Investor-Owned Utilities to Face Largest Liabilities from California Wildfires: Fitch -- Update

November 28 2018 - 3:29PM

Dow Jones News

(Adds details)

By Maria Armental

Fitch Ratings said Wednesday it sees a mixed credit fallout from

the recent California wildfires and investor-owned utilities like

PG&E Corp. taking the brunt of the risk.

Earlier this year, the credit-rating firm downgraded PG&E

and Edison International's Southern California Edison because of

potential outsized liabilities from the wildfires. PG&E remains

on negative credit watch, which means another downgrade could

follow.

"The increased frequency of wildfires and sheer magnitude of

potential exposure, coupled with an uncertain path to recovery,

meaningfully expands business risk for electric utilities operating

in California," Fitch said, adding that utilities' credit risks

reflect the application of California's application of inverse

condemnation.

Under a provision in California's constitution known as inverse

condemnation, utilities can be held liable for property damage and

legal expenses if their equipment is deemed to have been involved

in igniting a fire, even if the utility followed all rules and

regulations.

The state approved a law that gives utilities a clearer path to

recover wildfire-related costs by issuing bonds paid off by

customer surcharges -- provided that state regulators determine the

companies acted reasonably in maintaining and operating their

equipment and mitigating fire risks.

PG&E's stock has lost more than half of its value over the

past 12 months and spreads have widened significantly as its

financial exposure to the 2017 wildfires has been estimated at $15

billion. PG&E's liability would significantly increase if its

equipment is linked to the deadliest fires, the Tubbs Fire in 2017

and the Camp Fire this year.

PG&E, whose Pacific Gas & Electric Co. unit is

California's largest utility, has disclosed that a problem occurred

on one of its high-voltage power lines in Northern California some

15 minutes before the start of the Camp Fire was reported. Fire

officials haven't ruled on the cause of the fire.

Fitch also sees some counterparty risk for Kinder Morgan Inc.'s

Ruby Pipeline because of significant exposure to PG&E.

The re-insurance, home construction and U.S. public finance

sectors could also be impacted because of a state-wide economic

slowdown, damaged infrastructure and associated environmental

issues, Fitch said.

-- Erin Ailworth and Sara Randazzo contributed to this

article.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

November 28, 2018 15:14 ET (20:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

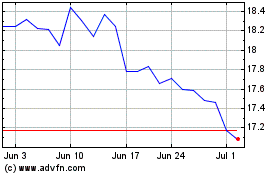

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

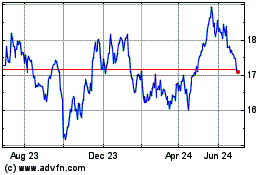

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024