QuickLinks

-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of March 2015

Commission File Number 001-11444

|

MAGNA INTERNATIONAL INC.

(Exact Name of Registrant as specified in its Charter) |

337 Magna Drive, Aurora, Ontario, Canada L4G 7K1

(Address of principal executive office)

|

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached

annual report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other

document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press

release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or

other Commission filing on EDGAR.

Indicate

by check mark whether the registrant, by furnishing the information contained in this Form, is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

If

"Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

MAGNA INTERNATIONAL INC.

(Registrant) |

Date: March 27,

2015

|

|

|

|

|

|

|

By: |

|

/s/ BASSEM A. SHAKEEL

Bassem A. Shakeel,

Vice-President and Corporate Secretary

|

EXHIBITS

|

|

|

Exhibit 22.1 |

|

Notice of Annual Meeting of Shareholders of the Registrant to be held on May 7, 2015 in Toronto, Ontario, Canada, and Management Information Circular/Proxy Statement. |

Exhibit 22.2 |

|

Form of Proxy for Common Shares |

Exhibit 23 |

|

Consent of Deloitte LLP |

Exhibit 99.1 |

|

Annual Report to Shareholders of the Registrant including the Management's Discussion and Analysis of Results of Operations and Financial Position and the audited consolidated financial statements of the Registrant for

the year ended December 31, 2014. |

QuickLinks

SIGNATURES

EXHIBITS

QuickLinks

-- Click here to rapidly navigate through this document

Exhibit

22.1

|

|

MANAGEMENT

PROXY

CIRCULAR

Annual

Meeting — May 7, 2015

|

|

|

Corporate Governance We believe that strong corporate governance

practices are essential to fostering stakeholder trust and confidence,

management accountability and long-term shareholder value. Accordingly, our

current corporate governance practices reflect virtually all best practices

recognized in Canada. Majority Voting

Annual Say on Pay Vote Disclosure

Active Shareholder Engagement Independent Board Chair

Diverse, Independent Board Professionalized

Director Recruitment Restrictions on Interlocks

Minimum Director Attendance Annual Board Assessment

Robust Director Share Maintenance Oversight of Strategy,

Capital Allocation,Succession, Risk Management 91% Board Independence 1:1

Share Vote 100% Committee

Independence William Young, Board

Chair Magna’s governance now ranks among the best in Canada and the

Board’s commitment to the implementation of best practices has been solidly

endorsed by shareholders. “

|

|

|

2014 Highlights

Last year was another year of record fi nancial and operating results for

Magna. In addition, Magna reinvested a record amount in our business while

also returning $2.1 billion to shareholders. In light of the company's strong

performance, the Board declared a record fourth quarter dividend, which was

16% higher than the prior quarter. Refl ecting the Board's optimism for the

future, the Board also announced a two-for-one stock split which was

completed on March 25, 2015. Magna continued to make progress in the

implementation of its strategic plan, including further refi nement of its

product portfolio and achievement of productivity, effi ciency and other

operational improvements. Importantly, the Board adopted a new process

relating to long-term incentive grants, which directly connects a key

component of executive compensation with implementation of the Board-approved

strategic plan. Based in part on feedback received from shareholders, regular

time-vested stock options were replaced with performancevested stock options

for the company's most senior executives. Lastly, 2014 was notable for

recognition of Magna's achievements, including numerous customer awards, as

well as Donald Walker being named as Canada's 2014 Outstanding CEO of the Year™.

Shares repurchased Returned to shareholders – dividends Returned to

shareholders – share repurchases 17.5M $316M $1.8B

|

|

|

Nominees

Nominees for Election to the Board 64 Average Age (Years) 0 Interlocks 4.6

Average Tenure (Years) The Board believes that the 11 nominees to be

individually elected at the Meeting possess a diverse range of skills,

experience and backgrounds which will enable the Board to function

effectively. Each nominee has agreed to abide by our majority voting policy.

91% Independent Directors 100% 99% Board/Committee Attendance 2014 Average

Votes FOR PETER G. BOWIE Independent Age: 68 Joined: 2012 Other Boards: 1 DR.

INDIRA V. SAMARASEKERA Independent Age: 62 Joined: 2014 Other Boards: 1 HON.

J. TREVOR EYTON Independent Age: 80 Joined: 2010 Other Boards: 4 DONALD J.

WALKER Management Age: 58 Joined: 2005 Other Boards: 0 V. PETER HARDER

Independent Age: 62 Joined: 2012 Other Boards: 4 LAWRENCE D. WORRALL

Independent Age: 71 Joined: 2005 Other Boards: 0 LADY BARBARA JUDGE

Independent Age: 68 Joined: 2007 Other Boards: 2 WILLIAM L. YOUNG Independent

Age: 60 Joined: 2011 Other Boards: 0 CHAIRMAN CEO DR. KURT J. LAUK

Independent Age: 68 Joined: 2011 Other Boards: 2 SCOTT B. BONHAM Independent

Age: 53 Joined: 2012 Other Boards: 0 CYNTHIA A. NIEKAMP Independent Age: 55

Joined: 2014 Other Boards: 0 27% Female Directors

|

|

|

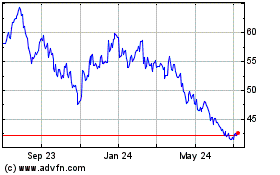

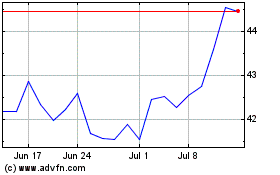

Performance

Compensation Global light vehicle production grew once again in 2014, driving

our sales up 5% to a record $36.6 billion. This is the fifth straight yearly

increase following the 2008/2009 recession. Adjusted EBIT, which we believe

is the most appropriate measure of operating profitability or loss for our

reporting segments, increased 27% to $2.63 billion, Return on Funds Employed

increased by 27% and Diluted EPS increased 29% to $8.69. Magna's 46.7% total

shareholder return (TSX) and 34.4% (NYSE) placed it in the 95th percentile

compared to the S&P/TSX60 and 93rd percentile compared to the S&P500,

respectively. Magna's approach to compensation reflects the company's

entrepreneurial corporate culture. The executive compensation program

includes belowmarket base salaries, annual profit-based incentives, a portion

of which is deferred and paid in the form of shares, as well as long-term

incentives in the form of stock options. The program does not include

pensions or other retirement benefits for executives. Magna's compensation

system generates pay outcomes which are strongly aligned with the company's

performance and most shareholders agree – over 82% of the votes cast on our

2014 Say on Pay resolution were in favour. 2014 COMPENSATION CHANGES Performance-adjusted

option pool – directly tied to achievement of strategic priorities

Performance-vested stock options – options only vest if relative TSR >

60th percentile 95th Percentile TSR vs S&P/TSX60 93rd Percentile TSR vs

S&P500 $36.6B +5% Sales $8.69 28.5% +29% Diluted EPS +27% ROFE $2.63B

+27% Adjusted EBIT FEATURES Minimal fixed compensation Significant

compensation "at risk" No pensions or retirement benefits Robust

share maintenance requirements Post-retirement hold-backs Clawbacks Anti-hedging

restrictions No tax gross-ups Limited perks 2 yrs. maximum severance Double-trigger

change in control with no enhanced severance Compensation risk management

This is a very tough industry and Magna's success is a direct reflection of

an exceptional executive team. “ William Young, Chairman

|

|

|

Chairman's

Letter Notice of Annual Meeting Meeting Information Voting Information 2 How

to Vote Your Shares 3 Business of the Meeting 6 Nominees for Election to the

Board 12 Director Compensation 23 Corporate Governance Corporate Governance

Overview 28 Report of the Audit Committee 42 Report of the Corporate

Governance, Compensation and Nominating Committee 45 Report of the Enterprise

Risk Oversight Committee 48 Performance CGCNC Compensation and Performance

Report 52 Compensation Compensation Discussion & Analysis 60 Summary

Compensation Table 85 Incentive Plans and Awards 87 Additional Information

Interests of Management and Other Insiders in Certain Transactions 92

Additional Information 92 Defi nitions and Interpretation 94 Table of

Contents 27 51 59

|

|

|

Magna International Inc.

337 Magna Drive

Aurora, Ontario, Canada L4G 7K1

Telephone: (905) 726-2462

Legal Fax: (905) 726-7164 |

March 25, 2015

Dear

Fellow Shareholder,

Magna

is an exceptional company – a Canadian-based global innovation and manufacturing leader, a valued supplier to every major automobile assembler, an

employer of choice for over 130,000 dedicated people around the globe, a governance leader and a good corporate citizen committed to the many communities in which we operate. While

the Board has long recognized the many factors which make Magna exceptional, we are delighted to know that many others share our view. In November, Magna's CEO, Don Walker, was named

Canada's 2014 Outstanding CEO of the Year™. Given that the judging panel considered factors such as Magna's corporate performance, global competitiveness and innovative

achievements, in addition to Don's vision, leadership and commitment to social responsibility, the award is a testament not just to Don's abilities, but to the success of the company, its

entire Management team and every one of the company's employees.

Last

year, you elected a diverse Board consisting of eleven directors. The following were some of the key topics on which we were focused in 2014, as well as some of the specific

accomplishments in these areas:

Long-term strategy – Magna continues to execute on its long-term strategy, including with respect to

product portfolio, innovation, geographic diversification, World Class Manufacturing and capital structure. In order to better link executive compensation with the achievement of

the company's strategic objectives, we adopted a new process that performance-adjusts the long-term incentive award pool based on the Board's evaluation of Management's performance in

achieving strategic priorities and milestones. You can read more about this new process in Section B of the CD&A in the accompanying proxy circular.

Capital Structure – the company is progressing in making Magna's balance sheet more efficient. We have

communicated our intent to achieve a target Adjusted Debt to Adjusted EBITDAR ratio of 1.0x to 1.5x by the end of 2015 and the company returned $2.1 billion of capital to shareholders

through dividends and share repurchases, issued $750 million of senior subordinated notes in June 2014 and continues to pursue M&A opportunities with the aim of achieving our

target leverage ratio by the end of this year.

Shareholder Engagement and Executive Compensation – as a Board, we believe active shareholder engagement

is very important and we continued to engage during 2014 to understand your perspectives on key issues. The CGCNC Compensation and Performance Report in the Circular includes some of the key

messages we have heard through our engagement, as well as the actions we have taken in response to your feedback. A substantial majority of shareholders have indicated support for Magna's

approach to executive compensation, which features low base salaries and bonuses tied directly to Magna's profitability, but does not include pensions or retirement benefits. Nevertheless,

some shareholders encouraged us to consider introducing a relative performance metric to further align pay and performance. Section B of the CD&A in the accompanying proxy circular

includes a description of a performance-vested stock option program the Board implemented in place of time-vested stock options for our top executives.

Succession Planning – the Board recognizes that a sustainable pipeline of talented employees is critical

to Magna's ability to succeed in the long-term. For this reason, the Board dedicated significant time to assessing the company's leading managerial talent and monitoring the company's

broad-based leadership development system, which currently includes around 4,000 employees. As a Board, we are comfortable that the company's short and long-term succession plans are

appropriate.

Risk Management – we see risk and reward as being "flip sides of the same coin". No company can achieve

long-term reward without taking risks, but the risks must be reasonable. The Board and its Committees continue to engage with Management and oversee risk mitigation efforts in various

important areas, including operations, IT and cyber security, occupational health and safety, environmental practices, as well as legal and regulatory compliance.

Overall,

2014 was another outstanding year for Magna – you can read about the company's financial and operational performance in the company's annual

report. The Board is very pleased with such performance and recently increased the quarterly dividend in respect of the fourth quarter of 2014 by 16%. We also implemented a two-for-one stock

split on March 25, 2015, reflecting our continued optimism in Magna's future.

On

May 7, 2015, Magna will hold its 2015 annual meeting of shareholders in Toronto, Canada. In connection with the annual meeting, we are seeking your support in re-electing the

Board's eleven directors, reappointing Deloitte LLP as Magna's external auditor and approving our annual advisory vote on executive compensation. The accompanying proxy circular

contains details on how you can vote, each of the items to be voted on and other important information which you should consider when voting your shares. Your vote is important and we

encourage you to vote in one of the ways detailed in the proxy circular.

Sincerely,

William L. Young

Chairman

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| Date: |

Thursday, May 7, 2015 |

Time: |

10:00 a.m. (Toronto time) |

Place: |

The Westin Prince

900 York Mills Road

Toronto, Ontario

Canada |

The Meeting is being held to:

| |

1. |

receive Magna's consolidated financial statements and the independent auditors' report thereon for the fiscal year ended December 31, 2014; |

|

2. |

elect eleven directors; |

|

3. |

reappoint Deloitte LLP as our independent auditors and authorize the Audit Committee to fix the independent auditors' remuneration; |

|

4. |

vote, in an advisory, non-binding manner, on Magna's approach to executive compensation described in the accompanying Management Information Circular/Proxy Statement; and |

|

5. |

transact any other business that may properly come before the Meeting. |

As a holder of record of Magna Common Shares at the close of business on March 24, 2015, you are entitled to receive notice of and vote at

the Meeting.

If

you are unable to attend the Meeting and want to ensure that your shares are voted, please submit your votes by proxy as described under "How to Vote Your Shares" in the accompanying circular. To

be valid, our transfer agent, Computershare Trust Company of Canada, must receive your proxy by 5:00 p.m. (Toronto time) on May 5, 2015. If the Meeting is adjourned or postponed,

Computershare must receive your proxy not later than 48 hours (excluding Saturdays, Sundays and holidays) prior to the time of the adjourned or postponed Meeting.

A

live webcast of the Meeting will also be available through Magna's website at www.magna.com.

Accompanying

this Notice of Annual Meeting is Magna's Management Information Circular/Proxy Statement, which contains more information on the matters to be addressed at the Meeting.

By

order of the Board of Directors.

|

/s/ "Bassem A. Shakeel" |

| March 25, 2015 |

BASSEM A. SHAKEEL |

| Aurora, Ontario |

Vice-President and Corporate Secretary |

|

|

Voting

Information 2 How to Vote Your Shares 3 Business of the Meeting 6 Nominees

for Election to the Board 12 Director Compensation 23 Meeting Information

|

Management Information Circular/Proxy Statement

This Circular is being provided to you in connection with the Annual Meeting of Magna's shareholders (the "Meeting"), which

will be held on Thursday, May 7, 2015 commencing at 10:00 a.m. (Toronto time) at The Westin Prince, 900 York Mills Road, Toronto, Ontario, Canada.

Voting Information

| Record Date |

|

March 24, 2015 is the record date for the Meeting (the "Record Date"). Only holders of our Common Shares as of the close of business on the Record Date are entitled to receive notice of and to

attend (in person or by proxy) and vote at the Meeting. |

Shares and Votes |

|

As of the Record Date, 205,258,333 Magna Common Shares were issued and outstanding. Each Magna Common Share is entitled to one vote. |

|

|

Effective March 25, 2015, Magna's Common Shares will be split on a two-for-one basis. All references in this Circular to a number of shares or options reflects the pre-stock split number of shares or options. |

Principal Shareholders |

|

To our knowledge, no shareholder beneficially owns or exercises control or direction, directly or indirectly, over 10% or more of Magna's Common Shares outstanding as at the Record Date. |

|

|

All of Magna's directors and executive officers as a group (18 persons) owned beneficially or exercised control or direction over 1,169,977 Common Shares representing approximately 0.6% of the class as at the Record Date. |

|

|

The Magna Deferred Profit Sharing Plan (Canada) and Employees Deferred Profit Sharing Plan (U.S.) (the "NADPSPs"), deferred profit sharing plans for Magna's participating employees, collectively hold 10,451,763 Magna Common Shares

representing approximately 5.1% of the class as at the Record Date. The shares held by the NADPSPs will be voted FOR each of the items to be voted on at the

Meeting. |

2 Meeting

Information

How To Vote Your Shares

| Your Vote Is Important |

|

Your vote is important. Please read the information below to ensure your shares are properly voted. |

Registered vs. Non-Registered Shareholder |

|

How you vote your shares depends on whether you are a registered shareholder or a non-registered shareholder. In either case, there are two ways you can vote at the Meeting – by appointing a proxyholder or by attending in person, although the specifics may differ slightly. |

|

|

Registered Shareholder: You are a registered shareholder if you hold one or more share certificates which indicate your name and the number of Magna Common

Shares which you own. As a registered shareholder, you will receive a form of proxy from Computershare Trust Company of Canada ("Computershare") representing the shares you hold. If you are a registered shareholder, refer to "How to

Vote – Registered Shareholders". |

|

|

Non-Registered Shareholder: You are a non-registered shareholder if a securities dealer, broker, bank, trust company or other nominee holds your shares for

you, or for someone else on your behalf. As a non-registered shareholder, you will most likely receive a Voting Instruction Form from either Broadridge Canada or Broadridge US, although in some cases you may receive a form of proxy from the

securities dealer, broker, bank, trust company or other nominee holding your shares. If you are a non-registered shareholder, refer to "How to Vote – Non-Registered Shareholders". |

Proxies Are Being Solicited by Management |

|

Management is soliciting your proxy in connection with the matters to be addressed at the Meeting (or any adjournment(s) or postponement(s) thereof) to be held at the time and place set out in

the accompanying Notice of Annual Meeting. We will bear all costs incurred in connection with Management's solicitation of proxies, including the cost of preparing and mailing this Circular and accompanying

materials. Proxies will be solicited primarily by mail, although our officers and employees may (for no additional compensation) also directly solicit proxies by phone, fax or other electronic methods. Banks, brokerage houses and other

custodians, nominees or fiduciaries will be requested to forward proxy solicitation material to the persons on whose behalf they hold Magna shares and to obtain authorizations for the execution of proxies. These institutions will be reimbursed for

their reasonable expenses in doing so. |

Proxy Solicitor – Kingsdale |

|

Magna has also retained Kingsdale to solicit shareholder proxies in connection with the Meeting. Kingsdale will be paid a fixed fee of C$21,500 plus out-of-pocket expenses, plus a "per call" fee of C$8.00 for each telephone call made by shareholders

to Kingsdale or by Kingsdale to shareholders in connection with the solicitation. If you have any questions about the information contained in this Circular or need assistance in completing your proxy form, please contact Kingsdale by e-mail at

contactus@kingsdaleshareholder.com or at the following telephone numbers: |

|

|

• within Canada or the U.S. (toll-free): 1-888-518-1552 |

|

|

• outside Canada and the U.S. (by collect call): 416-867-2272 |

Meeting Information 3

These securityholder materials are being sent to both registered

and non-registered owners of Magna Common Shares.

HOW TO VOTE –

REGISTERED SHAREHOLDERS

|

|

HOW TO VOTE –

NON-REGISTERED SHAREHOLDERS

|

|

|

|

If you are a registered shareholder, you may vote either by proxy or in person at the Meeting.

Submitting Votes by Proxy

There are three ways to submit your vote by proxy:

phone

phone

internet

internet

mail

mail

in accordance with the instructions on the form of proxy.

If you are voting by phone or internet, you will need the pre-printed Control Number, Holder Account Number and Access Number on your form of proxy.

A proxy submitted by mail must be in writing, dated the date on which you signed it and be signed by you (or your authorized attorney). If such a proxy is being submitted on behalf of a corporate shareholder, the proxy must be signed by an

authorized officer or attorney of that corporation. If a proxy submitted by mail is not dated, it will be deemed to bear the date on which it was sent to you.

If you are voting your shares by proxy, you must ensure that your completed and signed proxy form or your phone or internet vote is received by Computershare not later than 5:00 p.m. (Toronto time) on

May 5, 2015. If the Meeting is adjourned or postponed, you must ensure that your completed and signed proxy form or your phone or internet vote is received by Computershare not later than 48 hours

(excluding Saturdays, Sundays and holidays) prior to the time of the Meeting.

Appointment of Proxyholder

Unless you specify a different proxyholder or specify how you want your shares to be voted, the Magna officers whose names are pre-printed on the form of proxy will vote your shares:

• FOR the election to the Magna Board of Directors of all of the nominees named in this Circular;

• FOR the reappointment of Deloitte as Magna's independent auditors and the authorization of the Audit Committee to fix the

independent auditors' remuneration; and

• FOR the advisory resolution to accept the approach to executive compensation disclosed in this Circular.

You have the right to appoint someone else (who need not be a shareholder) as your proxyholder; however, if you do, that person must vote your shares in person on your behalf at the

Meeting. To appoint someone else as your proxyholder, insert the person's name in the blank space provided on the form of proxy or complete, sign, date and submit another proper form of proxy naming that person

as your proxyholder.

|

|

If you are a non-registered shareholder, the intermediary holding on your behalf (and not Magna) has assumed responsibility for (i) delivering these materials to you and (ii) executing your

proper voting instructions.

Submitting Voting Instructions

There are three ways to submit your vote by Voting Instruction Form:

phone

phone

internet

internet

mail

mail

in accordance with the instructions on the Voting Instruction Form.

If you are a non-registered shareholder and have received a Voting Instruction Form from Broadridge, you must complete and submit your vote by phone, internet or mail, in accordance with the instructions on the form. We have been advised by

Broadridge that, on receipt of a properly completed and submitted form, a form of proxy will be submitted on your behalf.

You must ensure that your completed, signed and dated Voting Instruction Form or your phone or internet vote is received by no later than any deadline specified by Broadridge, which we expect will be

5:00 p.m. (Toronto time) on May 4, 2015. If the Meeting is adjourned or postponed, you must ensure that your completed, signed and dated Voting Instruction Form or your phone or internet vote is

received by Broadridge Canada or Broadridge US, as applicable, not later than 72 hours (excluding Saturdays, Sundays and holidays) prior to the time of the Meeting. If a Voting Instruction Form submitted by mail or fax is not dated, it will

be deemed to bear the date on which it was sent to you.

In some cases, you may have received a form of proxy instead of a Voting Instruction Form, even though you are a non-registered shareholder. Such a form of proxy will likely be stamped by the securities dealer, broker, bank, trust company or other

nominee or intermediary holding your shares and be restricted as to the number of shares to which it relates. In this case, you must complete the form of proxy and submit it to Computershare as described to the left under "How to

Vote – Registered Shareholders – Submitting Votes By Proxy". |

4 Meeting

Information

HOW TO VOTE –

REGISTERED SHAREHOLDERS (cont'd)

|

|

HOW TO VOTE –

NON-REGISTERED SHAREHOLDERS (cont'd)

|

|

|

|

Appointment of Proxyholder (cont'd)

If you choose to vote by proxy, you are giving the person (referred to as a "proxyholder") or people named on your form of proxy the authority to vote your shares on your behalf at the Meeting (including any adjournment or postponement of

the Meeting).

You may indicate on the form of proxy how you want your proxyholder to vote your shares, or you can let your proxyholder decide for you. If you do not specify on the form of proxy how you want your shares to be voted, your proxyholder will have the

discretion to vote your shares as they see fit.

The form of proxy accompanying this Circular gives the proxyholder discretion with respect to any amendments or changes to matters described in the Notice of Annual Meeting and with respect to any other matters which may properly come before the

Meeting (including any adjournment or postponement of the Meeting). As of the date of this Circular, we are not aware of any amendments, changes or other matters to be addressed at the Meeting.

Voting in Person

If you attend in person, you do not need to complete or return your form of proxy. When you arrive at the Meeting, a Computershare representative will register your attendance before you enter the Meeting.

If you vote in person at the Meeting and had previously completed and returned your form of proxy, your proxy will be automatically revoked and any votes you cast on a poll at the Meeting will count.

Revoking a Vote Made by Proxy

You have the right to revoke a proxy by ANY of the following methods:

• Vote again by phone or internet not later than 5:00 p.m. (Toronto time) on May 5, 2015 (or not later than 48 hours prior to the time of the adjourned or

postponed Meeting);

• Deliver by mail another completed and signed form of proxy, dated later than the first form of proxy, such that it is received by Computershare not later than

5:00 p.m. (Toronto time) on May 5, 2015 (or not later than 48 hours prior to the time of the adjourned or postponed Meeting);

• Deliver to us at the following address a signed written notice revoking the proxy, provided it is received not later than 5:00 p.m. (Toronto time) on May 6, 2015

(or not later than 5:00 p.m. on the last business day prior to the date of the adjourned or postponed Meeting):

Magna International Inc.

337 Magna Drive

Aurora, Ontario, Canada L4G 7K1

Attention: Corporate Secretary

• Deliver a signed written notice revoking the proxy to the scrutineers of the Meeting, to the attention of the Chairman of the Meeting, at or prior to the commencement of

the Meeting (including in the case of any adjournment or postponement of the Meeting). |

|

Voting in Person

If you have received a Voting Instruction Form from your Canadian intermediary and wish to attend the Meeting in person or have someone else attend on your behalf, you must complete, sign and return the Voting Instruction Form or complete the

equivalent electronic form online, in each case in accordance with the instructions on the form.

If you have received a Voting Instruction Form from your US intermediary and wish to attend the Meeting in person or have someone else attend on your behalf, you must complete, sign and return the Voting Instruction Form in accordance with the

instructions on the form. Your intermediary will send you a legal proxy giving you or your designate the right to attend the meeting.

If you have received a form of proxy and wish to attend the Meeting in person or have someone else attend on your behalf, you must insert your name, or the name of the person you wish to attend on your behalf, in the blank space provided on the form

of proxy. If you are voting your shares by proxy, you must ensure that your completed and signed proxy form or your phone or internet vote is received by Computershare not later than 5:00 p.m. (Toronto

time) on May 5, 2015.

If the Meeting is adjourned or postponed, you must ensure that:

• your completed and signed Voting Instruction Form (or equivalent electronic form online) is received by Broadridge Canada or Broadridge US, as applicable, not later

than 72 hours (excluding Saturdays, Sundays and holidays) prior to the time of the adjourned or postponed Meeting; or

• your completed and signed proxy form or your phone or internet vote is received by Computershare not later than 48 hours (excluding Saturdays, Sundays and holidays)

prior to any adjournment or postponement of the Meeting.

When you arrive at the Meeting, a Computershare representative will register your attendance before you enter the Meeting.

Revoking a Voting Instruction Form or Proxy

If you wish to revoke a Voting Instruction Form or form of proxy for any matter on which a vote has not already been cast, you must contact your securities dealer, broker, bank, trust company or other nominee or intermediary (for a form of proxy

sent to you by such intermediary) and comply with any applicable requirements relating to the revocation of votes made by Voting Instruction Form or proxy. |

Meeting Information 5

Business of the Meeting

|

|

|

Purpose of the Meeting |

|

The Meeting is being held for shareholders to:

1. receive Magna's consolidated financial statements and the independent auditors' report thereon for the fiscal year ended December 31, 2014; |

|

|

2. elect eleven directors; |

|

|

3. reappoint Deloitte as our independent auditors and authorize the Audit Committee to fix the independent auditors' remuneration; |

|

|

4. vote, in an advisory, non-binding manner, on Magna's approach to executive compensation; and |

|

|

5. transact any other business that may properly come before the Meeting. |

|

|

As of the date of this Circular, we are not aware of any other business to be transacted at the Meeting. |

1.

Financial Statements |

|

Magna's consolidated financial statements and the independent auditors' report thereon for the fiscal year ended December 31, 2014 are included in the Annual Report, which was provided to shareholders with this Circular. The financial statements

will be presented at the Meeting, but no shareholder vote is required in connection with them. |

2.

Election of Directors |

|

Directors are elected by shareholders to act as stewards of the company. The Board is Magna's highest decision-making body, except to the extent certain rights have been reserved for shareholders under applicable law or Magna's articles of

incorporation or by-laws. Among other things, the Board is responsible for appointing our Chief Executive Officer and overseeing Management. In fulfilling their duties, directors are required under applicable law to act in the best interests of the

company. |

|

|

Board Size and Term

The CGCNC is responsible for making recommendations to the Board regarding optimal Board size and candidates for service on the Board. Some of the factors relevant to the CGCNC's consideration of optimal Board size include the scale and complexity of

Magna's business, the markets in which it operates, the company's strategic priorities, the need for a diverse range of skills and perspectives, Committee staffing needs and other factors. Magna's articles of incorporation permit the Board to

determine its size within a range of five to fifteen directors. Over the last ten years, the Board size has ranged between nine and fourteen, with an average of eleven directors. The number of directors to be elected at the Meeting is eleven and

the CGCNC believes that to be an appropriate size.

Each director is elected for a one-year term expiring at our next annual meeting of shareholders. |

6 Meeting

Information

|

|

Minimum Qualifications for Service as a Director of Magna |

|

|

We believe it is essential that the Board consists of directors who represent a diversity of skills, personal experience and backgrounds which will assist the Board in fulfilling its duties. Additionally, under our Board Charter each director must

possess the following attributes:

• personal and professional integrity;

• significant achievement in his or her field;

• experience and expertise relevant to our business;

• a reputation for sound and mature business judgment;

• the commitment and ability to devote the necessary time and effort in order to conduct his or her duties effectively; and

• financial literacy. |

|

|

2015 Nominees

The CGCNC has unanimously recommended, and the Board has unanimously approved, the nomination of the following individuals for election at the Meeting: |

| |

|

• Scott B. Bonham

• Peter G. Bowie

• Hon. J. Trevor Eyton

• V. Peter Harder

• Lady Barbara Judge

• Dr. Kurt J. Lauk |

|

• Cynthia A. Niekamp

• Dr. Indira V. Samarasekera

• Donald J. Walker

• Lawrence D. Worrall

• William L. Young |

|

|

|

|

|

All of the nominees for election at the Meeting were previously elected at our 2014 annual meeting of shareholders. On average, the nominees received 99% support from shareholders at our 2014 annual meeting of shareholders. None of our directors

serve together on any other boards, nor do any serve together on any board with a member of Magna's Management.

Refer to "Nominees for Election to the Board" for further information regarding the skills, expertise and other relevant information which you should consider in casting your vote for each nominee.

2015 Nomination Process

In recommending to the Board all eleven such nominees, the CGCNC considered a number of factors, including:

• the nominees' respective skills, expertise and experience, as well as the extent to which the nominees meet the minimum qualifications described above;

• results of the Board's annual self-assessment process, which incorporates both a self-evaluation and a peer review process;

• individual voting results from the 2014 annual meeting;

• feedback from shareholders and shareholder representative organizations; and

• feedback from the Board's independent advisors and other third parties. |

|

|

|

Meeting Information 7

|

|

CGCNC / Board Recommendation |

|

|

The CGCNC and the Board are confident that each of the eleven nominees:

• has skills, experience and expertise that provide the Board with the necessary insight to effectively carry out its mandate;

• exceeds the other minimum requirements set out in the Board Charter; and

• will, if elected, provide responsible oversight as stewards of the corporation, together with prudent oversight of Management. |

|

|

Accordingly, the CGCNC and the Board of Directors unanimously recommend that shareholders vote FOR the election of each nominee listed above and described in detail in "Nominees for Election to the Board" below.

|

|

|

Unless otherwise instructed, the Magna officers whose names have been pre-printed on the form of proxy or Voting Instruction Form intend to vote FOR each

such nominee. |

|

|

Individual Elections, Majority Voting and Disclosure of Voting Results |

|

|

At the Meeting, you will have the opportunity to vote for each nominee individually. We do not utilize slate voting.

Under Ontario corporate law, shareholders can only vote "for" or "withhold" (i.e. abstain) their vote for director nominees. As a result, a single "for" vote can result in a nominee being elected, no matter how many votes were withheld. We have

adopted a majority voting policy under which we treat "withhold" votes as if they were votes against a nominee in the case of an uncontested election (i.e. one in which the number of nominees equals the number of Board positions). A nominee who

receives more "withhold" votes than "for" votes must promptly tender a resignation to the Chair of the CGCNC for its consideration. Our majority voting policy is described in further detail below under "Corporate Governance" and each nominee has

agreed to abide by such policy.

Detailed voting results are promptly disclosed after shareholder meetings, so that shareholders can easily understand the level of support for each nominee, as well as each other item of business at the meeting. |

|

|

|

8 Meeting

Information

3.

Reappointment of Deloitte as Magna's Independent Auditors |

|

Deloitte, an Independent Registered Public Accounting Firm, was first appointed Magna's independent auditors on May 8, 2014. Deloitte performed reviews of Magna's interim consolidated financial statements for the first, second and third quarters

of 2014, and audited Magna's consolidated financial statements for the fiscal year ended December 31, 2014.

Services Provided by Deloitte

Deloitte provides Magna with four types of services: |

Audit Services: |

|

services performed in order to comply with the standards of the Public Company Accounting Oversight Board (United States) ("PCAOB"), including integrated audit of the consolidated financial statements, quarterly reviews and statutory audits of

foreign subsidiaries. In some cases, these may include an appropriate allocation of fees for tax services or accounting consultations, to the extent such services were necessary to comply with the standards of the PCAOB. This category includes fees

incurred in connection with the audit of our internal control over financial reporting for purposes of Section 404 of the Sarbanes-Oxley Act of 2002. |

Audit- Related Services: |

|

assurance and related services, including such things as due diligence relating to mergers and acquisitions, accounting consultations and audits in connection with acquisitions, attest services that are not required by statute or regulation and

consultation concerning financial accounting and reporting standards. Audit-related services actually provided by Deloitte in respect of 2014 consisted of: assurance services and procedures related to issuance of a comfort letter for a prospectus

supplement. |

Tax Services: |

|

services performed by Deloitte's tax professionals, except those services required in order to comply with the standards of the PCAOB which are included under "Audit Services". Tax services include tax compliance, tax planning and tax advice. The tax

services actually provided by Deloitte in respect of 2014 consisted of: domestic and international tax advisory, compliance and research services, as well as transfer pricing advisory services. |

Other Permitted Services: |

|

all permitted services not falling under any of the previous categories. |

|

|

|

Meeting Information 9

|

|

Deloitte's Independence

In order to protect Deloitte's independence from being compromised by engagements for other services, the Audit Committee has established and maintains a process for the review and pre-approval of all services and related fees to be paid to Deloitte.

Pursuant to this approval process, the Audit Committee approved and Magna was billed the following fees for services provided by Deloitte in respect of 2014: |

| |

|

|

|

|

|

| |

|

2014 |

| |

|

|

TYPE OF SERVICES

|

|

FEES

($) |

|

% OF TOTAL

|

|

| Audit |

|

11,500,000 |

|

90.7 |

|

| Audit-related |

|

99,000 |

|

0.8 |

|

| Tax |

|

1,075,000 |

|

8.5 |

|

| Other Permitted |

|

4,000 |

|

– |

|

| Total |

|

12,678,000 |

|

100 |

|

|

|

|

|

|

|

|

The Audit Committee has also established a process to pre-approve the future hiring (if any) of current and former partners and employees of Deloitte engaged on Magna's account. No such partners or employees were hired in 2014. |

|

|

Audit Committee Recommendation |

|

|

The Audit Committee unanimously recommends that shareholders vote FOR the resolution reappointing Deloitte as Magna's independent auditors and authorizing the Audit Committee to fix Deloitte's

remuneration.

|

|

|

Unless otherwise instructed, the persons designated in the form of proxy or Voting Instruction Form intend to vote FOR the resolution reappointing Deloitte. |

|

|

Representatives of Deloitte are expected to attend the Meeting, will have the opportunity to make a statement if they so desire and are expected to be available to respond to appropriate questions from shareholders. |

|

|

|

10 Meeting

Information

4.

Advisory Vote on Approach to Executive Compensation |

|

At the Meeting, shareholders will again have the opportunity to cast an advisory, non-binding vote on Magna's approach to executive compensation – this is often referred to as "say on pay". Although the vote is non-binding, the CGCNC

will consider the results when assessing future compensation decisions.

The text of the resolution reads as follows:

"Resolved, on an advisory basis and not to diminish the roles and responsibilities of the board of directors, that the shareholders accept the approach to executive compensation disclosed in the

accompanying Management Information Circular/Proxy Statement." |

|

|

Our approach to executive compensation is set out in detail in the CGCNC Compensation and Performance Report and the Compensation Discussion & Analysis in this Circular. Included in the CGCNC Compensation and Performance Report is a detailed

discussion and benchmarking results demonstrating the strong connection between executive compensation and corporate performance over a three-year period. We encourage you to carefully read these sections of this Circular. |

|

|

We most recently held an advisory vote on executive compensation at our May 8, 2014 annual meeting of shareholders. The say on pay resolution was supported by a significant majority (82%) of the votes cast on the resolution. In the

months which followed our 2014 say on pay vote, our Chairman engaged in discussions with a number of institutional shareholders, including some of those which were believed to have voted against our say on pay resolution. |

|

|

The CGCNC has carefully evaluated the feedback received from shareholders and has made further changes to our executive compensation system, including replacing time-vested stock options with performance-vested stock options for some of our most

senior executives. These changes are described in the CGCNC Compensation and Performance Report section of the Circular. Both the CGCNC and the Board as a whole believe that Magna's approach to executive compensation continues to be core to the

company's culture and prospects for future success, just as it has been critical to the company's historical success. |

|

|

Board Recommendation |

|

|

In light of all of the foregoing, the Board of Directors unanimously recommends that shareholders vote FOR the resolution relating to Magna's approach to executive compensation.

|

|

|

Unless otherwise instructed, the Magna officers whose names have been pre-printed on the form of proxy or Voting Instruction Form intend to vote FOR such

resolution. |

|

|

The Board will continue to monitor developments and evolving best practices and will continue to engage with shareholders, both at the request of shareholders and on the Board's own initiative, in order to understand their perspectives on various

matters of relevance to the company. |

Meeting Information 11

Nominees for Election to the Board

Board Skills and Expertise

The CGCNC seeks to recruit candidates who reflect a diversity of skills, experience and perspectives which are relevant to Magna's

business. While the specific mix may vary from time to time and

alternative categories may be considered in addition to or instead of those below, the following skills and types of experience are generally sought by the CGCNC:

- •

- Accounting/Audit: accounting and audit expertise are valued in order to enable the Board to oversee Management's handling

of

financial and financial reporting matters, including by: critically assessing Magna's financial performance and projections; understanding the company's critical accounting policies, as well as

technical issues relevant to the internal and external audit; and evaluating the robustness of the company's internal controls.

- •

- Automotive: as substantially all of Magna's business is derived from sales within the automotive

industry, the CGCNC seeks

candidates who possess a solid understanding of industry dynamics on a global and regional basis, preferably gained through management or board service with the company's customers, suppliers or

competitors. Automotive expertise also serves to align the Board with one of Magna's key strategic priorities – achieving World Class Manufacturing excellence on

a consistent basis, globally. From time to time, we may also consider candidates with experience in capital-intensive manufacturing industries, since the experience gained in such industries is

typically applicable to the automotive industry.

- •

- Emerging Markets: the CGCNC values candidates who have a track record of success in markets other than

North America and

Western Europe, since much of our and the automotive industry's growth is forecast to be in such markets. Priority markets include China, Brazil and India, but the automotive industry continues to

grow in other markets such as Indonesia, Thailand and Turkey, as well as various countries in Eastern Europe.

- •

- Finance/Financial Advisory: while we generally seek to ensure that all candidates have a baseline level

of financial

literacy, we value candidates who have experience in senior financial roles and/or in financial advisory roles. Such experience enhances the Board's oversight of financial performance, assists it in

its assessment of strategic opportunities and risks and allows it to more effectively address issues relevant to capital and capital structure.

- •

- Governance/Board: in light of the competing demands of stakeholders and the increasingly complex

governance environment in

which public companies operate, the CGCNC values candidates who possess a sophisticated understanding of corporate governance practices and norms, and/or board expertise.

- •

- Large Cap Company: while experience with companies of different scale can be valuable, the CGCNC seeks

candidates who have

board, management and/or other applicable experience with companies that have a market capitalization in excess of $10 billion. Magna's own market capitalization as of the date of this

Circular is over $20 billion and the CGCNC's prioritization of large cap company experience reflects the fact that companies of such size face different challenges and opportunities than small

and mid-cap companies.

12 Meeting

Information

- •

- Legal/Regulatory/Public Policy: Magna operates in, and is required to comply with, the laws of dozens of countries around

the

world. Candidates who possess an understanding of different legal systems and regulatory perspectives are valued by the CGCNC since such experiences assist the Board in more effectively carrying out

its compliance oversight responsibilities. Additionally, the CGCNC values candidates with experience in relevant areas of government and public policy to support the Board in understanding the

regulatory trends shaping the automotive industry and assessing the company's strategic response to such trends.

- •

- Mergers & Acquisitions ("M&A"): the CGCNC views board-level M&A expertise as

critical to the Board's ability to

effectively fulfill its oversight responsibilities relating to corporate strategy, particularly since Magna intends to pursue strategic M&A opportunities in certain automotive product areas.

- •

- R&D/Innovation/Technology: Magna has a long history of developing and bringing to market innovative

automotive products and

manufacturing techniques which have been significant contributors to the company's historic success. The CGCNC seeks candidates with technological expertise and skill to support the Board in assessing

Magna's efforts to build upon its technological advantages and thus further enhance long-term value. Board-level expertise and skill in technology/innovation also serves to align the Board with one of

Magna's key strategic priorities – innovation.

- •

- Risk Management: the CGCNC seeks candidates with practical expertise in enterprise risk management

frameworks, systems,

processes, tools and techniques, to assist the Board in understanding and assessing the risks and opportunities faced by the company generally, including those inherent in its strategic plan.

- •

- Senior/Executive Leadership: the CGCNC seeks business and other leaders who have demonstrated

leadership, mature judgment,

operating success and an understanding of complex organizations in progressively challenging roles. Such individuals are believed to provide the most effective counsel to Management, as well as

critical oversight on behalf of stakeholders.

- •

- Strategy Development: recognizing the importance of the Board's oversight role with respect to

corporate strategy, the CGCNC

seeks candidates who possess board, senior management and/or other experience in strategy development or analysis.

- •

- Talent Management/Compensation: the CGCNC values candidates with hands-on roles in developing, managing,

compensating and

motivating employees. Such skills and experience assist the Board in fulfilling its responsibility to ensure that the company maintains effective incentive programs which attract, motivate and retain

top talent, while at the same time reinforcing the company's strategic priorities. Talent management and compensation expertise also serve to align the Board with one of Magna's key strategic

priorities – leadership development/succession planning.

Meeting Information 13

A

skills matrix showing the skills, expertise and qualifications for each of the nominees is set forth below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Scott B. Bonham |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

MBA |

|

| Peter G. Bowie |

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

|

|

|

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

FCA, MBA |

|

| Hon. J. Trevor Eyton |

|

/*/ |

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

|

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

JD |

|

| V. Peter Harder |

|

|

|

|

|

/*/ |

|

|

|

/*/ |

|

|

|

/*/ |

|

|

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

MA |

|

| Lady Barbara Judge |

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

JD |

|

| Dr. Kurt J. Lauk |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

MBA, PhD |

|

| Cynthia A. Niekamp |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

MBA |

|

| Dr. Indira V. Samarasekera |

|

|

|

|

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

|

|

|

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

PhD, PEng |

|

| Lawrence D. Worrall |

|

/*/ |

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

|

|

|

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

|

|

CMA |

|

| William L. Young |

|

|

|

|

|

|

|

/*/ |

|

/*/ |

|

|

|

|

|

/*/ |

|

|

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

MBA, PEng |

|

| Donald J. Walker |

|

|

|

/*/ |

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

|

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

/*/ |

|

PEng |

|

Nominee Independence

Ten out of eleven, or 91%, of the nominees for election at the Meeting are independent. A summary of the independence determination

for each nominee is set forth below:

|

NOMINEE NAME

|

|

INDEPENDENT

|

|

NON-

INDEPENDENT

|

|

BASIS FOR DETERMINATION

|

|

|

|

|

|

|

|

|

| Scott B. Bonham |

|

ü |

|

|

|

No material relationship |

|

| Peter G. Bowie |

|

ü |

|

|

|

No material relationship |

|

| Hon. J. Trevor Eyton |

|

ü |

|

|

|

No material relationship |

|

| V. Peter Harder |

|

ü |

|

|

|

No material relationship |

|

| Lady Barbara Judge |

|

ü |

|

|

|

No material relationship |

|

| Dr. Kurt J. Lauk |

|

ü |

|

|

|

No material relationship |

|

| Cynthia A. Niekamp |

|

ü |

|

|

|

No material relationship |

|

| Dr. Indira V. Samarasekera |

|

ü |

|

|

|

No material relationship |

|

| Lawrence D. Worrall |

|

ü |

|

|

|

No material relationship |

|

| William L. Young |

|

ü |

|

|

|

No material relationship |

|

| Donald J. Walker |

|

|

|

ü |

|

Management |

|

14 Meeting

Information

Director Attendance

Directors are expected to attend all Board meetings, as well as all meetings of standing Committees on which they serve, and are

welcome to attend any other Committee meetings. However, we recognize that scheduling conflicts are unavoidable from time to time, particularly where meetings are called on short notice. Our Board

Charter requires Directors to attend a minimum of 75% of regularly scheduled Board and applicable standing Committee meetings, except where an absence is due to medical or

other valid reason. During 2014, directors achieved 100% attendance at all Board and applicable Committee meetings, as set forth below.

|

| |

|

BOARD

(6 meetings) |

|

AUDIT(2)

(7 meetings) |

|

CGCNC(2)

(11 meetings) |

|

EROC(2)

(5 meetings) |

|

TOTAL

|

| |

|

|

| NOMINEE(1) |

|

# |

|

% |

|

# |

|

% |

|

# |

|

% |

|

# |

|

% |

|

# |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Scott B. Bonham |

|

6/6 |

|

100 |

|

7/7 |

|

100 |

|

– |

|

– |

|

5/5 |

|

100 |

|

18/18 |

|

100 |

|

| Peter G. Bowie |

|

6/6 |

|

100 |

|

7/7 |

|

100 |

|

– |

|

– |

|

– |

|

– |

|

13/13 |

|

100 |

|

| Hon. J. Trevor Eyton |

|

6/6 |

|

100 |

|

– |

|

– |

|

11/11 |

|

100 |

|

– |

|

– |

|

17/17 |

|

100 |

|

| V. Peter Harder |

|

6/6 |

|

100 |

|

– |

|

– |

|

11/11 |

|

100 |

|

5/5 |

|

100 |

|

22/22 |

|

100 |

|

| Lady Barbara Judge |

|

6/6 |

|

100 |

|

– |

|

– |

|

– |

|

– |

|

5/5 |

|

100 |

|

11/11 |

|

100 |

|

| Dr. Kurt J. Lauk |

|

6/6 |

|

100 |

|

7/7 |

|

100 |

|

– |

|

– |

|

– |

|

– |

|

13/13 |

|

100 |

|

| Cynthia A. Niekamp |

|

3/3 |

|

100 |

|

– |

|

– |

|

– |

|

– |

|

3/3 |

|

100 |

|

6/6 |

|

100 |

|

| Dr. Indira V. Samarasekera |

|

3/3 |

|

100 |

|

– |

|

– |

|

4/4 |

|

100 |

|

– |

|

– |

|

7/7 |

|

100 |

|

| Lawrence D. Worrall |

|

6/6 |

|

100 |

|

7/7 |

|

100 |

|

– |

|

– |

|

5/5 |

|

100 |

|

18/18 |

|

100 |

|

| William L. Young |

|

6/6 |

|

100 |

|

– |

|

– |

|

11/11 |

|

100 |

|

– |

|

– |

|

17/17 |

|

100 |

|

| Donald J. Walker |

|

6/6 |

|

100 |

|

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

6/6 |

|

100 |

|

Notes:

- 1.

- For

the dates on which each Nominee served on the Board Committees, refer to the Committee Reports under "Corporate Governance" below.

- 2.

- Attendance

figures for Audit, CGCNC and EROC include only those directors who served as members of such committees during 2014.

2014 Annual Meeting Vote Results

Each of the eleven nominees who was elected at our 2014 annual meeting of shareholders received a substantial majority of votes "for"

his or her election, as set forth in the table below.

|

| |

|

2014 |

| |

|

|

| |

|

VOTES FOR

(%) |

|

VOTES WITHHELD

(%) |

|

|

|

|

|

|

| Scott B. Bonham |

|

99.5 |

|

0.5 |

|

| Peter G. Bowie |

|

99.9 |

|

0.1 |

|

| Hon. J. Trevor Eyton |

|

98.9 |

|

1.1 |

|

| V. Peter Harder |

|

97.8 |

|

2.2 |

|

| Lady Barbara Judge |

|

99.3 |

|

0.7 |

|

| Dr. Kurt J. Lauk |

|

99.4 |

|

0.6 |

|

| Cynthia A. Niekamp |

|

99.9 |

|

0.1 |

|

| Dr. Indira V. Samarasekera |

|

99.9 |

|

0.1 |

|

| Donald J. Walker |

|

99.8 |

|

0.2 |

|

| Lawrence D. Worrall |

|

99.8 |

|

0.2 |

|

| William L. Young |

|

99.5 |

|

0.5 |

|

Meeting Information 15

Nominees' Magna Equity Ownership

We believe it is important that each Independent Director be economically aligned with shareholders. We try to achieve such alignment

in two principal ways:

- •

- Deferred Share Units ("DSUs"): 60% of the Independent Director annual retainer is paid in the form of DSUs. DSUs are

notional

units, the value of which is tied to the market value of our Common Shares. The value represented by an Independent Director's DSUs can only be realized following his or her retirement from the Board

and remains "at risk" until that time.

- •

- Equity Maintenance Requirement: Each Independent Director other than the Chairman is required to hold a

minimum of $750,000

of Magna Common Shares and/or DSUs within five years of joining the Board. The Chairman is required to hold a minimum of $1,500,000 of Magna Common Shares and/or DSUs within three years of becoming

Chairman.

Each

of Magna's nominees is in compliance with the minimum equity maintenance requirement and many exceed it. New directors are entitled to a five year period in which to accumulate the minimum

required value of Common Shares and/or DSUs.

The

eleven nominees held Magna Common Shares and/or DSUs with the following total value, as of December 31, 2014:

|

|

|

COMMON SHARES

|

|

DSUS

|

|

TOTAL EQUITY "AT RISK"(1)

($)

|

|

EQUITY MAINTENANCE

REQUIREMENT

|

|

|

|

|

|

|

|

|

|

|

| Scott B. Bonham |

|

– |

|

12,713 |

|

1,382,000 |

|

Exceeds |

|

| Peter G. Bowie |

|

3,500 |

|

10,790 |

|

1,553,000 |

|

Exceeds |

|

| Hon. J. Trevor Eyton |

|

– |

|

11,808 |

|

1,283,000 |

|

Exceeds |

|

| V. Peter Harder |

|

– |

|

12,117 |

|

1,317,000 |

|

Exceeds |

|

| Lady Barbara Judge |

|

4,000 |

|

47,854 |

|

5,636,000 |

|

Exceeds |

|

| Dr. Kurt J. Lauk |

|

– |

|

7,974 |

|

867,000 |

|

Exceeds |

|

| Cynthia A. Niekamp |

|

500 |

|

792 |

|

140,000 |

|

Complies |

|

| Dr. Indira V. Samarasekera |

|

– |

|

1,980 |

|

215,000 |

|

Complies |

|

| Donald J. Walker |

|

479,114 |

|

159,174 |

(2) |

69,376,000 |

|

Exceeds |

|

| Lawrence D. Worrall |

|

6,814 |

|

22,373 |

|

3,172,000 |

|

Exceeds |

|

| William L. Young |

|

930 |

|

27,271 |

|

3,065,000 |

|

Exceeds |

|

Notes:

- 1.

- In

calculating the value of total equity at risk, we have used the closing price of Magna Common Shares on NYSE on December 31, 2014.

- 2.

- Represents

Mr. Walker's RSUs, as discussed further in the Compensation Discussion & Analysis section of this Circular.

16 Meeting

Information

Biographies of 2015 Nominees

| Scott B. Bonham |

Independent |

|

|

California, U.S.A.

Age: 53

Director Since:

May 10, 2012 |

|

Mr. Bonham brings to the Board a technology/innovation-centred perspective which reflects his deep understanding of the long-term value creation potential possessed by some of the world's most innovative

companies.

Mr. Bonham is Co-Founder of GGV Capital, an expansion stage venture capital firm with investments in the U.S. and China. Prior to co-founding GGV in 2000, Mr. Bonham served as Vice-President of the Capital Group of Companies, where he

managed technology investments across several mutual funds (1996-2000). Mr. Bonham also previously served in various marketing roles at Silicon Graphics (1992-1996), as a manufacturing and information systems strategy consultant at Booz,

Allen & Hamilton (1989-1992) and systems engineer and maintenance foreman at General Motors of Canada. Mr. Bonham has previously served on a number of private and public company boards and audit committees, including Hurray!

Holding Co. Ltd., the shares of which were quoted on the Nasdaq National Market. Mr. Bonham has a B.Sc in electrical engineering (Queen's) and an MBA (Harvard). |

|

|

|

|

Other Public Company Boards: None |

| Peter G. Bowie |

Independent |

|

|

Ontario, Canada

Age: 68

Director Since:

May 10, 2012 |

|

Mr. Bowie brings to the Board financial expertise, a dedication to Audit Committee excellence, a strong understanding of strategy and risk, as well as detailed insight of political and economic dynamics

within China.

Mr. Bowie is a corporate director who most recently served as the Chief Executive of Deloitte China from 2003 to 2008, as well as senior partner and a member of the board and the management committee of Deloitte China until his retirement from

the firm in 2010. Mr. Bowie was previously Chairman of Deloitte Canada (1998-2000), a member of the firm's management committee and a member of the board and governance committees of Deloitte International. He is a past member of the board of

the Asian Corporate Governance Association and has served on a variety of boards in the private and non-governmental organization sectors. Mr. Bowie has a B.Comm (St. Mary's), as well as an MBA (Ottawa) and has received an honorary

doctorate (Ottawa). Mr. Bowie completed the Advanced Management Program (Harvard) and is a Fellow of the Institute of Chartered Accountants of Ontario, as well as the Australian Institute of Corporate Directors. |

|

|

|

|

Other Public Company Boards: China COSCO Holding Company Ltd. (Strategic Development (Chair); Risk) |

Meeting Information 17

| Hon. J. Trevor Eyton |

Independent |

|

|

Ontario, Canada

Age: 80

Director Since:

May 6, 2010 |

|

Mr. Eyton brings to the Board broad-based counsel which reflects his extensive legal expertise, business acumen and "blue-chip" board experience. He also brings a balanced perspective reflecting a strong

appreciation for issues from the perspectives of both senior management and board.

Mr. Eyton is a corporate director who served as a Member of the Senate of Canada from 1990 until his retirement in 2009. He is highly respected for his lengthy service with Brascan Limited, now known as Brookfield Asset Management, a Canadian-based,

global asset manager focused on property, renewable power, infrastructure assets and private equity. Mr. Eyton served as Brascan's President and Chief Executive Officer (1979 to 1991), as well as its Chairman and Senior Chairman (to 1997)

and as a director (to 2014). Prior to his service with Brascan, Mr. Eyton was a partner with the law firm Torys and has served on numerous public and private company boards, including that of General Motors Canada. Mr. Eyton has been

appointed an Officer of the Order of Canada and Queen's Counsel for Ontario. He has a B.A. (Toronto), as well as a J.D. (Toronto) and has received two honorary doctorates of law (Waterloo; King's College (Dalhousie)). |

|

|

|

|

Other Public Company Boards: Silver Bear Resources Inc. (Audit; Compensation; Governance & Environmental); Ivernia Inc. (Compensation

(Chair)); Cancana Resources Corp. (Audit, Compensation & Governance); and Brookfield Real Estate Services Inc. (Compensation and Governance) |

| V. Peter Harder |

Independent |

|

|

Ontario, Canada

Age: 62

Director Since:

May 10, 2012 |

|

Mr. Harder brings to the Board a Canadian-centred, globally-aware perspective which draws upon his extensive experience in foreign affairs and international trade. In particular, he possesses a valuable

understanding of the workings of China's political establishment, as well as its economic drivers, in addition to Canada-China trade and investment issues. Mr. Harder also brings demonstrated expertise regarding compensation issues and

compensation governance.

Mr. Harder is Senior Policy Advisor to Dentons LLP since 2007. He possesses extensive expertise in public policy as a result of his involvement in decision-making within the Government of Canada for over thirty years. Prior to joining

Dentons, Mr. Harder was a long serving Deputy Minister in the Government of Canada, having first been appointed as Deputy Minister in 1991 and serving as the most senior public servant in a number of federal departments including Treasury Board,

Solicitor General, Citizenship and Immigration, Industry and Foreign Affairs and International Trade until 2007. While Deputy Minister of Foreign Affairs, Mr. Harder served as the first co-chair of the Canada-China Strategic Working Group which

had been established by the Canadian and Chinese governments to make recommendations on improving trade and investment flows between Canada and China. Mr. Harder currently serves as the President of the Canada-China Business Council (since 2008)

and as Vice-Chairman of the Canadian Defence and Foreign Affairs Institute. Mr. Harder has a B.A. (Waterloo) as well as an M.A. (Queen's) and has received an honorary doctorate in law (Waterloo). |

|

|

|

|

Other Public Company Boards*: Northland Power Corporation (Compensation (Chair); Audit); Power Financial Corporation (Related Party & Conduct Review

(Chair); Compensation); IGM Financial Corporation (Executive Committee; Community Affairs; Investment; Compensation); Energizer Resources Corporation |

- *

- Mr. Harder

was a director of Arise Technologies Corporation ("Arise") until June 24, 2011. Arise was deemed to have made an assignment into bankruptcy on

April 11, 2012.

18 Meeting

Information

| Lady Barbara Judge |

Independent |

|

|

London, England

Age: 68

Director Since:

September 20, 2007 |

|

Lady Judge brings to the Board a broad-based global business perspective, complemented by significant legal and regulatory expertise, as well as practical corporate governance and risk management experience.

Lady Judge's risk awareness and understanding of risk management processes, drawn in part from her experience in the nuclear industry and as a securities regulator, have been particularly valuable to the EROC, which she chairs.