ABOUT

NOVO NORDISK

Novo Nordisk is a global healthcare company with more than 90 years of

innovation and leadership in diabetes care. This heritage has given us experience and capabilities that also enable us to help

people defeat other serious chronic conditions: haemophilia, growth disorders and obesity. Headquartered in Denmark, Novo Nordisk

employs approximately 39,700 people in 75 countries, and markets its products in more than 180 countries. Novo Nordisk’s

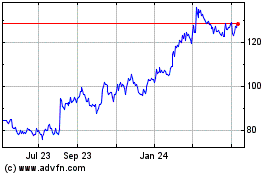

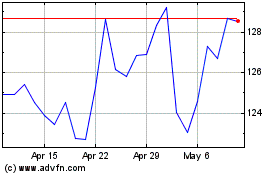

B shares are listed on Nasdaq Copenhagen (Novo-B). Its ADRs are listed on the New York Stock Exchange (NVO). For more information,

visit novonordisk.com

CONFERENCE CALL DETAILS

On 6 August 2015 at 13.00 CEST, corresponding to 7.00 am EDT, a conference

call will be held. Investors will be able to listen in via a link on novonordisk.com, which

can be found under ‘Inv esto rs ’. Presentation material for the conference call

will be available approximately one hour before on the same page.

WEBCAST DETAILS

On 7 August 2015 at 12.30 CEST, corresponding to 6.30 am EDT, management

will give a presentation to institutional investors and sell-side analysts in London. A webcast of the presentation can be followed

via a link on novonordisk.com, which can be found under ‘Investors’. Presentation material for the webcast will be made available on the same page.

FINANCIAL

CALENDAR

| 29 October 2015 |

Financial statement for the first nine months of 2015 |

| 3 February 2016 |

Financial statement for 2015 |

CONTACTS FOR FURTHER INFORMATION

| Media: |

| Katrine Sperling |

+45 3079 6718 |

krsp@novonordisk.com |

| Ken Inchausti (US) |

+1 609 514 8316 |

kiau@novonordisk.com |

| |

|

|

| Investors: |

| Kasper Roseeuw Poulsen |

+45 3079 4303 |

krop@novonordisk.com |

| Daniel Bohsen |

+45 3079 6376 |

dabo@novonordisk.com |

| Melanie Raouzeos |

+45 3075 3479 |

mrz@novonordisk.com |

| Frank Daniel Mersebach (US) |

+1 609 235 8567 |

fdni@novonordisk.com |

Further information about

Novo Nordisk is available on novonordisk.com.

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 3 of 28 |

| LIST OF CONTENTS |

|

| FINANCIAL PERFORMANCE |

4 |

| |

Consolidated financial statement for the first six months of 2015 |

4 |

| |

Sales development |

5 |

| |

Diabetes and obesity care, sales development |

5 |

| |

Biopharmaceuticals, sales development |

9 |

| |

Development in costs and operating profit |

10 |

| |

Net financials |

10 |

| |

Capital expenditure and free cash flow |

11 |

| |

Key developments in the second quarter of 2015 |

11 |

| OUTLOOK |

12 |

| RESEARCH & DEVELOPMENT UPDATE |

14 |

| |

Diabetes |

14 |

| |

Obesity |

16 |

| SUSTAINABILITY UPDATE |

17 |

| EQUITY |

17 |

| LEGAL MATTERS |

18 |

| MANAGEMENT STATEMENT |

20 |

| FINANCIAL INFORMATION |

21 |

| |

Appendix 1: |

Quarterly numbers in DKK |

21 |

| |

Appendix 2: |

Income statement and statement of comprehensive income |

22 |

| |

Appendix 3: |

Balance sheet |

23 |

| |

Appendix 4: |

Statement of cash flows |

24 |

| |

Appendix 5: |

Statement of changes in equity |

25 |

| |

Appendix 6: |

Regional sales split |

26 |

| |

Appendix 7: |

Key currency assumptions |

27 |

| |

Appendix 8: |

Quarterly numbers in USD (additional information) |

28 |

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 4 of 28 |

FINANCIAL PERFORMANCE

CONSOLIDATED FINANCIAL STATEMENT FOR THE FIRST SIX MONTHS OF 2015

These unaudited

consolidated financial statements for the first six months of 2015 have been prepared in accordance with IAS 34

‘Interim Financial Reporting’ and on the basis of the same accounting policies as were applied in the Annual

Report 2014 of Novo Nordisk, amended with accounting policy regarding associated companies as described in appendix 9 in

the company announcement No 31/2015 – Financial report for the period 1 January 2015 to 31 March 2015. Furthermore, the

financial report including the consolidated financial statements for the first six months of 2015 and Management’s

review have been prepared in accordance with additional Danish disclosure requirements for interim reports of listed

companies. Novo Nordisk has adopted all new, amended or revised accounting standards and interpretations

(‘IFRSs’) as published by the IASB, and also those that are endorsed by the EU effective for the accounting

period beginning on 1 January 2015. These IFRSs have not had a significant impact on the consolidated financial statements

for the first six months of 2015.

Amounts in DKK million, except number of shares, earnings per share and full-time

equivalent employees.

| |

|

|

|

|

|

|

| PROFIT AND LOSS |

H1 2015 |

|

H1 2014 |

|

% change |

|

| |

|

|

|

|

H1 2014 |

|

| |

|

|

|

|

to H1 2015 |

|

| DKK million |

|

|

|

|

|

|

| Net sales |

52,259 |

|

41,972 |

|

25% |

|

| |

|

|

|

|

|

|

| Gross profit |

44,526 |

|

34,835 |

|

28% |

|

| Gross margin |

85.2% |

|

83.0% |

|

|

|

| |

|

|

|

|

|

|

| Sales and distribution costs |

13,322 |

|

10,645 |

|

25% |

|

| Percent of sales |

25.5% |

|

25.4% |

|

|

|

| |

|

|

|

|

|

|

| Research and development costs |

6,285 |

|

6,243 |

|

1% |

|

| Percent of sales |

12.0% |

|

14.9% |

|

|

|

| |

|

|

|

|

|

|

| Administrative costs |

1,741 |

|

1,600 |

|

9% |

|

| Percent of sales |

3.3% |

|

3.8% |

|

|

|

| |

|

|

|

|

|

|

| Other operating income, net |

3,161 |

|

419 |

|

N/A |

|

| Non-recurring income from the initial public offering of NNIT A/S |

2,376 |

|

- |

|

N/A |

|

| Operating profit |

26,339 |

|

16,766 |

|

57% |

|

| Operating margin |

50.4% |

|

39.9% |

|

|

|

| |

|

|

|

|

|

|

| Net financials |

(3,306) |

|

524 |

|

N/A |

|

| Profit before income taxes |

23,033 |

|

17,290 |

|

33% |

|

| |

|

|

|

|

|

|

| Income taxes |

4,814 |

|

3,838 |

|

25% |

|

| Effective tax rate |

20.9% |

|

22.2% |

|

|

|

| |

|

|

|

|

|

|

| Net profit |

18,219 |

|

13,452 |

|

35% |

|

| Net profit margin |

34.9% |

|

32.0% |

|

|

|

| |

|

|

|

|

|

|

| OTHER KEY NUMBERS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Depreciation, amortisation and impairment losses |

1,311 |

|

1,324 |

|

(1%) |

|

| Capital expenditure (tangible assets) |

1,782 |

|

1,495 |

|

19% |

|

| |

|

|

|

|

|

|

| Net cash generated from operating activities |

16,080 |

|

12,194 |

|

32% |

|

| Free cash flow |

16,473 |

|

10,522 |

|

57% |

|

| |

|

|

|

|

|

|

| Total assets |

81,313 |

|

63,681 |

|

28% |

|

| Equity |

39,111 |

|

36,661 |

|

7% |

|

| Equity ratio |

48.1% |

|

57.6% |

|

|

|

| |

|

|

|

|

|

|

| Average number of diluted shares outstanding (million) |

2,594.1 |

|

2,645.2 |

|

(2%) |

|

| Diluted earnings per share / ADR (in DKK) |

7.02 |

|

5.09 |

|

38% |

|

| Diluted earnings per share / ADR adjusted for non-recurring income from NNIT IPO (in DKK) |

6.20 |

|

5.09 |

|

22% |

|

| |

|

|

|

|

|

|

| Full-time equivalent employees end of period 1) |

39,658 |

|

40,226 |

|

(1%) |

|

1)

Full-time equivalent employees in H1 2014 in NNIT A/S was 2,277

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 5 of 28 |

SALES DEVELOPMENT

Sales increased by 25% measured in Danish kroner and by 9% in local

currencies. While all regions contributed to sales growth, North America was the main contributor with 56% share of growth measured

in local currencies, followed by International Operations and Europe contributing 28% and 10% respectively. Sales growth was realised

within both diabetes care and biopharmaceuticals, with the majority of growth originating from Victoza®

and modern insulin.

| |

|

|

|

|

|

|

|

|

| |

Sales |

|

Growth |

|

Growth |

|

Share of |

|

| |

H1 2015 |

|

as reported |

|

in local |

|

growth |

|

| |

DKK |

|

|

|

currencies |

|

in local |

|

| |

million |

|

|

|

|

|

currencies |

|

| The diabetes and obesity care segment |

|

|

|

|

|

|

|

|

| New-generation insulin 1) |

601 |

|

N/A |

|

N/A |

|

10% |

|

| Modern insulin |

24,102 |

|

22% |

|

6% |

|

34% |

|

| - NovoRapid ® |

9,912 |

|

22% |

|

6% |

|

14% |

|

| - NovoMix ® |

5,596 |

|

16% |

|

2% |

|

2% |

|

| - Levemir ® |

8,594 |

|

28% |

|

10% |

|

18% |

|

| Human insulin |

5,681 |

|

13% |

|

0% |

|

0% |

|

| Victoza® |

8,443 |

|

41% |

|

22% |

|

35% |

|

| Other diabetes and obesity care 2) |

2,270 |

|

11% |

|

(2%) |

|

(1%) |

|

| Diabetes and obesity care total |

41,097 |

|

24% |

|

9% |

|

78% |

|

| The biopharmaceuticals segment |

|

|

|

|

|

|

|

|

| Haemophilia |

5,491 |

|

20% |

|

5% |

|

6% |

|

| - NovoSeven ® |

5,263 |

|

16% |

|

1% |

|

1% |

|

| Norditropin® |

3,913 |

|

30% |

|

15% |

|

12% |

|

| Other biopharmaceuticals 3) |

1,758 |

|

29% |

|

12% |

|

4% |

|

| |

|

|

|

|

|

|

|

|

| Biopharmaceuticals total |

11,162 |

|

25% |

|

9% |

|

22% |

|

| Total sales |

52,259 |

|

25% |

|

9% |

|

100% |

|

1)

Comprises Tresiba®, Ryzodeg® and Xultophy®.

2)

Primarily NovoNorm®, needles and Saxenda®.

3)

Primarily Vagifem® and Activelle®.

Please refer to appendix 6 for further details on sales in the first six months

of 2015.

In the following sections, unless otherwise noted, market

data are based on moving annual total (MAT) from May 2015 and May 2014 provided by the independent data provider IMS Health.

DIABETES AND OBESITY CARE, SALES DEVELOPMENT

Sales of diabetes care products increased by 24% measured in Danish

kroner and by 9% in local currencies to DKK 41,097 million. Novo Nordisk is the world leader in diabetes care with a global value

market share of 28%.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 6 of 28 |

Insulin

Sales of insulin increased by 22% measured in Danish kroner and by 6%

in local currencies to DKK 30,384 million. Measured in local currencies, sales growth was driven by International Operations, North

America and Region China. Novo Nordisk is the global leader with 47% of the total insulin market and 46% of the market for modern

insulin and new-generation insulin, both measured in volume.

Sales of new-generation insulin (Tresiba®,

Ryzodeg® and Xultophy®) reached DKK 601 million

compared with DKK 221 million in 2014.

The roll-out of Tresiba® (insulin

degludec), the once-daily new-generation insulin with an ultra-long duration of action, continues and the product has now been

launched in 30 countries. In Japan, where Tresiba® was launched in March 2013 with the

same level of reimbursement as insulin glargine, its share of the basal insulin market has grown steadily, and Tresiba®

has now captured 30% of the basal insulin market measured in monthly value market share. Similarly, Tresiba®

has shown solid penetration in other markets with reimbursement at a similar level to insulin glargine, whereas penetration

remains modest in markets with restricted market access compared with insulin glargine. In July 2015, Novo Nordisk announced the

decision to cease distribution of Tresiba® in Germany by the end of September following

a negative outcome of price negotiations with the GKV-Spitzenverband, the German national association of statutory health insurance

funds.

Ryzodeg®, a soluble formulation of

insulin degludec and insulin aspart, is marketed in three countries: Mexico, India and Bangladesh. Feedback from the countries

is positive.

Xultophy®, a once-daily single-injection

combination of insulin degludec (Tresiba®) and liraglutide (Victoza®),

first launched in Switzerland, has now also been launched in Germany and the UK. Launch activities are progressing as planned and

the early feedback from patients and prescribers is encouraging.

Sales of modern insulin increased by 22% in Danish kroner and by 6% in local

currencies to DKK 24,102 million. North America accounted for 50% of the growth, followed by International Operations and Region

China. Sales of modern insulin and new-generation insulin now constitute 81% of Novo Nordisk’s sales of insulin measured

in value.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 7 of 28 |

INSULIN MARKET SHARES

(volume, MAT)

|

Novo Nordisk’s share of

total insulin market

|

Novo Nordisk’s share

of the modern insulin and

new-generation insulin market

|

| |

May

2015 |

|

May

2014 |

|

May

2015 |

|

May

2014 |

|

| Global |

47% |

|

47% |

|

46% |

|

46% |

|

| USA |

37% |

|

37% |

|

38% |

|

38% |

|

| Europe |

47% |

|

48% |

|

47% |

|

48% |

|

| International Operations* |

55% |

|

55% |

|

52% |

|

53% |

|

| China** |

57% |

|

58% |

|

63% |

|

64% |

|

| Japan |

52% |

|

52% |

|

50% |

|

49% |

|

Source: IMS, May 2015 data. *: Data for 13 selected

markets representing approximately 70% of Novo Nordisk’s diabetes sales in the region. **: Data for mainland China, excluding

Hong Kong and Taiwan.

North America

Sales of insulin in North America increased by 28% in Danish kroner

and by 4% in local currencies. Sales growth is driven by the continued market share gains for Levemir®

and NovoLog® as well as a positive contribution from the underlying volume growth

of the insulin market. 60% of Novo Nordisk’s modern insulin volume in the US is used in the prefilled devices FlexPen®

and FlexTouch®.

Europe

Sales of insulin in Europe increased by 3% in Danish kroner and by 2%

in local currencies. Sales growth is driven by the penetration of Tresiba®, the continued

progress of NovoRapid® as well as a positive contribution from Xultophy®,

partly offset by a contracting premix insulin segment and declining human insulin sales.

Furthermore, sales are affected by a net negative impact from the implementation

of pricing reforms in several European countries. The device penetration in Europe is high and 96% of Novo Nordisk’s insulin

volume is being used in devices, primarily NovoPen® and FlexPen®.

International Operations

Sales of insulin in International Operations increased by 30% in Danish

kroner and by 22% in local currencies. The growth in local currencies is driven by the two modern insulins NovoRapid®

and NovoMix® as well as human insulin and Tresiba®.

Sales growth is positively impacted by timing of shipments and wholesalers’ stocking in a number of countries. Currently,

62% of Novo Nordisk’s insulin volume in the major private markets is used in devices.

Region China

Sales of insulin in Region China increased by 27% in Danish kroner and

by 5% in local currencies. The modest sales growth is driven by the continued market penetration of the three modern insulins offset

by a decline in the growth of the overall diabetes care market, reflecting cost containment measures in the healthcare system including

restrictions on access to healthcare professionals. In addition, sales growth is negatively impacted by the timing of shipments

to distributors and intensified competition.

Currently, 98% of Novo Nordisk’s insulin volume in China is used

in devices, primarily the durable device NovoPen®.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 8 of 28 |

Japan & Korea

Sales of insulin in Japan & Korea increased by 7% in Danish kroner

and by 1% in local currencies. The sales development reflects the continued strong uptake of Tresiba®

in the Japanese market which is partly offset by a declining Japanese insulin volume market. The device penetration in Japan

remains high with 98% of Novo Nordisk’s insulin volume being used in devices, primarily FlexPen®

and FlexTouch®.

Victoza® (GLP-1 therapy

for type 2 diabetes)

Victoza® sales increased by

41% in Danish kroner and by 22% in local currencies to DKK 8,443 million. Sales growth is driven by North America and Europe. The

GLP-1 segment’s value share of the total diabetes care market has increased to 7.3% compared with 6.9% in 2014. Victoza®

is the market leader in the GLP-1 segment with a 71% value market share.

GLP-1

MARKET SHARES

(value, MAT)

|

GLP-1

share of total

diabetes care market

|

Victoza® share

of GLP-1 market

|

| |

May

2015 |

|

May

2014 |

|

May

2015 |

|

May

2014 |

|

| Global |

7.3% |

|

6.9% |

|

71% |

|

72% |

|

| USA |

8.5% |

|

8.4% |

|

68% |

|

69% |

|

| Europe |

8.5% |

|

7.9% |

|

78% |

|

78% |

|

| International Operations* |

2.3% |

|

2.5% |

|

75% |

|

75% |

|

| China** |

0.8% |

|

0.7% |

|

54% |

|

64% |

|

| Japan |

2.4% |

|

2.0% |

|

64% |

|

64% |

|

Source: IMS, May 2015 data. *: Data for 13

selected markets representing approximately 70% of Novo Nordisk’s diabetes sales in the region. **: Data for mainland China,

excluding Hong Kong and Taiwan.

North America

Sales of Victoza® in North America

increased by 52% in Danish kroner and by 24% in local currencies. Sales growth is driven by an underlying prescription volume growth

of the GLP-1 class at around 15% in the US. The value share of the GLP-1 class of the total US diabetes care market is 8.5% and

its growth continues to be driven by Victoza®, despite launch of competing products. Victoza®

is the market leader with a 68% value market share.

Europe

Sales in Europe increased by 16% in Danish kroner and by 14% in local

currencies. Sales growth is primarily driven by Germany and France. In Europe, the share of the GLP-1 class of the total diabetes

care market in value has increased to 8.5%. Victoza® is the GLP-1 market leader with a

value market share of 78%.

International Operations

Sales in International Operations increased by 26% in Danish kroner

and by 19% in local currencies. Sales growth is primarily driven by a number of countries in the Middle East. The value share of

the GLP-1 class of the total diabetes care market is 2.3% and its growth continues to be driven by Victoza®

despite the launch of competing products.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 9 of 28 |

Victoza® is the GLP-1 market leader

across International Operations with a value market share of 75%.

Region China

Sales in Region China increased by 23% in Danish kroner and by 1% in

local currencies. The modest sales growth reflects the declining growth rate for the overall diabetes care market in China as well

as increased competition in the GLP-1 class. In China, the GLP-1 class, which represents 0.8% of the total diabetes care market

in value, is generally not reimbursed and relatively modest in size. Victoza® holds a

GLP-1 value market share of 54%.

Japan & Korea

Sales in Japan & Korea increased by 70% in Danish kroner and by

62% in local currencies. The sales growth reflects a positive impact of an improved product label in Japan in September 2014. In

Japan, the GLP-1 class now represents 2.4% of the total diabetes care market value compared with 2.0% in 2014. Victoza®

remains the leader in the class with a value market share of 64%.

Other diabetes and obesity care

Sales of other diabetes and obesity care, which predominantly consists

of oral antidiabetic products, needles and Saxenda®, increased by 11% in Danish kroner

and decreased by 2% in local currencies to DKK 2,270 million. This reflects a decline in sales of needles in Europe and North America

as well as a negative impact from the timing of NovoNorm® shipments to distributors in

2014 in China, which more than offset the positive contribution from the US launch of Saxenda®,

liraglutide 3 mg for weight management, in May 2015. In the US, market access for Saxenda® is

so far limited, but launch activities are progressing as planned and early feedback from patients and prescribers is encouraging.

BIOPHARMACEUTICALS, SALES DEVELOPMENT

Sales of biopharmaceutical products increased by 25% measured in Danish

kroner and by 9% in local currencies to DKK 11,162 million. Sales growth is primarily driven by North America, Europe and International

Operations.

Haemophilia

Sales of haemophilia products increased by 20% in Danish kroner and

by 5% in local currencies to DKK 5,491 million. The growth in local currencies is primarily driven by the roll-out of NovoEight®

in Europe, Japan and the US as well as by NovoSeven® in International Operations.

Norditropin® (growth

hormone therapy)

Sales of Norditropin® increased

by 30% in Danish kroner and by 15% in local currencies to DKK 3,913 million. The sales growth is primarily derived from North America

and reflects favourable pricing and adjustments to provisions for rebates as well as increased demand driven by the prefilled FlexPro®

device and local support programmes. Novo Nordisk is the leading company in the global growth hormone market with a 32%

market share measured in volume.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 10 of 28 |

Other biopharmaceuticals

Sales of other products within biopharmaceuticals, which predominantly

consist of hormone replacement therapy-related (HRT) products, increased by 29% in Danish kroner and by 12% in local currencies

to DKK 1,758 million. Sales growth is driven by a positive impact from pricing of Vagifem® in

the US.

DEVELOPMENT IN COSTS AND OPERATING PROFIT

The cost of goods sold increased by 8% to DKK 7,733 million, resulting

in a gross margin of 85.2% compared with 83.0% in 2014. This reflects a positive currency impact of 1.8 percentage points as well

as a positive impact from the product mix primarily due to increased sales of Victoza® and

modern insulin.

Sales and distribution costs increased by 25% in Danish kroner and by 10%

in local currencies to DKK 13,322 million. The increase in costs is driven by launch costs related to Saxenda®

in the US, sales force investments in selected countries in International Operations as well as adjustments to legal provisions.

Research and development costs increased by 1% in Danish kroner and decreased

by 5% in local currencies to DKK 6,285 million. The decline in costs reflects the discontinuation of activities within inflammatory

disorders in September 2014 whereas the underlying costs, excluding costs related to inflammatory disorders in the first half of

2014, increased by 6%. The increase in underlying costs reflects the progression of the late-stage diabetes care portfolio and

is primarily driven by the cardiovascular outcomes trial DEVOTE for insulin degludec and the phase 3a programme SUSTAIN for the

once-weekly GLP-1 analogue semaglutide. The increase in costs is partly offset by lower costs related to faster-acting insulin

aspart following the completion of the phase 3a development programme, onset®, in March

2015.

Administration costs increased by 9% in Danish kroner and by 2% in local currencies

to DKK 1,741 million.

Other operating income (net) was DKK 3,161 million compared with DKK 419

million in 2014. The increase is driven by the non-recurring income from the partial divestment of NNIT, an IT service and consultancy

company, in connection with the Initial Public Offering on Nasdaq Copenhagen under the symbol ‘NNIT’ (ISIN DK0060580512)

as well as non-recurring income related to the out-licensing of assets for inflammatory disorders.

Operating profit increased by 57% in Danish kroner and by 30% in local currencies

to DKK 26,339 million. Adjusted for the income related to the partial divestment of NNIT, the growth in operating profit was 16%

in local currencies.

NET FINANCIALS

Net financials showed a net loss of DKK 3,306 million compared with a

net income of DKK 524 million in 2014.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 11 of 28 |

In line with Novo Nordisk’s treasury policy, the most significant foreign

exchange risks for the group have been hedged, primarily through foreign exchange forward contracts. The foreign exchange result

was a loss of DKK 3,279 million compared with an income of DKK 543 million in 2014. This development reflects losses on foreign

exchange hedging involving especially the US dollar due to its appreciation versus the Danish krone compared with the prevailing

exchange rates in 2014.

CAPITAL EXPENDITURE AND FREE CASH FLOW

Net capital expenditure for property, plant and equipment was DKK 1.8

billion compared with DKK 1.5 billion in 2014. Net capital expenditure was primarily related to investments in additional insulin

filling capacity, expansion of the manufacturing capacity for biopharmaceutical products and the construction of new research facilities.

Free cash flow was DKK 16.5 billion compared with DKK 10.5 billion in 2014.

The increase of 57% compared with 2014 primarily reflects the increased cash flow from operating activities as well as the non-recurring

proceeds from the partial divestment of NNIT.

KEY DEVELOPMENTS IN THE SECOND QUARTER OF 2015

Please refer to appendix 1 for an overview of the quarterly numbers in

DKK and to appendix 6 for details on sales in the second quarter of 2015.

Sales in the second quarter of 2015 increased by 25% in Danish kroner and

by 8% in local currencies compared with the same period in 2014. The growth was driven by Victoza®

and Norditropin® as well as the modern insulins NovoRapid®

and Levemir®. From a geographic perspective, sales growth in local currencies was

driven by North America and International Operations, growing by 10% and 23% respectively, whereas sales declined by 6% in Region

China. The sales decline in Region China was driven by a negative impact from timing of shipments to distributors in 2014 as well

as a declining growth of the diabetes care market and increased competition.

The gross margin was 85.7% in the second quarter of 2015 compared with 83.0%

in the same period last year. The increase of 2.7 percentage points reflects a positive currency impact of 2.0 percentage points

as well as a favourable product mix and productivity development.

Sales and distribution costs increased by 29% in Danish kroner and by 12%

in local currencies in the second quarter of 2015 compared with the same period last year. The increase in costs was driven by

launch costs related to Saxenda® in the US, sales force investments in selected countries

in International Operations as well as adjustments to legal provisions.

Research and development costs decreased by 1% in Danish

kroner and by 7% in local currencies in the second quarter of 2015 compared with the same period last year. The decline in costs

reflects the discontinuation of activities within inflammatory disorders in

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 12 of 28 |

September 2014 whereas the underlying costs, excluding costs related

to inflammatory disorders in the second quarter of 2014, increased by 3%.

Administrative costs increased by 12% in Danish kroner and by 4% in local

currencies in the second quarter of 2015 compared with the same period last year.

Other operating income (net) was DKK 379 million in the second quarter of

2015 compared with DKK 204 million in the same period last year. The increase was driven by non-recurring income related to out-licensing

of assets for inflammatory disorders.

Operating profit in Danish kroner increased by 43% and by 15% in local currencies

in the second quarter of 2015 compared with the same period last year.

OUTLOOK

OUTLOOK 2015

The current expectations for 2015 are summarised in the table below:

| |

|

|

| Expectations are as reported, if not otherwise stated |

Current expectations 6 August 2015 |

Previous expectations 30 April 2015 |

| Sales growth |

|

|

| in local currencies |

7-9% |

7-9% |

| as reported |

Around 14 percentage points higher |

Around 16 percentage points higher |

| Operating profit growth |

|

|

| in local currencies |

Around 19% |

Around 17% |

| as reported |

Around 23 percentage points higher |

Around 25 percentage points higher |

| Net financials |

Loss of around DKK 5.7 billion |

Loss of around DKK 6 billion |

| Effective tax rate |

Around 21% |

Around 21% |

| Capital expenditure |

Around DKK 5.0 billion |

Around DKK 5.0 billion |

| Depreciation, amortisation and impairment losses |

Around DKK 3.0 billion |

Around DKK 3.0 billion |

| Free cash flow |

DKK 33-35 billion |

DKK 32-34 billion |

Sales growth for 2015 is expected to be 7–9% measured in

local currencies. This reflects expectations for continued robust performance for the portfolio of modern insulin, Victoza®

and Tresiba® as well as a modest sales contribution from the launches of Saxenda®,

Xultophy® and NovoEight®. These sales drivers

are expected to be partly countered by an impact from increased rebate levels in the US, intensifying competition within diabetes

and biopharmaceuticals as well as macroeconomic conditions in China and a number of markets in International Operations. Given

the current level of exchange rates versus the Danish krone, the reported sales growth is now expected to be around 14 percentage

points higher than growth measured in local currencies equivalent to a reported sales growth of 21–23%.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 13 of 28 |

For 2015, operating profit growth is now expected to be around

19% measured in local currencies. The expectations for operating profit growth above the level of sales growth reflect expectations

for modest growth in selling, distribution and administration costs as well as declining research and development costs reflecting

the 2014 cost impact of the decision to discontinue all activities within inflammatory disorders. The expectation for a higher

level of operating profit growth reflects increased expectations for non-recurring licence income. Given the current level of exchange

rates versus the Danish krone, the reported operating profit growth is now expected to be around 23 percentage points higher than

growth measured in local currencies equivalent to a reported operating profit growth of around 42%.

For 2015, Novo Nordisk expects a net financial loss of around DKK 5.7

billion. The current expectation primarily reflects losses associated with foreign exchange hedging contracts, particularly following

the appreciation of the US dollar versus the Danish krone compared with the average prevailing exchange rates in 2014. As a consequence

of these significant hedging losses, the reported pre-tax profit is expected to grow by approximately 27%.

The effective tax rate for 2015 is expected to be around 21% reflecting

an impact from the non-recurring tax-exempt income from the partial divestment of NNIT.

Capital expenditure is expected to be around DKK 5.0 billion in 2015,

primarily related to investments in an expansion of the manufacturing capacity for biopharmaceutical products, additional capacity

for insulin active pharmaceutical ingredients production, construction of new research facilities and an expansion of the insulin

filling capacity. Depreciation, amortisation and impairment losses are expected to be around DKK 3.0 billion. Free cash

flow is now expected to be DKK 33– 35 billion.

All of the above expectations are based on the assumption that the global

economic environment will not significantly change business conditions for Novo Nordisk during 2015, and that currency exchange

rates, especially the US dollar, will remain at the current level versus the Danish krone. Please refer to appendix 7 for key currency

assumptions.

Novo Nordisk has hedged expected net cash flows in a number of invoicing

currencies and, all other things being equal, movements in key invoicing currencies will impact Novo Nordisk’s operating

profit as outlined in the table below.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 14 of 28 |

| Key invoicing currencies |

Annual impact on Novo Nordisk’s

operating profit of a 5%

movement in currency |

Hedging period (months) |

| USD |

DKK 1,675 million |

11 |

| CNY |

DKK 270 million |

10* |

| JPY |

DKK 115 million |

13 |

| GBP |

DKK 80 million |

11 |

| CAD |

DKK 60 million |

11 |

* USD used as proxy when hedging Novo Nordisk’s CNY currency exposure

The financial impact from foreign exchange hedging is included in ‘Net financials’.

RESEARCH & DEVELOPMENT

UPDATE

DIABETES

Completion of the DEVOTE study now expected mid-2016

The review of the Class II resubmission to the US Food and Drug Administration

(FDA) of the New Drug Applications (NDAs) for Tresiba® and Ryzodeg®

including the prespecified interim analysis of DEVOTE, the double-blinded cardiovascular outcomes trial, is progressing.

Novo Nordisk still expects the review to be completed around 1 October 2015.

Based on the occurrence of major cardiovascular events (MACE) in DEVOTE to

date, the prespecified number of events for the final analysis is now expected to be accumulated by mid-2016, compared with the

previously expected completion time of second half of 2016.

Phase 2a trial initiated with oral insulin OI338GT (NN1953)

In June 2015, Novo Nordisk initiated the first phase 2a proof-of-principle

trial with the long-acting insulin analogue OI338GT. The trial is an eight-week randomised, double- blinded, multiple dose trial

investigating the glycaemic effect and safety of once-daily OI338GT in combination with subcutaneous placebo compared to once-daily

insulin glargine in combination with once-daily oral placebo in approximately 50 people with type 2 diabetes. Contingent on the

achievement of proof of principle, larger phase 2b trials are expected to be initiated.

Phase 1 trial initiated with oral insulin OI320GT (NN1957)

In June 2015, Novo Nordisk initiated the first phase 1 trial with OI320GT,

a new oral insulin analogue. The trial will investigate the safety, tolerability, pharmacokinetics and pharmacodynamics of OI320GT

in approximately 80 healthy volunteers.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 15 of 28 |

First phase 3a trial with liraglutide as adjunct therapy to insulin

for people with type 1 diabetes (NN9211) successfully completed

In July 2015, Novo Nordisk completed the first phase 3a trial with liraglutide as

adjunct to insulin therapy in people with type 1 diabetes. ADJUNCT TWO™ is a randomised, double-blinded

placebo-controlled trial investigating efficacy and safety of daily doses of 0.6 mg, 1.2 mg or 1.8 mg liraglutide compared

with placebo as adjunct to insulin treatment in 835 people with type 1 diabetes for 26 weeks. In agreement with regulatory

requirements, the maximum insulin dose in the trial was fixed in all treatment arms with an upper cap of the average daily

total insulin dose when entering the trial, to investigate the additional impact of liraglutide on glucose control.

From a mean baseline HbA1c of around

8.1%, people treated with liraglutide as adjunct to insulin therapy achieved a statistically significantly greater improvement

in HbA1c between 0.2% and 0.3% compared with 0.0% for people treated with placebo. The primary

endpoint of HbA1c superiority was met for all investigated doses. In addition, the total insulin

dose was reduced for people treated with liraglutide as adjunct to insulin therapy compared to placebo at the end of the 26 weeks.

Furthermore, from a mean baseline weight of around 84 kg, people treated

with liraglutide as adjunct to insulin therapy experienced a statistically significantly greater weight loss of between 2 kg and

5 kg whereas people treated with placebo experienced a stable weight development.

In the trial, liraglutide was safe and well tolerated. The most common adverse

events were related to the gastrointestinal system, primarily transient nausea and vomiting. The gastrointestinal adverse events

appeared to be dose-dependent and were mostly mild to moderate. A higher rate of symptomatic hypoglycaemia was observed among people

treated with liraglutide 1.2 mg compared to people treated with placebo. There was no difference in the severe hypoglycaemic episodes

or in the nocturnal symptomatic hypoglycaemic episodes and no apparent difference on overall adverse events and standard safety

parameters.

The results of the second and final pivotal phase 3a trial ADJUNCT ONE™

are expected to be reported shortly.

First phase 3a trial with semaglutide (NN9535) in people with type 2 diabetes

successfully completed

As previously announced on 10 July 2015, Novo Nordisk has successfully completed

SUSTAIN 1, the first phase 3a trial for semaglutide, a new GLP-1 analogue administered subcutaneously once weekly. The trial investigated

the efficacy and safety of 0.5 mg and 1.0 mg semaglutide as monotherapy during 30 weeks of treatment compared with placebo in 388

people with type 2 diabetes previously on diet and exercise.

The trial achieved its primary endpoint by demonstrating that from a mean

baseline HbA1c of 8.1%, people treated with doses of 0.5 mg and 1.0 mg semaglutide achieved

superior improvements in HbA1c of 1.5% and 1.6%, respectively, compared to no

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 16 of 28 |

change in HbA1c in the placebo group.

74% and 73% of the people treated with 0.5 mg and 1.0 mg semaglutide, respectively, achieved the American Diabetes Association

(ADA) and European Association for the Study of Diabetes (EASD) treatment target of HbA1c below

7% compared with 25% of the people treated with placebo.

Furthermore, from a mean baseline of 92 kg, people treated with semaglutide

in both doses of 0.5 mg and 1.0 mg experienced a superior weight loss of 3.8 kg and 4.6 kg, respectively, compared with a weight

loss of 1.0 kg for people treated with placebo, thus meeting the confirmatory secondary endpoint. In the trial, semaglutide was

safe and well tolerated. The most common adverse events were related to the gastrointestinal system, primarily nausea, and were

comparable to Victoza® in similar trials and diminished over time. The discontinuation

rates due to all adverse events for

0.5 mg and 1.0 mg semaglutide were 6% and 5% compared to a discontinuation

rate of 2% for placebo.

Novo Nordisk expects to announce headline results of the five remaining SUSTAIN

trials within the next nine months.

American Diabetes Association (ADA) meeting 5–9 June 2015 in Boston, US

At the annual meeting of the ADA held in Boston, results from Novo Nordisk’s

research and development activities were presented in 34 accepted abstracts. Among the key presentations was an oral presentation

of the 26-week DUAL® V phase 3b trial for Xultophy®.

Results from this trial were announced in January 2015. The key presentations also comprised results from a phase 3b trial investigating

Victoza® in people with type 2 diabetes during Ramadan, which were announced in June 2015,

and additional analyses of the clinical data for Saxenda® from SCALE®,

the phase 3a development programme.

OBESITY

Treatment with Saxenda® for three

years reduced the risk of developing type 2 diabetes compared with placebo

As previously announced on 22 May 2015, Novo Nordisk has successfully

completed the three-year extension of the SCALE® Obesity and Prediabetes trial in adults

with obesity or who were overweight with comorbidities, and had prediabetes at baseline. The trial met its primary endpoint, demonstrating

that ongoing treatment with Saxenda® (liraglutide 3 mg) in combination with a reduced-calorie

diet and increased physical activity delayed the onset of type 2 diabetes, compared with placebo (diet and exercise alone).

Over the course of this 160-week, randomised, blinded phase 3a trial, the

time to onset of type 2 diabetes was 2.6 times longer for people treated with Saxenda® compared

with placebo treatment. In addition, the risk of developing type 2 diabetes was reduced by approximately 80% and statistically

significant for those being treated with Saxenda®.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 17 of 28 |

At 160 weeks, Saxenda® provided an

average body weight loss of 6.1% from baseline, compared with 1.8% for placebo treatment, both in combination with a reduced-calorie

diet and increased physical activity. 49.6% of people treated with Saxenda® achieved a

weight loss of at least 5% of their baseline body weight, compared with 23.4% on placebo treatment; 24.3% lost more than 10% of

their body weight when treated with Saxenda® compared to 9.4% with placebo.

In the trial, Saxenda® was generally

well tolerated and no new safety issues were identified.

SUSTAINABILITY UPDATE

Number of employees in Novo Nordisk increased 4.5% adjusted for the NNIT

divestment

The number of full-time equivalent employees at the end of the second quarter of 2015 had decreased by 1.4% to 39,658

compared with 12 months ago reflecting the divestment of NNIT. Adjusted for the impact of the divestment, the number of employees

in Novo Nordisk grew by 4.5% compared with the second quarter of 2014.

The growth is driven by expansions in Denmark, primarily in Product Supply,

as well as in India and China.

Screening programme in Qatar detects diabetes

In June and July 2015, Action on Diabetes, a public-private partnership

set up in Qatar by Maersk Oil Qatar, Qatari Health Authorities and Novo Nordisk, conducted a diabetes screening covering more than

5,000 people during the Muslim Holy Month of Ramadan. Early detection is of vital importance in the prevention and management of

diabetes, and Muslims with type 2 diabetes who fast during the Ramadan have an estimated 7.5- fold increased risk of severe hypoglycaemia

and a fivefold increased risk of severe hyperglycaemia.

EQUITY

Total equity was DKK 39,111 million at the end of the first six months of

2015, equivalent to 48.1% of total assets, compared with 57.6% at the end of the first six months of 2014. The decrease in equity

as a percentage of total assets reflects the sustained policy of returning excess capital to the company’s shareholders while

the underlying operating activities have continued to expand and in addition been impacted by currencies related to the appreciation

of the US dollar versus the Danish krone.

2015 share repurchase programme

On 30 April 2015, Novo Nordisk announced a share repurchase programme

of up to DKK 9.3 billion to be executed from 30 April to 27 October 2015, as part of an overall 2015 programme of up to DKK 17.5

billion to be executed during a 12-month period beginning 30 January 2015. The purpose of the programme is to reduce the company’s

share capital. Under the programme announced 30 April 2015, Novo Nordisk has repurchased 12,652,200 B shares for an amount of DKK

4.8 billion in the period from 30 April to 4 August 2015.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 18 of 28 |

As of 4 August 2015, Novo Nordisk A/S has repurchased a total of 23,830,104

B shares equal to a transaction value of DKK 8.5 billion under the up to DKK 17.5 billion programme beginning 30 January 2015.

As of 4 August 2015, Novo Nordisk A/S and its wholly-owned affiliates owned

3Le2g,4a4l

1,891 of its own B shares, corresponding to 1.2% of the total share capital.

LEGAL MATTERS

Product liability lawsuits related to Victoza®

As of 3 August 2015, Novo Nordisk, along with the majority of incretin-based

product manufacturers in the US, is a defendant in product liability lawsuits related to use of incretin-based medications. To

date, 174 plaintiffs have named Novo Nordisk in product liability lawsuits, predominantly claiming damages for pancreatic cancer

that allegedly developed as a result of using Victoza® and other GLP-1/DPP-IV products.

121 of the Novo Nordisk plaintiffs have also named other defendants in their lawsuits. Most Novo Nordisk plaintiffs have filed

suit in California federal court. Currently, Novo Nordisk does not have any individual trials scheduled in 2015. Novo Nordisk does

not expect the pending claims to have a material impact on its financial position, operating profit and cash flow.

Lawsuit related to the UN Oil for Food Programme against the Republic of

Iraq closed

Novo Nordisk, along with 93 other defendants, was named in a lawsuit filed in 2009 in the United States by the

Republic of Iraq. The lawsuit alleged damages related to the defendants’ participation in the United Nations’ defunct

Oil for Food Programme. Novo Nordisk succeeded on a motion to dismiss this case in 2013, and the Republic of Iraq has now exhausted

its ability to appeal the dismissal, thus bringing the matter to a close. This has not had a material impact on Novo Nordisk’s

financial position, operating profit or cash flow.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 19 of 28 |

FORWARD-LOOKING STATEMENTS

Novo Nordisk’s reports filed with or furnished to the US Securities

and Exchange Commission (SEC), including this document as well as the company’s Annual Report 2014 and Form 20-F,

both filed with the SEC in February 2015, and written information released, or oral statements made, to the public in the future

by or on behalf of Novo Nordisk, may contain forward-looking statements. Words such as ‘believe’, ‘expect’,

‘may’, ‘will’, ‘plan’, ‘strategy’, ‘prospect’, ‘foresee’,

‘estimate’, ‘project’, ‘anticipate’, ‘can’, ‘intend’, ‘target’

and other words and terms of similar meaning in connection with any discussion of future operating or financial performance identify

forward-looking statements. Examples of such forward-looking statements include, but are not limited to:

| • | | statements of targets, plans, objectives or goals for future operations, including those related

to Novo Nordisk’s products, product research, product development, product introductions and product approvals as well as

cooperation in relation thereto |

| • | | statements containing projections of or targets for revenues, costs, income (or loss), earnings

per share, capital expenditures, dividends, capital structure, net financials and other financial measures |

| • | | statements regarding future economic performance, future actions and outcome of contingencies

such as legal proceedings |

| • | | statements regarding the assumptions underlying or relating to such statements. |

In this document, examples of forward-looking statements can be found under

the headings ‘Outlook’, ‘Research and Development update’, Equity’ and ‘Legal matters’.

These statements are based on current plans, estimates and projections. By

their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific. Novo Nordisk

cautions that a number of important factors, including those described in this document, could cause actual results to differ materially

from those contemplated in any forward-looking statements.

Factors that may affect future results include, but are not limited to, global

as well as local political and economic conditions, including interest rate and currency exchange rate fluctuations, delay or failure

of projects related to research and/or development, unplanned loss of patents, interruptions of supplies and production, product

recalls, unexpected contract breaches or terminations, government-mandated or market-driven price decreases for Novo Nordisk’s

products, introduction of competing products, reliance on information technology, Novo Nordisk’s ability to successfully

market current and new products, exposure to product liability and legal proceedings and investigations, changes in governmental

laws and related interpretation thereof, including on reimbursement, intellectual property protection and regulatory controls on

testing, approval, manufacturing and marketing, perceived or actual failure to adhere to ethical marketing practices, investments

in and divestitures of domestic and foreign companies, unexpected growth in costs and expenses, failure to recruit and retain the

right employees, and failure to maintain a culture of compliance.

Please also refer to the overview of risk factors in ‘Be aware of the

risk’ on pp 42–43 of the Annual Report 2014 available on novonordisk.com.

Unless required by law, Novo Nordisk is under no duty

and undertakes no obligation to update or revise any forward-looking statement after the distribution of this document, whether

as a result of new information, future events or otherwise.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 20 of 28 |

MANAGEMENT STATEMENT

The Board of Directors and Executive Management have reviewed and approved

the financial report of Novo Nordisk A/S for the first six months of 2015. The financial report has not been audited or reviewed

by the company’s independent auditors.

The financial report for the first six months of 2015 has been prepared

in accordance with IAS 34 ‘Interim Financial Reporting’ and accounting policies set out in the Annual Report 2014

of Novo Nordisk, amended with accounting policy regarding associated companies. Furthermore, the financial report for the first

six months of 2015 and Management’s Review are prepared in accordance with additional Danish disclosure requirements for

interim reports of listed companies.

In our opinion, the accounting policies used are appropriate and the overall

presentation of the financial report for the first six months of 2015 is adequate. Furthermore, in our opinion, Management’s

Review includes a true and fair account of the development in the operations and financial circumstances, of the results for the

period and of the financial position of the Group as well as a description of the most significant risks and elements of uncertainty

facing the Group in accordance with Danish disclosure requirements for listed companies.

Besides what has been disclosed in the quarterly financial

report, no changes in the Group’s most significant risks and uncertainties have occurred relative to what was disclosed in

the consolidated annual report for 2014.

Bagsværd, 6 August 2015

| Executive Management: |

| |

|

|

| Lars Rebien Sørensen |

Jesper Brandgaard |

Lars Fruergaard Jørgensen |

| President and CEO |

CFO |

|

| |

|

|

| Jakob Riis |

Mads Krogsgaard Thomsen |

|

| |

| |

| |

| Board of Directors: |

| |

|

|

| Göran Ando |

Jeppe Christiansen |

Bruno Angelici |

| Chairman |

Vice chairman |

|

| |

|

|

| Sylvie Grégoire |

Liz Hewitt |

Liselotte Hyveled |

| |

|

|

| Thomas Paul Koestler |

Eivind Kolding |

Anne Marie Kverneland |

| |

|

|

| Søren Thuesen Pedersen |

Stig Strøbæk |

Mary Szela |

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 21 of 28 |

FINANCIAL INFORMATION

APPENDIX 1: QUARTERLY NUMBERS IN DKK

(Amounts in DKK million, except number of full-time equivalent employees,

earnings per share and number of shares outstanding).

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%

change |

|

| |

2015 |

|

|

2014 |

|

|

Q2 2015 vs |

|

| |

Q2 |

|

Q1 |

|

|

Q4 |

|

Q3 |

|

Q2 |

|

Q1 |

|

|

Q2

2014 |

|

| Net sales |

27,059 |

|

25,200 |

|

|

24,585 |

|

22,249 |

|

21,629 |

|

20,343 |

|

|

25% |

|

| Gross profit |

23,200 |

|

21,326 |

|

|

20,586 |

|

18,823 |

|

17,958 |

|

16,877 |

|

|

29% |

|

| Gross margin |

85.7% |

|

84.6% |

|

|

83.7% |

|

84.6% |

|

83.0% |

|

83.0% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and distribution costs |

7,175 |

|

6,147 |

|

|

6,679 |

|

5,899 |

|

5,559 |

|

5,086 |

|

|

29% |

|

| Percentage of sales |

26.5% |

|

24.4% |

|

|

27.2% |

|

26.5% |

|

25.7% |

|

25.0% |

|

|

|

|

| Research and development costs |

3,035 |

|

3,250 |

|

|

3,865 |

|

3,654 |

|

3,075 |

|

3,168 |

|

|

(1%) |

|

| Hereof costs related to discontinuation of activities

within inflammatory disorders |

- |

|

- |

|

|

- |

|

600 |

|

- |

|

- |

|

|

N/A |

|

| Percentage of sales |

11.2% |

|

12.9% |

|

|

15.7% |

|

16.4% |

|

14.2% |

|

15.6% |

|

|

|

|

| Administrative costs |

887 |

|

854 |

|

|

1,067 |

|

870 |

|

795 |

|

805 |

|

|

12% |

|

| Percentage of sales |

3.3% |

|

3.4% |

|

|

4.3% |

|

3.9% |

|

3.7% |

|

4.0% |

|

|

86% |

|

| Other operating income, net |

379 |

|

2,782 |

|

|

182 |

|

169 |

|

204 |

|

215 |

|

|

|

|

| Hereof non-recurring income from the initial

public offering of NNIT A/S |

- |

|

2,376 |

|

|

- |

|

- |

|

- |

|

- |

|

|

N/A |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

12,482 |

|

13,857 |

|

|

9,157 |

|

8,569 |

|

8,733 |

|

8,033 |

|

|

43% |

|

| Operating margin |

46.1% |

|

55.0% |

|

|

37.2% |

|

38.5% |

|

40.4% |

|

39.5% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial income |

(227) |

|

285 |

|

|

(1,141) |

|

326 |

|

396 |

|

586 |

|

|

N/A |

|

| Financial expenses |

1,707 |

|

1,657 |

|

|

(336) |

|

441 |

|

140 |

|

318 |

|

|

N/A |

|

| Net financials |

(1,934) |

|

(1,372) |

|

|

(805) |

|

(115) |

|

256 |

|

268 |

|

|

N/A |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit before income taxes |

10,548 |

|

12,485 |

|

|

8,352 |

|

8,454 |

|

8,989 |

|

8,301 |

|

|

17% |

|

| Income taxes |

2,205 |

|

2,609 |

|

|

1,823 |

|

1,954 |

|

1,995 |

|

1,843 |

|

|

11% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit |

8,343 |

|

9,876 |

|

|

6,529 |

|

6,500 |

|

6,994 |

|

6,458 |

|

|

19% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, amortisation and impairment losses 1) |

648 |

|

663 |

|

|

928 |

|

1,183 |

|

667 |

|

657 |

|

|

(3%) |

|

| Capital expenditure |

1,018 |

|

764 |

|

|

1,505 |

|

986 |

|

802 |

|

693 |

|

|

27% |

|

| Net cash generated from operating activities |

11,974 |

|

4,106 |

|

|

7,301 |

|

12,197 |

|

8,125 |

|

4,069 |

|

|

47% |

|

| Free cash flow |

10,830 |

|

5,643 |

|

|

5,717 |

|

11,157 |

|

7,250 |

|

3,272 |

|

|

49% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

81,313 |

|

77,457 |

|

|

77,062 |

|

71,283 |

|

63,681 |

|

63,241 |

|

|

28% |

|

| Total equity |

39,111 |

|

32,108 |

|

|

40,294 |

|

37,967 |

|

36,661 |

|

33,583 |

|

|

7% |

|

| Equity ratio |

48.1% |

|

41.5% |

|

|

52.3% |

|

53.3% |

|

57.6% |

|

53.1% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Full-time equivalent employees end of period |

39,658 |

|

39,062 |

|

|

40,957 |

|

40,700 |

|

40,226 |

|

39,579 |

|

|

(1%) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share/ADR (in DKK) |

3.24 |

|

3.8 |

|

|

2.51 |

|

2.49 |

|

2.66 |

|

2.44 |

|

|

22% |

|

| Diluted earnings per share/ADR (in DKK) |

3.23 |

|

3.79 |

|

|

2.51 |

|

2.47 |

|

2.66 |

|

2.43 |

|

|

21% |

|

| Average number of shares outstanding (million) |

2,578.1 |

|

2,596.7 |

|

|

2,599.7 |

|

2,613.9 |

|

2,628.9 |

|

2,642.4 |

|

|

(2%) |

|

| Average number of diluted shares outstanding (million) |

2,584.1 |

|

2,604.2 |

|

|

2,608.2 |

|

2,622.2 |

|

2,637.3 |

|

2,653.1 |

|

|

(2%) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales by business segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| New-generation insulin |

330 |

|

271 |

|

|

262 |

|

175 |

|

141 |

|

80 |

|

|

134% |

|

| Modern insulin (insulin analogues) |

12,604 |

|

11,498 |

|

|

11,168 |

|

10,641 |

|

10,351 |

|

9,377 |

|

|

22% |

|

| Human insulin |

2,784 |

|

2,897 |

|

|

2,772 |

|

2,478 |

|

2,475 |

|

2,573 |

|

|

12% |

|

| Victoza® |

4,486 |

|

3,957 |

|

|

4,010 |

|

3,441 |

|

3,059 |

|

2,916 |

|

|

47% |

|

| Other diabetes and obesity care |

1,075 |

|

1,195 |

|

|

1,064 |

|

953 |

|

1,031 |

|

1,013 |

|

|

4% |

|

| Diabetes and obesity care total |

21,279 |

|

19,818 |

|

|

19,276 |

|

17,688 |

|

17,057 |

|

15,959 |

|

|

25% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Haemophilia |

2,757 |

|

2,734 |

|

|

2,610 |

|

2,112 |

|

2,327 |

|

2,255 |

|

|

18% |

|

| Norditropin® |

2,083 |

|

1,830 |

|

|

1,811 |

|

1,686 |

|

1,509 |

|

1,500 |

|

|

38% |

|

| Other biopharmaceuticals 2) |

940 |

|

818 |

|

|

888 |

|

763 |

|

736 |

|

629 |

|

|

28% |

|

| Biopharmaceuticals total |

5,780 |

|

5,382 |

|

|

5,309 |

|

4,561 |

|

4,572 |

|

4,384 |

|

|

26% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales by geographic segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America |

14,325 |

|

12,455 |

|

|

12,164 |

|

11,133 |

|

10,561 |

|

9,265 |

|

|

36% |

|

| Europe |

5,222 |

|

4,977 |

|

|

5,413 |

|

5,045 |

|

4,989 |

|

4,703 |

|

|

5% |

|

| International Operations |

3,884 |

|

3,684 |

|

|

3,602 |

|

2,938 |

|

2,968 |

|

3,032 |

|

|

31% |

|

| Region China |

2,284 |

|

2,847 |

|

|

2,089 |

|

1,881 |

|

1,947 |

|

2,171 |

|

|

17% |

|

| Japan & Korea |

1,344 |

|

1,237 |

|

|

1,317 |

|

1,252 |

|

1,164 |

|

1,172 |

|

|

15% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment operating profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diabetes and obesity care |

8,713 |

|

7,950 |

|

|

6,383 |

|

6,989 |

|

6,376 |

|

5,785 |

|

|

37% |

|

| Biopharmaceuticals |

3,769 |

|

3,531 |

|

|

2,774 |

|

1,580 |

|

2,357 |

|

2,248 |

|

|

60% |

|

| Income from the initial public offering of NNIT A/S (unallocated to segments) |

- |

|

2,376 |

|

|

- |

|

- |

|

- |

|

- |

|

|

N/A |

|

1) Hereof impairments of around DKK 480

million in Q3 and Q4 2014 related to discontinuation of activities within inflammatory disorders.

2)

Comparative figures have been restated as NovoEight® and NovoThirteen® are now reported as Haemophilia together

with NovoSeven®.

| |

Financial

performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Legal

|

Financial

information

|

|

Company announcement No 46 / 2015

Financial report for the period 1 January 2015 to 30 June 2015 | Page 22 of 28 |

APPENDIX 2: INCOME STATEMENT AND STATEMENT

OF COMPREHENSIVE INCOME

| |

H1 |

|

H1 |

|

Q2 |

|

Q2 |

|

| DKK million |

2015 |

|

2014 |

|

2015 |

|

2014 |

|

| |

|

|

|

|

|

|

|

|

| Income statement |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Net sales |

52,259 |

|

41,972 |

|

27,059 |

|

21,629 |

|

| Cost of goods sold |

7,733 |

|

7,137 |

|

3,859 |

|

3,671 |

|

| Gross profit |

44,526 |

|

34,835 |

|

23,200 |

|

17,958 |

|

| |

|

|

|

|

|

|

|

|

| Sales and distribution costs |

13,322 |

|

10,645 |

|

7,175 |

|

5,559 |

|

| Research and development costs |

6,285 |

|

6,243 |

|

3,035 |

|

3,075 |

|

| Administrative costs |

1,741 |

|

1,600 |

|

887 |

|

795 |

|

| Other operating income, net |

3,161 |

|

419 |

|

379 |

|

204 |

|

| Hereof non-recurring income from the initial public offering of NNIT A/S |