Emisphere Technologies, Inc. (OTCBB:EMIS) today reported financial

results for the second quarter ended June 30, 2016, and provided an

overview of corporate accomplishments and plans.

“During the first half of 2016, we continued to

focus our efforts on business development initiatives, including

advancing discussions with potential partners for a strategic

transaction or alliance for our commercial oral Eligen B12™

product, the first and only prescription B12 replacement

therapeutic,” said Alan L. Rubino, President and Chief Executive

Officer of Emisphere. “In parallel, our Novo Nordisk A/S

(NYSE:NVO) partnership continues on track with Phase 3a trials well

underway evaluating oral semaglutide, a once daily type 2 diabetes

treatment utilizing SNAC, one of our Eligen® Technology carriers.

Efforts to secure new development partnerships centered around this

unique, absorption enhancing delivery technology continue and there

has been significant interest expressed by several pharmaceutical

companies with the shared goal of creating new oral formulations to

replace existing injectables.”

Mr. Rubino continued: “As a result of our

strategic decision to partner Eligen B12™, we also successfully

implemented several cost control measures which enabled us to

significantly reduce our operating expenses and preserve our

financial resources during the first half of the year.

Looking ahead to the remainder of 2016, we will continue to

aggressively explore, identify and advance discussions with

potential partners and we look forward to keeping you updated on

our progress.”

FIRST HALF 2016 HIGHLIGHTS

Exploring Strategic Partnership

Opportunities for Oral Eligen B12™ in the U.S. and

Internationally. Eligen B12™ is the first and only

once-daily oral prescription medical food tablet shown to normalize

B12 levels without the need for an injection. Eligen B12™ is

indicated for the dietary management of patients who have a

medically-diagnosed vitamin B12 deficiency, associated with a

disease or condition that cannot be managed by a modification of

the normal diet alone. Eligen B12™ utilizes Emisphere's SNAC

carrier to chaperone B12 through the gastric lining and directly

into the bloodstream even in the absence of intrinsic factor, a

protein made in the stomach that normally facilitates B12

absorption.

Novo Nordisk Commenced Global Phase 3a

Clinical Trials for Oral Semaglutide. During the

first half of 2016, Novo Nordisk commenced Phase 3a testing for

oral semaglutide, which utilizes Emisphere's absorption-enhancing

monosodium N-[8-(2-hydroxybenzoyl) amino] caprylate (SNAC) carrier.

Novo Nordisk plans to conduct ten clinical trials enrolling

approximately 9,300 patients with Type-2 diabetes in this Phase 3a

program. The advancement of oral semaglutide into Phase 3a

development represents a significant milestone for both Emisphere

and the Eligen® Technology platform and supports the Company's

belief that products developed using Eligen® carriers have the

potential to overcome bioavailability challenges commonly

associated with the oral administration of peptides and certain

other compounds.

Novo Nordisk Continues Feasibility

Studies under our Development and License Agreement to Develop Oral

Formulations Targeting Metabolic Indications. In

October 2015, Emisphere and Novo Nordisk entered into a new license

agreement to develop and commercialize oral formulations of four

classes of Novo Nordisk's investigational molecules targeting major

metabolic disorders, including diabetes and obesity, using

Emisphere's oral Eligen® Technology. Emisphere received a

$5.0 million upfront licensing fee, and is eligible to receive up

to $207 million in development and sales milestone payments in

addition to royalties on sales of each successfully commercialized

product under this agreement.

Global Eligen® Technology Business

Development Initiatives Continue. During the first

half 2016, Emisphere continued to pursue its comprehensive business

development initiative designed to identify and secure new Eligen®

Technology partnerships. Eligen® Technology is a proven

delivery system technology that is applicable to a broad range of

chemical entities and has been shown to increase the benefit of the

therapy by improving bioavailability or absorption or by decreasing

time to onset of action. The Company currently owns rights to

an extensive portfolio of carriers with strong patent protection.

The current focus of the business development initiative is

on next generation, smaller proteins and peptides, proven and/or

approved drug compounds, and the development of new oral

formulations to replace injectables.

Grant of Waivers and Extensions Under

Debt Facility, Convertible Notes and Reimbursement

Notes. During November 2015, the creditor under our

Loan Agreement, Convertible Notes and Reimbursement notes agreed to

waive any event of default resulting from our failure to satisfy

the net sales milestone for the Eligen B12™ product for the 2015

fiscal year specified in our Loan and Royalty Agreements. The

creditor has also agreed to extend the date by which we are

required to use 50% of the $14 million received from Novo Nordisk

to pre-pay certain loans and notes (the "Loan Prepayment") until

August 16, 2016. We believe that our current cash balance

will provide sufficient capital to continue operations through

September 2016. However, if the pre-payment obligation is

further extended or waived, the Company will have sufficient cash

to operate through September 2017.

SECOND QUARTER 2016 FINANCIAL

RESULTS

Emisphere reported a net loss of $7.5 million,

or ($0.12) per basic and diluted share, for the quarter ended June

30, 2016, compared to net income of $7.1 million, or $0.12 per

basic share and ($0.04) per diluted share, for the quarter ended

June 30, 2015.

The Company reported an operating loss of $2.0

million for the second quarter 2016, compared to an operating loss

of $4.6 million for the same period in 2015.

Total operating expenses were $1.6 million for

the second quarter 2016, a decrease of $3.0 million or 66% compared

to the same period in 2015. Total operating expenses include

research and development costs of $0.10 million compared to $0.10

million in 2015, and selling, general and administrative expenses

of $1.5 million, a decrease of $3.1 million or 68% compared to the

same period in 2015. Other non-operating expense for the second

quarter of 2016 was $5.5 million compared to other non-operating

income of $11.7 million for the second quarter 2015.

Weighted average basic and diluted shares

outstanding for the three months ended June 30, 2016, was

60,687,478. Weighted average basic and diluted shares

outstanding for the three months ended June 30, 2015, was

60,687,478 and 123,445,160, respectively.

YEAR TO DATE FINANCIAL

RESULTS

For the six months ended June 30, 2016,

Emisphere reported a net loss of $9.3 million, or $(0.15) per basic

and diluted share, compared to net loss of $25.8 million, or

$(0.43) per basic and diluted share, for the same period last

year.

The Company reported an operating loss of $4.7

million for the six months ended June 30, 2016, compared to an

operating loss of $9.2 million for the same period in 2015.

Total operating expense for the six months ended

June 30, 2016 was $4.6 million, a decrease of $4.7 million or 50%.

Total operating expenses for the six months ended June 30, 2016

include research and development costs of $0.2 million compared to

$0.3 million in 2015, and selling, general and administrative

expenses of $4.4 million, a decrease of $4.6 million or 51%

compared to the same period in 2015. Other expense for the six

months ended June 30, 2016 was $4.7 million compared to $16.6

million for the same period in 2015.

Weighted average basic and diluted shares

outstanding for the six months ended June 30, 2016 and June 30,

2015 was 60,687,478.

LIQUIDITY

As of June 30, 2016, Emisphere had approximately

$8.7 million in cash, a net decrease of $4.2 million from December

31, 2015, a stockholders' deficit of approximately $161.1 million

and an accumulated deficit of approximately $563.9 million.

As of June 30, 2016, the Company's obligations

included approximately $49.7 million (face value) under its Second

Amended and Restated Convertible Notes (the "Convertible Notes"),

approximately $24.3 million (face value) under a loan agreement

dated August 20, 2014 (the "Loan Agreement"), approximately $0.8

million (face value) under its Second Amended and Restated

Reimbursement Notes (the "Reimbursement Notes"), and approximately

$2.3 million (face value) under its Second Amended and Restated

Bridge Notes (the "Bridge Notes"). The Convertible Notes and

the Loan Agreement are subject to various sales, operating and

manufacturing performance criteria.

On October 26, 2015, we received a total payment

of $14 million from Novo Nordisk pursuant to, and consisting of, $5

million as payment for entry into the Expansion License Agreement

and $9 million as prepayment of a product development milestone and

in exchange for a reduction in certain future royalty payments that

may have become due and payable under the terms of our GLP-1

Development License Agreement with Novo Nordisk. Under the

terms of our loan agreements, we are obligated to pre-pay certain

loans and notes using 50% of any extraordinary receipts, such as

the $14 million received from Novo Nordisk. The creditor under our

Loan Agreement and Reimbursement Notes has agreed to extend the

date by which we are required to use 50% of the $14 million

received from Novo Nordisk to pre-pay certain loans and notes until

August 16, 2016. Because the Loan Prepayment deadline has not

been extended beyond one year from June 30, 2016, we have

classified $7.0 million of the loans and notes as a current

liability as of June 30, 2016.

We believe that our current cash balance will

provide sufficient capital to continue operations through September

2016. However, if the pre-payment obligation is further extended or

waived, the Company will have sufficient cash to operate through

approximately September 2017. The Company’s future capital

requirements beyond September 2016 (or September 2017, in the event

the pre-payment obligation is further extended or waived) and our

financial success depend largely on our ability to raise additional

capital, including by leveraging existing and securing new

partnering opportunities for Eligen B12 and the Eligen®

Technology.

While our plan is to raise capital from

commercial operations and/or product partnering opportunities to

address our capital deficiencies and meet our operating cash

requirements, there is no assurance that our plans will be

successful. If we fail to generate sufficient capital from

commercial operations or partnerships, we will need to seek capital

from other sources and risk default under the terms of our existing

loans. We cannot assure you that financing will be available on

favorable terms or at all. If we fail to generate sufficient

additional capital from sales of oral Eligen B12 or to obtain

substantial cash inflows from existing or new partners or other

sources prior to September 2016 (or September 2017, in the event

the prepayment obligations is further extended or waived), we could

be forced to cease operations. Additionally, if additional capital

is raised through the sale of equity or convertible debt

securities, the issuance of such securities would result in

dilution to our existing stockholders. These conditions raise

substantial doubt about our ability to continue as a going concern.

Consequently, the audit reports prepared by our independent

registered public accounting firm relating to our financial

statements for the years ended December 31, 2015, 2014 and 2013

include an explanatory paragraph expressing substantial doubt about

our ability to continue as a going concern.

CONFERENCE CALL AND WEBCAST

INFORMATION

The live webcast of the conference call can be

accessed through the Company's web site at www.emisphere.com. The

call can also be accessed by dialing (877) 303-9483 (United States

and Canada) or (760) 666-3584 (international), and entering

Conference ID# 59804462. In addition, an archive of the

webcast can be accessed through the same link and an audio replay

of the call will be available beginning Monday, August 15, 2016 at

11:30 AM ET through 11:59 PM ET on August 22, 2016, by calling

(855) 859-2056 (United States and Canada) or (404) 537-3406

(International), and entering Conference ID# 59804462.

ABOUT ELIGEN B12™

Eligen B12 is indicated for the dietary

management of patients who have a medically-diagnosed vitamin B12

deficiency, associated with a disease or condition that cannot be

managed by a modification of the normal diet alone. Eligen

B12 is designed so that patients only need to take a single oral

tablet (cyanocobalamin 1000 mcg/salcaprozate sodium [SNAC] 100 mg)

of B12 daily.

Eligen B12 is the first and only prescription

medical food that has been shown to normalize vitamin B12 levels

comparable to an intramuscular (IM) injection of B12. In a study

that compared the impact of Eligen B12 and IM B12 on plasma B12

levels in 50 patients with demonstrated B12 deficiency (serum B12

<350 pg/mL), both products normalized B12 levels by Day 15

(first observation) and maintained normal levels over the duration

of the study (three months). In a study that compared

bioavailability in 20 healthy subjects of Eligen B12™ with that of

a standard oral B12 supplement, the bioavailability of Eligen B12

was 5.09 percent compared with 2.16 percent, which is more than

double the bioavailability of the conventional over-the-counter

oral B12 supplement formulation at the same dose.

Eligen B12 is classified by the U.S. Food and

Drug Administration as a medical food. A medical food is a

prescription product formulated to be consumed or administered

orally under medical supervision for the treatment of a disease or

condition that cannot be managed by a modification of the normal

diet alone.

For more information, visit

www.eligenb12.com.

ELIGEN B12™ IMPORTANT SAFETY

INFORMATION

Those with an allergy to B12, cobalt or any

ingredients of Eligen B12 should not take this product. Eligen B12

should not be taken by people who have Leber’s disease, which

physicians may refer to as hereditary optic nerve atrophy.

Cyanocobalamin (B12) can lead to optic nerve damage (and possibly

blindness) in people with Leber’s disease. Note that Eligen B12 has

not been studied in patients below 18 years of age.

ABOUT EMISPHERE

Emisphere Technologies, Inc. ("Emisphere" or the

"Company") is a pharmaceutical and drug delivery company. The

Company launched its first prescription product, oral Eligen B12™,

in the U.S. in March 2015 and we are currently engaged in strategic

discussions to optimize its economic value in the U.S. and global

markets. Beyond Eligen B12™, the Company utilizes its proprietary

Eligen® Technology to create new oral formulations of therapeutic

agents. Emisphere is currently partnered with global pharmaceutical

companies for the development of new orally delivered therapeutics.

For more information, please visit www.emisphere.com.

SAFE HARBOR STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

The statements in this release or oral

statements made by representatives of Emisphere relating to matters

that are not historical facts are forward-looking statements that

involve risks and uncertainties, including, but not limited to, the

sufficiency of the Company's cash position, the Company's ability

to enter into strategic partnerships, the Company's ability to

capture market share for oral Eligen B12™ or any potential

products, the success of the Company's commercialization

initiatives, the ability of the Company and/or that of its partners

to develop, manufacture and commercialize products using

Emisphere's drug delivery technology, and other risks and

uncertainties detailed in Emisphere's filings with the Securities

and Exchange Commission, including those factors discussed under

the caption "Risk Factors" identified in the documents Emisphere

has filed, or will file, with the Securities and Exchange

Commission ("SEC"). Copies of Emisphere's filings with the SEC may

be obtained from the SEC Internet site at http://www.sec.gov.

Emisphere expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in Emisphere's

expectations with regard thereto or any change in events,

conditions, or circumstances on which any such statements are

based.

| EMISPHERE

TECHNOLOGIES INC.CONDENSED BALANCE

SHEETSJUNE 30, 2016 AND DECEMBER 31,

2015(in thousands, except share and per share data) |

|

| |

|

|

|

|

|

|

|

|

| |

|

June 30, 2016 (unaudited) |

|

|

|

December 31, 2015 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

|

8,740 |

|

|

|

$ |

12,898 |

|

| Accounts

Receivable, net |

|

|

|

246 |

|

|

|

|

455 |

|

|

Inventories |

|

|

|

656 |

|

|

|

|

1,340 |

|

| Prepaid

expenses and other current assets |

|

|

|

448 |

|

|

|

|

1,081 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Total

Current Assets |

|

|

|

10,090 |

|

|

|

|

15,774 |

|

| Equipment and leasehold

improvements, net |

|

|

|

4 |

|

|

|

|

12 |

|

| Security deposits |

|

|

|

24 |

|

|

|

|

24 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

|

10,118 |

|

|

|

$ |

15,810 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS DEFICIT |

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

| Accounts

payable and accrued expenses |

|

$ |

|

878 |

|

|

|

$ |

2,121 |

|

| Notes

payable, related party |

|

|

|

7,000 |

|

|

|

|

7,000 |

|

| Deferred

Revenue, current portion |

|

|

|

677 |

|

|

|

|

631 |

|

| Royalty

payable, related party |

|

|

|

208 |

|

|

|

|

208 |

|

| Derivative

instruments |

|

|

|

|

|

|

|

|

|

|

| Related

party |

|

|

|

12,274 |

|

|

|

|

12,690 |

|

| Others |

|

|

|

— |

|

|

|

|

205 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Total

current liabilities |

|

|

|

21,037 |

|

|

|

|

22,855 |

|

| Notes payable, related

party, net of related discount |

|

|

|

57,113 |

|

|

|

|

54,172 |

|

| Derivative instruments,

related party |

|

|

|

37,289 |

|

|

|

|

35,071 |

|

| Deferred revenue |

|

|

|

55,616 |

|

|

|

|

55,616 |

|

| Royalty payable – related

party |

|

|

|

141 |

|

|

|

|

— |

|

| Deferred lease liability

and other liabilities |

|

|

|

9 |

|

|

|

|

14 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Total

liabilities |

|

|

|

171,205 |

|

|

|

|

167,728 |

|

| |

|

|

|

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

| Stockholders’

deficit: |

|

|

|

|

|

|

|

|

|

|

| Preferred stock, $.01 par

value; 4,000,000 shares authorized; none issued and

outstanding |

|

|

|

— |

|

|

|

|

— |

|

| Common stock, $.01 par

value; 400,000,000 shares authorized; issued 60,977,210 shares

(60,687,478 outstanding) as of June 30, 2016 and December 31,

2015 |

|

|

|

610 |

|

|

|

|

610 |

|

| Additional

paid-in-capital |

|

|

|

406,117 |

|

|

|

|

405,944 |

|

| Accumulated deficit |

|

|

|

(563,862 |

) |

|

|

|

(554,520 |

) |

| Common stock held in

treasury, at cost; 289,732 shares |

|

|

|

(3,952 |

) |

|

|

|

(3,952 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Total

stockholders’ deficit |

|

|

|

(161,087 |

) |

|

|

|

(151,918 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Total

liabilities and stockholders’ deficit |

|

$ |

|

10,118 |

|

|

|

$ |

15,810 |

|

| |

|

|

|

|

|

|

|

|

|

|

| EMISPHERE TECHNOLOGIES,

INC.CONDENSED STATEMENT OF

OPERATIONSFor the three and six months ended June

30, 2016 and 2015(in thousands, except share and per share

data)(unaudited) |

|

|

| |

For the three months ended |

|

For the six months ended |

| |

June 30, |

|

June 30, |

| |

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| |

|

|

|

|

|

|

|

| Net revenue |

$ |

286 |

|

|

$ |

88 |

|

|

$ |

659 |

|

|

$ |

94 |

|

| |

|

|

|

|

|

|

|

| Cost of goods sold |

|

46 |

|

|

|

55 |

|

|

|

98 |

|

|

|

80 |

|

| Write-off of slow

moving inventory |

|

654 |

|

|

|

— |

|

|

|

654 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

| Gross profit

(loss) |

|

(414 |

) |

|

|

33 |

|

|

|

(93 |

) |

|

|

14 |

|

| |

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

| Research and development |

|

89 |

|

|

|

59 |

|

|

|

180 |

|

|

|

287 |

|

| General and administrative

expenses |

|

1,322 |

|

|

|

1,528 |

|

|

|

2,662 |

|

|

|

2,820 |

|

| Selling expenses |

|

137 |

|

|

|

3,007 |

|

|

|

1,731 |

|

|

|

6,132 |

|

| Depreciation and amortization |

|

3 |

|

|

|

3 |

|

|

|

8 |

|

|

|

7 |

|

| Total costs and expenses |

|

1,551 |

|

|

|

4,597 |

|

|

|

4,581 |

|

|

|

9,246 |

|

| Operating loss |

|

(1,965 |

) |

|

|

(4,564 |

) |

|

|

(4,674 |

) |

|

|

(9,232 |

) |

| |

|

|

|

|

|

|

|

| Other non-operating

income (expense): |

|

|

|

|

|

|

|

| Other income |

|

4 |

|

|

|

3 |

|

|

|

9 |

|

|

|

7 |

|

| Change in fair value of derivative

instruments |

|

|

|

|

|

|

|

| Related

party |

|

(2,993 |

) |

|

|

13,493 |

|

|

|

456 |

|

|

|

(12,117 |

) |

|

Other |

|

83 |

|

|

|

433 |

|

|

|

205 |

|

|

|

(420 |

) |

| Interest expense related party |

|

(2,642 |

) |

|

|

(2,229 |

) |

|

|

(5,338 |

) |

|

|

(4,070 |

) |

| Total other

non-operating income (expense) |

|

(5,548 |

) |

|

|

11,700 |

|

|

|

(4,668 |

) |

|

|

(16,600 |

) |

| Net income (loss) |

$ |

(7,513 |

) |

|

$ |

7,136 |

|

|

$ |

(9,342 |

) |

|

$ |

(25,832 |

) |

| Net income (loss) per

share, basic |

$ |

(0.12 |

) |

|

$ |

0.12 |

|

|

$ |

(0.15 |

) |

|

$ |

(0.43 |

) |

| Net income (loss) per

share, fully diluted |

$ |

(0.12 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.43 |

) |

| Weighted average shares

outstanding, basic |

|

60,687,478 |

|

|

|

60,687,478 |

|

|

|

60,687,478 |

|

|

|

60,687,478 |

|

| Weighted average shares

outstanding, diluted |

|

60,687,478 |

|

|

|

123,445,160 |

|

|

|

60,687,478 |

|

|

|

60,687,478 |

|

COMPANY CONTACTS:

Alan L. Rubino, CEO

973.532.8000

arubino@emisphere.com

Alan Gallantar, Acting CFO

973.532.8005

agallantar@emisphere.com

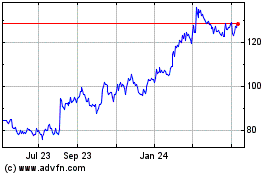

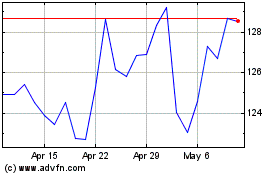

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Apr 2023 to Apr 2024