Current Report Filing (8-k)

February 07 2017 - 5:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2017

OFG Bancorp

(Exact Name

of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Commonwealth of Puerto Rico

|

|

001-12647

|

|

66-0538893

|

|

(State or other Jurisdiction

of Incorporation)

|

|

(Commission

File No.)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

Oriental Center, 15

th

Floor

|

|

|

|

254 Muñoz Rivera Avenue

|

|

|

|

San Juan, Puerto Rico

|

|

00918

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(787) 771-6800

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to

Rule 14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Item 1.02 Termination of a Material Definitive Agreement.

Effective February 6, 2017, Oriental Bank (the “Bank”), the banking subsidiary of OFG Bancorp (the “Company”), entered

into a termination agreement (the “Termination Agreement”) with the Federal Deposit Insurance Corporation (the “FDIC”) to terminate the Single Family Shared-Loss Agreement and the Commercial Shared-Loss Agreement (collectively,

the “Shared-Loss Agreements”) between the Bank and the FDIC prior to their respective contractual maturities. The Shared-Loss Agreements were related to the Bank’s acquisition of certain assets and liabilities of Eurobank Puerto Rico

through an FDIC-assisted transaction on April 30, 2010.

Pursuant to the terms of the Shared-Loss Agreements, the FDIC would

reimburse the Bank for 80% of all qualifying losses with respect to assets covered by such agreements, and the Bank would reimburse the FDIC for 80% of qualifying recoveries with respect to losses for which the FDIC reimbursed the Bank. The Single

Family Shared-Loss Agreement provided for FDIC loss sharing and the Bank’s reimbursement to the FDIC to last for ten years, and the Commercial Shared-Loss Agreement provided for FDIC loss sharing and the Bank’s reimbursement to the FDIC to

last for five years, with additional recovery sharing for three years thereafter. At December 31, 2016, $52.7 million in net carrying value of single family mortgages and $1.7 million in real estate owned were covered by the

Shared-Loss Agreements.

The loss share termination transaction was completed on February 6, 2017. Under the terms of the Termination

Agreement, the Bank made a payment of $10,124,698 to the FDIC as consideration for the termination of the Shared-Loss Agreements. Such termination payment takes into account the amount of shared-loss claims filed by the Bank but not yet paid by the

FDIC. All rights and obligations of the parties under the Shared-Loss Agreements terminated as of the closing date of the Termination Agreement.

The foregoing description of the Termination Agreement is not complete and is qualified in its entirety by reference to the Termination

Agreement, a copy of which is filed as Exhibit 10.1 hereto and incorporated by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d)

Exhibits

|

|

|

|

|

Exhibit No.

|

|

Description of Document

|

|

|

|

|

10.1

|

|

Termination Agreement by and among the Federal Deposit Insurance Corporation, as receiver of Eurobank, the Federal Deposit Insurance Corporation, acting in its corporate capacity, and Oriental Bank, dated as of February 6,

2017.

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

OFG BANCORP

|

|

|

|

|

Date: February 7, 2017

|

|

By:

/s/ Carlos O. Souffront

|

|

|

|

Carlos O. Souffront

|

|

|

|

General Counsel and

|

|

|

|

Secretary of the Board of Directors

|

3

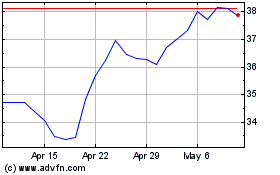

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

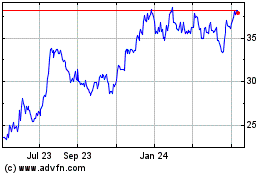

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Apr 2023 to Apr 2024