Current Report Filing (8-k)

July 13 2016 - 4:32PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported)

July

13, 2016

Radian Group Inc.

(Exact

Name of Registrant as Specified in Its Charter)

|

Delaware

|

1-11356

|

23-2691170

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

1601

Market Street, Philadelphia, Pennsylvania

|

19103

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

(215) 231 - 1000

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions

(

see

General Instruction

A.2. below)

:

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 8.01. Other Events

Notice of Redemption to the Holders of the Radian Group Inc. 9.000%

Senior Notes due 2017

On July 13, 2016, Radian Group Inc. (the “Company”) delivered notices of

redemption (the “Redemption Notices”) to all of the holders of its

outstanding 9.000% Senior Notes due 2017 (the “Notes”), issued pursuant

to that certain Senior Indenture, dated as of June 7, 2005, by and among

the Company and U.S. Bank National Association, as successor trustee to

Wells Fargo Bank, NA (the “Senior Indenture”), as supplemented by

Officers’ Certificates, dated as of February 28, 2013 and dated as of

June 15, 2013 (together with the Senior Indenture, the

“Indenture”). The Company will redeem the entire $195.5 million

aggregate principal amount outstanding of the Notes. The redemption

date will be August 12, 2016 (the “Redemption Date”).

Pursuant to the Indenture, the Notes will be redeemed at a redemption

price (the “Redemption Price”) equal to the greater of: (i) 100% of the

aggregate principal amount of the outstanding Notes; or (ii) the sum of

the present value of the remaining scheduled payments of principal and

interest on the outstanding Notes (not including any portion of such

payments of interest accrued to the Redemption Date) discounted to the

Redemption Date on a semi-annual basis (assuming a 360-day year

consisting of twelve 30-day months) at the Adjusted Treasury Rate (as

defined in the Indenture) plus 50 basis points, as calculated by an

Independent Investment Banker (as defined in the Indenture), plus, in

each case accrued and unpaid interest. The Adjusted Treasury Rate will

be calculated on the second business day preceding the Redemption

Date. The Company will publicly announce the Redemption Price as soon

as reasonably practical after it is calculated.

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

RADIAN GROUP INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

Date:

|

July 13, 2016

|

By:

|

/s/ J. Franklin Hall

|

|

|

|

|

J. Franklin Hall

|

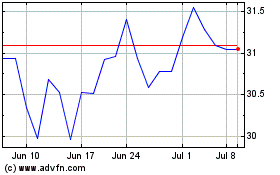

Radian (NYSE:RDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

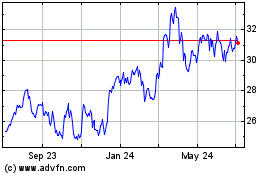

Radian (NYSE:RDN)

Historical Stock Chart

From Apr 2023 to Apr 2024