Prologis Posts Revenue Gains on Low Vacancy

January 26 2016 - 10:30AM

Dow Jones News

By Austen Hufford

Industrial real-estate company Prologis Inc. (PLD) said

record-low vacancy rates boosted revenue, though profit dropped

from a year-earlier quarter that was boosted by hefty gains.

Chief Executive Hamid Moghadam said the company expects an

extended period of low vacancy rates. The company projected 2016

earnings per share of 28 cents to 36 cents, as well as core funds

from operations of $2.50 to $2.60 a share. Analysts polled by

Thomson Reuters projected core FFO of $2.45.

The current Prologis was formed in June 2011, when the nation's

two biggest publicly traded warehouse owners--Prologis and AMB

Property Corp.--merged in one of the largest real estate deals

since the recession.

In the latest quarter, Prologis said occupancy for real estate

it owns and manages increased to 96.9% from 96.1% a year

earlier.

In all for the period ended Dec. 31, Prologis's profit fell to

$120 million from $410.3 million a year earlier, which was boosted

by a one-time gain of $341.9 million. On a per-share basis after

the payout of preferred dividends, the company earned 23 cents a

share, down from 81 cents a year earlier.

Core funds from operations were 64 cents a share, compared with

48 cents a share a year prior. Revenue surged 43% to $643.2

million.

Analysts had forecast 13 cents a share in earnings on $545

million in revenue and 58 cents of core FFO.

Prologis shares, down around 11% in the last three months,

gained 1% to $38.59 in early trading.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

January 26, 2016 10:15 ET (15:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

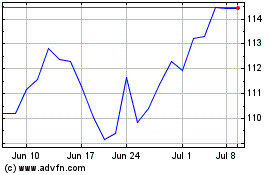

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

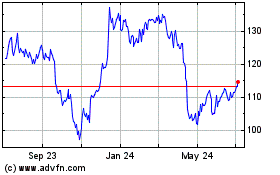

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024