Activist Elliott Takes Stake in PulteGroup

June 07 2016 - 6:00PM

Dow Jones News

Hedge fund Elliott Management Corp. has taken a stake in home

builder PulteGroup, which in recent months has been embroiled in a

battle between its founder and chief executive over the company's

future.

A Pulte spokeswoman confirmed that Elliott Management has taken

a position, though she didn't specify the size of the stake.

In a statement, the company said "we welcome dialogue with all

of our shareholders." A spokesman for Elliott Management declined

to comment.

The move by the activist hedge fund marks the latest twist in a

saga that began with a public spat between PulteGroup founder

William J. "Bill" Pulte and chairman and chief executive Richard

Dugas two months ago.

Amid pressure from Mr. Pulte, who is the company's largest

shareholder, Mr. Dugas announced in early April he would be

retiring next year. But Mr. Pulte continued to demand Mr. Dugas's

immediate resignation, arguing to board members and shareholders in

a series of letters that PulteGroup's stock performance and sales

volume have lagged behind rival home builders throughout the

housing recovery.

Shareholders re-elected Mr. Dugas as chairman and chief

executive, along with the entire board, at the company's annual

meeting in May.

Mr. Pulte couldn't be reached for comment. His grandson, also

William J. "Bill" Pulte, declined to comment on the Elliott

Management stake.

Jack Micenko, an analyst with Susquehanna Financial Group, said

the founder and grandson have been speaking with institutional

investors over the last month and he believes "their message is

beginning to resonate with folks."

"It's clear they're not going away any time in the near future,"

Mr. Micenko said. "That's the one thing I'm absolutely sure of as I

come out of these meetings."

He said the two men are pushing for a new chief executive and a

shake-up of the company's board that would involve bringing on

people with more experience in the home building business.

In a research note last month, Mr. Micenko noted that the Pulte

family had hired a proxy advisory firm, Okapi Partners, and that

representatives of the firm were in attendance at his meeting with

them.

Michael Fein, a senior managing director at Okapi Partners, said

the firm isn't currently soliciting on behalf of the Pultes but

they have attended meetings with other shareholders. He declined to

comment further.

Elliott Management last year took a position in struggling

outdoor recreation retailer Cabela's. It also had a stake in

computer data and security company EMC Corp. before it was acquired

by computer maker Dell Inc. last year.

Write to Chris Kirkham at chris.kirkham@wsj.com

(END) Dow Jones Newswires

June 07, 2016 17:45 ET (21:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

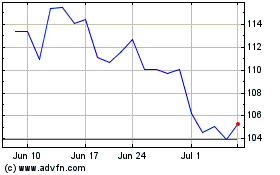

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Apr 2023 to Apr 2024