Oman Joins Oil Rivals Selling Debt -- WSJ

June 10 2016 - 3:04AM

Dow Jones News

By Carolyn Cui

The Oman government sold $2.5 billion of bonds Wednesday,

becoming the latest Persian Gulf state to tap the debt markets in a

move to shore up its budget during a period of low oil prices.

The bond deal represented the country's first issuance in the

international debt market in nearly two decades. The government

sold five-year notes at a coupon rate of 3.625% and 10-year ones at

4.75%, according to a person familiar with the deal.

Yields on both portions came in lower than initial indications

to investors, reflecting strong demand from both regional and

international buyers. Total demand was about $7 billion, this

person said.

This year, Middle Eastern governments have raised $20 billion

from international debt markets, already a record year for debt

issuance, according to data provider Dealogic. Abu Dhabi and Qatar

tapped the markets earlier this year, raising $5 billion and $9

billion, respectively, while Kuwait is expected to issue $5 billion

of debt in the weeks ahead.

Saudi Arabia, meanwhile, has indicated plans to sell $15 billion

in global debt. That would be one of the largest sales ever by a

developing country.

Oman is the largest Middle East oil producer outside of the

Organization of the Petroleum Exporting Countries. With oil and gas

contributing about 85% to government revenue, Oman was hit hard by

the plunge in the price of oil since mid-2014.

Even after the government took steps to cut expenditures and

remove fuel subsidies, Oman faces a 17% budget deficit for this

year. The government tapped its foreign reserves, which stood at

$17.5 billion last year, according to the International Monetary

Fund, and borrowed from local and foreign banks before turning to

the debt markets.

"It's a good deal, but the pricing is not cheap," said Anita

Yadav, head of fixed-income research at Emirates NBD, a Dubai-based

bank, referring to the Oman bonds. She said the yield on Oman's

10-year note is higher than on debt sold by Indonesia, which has a

lower credit rating.

The Indonesian securities yield 3.84%, while the Oman yield is

about 4.72%, near the coupon rate.

Citigroup Inc., J.P. Morgan Chase & Co., Mitsubishi UFJ

Financial Group Inc., National Bank of Abu Dhabi and Natixis were

the underwriters for the sale.

Write to Carolyn Cui at carolyn.cui@wsj.com

(END) Dow Jones Newswires

June 10, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

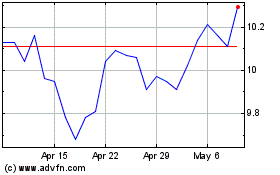

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2024 to May 2024

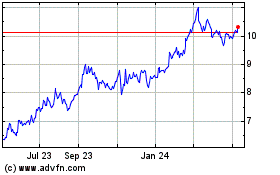

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From May 2023 to May 2024