Current Report Filing (8-k)

April 22 2015 - 5:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 22, 2015

OFG Bancorp

(Exact Name

of Registrant as Specified in its Charter)

|

|

|

|

|

| Commonwealth of Puerto Rico |

|

001-12647 |

|

66-0538893 |

| (State or other Jurisdiction

of Incorporation) |

|

(Commission

File No.) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| Oriental Center, 15th Floor

254 Muñoz Rivera Avenue

San Juan, Puerto Rico |

|

00918 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (787) 771-6800

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. |

Regulation FD Disclosure. |

José Rafael Fernández, President, Chief

Executive Officer and Vice Chairman of the Board of Directors of Oriental Financial Group Inc. (the “Company”), will make a presentation at the Company’s annual meeting of shareholders on the date hereof, which will be held at 10:00

a.m. (EST). The slides that will accompany the presentation are furnished in this report as Exhibit 99.1 and are incorporated herein by reference, including the text of the slide entitled “Forward-Looking Statements.” The slides will also

be available in the “Investor Relations” section of the Company’s web site at www.ofgbancorp.com.

The information

in this report furnished pursuant to Item 7.01 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). It may only be incorporated by reference

in another filing under the Exchange Act or the Securities Act of 1933, as amended, if such subsequent filing specifically references the information furnished pursuant to Item 7.01 of this report.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit

No. |

|

Description of Document |

|

|

| 99.1 |

|

Slide presentation for the Company’s annual meeting of shareholders on April 22, 2015 (furnished pursuant to Item 7.01 hereof). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

OFG BANCORP |

|

|

|

|

| Date: April 22, 2015 |

|

|

|

By: |

|

/s/ Carlos O. Souffront |

|

|

|

|

|

|

Carlos O. Souffront |

|

|

|

|

|

|

General Counsel and Secretary of the Board of Directors |

|

|

|

Forward Looking Statements

2

The information included in this document contains certain forward-looking

statements within the meaning of the Private Securities Litigation Reform

Act of 1995. These statements are based on management’s current expectations and involve

certain risks and uncertainties that may cause actual results to

differ materially from those expressed in the forward-looking

statements.

Factors that might cause such a difference include, but are not limited to (i)

the rate of growth in the economy and employment levels, as well as

general business and economic conditions; (ii) changes in interest rates, as well as the

magnitude of such changes; (iii) a credit default by the government of Puerto

Rico; (iv) the fiscal and monetary policies of the federal government and

its agencies; (v) changes in federal bank regulatory and supervisory

policies, including required levels of capital; (vi) the relative strength

or weakness of the consumer and commercial credit sectors and of the real estate market in

Puerto Rico; (vii) the performance of the stock and bond markets; (viii)

competition in the financial services industry; and (ix) possible

legislative, tax or regulatory changes. For a discussion of such factors

and certain risks and uncertainties to which OFG is subject, see OFG’s annual report on Form

10-K for the year ended December 31, 2014, as well as its other filings with

the U.S. Securities and Exchange Commission. Other than to the extent

required by applicable law, including the requirements of applicable securities laws, OFG assumes no

obligation to update any forward-looking statements to reflect occurrences or

unanticipated events or circumstances after the date of such

statements. |

|

|

| Well

Diversified Business Focused on Puerto Rico 3

Highlights

Financials (12/31/14)

53 Branches, 332 ATMs in All Major Markets (4/1/15)

Loans

Deposits

* 4Q14 excludes $3.8 million accrual for cost savings in 2015

•

94% TBV growth 2008-2014

•

No. 2 bank in auto loans, No. 3 overall

•

Consumer / commercial banking

•

Well developed wealth management fee businesses

•

Efficiency ratio 49.19%* in 4Q14, down from 57.46% in

1Q13

•

Assets: $7.5 billion

•

Loans: $4.8 billion (42% under purchase accounting)

•

Deposits: $4.9 billion

•

AUM: $2.6 billion in BD, $2.8 billion in Trust

•

Market Cap: ~$744 million

Mortgage

30%

Commercial

25%

Auto

21%

Gov't

13%

Covered

6%

Consumer

5%

Demand

41%

Savings

26%

Time

21%

Brokered

13% |

|

|

| What

Makes OFG Distinctive 4

Overview

•

Strongest bank locally and among best performing compared to mainland banks

•

Disciplined management with prudent decision-making track record

•

Proven capabilities in bank acquisitions and integrations

•

Despite prolonged recession in Puerto Rico, bank has been successful by adapting

to evolving market conditions Focus on Markets Where We Can Make a

Difference •

Loan products that target market characteristics (auto and consumer loans)

•

Avoiding residential real estate risk by focusing on originate-to-sell

conforming mortgages •

Differentiating ourselves through service delivery and customer-facing

technology •

Diversified revenue sources include focus on SMEs, wealth management and trust

services Tight Controls

•

Ability to optimize investments and overall expenditure to keep efficiency ratio

down •

Franchise strength evident from low elasticity in deposits despite consistent

reductions in pricing •

Managing collections to control net charge offs

Generating Steady Profits, Growing Capital

•

Increasing dividends—$0.10 4Q14 dividend up 150% from 4Q09

•

Share buybacks—Bought back 2.3% of shares in 2014 spending $16.9

million •

Able to consider in/out market acquisitions |

|

|

| 2014:

Another Year of Accomplishment 5

Overview

•

First full year of combined operations after integration of BBVA

PR businesses

•

Improved consistency in quarterly operating results

•

NII close to 2013 despite lower average interest earning assets

Balance Sheet

•

Acquired loan balances lower as a portion of total portfolio

•

Improved funding profile by maintaining transactional and savings deposit

balances, while reducing time deposits, brokered CDs and borrowings

•

Reduced exposure to Puerto Rico government sector

Income Statement

•

Provisions higher than 2013, excluding the effect of NPL sales last year,

reflecting increasing balances in originated loans versus acquired

•

Fee income pressure in mortgage and banking segments, while wealth management

continues to be strong •

Lower non-interest expenses, even adjusting for non-recurring items

|

|

|

|

Performance Metrics: Compare Well to Other Publicly Traded Banks

6

1)

Efficiency ratio excludes $3.8 million accrual for cost savings in 2015

2)

KBW Industry Update, February 4, 2015

3)

Includes $16.3 million positive impact from 2Q13 non-recurring items

4Q14

OFG

OFG

1

SMID Cap

Banks

2

3 Year

Target

2014

2013

3

2012

Return on Average Assets

1.09%

1.25%

1.10%

1.15%

0.37%

Return on Average Tangible

Common Equity

10.16%

10.77%

12.00%

10.91%

14.01%

2.32%

Efficiency

Ratio

49.19%

64.29%

Low 50%

range

49.90%

53.27%

64.05%

Net Interest Margin

5.65%

3.61%

~5%

5.84%

5.46%

2.67%

0.94% |

|

|

|

Capital Ratios: Exceed Requirements for Well-Capitalized Institution

7

1)

Includes $3.8 million accrual for cost savings in 2015

2)

Includes $16.3 million positive impact from 2Q13 non-recurring items

2014 with Basel III

Calculation

2014

As

Reported 1

2013

2

2012

Leverage Ratio

11.28%

10.61%

9.06%

6.55%

Tier 1 Common Ratio

13.29%

11.88%

10.46%

9.36%

Tier 1 Risk-based Capital Ratio

16.71%

16.02%

14.38%

13.18%

Total Risk-based Capital Ratio

18.24%

17.57%

16.16%

15.40%

Tangible Common Equity (TCE) Ratio

9.25%

7.71%

6.45% |

|

|

|

TBV

¹

:

Out

Performed

vs.

PR

Peers,

Fast

Growing

Regionals

8

OFG +94%

KBW Highly

Profitable

SMID Caps

+75%

²

PR

Peers

-53%

³

12/31/08-12/31/14

1)

Per basic share

2)

KBW’s List of Highly Profitable SMID-Cap Banks, November

2014: BKU, BOFI, CBU, FFIN, FLIC, HAFC, HOMB, HTH, NYCB,

OFG, OZRK, PACW, PB, RNST, SCBT, TCBI, UMPQ, WABC

3)

BPOP and FBP

Source: SNL

OFG 2012 decline reflects

dilution related to BBVA PR

acquisition capital plan

-60%

-40%

-20%

0%

20%

40%

60%

80%

100%

12/31/08

12/31/09

12/31/10

12/31/11

12/31/12

12/31/13

12/31/14 |

|

|

| +20

Years of Progress Listed on NYSE 9

Highlights

Source: SNL

Source: SNL

Source: Yahoo Finance

OFG (+754%)

S&P (+351%)

•

Stock has performed 2x better than S&P 500

(12/29/94 to 4/7/15)

•

Uninterrupted payment of quarterly

dividends

•

Tangible book value per share (basic) on

long-term upward trend

TBVPS (Basic)

Quarterly Dividend Per Common Share

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

$16.00

12/31/97

12/31/99

12/31/01

12/31/03

12/31/05

12/31/07

12/31/09

12/31/11

12/31/13

$0.00

$0.02

$0.04

$0.06

$0.08

$0.10

$0.12

$0.14

$0.16

1/1/1995

1/1/1997

1/1/1999

1/1/2001

1/1/2003

1/1/2005

1/1/2007

1/1/2009

1/1/2011

1/1/2013

1/1/2015

0%

200%

400%

600%

800%

1000%

12/31/94

12/31/96

12/31/98

12/31/00

12/31/02

12/31/04

12/31/06

12/31/08

12/31/10

12/31/12 |

|

|

|

Strategy

10

Oriental Bank

•

Only bank to have avoided legacy credit problems–opportunity to gain market

share •

Rational market pricing on big commercial loans in Puerto Rico

•

Focus on generating interest income from

•

Consumer and retail businesses (auto, consumer)

•

Small/mid-sized commercial loans from companies ignored by the

competition •

Focus on generating fee income from banking, wealth management and residential

mortgage •

Leverage mobile banking to attract deposits and enhance customer

service

OFG Bancorp

•

Increased capital allows for expanded dividends, stock buybacks,

and ability to make acquisitions

•

If there is an opportunity for an in-market acquisition, we are the only

buyer, but the price has to be reasonable •

Would consider out-of-market acquisitions if they meet the right

financial parameters •

Strong track record for making accretive acquisitions (Eurobank in 2010, BBVA PR

in 2012) |

|

|

|

Building Our Brand

11

Focus on Service Leadership

•

Research indicates that consumers look for excellence in

service when choosing a bank

•

Oriental is the most well thought of brand for quality of

service in banking in Puerto Rico

•

We are the “Can Do”

bank

•

Five major brand attributes:

o

Easy to access

o

Simple to use

o

Pro-active problem solvers

o

Fast execution

o

Enjoyable experience

Brand Attributes & Value Proposition

•

Make Oriental Puerto Rico’s “most convenient bank”

offering clients banking on their terms

•

Redefine customer convenience and accessibility in the local

market through service leadership and innovation

The Opportunity |

|

|

|

Retail Optimization & Innovation to Grow Revenues, Reduce Costs

12

Banking

Banking

Has

Has

Changed

Changed

The Old Way

You go to the bank

New Customer-Centric Way

The bank goes to you

Strategy #1

Introduce Market Leading Innovations in PR

Strategy #2

Retail Optimization

•

Redefine the customer engagement model

•

Enable processes and people to revolve around the

customer

•

Focus on continuous improvement

•

Transaction migration to alternate channels

•

Optimize distribution network footprint

•

First in Puerto Rico to implement model

•

FOTOdepósito

•

Cuenta Libre

•

Mobile People Pay

•

Online Account Opening

•

Enhanced ATM Kiosks for Self-Service

•

Mobile Business Banking |

|

|

|

Non-Interest Expenses: Enhanced Operating Efficiencies ($ in

millions) 13

Efficiency Ratio

1, 2

1)

4Q14 excludes $3.8 million accrual for cost savings in 2015

2)

Operating expenses and efficiency ratio exclude FDIC indemnification asset

amortization Highlights

•

Expect modest improvement 2015

•

Consolidating two branches in 1Q15

•

Need to continue to invest in branding, customer

facing capabilities, service innovation

$63.2

$65.6

$61.4

$59.8

$59.6

$58.1

$35

$45

$55

$65

$75

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

52.27%

51.27%

50.12%

47.89%

49.30%

49.19%

47.0%

48.5%

50.0%

51.5%

53.0%

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Operating

Expenses

1, 2 |

|

|

|

Earnings: Expanding Performance

14

EPS Diluted

Return on Average Assets

Highlights

•

Have been able to maintain EPS in mid-$0.30 range

•

As IEA declines, have been able to increase ROAA

•

Enables capital build

$0.34

$0.35

$0.42

$0.38

$0.34

$0.36

$0.05

$0.15

$0.25

$0.35

$0.45

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

0.93%

0.97%

1.18%

1.10%

1.02%

1.09%

0.8%

0.9%

1.1%

1.2%

1.3%

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14 |

|

|

|

Tangible Common Equity: Continuing to Build

15

TBV Per Common Share

ROATCE

Highlights

•

Gives us the flexibility to increase dividends, buy

back shares, or make acquisitions

•

Need to keep some cushion due to PR market

TCE Ratio

$13.47

$13.60

$14.07

$14.71

$14.82

$15.25

$12.50

$13.25

$14.00

$14.75

$15.50

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

10.71%

10.78%

12.86%

10.96%

9.78%

10.16%

6.0%

8.0%

10.0%

12.0%

14.0%

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

7.41%

7.71%

8.16%

8.70%

8.81%

9.25%

6.0%

7.0%

8.0%

9.0%

10.0%

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14 |

|

|

|

Return on Capital: Growing ($ in millions)

16

Total Payout Ratio

Annual Dividends Per Common Share

Highlights

•

General strategy is to buy back shares when the price

approaches TBV

•

Approximately $16.7 million of BOD authorization

remains

•

BOD decides dividend increases in December

•

Only PR bank paying common dividend

Cumulative Stock Buyback

$0.16

$0.17

$0.21

$0.24

$0.26

$0.34

$0.00

$0.10

$0.20

$0.30

$0.40

2009

2010

2011

2012

2013

2014

$59.4

$66.4

$66.4

$83.3

$0

$25

$50

$75

$100

2009

2010

2011

2012

2013

2014

21.33%

16.02%

231.22%

116.77%

14.04%

42.30%

0%

75%

150%

225%

300%

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14 |

|

|

|

Outlook

17

Puerto Rico

GDB Economic activity index has seen consistent declines in

the last few months

Treasury inflows for Jul-Dec lag last fiscal year as well as current year

estimates GDB is planning to raise debt again, facing challenging

liquidity conditions Sustained drop in oil prices provides an additional

lever in managing current conditions Local Banking Industry

Balance sheets are shrinking

FDIC acquirers face expiry of commercial loss share agreements in 2Q15

Credit quality continues to be a concern

Consolidation opportunities are still the key for boosting bank

performances OFG

Continue managing the situation prudently and building capital

Be flexible in our capital management approach

Opportunistic share buybacks

Review quarterly dividend on an annual basis

Explore strategic growth opportunities |

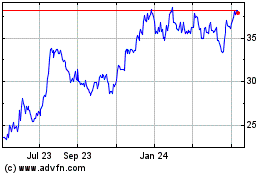

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

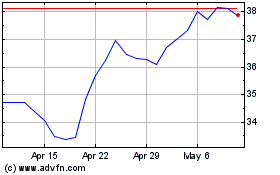

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Apr 2023 to Apr 2024