UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 29, 2015

REINSURANCE GROUP OF AMERICA, INCORPORATED

(Exact Name of Registrant as Specified in its Charter)

|

| | | | |

Missouri | | 1-11848 | | 43-1627032 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

16600 Swingley Ridge Road, Chesterfield, Missouri 63017

(Address of Principal Executive Office)

Registrant’s telephone number, including area code: (636) 736-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

r | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

r | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

r | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

r | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

On October 29, 2015, Reinsurance Group of America, Incorporated issued (1) a press release (the “Press Release”) announcing its earnings for the three-month period ended September 30, 2015, and providing certain additional information, a copy of which is furnished with this report as Exhibit 99.1, and (2) a quarterly financial supplement (the "Quarterly Financial Supplement") for the quarter ended September 30, 2015, a copy of which is attached hereto as Exhibit 99.2. The Press Release also notes that a conference call will be held on October 30, 2015 to discuss the financial and operating results for the three-month period ended September 30, 2015. The information set forth in this Current Report on Form 8-K, including the Press Release and Quarterly Financial Supplement, is being furnished and shall not be deemed to be "filed", as described in Instruction B.2 of Form 8-K.

|

| |

Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

|

| | |

| | |

Exhibit No. | | Exhibit |

99.1 | | Press Release of Reinsurance Group of America, Incorporated dated October 29, 2015 |

| |

99.2 | | Quarterly Financial Supplement for the quarter ended September 30, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | REINSURANCE GROUP OF AMERICA, INCORPORATED |

| | | |

Date: October 29, 2015 | | | By: | | /s/ Jack B. Lay |

| | | | | Jack B. Lay |

| | | | | Senior Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

| |

99.1 | | Press Release dated October 29, 2015 |

| |

99.2 | | Quarterly Financial Supplement for the quarter ended September 30, 2015 |

PRESS RELEASE

REINSURANCE GROUP OF AMERICA REPORTS THIRD-QUARTER RESULTS

| |

• | Earnings per diluted share: operating income* $1.90, net income $1.25 |

| |

• | Operating ROE* 11 percent, trailing 12 months |

| |

• | Expiration of Active Financing Exception (AFE) and strengthening U.S. dollar each reduced operating EPS* by $0.15 |

| |

• | Continuing strong results in Global Financial Solutions (GFS) and overall favorable claims experience in Canada and international operations |

| |

• | U.S. Traditional hampered by unusually high claims in older issue-age policies |

| |

• | Reported net premiums decreased 4 percent; up 8 percent net of foreign currency and the effect of fourth-quarter 2014 retrocession transaction |

| |

• | Repurchased approximately 782,000 shares for $71 million during the quarter |

ST. LOUIS, October 29, 2015 - Reinsurance Group of America, Incorporated (NYSE: RGA), a leading global provider of life reinsurance, reported operating income* of $127.1 million, or $1.90 per diluted share, compared with $159.8 million, or $2.31 per diluted share, in the prior-year quarter. Net income totaled $83.5 million, or $1.25 per diluted share, compared with $158.0 million, or $2.28 per diluted share, the year before. In addition to the effects on operating income noted above, the significant decrease in current-period net income reflected net investment related losses, including the change in fair value of certain stand-alone and embedded derivatives.

|

| | | | | | | | | | | | | | | | |

| | Quarterly Results | | Year-to-Date Results |

($ in thousands, except per share data) | | 2015 | | 2014 | | 2015 | | 2014 |

Net premiums | | $ | 2,089,345 |

| | $ | 2,168,285 |

| | $ | 6,242,240 |

| | $ | 6,452,082 |

|

Net income | | 83,534 |

| | 157,996 |

| | 339,039 |

| | 492,956 |

|

Net income per diluted share | | 1.25 |

| | 2.28 |

| | 5.01 |

| | 7.03 |

|

Operating income* | | 127,086 |

| | 159,823 |

| | 379,134 |

| | 429,761 |

|

Operating income per diluted share* | | 1.90 |

| | 2.31 |

| | 5.60 |

| | 6.13 |

|

Book value per share | | 94.92 |

| | 97.28 |

| | | | |

Book value per share (excl. Accumulated Other Comprehensive Income “AOCI”)* | | 81.14 |

| | 75.44 |

| | | | |

Total assets | | 47,606,120 |

| | 42,910,363 |

| | | | |

* See "Use of Non-Gaap Financial Measures" below |

Consolidated net premiums decreased 4 percent and totaled $2.1 billion this quarter, reflecting adverse foreign currency effects of approximately $147 million and a $114 million reduction associated with the previously announced fourth-quarter 2014 U.S. retrocession agreement. Excluding those effects, premiums increased 8 percent over the prior-year quarter. Investment income decreased 13 percent from $447.1 million to $389.6 million this period, primarily attributable to a $76.4 million decrease in the fair value of options contracts that are included in funds withheld at interest on the consolidated balance sheet and support the crediting rates for equity-indexed annuities. Excluding spread-based businesses and the value of associated derivatives, investment income was even with year-ago levels.

- more -

Add One

The average investment yield was 4.66 percent, 14 basis points below the third quarter of 2014, and 22 basis points lower than the second-quarter yield, with both of those comparable yields benefiting from investment prepayments.

For the first nine months of 2015, net adverse foreign currency fluctuations lowered operating income by approximately $0.35 per diluted share and the non-extension of the Active Financing Exception (AFE) further reduced operating income per share by $0.35. Aside from those items, underlying operating results were modestly favorable compared with the prior-year period.

The effective tax rate on operating income was 38.6 percent this quarter, well above the ongoing expected range of 33 percent to 34 percent, and the comparable prior-year rate of 31.9 percent. Although an extension is expected in the fourth quarter of 2015, Congress has not yet extended the AFE legislation, and as a result, the company increased its tax provision by $10.1 million in the third quarter, an adverse effect of $0.15 per diluted share. Excluding this increase, the effective tax rate was 33.8 percent in the third quarter. Through the first nine months of 2015, the AFE-related increase to the tax provision totaled $23.7 million, or $0.35 per share, which would be reversed upon extension of the AFE.

Greig Woodring, president and chief executive officer, commented, “Similar to the second quarter, the results were negatively affected by a higher effective tax rate and foreign currency weakness that together provided a considerable headwind to our quarterly and year-to-date results, although we still expect a reversal of AFE-related tax provisions in this year’s fourth quarter. Beyond these headwinds, year-to-date operating EPS were modestly improved over 2014 levels, as continued strong results in our GFS and international operations, ongoing in-force transactions, and effective capital management partially mitigated unusually high claims in our U.S. individual mortality business.

“In the third quarter, GFS results were strong across all geographies, Canada performed well due to favorable mortality experience, and further, our EMEA and Asian operations produced solid results but faced tough comparisons with unusually strong year-ago results. The U.S. individual mortality business had another challenging quarter, driven primarily by large claims (those over $1 million) from older issue-age policies. This continues a trend of higher volatility in this business more recently and adverse experience on the older issue-age block over time.

“Our ongoing analysis suggests a continuing negative effect from the older issue-age block and some degree of diminished future returns. However, we view this situation as manageable given that block’s relative size and declining influence, and we expect some rebound from this year’s unusually volatile results. Furthermore, we are encouraged by the ongoing strength from other parts of our business, a growing influence from in-force transactions, and effective capital management actions. We remain optimistic about our business overall given its strong global position and ample opportunities to put our client-centric solutions to work.

“In the third quarter, we continued to implement our capital management strategy, reflecting a continuation of our share repurchase activity and the announcement of a meaningful in-force block transaction. Thus, we have had the opportunity to deploy a considerable amount of excess capital throughout the year, continuing the trend from 2014. At the end of the quarter, we had capacity under our current share repurchase authorization of approximately $126 million, and our deployable, excess capital position is approximately $700 million. Ending book value per share this quarter was $94.92 including

- more -

Add Two

AOCI, and $81.14 excluding AOCI, a 9 percent increase over that of a year ago on a total returns basis.”

SEGMENT RESULTS

U.S. and Latin America

Traditional

The U.S. and Latin America Traditional segment reported pre-tax operating income of $54.7 million, a 31 percent decrease from last year’s third-quarter total of $78.9 million. Both periods reflected high claims flow, with the current-period mortality experience being unusually poor and driven by large policies issued to those over 70 years of age. Traditional net premiums decreased 2 percent from last year’s second quarter to $1,150.9 million, including the retrocession agreement effective in last year’s fourth quarter, and increased 8 percent excluding that agreement. Pre-tax net income totaled $55.7 million for the quarter, compared with $77.8 million in last year’s third quarter.

Non-Traditional

The Asset-Intensive business reported pre-tax operating income of $55.2 million compared with $58.0 million last year. Results continue to outpace expectations and benefited from favorable net interest rate spread performance on fixed annuities, as well as strong contributions from this segment’s annuity block acquisitions. The prior-year quarter benefited from prepayment fees of $8.4 million associated with commercial mortgage loans. Pre-tax net income decreased to $24.2 million from $63.8 million a year ago, attributable to changes in the fair value of various embedded derivatives.

The Financial Reinsurance business reported pre-tax operating income of $12.1 million, a decrease from the $13.8 million posted in last year’s third quarter. Pre-tax net income totaled $12.1 million in the current period compared with $13.7 million in the prior-year quarter. This business is driven by fees earned on financial reinsurance transactions, and quarterly earnings can vary depending on the size and timing of transactions.

Canada

Traditional

The Canada Traditional business reported pre-tax operating income of $37.8 million this quarter, a 52 percent increase over $24.9 million the year before, overcoming the significantly negative effect of a weaker Canadian currency. Individual mortality claims experience continued to improve and was better than expected in the third quarter. Reported net premiums decreased 17 percent to $200.0 million, primarily due to the significantly weaker Canadian dollar. Pre-tax net income totaled $34.1 million compared with $24.2 million in the third quarter of 2014.

- more -

Add Three

Non-Traditional

The Canada Non-Traditional business segment, which consists of longevity and fee-based transactions, posted pre-tax operating income and pre-tax net income of $3.3 million this quarter compared with $0.9 million in the prior-year quarter.

In total, a relatively weaker Canadian dollar lowered net premiums and pre-tax operating income by approximately $42.2 million and $8.3 million, respectively, during the quarter. In Canadian dollars, premiums increased 3 percent over the third quarter of 2014.

Europe, Middle East and Africa (EMEA)

Traditional

The EMEA Traditional segment reported pre-tax operating income of $15.6 million compared with $20.3 million in last year’s third quarter. Both periods had favorable overall claims experience, with the year-ago period being unusually strong. Net reported premiums decreased 5 percent and totaled $276.1 million, compared with $291.0 million in the prior-year quarter. Net foreign currency fluctuations had an adverse effect on pre-tax operating income and premiums again this quarter and for the first nine months. Pre-tax net income totaled $15.9 million versus $21.3 million in the year‑ago quarter.

Non-Traditional

The EMEA Non-Traditional segment includes asset-intensive, longevity and fee-based transactions. Pre-tax operating income increased 22 percent to $28.8 million from $23.7 million a year ago, primarily due to contributions from new longevity transactions and favorable experience on existing longevity and asset-intensive business. Pre-tax net income totaled $29.2 million this quarter, compared with $23.9 million in last year’s third quarter.

In total, adverse foreign currency fluctuations reduced net premiums and pre-tax operating income by $33.3 million and $3.5 million, respectively. EMEA premiums based in local currencies increased 2 percent over the third quarter of 2014.

Asia Pacific

Traditional

Asia Pacific’s Traditional business reported pre-tax operating income of $13.0 million, compared with a very strong $24.6 million in the prior-year quarter. Overall claims experience was better than expected, with most markets performing well, and was especially favorable in the year-ago period. Operations in Australia reported a modest loss for the quarter, versus a modest gain in last year’s third quarter. Traditional net premiums increased 2 percent to $400.3 million, including a significant foreign currency headwind compared with the prior year. Pre-tax net income totaled $11.3 million compared with $24.3 million in last year’s third quarter.

- more -

Add Four

Non-Traditional

Asia Pacific’s Non-Traditional business includes asset-intensive, fee-based and various other transactions. Pre-tax operating income in this segment increased to $6.3 million from $2.8 million last year due to the effects of several new treaties and favorable experience on existing treaties in the current period. Pre-tax net income totaled $5.4 million this quarter versus a pre-tax net loss of $3.9 million in the year-ago period. The prior-year result was driven by investment related losses.

In total, adverse foreign currency fluctuations reduced Asia Pacific net premiums and pre-tax operating income by $69.5 million and $2.3 million, respectively. Premiums based in local currencies increased 18 percent over the third quarter of 2014.

Corporate and Other

The Corporate and Other segment’s pre-tax operating losses increased to $19.7 million from $13.2 million in the third quarter of 2014, mainly attributable to the retention of certain executive costs that were previously allocated to other segments. Pre-tax net losses were $50.9 million this quarter, including net investment related losses, and $14.2 million a year ago.

Dividend Declaration

The board of directors declared a regular quarterly dividend of $0.37, payable December 1 to shareholders of record as of November 10.

Earnings Conference Call

A conference call to discuss third-quarter results will begin at 9 a.m. Eastern Time on Friday, October 30. Interested parties may access the call by dialing 1-877-795-3599 (domestic) or 719-325-4785 (international). The access code is 8717800. A live audio webcast of the conference call will be available on the company’s investor relations website at www.rgare.com. A replay of the conference call will be available at the same address for 90 days following the conference call. A telephonic replay also will be available through November 7 at 888-203-1112 (domestic) or 719-457-0820 (international), access code 8717800.

The company has posted to its website a Quarterly Financial Supplement that includes financial information for all segments as well as information on its investment portfolio. Additionally, the company posts periodic reports, press releases and other useful information on its investor relations website.

Use of Non-GAAP Financial Measures

RGA uses a non-GAAP financial measure called operating income as a basis for analyzing financial results. This measure also serves as a basis for establishing target levels and awards under RGA’s management incentive programs. Management believes that operating income, on a pre-tax and after‑tax basis, better measures the ongoing profitability and underlying trends of the company’s continuing operations, primarily because that measure excludes substantially all of the effect of net investment related gains and losses, as well as changes in the fair value of certain embedded derivatives and related deferred acquisition costs. These items can be volatile, primarily due to the credit market and interest rate

- more -

Add Five

environment, and are not necessarily indicative of the performance of the company’s underlying businesses. Additionally, operating income excludes any net gain or loss from discontinued operations, the cumulative effect of any accounting changes, and other items that management believes are not indicative of the company’s ongoing operations. The definition of operating income can vary by company and is not considered a substitute for GAAP net income.

Reconciliations to GAAP net income are provided in the following tables. Additional financial information can be found in the Quarterly Financial Supplement on RGA’s Investor Relations

website at www.rgare.com in the “Quarterly Results” tab and in the “Featured Report” section.

Book value per share before impact of AOCI is a non-GAAP financial measure that management believes is important in evaluating the balance sheet in order to ignore the effects of unrealized amounts primarily associated with mark-to-market adjustments on investments and foreign currency translation.

Operating income per diluted share is a non-GAAP financial measure calculated as operating income divided by weighted average diluted shares outstanding. Operating return on equity is a non-GAAP financial measure calculated as operating income divided by average shareholders’ equity excluding AOCI.

About RGA

Reinsurance Group of America, Incorporated is among the largest global providers of life reinsurance, with operations in Australia, Barbados, Bermuda, Canada, China, France, Germany, Hong Kong, India, Ireland, Italy, Japan, Malaysia, Mexico, the Netherlands, New Zealand, Poland, Singapore, South Africa, South Korea, Spain, Taiwan, Turkey, the United Arab Emirates, the United Kingdom and the United States. Worldwide, the company has approximately $2.8 trillion of life reinsurance in force, and assets of $47.6 billion.

Cautionary Statement Regarding Forward-looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, among others, statements relating to projections of the earnings, revenues, income or loss, future financial performance and growth potential of Reinsurance Group of America, Incorporated and its subsidiaries (which we refer to in the following paragraphs as “we,” “us” or “our”). The words “intend,” “expect,” “project,” “estimate,” “predict,” “anticipate,” “should,” “believe,” and other similar expressions also are intended to identify forward-looking statements. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future events and actual results, performance and achievements could differ materially from those set forth in, contemplated by or underlying the forward-looking statements.

Numerous important factors could cause actual results and events to differ materially from those expressed or implied by forward-looking statements including, without limitation, (1) adverse capital and credit market conditions and their impact on the Company’s liquidity, access to capital and cost of capital, (2) the impairment of other financial institutions and its effect on the Company’s business, (3) requirements to post collateral or make payments due to declines in market value of assets subject to the Company’s collateral arrangements, (4) the fact that the determination of allowances and impairments taken

- more -

Add Six

on the Company’s investments is highly subjective, (5) adverse changes in mortality, morbidity, lapsation or claims experience, (6) changes in the Company’s financial strength and credit ratings and the effect of such changes on the Company’s future results of operations and financial condition, (7) inadequate risk analysis and underwriting, (8) general economic conditions or a prolonged economic downturn affecting the demand for insurance and reinsurance in the Company’s current and planned markets, (9) the availability and cost of collateral necessary for regulatory reserves and capital, (10) market or economic conditions that adversely affect the value of the Company’s investment securities or result in the impairment of all or a portion of the value of certain of the Company’s investment securities, that in turn could affect regulatory capital, (11) market or economic conditions that adversely affect the Company’s ability to make timely sales of investment securities, (12) risks inherent in the Company’s risk management and investment strategy, including changes in investment portfolio yields due to interest rate or credit quality changes, (13) fluctuations in U.S. or foreign currency exchange rates, interest rates, or securities and real estate markets, (14) adverse litigation or arbitration results, (15) the adequacy of reserves, resources and accurate information relating to settlements, awards and terminated and discontinued lines of business, (16) the stability of and actions by governments and economies in the markets in which the Company operates, including ongoing uncertainties regarding the amount of United States sovereign debt and the credit ratings thereof, (17) competitive factors and competitors’ responses to the Company’s initiatives, (18) the success of the Company’s clients, (19) successful execution of the Company’s entry into new markets, (20) successful development and introduction of new products and distribution opportunities, (21) the Company’s ability to successfully integrate acquired blocks of business and entities, (22) action by regulators who have authority over the Company’s reinsurance operations in the jurisdictions in which it operates, (23) the Company’s dependence on third parties, including those insurance companies and reinsurers to which the Company cedes some reinsurance, third-party investment managers and others, (24) the threat of natural disasters, catastrophes, terrorist attacks, epidemics or pandemics anywhere in the world where the Company or its clients do business, (25) interruption or failure of the Company’s telecommunication, information technology or other operational systems, or the Company’s failure to maintain adequate security to protect the confidentiality or privacy of personal or sensitive data stored on such systems, (26) changes in laws, regulations, and accounting standards applicable to the Company, its subsidiaries, or its business, (27) the effect of the Company’s status as an insurance holding company and regulatory restrictions on its ability to pay principal of and interest on its debt obligations, and (28) other risks and uncertainties described in this document and in the Company’s other filings with the SEC.

Forward-looking statements should be evaluated together with the many risks and uncertainties that affect our business, including those mentioned in this document and described in the periodic reports we file with the Securities and Exchange Commission. These forward-looking statements speak only as of the date on which they are made. We do not undertake any obligations to update these forward-looking statements, even though our situation may change in the future. We qualify all of our forward-looking statements by these cautionary statements. For a discussion of the risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements, you are advised to review the risk factors in our Annual Report on Form 10-K for the year ended December 31, 2014.

Investor Contact

Jeff Hopson

Senior Vice President - Investor Relations

(636) 736-7000

- tables attached -

Add Seven

REINSURANCE GROUP OF AMERICA, INCORPORATED AND SUBSIDIARIES

Reconciliation of Consolidated Net Income to Operating Income

(Dollars in thousands)

|

| | | | | | | | | | | | | | | |

(Unaudited) | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

GAAP net income | $ | 83,534 |

| | $ | 157,996 |

| | $ | 339,039 |

| | $ | 492,956 |

|

Reconciliation to operating income: | | | | | | | |

Capital (gains) losses, derivatives and other, included in investment related (gains) losses, net | (22,750 | ) | | (5,517 | ) | | (10,183 | ) | | (49,344 | ) |

Capital (gains) losses on funds withheld, included in investment income | (1,438 | ) | | (3,576 | ) | | (10,801 | ) | | (7,699 | ) |

Embedded derivatives: | | | | | | | |

Included in investment related (gains) losses, net | 92,002 |

| | (6,067 | ) | | 91,793 |

| | (88,767 | ) |

Included in interest credited | (7,147 | ) | | (269 | ) | | (7,261 | ) | | (38 | ) |

DAC offset, net | (16,865 | ) | | 17,238 |

| | (23,454 | ) | | 82,635 |

|

Non-investment derivatives | (250 | ) | | 18 |

| | 1 |

| | 18 |

|

Operating income | $ | 127,086 |

| | $ | 159,823 |

| | $ | 379,134 |

| | $ | 429,761 |

|

Reconciliation of Consolidated Pre-tax Net Income to Pre-tax Operating Income

(Dollars in thousands)

|

| | | | | | | | | | | | | | | |

(Unaudited) | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Income before income taxes | $ | 140,137 |

| | $ | 231,815 |

| | $ | 538,052 |

| | $ | 731,790 |

|

Reconciliation to pre-tax operating income: | | | | | | | |

Capital (gains) losses, derivatives and other, included in investment related (gains) losses, net | (35,028 | ) | | (8,413 | ) | | (14,448 | ) | | (72,855 | ) |

Capital (gains) losses on funds withheld, included in investment income | (2,212 | ) | | (5,501 | ) | | (16,616 | ) | | (11,844 | ) |

Embedded derivatives: | | | | | | | |

Included in investment related (gains) losses, net | 141,542 |

| | (9,333 | ) | | 141,220 |

| | (136,565 | ) |

Included in interest credited | (10,995 | ) | | (415 | ) | | (11,170 | ) | | (59 | ) |

DAC offset, net | (25,945 | ) | | 26,521 |

| | (36,083 | ) | | 127,132 |

|

Non-investment derivatives | (383 | ) | | 28 |

| | 2 |

| | 28 |

|

Pre-tax operating income | $ | 207,116 |

| | $ | 234,702 |

| | $ | 600,957 |

| | $ | 637,627 |

|

- more -

Add Eight

REINSURANCE GROUP OF AMERICA, INCORPORATED AND SUBSIDIARIES

Reconciliation of Pre-tax Net Income to Pre-tax Operating Income

(Dollars in thousands)

|

| | | | | | | | | | | | | | | |

(Unaudited) | Three Months Ended September 30, 2015 |

| Pre-tax net income (loss) | | Capital (gains) losses, derivatives and other, net | | Change in value of embedded derivatives, net | | Pre-tax operating income (loss) |

U.S. and Latin America: | | | | | | | |

Traditional | $ | 55,652 |

| | $ | (1 | ) | | $ | (925 | ) | | $ | 54,726 |

|

Non-Traditional: | | | | | | | |

Asset Intensive | 24,182 |

| | (164,382 | ) | (1) | 195,430 |

| (2) | 55,230 |

|

Financial Reinsurance | 12,073 |

| | — |

| | — |

| | 12,073 |

|

Total U.S. and Latin America | 91,907 |

| | (164,383 | ) | | 194,505 |

| | 122,029 |

|

Canada Traditional | 34,072 |

| | 3,721 |

| | — |

| | 37,793 |

|

Canada Non-Traditional | 3,257 |

| | — |

| | — |

| | 3,257 |

|

Total Canada | 37,329 |

| | 3,721 |

| | — |

| | 41,050 |

|

EMEA Traditional | 15,910 |

| | (289 | ) | | — |

| | 15,621 |

|

EMEA Non-Traditional | 29,234 |

| | (396 | ) | | — |

| | 28,838 |

|

Total EMEA | 45,144 |

| | (685 | ) | | — |

| | 44,459 |

|

Asia Pacific Traditional | 11,276 |

| | 1,706 |

| | — |

| | 12,982 |

|

Asia Pacific Non-Traditional | 5,412 |

| | 881 |

| | — |

| | 6,293 |

|

Total Asia Pacific | 16,688 |

| | 2,587 |

| | — |

| | 19,275 |

|

Corporate and Other | (50,931 | ) | | 31,234 |

| | — |

| | (19,697 | ) |

Consolidated | $ | 140,137 |

| | $ | (127,526 | ) | | $ | 194,505 |

| | $ | 207,116 |

|

| |

(1) | Asset Intensive is net of $(89,903) DAC offset. |

| |

(2) | Asset Intensive is net of $63,958 DAC offset. |

|

| | | | | | | | | | | | | | | |

(Unaudited) | Three Months Ended September 30, 2014 |

| Pre-tax net income (loss) | | Capital (gains) losses, derivatives and other, net | | Change in value of embedded derivatives, net | | Pre-tax operating income (loss) |

U.S. and Latin America: | | | | | | | |

Traditional | $ | 77,833 |

| | $ | 1,414 |

| | $ | (322 | ) | | $ | 78,925 |

|

Non-Traditional: | | | | | | | |

Asset Intensive | 63,796 |

| | 54,500 |

| (1) | (60,320 | ) | (2) | 57,976 |

|

Financial Reinsurance | 13,704 |

| | 100 |

| | — |

| | 13,804 |

|

Total U.S. and Latin America | 155,333 |

| | 56,014 |

| | (60,642 | ) | | 150,705 |

|

Canada Traditional | 24,160 |

| | 695 |

| | — |

| | 24,855 |

|

Canada Non-Traditional | 884 |

| | (3 | ) | | — |

| | 881 |

|

Total Canada | 25,044 |

| | 692 |

| | — |

| | 25,736 |

|

EMEA Traditional | 21,281 |

| | (990 | ) | | — |

| | 20,291 |

|

EMEA Non-Traditional | 23,895 |

| | (206 | ) | | — |

| | 23,689 |

|

Total EMEA | 45,176 |

| | (1,196 | ) | | — |

| | 43,980 |

|

Asia Pacific Traditional | 24,302 |

| | 324 |

| | — |

| | 24,626 |

|

Asia Pacific Non-Traditional | (3,889 | ) | | 6,707 |

| | — |

| | 2,818 |

|

Total Asia Pacific | 20,413 |

| | 7,031 |

| | — |

| | 27,444 |

|

Corporate and Other | (14,151 | ) | | 988 |

| | — |

| | (13,163 | ) |

Consolidated | $ | 231,815 |

| | $ | 63,529 |

| | $ | (60,642 | ) | | $ | 234,702 |

|

| |

(1) | Asset Intensive is net of $77,415 DAC offset. |

| |

(2) | Asset Intensive is net of $(50,894) DAC offset. |

- more -

Add Nine

REINSURANCE GROUP OF AMERICA, INCORPORATED AND SUBSIDIARIES

Reconciliation of Pre-tax Net Income to Pre-tax Operating Income

(Dollars in thousands)

|

| | | | | | | | | | | | | | | |

(Unaudited) | Nine Months Ended September 30, 2015 |

| Pre-tax net income (loss) | | Capital (gains) losses, derivatives and other, net | | Change in value of embedded derivatives, net | | Pre-tax operating income (loss) |

U.S. and Latin America: | | | | | | | |

Traditional | $ | 156,288 |

| | $ | (2 | ) | | $ | (1,811 | ) | | $ | 154,475 |

|

Non-Traditional: | | | | | | | |

Asset Intensive | 122,072 |

| | (162,035 | ) | (1) | 191,929 |

| (2) | 151,966 |

|

Financial Reinsurance | 39,081 |

| | — |

| | — |

| | 39,081 |

|

Total U.S. and Latin America | 317,441 |

| | (162,037 | ) | | 190,118 |

| | 345,522 |

|

Canada Traditional | 79,535 |

| | (810 | ) | | — |

| | 78,725 |

|

Canada Non-Traditional | 10,482 |

| | — |

| | — |

| | 10,482 |

|

Total Canada | 90,017 |

| | (810 | ) | | — |

| | 89,207 |

|

EMEA Traditional | 35,551 |

| | (338 | ) | | — |

| | 35,213 |

|

EMEA Non-Traditional | 80,300 |

| | (993 | ) | | — |

| | 79,307 |

|

Total EMEA | 115,851 |

| | (1,331 | ) | | — |

| | 114,520 |

|

Asia Pacific Traditional | 68,239 |

| | 1,706 |

| | — |

| | 69,945 |

|

Asia Pacific Non-Traditional | 14,152 |

| | 2,916 |

| | — |

| | 17,068 |

|

Total Asia Pacific | 82,391 |

| | 4,622 |

| | — |

| | 87,013 |

|

Corporate and Other | (67,648 | ) | | 32,343 |

| | — |

| | (35,305 | ) |

Consolidated | $ | 538,052 |

| | $ | (127,213 | ) | | $ | 190,118 |

| | $ | 600,957 |

|

| |

(1) | Asset Intensive is net of $(96,151) DAC offset. |

| |

(2) | Asset Intensive is net of $60,068 DAC offset. |

|

| | | | | | | | | | | | | | | |

(Unaudited) | Nine Months Ended September 30, 2014 |

| Pre-tax net income (loss) | | Capital (gains) losses, derivatives and other, net | | Change in value of embedded derivatives, net | | Pre-tax operating income (loss) |

U.S. and Latin America: | | | | | | | |

Traditional | $ | 222,793 |

| | $ | (8,777 | ) | | $ | 2,066 |

| | $ | 216,082 |

|

Non-Traditional: | | | | | | | |

Asset Intensive | 216,208 |

| | 12,448 |

| (1) | (85,648 | ) | (2) | 143,008 |

|

Financial Reinsurance | 39,890 |

| | (51 | ) | | — |

| | 39,839 |

|

Total U.S. and Latin America | 478,891 |

| | 3,620 |

| | (83,582 | ) | | 398,929 |

|

Canada Traditional | 75,602 |

| | (1,471 | ) | | — |

| | 74,131 |

|

Canada Non-Traditional | 4,526 |

| | (72 | ) | | — |

| | 4,454 |

|

Total Canada | 80,128 |

| | (1,543 | ) | | — |

| | 78,585 |

|

EMEA Traditional | 47,076 |

| | (5,858 | ) | | — |

| | 41,218 |

|

EMEA Non-Traditional | 74,627 |

| | (13,208 | ) | | — |

| | 61,419 |

|

Total EMEA | 121,703 |

| | (19,066 | ) | | — |

| | 102,637 |

|

Asia Pacific Traditional | 71,382 |

| | (1,746 | ) | | — |

| | 69,636 |

|

Asia Pacific Non-Traditional | 10,270 |

| | 1,523 |

| | — |

| | 11,793 |

|

Total Asia Pacific | 81,652 |

| | (223 | ) | | — |

| | 81,429 |

|

Corporate and Other | (30,584 | ) | | 6,631 |

| | — |

| | (23,953 | ) |

Consolidated | $ | 731,790 |

| | $ | (10,581 | ) | | $ | (83,582 | ) | | $ | 637,627 |

|

| |

(1) | Asset Intensive is net of $74,090 DAC offset. |

| |

(2) | Asset Intensive is net of $53,042 DAC offset. |

- more -

Add Ten

REINSURANCE GROUP OF AMERICA, INCORPORATED AND SUBSIDIARIES

Per Share and Shares Data

(In thousands, except per share data)

|

| | | | | | | | | | | | | | | |

(Unaudited) | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Diluted earnings per share from operating income | $ | 1.90 |

| | $ | 2.31 |

| | $ | 5.60 |

| | $ | 6.13 |

|

Earnings per share from net income: | | | | | | | |

Basic earnings per share | $ | 1.26 |

| | $ | 2.30 |

| | $ | 5.07 |

| | $ | 7.10 |

|

Diluted earnings per share | $ | 1.25 |

| | $ | 2.28 |

| | $ | 5.01 |

| | $ | 7.03 |

|

Weighted average number of common and common equivalent shares outstanding | 66,882 |

| | 69,335 |

| | 67,644 |

| | 70,101 |

|

|

| | | | | | | |

(Unaudited) | At or for the Nine Months Ended September 30, |

| 2015 | | 2014 |

Treasury shares | 13,389 |

| | 10,472 |

|

Common shares outstanding | 65,749 |

| | 68,666 |

|

Book value per share outstanding | $ | 94.92 |

| | $ | 97.28 |

|

Book value per share outstanding, before impact of AOCI | $ | 81.14 |

| | $ | 75.44 |

|

- more -

Add Eleven

REINSURANCE GROUP OF AMERICA, INCORPORATED AND SUBSIDIARIES

Condensed Consolidated Statements of Income

(Dollars in thousands)

|

| | | | | | | | | | | | | | | |

(Unaudited) | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenues: | | | | | | | |

Net premiums | $ | 2,089,345 |

| | $ | 2,168,285 |

| | $ | 6,242,240 |

| | $ | 6,452,082 |

|

Investment income, net of related expenses | 389,597 |

| | 447,106 |

| | 1,267,027 |

| | 1,262,088 |

|

Investment related gains (losses), net: | | | | | | | |

Other-than-temporary impairments on fixed maturity securities | (23,111 | ) | | (246 | ) | | (29,775 | ) | | (1,419 | ) |

Other investment related gains (losses), net | (88,235 | ) | | 22,564 |

| | (90,166 | ) | | 226,835 |

|

Total investment related gains (losses), net | (111,346 | ) | | 22,318 |

| | (119,941 | ) | | 225,416 |

|

Other revenue | 71,038 |

| | 78,879 |

| | 200,261 |

| | 267,195 |

|

Total revenues | 2,438,634 |

| | 2,716,588 |

| | 7,589,587 |

| | 8,206,781 |

|

Benefits and expenses: | | | | | | | |

Claims and other policy benefits | 1,831,819 |

| | 1,855,037 |

| | 5,473,453 |

| | 5,540,599 |

|

Interest credited | 34,008 |

| | 120,952 |

| | 231,932 |

| | 347,508 |

|

Policy acquisition costs and other insurance expenses | 249,702 |

| | 336,411 |

| | 827,157 |

| | 1,100,658 |

|

Other operating expenses | 142,270 |

| | 133,737 |

| | 395,488 |

| | 372,135 |

|

Interest expense | 35,565 |

| | 36,065 |

| | 107,043 |

| | 106,360 |

|

Collateral finance and securitization expense | 5,133 |

| | 2,571 |

| | 16,462 |

| | 7,731 |

|

Total benefits and expenses | 2,298,497 |

| | 2,484,773 |

| | 7,051,535 |

| | 7,474,991 |

|

Income before income taxes | 140,137 |

| | 231,815 |

| | 538,052 |

| | 731,790 |

|

Provision for income taxes | 56,603 |

| | 73,819 |

| | 199,013 |

| | 238,834 |

|

Net income | $ | 83,534 |

| | $ | 157,996 |

| | $ | 339,039 |

| | $ | 492,956 |

|

# # #

Exhibit 99.2

Financial Supplement

Third Quarter 2015

(Unaudited)

|

| | | | |

World Headquarters | | Internet address | | Contacts: |

16600 Swingley Ridge Road | | www.rgare.com | | Jack B. Lay |

Chesterfield, Missouri 63017 U.S.A. | | | | Senior Executive Vice President |

| | | | and Chief Financial Officer |

| | | | Phone: (636) 736-7000 |

| | | | e-mail: jlay@rgare.com |

| | | | |

| | | | Jeff Hopson |

| | | | Sr. Vice President, Investor Relations |

| | | | Phone: (636) 736-2068 |

| | | | e-mail: jhopson@rgare.com |

|

| | | | | | |

Current Ratings |

| | | |

| | Standard & Poor’s | | A.M. Best | | Moody’s |

Financial Strength Ratings | | | | | | |

RGA Reinsurance Company | | AA- | | A+ | | A1 |

RGA Life Reinsurance Company of Canada | | AA- | | A+ | | NR |

RGA International Reinsurance Company Limited | | AA- | | NR | | NR |

RGA Global Reinsurance Company Limited | | AA- | | NR | | NR |

RGA Reinsurance Company of Australia Limited | | AA- | | NR | | NR |

RGA Americas Reinsurance Company, Ltd. | | AA- | | A+ | | NR |

RGA Atlantic Reinsurance Company Ltd. | | NR | | A+ | | NR |

Senior Debt Ratings | | | | | | |

Reinsurance Group of America, Incorporated | | A- | | a- | | Baa1 |

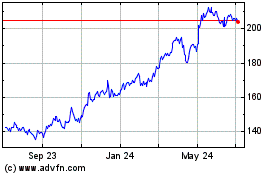

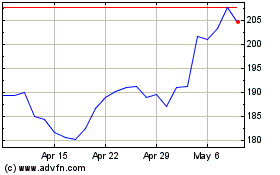

Our common stock is traded on the New York Stock Exchange under the symbol “RGA.”

Reinsurance Group of America, Incorporated

Financial Supplement

3rd Quarter 2015

Table of Contents

|

| |

| Page |

| |

| |

| |

| |

Consolidated | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Segment Pre-tax Operating Income Summaries and Reconciliations to U.S. GAAP | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Investments | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Reinsurance Group of America, Incorporated

Financial Supplement

This Financial Supplement is for information purposes only and includes unaudited figures. This report should be read in conjunction with documents filed by Reinsurance Group of America, Incorporated ("RGA") with the SEC.

Non-GAAP Disclosures

RGA uses a non-GAAP financial measure called operating income as a basis for analyzing financial results. This measure also serves as a basis for establishing target levels and awards under RGA’s management incentive programs. Management believes that operating income, on a pre-tax and after-tax basis, better measures the ongoing profitability and underlying trends of the company’s continuing operations, primarily because that measure excludes substantially all of the effect of net investment related gains and losses, as well as changes in the fair value of certain embedded derivatives and related deferred acquisition costs. These items can be volatile, primarily due to the credit market and interest rate environment and are not necessarily indicative of the performance of the company’s underlying businesses. Additionally, operating income excludes any net gain or loss from discontinued operations, the cumulative effect of any accounting changes, and other items that management believes are not indicative of the company’s ongoing operations. The definition of operating income can vary by company and is not considered a substitute for GAAP net income. A reconciliation of income before income taxes of the operating segments to pre-tax operating income (loss) is presented herein.

RGA evaluates its stockholder equity position excluding the impact of Accumulated Other Comprehensive Income (“AOCI”) since the net unrealized gains or losses included in AOCI primarily relate to changes in interest rates, credit spreads on its investment securities and foreign currency fluctuations that are not permanent and can fluctuate significantly from period to period.

Additionally, RGA uses a non-GAAP financial measure called operating return on equity, which is calculated as operating income divided by average shareholders’

equity excluding AOCI.

Reinsurance Group of America, Incorporated

PRIOR PERIOD RECLASSIFICATIONS

Effective January 1, 2015, the Company further segmented the Canada; Europe, Middle East and Africa; and Asia Pacific segments into traditional and non-traditional businesses to reflect the expanded product offerings within its geographic-based segments. The prior-period presentation has been adjusted to conform to the new segment reporting structure.

Reinsurance Group of America, Incorporated Financial Highlights |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Current Qtr vs. PY Quarter | | | | Year-to Date |

(USD thousands, except inforce & per share data) | | Sept. 30, | | June 30, | | March 31, | | Dec. 31, | | Sept. 30, | | | | | Sept. 30, | | Sept. 30, | | |

| | 2015 | | 2015 | | 2015 | | 2014 | | 2014 | | | | | 2015 | | 2014 | | Change |

Net premiums | | $ | 2,089,345 |

| | $ | 2,129,043 |

| | $ | 2,023,852 |

| | $ | 2,217,772 |

| | $ | 2,168,285 |

| | $ | (78,940 | ) | | | | $ | 6,242,240 |

| | $ | 6,452,082 |

| | $ | (209,842 | ) |

Net income | | 83,534 |

| | 130,391 |

| | 125,114 |

| | 191,091 |

| | 157,996 |

| | (74,462 | ) | | | | 339,039 |

| | 492,956 |

| | (153,917 | ) |

Operating income | | 127,086 |

| | 130,270 |

| | 121,778 |

| | 208,288 |

| | 159,823 |

| | (32,737 | ) | | | | 379,134 |

| | 429,761 |

| | (50,627 | ) |

Operating return on equity (ex AOCI) - | | | | | | | | | | | | | | | | | | | | |

annualized | | 9.5 | % | | 9.8 | % | | 9.2 | % | | 15.8 | % | | 12.5 | % | | (3.0 | )% | | | | | | | | |

trailing 12 months | | 11.1 | % | | 11.8 | % | | 12.5 | % | | 12.5 | % | | 11.7 | % | | (0.6 | )% | | | | | | | | |

Total assets | | 47,606,120 |

| | 47,460,271 |

| | 44,691,268 |

| | 44,679,611 |

| | 42,910,363 |

| | 4,695,757 |

| | | | | | | | |

Assumed Life Reinsurance in Force (in billions) | | | | | | | | | | | | | | | | | | | | |

U.S. and Latin America Traditional | | $ | 1,476.1 |

| | $ | 1,475.6 |

| | $ | 1,479.4 |

| | $ | 1,483.9 |

| | $ | 1,387.2 |

| | $ | 88.9 |

| | | | | | | | |

U.S. and Latin America Non-Traditional | | 2.2 |

| | 2.1 |

| | 2.1 |

| | 1.4 |

| | 2.2 |

| | — |

| | | | | | | | |

Canada Traditional | | 343.0 |

| | 360.7 |

| | 349.0 |

| | 402.8 |

| | 383.9 |

| | (40.9 | ) | | | | | | | | |

Europe, Middle East and Africa Traditional | | 566.0 |

| | 573.9 |

| | 553.3 |

| | 561.1 |

| | 573.0 |

| | (7.0 | ) | | | | | | | | |

Asia Pacific Traditional | | 461.8 |

| | 512.7 |

| | 460.6 |

| | 494.0 |

| | 577.0 |

| | (115.2 | ) | | | | | | | | |

Asia Pacific Non-Traditional | | 0.3 |

| | 0.3 |

| | 0.3 |

| | 0.3 |

| | 0.3 |

| | — |

| | | | | | | | |

Total Life Reinsurance in Force | | $ | 2,849.4 |

| | $ | 2,925.3 |

| | $ | 2,844.7 |

| | $ | 2,943.5 |

| | $ | 2,923.6 |

| | $ | (74.2 | ) | | | |

|

| |

|

| |

|

|

Assumed New Business Production (in billions) | | | | | | | | | | | | | | | | | | | | |

U.S. and Latin America Traditional | | $ | 26.4 |

| | $ | 15.7 |

| | $ | 19.7 |

| | $ | 118.1 |

| (1) | $ | 16.6 |

| | $ | 9.8 |

| | | | $ | 61.8 |

| | $ | 58.8 |

| | $ | 3.0 |

|

Canada Traditional | | 9.1 |

| | 11.1 |

| | 9.7 |

| | 13.9 |

| | 11.6 |

| | (2.5 | ) | | | | 29.9 |

| | 34.4 |

| | (4.5 | ) |

Europe, Middle East and Africa Traditional | | 24.7 |

| | 32.3 |

| | 48.6 |

| | 38.5 |

| | 22.5 |

| | 2.2 |

| | | | 105.6 |

| | 136.7 |

| | (31.1 | ) |

Asia Pacific Traditional | | 24.4 |

| | 12.6 |

| | 27.8 |

| | 22.4 |

| | 21.1 |

| | 3.3 |

| | | | 64.8 |

| | 59.2 |

| | 5.6 |

|

Total New Business Production | | $ | 84.6 |

| | $ | 71.7 |

| | $ | 105.8 |

| | $ | 192.9 |

| | $ | 71.8 |

| | $ | 12.8 |

| | | | $ | 262.1 |

| | $ | 289.1 |

| | $ | (27.0 | ) |

Per Share and Shares Data | | | | | | | | | | | | | | | | | | | | |

Basic earnings per share | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 1.26 |

| | $ | 1.97 |

| | $ | 1.84 |

| | $ | 2.78 |

| | $ | 2.30 |

| | $ | (1.04 | ) | | | | $ | 5.07 |

| | $ | 7.10 |

| | $ | (2.03 | ) |

Operating income | | $ | 1.92 |

| | $ | 1.96 |

| | $ | 1.79 |

| | $ | 3.03 |

| | $ | 2.33 |

| | $ | (0.41 | ) | | | | $ | 5.67 |

| | $ | 6.19 |

| | $ | (0.52 | ) |

Diluted earnings per share | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 1.25 |

| | $ | 1.94 |

| | $ | 1.81 |

| | $ | 2.75 |

| | $ | 2.28 |

| | $ | (1.03 | ) | | | | $ | 5.01 |

| | $ | 7.03 |

| | $ | (2.02 | ) |

Operating income | | $ | 1.90 |

| | $ | 1.94 |

| | $ | 1.77 |

| | $ | 2.99 |

| | $ | 2.31 |

| | $ | (0.41 | ) | | | | $ | 5.60 |

| | $ | 6.13 |

| | $ | (0.53 | ) |

| | | | | | | | | | | | | | | | | | | | |

Wgt. average common shares outstanding | | | | | | | | | | | | | | | | | | | | |

(basic) | | 66,205 |

| | 66,351 |

| | 68,141 |

| | 68,718 |

| | 68,642 |

| | (2,437 | ) | | | | 66,895 |

| | 69,426 |

| | (2,531 | ) |

(diluted) | | 66,882 |

| | 67,120 |

| | 68,942 |

| | 69,550 |

| | 69,335 |

| | (2,453 | ) | | | | 67,644 |

| | 70,101 |

| | (2,457 | ) |

| | | | | | | | | | | | | | | | | | | | |

Common shares issued | | 79,138 |

| | 79,138 |

| | 79,138 |

| | 79,138 |

| | 79,138 |

| | — |

| | | | 79,138 |

| | 79,138 |

| | — |

|

Treasury shares | | 13,389 |

| | 12,716 |

| | 12,699 |

| | 10,365 |

| | 10,472 |

| | 2,917 |

| | | | 13,389 |

| | 10,472 |

| | 2,917 |

|

Common shares outstanding | | 65,749 |

| | 66,422 |

| | 66,439 |

| | 68,773 |

| | 68,666 |

| | (2,917 | ) | | | | 65,749 |

| | 68,666 |

| | (2,917 | ) |

| | | | | | | | | | | | | | | | | | | | |

Book value per share | | $ | 94.92 |

| | $ | 97.61 |

| | $ | 107.62 |

| | $ | 102.13 |

| | $ | 97.28 |

| | | | | | | | | | |

Per share effect of accumulated other | | | | | | | | | | | | | | | | | | | | |

comprehensive income (AOCI) | | $ | 13.78 |

| | $ | 17.31 |

| | $ | 28.36 |

| | $ | 24.10 |

| | $ | 21.84 |

| | | | | | | | | | |

Book value per share, excluding AOCI | | $ | 81.14 |

| | $ | 80.30 |

| | $ | 79.26 |

| | $ | 78.03 |

| | $ | 75.44 |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Shareholder dividends paid | | $ | 24,592.1 |

| | $ | 21,850.5 |

| | $ | 22,668.8 |

| | $ | 22,669.4 |

| | $ | 22,632.1 |

| | $ | 1,960.0 |

| | | | $ | 69,111.4 |

| | $ | 64,586.8 |

| | $ | 4,524.6 |

|

(1) Increase in new business production related to the Voya Financial transaction that closed during the 4th quarter of 2014. |

Reinsurance Group of America, Incorporated Consolidated GAAP Income Statement (incl. Operating Income Reconciliations) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Current Qtr | | | | Year-to Date |

| | Sept. 30, | | June 30, | | March 31, | | Dec. 31, | | Sept. 30, | | vs. PY | | | | Sept. 30, | | Sept. 30, | | |

(USD thousands) | | 2015 | | 2015 | | 2015 | | 2014 | | 2014 | | Quarter | | | | 2015 | | 2014 | | Change |

Revenues: | | | | | | | | | | | | | | | | | | | | |

Net premiums | | $ | 2,089,345 |

| | $ | 2,129,043 |

| | $ | 2,023,852 |

| | $ | 2,217,772 |

| | $ | 2,168,285 |

| | $ | (78,940 | ) | | | | $ | 6,242,240 |

| | $ | 6,452,082 |

| | $ | (209,842 | ) |

Investment income, net of related expenses | | 389,597 |

| | 450,539 |

| | 426,891 |

| | 451,603 |

| | 447,106 |

| | (57,509 | ) | | | | 1,267,027 |

| | 1,262,088 |

| | 4,939 |

|

Investment related gains (losses), net | | | | | | | | | | | | | | | | | | | | |

OTTI on fixed maturity securities | | (23,111 | ) | | (4,137 | ) | | (2,527 | ) | | (6,347 | ) | | (246 | ) | | (22,865 | ) | | | | (29,775 | ) | | (1,419 | ) | | (28,356 | ) |

Other investment related gains (losses), net | | (88,235 | ) | | (12,041 | ) | | 10,110 |

| | (32,876 | ) | | 22,564 |

| | (110,799 | ) | | | | (90,166 | ) | | 226,835 |

| | (317,001 | ) |

Total investment related gains (losses), net | | (111,346 | ) | | (16,178 | ) | | 7,583 |

| | (39,223 | ) | | 22,318 |

| | (133,664 | ) | | | | (119,941 | ) | | 225,416 |

| | (345,357 | ) |

Other revenue | | 71,038 |

| | 66,936 |

| | 62,287 |

| | 67,261 |

| | 78,879 |

| | (7,841 | ) | | | | 200,261 |

| | 267,195 |

| | (66,934 | ) |

Total revenues | | 2,438,634 |

| | 2,630,340 |

| | 2,520,613 |

| | 2,697,413 |

| | 2,716,588 |

| | (277,954 | ) | | | | 7,589,587 |

| | 8,206,781 |

| | (617,194 | ) |

Benefits and expenses: | | | | | | | | | | | |

|

| | | | | | | | |

Claims and other policy benefits | | 1,831,819 |

| | 1,866,183 |

| | 1,775,451 |

| | 1,866,042 |

| | 1,855,037 |

| | (23,218 | ) | | | | 5,473,453 |

| | 5,540,599 |

| | (67,146 | ) |

Interest credited | | 34,008 |

| | 77,246 |

| | 120,678 |

| | 103,523 |

| | 120,952 |

| | (86,944 | ) | | | | 231,932 |

| | 347,508 |

| | (115,576 | ) |

Policy acquisition costs and other insurance expenses | | 249,702 |

| | 300,412 |

| | 277,043 |

| | 290,775 |

| | 336,411 |

| | (86,709 | ) | | | | 827,157 |

| | 1,100,658 |

| | (273,501 | ) |

Other operating expenses | | 142,270 |

| | 131,600 |

| | 121,618 |

| | 166,280 |

| | 133,737 |

| | 8,533 |

| | | | 395,488 |

| | 372,135 |

| | 23,353 |

|

Interest expense | | 35,565 |

| | 35,851 |

| | 35,627 |

| | (9,660 | ) | | 36,065 |

| | (500 | ) | | | | 107,043 |

| | 106,360 |

| | 683 |

|

Collateral finance and securitization expense | | 5,133 |

| | 5,258 |

| | 6,071 |

| | 3,710 |

| | 2,571 |

| | 2,562 |

| | | | 16,462 |

| | 7,731 |

| | 8,731 |

|

Total benefits and expenses | | 2,298,497 |

| | 2,416,550 |

| | 2,336,488 |

| | 2,420,670 |

| | 2,484,773 |

| | (186,276 | ) | | | | 7,051,535 |

| | 7,474,991 |

| | (423,456 | ) |

Income before income taxes | | 140,137 |

| | 213,790 |

| | 184,125 |

| | 276,743 |

| | 231,815 |

| | (91,678 | ) | | | | 538,052 |

| | 731,790 |

| | (193,738 | ) |

Income tax expense | | 56,603 |

| | 83,399 |

| | 59,011 |

| | 85,652 |

| | 73,819 |

| | (17,216 | ) | | | | 199,013 |

| | 238,834 |

| | (39,821 | ) |

Net income | | $ | 83,534 |

| | $ | 130,391 |

| | $ | 125,114 |

| | $ | 191,091 |

| | $ | 157,996 |

| | $ | (74,462 | ) | | | | $ | 339,039 |

| | $ | 492,956 |

| | $ | (153,917 | ) |

Pre-tax Operating Income Reconciliation: | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | 140,137 |

| | 213,790 |

| | 184,125 |

| | 276,743 |

| | 231,815 |

| | (91,678 | ) | | | | 538,052 |

| | 731,790 |

| | (193,738 | ) |

Investment and derivative losses (gains)— | | | | | | | | | | | | | | | | | | | | |

non-operating (1) | | (35,028 | ) | | 41,526 |

| | (20,946 | ) | | (22,453 | ) | | (8,413 | ) | | (26,615 | ) | | | | (14,448 | ) | | (72,855 | ) | | 58,407 |

|

Change in value of modified coinsurance and | | | | | | | | | | | | | | | | | | | | |

funds withheld embedded derivatives (1) | | 46,169 |

| | 23,098 |

| | 2,325 |

| | 14,523 |

| | (56,812 | ) | | 102,981 |

| | | | 71,592 |

| | (212,888 | ) | | 284,480 |

|

GMXB embedded derivatives (1) | | 95,373 |

| | (50,878 | ) | | 25,133 |

| | 52,901 |

| | 47,479 |

| | 47,894 |

| | | | 69,628 |

| | 76,323 |

| | (6,695 | ) |

Funds withheld losses (gains)—investment income | | (2,212 | ) | | (3,002 | ) | | (11,402 | ) | | (1,371 | ) | | (5,501 | ) | | 3,289 |

| | | | (16,616 | ) | | (11,844 | ) | | (4,772 | ) |

EIA embedded derivatives—interest credited | | (10,995 | ) | | (10,488 | ) | | 10,313 |

| | (362 | ) | | (415 | ) | | (10,580 | ) | | | | (11,170 | ) | | (59 | ) | | (11,111 | ) |

DAC offset, net | | (25,945 | ) | | (1,187 | ) | | (8,951 | ) | | (15,253 | ) | | 26,521 |

| | (52,466 | ) | | | | (36,083 | ) | | 127,132 |

| | (163,215 | ) |

Non-investment derivatives | | (383 | ) | | 493 |

| | (108 | ) | | (472 | ) | | 28 |

| | (411 | ) | | | | 2 |

| | 28 |

| | (26 | ) |

Operating Income Before Income Taxes | | $ | 207,116 |

| | $ | 213,352 |

| | $ | 180,489 |

| | $ | 304,256 |

| | $ | 234,702 |

| | $ | (27,586 | ) | | | | $ | 600,957 |

| | $ | 637,627 |

| | $ | (36,670 | ) |

After-tax Operating Income Reconciliation: | | | | | | | | | | | | | | | | | | | | |

Net Income | | 83,534 |

| | 130,391 |

| | 125,114 |

| | 191,091 |

| | 157,996 |

| | (74,462 | ) | | | | 339,039 |

| | 492,956 |

| | (153,917 | ) |

Investment and derivative losses (gains)— | | | | | | | | | | | | | | | | | | | |

|

|

non-operating (1) | | (22,750 | ) | | 27,152 |

| | (14,585 | ) | | (15,281 | ) | | (5,517 | ) | | (17,233 | ) | | | | (10,183 | ) | | (49,344 | ) | | 39,161 |

|

Change in value of modified coinsurance | | | | | | | | | | | | | | | | | | | | |

and funds withheld embedded derivatives (1) | | 30,010 |

| | 15,014 |

| | 1,511 |

| | 9,440 |

| | (36,928 | ) | | 66,938 |

| | | | 46,535 |

| | (138,377 | ) | | 184,912 |

|

GMXB embedded derivatives (1) | | 61,992 |

| | (33,070 | ) | | 16,336 |

| | 34,386 |

| | 30,861 |

| | 31,131 |

| | | | 45,258 |

| | 49,610 |

| | (4,352 | ) |

Funds withheld losses (gains)—investment income | | (1,438 | ) | | (1,951 | ) | | (7,412 | ) | | (891 | ) | | (3,576 | ) | | 2,138 |

| | | | (10,801 | ) | | (7,699 | ) | | (3,102 | ) |

EIA embedded derivatives—interest credited | | (7,147 | ) | | (6,817 | ) | | 6,703 |

| | (236 | ) | | (269 | ) | | (6,878 | ) | | | | (7,261 | ) | | (38 | ) | | (7,223 | ) |

DAC offset, net | | (16,865 | ) | | (770 | ) | | (5,819 | ) | | (9,914 | ) | | 17,238 |

| | (34,103 | ) | | | | (23,454 | ) | | 82,635 |

| | (106,089 | ) |

Non-investment derivatives | | (250 | ) | | 321 |

| | (70 | ) | | (307 | ) | | 18 |

| | (268 | ) | | | | 1 |

| | 18 |

| | (17 | ) |

Operating Income | | $ | 127,086 |

| | $ | 130,270 |

| | $ | 121,778 |

| | $ | 208,288 |

| | $ | 159,823 |

| | $ | (32,737 | ) | | | | $ | 379,134 |

| | $ | 429,761 |

| | $ | (50,627 | ) |

| | | | | | | | | | | | | | | | | | | | |

(1) Included in “Investment related gains (losses), net” on Consolidated GAAP Income Statement

|

Reinsurance Group of America, Incorporated Consolidated Operating Income Statement |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Current Qtr vs. PY Quarter | | | | Year-to-Date |

| | Sept. 30, | | June 30, | | March 31, | | Dec. 31, | | Sept. 30, | | | | | Sept. 30, | | Sept. 30, | | |

(USD thousands, except per share data) | | 2015 | | 2015 | | 2015 | | 2014 | | 2014 | | | | | 2015 | | 2014 | | Change |

Revenues: | | | | | | | | | | | | | | | | | | | | |

Net premiums | | $ | 2,089,345 |

| | $ | 2,129,043 |

| | $ | 2,023,852 |

| | $ | 2,217,772 |

| | $ | 2,168,285 |

| | $ | (78,940 | ) | | | | $ | 6,242,240 |

| | $ | 6,452,082 |

| | $ | (209,842 | ) |

Investment income, net of related expenses | | 387,385 |

| | 447,537 |

| | 415,489 |

| | 450,232 |

| | 441,605 |

| | (54,220 | ) | | | | 1,250,411 |

| | 1,250,244 |

| | 167 |

|

Investment related gains (losses), net | | (4,832 | ) | | (2,432 | ) | | 14,095 |

| | 5,748 |

| | 4,572 |

| | (9,404 | ) | | | | 6,831 |

| | 15,996 |

| | (9,165 | ) |

Other revenue | | 70,655 |

| | 67,429 |

| | 62,179 |

| | 66,789 |

| | 78,907 |

| | (8,252 | ) | | | | 200,263 |

| | 267,223 |

| | (66,960 | ) |

Total revenues | | 2,542,553 |

| | 2,641,577 |

| | 2,515,615 |

| | 2,740,541 |

| | 2,693,369 |

| | (150,816 | ) | | | | 7,699,745 |

| | 7,985,545 |

| | (285,800 | ) |

| | | | | | | | | | | | | | | | | | | | |

Benefits and expenses: | | | | | | | | | | | | | | | | | | | | |

Claims and other policy benefits | | 1,831,819 |

| | 1,866,183 |

| | 1,775,451 |

| | 1,866,042 |

| | 1,855,037 |

| | (23,218 | ) | | | | 5,473,453 |

| | 5,540,599 |

| | (67,146 | ) |

Interest credited | | 45,003 |

| | 87,734 |

| | 110,365 |

| | 103,885 |

| | 121,367 |

| | (76,364 | ) | | | | 243,102 |

| | 347,567 |

| | (104,465 | ) |

Policy acquisition costs and other insurance expenses | | 275,647 |

| | 301,599 |

| | 285,994 |

| | 306,028 |

| | 309,890 |

| | (34,243 | ) | | | | 863,240 |

| | 973,526 |

| | (110,286 | ) |

Other operating expenses | | 142,270 |

| | 131,600 |

| | 121,618 |

| | 166,280 |

| | 133,737 |

| | 8,533 |

| | | | 395,488 |

| | 372,135 |

| | 23,353 |

|

Interest expense | | 35,565 |

| | 35,851 |

| | 35,627 |

| | (9,660 | ) | | 36,065 |

| | (500 | ) | | | | 107,043 |

| | 106,360 |

| | 683 |

|

Collateral finance and securitization expense | | 5,133 |

| | 5,258 |

| | 6,071 |

| | 3,710 |

| | 2,571 |

| | 2,562 |

| | | | 16,462 |

| | 7,731 |

| | 8,731 |

|

Total benefits and expenses | | 2,335,437 |

| | 2,428,225 |

| | 2,335,126 |

| | 2,436,285 |

| | 2,458,667 |

| | (123,230 | ) | | | | 7,098,788 |

| | 7,347,918 |

| | (249,130 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating income before income taxes | | 207,116 |

| | 213,352 |

| | 180,489 |

| | 304,256 |

| | 234,702 |

| | (27,586 | ) | | | | 600,957 |

| | 637,627 |

| | (36,670 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating income tax expense | | 80,030 |

| | 83,082 |

| | 58,711 |

| | 95,968 |

| | 74,879 |

| | 5,151 |

| | | | 221,823 |

| | 207,866 |

| | 13,957 |

|

| | | | | | | | | | | | | | | | | | | | |

Operating income | | $ | 127,086 |

| | $ | 130,270 |

| | $ | 121,778 |

| | $ | 208,288 |

| | $ | 159,823 |

| | $ | (32,737 | ) | | | | $ | 379,134 |

| | $ | 429,761 |

| | $ | (50,627 | ) |

| | | | | | | | | | | | | | | | | | | | |

Wgt. Average Common Shares Outstanding (Diluted) | | 66,882 |

| | 67,120 |

| | 68,942 |

| | 69,550 |

| | 69,335 |

| | (2,453) |

| | | | 67,644 |

| | 70,101 |

| | (2,457) |

|

| | | | | | | | | | | | | | | | | | | | |

Diluted Earnings Per Share—Operating Income | | $ | 1.90 |

| | $ | 1.94 |

| | $ | 1.77 |

| | $ | 2.99 |

| | $ | 2.31 |

| | $ | (0.41 | ) | | | | $ | 5.60 |

| | $ | 6.13 |

| | $ | (0.53 | ) |

| | | | | | | | | | | | | | | | | | | | |

Foreign currency effect on (1): | | | | | | | | | | | | | | | | | | | | |

Net premiums | | $ | (145,047 | ) | | $ | (121,287 | ) | | $ | (96,024 | ) | | $ | (61,093 | ) | | $ | 5,906 |

| | $ | (150,953 | ) | | | | $ | (362,358 | ) | | $ | (49,283 | ) | | $ | (313,075 | ) |

Operating income before income taxes | | $ | (15,526 | ) | | $ | (8,700 | ) | | $ | (11,833 | ) | | $ | (9,276 | ) | | $ | (2,016 | ) | | $ | (13,510 | ) | | | | $ | (36,059 | ) | | $ | (9,430 | ) | | $ | (26,629 | ) |

| | | | | | | | | | | | | | | | | | | | |

(1) Compared to comparable prior year period |

Reinsurance Group of America, Incorporated Consolidated Balance Sheets |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | Sept. 30, | | June 30, | | March 31, | | Dec. 31, | | Sept. 30, |

(USD thousands) | | 2015 | | 2015 | | 2015 | | 2014 | | 2014 |

Assets | | | | | | | | | | |

Fixed maturity securities, available-for-sale | | $ | 27,411,788 |

| | $ | 28,063,975 |

| | $ | 25,801,223 |

| | $ | 25,480,972 |

| | $ | 24,475,451 |

|

Mortgage loans on real estate | | 3,170,002 |

| | 3,073,313 |

| | 2,913,486 |

| | 2,712,238 |

| | 2,617,091 |

|

Policy loans | | 1,444,009 |

| | 1,438,156 |

| | 1,284,085 |

| | 1,284,284 |

| | 1,249,948 |

|

Funds withheld at interest | | 5,675,174 |

| | 5,840,076 |

| | 5,841,554 |

| | 5,922,561 |

| | 5,969,006 |

|

Short-term investments | | 58,200 |

| | 76,118 |

| | 89,136 |

| | 97,694 |

| | 44,437 |

|

Other invested assets | | 1,187,504 |

| | 1,110,107 |

| | 1,243,033 |

| | 1,198,319 |

| | 1,165,021 |

|

Total investments | | 38,946,677 |

| | 39,601,745 |

| | 37,172,517 |

| | 36,696,068 |

| | 35,520,954 |

|

Cash and cash equivalents | | 1,747,692 |

| | 1,335,661 |

| | 1,083,179 |

| | 1,645,669 |

| | 1,118,745 |

|

Accrued investment income | | 342,088 |

| | 322,069 |

| | 283,665 |

| | 261,096 |

| | 305,880 |

|

Premiums receivable and other reinsurance balances | | 1,553,093 |

| | 1,518,208 |

| | 1,509,810 |

| | 1,527,729 |

| | 1,491,993 |

|

Reinsurance ceded receivables | | 661,185 |

| | 711,463 |

| | 665,797 |

| | 578,206 |

| | 596,704 |

|

Deferred policy acquisition costs | | 3,311,086 |

| | 3,299,541 |

| | 3,286,348 |

| | 3,342,575 |

| | 3,297,616 |

|

Other assets | | 1,044,299 |

| | 671,584 |

| | 689,952 |

| | 628,268 |

| | 578,471 |

|

Total assets | | $ | 47,606,120 |

| | $ | 47,460,271 |

| | $ | 44,691,268 |

| | $ | 44,679,611 |

| | $ | 42,910,363 |

|

| | | | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | | | |

Future policy benefits | | $ | 16,574,783 |

| | $ | 16,773,035 |

| | $ | 14,152,780 |

| | $ | 14,476,637 |

| | $ | 13,541,687 |

|

Interest-sensitive contract liabilities | | 13,699,896 |

| | 13,516,059 |

| | 12,508,201 |

| | 12,591,497 |

| | 12,638,117 |

|

Other policy claims and benefits | | 3,892,036 |

| | 3,857,610 |

| | 3,822,699 |

| | 3,824,069 |

| | 3,861,060 |

|

Other reinsurance balances | | 280,093 |

| | 311,388 |

| | 320,950 |

| | 306,915 |

| | 276,314 |

|

Deferred income taxes | | 2,285,066 |

| | 2,246,086 |

| | 2,529,733 |

| | 2,365,817 |

| | 2,149,076 |

|

Other liabilities | | 1,405,675 |

| | 1,032,980 |

| | 1,118,645 |

| | 994,230 |

| | 967,303 |

|

Long-term debt | | 2,313,053 |

| | 2,313,470 |

| | 2,313,884 |

| | 2,314,293 |

| | 2,314,693 |

|

Collateral finance and securitization notes | | 914,452 |

| | 926,410 |

| | 774,351 |

| | 782,701 |

| | 482,115 |

|

Total liabilities | | 41,365,054 |

| | 40,977,038 |

| | 37,541,243 |

| | 37,656,159 |

| | 36,230,365 |

|

| | | | | | | | | | |

Stockholders’ Equity: | | | | | | | | | | |

Common stock, at par value | | 791 |

| | 791 |

| | 791 |

| | 791 |

| | 791 |

|

Additional paid-in-capital | | 1,812,377 |

| | 1,805,858 |

| | 1,802,774 |

| | 1,798,279 |

| | 1,784,818 |

|

Retained earnings | | 4,482,709 |

| | 4,425,302 |

| | 4,339,028 |

| | 4,239,647 |

| | 4,074,047 |

|

Treasury stock | | (961,290 | ) | | (898,082 | ) | | (876,804 | ) | | (672,394 | ) | | (679,265 | ) |

Accumulated other comprehensive income (AOCI): | | | | | | | | | | |

Accumulated currency translation adjustment, net of income taxes | | (119,493 | ) | | (13,989 | ) | | (35,924 | ) | | 81,847 |

| | 131,936 |

|

Unrealized appreciation of securities, net of income taxes | | 1,071,990 |

| | 1,211,056 |

| | 1,968,697 |

| | 1,624,773 |

| | 1,387,957 |

|

Pension and postretirement benefits, net of income taxes | | (46,018 | ) | | (47,703 | ) | | (48,537 | ) | | (49,491 | ) | | (20,286 | ) |

Total stockholders’ equity | | 6,241,066 |

| | 6,483,233 |

| | 7,150,025 |

| | 7,023,452 |

| | 6,679,998 |

|

Total liabilities and stockholders’ equity | | $ | 47,606,120 |

| | $ | 47,460,271 |

| | $ | 44,691,268 |

| | $ | 44,679,611 |

| | $ | 42,910,363 |

|

| | | | | | | | | | |

Total stockholders’ equity, excluding AOCI | | $ | 5,334,587 |

| | $ | 5,333,869 |

| | $ | 5,265,789 |

| | $ | 5,366,323 |

| | $ | 5,180,391 |

|

| | | | | | | | | | |

| | | | | | | | | | |

Reinsurance Group of America, Incorporated U.S. and Latin America Traditional Segment Pre-tax Operating Income |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Current Qtr vs. PY Quarter | | | | Year-to-date |

| | Sept. 30, | | June 30, | | March 31, | | Dec. 31, | | Sept. 30, | | | | | Sept. 30, | | Sept. 30, | | |

(USD thousands) | | 2015 | | 2015 | | 2015 | | 2014 | | 2014 | | | | | 2015 | | 2014 | | Change |

Revenues: | | | | | | | | | | | | | | | | | | | | |

Net premiums | | $ | 1,150,936 |

| | $ | 1,170,931 |

| | $ | 1,114,094 |

| | $ | 1,221,862 |

| | $ | 1,171,916 |

| | $ | (20,980 | ) | | | | $ | 3,435,961 |

| | $ | 3,503,643 |

| | $ | (67,682 | ) |

Investment income, net of related expenses | | 154,210 |

| | 163,390 |

| | 143,005 |

| | 142,753 |

| | 139,272 |

| | 14,938 |

| | | | 460,605 |

| | 410,052 |

| | 50,553 |

|

Other revenue | | 6,566 |

| | 4,567 |

| | 664 |

| | 1,323 |

| | 783 |

| | 5,783 |

| | | | 11,797 |

| | 2,192 |

| | 9,605 |

|

Total revenues | | 1,311,712 |

| | 1,338,888 |

| | 1,257,763 |

| | 1,365,938 |

| | 1,311,971 |

| | (259 | ) | | | | 3,908,363 |

| | 3,915,887 |

| | (7,524 | ) |

| | | | | | | | | | | | | | | | | | | | |

Benefits and expenses: | | | | | | | | | | | | | | | | | | | |

|

Claims and other policy benefits | | 1,049,973 |

| | 1,041,390 |

| | 1,039,407 |

| | 1,021,046 |

| | 1,030,525 |

| | 19,448 |

| | | | 3,130,770 |

| | 3,109,262 |

| | 21,508 |

|

Interest credited | | 20,999 |

| | 21,875 |

| | 12,944 |

| | 13,101 |

| | 12,993 |

| | 8,006 |

| | | | 55,818 |

| | 38,083 |

| | 17,735 |

|

Policy acquisition costs and other insurance expenses | | 158,452 |

| | 169,035 |

| | 158,567 |

| | 168,395 |

| | 161,120 |

| | (2,668 | ) | | | | 486,054 |

| | 473,390 |

| | 12,664 |

|

Other operating expenses | | 27,562 |

| | 27,155 |

| | 26,529 |

| | 29,276 |

| | 28,408 |

| | (846 | ) | | | | 81,246 |

| | 79,070 |

| | 2,176 |

|

Total benefits and expenses | | 1,256,986 |

| | 1,259,455 |

| | 1,237,447 |

| | 1,231,818 |

| | 1,233,046 |

| | 23,940 |

| | | | 3,753,888 |

| | 3,699,805 |

| | 54,083 |

|

| | | | | | | | | | | | | | | | | | | | |

Operating income before income taxes | | 54,726 |

| | 79,433 |

| | 20,316 |

| | 134,120 |

| | 78,925 |

| | (24,199 | ) | | | | 154,475 |

| | 216,082 |

| | (61,607 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating to U.S. GAAP Reconciliation: | | | | | | | | | | | | | | | | | | | |

|

Operating income before income taxes | | 54,726 |

| | 79,433 |

| | 20,316 |

| | 134,120 |

| | 78,925 |

| | (24,199 | ) | | | | 154,475 |

| | 216,082 |

| | (61,607 | ) |

Investment and derivative (losses) gains - non-operating | | 926 |

| | 3,360 |

| | (2,473 | ) | | (5,268 | ) | | (1,092 | ) | | 2,018 |

| | | | 1,813 |

| | 6,711 |

| | (4,898 | ) |

Income before income taxes | | $ | 55,652 |

| | $ | 82,793 |

| | $ | 17,843 |

| | $ | 128,852 |

| | $ | 77,833 |

| | $ | (22,181 | ) | | | | $ | 156,288 |

| | $ | 222,793 |

| | $ | (66,505 | ) |

| | | | | | | | | | | | | | | | | | | | |

Loss and Expense Ratios: | | | | | | | | | | | | | | | | | | | | |

Claims and other policy benefits | | 91.2 | % | | 88.9 | % | | 93.3 | % | | 83.6 | % | | 87.9 | % | | 3.3 | % | | | | 91.1 | % | | 88.7 | % | | 2.4 | % |

Policy acquisition costs and other insurance expenses | | 13.8 | % | | 14.4 | % | | 14.2 | % | | 13.8 | % | | 13.7 | % | | 0.1 | % | | | | 14.1 | % | | 13.5 | % | | 0.6 | % |

Other operating expenses | | 2.4 | % | | 2.3 | % | | 2.4 | % | | 2.4 | % | | 2.4 | % | | 0.0 | % | | | | 2.4 | % | | 2.3 | % | | 0.1 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Reinsurance Group of America, Incorporated U.S. and Latin America Non-Traditional Segment—Asset Intensive Reinsurance Pre-tax Operating Income |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Current Qtr vs. PY Quarter | | | | Year-to-date |

| | Sept. 30, | | June 30, | | March 31, | | Dec. 31, | | Sept. 30, | | | | | Sept. 30, | | Sept. 30, | | |

(USD thousands) | | 2015 | | 2015 | | 2015 | | 2014 | | 2014 | | | | | 2015 | | 2014 | | Change |

Revenues: | | | | | | | | | | | | | | | | | | | | |

Net premiums | | $ | 5,177 |

| | $ | 5,941 |

| | $ | 5,041 |

| | $ | 4,747 |

| | $ | 5,168 |

| | $ | 9 |

| | | | $ | 16,159 |

| | $ | 15,332 |

| | $ | 827 |

|

Investment income, net of related expenses | | 103,052 |

| | 152,616 |

| | 141,470 |

| | 155,557 |

| | 170,608 |

| | (67,556 | ) | | | | 397,138 |

| | 473,154 |