Peltz Unlikely To Bring Quick Improvements To Ingersoll-Rand - Analysts

May 10 2012 - 8:04AM

Dow Jones News

Activist investor Nelson Peltz will likely have difficulty

leveraging his big stake Ingersoll-Rand PLC (IR) into a quick and

comprehensive overhaul of Ingersoll's business portfolio, analysts

predicted Wednesday.

In a regulatory filing Wednesday that disclosed a 7.1% stake in

Ingersoll's stock, Peltz's Trian Fund Management LP said it plans

to engage in talks with Ingersoll executives to press its case for

enhancing "shareholder value by ... considering various strategic

alternatives, including a restructuring of [the company's] key

business segments."

Trian did not outline specific strategies, but Peltz has a

record of lobbying for asset sales and corporate breakups to pump

up flagging stock prices. Trian also noted that it will push for

the "addition of several new independent directors" for the

Ingersoll board and aligning "management compensation with the

[company's] performance."

Peltz is the latest activist investor to wade into industrial

stocks in search of big returns from companies some consider

laggards. Other recent activist forays include Carl Icahn's large

stakes in truck makers Oshkosh Corp. (OSK) and Navistar

International Corp. (NAV) and Relational Investors LLC's stake in

Illinois Tool Works Inc. (ITW).

But Icahn's attempt to install an alternative slate of Oshkosh

directors was soundly rejected by shareholders in January. ITW

granted a seat on its board to one Relational's co-founders in

exchange for the investment-management firm's pledge to refrain

from a proxy fight. Illinois Tool recently outlined a plan to focus

its business portfolio on higher-growth companies. But the strategy

is likely to take years to execute as ITW methodically evaluates

hundreds of businesses and sells units that don't fit into its

plans.

"The industrials seem to be attracting these activists, but none

of the situations that we've seen has really been effective,"

Stephen Volkmann, an analyst for Jefferies & Co., said

Wednesday.

Peltz's intervention comes at a time when Ingersoll's stock

price is soaring. The stock is up 46% since the beginning of the

year, compared to 7.7% for the Standard & Poor's Composite

Index. In New York Stock Exchange trading Wednesday, Ingersoll rose

5.4%, closing at $44.54 a share.

Volkmann said he is skeptical about Peltz's ability to be the

catalyst for significant improvement at Ingersoll. While

Ingersoll's performance has trailed its multi-industry peers in

recent years, analysts add there are no immediate remedies for the

company's anemic profit margins and sluggish sales growth. Many of

Ingersoll's businesses are in highly cyclical industries or

dependent on long-slumping sectors such as residential and

commercial construction.

Ingersoll's businesses lines include Trane heating and air

conditioning equipment, Club Car golf carts, Thermo King truck

trailer refrigerators, Schlage door locks, and pneumatic power

tools.

Analysts say the profits generated by individual parts of the

company aren't compelling enough to justify the creation of new,

public companies that could be spun off to Ingersoll shareholders.

It's a strategy used by ITT Corp. (ITT) to dismantle itself last

year and Tyco International Ltd. (TYC) is pursuing a similar

breakup later this year.

Ingersoll has sold businesses in recent years, most notably its

construction equipment business in 2008. It sold a majority stake

of its Hussmann refrigerated-case business last year to

private-equity firm Clayton Dubilier & Rice LLC for $370

million. Although Ingersoll used the proceeds from the sale to buy

back its stock, the company's inability to sell no more than a 60%

share of the business was perceived as an indication of Hussmann's

diminished value.

Some analysts have suggested the company consider selling Club

Car. But the tax ramifications of a sale could dampen the benefits

for Ingersoll, which is headquartered in Ireland.

Nevertheless, observers say pressure from Peltz could be

beneficial for the company, which has a reputation for inefficient

operations that are difficult to improve.

Chairman and Chief Executive Michael Lamach last year was forced

to abandon an ambitious set of goals that included earnings per

share of $5 to $5.75 in 2013 and an operating margins of 15% to

17%. For 2011, Ingersoll reported earnings per share of $1.01.

Meanwhile, its first-quarter operating margin was 6.7%, down from

7.6% a year earlier.

Peltz's intervention in the Ingersoll "shouldn't be too

surprising," said Deane Dray, an analyst for Citi Investment

Research. "The conditions are ripe. You've had a company that has

chronically underperformed."

-By Bob Tita, Dow Jones Newswires; 312-750-4129;

robert.tita@dowjones.com

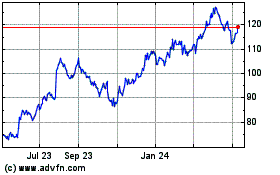

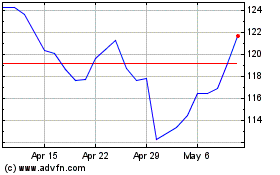

Oshkosh (NYSE:OSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oshkosh (NYSE:OSK)

Historical Stock Chart

From Apr 2023 to Apr 2024