Japan's Biggest Bank Picks Next Leader

December 09 2015 - 8:30AM

Dow Jones News

TOKYO—Japan's largest bank is preparing to name an executive

with long domestic experience to its top job, tapping an insider

with deep Tokyo contacts to run an institution that is looking

overseas for profits.

The management of Mitsubishi UFJ Financial Group Inc. plans to

nominate 60-year-old Takashi Oyamada as the next president and

chief executive of its core banking unit, a person familiar with

the matter said Wednesday. The appointment, subject to approval by

a committee that includes independent directors, would take effect

in April, the person said.

The bank is No. 1 in Japan by assets and market capitalization.

It owns slightly more than 20% of U.S. investment bank Morgan

Stanley and earns about 20% of its profit from international

business.

Leaders of the bank traditionally serve for four years. The

current president and CEO, Nobuyuki Hirano, took the helm in April

2012. He is expected to stay on as president of the parent group

for an additional year or so beyond April 2016 before stepping

aside from that post as well.

Mr. Hirano, 64, spent much of his early career in Europe and New

York, and he has been accustomed to speak one-on-one in English on

the phone with Morgan Stanley Chief Executive James Gorman.

By contrast, Mr. Oyamada built his career in domestic roles,

although he did study briefly at the Massachusetts Institute of

Technology. Acquaintances say he understands English but isn't

comfortable speaking it in business situations. A University of

Tokyo graduate who joined what was then known as Mitsubishi Bank in

1979, Mr. Oyamada has built a strong network among government

officials and financial regulators.

A bank spokesman declined to make Mr. Oyamada available for

comment.

To offset weak loan demand at home, Japanese banks are gearing

up for more overseas lending, despite concerns about a possible

slowdown in emerging markets.

Mitsubishi UFJ Financial Group has taken advantage of its solid

financial footing to expand in the U.S., acquiring small and

midsize lenders through Union Bank, which the Tokyo bank made a

wholly owned unit in 2008. In 2012, Union Bank acquired a

California lender, Pacific Capital Bancorp, for $1.5 billion.

"We've been saying that our goal is to become a top-10 lender in

the U.S.," said Mr. Hirano in a September interview. "I think we

need a scale-up of size because our revenue isn't sufficient to

cover the rising cost of complying with legal and regulatory

frameworks."

In the year ended March 2015, Mitsubishi UFJ Financial Group

became the second Japanese company after Toyota Motor Corp. to post

a net profit of more than ¥ 1 trillion ($8.3 billion), boosted by

strong performance in its overseas operations. By the bank's tally,

as of September 2014, it was the world's eighth-largest bank by

deposits, trailing four Chinese banks as well as Bank of America

Corp., HSBC Holdings PLC and J.P. Morgan Chase & Co.

Write to Atsuko Fukase at atsuko.fukase@wsj.com

(END) Dow Jones Newswires

December 09, 2015 08:15 ET (13:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

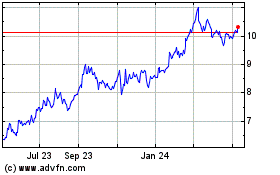

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

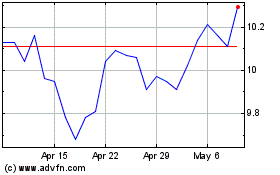

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024