Philips Lighting Business Sale Halted by Regulatory Concerns

January 22 2016 - 3:40AM

Dow Jones News

AMSTERDAM—Royal Philips NV said Friday it has terminated the

planned sale of its lighting components and automotive-lighting

unit to a Chinese investor because of regulatory concerns in the

U.S.

The Dutch electronics group said the Committee on Foreign

Investment in the U.S., or CFIUS, didn't clear the planned disposal

of an 80% stake in its Lumileds business despite "extensive

efforts" to mitigate its concerns. Chief Executive Frans van Houten

said he was "very disappointed" about the committee's decision and

that Philips will now engage with other potential buyers who have

shown an interest in the business.

In March, Philips agreed to sell the stake to Go Scale Capital,

which is an investment fund led by Chinese venture-capital firm GSR

Ventures. The deal valued the business at $3.3 billion and was an

important step for Philips in its plan to exit its lighting

activities. The Dutch company is currently preparing to dispose of

its remaining lighting business through a listing or a sale.

Philips didn't say what type of concerns were raised by CFIUS,

which reviews international transactions on national security

grounds and has increased scrutiny of technology deals in the U.S.

involving Chinese buyers. The Lumileds business in the U.S.

comprises manufacturing as well as research-and-development

facilities.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

January 22, 2016 03:25 ET (08:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

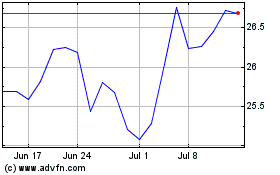

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

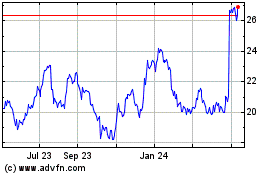

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024