associated with international operations, actions by customers, the SIX listing authorities and other third parties, fleet utilization, the future prices of oil and gas, capital markets and other factors, including those and other risks discussed in the company's most recent Annual Report on Form 10-K for the year ended December 31, 2014, and in the company's other filings with the SEC, which are available free of charge on the SEC's website at www.sec.gov. Should one or more of these risks or uncertainties materialize (or the other consequences of such a development worsen), or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or expressed or implied by such forward-looking statements. All subsequent written and oral forward-looking statements attributable to the company or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that occur, or which we become aware of, after the date hereof, except as otherwise may be required by law.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

|

| | | |

Exhibit No. | | Description |

| | | |

99.1 | | | Press Release Announcing Intent to Delist from the SIX Swiss Exchange

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| TRANSOCEAN LTD. |

| | |

| | |

Date: November 23, 2015 | By | /s/ Jill S. Greene |

| | Jill S. Greene |

| | Authorized Person |

Index to Exhibits

Exhibit

Number Description

99.1 Press Release Announcing Intent to Delist from the SIX Swiss Exchange

|

| | | |

| Transocean Ltd. Investor Relations and Corporate Communications |

| | | |

Analyst Contacts: | | Bradley Alexander | News Release |

| | +1 713-232-7515 |

| | | |

| | Diane Vento | |

| | +1 713-232-8015 | |

| | | |

Media Contact | | Pam Easton | |

| | +1 713-232-7647 | |

| | | |

Transocean Ltd. Announces Its Intent to Delist from SIX Swiss Exchange

ZUG, SWITZERLAND-November 23, 2015-Transocean Ltd. (NYSE: RIG) (SIX: RIGN) announced today its intent to delist its shares from the SIX Swiss Exchange (SIX). The company expects the SIX listing authorities to approve its delisting application prior to year-end and the related delisting to occur in the first quarter of 2016.

The company will remain incorporated in Switzerland and its shares will continue to be listed and traded on the New York Stock Exchange (NYSE).

Forward-Looking Statements

The statements described in this press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements contain words such as "possible," "intend," "will," "if," "expect" or other similar expressions. Forward-looking statements are based on management's current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, changes in tax estimates, impairment of goodwill, asset impairments, operating hazards and delays, risks associated with international operations, actions by customers, the SIX listing authorities and other third parties, fleet utilization, the future prices of oil and gas, capital markets and other factors, including those and other risks discussed in the company's most recent Annual Report on Form 10-K for the year ended December 31, 2014, and in the company's other filings with the SEC, which are available free of charge on the SEC's website at www.sec.gov. Should one or more of these risks or uncertainties materialize (or the other consequences of such a development worsen), or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or expressed or implied by such forward-looking statements. All subsequent written and oral forward-looking statements attributable to the company or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks

and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that occur, or which we become aware of, after the date hereof, except as otherwise may be required by law.

This press release, or referenced documents, do not constitute an offer to sell, or a solicitation of an offer to buy, any securities, and do not constitute an offering prospectus within the meaning of article 652a or article 1156 of the Swiss Code of Obligations or a listing prospectus within the meaning of the listing rules of the SIX Swiss Exchange. Investors must rely on their own evaluation of Transocean and its securities, including the merits and risks involved. Nothing contained herein is, or shall be relied on as, a promise or representation as to the future performance of Transocean.

About Transocean

Transocean is a leading international provider of offshore contract drilling services for oil and gas wells. The company specializes in technically demanding sectors of the global offshore drilling business with a particular focus on deepwater and harsh environment drilling services, and believes that it operates one of the most versatile offshore drilling fleets in the world.

Transocean owns or has partial ownership interests in, and operates a fleet of, 62 mobile offshore drilling units consisting of 27 ultra-deepwater floaters, seven harsh-environment semisubmersibles, six deepwater floaters, 12 midwater semisubmersibles, and 10 high-specification jackups. In addition, the company has seven ultra-deepwater drillships and five high-specification jackups under construction.

For more information about Transocean, please visit: www.deepwater.com.

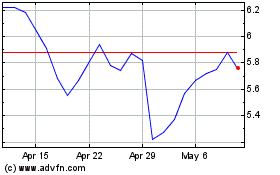

Transocean (NYSE:RIG)

Historical Stock Chart

From Aug 2024 to Sep 2024

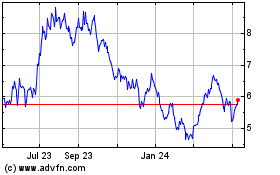

Transocean (NYSE:RIG)

Historical Stock Chart

From Sep 2023 to Sep 2024