UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________________

FORM 11-K

_________________________

FOR ANNUAL REPORTS OF EMPLOYEE

STOCK REPURCHASE SAVINGS AND

SIMILAR PLANS PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One):

x

ANNUAL

REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the fiscal year ended

December 31, 2015

OR

☐

TRANSITION

REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For

the transition period from __________ to __________

Commission

file number

001-12647

A. Full title of the plan and the address of the plan,

if different from that of the issuer named below:

The Oriental Bank CODA Profit

Sharing Plan

c/o Oriental Bank

254 Muñoz Rivera Avenue,

Oriental Center 15

th

Floor

San Juan, Puerto Rico 00918

B. Name of issuer of the securities held pursuant to

the plan and the address of its principal executive office:

OFG BANCORP

254 Muñoz Rivera Avenue,

Oriental Center 15

th

Floor

San Juan, Puerto Rico 00918

The Oriental Bank CODA Profit Sharing Plan

TABLE OF CONTENTS

|

|

|

|

|

Page

|

|

|

|

|

Report

of Independent Registered Public Accounting Firm

|

1

|

|

|

|

|

Financial

Statements:

|

|

|

|

|

|

Statements of

Net Assets Available for Benefits as of December 31, 2015 and 2014

|

2

|

|

|

|

|

Statement of

Changes in Net Assets Available for Benefits for the year ended

December 31,

2015

|

3

|

|

|

|

|

Notes to Financial

Statements

|

4 – 10

|

|

|

|

|

Supplemental

Schedule:

|

|

|

Schedule I

– Schedule H, Line 4i - Schedule of Assets (Held at Year End) as of

December 31,

2015

|

11

|

|

|

|

|

Exhibits

|

12

|

|

|

|

|

Signatures

|

13

|

|

|

|

Report of

Independent Registered Public Accounting Firm

The 1165(e) Retirement Plan Committee

The Oriental Bank CODA Profit Sharing Plan:

We have audited the accompanying statements of net assets

available for benefits of The Oriental Bank CODA Profit Sharing Plan (the Plan)

as of December 31, 2015 and 2014, and the related statement of changes in net

assets available for benefits for the year ended December 31, 2015. These

financial statements are the responsibility of the Plan’s management. Our

responsibility is to express an opinion on these financial statements based on

our audits.

We conducted our audits in accordance with the standards of the

Public Company Accounting Oversight Board (United States). Those standards

require that we plan and perform the audit to obtain reasonable assurance about

whether the financial statements are free of material misstatement. An audit

includes examining, on a test basis, evidence supporting the amounts and

disclosures in the financial statements. An audit also includes assessing the

accounting principles used and significant estimates made by management, as

well as evaluating the overall financial statement presentation. We believe

that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present

fairly, in all material respects, the net assets available for benefits of the

Plan as of December 31, 2015 and 2014, and the changes in net assets available

for benefits for the year ended December 31, 2015, in conformity with U.S.

generally accepted accounting principles.

The supplemental information in the accompanying Schedule H, Line

4i – Schedule of Assets (Held at End of Year) as of December 31, 2015, has been

subjected to audit procedures performed in conjunction with the audit of the

Plan’s 2015 financial statements. The supplemental information is presented for

the purpose of additional analysis and is not a required part of the financial

statements but include supplemental information required by the Department of

Labor’s Rules and Regulations for Reporting and Disclosure under the Employee

Retirement Income Security Act of 1974. The supplemental information is the

responsibility of the Plan’s management. Our audit procedures included

determining whether the supplemental information reconciles to the financial

statements or the underlying accounting and other records, as applicable, and

performing procedures to test the completeness and accuracy of the information

presented in the supplemental information. In forming our opinion on the

supplemental information, we evaluated whether the supplemental information,

including its form and content, is presented in conformity with the Department

of Labor’s Rules and Regulations for Reporting and Disclosure under the

Employee Retirement Income Security Act of 1974. In our opinion, the

supplemental information in the accompanying Schedule H, Line 4i – Schedule of

Assets (Held at End of Year) as of December 31, 2015, is fairly stated in all

material respects in relation to the 2015 financial statements as a whole.

/s/

KPMG LLP

June

24, 2016

San

Juan, Puerto Rico

Certified

Public Accountants

|

THE

ORIENTAL BANK CODA PROFIT SHARING PLAN

|

|

Statements of Net Assets Available for Benefits

|

|

December 31, 2015 and 2014

|

|

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

Assets:

|

|

|

|

|

|

|

Investments at fair value:

|

|

|

|

|

|

|

Cash and money market instruments

|

$

|

7,640

|

|

$

|

12,427

|

|

Common stock

|

|

2,015,839

|

|

|

4,056,456

|

|

Insurance company investment contracts

|

|

|

|

|

|

|

(pooled separate accounts)

|

|

31,790,475

|

|

|

31,249,800

|

|

|

|

33,813,954

|

|

|

35,318,683

|

|

Fully benefit-responsive investment contract

|

|

|

|

|

|

|

(stable value fund), at contract value

|

|

7,377,514

|

|

|

7,260,285

|

|

Total investments

|

|

41,191,468

|

|

|

42,578,968

|

|

Receivables:

|

|

|

|

|

|

|

Dividends

|

|

16,523

|

|

|

24,363

|

|

Notes receivable from participants

|

|

19,851

|

|

|

32,497

|

|

Total receivables

|

|

36,374

|

|

|

56,860

|

|

Other assets

|

|

12,166

|

|

|

-

|

|

Total assets

|

$

|

41,240,008

|

|

$

|

42,635,828

|

|

Liabilities:

|

|

|

|

|

|

|

Other liabilities

|

$

|

105,216

|

|

$

|

71,284

|

|

Total liabilities

|

|

105,216

|

|

|

71,284

|

|

Net assets available for benefits

|

$

|

41,134,792

|

|

$

|

42,564,544

|

|

|

|

|

|

|

|

|

See accompanying notes to

financial statements.

|

|

THE

ORIENTAL BANK CODA PROFIT SHARING PLAN

|

|

Statement of Changes in Net Assets Available for

Benefits

|

|

Year ended December 31, 2015

|

|

|

2015

|

|

Additions to net assets attributed to:

|

|

|

|

Dividends

|

$

|

85,583

|

|

Interest and other

|

|

108,614

|

|

Contributions:

|

|

|

|

Participants

|

|

2,958,875

|

|

Employer

|

|

799,517

|

|

Total additions

|

|

3,952,589

|

|

Deductions from assets attributed to:

|

|

|

|

Benefits paid to participants

|

|

(2,998,023)

|

|

Net depreciation in fair value of investments

|

|

(2,277,127)

|

|

Administrative fees

|

|

(107,191)

|

|

Total deductions

|

|

(5,382,341)

|

|

Net decrease

|

|

(1,429,752)

|

|

Net assets available for benefits:

|

|

|

|

Beginning of year

|

|

42,564,544

|

|

End of year

|

$

|

41,134,792

|

|

|

|

|

|

See accompanying notes to

financial statements.

|

THE ORIENTAL BANK

CODA PROFIT SHARING PLAN

NOTES TO FINANCIAL

STATEMENTS

YEARS ENDED DECEMBER

31, 2015 AND 2014

(1)

Description of the Plan

The following description of The Oriental

Bank CODA Profit Sharing Plan (the “Plan”) provides only general information.

Participants should refer to the plan agreement for a more complete description

of the Plan’s provisions.

(a)

General

The Plan was organized on January 1, 1992 as a defined

contribution plan originally maintained by Oriental Bank (the “Employer”), a

wholly owned subsidiary of OFG Bancorp (the “Company”), for the benefit of the

Employer’s and its affiliated companies’ employees who are residents of Puerto

Rico and are age 21 or older. The Plan is intended to be a qualified plan

pursuant to the Puerto Rico Internal Revenue Code of 2011, as amended (the

“2011 Code”). It contains a cash or deferred arrangement qualifying under the

2011 Code and is subject to the provisions of the Employee Retirement Income

Security Act of 1974, as amended (“ERISA”).

(b)

Contributions

Each year, participants may contribute up to the

maximum deferral amount under the provisions of Code Section 402(g) of the U.S.

Code as annually indexed by the U.S. Internal Revenue Service (for 2015 and

2014 the limits were $18,000 and $17,500, respectively). If in addition to a

deferral election under the Plan, participants contribute to an individual

retirement account in Puerto Rico (“PR-IRA”), pre-tax contributions to both the

Plan and a PR-IRA in the aggregate cannot exceed the sum of the annual deferral

limit under the 2011 Code ($20,000 for the tax years ended December 31, 2015

and 2014). Participants may also contribute amounts representing distributions

from other Puerto Rico and U.S. qualified defined benefit or contribution

plans.

Participants direct the investment of their

contributions into various investment options offered by the Plan. The Plan

currently offers pooled separate accounts, a stable value fund, and shares of

common stock of the Company as investment options for participants. Participants

direct the investment of their matching contributions in the Plan. The Employer

provides a discretionary matching contribution of 50% of each participant’s

contributions up to a maximum contribution for matching purposes of 4% of the

participant’s compensation per year.

(c)

Participant Accounts

Each participant’s account is credited with the

participant’s contribution and allocations of the Employer’s contribution and

Plan earnings, and charged with an allocation of administrative fees.

Allocations are based on participant earnings or account balances, as defined.

The benefit to which a participant is entitled to is the benefit that can be

provided from the participant’s vested account.

(d)

Vesting

Participants are immediately vested in their

contributions plus actual earnings thereon. The Employer’s contribution portion

of their accounts plus actual earnings thereon vest upon the occurrence of any

of the following events: completion of three years of credited service;

attaining age 65; total disability while employed by the Employer; or death

while employed by the Employer.

(e)

Payment of Benefits

On termination of service due to death, disability, or

retirement, a participant or its heirs may elect to receive the value of the

vested interest in his or her account in either a lump sum amount, a fixed

period that may not exceed the participant’s life expectancy or through a fixed

annuity contract. For termination of service for other reasons, a participant

may receive the value of the vested interest in his or her account as a lump

sum distribution.

THE ORIENTAL BANK

CODA PROFIT SHARING PLAN

NOTES TO FINANCIAL

STATEMENTS

YEARS ENDED DECEMBER

31, 2015 AND 2014

(f)

Loans to Participants

The Plan does not allow for loans to participants. In

October 2013, the Plan Participación en Beneficios 1081 Banco Bilbao Vizcaya

Argentaria Puerto Rico ("BBVAPR"), a defined contribution plan which

covered all fulltime employees of the former BBVAPR Bank, transferred its

existing participant loans amounting to approximately $54,000 to the Plan.

These loans will be extinguished as they are repaid by participants. Loan terms

range from 1-5 years or up to 30 years for a home loan. The loans are secured

by the balance in the participant’s account and bear interest at a rate

commensurate with the interest rate charged by persons in the business of

lending money for loans which would be made under similar circumstances.

Principal and interest is paid ratably through payroll deductions. No

additional loans will be granted to participants.

(g)

Forfeited Accounts

Employer contributions that are not vested upon

termination of employment are forfeited and may be used to pay administrative

expenses and then reduce future contributions to the Plan by the Employer. For

the years ended December 31, 2015 and 2014, forfeitures totaling approximately

$9,000 and $197,000, respectively, were used to offset Employer contributions.

At December 31, 2015 and 2014 the forfeiture account had no balance.

(h)

Plan Termination

Although it has not expressed any intent to do so, the

Employer has the right under the Plan to discontinue its contributions at any

time and to terminate the Plan subject to the provisions of ERISA. In the event

of Plan termination, participants will become 100% vested in their Employer’s

contributions.

(2)

Summary of Significant Accounting

Policies

Following are the significant accounting

policies followed by the Plan:

(a)

Basis of Presentation

The accompanying financial statements have been

prepared under the accrual method of accounting.

Investment contracts held by a defined contribution

plan are required to be reported at fair value. However, for a defined

contribution plan attributable to fully benefit responsive investment

contracts, such as the stable value fund, the contract value is the relevant

measurement attribute for that portion of the net assets available for plan

benefits since it is the amount participants would receive if they were to

initiate permitted transactions under the terms of the Plan. The statement of

net assets available for benefits presents the contract value of the fully

benefit-responsive investment contracts.

(b)

Use of Estimates

The preparation of financial statements in conformity

with U.S. generally accepted accounting principles requires the plan

administrator to make estimates and assumptions that affect the reported

amounts of assets and liabilities and changes therein, and disclosure of

contingent assets and liabilities. Actual results could differ from those

estimates. A material estimate that is particularly susceptible to significant

change in the near term is the valuation of investments.

(c)

Risks and Uncertainties

The Plan invests in various financial instruments.

Investment securities are exposed to various risks, such as interest rate,

credit, and market risks. Due to the level of risk associated with certain

investment securities, it is reasonably possible that changes in the fair

values of investment securities will occur in the near term and that such

changes could materially affect participants’ account balances and the amounts

reported in the statements of net assets available for benefits.

THE ORIENTAL BANK

CODA PROFIT SHARING PLAN

NOTES TO FINANCIAL

STATEMENTS

YEARS ENDED DECEMBER

31, 2015 AND 2014

(d)

Investments Valuation and Income

Recognition

Fully

benefit-responsive investment contracts (FBRICs) are reported at contract

value, which is the amount participants would receive if they were to initiate

permitted transactions under the terms of the Plan. The Plan invests in FBRICs

through the Stable Value Fund.

Plan investments, other than FBRICs, are stated at

fair value. See Note 3 for discussion of fair value measurements.

Shares of registered investment companies are valued

at quoted market prices which represent the net asset value of shares held by

the Plan at year-end.

Purchases and sales of securities are recorded on a

trade date basis. Interest income is recorded on the accrual basis. Dividends

are recorded on the declaration date, taking into consideration the ex-dividend

date. Net appreciation/ depreciation includes the Plan’s gains and losses on

investments bought and sold as well as held during the year.

(e)

Payments of Benefits

Benefits are recorded when paid.

(f)

Plan Expenses

Under the Plan’s contract entered into with

Transamerica Retirement Solutions Corporation ("Transamerica"),

contract asset charges are assessed each month based on the actual combined

balance of all separate accounts and the stable value fund. These charges are

presented as administrative fees in the statement of changes in net assets

available for benefits.

Administrative expenses, including trustee, legal,

auditing, and other fees, may be paid out of the invested assets unless paid by

the Employer. Expenses paid and absorbed by the Employer during the year ended

December 31, 2015 amounted to $103,617.

(g)

Recent Accounting Developments

In May 2015, the Financial Accounting Standards Board

(“FASB”) issued Accounting Standards Update (“ASU”) No. 2015-07, Fair Value

Measurement (Topic 820): Disclosures for Investments in Certain Entities That

Calculate Net Asset Value per Share (or Its Equivalent). ASU 2015-07 removes

the requirement to include investments in the fair value hierarchy for which

fair value is measured using the net asset value practical expedient in

Accounting Standards Codification 820. ASU 2015-07 requires retrospective

application and is effective for fiscal years beginning after December 15, 2015

with early adoption permitted. Management elected the early adoption of the

provisions of this new standard. Accordingly, the standard was retrospectively

applied.

THE ORIENTAL BANK

CODA PROFIT SHARING PLAN

NOTES TO FINANCIAL

STATEMENTS

YEARS ENDED DECEMBER

31, 2015 AND 2014

In July 2015, the FASB

issued ASU No. 2015-12, Plan Accounting: Defined Benefit Pension Plans (Topic

960), Defined Contribution Pension Plans (Topic 962), and Health and Welfare

Benefit Plans (Topic 965) - I. Fully Benefit-Responsive Investment Contracts;

II. Plan Investment Disclosures, and III. Measurement Date Practical Expedient.

Part I requires fully-benefit responsive investment contracts to be measured,

presented, and disclosed only at contract value. Part II requires that

investments that are measured using fair value (both participant-directed and

nonparticipant-directed investments) be grouped only by general type,

eliminating the need to disaggregate the investments by nature,

characteristics, and risks. Part II also eliminates the disclosure of

individual investments that represent 5 percent or more of net assets available

for benefits and the disclosure of net appreciation or depreciation for

investments by general type, requiring only presentation of net appreciation or

depreciation in investments in the aggregate. Additionally, if an investment is

measured using the net asset value per share as a practical expedient and that

investment is a fund that files a U.S. Department of Labor Form 5500, as a

direct filing entity, disclosure of that investment’s strategy is no longer

required. Part III is not applicable to the Plan. The amendments in ASU 2015-12

are effective for fiscal years beginning after December 15, 2015, with early

application permitted. The amendments within Parts I and II require

retrospective application. Management elected the early adoption of the provisions

of Parts I and II of this new standard. Accordingly, these provisions were

retrospectively applied.

(3)

Fair Value

As discussed in Note 2,

the Plan uses the fair value measurement framework under U.S. generally

accepted accounting principles.

Fair Value Measurement

Fair value is the exchange price that

would be received for an asset or paid to transfer a liability (an exit price)

in the principal or most advantageous market for the asset or liability in an

orderly transaction between market participants on the measurement date. The

fair value hierarchy requires an entity to maximize the use of observable

inputs and minimize the use of unobservable inputs when measuring fair value.

The three levels of inputs that may be used to measure fair value are:

Level 1

–

assets include equity securities that are traded in an active exchange market,

as well as certain money market instruments. Valuations are obtained from

readily available pricing sources for market transactions involving identical

assets.

Level 2

–

observable inputs other than Level 1 prices such as quoted prices for similar

assets; quoted prices in markets that are not active; or other inputs that are

observable or can be corroborated by observable market data for substantially

the full term of the assets.

Level 3

–

unobservable inputs that are supported by little or no market activity and that

are significant to the fair value of the assets or liabilities. Level 3 assets

include financial instruments whose value is determined using pricing models,

for which the determination of fair value requires significant management

judgment or estimation. As of December 31, 2015 and 2014, the Plan did not have

such assets.

The following is a description of the valuation

methodologies used for instruments measured at fair value:

Shares of the Company’s common stock

: valued at quoted closing market prices (“Level 1”).

Money Market Instruments

: stated at fair value, which approximates cost plus

accumulated interest earnings less distributions to date (“Level 1”).

The estimated fair value is subjective in nature and

involves uncertainties and matters of significant judgment and, therefore,

cannot be determined with precision. Changes in assumptions could affect these

fair value estimates. The fair value estimates do not take into consideration

the value of future business and the value of assets and liabilities that are

not financial instruments.

THE ORIENTAL BANK

CODA PROFIT SHARING PLAN

NOTES TO FINANCIAL

STATEMENTS

YEARS ENDED DECEMBER

31, 2015 AND 2014

There

were no transfers into or out of Level 1 and Level 2 fair value measurements

during the years ended December 31, 2015 and 2014.

The following tables set forth

by level, within the fair value hierarchy, the Plan’s fair value measurements

at December 31, 2015 and 2014:

|

|

December 31, 2015

|

|

|

Fair Value Measurements

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Cash and money market instruments

|

$

|

7,640

|

|

$

|

-

|

|

$

|

-

|

|

$

|

7,640

|

|

Common stock

|

|

2,015,839

|

|

|

-

|

|

|

-

|

|

|

2,015,839

|

|

|

|

2,023,479

|

|

|

-

|

|

|

-

|

|

|

2,023,479

|

|

Investment measured at net asset value (a)

|

|

-

|

|

|

-

|

|

|

-

|

|

|

31,790,475

|

|

|

$

|

2,023,479

|

|

$

|

-

|

|

$

|

-

|

|

$

|

33,813,954

|

|

(a) Certain investments that are measured at fair value using

the net asset value per share (or its equivalent) practical expedient have

not been categorized in the fair value hierarchy. The fair value amounts

presented in this table are intended to permit reconciliation of the fair

value hierarchy to the amounts presented in the statement of financial

position.

|

|

|

December 31, 2014

|

|

|

Fair Value Measurements

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Money market instruments

|

$

|

12,427

|

|

$

|

-

|

|

$

|

-

|

|

$

|

12,427

|

|

Common stock

|

|

4,056,456

|

|

|

-

|

|

|

-

|

|

|

4,056,456

|

|

|

|

4,068,883

|

|

|

-

|

|

|

-

|

|

|

4,068,883

|

|

Investment measured at net asset value (a)

|

|

-

|

|

|

-

|

|

|

-

|

|

|

31,249,800

|

|

|

$

|

4,068,883

|

|

$

|

-

|

|

$

|

-

|

|

$

|

35,318,683

|

|

(a) Certain investments that are measured at fair value using

the net asset value per share (or its equivalent) practical expedient have

not been categorized in the fair value hierarchy. The fair value amounts

presented in this table are intended to permit reconciliation of the fair

value hierarchy to the amounts presented in the statement of financial

position.

|

THE ORIENTAL BANK

CODA PROFIT SHARING PLAN

NOTES TO FINANCIAL

STATEMENTS

YEARS ENDED DECEMBER

31, 2015 AND 2014

(4)

Stable Value Fund

Transamerica

offers a stable value fund that the participant may elect to transfer all or

part of their funds into. The stable value fund is considered to be a fully

benefit-responsive investment contract. Contract value is the relevant

measurement attribute for that portion of the net assets available for

benefits. Contract value, as reported by Transamerica, is the beginning balance

plus any deposit and credited interest, less any withdrawals, charges, or

expenses, a measurement that approximates fair value. Participants may

ordinarily direct the withdrawal or transfer of all or a portion of their

investment at contract value.

There are

no reserves against contract value for credit risk of Transamerica or

otherwise. The fair value of the investment contract at December 31, 2015 and

2014 was $7,377,514 and $7,260,285, respectively. The stable value funds invests

in Guaranteed Investment Contracts ("GICs"). This investment seeks to

protect against any loss of principal while providing returns in excess of

money market funds and one year U.S. Treasury bills. The investment has a

portfolio investment rate design in which all deposits are credited with the

same interest rate, on a daily basis, and with no set maturity. The effective

credited interest rate is set monthly and effective on the first day of the

month. Contract charges may reduce this return. The Transamerica sable value fund

is not a separate account investment choice – it is an investment in Transamerica’s

general account.

Certain

events limit the ability of the Plan to transact at contract value with

Transamerica. Such events include the following: (1) the Plan is changed so as

to significantly affect Transamerica’s obligations to the contract, (2) the

contract can no longer be treated as a pension plan contract, (3) the Plan is

terminated, (4) failure to comply with the contract’s requirements, (5) failure

to provide information, (6) the sum of the contract account values at any time

equals $20,000 or less, or (7) the failure of the trust to qualify for

exemption from federal income taxes or any required prohibited transaction

exemption under ERISA. The plan administrator is not aware of any events, which

would limit the Plan’s ability to transact at contract value with participants

that are probable.

(5)

Other assets

During

the plan year ended December 31, 2015, the Employer successfully negotiated a

fee concession with Transamerica that resulted in Transamerica rebating certain

amounts to the plan. The rebate amount is equal to 12.5 basis points per year

based on the balances with Transamerica. This rebate is calculated on a monthly

basis and credited to the Expense Budge Account, a suspense account used by

Transamerica.

The

Expense Budget Account may be used for plan expenses or allocated to

participants as additional income. At December 31, 2015, the Plan did not

apply this amount to expenses or to participants. The balance remains in the

Expense Budget Account and is included as other assets in the statements of net

asset available for benefits.

(6)

Related‑Party Transactions

Certain Plan investments

are shares of the Company’s common stock. The Employer is the Plan sponsor and

trustee and a wholly owned subsidiary of the Company and, therefore, qualifies

as a party in interest. At December 31, 2015 and 2014, the Plan held an

investment of 275,388 and 243,631 shares of the Company’s common stock,

respectively. The fair value of the common stock at December 31, 2015 and 2014

was $2,015,839 and $4,056,456, respectively.

The recordkeeper of the

Plan is Oriental Pension Consultants, Inc. (“OPC”), a subsidiary of the

Company. Fees charged by OPC for services provided were absorbed by the

Employer.

THE ORIENTAL BANK

CODA PROFIT SHARING PLAN

NOTES TO FINANCIAL

STATEMENTS

YEARS ENDED DECEMBER

31, 2015 AND 2014

(7)

Income Taxes

The trust established to fund

the Plan is intended to be exempt from Puerto Rico and U.S. income taxes, the

2011 Code, and the U.S. Code. As applicable, the Plan is required to operate in

conformity with the 2011 Code and the U.S. Code to maintain its qualification.

The Plan administrator believes that the Plan is designed and operating in

compliance with the applicable requirements of the Puerto Rico Treasury

Department (“PR Treasury”) and U.S. Code and remains qualified.

U.S. generally accepted

accounting principles require plan management to evaluate tax positions taken

by the Plan and recognize a tax liability (or asset) if the Plan has taken an

uncertain position that more likely than not would not be sustained upon

examination by the IRS and the PR Treasury. As of December 31, 2015 and 2014,

there are no uncertain tax positions taken or expected to be taken that would

require recognition or disclosure in the financial statements. The Plan is

subject to routine audits by taxing jurisdictions. However, there are currently

no audits in progress for any tax periods. The Plan is no longer subject to

income tax examinations for the years prior to 2012.

(8)

Excess Contributions Payable to

Participants

The

Plan is subject to certain non-discrimination rules under ERISA and the 2011

Code. For 2015 and 2014 the Plan failed certain of the non-discrimination tests

under the 2011 Code due to lower contribution percentages by non-highly

compensated eligible employees relative to the contribution percentages of

highly compensated eligible employees. In order to meet the requirements of the

non-discrimination rules, the Plan refunded a portion of the contributions made

by highly compensated participants, in accordance with applicable provisions of

the 2011 Code. The refund for 2015, paid in March 2016, totaled $105,216. The

refund for 2014, paid in March 2015, totaled $71,274. The refunds are included

as other liabilities in the statements of net assets available for benefits.

(9)

Prohibited Transaction –

Participants’ Contributions Remittances

In accordance with the

U.S. Department of Labor’s Regulation 2510.3102, an employer is required to

segregate participants’ contributions from its general assets as soon as practical

when amounts are contributed by participants or withheld from their wages for a

pension benefit plan such as the Plan. No prohibited transactions occurred

during the years ended December 31, 2015 and 2014.

(10)

Subsequent events

The Plan has evaluated subsequent

events from the statement of net assets available for benefits date through

June 24, 2016, the date of filing this Annual Report on Form 11-K for the year

ended December 31, 2015.

|

SCHEDULE I

|

|

THE

ORIENTAL BANK CODA PROFIT SHARING PLAN

|

|

Schedule H, Line 4i - Schedule of Assets (Held at

End of Year)

|

|

December 31, 2015

|

|

|

|

|

|

|

|

|

|

(c)

|

|

|

|

|

|

|

|

(b)

|

|

|

Description of Investment,

including maturity

date, rate of interest,

collateral, par,

or maturity value

|

|

|

|

|

|

|

|

Identity of issue,

borrower,

lessor, or similar party

Identity of issue,

borrower,

lessor, or similar party

|

|

|

|

(d)

|

|

(e)

|

|

(a)

|

|

|

|

|

Cost

|

|

Current value

|

|

|

|

Participant directed:

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

OFG Bancorp

|

OFG Bancorp:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock; 275,388 shares

|

|

**

|

$

|

2,015,839

|

|

|

|

|

Transamerica

|

Pooled Separate Accounts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transamerica AA - Moderate; 283,324 units

|

|

**

|

|

5,574,814

|

|

|

|

|

|

|

|

|

|

|

WMC Core Equity; 473,798 units

|

|

**

|

|

5,063,039

|

|

|

|

|

|

|

|

|

|

|

AEGON Balanced; 60,630 units

|

|

**

|

|

4,863,184

|

|

|

|

|

|

|

|

|

|

|

SSgA Russell Lg Cap Grth Ind; 241,367 units

|

|

**

|

|

3,674,992

|

|

|

|

|

|

|

|

|

|

|

American Century Government Bond; 164,578 units

|

|

**

|

|

3,163,379

|

|

|

|

|

|

|

|

|

|

|

Fidelity Advisor Lev Co Stk; 39,759 units

|

|

**

|

|

2,249,873

|

|

|

|

|

|

|

|

|

|

|

SSgA International Index; 64,471

|

|

**

|

|

1,643,657

|

|

|

|

|

|

|

|

|

|

|

Loomis Sayles Inv Grade Bond; 28,383

|

|

**

|

|

1,048,120

|

|

|

|

|

|

|

|

|

|

|

Transamerica AA - Moderate Growth; 42,948 units

|

|

**

|

|

852,834

|

|

|

|

|

|

|

|

|

|

|

Thornburg Core Growth; 32,898 units

|

|

**

|

|

784,752

|

|

|

|

|

|

|

|

|

|

|

Transamerica AA - Growth; 26,959 units

|

|

**

|

|

532,900

|

|

|

|

|

|

|

|

|

|

|

SSgA Russell LC Value Index; 20,906 units

|

|

**

|

|

499,244

|

|

|

|

|

|

|

|

|

|

|

Transameric Partners High Yield Bond; 12,212 units

|

|

**

|

|

428,881

|

|

|

|

|

|

|

|

|

|

|

TA Vanguard Small- Cap Index; 2,356 units

|

|

**

|

|

418,188

|

|

|

|

|

|

|

|

|

|

|

Loomis Sayles Bond; 5,480 units

|

|

**

|

|

359,832

|

|

|

|

|

|

|

|

|

|

|

SSgA Russell SC Value Index; 4,485 units

|

|

**

|

|

313,863

|

|

|

|

|

|

|

|

|

|

|

Transamerica AA - Conservative; 15,610 units

|

|

**

|

|

299,820

|

|

|

|

|

|

|

|

|

|

|

TA Vanguard Small- Cap Grth Idx; 253 units

|

|

**

|

|

8,614

|

|

|

|

|

|

|

|

|

|

|

Franklin Small-Mid Cap Growth; 297 units

|

|

**

|

|

7,075

|

|

|

|

|

|

|

|

|

|

|

Invesco American Value; 237 units

|

|

**

|

|

3,414

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31,790,475

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and money markets

|

|

|

|

Cash and Bank Deposit Sweep Program

|

|

**

|

|

7,640

|

|

|

|

Fully benefit-responsive investment contract:

|

|

|

|

|

|

|

|

|

|

|

Transamerica

|

|

Transamerica Stable Value; 382,321 units

|

|

**

|

|

7,377,514

|

|

|

|

Other assets:

|

|

|

|

|

|

|

|

|

|

|

Transamerica

|

|

Expense Budget Account

|

|

—

|

|

12,166

|

|

*

|

|

Notes receivable from participants

|

|

Notes, with interest rate of 9.5%; maturities ranges

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

through 2032

|

|

—

|

|

19,851

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

41,223,485

|

|

*

|

|

Party-in-interest as defined by ERISA

|

|

|

|

|

|

**

|

|

Not applicable as these are participant directed.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See the accompanying report of independent registered public

accounting firm.

|

INDEX

OF EXHIBITS

|

Exhibit

No.

|

|

Description

of Document

|

|

23.1

|

|

Consent

of KPMG LLP

|

SIGNATURES

The

Plan

. Pursuant

to the requirements of the Securities Exchange Act of 1934, the trustees (or

other persons who administer the employee benefit plan) have duly caused this

annual report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

|

THE

ORIENTAL BANK CODA

PROFIT

SHARING PLAN

(Name

of Plan)

|

|

|

|

|

|

|

Date:

|

June

24, 2016

|

|

/s/

Ganesh Kumar

|

|

|

Ganesh

Kumar

|

|

|

|

Executive

Vice President and

|

|

|

|

Chief

Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Juan J. Santiago

|

|

|

|

Vice

President and Trust Officer

|

|

|

|

|

|

|

|

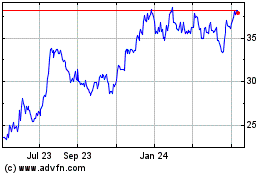

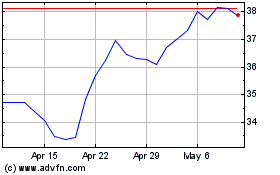

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Apr 2023 to Apr 2024