Are Co-Branded Travel Cards Rewarding Enough?

May 25 2016 - 9:18AM

Business Wire

Oliver Wyman Examines How to Win the Millennial

Wallet in Time for Summer Travel

Oliver Wyman examined how consumers use co-branded credit cards

as part of its annual Transport & Logistics Journal and found

that co-branded travel cards may not be rewarding enough.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20160525005882/en/

(Graphic: Business Wire)

Consumers like co-branded credit cards. In fact, 80 percent of

card holders believe co-branded cards offer as much or more value

than bank-issued rewards cards. But consumers also are willing to

switch when the grass appears greener: 40 percent change their

primary credit card at least every two years.

This leads to a critical question for airlines and hotels – how

do they persuade consumers to acquire their cobranded card, spend

with it, and not switch?

Half of consumers leave for better rewards. Even customers who

carry a monthly balance are more likely to switch because of

rewards rather than a lower interest rate (11 percent).

“To create offers that “stick” with consumers, hotels and

airlines need to carefully consider the needs, preferences, and

travel and purchasing behaviors of their target customers,” said

Jessica McLaughlin, a partner with Oliver Wyman. “Discounts on

in-flight meals and room service are popular among travelers, but

are becoming common. Rewards need to be highly personalized with

perceived exclusivity. Think flight simulator tours, suite upgrades

or private dinners with renowned chefs.”

The personalization trend can be most seen among Millennials,

the generation aged 18-34. In fact, this group favored options for

individual card design as the highest of any other age groups.

Today, only a third of credit card-carrying Millennials have a

cobranded travel card, compared to half of credit card users who

are their parents’ age. These tech-savvy consumers also value

different features and use credit cards in different ways than

older generations. For example:

- Millennials expect credit card payment

capabilities and other features to be wholly integrated with their

digital lives and rank these features significantly higher than

other age groups.

- Millennials are twice as likely to use

mobile wallet applications than the average cardholder and more

than three times as likely as Baby Boomers (52 percent vs 16

percent).

“Winning the wallets of this generation this summer and beyond

will require figuring out what rewards and experiences they most

value,” added McLaughlin. “The good news for travel companies is

that Millennials exhibit a passion for travel, spending a greater

share of their income on flights and hotels than any other age

segment.”

The co-branded credit card survey was conducted between December

2015 and January 2016 among 1,311 card holders in the US across

various demographics.

The Oliver Wyman Transport & Logistics Journal is one of the

firm’s longest-standing publications. This edition also includes

articles on the digitalization of the rail industry, the European

motor coach market, changes to the postal service worldwide,

Uber-trucking, aerospace innovation, among others.

Oliver Wyman

With offices in 50+ cities across 26 countries, Oliver Wyman is

a global leader in management consulting that combines deep

industry knowledge with specialized expertise in strategy,

operations, risk management, and organization transformation.

Oliver Wyman is a wholly owned subsidiary of Marsh & McLennan

Companies [NYSE: MMC]. Follow Oliver Wyman on Twitter

@OliverWyman.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160525005882/en/

Media:Oliver WymanFrancine Minadeo,

212-345-6417francine.minadeo@oliverwyman.com

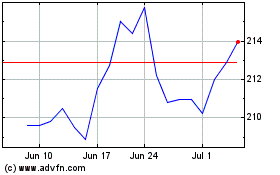

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024