UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of

1934

For the month of May 2015

Commission File No. 000-54189

MITSUBISHI

UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1, Marunouchi 2-chome, Chiyoda-ku

Tokyo 100-8330, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in

paper as permitted by Regulation S-T Rule 101(b)(7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 15, 2015

|

|

|

| Mitsubishi UFJ Financial Group, Inc. |

|

|

| By: |

|

/s/ Akira Takeda |

| Name: |

|

Akira Takeda |

| Title: |

|

Chief Manager, General Affairs |

|

|

Corporate Administration Division |

Mitsubishi UFJ Financial Group, Inc.

Notice concerning Partial Amendment to the Articles of Incorporation

Tokyo, May 15, 2015 — Mitsubishi UFJ Financial Group, Inc. (MUFG) resolved, at a meeting of the Board of Directors held today, to submit a proposal for partial amendment to the Articles

of Incorporation of MUFG, as stated below, at the 10th Annual General Meeting of Shareholders to be held on June 25, 2015.

| 1. |

Reasons for Amendments |

| (1) |

As MUFG evolves and undergoes reform as a global financial group, it will become a company with three committees in order to separate executive and oversight functions,

strengthen its Board of Directors’ oversight functions and further improve its corporate governance structure. Accordingly, changes are required to its Articles of Incorporation, including additional provisions related to each committee and

executive officers, and the removal of provisions related to corporate auditors and the Board of Corporate Auditors. Among the planned amendments to the Articles of Incorporation, each corporate auditor has given their consent for the change in

provisions (Article 40 of the Proposed Amendments) permitting the exemption of responsibilities of executive officers within codified limits. |

| (2) |

The following amendments will be made with respect to the First Series of Class 5 and Class 11 Preferred Shares, all of which have already been cancelled.

|

| |

(i) |

The aggregate number of shares authorized to be issued by MUFG will be decreased, and the aggregate number of the First Series of Class 5 and Class 11 Preferred Shares

authorized to be issued will be deleted. |

| |

(ii) |

The descriptions with respect to the First Series of Class 5 and Class 11 Preferred Shares in the provisions concerning preferred dividends, preferred interim dividends

and distribution of residual assets will be deleted. Provisions for acquisitions of the First Series of Class 5 Preferred Shares will be deleted. Provisions for acquisition rights and conversion of First Series of Class 11 Preferred Shares will be

deleted. |

| (3) |

Due to the Act to Amend the Corporate Law (Act No. 90 of 2014) taking effect on May 1, 2015, changing the range of corporate officers who can conclude

liability limitation contracts, provisions (Article 34 of the Proposed Amendments) will be changed to ensure that Directors who do not execute business but will be newly enabled to conclude liability limitation contracts will be able to fully carry

out their expected duties. |

| (4) |

Changes will be made to provisions for the preceding and other items. |

— 1

—

The details of amendments

are as shown in the attached document.

Date of resolution at

a meeting of the Board of Directors

May 15, 2015 (Friday)

Date of resolution at the general meeting of shareholders

June 25, 2015 (Thursday)

Effective date of the amendments to Articles of

Incorporation

June 25, 2015 (Thursday)

* * *

Contact:

Mitsubishi UFJ Financial Group, Inc.

Public Relations Division

81-3-3240-7651

— 2

—

PROPOSED AMENDMENTS TO THE ARTICLES OF INCORPORATION

OF

MITSUBISHI UFJ

FINANCIAL GROUP, INC.

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| CHAPTER I. GENERAL PROVISIONS |

|

CHAPTER I. GENERAL PROVISIONS |

|

|

| Article 1. through Article 3.

(Omitted.) |

|

Article 1. through Article 3.

(Unchanged.) |

|

|

| (Organization)

Article 4.

The Company shall establish the following organizations in addition to general meeting of shareholders and directors: |

|

(Organization)

Article 4.

The Company, being a company with three committees, shall establish the following organizations in addition to the general

meeting of shareholders and the Directors: |

|

|

| 1. Board of Directors;

2. Corporate Auditors; |

|

1. The Board of Directors;

2. The Nominating and Governance Committee (which constitutes a Nominating Committee defined in the Corporation Act), the Audit Committee, and the

Compensation Committee; |

|

|

| 3. Board of Corporate Auditors; and |

|

3. Executive Officers; and |

|

|

| 4. Accounting Auditor. |

|

4. An Accounting Auditor. |

|

|

| Article 5.

(Omitted.) |

|

Article 5

(Unchanged.) |

|

|

| CHAPTER II. SHARES |

|

CHAPTER II. SHARES |

|

|

| (Total Number of Shares Authorized to be Issued) |

|

(Total Number of Shares Authorized to be Issued) |

|

|

| Article 6.

The aggregate number of shares authorized to be issued by the Company shall be thirty-three billion eight hundred million one

thousand (33,800,001,000) shares, and the aggregate number of each class shares authorized to be issued shall be as set forth below; provided, however, that the aggregate number of shares authorized to be issued with respect to the

First to the Fourth Series of Class 5 Preferred Shares shall not exceed four hundred million (400,000,000) in total, the aggregate number of shares authorized to be issued with respect to the First to the Fourth Series of Class 6 Preferred

Shares shall not exceed two hundred million (200,000,000) in total, and the aggregate number of shares authorized to be issued with respect to the First to the Fourth Series of Class 7 Preferred Shares shall not exceed two hundred million

(200,000,000) in total. |

|

Article 6.

The aggregate number of shares authorized to be issued by the Company shall be thirty-three billion eight hundred million

(33,800,000,000) shares, and the aggregate number of each class shares authorized to be issued shall be as set forth below; provided, however, that the aggregate number of shares authorized to be issued with respect to the Second to the

Fourth Series of Class 5 Preferred Shares shall not exceed four hundred million (400,000,000) in total, the aggregate number of shares authorized to be issued with respect to the First to the Fourth Series of Class 6 Preferred Shares shall not

exceed two hundred million (200,000,000) in total, and the aggregate number of shares authorized to be issued with respect to the First to the Fourth Series of Class 7 Preferred Shares shall not exceed two hundred million (200,000,000) in

total. |

— 3

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

| Ordinary Shares:

thirty-three billion (33,000,000,000) shares

The First Series of Class 5 Preferred Shares:

four hundred million (400,000,000) shares

The Second Series of Class 5 Preferred Shares:

four hundred million (400,000,000) shares

The Third Series of Class 5 Preferred Shares:

four hundred million (400,000,000) shares

The Fourth Series of Class 5 Preferred Shares:

four hundred million (400,000,000) shares

The First Series of Class 6 Preferred Shares:

two hundred million (200,000,000) shares

The Second Series of Class 6 Preferred Shares:

two hundred million (200,000,000) shares

The Third Series of Class 6 Preferred Shares:

two hundred million (200,000,000) shares

The Fourth Series of Class 6 Preferred Shares:

two hundred million (200,000,000) shares

The First Series of Class 7 Preferred Shares:

two hundred million (200,000,000) shares

The Second Series of Class 7 Preferred Shares:

two hundred million (200,000,000) shares

The Third Series of Class 7 Preferred Shares:

two hundred million (200,000,000) shares

The Fourth Series of Class 7 Preferred Shares:

two hundred million (200,000,000) shares

Class 11 Preferred Shares:

one thousand (1,000) shares |

|

Ordinary Shares:

thirty-three billion (33,000,000,000) shares

(Deleted.)

The Second Series of Class 5 Preferred Shares:

four hundred million (400,000,000) shares

The Third Series of Class 5 Preferred Shares:

four hundred million (400,000,000) shares

The Fourth Series of Class 5 Preferred Shares:

four hundred million (400,000,000) shares

The First Series of Class 6 Preferred Shares:

two hundred million (200,000,000) shares

The Second Series of Class 6 Preferred Shares:

two hundred million (200,000,000) shares

The Third Series of Class 6 Preferred Shares:

two hundred million (200,000,000) shares

The Fourth Series of Class 6 Preferred Shares:

two hundred million (200,000,000) shares

The First Series of Class 7 Preferred Shares:

two hundred million (200,000,000) shares

The Second Series of Class 7 Preferred Shares:

two hundred million (200,000,000) shares

The Third Series of Class 7 Preferred Shares:

two hundred million (200,000,000) shares

The Fourth Series of Class 7 Preferred Shares:

two hundred million (200,000,000) shares

(Deleted.) |

— 4

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| Article 7. through Article 12.

(Omitted.) |

|

Article 7. through Article 12.

(Unchanged.) |

|

|

| CHAPTER III. PREFERRED SHARES |

|

CHAPTER III. PREFERRED SHARES |

|

|

| (Preferred Dividends)

Article 13. 1. The Company shall distribute cash dividends from surplus on Preferred Shares (hereinafter referred to as the “Preferred Dividends”) in such respective amount as prescribed below to the

holders of Preferred Shares (hereinafter referred to as the “Preferred Shareholders”) or registered share pledgees who hold pledges over Preferred Shares (hereinafter referred to as the “Registered Preferred Share Pledgees”),

whose names have been entered or recorded in the latest register of shareholders as of March 31 of each year, with priority over the holders of Ordinary Shares (hereinafter referred to as the “Ordinary Shareholders”) or registered

share pledgees who hold pledges over Ordinary Shares (hereinafter referred to as the “Registered Ordinary Share Pledgees”) ; provided, however, that in the event that the Preferred Interim Dividends provided for in Article 14 hereof have

been paid in the relevant business year, the amount so paid shall be deducted accordingly from the amount of the Preferred Dividends set forth below for each relevant class of Preferred Shares. |

|

(Preferred Dividends)

Article 13. 1. The Company shall distribute cash dividends from surplus on Preferred Shares (hereinafter referred to as the “Preferred Dividends”) in such respective amount as prescribed below to the

holders of Preferred Shares (hereinafter referred to as the “Preferred Shareholders”) or registered share pledgees who hold pledges over Preferred Shares (hereinafter referred to as the “Registered Preferred Share Pledgees”),

whose names have been entered or recorded in the latest register of shareholders as of March 31 of each year, with priority over the holders of Ordinary Shares (hereinafter referred to as the “Ordinary Shareholders”) or registered share

pledgees who hold pledges over Ordinary Shares (hereinafter referred to as the “Registered Ordinary Share Pledgees”) ; provided, however, that in the event that the Preferred Interim Dividends provided for in Article 14 hereof have been

paid in the relevant business year, the amount so paid shall be deducted accordingly from the amount of the Preferred Dividends set forth below for each relevant class of Preferred Shares. |

|

|

| The First to the Fourth Series of Class 5 Preferred Shares:

Amount to be determined by resolution of the Board of Directors

adopted at the time of issuance of the Class 5 Preferred Shares, up to two hundred fifty (250) yen per share per year |

|

The Second to the Fourth Series of Class 5 Preferred Shares:

Amount to be determined by resolution of the Board of Directors

adopted at the time of issuance of the Class 5 Preferred Shares, up to two hundred fifty (250) yen per share per year |

|

|

| The First to the Fourth Series of Class 6 Preferred Shares:

Amount to be determined by resolution of the Board of Directors

adopted at the time of issuance of the Class 6 Preferred Shares, up to one hundred twenty-five (125) yen per share per year |

|

The First to the Fourth Series of Class 6 Preferred Shares:

Amount to be determined by resolution of the Board of Directors

adopted at the time of issuance of the Class 6 Preferred Shares, up to one hundred twenty-five (125) yen per share per year |

|

|

| The First to the Fourth Series of Class 7 Preferred Shares:

Amount to be determined by resolution of the Board of Directors

adopted at the time of issuance of the Class 7 Preferred Shares, up to one hundred twenty-five (125) yen per share per year |

|

The First to the Fourth Series of Class 7 Preferred Shares:

Amount to be determined by resolution of the Board of Directors

adopted at the time of issuance of the Class 7 Preferred Shares, up to one hundred twenty-five (125) yen per share per year |

|

|

| Class 11 Preferred Shares: |

|

(Deleted.) |

|

|

| Five and thirty hundredths (5.30) yen per share per year |

|

|

|

|

| 2. and 3. (Omitted.) |

|

2. and 3. (Unchanged.) |

— 5

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

| (Preferred Interim Dividends)

Article 14.

In the event of payment of Interim Dividends provided for in

Article 50 of these Articles (hereinafter referred to as the “Preferred Interim Dividends”), the Company shall make a cash distribution from surplus in such respective amount as prescribed below for each class of Preferred Shares to

the Preferred Shareholders or Registered Preferred Share Pledgees with priority over the Ordinary Shareholders or Registered Ordinary Share Pledgees. |

|

(Preferred Interim Dividends)

Article 14.

In the event of payment of Interim Dividends provided for in

Article 46 of these Articles (hereinafter referred to as the “Preferred Interim Dividends”), the Company shall make a cash distribution from surplus in such respective amount as prescribed below for each class of Preferred Shares to

the Preferred Shareholders or Registered Preferred Share Pledgees with priority over the Ordinary Shareholders or Registered Ordinary Share Pledgees. |

|

|

| The First to the Fourth Series of Class 5 Preferred Shares:

Amount to be determined by resolution of the Board of Directors

adopted at the time of issuance of the Class 5 Preferred Shares, up to one hundred twenty-five (125) yen per share The First to the Fourth Series of Class 6 Preferred Shares: Amount to be determined by resolution of the Board of Directors adopted at the time of issuance of the Class 6 Preferred Shares, up to sixty-two and fifty hundredths (62.50) yen per share

The First to the Fourth Series of Class 7 Preferred Shares:

Amount to be determined by resolution of the Board of Directors

adopted at the time of issuance of the Class 7 Preferred Shares, up to sixty-two and fifty hundredths (62.50) yen per share Class 11 Preferred Shares: Two and sixty-five hundredths (2.65) yen per share |

|

The Second to the Fourth Series of Class 5 Preferred Shares:

Amount to be determined by resolution of the Board of Directors

adopted at the time of issuance of the Class 5 Preferred Shares, up to one hundred twenty-five (125) yen per share The First to the Fourth Series of Class 6 Preferred Shares: Amount to be determined by resolution of the Board of Directors adopted at the time of issuance of the Class 6 Preferred Shares, up to sixty-two and fifty hundredths (62.50) yen per share

The First to the Fourth Series of Class 7 Preferred Shares:

Amount to be determined by resolution of the Board of Directors

adopted at the time of issuance of the Class 7 Preferred Shares, up to sixty-two and fifty hundredths (62.50) yen per share

(Deleted.) |

— 6

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (Distribution of Residual Assets)

Article 15. 1. If the Company distributes its residual assets in cash upon liquidation, the Company shall pay cash to the Preferred Shareholders or Registered Preferred Share Pledgees with priority over the Ordinary

Shareholders or Registered Ordinary Share Pledgees in such respective amount as prescribed below: |

|

(Distribution of Residual Assets)

Article 15. 1. If the Company distributes its residual assets in cash upon liquidation, the Company shall pay cash to the Preferred Shareholders or Registered Preferred Share Pledgees with priority over the Ordinary

Shareholders or Registered Ordinary Share Pledgees in such respective amount as prescribed below: |

| The First to the Fourth Series of Class 5 Preferred

Shares: |

|

The Second to the Fourth Series of Class 5 Preferred

Shares: |

| Two thousand five hundred (2,500) yen per

share The First to the Fourth Series of Class 6 Preferred

Shares: Two thousand five hundred (2,500) yen per

share The First to the Fourth Series of Class 7 Preferred

Shares: Two thousand five hundred (2,500) yen per

share Class 11 Preferred Shares:

One thousand (1,000) yen per share |

|

Two thousand five hundred (2,500) yen per

share The First to the Fourth Series of Class 6 Preferred

Shares: Two thousand five hundred (2,500) yen per

share The First to the Fourth Series of Class 7 Preferred

Shares: Two thousand five hundred (2,500) yen per

share (Deleted.) |

| 2.

(Omitted.) |

|

2. (Unchanged.) |

|

|

| Article 16. through Article 17.

(Omitted.) |

|

Article 16. through Article 17.

(Unchanged.) |

— 7

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (Provisions for Acquisition)

Article 18. 1. In respect of the First to the Fourth Series of Class 5 Preferred Shares and/or the First to the Fourth Series of Class 6 Preferred Shares, the Company may, after issuance of the respective

Preferred Shares and after the lapse of the period designated by resolution of the Board of Directors adopted at the time of the issuance of respective Preferred Shares, acquire such Preferred Shares, in whole or in part, in exchange for the amount

of cash as deemed appropriate as the acquisition price giving due consideration to the prevailing market conditions, as determined by such resolution of the Board of Directors, on a certain date as separately determined by the Company by a

resolution of the Board of Directors after the issue of the relevant Preferred Shares. |

|

(Provisions for Acquisition)

Article 18. 1. In respect of the Second to the Fourth Series of Class 5 Preferred Shares and/or the First to the Fourth Series of Class 6 Preferred Shares, the Company may, after issuance of the respective

Preferred Shares and after the lapse of the period designated by resolution of the Board of Directors adopted at the time of the issuance of respective Preferred Shares, acquire such Preferred Shares, in whole or in part, in exchange for the amount

of cash as deemed appropriate as the acquisition price giving due consideration to the prevailing market conditions, as determined by such resolution of the Board of Directors, on a certain date as separately determined by the Company by a

resolution of the Board of Directors after the issue of the relevant Preferred Shares. |

|

|

| 2. (Omitted.) |

|

2. (Unchanged.) |

|

|

| (Right to Request Acquisition)

Article 19. 1. Any holder of the First to the Fourth Series of Class 6 or the First to the Fourth Series of Class 7 Preferred Shares may request acquisition of such Preferred Shares during the period in which

such Preferred Shareholder is entitled to request acquisition as determined by resolution of the Board of Directors adopted at the time of issuance of such Preferred Shares, in exchange for Ordinary Shares of the Company in the number as is

calculated by the formula designated by such resolution. |

|

(Right to Request Acquisition)

Article 19.

Any holder of the First to the Fourth Series of Class 6 or the First to the Fourth Series of Class 7 Preferred Shares may request

acquisition of such Preferred Shares during the period in which such Preferred Shareholder is entitled to request acquisition as determined by resolution of the Board of Directors adopted at the time of issuance of such Preferred Shares, in exchange

for Ordinary Shares of the Company in the number as is calculated by the formula designated by such resolution. |

| 2. Any holder of Class 11 Preferred Shares may request

acquisition of such Preferred Shares during the period in which such Preferred Shareholder is entitled to request acquisition as provided for in Attachment, in exchange for Ordinary Shares of the Company in the number as is calculated by the formula

provided for in such Attachment. |

|

(Deleted.) |

— 8

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (Mandatory Acquisition) |

|

(Mandatory Acquisition) |

|

|

| Article 20.

1. (Omitted.) 2. The Company shall mandatorily acquire Class 11 Preferred Shares for which no request for acquisition is made during the period in which such Preferred Shareholder is entitled to request for

acquisition on the day immediately following the last day of such period in exchange for Ordinary Shares in the number as is obtained by dividing one thousand (1,000) yen per share by the average daily closing price (including closing bids or

offered prices) of Ordinary Shares of the Company (in regular trading) as reported by the Tokyo Stock Exchange for the thirty (30) consecutive trading days (excluding a trading day or days on which no closing price or closing bid or offered price is

reported) commencing on the forty-fifth (45th) trading day prior to such date; provided, however, that such calculation shall be made to the second decimal place denominated in Yen, and rounded up to the first decimal place when the fraction is

equal to or more than 0.05 yen, discarding amounts less than 0.05 yen. If the average price is less than eight hundred two and sixty hundredths (802.60) yen, the Preferred Shares shall be acquired in exchange for Ordinary Shares in the number as is

obtained by dividing one thousand (1,000) yen per share by eight hundred two and sixty hundredths (802.60) yen. |

|

Article 20.

1. (Unchanged.)

(Deleted.) |

— 9

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| 3. (Omitted.) |

|

2. (Unchanged.) |

|

|

| 4. In the calculation of the number of Ordinary Shares provided for in the preceding three paragraphs of this article, if any number less than one (1) share is

yielded, such fractions shall be handled by the method provided for in Article 234 of the Corporation Act. |

|

3. In the calculation of the number of Ordinary Shares provided for in the preceding two paragraphs of this article, if any number less than one (1) share is yielded,

such fractions shall be handled by the method provided for in Article 234 of the Corporation Act |

|

|

| Article 21.

(Omitted.) |

|

Article 21.

(Unchanged.) |

|

|

| (Prescription Period)

Article 22.

The provisions set forth in Article 51 of these Articles shall apply mutatis mutandis to the payment of Preferred

Dividends and Preferred Interim Dividends. |

|

(Prescription Period)

Article 22.

The provisions set forth in Article 47 of these Articles shall apply mutatis mutandis to the payment of Preferred

Dividends and Preferred Interim Dividends. |

|

|

| CHAPTER IV. GENERAL MEETING OF SHAREHOLDERS |

|

CHAPTER IV. GENERAL MEETING OF SHAREHOLDERS |

|

|

| Article 23.

(Omitted.) |

|

Article 23.

(Unchanged.) |

|

|

| (Chairman)

Article 24. 1. The President and Director of the Company shall act as chairman of general meetings of shareholders. |

|

(Chairman)

Article 24. 1. The Director concurrently serving as President and Group Chief Executive Officer shall act as chairman of general meetings of shareholders. |

|

|

| 2. If the President and Director is unable to act as such, one of the other Directors shall act as chairman in accordance with the order of priority previously determined by

the Board of Directors. |

|

2. If the Director concurrently serving as President and Group Chief Executive Officer is unable to act as such, one of the other Directors shall act as chairman in

accordance with the order of priority determined in advance by the Board of Directors. |

|

|

| Article 25. through Article 29.

(Omitted.) |

|

Article 25. through Article 29.

(Unchanged.) |

— 10

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| CHAPTER V. |

|

CHAPTER V. |

| DIRECTORS AND BOARD OF DIRECTORS |

|

DIRECTORS AND BOARD OF DIRECTORS |

|

|

| Article 30. through Article 31.

(Omitted.) |

|

Article 30. through Article 31.

(Unchanged.) |

|

|

| (Representative Director and Directors with Executive Power)

Article 32.

1. The Board of Directors shall, by resolution, elect Representative

Director(s) from among the Directors. 2. Representative

Directors shall severally represent the Company. 3. The

Board of Directors shall, by resolution, appoint the President and Director. 4. The Board of Directors may, by resolution, appoint the Chairman and Director, several Deputy Chairman and Directors, Deputy Presidents, Senior Managing Directors and Managing

Directors. |

|

(Deleted.) |

|

|

| (Board of Directors)

Article 33. 1. The Board of Directors shall determine the management of the affairs of the Company and supervise the performance of duties of Directors. |

|

(Board of Directors)

Article 32. 1. The Board of Directors shall decide the business execution of the Company and oversee the performance of duties of Executive Officers and Directors. |

|

|

| (Newly established.) |

|

2. Unless otherwise provided for by laws and regulations, the Board of Directors may delegate decisions on the business execution of the Company to Executive

Officers. |

|

|

| 2. Unless otherwise provided for by laws and regulations, the Chairman and Director shall convene meetings of the Board of Directors and act as chairman. If the

Chairman and Director is unable to act as such, or if the Board of Directors does not appoint the Chairman and Director by its resolution, one of the other Directors shall act as Chairman and Director in accordance with the order of

priority previously determined by the Board of Directors. |

|

3. Unless otherwise provided for by laws and regulations, the Director determined in advance by the Board of Directors shall convene meetings of the Board of Directors

and act as chairman. If the Director determined in advance by the Board of Directors is unable to act as such, one of the other Directors shall act as Chairman and Director in accordance with the order of priority determined in advance by the

Board of Directors. |

|

|

| 3. Notice to convene a meeting of the Board of Directors shall be given to each Director and Corporate Auditor at least three (3) days prior to the date of such

meeting; provided, however, that the foregoing shall not apply in cases of emergency. |

|

4. Notice to convene a meeting of the Board of Directors shall be given to each Director at least three (3) days prior to the date of such meeting; provided, however, that

the foregoing shall not apply in cases of emergency. |

— 11

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| 4. (Omitted.)

5. With respect to the matters to be resolved by the Board of Directors, the Company shall deem that such matters were approved by a resolution of

the Board of Directors when all the Directors express their agreement in writing or by an electromagnetic device; provided, however, that this provision shall not apply when any Corporate Auditor expresses his/her objection to such

matters. |

|

5. (Unchanged.)

6. With respect to the matters to be resolved by the Board of Directors, the Company shall deem that such matters were approved by a resolution of

the Board of Directors when all the Directors express their agreement in writing or by an electromagnetic device. |

|

|

| 6. The proceedings of meetings of the Board of Directors shall, pursuant to laws and regulations, be stated or recorded in the minutes, to which the Directors and

Corporate Auditors present shall put their names and affix their seals or electronic signatures. |

|

7. The proceedings of meetings of the Board of Directors shall, pursuant to laws and regulations, be stated or recorded in the minutes, to which the Directors present shall

put their names and affix their seals or electronic signatures. |

|

|

| (Remuneration, etc. for Directors)

Article 34.

Remuneration, etc. for Directors shall be determined by resolution of general meeting of shareholders. |

|

(Deleted.) |

|

|

| Article 35. (Omitted.) |

|

Article 33. (Unchanged.) |

— 12

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (Limited Liability Agreement with Outside Director)

Article 36.

Pursuant to the provisions of Article 427, Paragraph 1 of the

Corporation Act, the Company may execute agreements with Outside Directors, which limit the liability of such Outside Directors arising from any act provided for in Article 423, Paragraph 1 of the Corporation Act; provided, however,

that the limit of the liability under such agreements shall be the greater of an amount determined in advance which shall not be less than ten million (10,000,000) yen or the minimum liability amount prescribed by laws or

regulations. |

|

(Limited Liability Agreement with Directors)

Article 34.

Pursuant to the provisions of Article 427, Paragraph 1 of the

Corporation Act, the Company may execute agreements with Directors other than Executive Directors etc., which limit the liability of such Directors provided for in Article 423, Paragraph 1 of the Corporation Act; provided, however,

that the limit of the liability under such agreements shall be the greater of an amount determined in advance which shall not be less than ten million (10,000,000) yen or the minimum liability amount prescribed by laws or

regulations. |

|

|

| CHAPTER VI. CORPORATE AUDITORS AND BOARD OF CORPORATE AUDITORS |

|

(Deleted.) |

|

|

| (Number of Corporate Auditors and Method of Election)

Article 37.

1. The Company shall have not more than seven (7) Corporate Auditors, who

shall be elected at a general meeting of shareholders. 2. A

resolution for the election of Corporate Auditors shall be adopted at a general meeting of shareholders by an affirmative vote of a majority of the voting rights of the shareholders in attendance, who hold voting rights representing in the aggregate

one-third (1/3) or more of the total number of voting rights of all shareholders who are entitled to vote. |

|

(Deleted.) |

|

|

| (Term of Office)

Article 38.

The term of office of Corporate Auditors shall expire at the

close of the ordinary general meeting of shareholders held in respect of the last business year ending four (4) years after their election. |

|

(Deleted.) |

— 13

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (Full-time Corporate Auditors)

Article 39.

The Board of Corporate Auditors shall appoint several full-time Corporate Auditors from among the Corporate

Auditors. |

|

(Deleted.) |

|

|

| (Board of Corporate Auditors)

Article 40. 1. The Board of Corporate Auditors shall have the authority provided for by law and regulation and also shall determine matters concerning the performance of duties by Corporate Auditors;

provided, however, that the Board of Corporate Auditors shall not prevent the Corporate Auditors from exercising their power and authority.

2. Notice to convene a meeting of the Board of Corporate Auditors shall be given to each Corporate Auditor at least three (3) days prior to the

date of such meeting; provided, however, that the foregoing shall not apply in cases of emergency. 3. Unless otherwise provided for by law or regulation, resolutions of a meeting of the Board of Corporate Auditors shall be adopted by an affirmative vote of a majority of the Corporate

Auditors. 4. The proceedings of meetings of the Board of

Corporate Auditors shall be stated or recorded in the minutes pursuant to laws and regulations, to which the Corporate Auditors present shall put their names and affix their seals or electronic signatures. |

|

(Deleted.) |

— 14

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (Remuneration, etc. for Corporate Auditors)

Article 41.

Remuneration, etc. for Corporate Auditors shall be determined

by resolution of general meeting of shareholders. |

|

(Deleted.) |

|

|

| (Exemption from Liability of Corporate Auditors)

Article 42.

In accordance with the provisions of Article 426, Paragraph 1

of the Corporation Act, the Company may, by a resolution of the Board of Directors, exempt Corporate Auditors (including former Corporate Auditors) from their liabilities provided for in Article 423, Paragraph 1 of the Corporation Act within the

limits stipulated by laws and regulations provided that such Corporate Auditor is bona fide and without gross negligence. |

|

(Deleted.) |

|

|

| (Limited Liability Agreement with Outside Corporate Auditor)

Article 43.

Pursuant to the provisions of Article 427, Paragraph 1 of the

Corporation Act, the Company may execute agreements with Outside Corporate Auditors, limiting the liability of such Outside Corporate Auditors arising from any act provided for in Article 423, Paragraph 1 of the Corporation Act; provided, however,

that the limit of the liability under such agreements shall be the greater of an amount determined in advance which shall not be less than ten million (10,000,000) yen or the minimum liability amount prescribed by laws or

regulations. |

|

(Deleted.) |

|

|

| (Newly established.) |

|

CHAPTER VI. COMMITTEES |

— 15

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (Newly established.) |

|

(Method of Appointment of Committee Members)

Article 35.

The members of the Nominating and Governance Committee (which

constitutes a Nominating Committee defined in the Corporation Act), the Audit Committee, and the Compensation Committee shall be appointed from among the Directors by the resolution of the Board of Directors. |

|

|

| (Newly established.) |

|

(Authority etc. of Committees)

Article 36.

Matters concerning the Nominating and Governance Committee (which constitutes a Nominating Committee defined in the Corporation

Act), the Audit Committee, and the Compensation Committee shall be governed by the Regulations thereof established by each Committee, as well as by applicable laws and regulations, these Articles of Incorporation, or resolutions of the Board of

Directors. |

|

|

| (Newly established.) |

|

CHAPTER VII. EXECUTIVE OFFICERS |

|

|

| (Newly established.) |

|

(Method of Election)

Article 37.

Executive Officers shall be elected by the Board of Directors. |

|

|

| (Newly established.) |

|

(Term of Office)

Article 38.

The term of office of Executive Officers shall expire at the close of the first meeting of the Board of Directors convened after

the close of the ordinary general meeting of shareholders held in respect of the last business year ending within one (1) year after their election. |

— 16

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (Newly established.) |

|

(Representative Executive Officer and Executive Officer with Executive Power)

Article 39.

1. The Board of Directors shall, by its resolution, elect Representative

Executive Officer(s) from among the Executive Officers. 2. The

Board of Directors may, by its resolution, appoint the President and Group Chief Executive Officer, Chairman and Executive Officer, Deputy Chairman and Executive Officer(s), Deputy President and Group Chief Operating Officer(s), Senior Managing

Executive Officer(s) and Managing Executive Officer(s). |

|

|

| (Newly established.) |

|

(Exemption from Liability of Executive Officers)

Article 40.

In accordance with the provisions of Article 426, Paragraph 1

of the Corporation Act, the Company may, by a resolution of the Board of Directors, exempt Executive Officers (including former Executive Officers) from their liabilities provided for in Article 423, Paragraph 1 of the Corporation Act within the

limits stipulated by laws and regulations provided that such Executive Officer has acted in good faith and without gross negligence. |

|

|

| CHAPTER VII. ACCOUNTING AUDITOR |

|

CHAPTER VIII. ACCOUNTING AUDITOR |

|

|

| Article 44. through Article 45.

(Omitted.) |

|

Article 41. through Article 42.

(Unchanged.) |

|

|

| (Remuneration, etc. for Accounting Auditor)

Article 46.

Remuneration, etc. for the Accounting Auditor shall be

determined by the Representative Director with the consent of the Board of Corporate Auditors. |

|

(Deleted.) |

|

|

| CHAPTER VIII. ACCOUNTS |

|

CHAPTER IX. ACCOUNTS |

|

|

| Article 47. through Article 51.

(Omitted.) |

|

Article 43. through Article 47.

(Unchanged.) |

— 17

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (Newly established.) |

|

Additional Rule |

|

|

|

|

(Transitional Measure Regarding Exemption from Liability of Corporate Auditors)

Article 1.

In accordance with the provisions of Article 426, Paragraph 1

of the Corporation Act, the Company may, by a resolution of the Board of Directors, exempt Corporate Auditors (including former Corporate Auditors) from their liabilities provided for in Article 423, Paragraph 1 of the Corporation Act in relation to

the acts conducted before the close of the 10th Ordinary General Meeting of Shareholders within the limits stipulated by laws and regulations provided that such Corporate Auditor has acted in good faith and without gross

negligence. |

|

|

| (Attachment)

Request for Acquisition of Class 11 Preferred Shares

Any Class 11 Preferred Shareholder may request acquisition of Class 11 Preferred Shares during the period in which such Preferred

Shareholder is entitled to request acquisition as provided for in Paragraph 1 of this Attachment, in exchange for Ordinary Shares of the Company in the number as is calculated by the formula provided for in Paragraph 2 and 3 of this

Attachment. 1. Period during which Preferred Shareholders

are Entitled to Request Acquisition On and after the issuance date

of the Class 11 Preferred Shares to and including July 31, 2014

2. Number of Ordinary Shares to be Delivered in Exchange for Acquisition

The number of the Ordinary Shares to be delivered in exchange for acquisition of

Class 11 Preferred Shares shall be as follows: |

|

(Deleted.) |

|

|

|

|

|

|

|

|

|

|

|

| Number of the Ordinary Shares to be delivered in

exchange for acquisition |

|

= |

|

Number of the Class 11 Preferred Shares requested for acquisition by

their

holders |

|

x |

|

1,000 yen |

|

|

| |

|

|

Acquisition price |

|

|

|

|

|

| In the calculation of the number of the Ordinary Shares to be delivered in exchange for the acquisition, such number shall be calculated by rounding up to the nearest tenth whole

number. In the calculation of the number of Ordinary Shares provided for above, if any shares less than one (1) unit are yielded, such fractions shall be deemed to be exercised and an amount of cash equivalent to the value of such fractional unit

shares shall be paid. |

|

|

— 18

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| 3. Acquisition Price and Other Conditions

a. Initial Acquisition Price

The initial acquisition price shall be nine hundred eighteen thousand seven hundred (918,700) yen.

b. Reset of Acquisition Price

If the average daily closing price (including closing bids or offered prices) of

Ordinary Shares of the Company (in regular trading) as reported by the Tokyo Stock Exchange (any fraction less than one (1) yen being rounded up to the nearest one (1) yen) for thirty (30) consecutive Trading Days (“Trading Day” means a

day on which a closing price (including closing bids or offered prices) (in regular trading) for the Ordinary Shares of the Company is reported on the Tokyo Stock Exchange) (such thirty (30) Trading Day period shall hereinafter be referred to as the

“Reset Calculation Period”) ending on July 15 of each year from 2006 through and including 2013 (or, if any such day is not a Trading Day, the Trading Day immediately preceding such day) (each, hereinafter referred to as the

“Setting Date”) is at least one (1) yen less than the acquisition price effective as of the relevant Setting Date, the acquisition price shall, effective as of the August 1 immediately following the relevant Setting Date (each,

hereinafter referred to as the “Effective Date”), be reset to the average daily closing price as calculated in the manner set forth above. |

|

|

— 19

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| However, if such amount so calculated is less than nine hundred eighteen thousand seven hundred (918,700) yen (subject to any

adjustment in accordance with c. below) (hereinafter referred to as the “Acquisition Floor Price”), the acquisition price shall be equal to the Acquisition Floor Price. If, during the Reset Calculation Period, any event has occurred which

would require adjustment in accordance with c. below, the average price above shall be adjusted in a manner consistent with c. below.

c. Adjustment of Acquisition Price

(a) After the issuance of the Class 11 Preferred Shares, the acquisition price (including the Acquisition Floor Price) will be adjusted in accordance

with the following formula (hereinafter referred to as the “Acquisition Price Adjustment Formula”) in the event any of the items set forth below occurs; provided, however, that if the acquisition price when adjusted in accordance with the

Acquisition Price Adjustment Formula is less than one hundred (100) yen, the acquisition price after adjustment shall be one hundred (100) yen. |

|

|

— 20

—

(The underlined portions indicate amendments.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

|

|

|

|

|

|

|

|

| Acquisition price after adjustment |

|

= |

|

Acquisition price before adjustment |

|

x |

|

Number of Ordinary Shares already issued |

|

+ |

|

Number of Ordinary Shares to be newly issued or transferred |

|

x |

|

Subscription price per share |

|

|

| |

|

|

|

|

|

|

|

Current market price per share |

|

|

| |

|

|

|

|

Number of Ordinary Shares already issued |

|

+ |

|

Number of Ordinary Shares to be newly issued or transferred |

|

|

|

|

| (i) In the event that the Company issues Ordinary Shares or transfers Ordinary Shares held by the Company at a

subscription price less than the current market price to be used in the Acquisition Price Adjustment Formula (except for any acquisition of securities (interests) which will be acquired by the Company in exchange for the Ordinary Shares or

securities (interests) which will be caused by the holder of such securities (interests) to be acquired by the Company in exchange for the Ordinary Shares, or the exercise of stock acquisition rights):

The acquisition price after adjustment shall become effective as of the date

immediately following the payment date or the last date of the payment period, or as of the date immediately following the record date (if set) for the issuance or the transfer of such Ordinary Shares to shareholders. |

|

|

— 21

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (ii) In the event that the Company splits Ordinary Shares or conducts free allotment of Ordinary Shares (including those in

which the Company transfers its own shares): The acquisition price

after adjustment shall become effective as of the date immediately following the record date set for the stock split or free allotment of such Ordinary Shares.

However, if the Board of Directors of the Company determines that the stock split or free allotment of Ordinary Shares (including the cases in which

the Company transfers its own shares) thereby shall be effected by an increase of stated capital by virtue of the reduction of the amount of surplus and the record date set for the stock split or free allotment of such Ordinary Shares to

shareholders falls on or prior to the date of the closing of the relevant ordinary general meeting of shareholders held to approve the increase of the stated capital, the acquisition price after adjustment shall become effective as of the date

immediately following the date on which the ordinary general meeting of shareholders approving such increase is concluded.

(iii) In the event that the Company issues (including free allotment) securities (interests) which will be acquired by the Company in exchange

for the Ordinary Shares or the stock acquisition rights to acquire Ordinary Shares, or securities (interests) which will be caused by the holder of such securities (interests) to be acquired by the Company in exchange for the Ordinary Shares, or the

stock acquisition rights to acquire Ordinary Shares (including the bonds with stock acquisition rights), in either case, at a price less than the current market price to be applied to the Acquisition Price Adjustment Formula: |

|

|

— 22

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| The acquisition price after adjustment shall become effective as of the date immediately following the payment date or the last date

of the payment period of such securities (interests) or as of the date immediately following the record date (if set) for the issuance or the issuance of such securities (interests) to shareholders, on the assumption that all such securities

(interests) are acquired or all the stock acquisition rights are exercised on the payment date or the last date of the payment period of such securities (interests) or at the close of the record date set for the issuance of such securities

(interests), as the case may be. (b) In addition to the

events set forth above, if an adjustment of the acquisition price (including the Acquisition Floor Price) is required by virtue of any amalgamation or merger, capital reduction, or consolidation of Ordinary Shares, etc., the acquisition price shall

be adjusted to such price as the Board of Directors of the Company determines appropriate. (c) The “Current market price per share” in the Acquisition Price Adjustment Formula means the average daily closing price (including closing bids or offered prices) of Ordinary Shares

of the Company (in regular trading) as reported by the Tokyo Stock Exchange for the thirty (30) consecutive trading days (excluding a trading day or days on which no closing price or closing bid or offered price is reported) commencing on the

forty-fifth (45th) trading day prior to the date on which the acquisition price after adjustment becomes effective (or, in the case as provided for in the proviso of c.(a)(ii) above, the record date set for the stock split or free allotment of

Ordinary Shares to shareholders), calculated by rounding up to the nearest first decimal place when the fraction is equal to or more than 0.05 yen, discarding amounts less than 0.05 yen.

If any of the events of adjustment of acquisition price as set forth in c.(a) or

(b) above occurs during the above forty-five (45) trading day period, the average price above shall be adjusted in a manner consistent with c.(a) or (b) above. |

|

|

— 23

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (d) The “Acquisition price before adjustment” in the Acquisition Price Adjustment Formula means the acquisition

price in effect on the date immediately preceding the date on which the acquisition price after adjustment becomes effective, and the “Number of Ordinary Shares already issued” in the Acquisition Price Adjustment Formula means the number

of Ordinary Shares of the Company issued and outstanding (excluding the number of Ordinary Shares held by the Company) on the record date (if set) for the issuance, transfer, stock split or free allotment to shareholders, or if such date is not set,

on the date one (1) calendar month prior to the date on which the acquisition price after adjustment is to become effective.

(e) The “Subscription price per share” in the Acquisition Price Adjustment Formula means (1) in the event that the Company issues or

transfers Ordinary Shares with a subscription price less than the current market price as set forth in c.(a)(i) above, such subscription price (in the event that payment thereof is made by any consideration other than cash, the fair value of such

consideration), (2) in the event that the Company splits Ordinary Shares or conducts free allotment of Ordinary Shares as set forth in c.(a)(ii) above (including those in which the Company transfers its own shares), zero, and (3) in the event that

the Company issues (including free allotment) securities (interests) which will be acquired by the Company in exchange for the Ordinary Shares or the stock acquisition rights to acquire Ordinary Shares, securities (interests) which will be caused by

the holder of such securities (interests) to be acquired by the Company in exchange for the Ordinary Shares, or the stock acquisition rights to acquire Ordinary Shares (including the bonds with stock acquisition rights) at a price less than the

current market price as set forth in c.(a)(iii) above, the relevant acquisition or exercise price. |

|

|

— 24

—

(The underlined portions indicate amendments.)

|

|

|

| Current Articles of Incorporation |

|

Proposed Amendments |

|

|

| (f) The result of the calculation by the Acquisition Price Adjustment Formula shall be rounded up to the nearest first decimal

place yen when the fraction is equal to or more than 0.05 yen, discarding amounts less than 0.05 yen. (g) In the event that the difference between the acquisition price after adjustment calculated by the Acquisition Price Adjustment Formula and the acquisition price before adjustment is less

than one (1) yen, no adjustment shall be made; provided, however, that if any event occurs thereafter that would require adjustment of the acquisition price, when calculating the acquisition price, such difference shall be deducted from the

acquisition price before adjustment in the Acquisition Price Adjustment Formula. – End – |

|

|

— 25

—

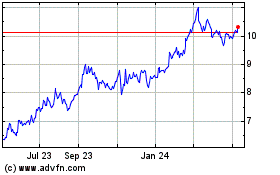

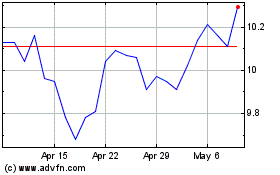

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024