- Revenues were $1.884 billion, compared with

$2.043 billion in the first quarter of 2015;

- Operating and maintenance expenses were $197

million, including $788 million in net favorable items associated

with Macondo-related settlement agreements and insurance

recoveries. This compares with $1.084 billion in the prior

period;

- Adjusted net income was $408 million, $1.11 per

diluted share, excluding net unfavorable items. This compares with

$398 million, $1.10 per diluted share, in the first quarter of

2015;

- Net income attributable to controlling interest

was $342 million, $0.93 per diluted share, including $66 million of

net unfavorable items. This compares with first quarter net loss of

$483 million, $1.33 per diluted share, including $881 million of

net unfavorable items;

- The Annual Effective Tax Rate(1) was

16.9 percent, down from 25.8 percent in the prior quarter;

- Cash flows from operating activities were $1.311

billion, up from $526 million in the first quarter of 2015

primarily due to $445 million of Macondo-related insurance

recoveries;

- Fleet revenue efficiency(2) was 97.3

percent, up from 95.9 percent in the first quarter of 2015;

- Fleet utilization(3) was 75

percent, compared with 79 percent in the first quarter of 2015;

and

- Subsequent to the April 16, 2015 Fleet Status

Report, the total value of new contracts secured was approximately

$178 million. Contract backlog was $18.6 billion as of the July 15,

2015 Fleet Status Report.

ZUG, SWITZERLAND-August 5, 2015-Transocean Ltd. (NYSE: RIG) (SIX:

RIGN) today reported net income attributable to controlling

interest of $342 million, $0.93 per diluted share, for the three

months ended June 30, 2015. Second quarter 2015 results included

net unfavorable items of $66 million, $0.18 per diluted share, as

follows:

- $653 million, $1.79 per diluted share, associated

with an impairment of the Midwater Floater asset group due

primarily to the deterioration of the market outlook for this rig

class;

- $144 million, $0.39 per diluted share, primarily

related to impairment of assets held for sale; and

- $11 million, $0.03 per diluted share, in costs

related to one-time termination benefits.

These net unfavorable items were partially offset

by:

- $735 million, $2.02 per diluted share, associated

with Macondo-related settlement agreements and insurance

recoveries; and

- $7 million, $0.01 per diluted share, associated

with the gain on disposal of assets and other miscellaneous

items.

After consideration of these net unfavorable items, second quarter

2015 adjusted net income was $408 million, or $1.11 per diluted

share.

For the three months ended June 30, 2014, the company reported both

net income attributable to controlling interest and adjusted net

income of $587 million, or $1.61 per diluted share.

Revenues for the three months ended June 30, 2015 decreased $159

million sequentially to $1.884 billion due primarily to lower

utilization partly offset by higher revenue efficiency.

Excluding $788 million ($735 million after taxes) in net favorable

items associated with Macondo-related insurance proceeds,

reimbursement of legal fees, crew claims and other contingent

liability adjustments, operating and maintenance expenses were $985

million. This compares with $1.084 billion in the prior quarter.

The decrease of $99 million was due primarily to reduced activity

mainly related to rig retirements, stacked and idle rigs, and the

company's ongoing cost reduction initiatives.

General and administrative expenses decreased $2 million to $44

million from the prior quarter.

Depreciation expense decreased $42 million sequentially to $249

million due to rig retirements and the impairment of the Deepwater

Floater asset group.

Transocean's second quarter 2015 Effective Tax Rate(4) was 10.3

percent, compared with (21.6) percent in the previous quarter. The

increase was due mainly to the Macondo-related settlements.

Transocean's Annual Effective Tax Rate for the second quarter of

2015 was 16.9 percent, down from 25.8 percent in the prior quarter.

The decrease was due to the overall level of adjusted pre-tax

income. Second quarter income tax expense also included a tax

benefit of $23 million, $0.06 per diluted share, to reflect the

decrease in the Annual Effective Tax Rate to 21.6 percent for the

six months ended June 30, 2015 from 25.8 percent for the three

months ended March 31, 2015.

Interest expense, net of amounts capitalized, was $120 million in

the second quarter, compared with $116 million in the previous

quarter. Interest income was $6 million, unchanged from the prior

quarter. Capitalized interest was $29 million, compared with $26

million in the first quarter of 2015.

Cash flows from operating activities increased $785 million from

the first quarter of 2015 to $1.311 billion due mainly to the

Macondo-related settlements.

Fleet-wide capital expenditures were $195 million, including costs

associated with the company's newbuild program. Capital

expenditures were $201 million in the first quarter of

2015.

"Despite the challenging market conditions, Transocean delivered

strong operating results and underlying cash flow in the period due

to exceptional revenue efficiency and a relentless emphasis on cost

management," said President and Chief Executive Officer, Jeremy

Thigpen. "Although this is a full team effort, I particularly

commend our operations teams and crews for their hard work and

dedication to maximizing uptime on our rigs. In addition, I remind

all of our stakeholders of our commitment to the continuous

improvement of our business, which includes taking the necessary

steps to ensure that we have the right rig fleet to compete

effectively in all market conditions."

Non-GAAP Financial Measures

All non-GAAP financial measure

reconciliations to the most comparative GAAP measure are displayed

in quantitative schedules on the company's website at

www.deepwater.com.

Forward-Looking Statements

The statements described in this press

release that are not historical facts are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

These statements contain words such as "possible," "intend,"

"will," "if," "expect" or other similar expressions.

Forward-looking statements are based on management's current

expectations and assumptions, and are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. As a result, actual results could differ

materially from those indicated in these forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, changes in tax

estimates, impairment of goodwill, asset impairments, operating

hazards and delays, risks associated with international operations,

actions by customers and other third parties, the future prices of

oil and gas, capital markets and other factors, including those and

other risks discussed in the company's most recent Annual Report on

Form 10-K for the year ended December 31, 2014, and in the

company's other filings with the SEC, which are available free of

charge on the SEC's website at www.sec.gov. Should one or more of

these risks or uncertainties materialize (or the other consequences

of such a development worsen), or should underlying assumptions

prove incorrect, actual results may vary materially from those

indicated or expressed or implied by such forward-looking

statements. All subsequent written and oral forward-looking

statements attributable to the company or to persons acting on our

behalf are expressly qualified in their entirety by reference to

these risks and uncertainties. You should not place undue reliance

on forward-looking statements. Each forward-looking statement

speaks only as of the date of the particular statement, and we

undertake no obligation to publicly update or revise any

forward-looking statements to reflect events or circumstances that

occur, or which we become aware of, after the date hereof, except

as otherwise may be required by law.

This press release, or referenced documents, do not constitute an

offer to sell, or a solicitation of an offer to buy, any

securities, and do not constitute an offering prospectus within the

meaning of article 652a or article 1156 of the Swiss Code of

Obligations or a listing prospectus within the meaning of the

listing rules of the SIX Swiss Exchange. Investors must rely on

their own evaluation of Transocean and its securities, including

the merits and risks involved. Nothing contained herein is, or

shall be relied on as, a promise or representation as to the future

performance of Transocean.

Conference Call Information

Transocean will conduct a teleconference

starting at 9:30 a.m. EDT, 3:30 p.m. CEST, on Thursday, August 6,

2015, to discuss the results. To participate, dial +1 913-312-9323

and refer to confirmation code 5105813 approximately 10 minutes

prior to the scheduled start time.

The teleconference will be simulcast in a listen-only mode over the

Internet and can be accessed at Transocean's website,

www.deepwater.com, by selecting "Investor Relations/Overview."

Supplemental materials that may be referenced during the

teleconference will be posted to Transocean's website and can be

found by selecting "Investor Relations/Financial

Reports."

A replay of the conference call will be available after 12:30 p.m.

EDT, 6:30 p.m. CEST, on August 6, 2015. The replay, which will be

archived for approximately 30 days, can be accessed by dialing +1

719-457-0820 and referring to the confirmation code 5105813. The

replay will also be available on the company's website.

About Transocean

Transocean is a leading international

provider of offshore contract drilling services for oil and gas

wells. The company specializes in technically demanding sectors of

the global offshore drilling business with a particular focus on

deepwater and harsh environment drilling services, and believes

that it operates one of the most versatile offshore drilling fleets

in the world.

Transocean owns or has partial ownership interests in, and operates

a fleet of 63 mobile offshore drilling units consisting of 27

ultra-deepwater floaters, seven harsh-environment semisubmersibles,

six deepwater floaters, 13 midwater semisubmersibles and 10

high-specification jackups. In addition, the company has seven

ultra-deepwater drillships and five high-specification jackups

under construction.

For more information about Transocean, please visit:

www.deepwater.com.

Analyst Contacts:

Thad

Vayda

+1 713-232-7551

Diane Vento

+1 713-232-8015

Media Contact:

Pam Easton

+1 713-232-7647

Notes

(1) Annual Effective Tax Rate is defined as

income tax expense from continuing operations excluding various

discrete items (such as changes in estimates and tax on items

excluded from income before income tax expense), divided by income

from continuing operations before income tax expense excluding

gains on sales and similar items pursuant to the accounting

standards for income taxes. See the accompanying schedule entitled

"Supplemental Effective Tax Rate Analysis."

(2) Revenue efficiency is defined as actual contract drilling

revenues for the measurement period divided by the maximum revenue

calculated for the measurement period, expressed as a

percentage. Maximum revenue is defined as the greatest amount

of contract drilling revenues the drilling unit could earn for the

measurement period, excluding amounts related to incentive

provisions. See the accompanying schedule entitled "Revenue

Efficiency."

(3) Rig utilization is defined as the total number of operating

days divided by the total number of rig calendar days in the

measurement period, expressed as a percentage. See the accompanying

schedule entitled "Utilization."

(4) Effective Tax Rate is defined as income tax expense for

continuing operations divided by income from continuing operations

before income taxes. See the accompanying schedule entitled

"Supplemental Effective Tax Rate Analysis."

TRANSOCEAN LTD.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In millions, except per share data)

(Unaudited)

| |

|

Three months ended

June 30, |

|

|

|

Six months ended

June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contract drilling revenues |

|

$ |

1,777 |

|

|

$ |

2,278 |

|

|

|

$ |

3,777 |

|

|

$ |

4,570 |

|

| Other revenues |

|

|

107 |

|

|

|

50 |

|

|

|

|

150 |

|

|

|

97 |

|

| |

|

|

1,884 |

|

|

|

2,328 |

|

|

|

|

3,927 |

|

|

|

4,667 |

|

| Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating and maintenance |

|

|

197 |

|

|

|

1,213 |

|

|

|

|

1,281 |

|

|

|

2,482 |

|

| Depreciation |

|

|

249 |

|

|

|

288 |

|

|

|

|

540 |

|

|

|

561 |

|

| General and administrative |

|

|

44 |

|

|

|

63 |

|

|

|

|

90 |

|

|

|

120 |

|

| |

|

|

490 |

|

|

|

1,564 |

|

|

|

|

1,911 |

|

|

|

3,163 |

|

| Loss on impairment |

|

|

(890 |

) |

|

|

- |

|

|

|

|

(1,826 |

) |

|

|

(65 |

) |

| Gain (loss) on disposal of assets, net |

|

|

2 |

|

|

|

1 |

|

|

|

|

(5 |

) |

|

|

(2 |

) |

| Operating income |

|

|

506 |

|

|

|

765 |

|

|

|

|

185 |

|

|

|

1,437 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense),

net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

6 |

|

|

|

15 |

|

|

|

|

12 |

|

|

|

25 |

|

| Interest expense, net of amounts capitalized |

|

|

(120 |

) |

|

|

(112 |

) |

|

|

|

(236 |

) |

|

|

(238 |

) |

| Other, net |

|

|

(5 |

) |

|

|

8 |

|

|

|

|

42 |

|

|

|

6 |

|

| |

|

|

(119 |

) |

|

|

(89 |

) |

|

|

|

(182 |

) |

|

|

(207 |

) |

| Income

(loss) from continuing operations before income tax expense |

|

|

387 |

|

|

|

676 |

|

|

|

|

3 |

|

|

|

1,230 |

|

| Income tax expense |

|

|

40 |

|

|

|

72 |

|

|

|

|

123 |

|

|

|

152 |

|

| Income (loss) from continuing

operations |

|

|

347 |

|

|

|

604 |

|

|

|

|

(120 |

) |

|

|

1,078 |

|

| Income (loss) from discontinued operations, net of

tax |

|

|

1 |

|

|

|

(7 |

) |

|

|

|

(1 |

) |

|

|

(15 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

348 |

|

|

|

597 |

|

|

|

|

(121 |

) |

|

|

1,063 |

|

| Net income attributable to noncontrolling interest |

|

|

6 |

|

|

|

10 |

|

|

|

|

20 |

|

|

|

20 |

|

| Net income (loss) attributable to

controlling interest |

|

$ |

342 |

|

|

$ |

587 |

|

|

|

$ |

(141 |

) |

|

$ |

1,043 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per

share-basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) from continuing operations |

|

$ |

0.93 |

|

|

$ |

1.63 |

|

|

|

$ |

(0.39 |

) |

|

$ |

2.90 |

|

| Loss from discontinued operations |

|

|

- |

|

|

|

(0.02 |

) |

|

|

|

- |

|

|

|

(0.04 |

) |

| Earnings (loss) per share |

|

$ |

0.93 |

|

|

$ |

1.61 |

|

|

|

$ |

(0.39 |

) |

|

$ |

2.86 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per

share-diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) from continuing operations |

|

$ |

0.93 |

|

|

$ |

1.63 |

|

|

|

$ |

(0.39 |

) |

|

$ |

2.90 |

|

| Loss from discontinued operations |

|

|

- |

|

|

|

(0.02 |

) |

|

|

|

- |

|

|

|

(0.04 |

) |

| Earnings (loss) per share |

|

$ |

0.93 |

|

|

$ |

1.61 |

|

|

|

$ |

(0.39 |

) |

|

$ |

2.86 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

363 |

|

|

|

362 |

|

|

|

|

363 |

|

|

|

362 |

|

| Diluted |

|

|

363 |

|

|

|

362 |

|

|

|

|

363 |

|

|

|

362 |

|

TRANSOCEAN LTD.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In millions, except per share data)

(Unaudited)

| |

|

June 30,

2015 |

|

December 31,

2014 |

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

3,769 |

|

|

$ |

2,635 |

|

Accounts receivable, net of allowance for doubtful

accounts

of $14 at June 30, 2015 and December 31 |

|

|

1,806 |

|

|

|

2,120 |

|

Materials and supplies, net of allowance for obsolescence

of $107 and $109 at June 30, 2015 and December 31, 2014,

respectively |

|

|

741 |

|

|

|

818 |

|

| Assets held for sale |

|

|

9 |

|

|

|

25 |

|

| Deferred income taxes, net |

|

|

180 |

|

|

|

161 |

|

| Other current assets |

|

|

214 |

|

|

|

242 |

|

| Total current assets |

|

|

6,719 |

|

|

|

6,001 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment |

|

|

24,708 |

|

|

|

28,516 |

|

| Less accumulated depreciation |

|

|

(5,051 |

) |

|

|

(6,978 |

) |

| Property and equipment, net |

|

|

19,657 |

|

|

|

21,538 |

|

| Other assets |

|

|

597 |

|

|

|

874 |

|

| Total assets |

|

$ |

26,973 |

|

|

$ |

28,413 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and equity |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

585 |

|

|

$ |

784 |

|

| Accrued income taxes |

|

|

76 |

|

|

|

131 |

|

| Debt due within one year |

|

|

1,026 |

|

|

|

1,033 |

|

| Other current liabilities |

|

|

1,215 |

|

|

|

1,822 |

|

| Total current liabilities |

|

|

2,902 |

|

|

|

3,770 |

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt |

|

|

8,989 |

|

|

|

9,059 |

|

| Deferred income taxes, net |

|

|

188 |

|

|

|

237 |

|

| Other long-term liabilities |

|

|

1,236 |

|

|

|

1,354 |

|

| Total long-term liabilities |

|

|

10,413 |

|

|

|

10,650 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interest |

|

|

10 |

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

Shares, CHF 15.00 par value, 396,260,487 authorized, 167,617,649

conditionally authorized, 373,830,649 issued at June 30, 2015

and December 31, 2014 and 363,548,290 and 362,279,530

outstanding at June 30, 2015 and December 31, 2014,

respectively |

|

|

5,186 |

|

|

|

5,169 |

|

| Additional paid-in capital |

|

|

5,596 |

|

|

|

5,797 |

|

| Treasury shares, at cost, 2,863,267 held at

June 30, 2015 and December 31, 2014 |

|

|

(240 |

) |

|

|

(240 |

) |

| Retained earnings |

|

|

3,208 |

|

|

|

3,349 |

|

| Accumulated other comprehensive loss |

|

|

(410 |

) |

|

|

(404 |

) |

| Total controlling interest shareholders' equity |

|

|

13,340 |

|

|

|

13,671 |

|

| Noncontrolling interest |

|

|

308 |

|

|

|

311 |

|

| Total equity |

|

|

13,648 |

|

|

|

13,982 |

|

| Total liabilities and equity |

|

$ |

26,973 |

|

|

$ |

28,413 |

|

TRANSOCEAN LTD.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In millions)

(Unaudited)

| |

|

Three months ended

June 30, |

|

|

|

Six months ended

June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income (loss) |

|

$ |

348 |

|

|

$ |

597 |

|

|

|

$ |

(121 |

) |

|

$ |

1,063 |

|

|

Adjustments to reconcile to net cash provided by operating

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of drilling contract intangibles |

|

|

(3 |

) |

|

|

(4 |

) |

|

|

|

(7 |

) |

|

|

(8 |

) |

|

Depreciation |

|

|

249 |

|

|

|

288 |

|

|

|

|

540 |

|

|

|

561 |

|

|

Share-based compensation expense |

|

|

14 |

|

|

|

23 |

|

|

|

|

33 |

|

|

|

51 |

|

| Loss

on impairment |

|

|

890 |

|

|

|

- |

|

|

|

|

1,826 |

|

|

|

65 |

|

| (Gain)

loss on disposal of assets, net |

|

|

(2 |

) |

|

|

(1 |

) |

|

|

|

5 |

|

|

|

2 |

|

| Loss

on disposal of assets in discontinued operations, net |

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

10 |

|

|

Deferred income taxes |

|

|

8 |

|

|

|

(25 |

) |

|

|

|

(90 |

) |

|

|

(40 |

) |

| Other,

net |

|

|

16 |

|

|

|

5 |

|

|

|

|

28 |

|

|

|

17 |

|

|

Changes in deferred revenues, net |

|

|

(68 |

) |

|

|

96 |

|

|

|

|

(107 |

) |

|

|

70 |

|

|

Changes in deferred costs, net |

|

|

59 |

|

|

|

(18 |

) |

|

|

|

116 |

|

|

|

20 |

|

| Changes in operating assets and liabilities |

|

|

(200 |

) |

|

|

(325 |

) |

|

|

|

(386 |

) |

|

|

(1,039 |

) |

| Net cash provided by operating activities |

|

|

1,311 |

|

|

|

636 |

|

|

|

|

1,837 |

|

|

|

772 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(195 |

) |

|

|

(351 |

) |

|

|

|

(396 |

) |

|

|

(1,482 |

) |

|

Proceeds from disposal of assets, net |

|

|

23 |

|

|

|

10 |

|

|

|

|

30 |

|

|

|

101 |

|

|

Proceeds from disposal of assets in discontinued operations,

net |

|

|

1 |

|

|

|

22 |

|

|

|

|

3 |

|

|

|

36 |

|

|

Proceeds from repayment of loans and notes receivable |

|

|

15 |

|

|

|

98 |

|

|

|

|

15 |

|

|

|

101 |

|

| Other, net |

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

(15 |

) |

| Net cash used in investing activities |

|

|

(156 |

) |

|

|

(221 |

) |

|

|

|

(348 |

) |

|

|

(1,259 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repayments of debt |

|

|

(6 |

) |

|

|

(6 |

) |

|

|

|

(69 |

) |

|

|

(243 |

) |

|

Proceeds from restricted cash investments |

|

|

- |

|

|

|

- |

|

|

|

|

57 |

|

|

|

107 |

|

|

Deposits to restricted cash investments |

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

(20 |

) |

|

Distributions of qualifying additional paid-in capital |

|

|

(55 |

) |

|

|

(272 |

) |

|

|

|

(327 |

) |

|

|

(474 |

) |

|

Distributions to holders of noncontrolling interest |

|

|

(7 |

) |

|

|

- |

|

|

|

|

(14 |

) |

|

|

- |

|

| Other, net |

|

|

- |

|

|

|

(7 |

) |

|

|

|

(2 |

) |

|

|

(9 |

) |

| Net cash used in financing activities |

|

|

(68 |

) |

|

|

(285 |

) |

|

|

|

(355 |

) |

|

|

(639 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

increase (decrease) in cash and cash equivalents |

|

|

1,087 |

|

|

|

130 |

|

|

|

|

1,134 |

|

|

|

(1,126 |

) |

| Cash and cash equivalents at beginning of period |

|

|

2,682 |

|

|

|

1,987 |

|

|

|

|

2,635 |

|

|

|

3,243 |

|

| Cash and cash equivalents at end of period |

|

$ |

3,769 |

|

|

$ |

2,117 |

|

|

|

$ |

3,769 |

|

|

$ |

2,117 |

|

TRANSOCEAN LTD.

AND SUBSIDIARIES

FLEET OPERATING STATISTICS

|

|

Operating Revenues (in millions) |

|

|

Three months ended |

|

|

Six months ended

June 30, |

|

|

June 30,

2015 |

|

|

March 31,

2015 |

|

|

June 30,

2014 |

|

|

2015 |

|

|

2014 |

|

Contract drilling revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ultra-Deepwater Floaters |

$ |

853 |

|

|

$ |

932 |

|

|

$ |

1,167 |

|

|

$ |

1,785 |

|

|

$ |

2,363 |

|

Harsh Environment Floaters |

|

241 |

|

|

|

261 |

|

|

|

254 |

|

|

|

502 |

|

|

|

540 |

|

Deepwater Floaters |

|

162 |

|

|

|

219 |

|

|

|

252 |

|

|

|

381 |

|

|

|

511 |

|

Midwater Floaters |

|

381 |

|

|

|

429 |

|

|

|

441 |

|

|

|

810 |

|

|

|

853 |

|

High-Specification Jackups |

|

136 |

|

|

|

155 |

|

|

|

160 |

|

|

|

291 |

|

|

|

295 |

|

Contract intangible revenue |

|

4 |

|

|

|

4 |

|

|

|

4 |

|

|

|

8 |

|

|

|

8 |

| Total

contract drilling revenues |

|

1,777 |

|

|

|

2,000 |

|

|

|

2,278 |

|

|

|

3,777 |

|

|

|

4,570 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Client reimbursable revenues |

|

34 |

|

|

|

42 |

|

|

|

43 |

|

|

|

76 |

|

|

|

87 |

|

Integrated services and other |

|

73 |

|

|

|

1 |

|

|

|

7 |

|

|

|

74 |

|

|

|

10 |

| Total

other revenues |

|

107 |

|

|

|

43 |

|

|

|

50 |

|

|

|

150 |

|

|

|

97 |

| Total

revenues |

|

1,884 |

|

|

|

2,043 |

|

|

|

2,328 |

|

|

|

3,927 |

|

|

|

4,667 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Daily Revenue (1) |

|

|

Three months ended |

|

|

Six months ended

June 30, |

|

|

June 30,

2015 |

|

|

March 31, 2015 |

|

|

June 30,

2014 |

|

|

2015 |

|

|

2014 |

|

Ultra-Deepwater Floaters |

$ |

531,400 |

|

|

$ |

534,300 |

|

|

$ |

538,700 |

|

|

$ |

532,900 |

|

|

$ |

542,900 |

|

Harsh Environment Floaters |

|

513,300 |

|

|

|

531,300 |

|

|

|

452,000 |

|

|

|

522,600 |

|

|

|

453,400 |

|

Deepwater Floaters |

|

364,000 |

|

|

|

342,100 |

|

|

|

371,100 |

|

|

|

351,100 |

|

|

|

381,400 |

|

Midwater Floaters |

|

338,800 |

|

|

|

343,300 |

|

|

|

363,100 |

|

|

|

341,200 |

|

|

|

348,700 |

|

High-Specification Jackups |

|

172,100 |

|

|

|

174,400 |

|

|

|

173,400 |

|

|

|

173,300 |

|

|

|

168,000 |

|

Total |

$ |

399,700 |

|

|

|

398,100 |

|

|

$ |

410,000 |

|

|

$ |

398,800 |

|

|

$ |

411,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

Average daily revenue is defined as contract

drilling revenues earned per operating day. An operating day

is defined as a calendar day during which a rig is contracted to

earn a dayrate during the firm contract period after commencement

of operations.

|

TRANSOCEAN LTD.

AND SUBSIDIARIES

FLEET OPERATING STATISTICS (continued)

|

|

Utilization (2) |

|

|

Three months ended |

|

|

Six months ended

June 30, |

|

|

June 30,

2015 |

|

|

March 31,

2015 |

|

|

June 30,

2014 |

|

|

2015 |

|

|

2014 |

|

Ultra-Deepwater Floaters |

65% |

|

|

68% |

|

|

88% |

|

|

66% |

|

|

89% |

|

Harsh Environment Floaters |

74% |

|

|

78% |

|

|

88% |

|

|

76% |

|

|

94% |

|

Deepwater Floaters |

71% |

|

|

85% |

|

|

62% |

|

|

79% |

|

|

62% |

|

Midwater Floaters |

89% |

|

|

85% |

|

|

64% |

|

|

87% |

|

|

63% |

|

High-Specification Jackups |

87% |

|

|

99% |

|

|

95% |

|

|

93% |

|

|

89% |

| Total

Drilling Fleet |

75% |

|

|

79% |

|

|

78% |

|

|

77% |

|

|

78% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. Rig utilization is defined as the total number of

operating days divided by the total number of available rig

calendar days in the measurement period, expressed as a

percentage. |

| Revenue

Efficiency(3) |

|

| Trailing Five

Quarters and Historical Data |

|

|

|

|

|

|

|

|

|

|

|

|

2Q 2015 |

1Q 2015 |

4Q 2014 |

3Q 2014 |

2Q 2014 |

FY 2014 |

FY 2013 |

|

Ultra-Deepwater Floaters |

97.2% |

97.2% |

95.4% |

91.6% |

94.0% |

94.3% |

89.4% |

| Harsh

Environment Floaters |

98.5% |

96.8% |

96.0% |

94.7% |

95.7% |

95.7% |

96.9% |

|

Deepwater Floaters |

100.3% |

95.9% |

96.3% |

93.3% |

94.5% |

96.2% |

91.0% |

|

Midwater Floaters |

95.3% |

91.4% |

93.0% |

92.2% |

97.0% |

93.3% |

93.5% |

|

High-Specification Jackups |

98.6% |

99.3% |

99.0% |

97.0% |

97.3% |

97.0% |

97.8% |

|

Total |

97.3% |

95.9% |

95.3% |

92.6% |

95.0% |

94.7% |

91.7% |

|

|

|

|

|

|

|

|

|

| 3. Revenue efficiency is defined as actual contract drilling

revenues for the measurement period divided by the maximum revenue

calculation for the measurement period, expressed as a

percentage. Maximum revenue is defined as the greatest amount

of contract drilling revenues the drilling unit could earn for the

measurement period, excluding amounts related to incentive

provisions. |

|

TRANSOCEAN LTD.

AND SUBSIDIARIES

| Supplemental

Effective Tax Rate Analysis |

|

| (In US$ millions) |

|

| |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

Three months

ended |

|

|

Six months

ended |

|

| |

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

| |

2015 |

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Income from continuing operations before income

taxes |

$ |

387 |

|

|

$ |

(384 |

) |

|

$ |

676 |

|

|

$ |

3 |

|

|

$ |

1,230 |

|

| Add back (subtract): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Litigation matters |

|

(788) |

|

|

|

- |

|

|

|

- |

|

|

|

(788) |

|

|

|

3 |

|

| One-time termination benefits |

|

12 |

|

|

|

5 |

|

|

|

4 |

|

|

|

17 |

|

|

|

5 |

|

| Loss on impairment of goodwill and other

assets |

|

890 |

|

|

|

936 |

|

|

|

- |

|

|

|

1,826 |

|

|

|

65 |

|

| Gain on disposal of other assets, net |

|

(3) |

|

|

|

(2 |

) |

|

|

(1 |

) |

|

|

(5) |

|

|

|

(1 |

) |

| Loss on retirement of debt |

|

- |

|

|

|

- |

|

|

|

4 |

|

|

|

- |

|

|

|

5 |

|

| Adjusted income from continuing operations before

income taxes |

|

498 |

|

|

|

555 |

|

|

|

683 |

|

|

|

1,053 |

|

|

|

1,307 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense from continuing operations |

|

40 |

|

|

|

83 |

|

|

|

72 |

|

|

|

123 |

|

|

|

152 |

|

| Add back (subtract): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Litigation matters |

|

(53) |

|

|

|

- |

|

|

|

- |

|

|

|

(53) |

|

|

|

1 |

|

| One-time termination benefits |

|

1 |

|

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

| Loss on impairment of goodwill and other

assets |

|

93 |

|

|

|

62 |

|

|

|

- |

|

|

|

155 |

|

|

|

- |

|

| Gain on disposal of other assets, net |

|

2 |

|

|

|

(1 |

) |

|

|

- |

|

|

|

1 |

|

|

|

- |

|

| Changes in estimates (1) |

|

1 |

|

|

|

(1 |

) |

|

|

14 |

|

|

|

- |

|

|

|

27 |

|

| Adjusted income tax expense from

continuing operations (2) |

$ |

84 |

|

|

$ |

143 |

|

|

$ |

86 |

|

|

$ |

227 |

|

|

$ |

180 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effective Tax Rate (3) |

|

10.3 |

% |

|

|

(21.6) |

% |

|

|

10.7 |

% |

|

|

4100 |

% |

|

|

12.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Annual Effective Tax Rate

(4) |

|

16.9 |

% |

|

|

25.8 |

% |

|

|

12.6 |

% |

|

|

21.6 |

% |

|

|

13.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. Our estimates change as we file tax returns, settle

disputes with tax authorities or become aware of other events and

include changes in (a) deferred taxes, (b) valuation of allowances

on deferred taxes and (c) other tax liabilities. |

| 2. The three months and six months ended June 30, 2015

includes $(23) million of additional tax expense (benefit)

reflecting the catch-up effect of an increase (decrease) in the

annual effective tax rate from the previous quarter estimate. |

| 3. Effective Tax Rate is income tax expense for continuing

operations, divided by income from continuing operations before

income taxes. |

| 4. Annual Effective Tax Rate is income tax expense for

continuing operations, excluding various discrete items (such as

changes in estimates and tax on items excluded from income before

income taxes) divided by income from continuing operations before

income tax expense excluding gains and losses on sales and similar

items pursuant to the accounting standards for income taxes and

estimating the annual effective tax rate. |

TRANSOCEAN LTD.

AND SUBSIDIARIES

Non-GAAP Financial Measures and

Reconciliations

Adjusted Net Income and Adjusted Diluted Earnings

Per Share

(in US$ millions, except per share data)

|

|

YTD |

QTD |

QTD |

|

|

06/30/15 |

06/30/15 |

03/31/15 |

|

Adjusted Net Income |

|

|

|

| Net

income (loss) attributable to controlling interest, as

reported |

$(141) |

$342 |

$(483) |

| Add

back (subtract): |

|

|

|

|

Litigation matters |

(735) |

(735) |

- |

|

One-time termination benefits |

16 |

11 |

5 |

| Loss

on impairment of assets |

1,671 |

797 |

874 |

| Gain

on disposal of assets, net |

(6) |

(5) |

(1) |

| Loss

(income) from discontinued operations |

1 |

(1) |

2 |

|

Discrete tax items and other, net |

- |

(1) |

1 |

| Net

income, as adjusted |

$806 |

$408 |

$398 |

|

|

|

|

|

|

Adjusted Diluted Earnings Per Share: |

|

|

|

|

Diluted earnings (loss) per share, as reported |

$(0.39) |

$0.93 |

$(1.33) |

| Add

back (subtract): |

|

|

|

|

Litigation matters |

(2.02) |

(2.02) |

- |

|

One-time termination benefits |

0.04 |

0.03 |

0.01 |

| Loss

on impairment of assets |

4.60 |

2.18 |

2.41 |

| Gain

on disposal of assets, net |

(0.02) |

(0.01) |

- |

| Loss

(income) from discontinued operations |

- |

- |

0.01 |

|

Discrete tax items and other, net |

- |

- |

- |

|

Diluted earnings per share, as adjusted |

$2.21 |

$1.11 |

$1.10 |

|

|

YTD |

QTD |

YTD |

QTD |

YTD |

QTD |

QTD |

|

|

12/31/14 |

12/31/14 |

09/30/14 |

09/30/14 |

06/30/14 |

06/30/14 |

03/31/14 |

|

Adjusted Net Income |

|

|

|

|

|

|

|

| Net

income (loss) attributable to controlling interest, as

reported |

$(1,913) |

$(739) |

$(1,174) |

$(2,217) |

$1,043 |

$587 |

$456 |

| Add

back (subtract): |

|

|

|

|

|

|

|

|

Litigation matters |

(12) |

- |

(12) |

(14) |

2 |

- |

2 |

|

One-time termination benefits |

9 |

1 |

8 |

3 |

5 |

4 |

1 |

| Loss

on impairment of goodwill and other assets |

3,826 |

1,140 |

2,686 |

2,621 |

65 |

- |

65 |

| (Gain)

loss on disposal of assets, net |

(2) |

(4) |

2 |

3 |

(1) |

(1) |

- |

| Loss

on retirement of debt |

13 |

8 |

5 |

- |

5 |

4 |

1 |

| Loss

on disposal of assets in discontinued operations |

10 |

- |

10 |

- |

10 |

- |

10 |

| Loss

(income) from discontinued operations |

10 |

4 |

6 |

1 |

5 |

7 |

(2) |

|

Discrete tax items and other, net |

(138) |

(66) |

(72) |

(45) |

(27) |

(14) |

(13) |

| Net

income, as adjusted |

$1,803 |

$344 |

$1,459 |

$352 |

$1,107 |

$587 |

$520 |

|

|

|

|

|

|

|

|

|

|

Adjusted Diluted Earnings Per Share: |

|

|

|

|

|

|

|

|

Diluted earnings (loss) per share, as reported |

$(5.29) |

$(2.04) |

$(3.24) |

$(6.12) |

$2.86 |

$1.61 |

$1.25 |

| Add

back (subtract): |

|

|

|

|

|

|

|

|

Litigation matters |

(0.03) |

- |

(0.03) |

(0.04) |

0.01 |

- |

0.01 |

|

One-time termination benefits |

0.02 |

- |

0.02 |

0.01 |

0.01 |

0.01 |

- |

| Loss

on impairment of goodwill and other assets |

10.53 |

3.15 |

7.39 |

7.22 |

0.19 |

- |

0.19 |

| (Gain)

loss on disposal of assets, net |

(0.01) |

(0.01) |

0.01 |

0.01 |

- |

- |

- |

| Loss

on retirement of debt |

0.04 |

0.02 |

0.01 |

- |

0.01 |

0.01 |

- |

| Loss

on disposal of assets in discontinued operations |

0.03 |

- |

0.03 |

- |

0.03 |

- |

0.03 |

| Loss

(income) from discontinued operations |

0.03 |

0.01 |

0.02 |

- |

0.01 |

0.02 |

(0.01) |

|

Discrete tax items and other, net |

(0.38) |

(0.18) |

(0.21) |

(0.12) |

(0.08) |

(0.04) |

(0.04) |

|

Diluted earnings per share, as adjusted |

$4.94 |

$0.95 |

$4.00 |

$0.96 |

$3.04 |

$1.61 |

$1.43 |

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Transocean Ltd via Globenewswire

HUG#1943971

Transocean (NYSE:RIG)

Historical Stock Chart

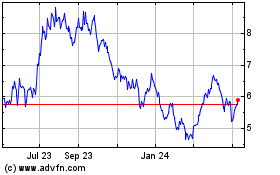

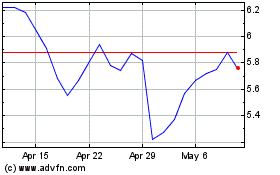

From Mar 2024 to Apr 2024

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024