Australian Election Losers Could Include Triple-A Rating

July 04 2016 - 7:54AM

Dow Jones News

By James Glynn

SYDNEY -- Australia could lose its rare triple-A credit rating

after a tight general election raised questions about the next

government's ability to curb spending and bring down debt.

The election remains too close to call, but the prospect of a

lengthy period of political instability -- such as a hung

parliament in the 150-seat House of Representatives, where

governments are formed -- complicates Australia's challenge in

revving up an economy hit by the end of a decadelong mining

boom.

On Monday, Standard & Poor's Global Ratings said

"parliamentary gridlock" could trigger a downgrade if it means

Australia's finances don't improve. Moody's Investors Service said

its assessment could change if the new parliament led to an

undesirable shift in policy.

It highlights how politics is increasingly influencing the

thinking of ratings companies as signs grow that the global

economic recovery is faltering. S&P stripped the U.K. of its

pristine triple-A rating within days of the country's vote to leave

the European Union, citing concerns about constitutional and

economic integrity.

Australia has notched up 24 years without a recession -- the

longest current streak in the developed world -- and its problems

are such that other economies might wish for. In 2015 its economy

grew by 3%, with gross government debt estimated at 37%. By

contrast, the eurozone reported growth of 1.5% and Japan of 0.4%,

and the International Monetary Fund put their debt ratios at 93%

and 248%, respectively.

Australia's debt load, however, is growing at a pace that is

among the fastest in the world. After rolling out one of the

biggest fiscal expansions of any major economy in response to the

global financial crisis, the country has failed to bring the budget

back under control as commodity prices have fallen.

Neither the Liberal-National coalition, led by Prime Minister

Malcolm Turnbull, nor the center-left Labor Party, led by Bill

Shorten, made budget repair a central campaign issue -- and ratings

companies fear neither man will be able to push through tough

economic policies to slow the rise in debt if he has to horse-trade

to cobble together a coalition government.

"Irrespective of the political composition of any new

government, we could lower the rating if parliamentary gridlock on

the budget continues and Australia's budgetary performance doesn't

improve broadly as we expected a year ago," said S&P, which is

expected to publish its next official review of the sovereign

rating this month.

Moody's said the credit implications of political uncertainty

would be limited -- if it is short-lived. "The electoral outcome

would affect the sovereign credit profile only if it changed broad

policy priorities and the effectiveness of their implementation,"

said Marie Diron, a senior vice president at the ratings

company.

Investors rely on ratings from S&P, Moody's and Fitch

Ratings when deciding whether to buy bonds. Australia is one of a

handful of AAA sovereigns left, and losing the rating would make it

harder and costlier to attract foreign capital.

To be sure, even lower-rated sovereign debt remains attractive

to investors who consider it a safer bet than global equities or

currencies. Australian government 10-year bond yields hit record

lows last month -- reflecting global trends, but also benign local

inflation.

Paul Dales, chief economist for Australia and New Zealand at

Capital Economics, said a downgrade could be imminent. "A minority

government is unlikely to pass the fiscal measures required to

satisfy the ratings agencies. They may even pull the plug this

week," he said.

Attempts at budget repair by various governments over recent

years have been repeatedly thwarted by a hostile Senate, the upper

house of Parliament. Early counting indicates the next prime

minister will have to deal with an even more disparate band of

Senators, ranging from anti-immigrationists to free-trade

skeptics.

One of the first tasks of the new parliament will be to debate

the last budget, announced in May.

Su-Lin Ong, senior economist at RBC Capital Markets, based in

Sydney, said the prospect of an ineffectual parliament will have

widespread consequences. "The likely outcome bodes poorly for

confidence, growth, and reform and we believe will weaken further

the nation's AAA sovereign rating while keeping pressure on the

Reserve Bank of Australia to do the heavy lifting."

The RBA, which will decide on interest rates Tuesday at its

regular monthly board meeting, has called for reform to boost the

economy as it transitions away from mining-reliant to more

services-based.

In an interview in May, RBA board member John Edwards said the

government's plans to restore the budget to surplus were

implausible, and warned that the ratings companies were moving

closer to action.

"I don't think we can disregard the possibility that the ratings

agencies will lose patience with a fiscal trajectory which is

simply not plausible," Mr. Edwards said. "There is always a risk we

are going to be kicked out of the (AAA) club."

Write to James Glynn at james.glynn@wsj.com

(END) Dow Jones Newswires

July 04, 2016 07:39 ET (11:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

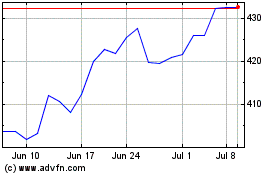

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

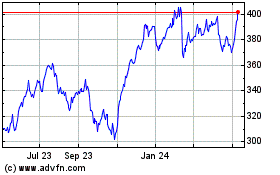

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024