Pearson To Slash 4,000 Jobs

January 22 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 1/22/16)

By Simon Zekaria

LONDON -- Pearson PLC on Thursday said it was launching fresh

cost-savings of half a billion dollars and planned to ax 10% of its

workforce world-wide after cutting its earnings guidance.

The London-based company, which makes most of its revenue from

educational services in the U.S., said it was cutting 4,000 jobs

and had underestimated the effect of trading pressures across its

main markets. The company plans to simplify its structure by

merging businesses and focusing on fewer, bigger opportunities.

Pearson has raised $2.5 billion from disposals during the last

three years, including its flagship publishing asset, the Financial

Times newspaper, to fund its growth across global education, which

includes textbooks in Western markets, learning programs and

English-language schools.

In August, Pearson sold its 50% non-controlling stake in the

publisher of the Economist magazine for $731 million. The disposal

followed its sale of the FT Group for $1.32 billion.

But Pearson said rapid growth in employment and increasing

regulation in the U.S. has resulted in higher-education enrollments

falling approximately 10% to about 19 million in 2015 from a peak

of around 21 million in 2010. It also said certain enrollments in

the U.K. have fallen, and purchases of textbooks in South Africa

had dropped significantly.

"In combination, these factors have reduced Pearson's operating

profit by approximately GBP 230 million from its peak. We

overestimated how quickly those markets would return to sustainable

levels of revenues and profits from their peak," the company

said.

(END) Dow Jones Newswires

January 22, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

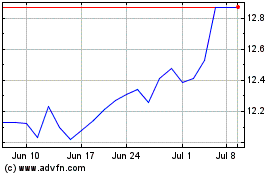

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

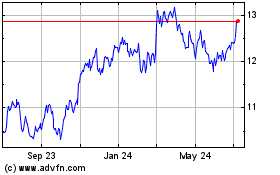

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024